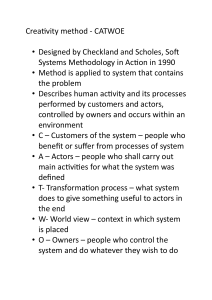

The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/1176-6093.htm Paradoxical puzzles of control and circuits of power Paradoxical puzzles João Oliveira University of Porto School of Economics and Management, Porto, Portugal, and Stewart Clegg University of Technology Sydney, Sydney, Australia 425 Received 10 February 2015 Revised 18 August 2015 Accepted 21 August 2015 Abstract Purpose – This paper aims to clarify a paradox in an organisation: in the past, formally powerful “central” actors confronted important limitations in their relations with formally less powerful actors. However, three innovations – the financial accounting module of an enterprise resource planning (ERP) system, a corporate centre (CC) and a shared services centre (SSC) – substantially changed and re-centred network power relations. The authors adopt a critical discourse to explain this paradox, contributing to the emerging literature on SSCs and bridging the management control and power literatures. Design/methodology/approach – An in-depth, processual, actor-network theory-inspired three-year case study of a large Portuguese manufacturer. Findings – As the intertwined accounting-related innovations were (re)mobilised by actors, dynamically adjusting to unfolding repercussions, control and power effects emerged, enabling enhanced organisational steering. Research limitations/implications – Based on a single case, this paper highlights effects of managerial technologies, in particular ERPs and SSCs, on control and power relations, and refines Clegg’s model for future research. Practical implications – The transactional, low value-added activities typically performed by SSCs should not lead to underestimating their potentially profound organisational consequences. However, the surrounding socio-technical network is decisive for the emerging, inter-related repercussions. Originality/value – This paper explains the relative capacity of actors to influence the practices and configuration of the organisational network structurally, fixing power relations within the socio-technical network through innovations in the accounting area, in particular ERPs and SSCs. By revising Clegg’s circuits of power framework, this paper contributes to understanding possibilities and limits of accounting techniques in management control procedures. Keywords ERP, Shared services centre, Power, Management control, Actor-network theory, Obligatory passage point Paper type Research paper 1. Introduction Power relations are everywhere in organisations but, in the past, were rarely addressed (Pfeffer, 1992, p. 8; Kanter, 1979). In the management control literature, this relative lack of attention is surprising (Burns, 2000; Carter et al., 2010; Clegg et al., 2006; Ribeiro, 2003; The first author acknowledges the support of the University of Porto School of Economics and Management, the University of Dundee, the Gulbenkian Foundation and the IBM PhD Fellowship. Qualitative Research in Accounting & Management Vol. 12 No. 4, 2015 pp. 425-451 © Emerald Group Publishing Limited 1176-6093 DOI 10.1108/QRAM-02-2015-0023 QRAM 12,4 426 Siti-Nabiha and Scapens, 2005), as power relations constitute management and organisational control. The traditional definition of power as “a resource to get things done through other people” (Fleming and Spicer, 2014, p. 239) mirrors the traditional definition of management, and management control practices are necessarily founded on power relations designed to obtain outcomes through organisational relations, linking organisational levels and functions, including the core disciplines of management accounting and control (Jakobsen, 2012). Power is an essentially contested concept, one whose multiple faces (Clegg and Haugaard, 2009; Lukes, 2005) play out in sites of organisational politics (Fleming and Spicer, 2014; Foucault, 1998). Fleming and Spicer (2014, p. 279) note debate about “how power functions (whether it operates in an episodic or systemic fashion)” and suggest that episodic and systemic dynamics are “two dimensions of the broader construct of power”. These dimensions underlie Clegg’s (1989) “circuits of power”, a seminal framework whose “explicit mechanism for tracing the exercise of power” (Lapsley and Giordano, 2010) allows researchers to identify and understand both how power shifts across actor networks and how power generates such networks. In this paper, we address the management and organisational control literature, in particular, the emerging stream focusing on Shared Services Centres (SSC). The “paradoxical puzzle of being in control yet not in control” as well as “how organizations are being steered” (see the Call for Papers for this special issue) link to major accounting-related innovations. We encountered an empirical paradox of power that we analysed using Clegg’s (1989) “circuits of power” to explain the relative capacity of various actors to influence organisational relations. In particular, we highlight the role of intertwined assemblages of innovations related with accounting and management control – in particular, the financial module of an Enterprise Resource Planning (ERP) system, a relocated corporate centre (CC) and a new SSC. These innovations co-produced dispositional and action effects across the network, providing an opportunity for a rich understanding of traditional central control in the context of the emergence of new organisational capabilities and forms, providing a more powerful, nuanced and in-depth understanding than merely assembling simple lists of “impacts” or “critical success factors”. In so doing, we re-specify Clegg’s framework. Contributing to recent calls to solve disagreements on how power operates (Fleming and Spicer, 2014), we clarify how the structural circuits of power may emerge and operate, hence enhancing the adoption of this (revised) framework in future research. The paper begins by discussing alternative conceptualisations of power and briefly sketches how ERPs and SSCs have been positioned relative to power in organisations. Three research questions are then elaborated regarding the case study organisation. First, why and how were formally powerful, central actors, seemingly in control of strategically contingent resources, limited in power relations? Second, why and how did these actors introduce and mobilise technological and organisational innovations for change? Third, how did these technological and organisational innovations reconfigure the relations of power among actors? The design of the research is sketched next, before introducing the case organisation and the three accounting-related innovations. These innovations and accompanying changes in the circuits of power are investigated and the repercussions identified in terms of changes in power and practices, in accounting and beyond. Building on the analysis, we discuss the roles of ERPs, CCs and SSCs as innovations within the network of management control and propose several developments to Clegg’s framework, before presenting the main conclusions. 2. Power, ERPs and SSCs Conventional organisational conceptions of power privilege the effects that power produces when exercised; in other words, they consider “power as cause”, as an exogenous variable, where power is exercised over some agent(s) or situation(s), with strategic contingencies theory (Hickson et al., 1971) being the classic case. Control of resources is seen to be the source of power being exercised over other actors in a zero-sum game; this sense of “power over” underlies the traditional notion of control and one-dimensional power (Lukes, 2005). In the resource-based approach (Donaldson, 2001), power is conceptualised as a structurally generated “ability or capacity, which may or may not even be exercised” (Lukes, 2005, p. 109; Dean, 2013; Göhler, 2009 on “power to”). Most frequently, this conception sees power exercised over one agent by another (Dahl, 1957). However, power can also be seen as positive, as a capacity to produce effects, with evident similarities with the accounting and control literature’s wider notion of organisational control as “causing to happen” (Dermer, 1988, p. 26; Seeck and Kantola, 2009). A key question from this framework is “what causes the [contingent] capacity of some actors to produce outcomes”, seeing power as a “capacity for collective action”, “relationally attributed or available” to given actors “within a collective capable of acting in concert” (Ribeiro, 2003, pp. 63-64, emphasis in the original). Clegg et al. (2006) note that particular agencies’ “power to” achieve objectives often requires “power over” other agencies and that “power to” may also require directing and even imposing constraints on agencies, without implying that they will be worse off (such as when conducting an orchestra or controlling traffic). Effective (and additive) “power to” in organisations is thus complemented by (equally additive) “power with” (Follett, 1995). Therefore, power includes not only the capacity to control agencies’ compliance with desired standards but also the capacity to frame the overall organisational direction and coordination of interrelated agencies. Following Foucault (1975/1977), Callon (1986) and Latour (1997, 2005) developed alternative actor network capacity concepts of power. Foucault conceived of a capillary form of power, tracing its effects flowing through dispersed social relations generating control of specific resources. The relational power of an actor is based on ever-shifting networks and subjections through technologies of administration, surveillance and assessment. Actor-network theory’s (ANT) distinctive ontology includes both human and non-human actors, “collectively referred to as actants […], all […] participants in a network of heterogeneous components” (Volkoff et al., 2007, p. 834; Ahrens and Chapman, 2007; Quattrone and Hopper, 2006). “Obligatory passage points” (OPPs) (Callon, 1986) represent devices (rhetorical and material) channelling and framing the “conduct of conduct” (Dean, 2013) in specific situational contexts; actors seek to maintain, gain or deny strategic advantage by controlling or contesting the meaning and control of these OPPs. OPPs also fix the rules guiding actors’ actions and constrain available possibilities. When successful, OPPs lead to a (temporary and partial) stabilisation or fixity of such rules, though permanently challengeable as actors continuously deploy their strategies of and for power. Paradoxical puzzles 427 QRAM 12,4 428 Building on these concepts, Clegg’s (1989) framework of “circuits of power” depicts three circuits through which power flows. First, the episodic circuit captures visible exercises of power by actors in particular, day-to-day encounters, seeking to obtain outcomes favouring their definition of interests. These exercises depend on the configuration of the network of relations stabilised through the other two circuits. The circuit of social integration captures prevailing rules of practice shaping actors’ dispositions to behave in certain ways and includes rules of meaning and membership: rules of meaning guide actors in making sense of the world, events, others and themselves, hence shaping the actors’ knowledge which, in turn, underlies their (re)actions; rules of membership frame considerations about actors’ appropriate behaviour, in the context of identity assumptions and claims, given their (actual or desired) status as members of certain groups. Finally, the circuit of system integration consists of “material conditions”, based on techniques of production and discipline, such as production machinery, information systems, organisational structures and business processes – hence conveying power as facilitative, productive and positive. Together, rules of meaning and membership and techniques of production and discipline that become OPPs frame the institutional field in which actors episodically exercise power in specific interactions. Clegg’s (1989) analytical (rather than normative – Dean, 2013) account of how power operates has been extensively applied (Clegg et al., 2006), including in management accounting and control (Carter et al., 2010; Lapsley and Giordano, 2010; Mutiganda, 2014; Ribeiro, 2003; Ribeiro and Scapens, 2006). Applying Clegg’s (1989) model to accounting and management control provides a framework for understanding dynamic interplays between power relations in organisations and interdependent management control devices shaping patterns of governmentality (Dean, 2013; Foucault, 1991), whether complementary or substitutive (Grabner and Moers, 2013; Kärreman and Alvesson, 2004). Governmentality refers to the organised practices through which subjects are governed. The concept of governmentality has been extensively applied in the accounting field (Ahrens and Chapman, 2007; McKinlay et al., 2010; Spence and Rinaldi, 2014), as accounting controls are a significant practice in local regimes of governmentality, framing mentalities and rationalities through their techniques. The management control literature has long researched the innovation of ERP systems, but is only recently addressing the innovation of SSCs. ERPs, as widespread integrated business software, are central to management control (Grabski et al., 2009; Granlund and Malmi, 2002; Sánchez-Rodríguez and Spraakman, 2012; Scapens and Jazayeri, 2003). ERPs are devices that enable (and restrict) different configurations of management control and resistance (DeChow and Mouritsen, 2005; Lodh and Gaffikin, 2003; Quattrone and Hopper, 2005, 2006; Wagner et al., 2011). Emergent actor-networks form assemblages (Latour, 2005) within intra-organisational power relations and configurations, defining OPPs in contentious and a priori unpredictable ways (Quattrone and Hopper, 2005). SSCs are increasingly relevant as a new organisational form in global operations and governance (Gospel and Sako, 2010; Herbert and Seal, 2009; Seal and Herbert, 2013). As an alternative to outsourcing, SSCs combine “a market-style, customer-centred outlook with in-house management direction and control” (Herbert and Seal, 2012, p. 83). SSCs’ hybrid, multiple alternatives of scope and independence (Bergeron, 2003) result in variable potential outcomes in terms of management control and intra-organisational power relations (Gospel and Sako, 2010). Linkages and interdependencies between ERPs and SSCs adoption and development (Gospel and Sako, 2010; Joseph, 2006) occurring in management control (Herbert and Seal, 2009, 2012) have been researched from transaction cost and the resource-based perspectives (Gospel and Sako, 2010), as well as from structuration theory (Seal and Herbert, 2013). Seal and Herbert (2013) highlight that further research regarding control issues around SSCs, in particular through non-functionalist approaches, would be timely. Our concern is with how ERPs and SSCs change power relations, promote governmentality and “internal control” as well as new ways of “organisational steering”. 3. Research design and questions A paradox inspired this paper: at the end of the 1990s in the case organisation, “central” and formally authoritative actors lacked power in their relations with “local”, less formally authoritative actors, situated in subsidiaries, particularly at a plant level. Albeit the central formal authority, they were routinely outflanked by other loci of power in the organisation. By the mid-2000s, the relations of power had changed significantly, prompting the researchers to question “what causes power relations to change?” (Clegg, 1989; Seal, 2003). We theoretically address this empirical puzzle, focusing on shifts in actors’ relational power, through in-depth investigation of organisational change processes; using a naturalistic, interpretive research approach (Ahrens et al., 2008), we generated case-specific, qualitative data with a processual perspective. The explanatory case study method was used to study organisational change processes in a holistic, longitudinal and retrospective way. The single unit of analysis (Yin, 2009) was the large organisation “IndCo” (fictitious name), with headquarters in Portugal and production facilities in several countries. The fieldwork extended from March 2005 to April 2008. Multiple data sources were used to allow triangulation and construct a “chain of evidence” (Hopper and Major, 2007, p. 68). Understanding unfolding and long-term organisational change requires both longitudinal and retrospective perspectives. Traces left by the actors’ strategies enable one to “follow” the actors retrospectively. Most information was obtained through 54 semi-structured interviews with 29 actors as well as observation of 9 meetings and presentations, a total of over 110 hours of data (see Appendix). Virtually all interviews were recorded and transcribed; presentations were partly transcribed, according to their research relevance. Extensive notes were taken regarding direct observation during several days spent in the information technology (IT) department open plan office and during coffee and lunch periods at headquarters and local plants. Internal documentation including project plans, reports, presentations and user manuals were obtained, as well as a large number of publicly available sources of information. Relevant extracts and insights were copied from over 1,000 pages of transcripts and observation notes into a large file organised by themes. Cross-links between the documents enabled an integrated view over the data. We used purposeful, snowball sampling to select relevant actors. At the time of the interviews, five respondents worked as plant directors or plant controllers; 9 (out of 21) centrally located actors had previously held positions at various local levels, such that 14 actors had worked in local contexts. Three external IT consultants were also interviewed. Many interviewees had a long company history: more than one-third had been at IndCo for 18 years or more; 50 per cent had 12 years or more service while 90 per Paradoxical puzzles 429 QRAM 12,4 430 cent had 6 years or more (see Appendix): this historical embeddedness enabled the recovery of past traces, with the usual caveats about historical reconstruction, concerning the passage of time (Judt, 2012, p. 395). In addition, the change process was still unfolding (e.g. new SAP modules were being implemented during the fieldwork), facilitating a grounded approach to data collected before the technology was totally “fixed, known and unproblematic” (Preston et al., 1992, p. 564). In addition to general triangulation across and within various data sources, internal validity (Silverman, 2005) was improved by most respondents being interviewed multiple times: two-thirds of total respondents were interviewed between two and four times. The results of often lengthy intervals between interviews allowed for cross-checking (occasionally conflicting) insights across respondents[1]. 4. Power and innovations at the case organisation 4.1 The case context “IndCo” began its activity more than half a century ago in Portugal. IndCo’s products are well-established, simple, low in technology and relatively homogeneous and undifferentiated. IndCo has grown mainly through acquisitions: first, in Portugal and, later, starting in the late 1980s, internationally. In the early 1990s, it acquired a large Spanish competitor and in 1998 it acquired a very large, financially stressed and technologically out-dated European competitor, substantially increasing IndCo’s world-wide presence (to preserve anonymity, the only countries identified are Portugal and Spain). The latter acquisition and an industry recession led, in the early years of the twenty-first century, to reduced margins, creating financial difficulties, until IndCo’s management developed turnaround programs and the industry recovered. However, the global economic crisis at the end of the decade affected the company’s performance again. “Mr A” was IndCo’s chairman and majority shareholder for several decades. During the period researched (mid 1990s-2008), he was the ultimate and undisputed source of formal authority in IndCo and its group. However, after the acquisition of the Spanish competitor, most top management – with the notable exception of Mr A – moved to Spain, where a CC was developed, replacing the previous CC in Portugal. Several interviewees reported that by 1998, in practice, the main decision centre was located in Spain. Mr A, as well as other top managers in Portugal, although still the ultimate decision makers, now had less opportunities to obtain knowledge and intervene in the daily management of the business. Significantly, some centrally driven initiatives involving work practices and information systems failed to produce the desired effects of centralisation in IndCo. As a former director put it, “plant directors were the Lords at IndCo”, successfully resisting the introduction of changes not suiting their interests. Given central actors’ formal power and control over resources, their limited effectiveness emerged as an empirical puzzle that begged suitable explanation. The diversity of local markets (small and separated due to high transportation costs) and IndCo’s history of acquisitions created a decentralised, autonomous and diverse company, both at plant and country levels during the 1990s. The acquired companies typically preserved some local organisational structures and capabilities in commercial, purchasing, financial, accounting and IT areas. In spite of its focus on a single industry and ambition to define strategies and control centrally, IndCo lacked global “cohesion”, being “an amalgam of plants, not a company” (senior manager, 2006). It was a substantially decentralised organisation, even for the multi-divisional form model (Bartlett and Ghoshal, 1993; Clegg et al., 2011). Finally, considerable diversity of IT solutions, management practices and prevailing rules and beliefs existed across local sites and also vis-à-vis the centre. However, after 1999, the CC was gradually transferred to IndCo’s headquarters in Portugal, and a SSC was created at the same site. Next, we deploy Clegg’s (1989) framework: first, to account for power up to the late 1990s, based on the episodic, social integration and system integration circuits; second, we account for the innovations introduced in IndCo; and third, we analyse the repercussions of innovations for circuits of power. 4.2 Phase 1: accounting for power up to the late 1990s 4.2.1 The episodic circuit of power. In the episodic circuit of power, in which power by decision occurs, particular attention must be devoted to Mr A. The long-standing, extremely wealthy majority shareholder and chairman had the greatest formal control of organisational resources – a key basis of the episodic circuit. Mr A’s capacity to achieve objectives in concrete social interactions was not in doubt, and his orders were typically followed[2]. However, outcomes do not rely exclusively on such episodic exercises of power: the field of power is one in which concrete interactions meet embedded circuits of social and system integration. 4.2.2 The circuit of social integration. Local rather than company-level issues were generally prioritised, representing rules of membership towards the local level. In an extreme case, in a particular country, plants competed among themselves over the same customer orders, damaging global profit margins. Another example was sticking to plant-specific rules regarding the timing to confirm product availability and orders, varying from a few hours to a few days, to the detriment of the commercial activity of the company as a whole. Despite central actors organising regular meetings with managers involved to promote uniformity, few changes actually occurred and plant-level logics and priorities tended to prevail. Social integration was resolutely local. Within the financial area, some actors enacted (i.e. complied with) local rules concerning reporting timings but did not enact rules concerning the (tighter) timings to report to the CC. More generally, financial directors in each country were mostly concerned with locally oriented information and requirements (“They gave total and absolute priority to country-level reporting, not to internal group reporting” – senior manager, 2005). Prevalent rules of meaning tended to favour local definitions of objectives and interests. In the financial area, accountants in different plants and companies attributed different meanings to particular accounts and might classify given transactions using different accounts and criteria (for example, whether particular machine parts were an asset or a period cost). In the operational area, product references and commercial brands differed both across countries and even within the same country. Consequently, the enactment of different rules of meaning (i.e. what accounts, transactions and products meant across IndCo) created difficulties in processes involving multiple units. 4.2.3 The circuit of system integration. IndCo’s information systems and organisational structures and processes worked as techniques of discipline and production. Until the late 1990s, the information systems architecture was a bricolage of dispersed systems. An operational system encompassing logistics and production was developed in-house in the late 1980s, highly tailored to fit specific requirements of local businesses and users. It was installed in each site, and as it allowed development of Paradoxical puzzles 431 QRAM 12,4 432 site-specific functionalities, it did not impose uniformity. Furthermore, disparate production equipment did not provide detailed information to central actors to improve efficiency in other plants. Financial accounting was supported by different commercial packages across countries, using different accounting structures (charts of accounts), making remote access difficult or impossible. Headquarters had to rely on information produced and sent by each local team, manually entered into the central software, Hyperion Enterprise for Reporting. Management accounting and control activities were supported by two systems: Excel spreadsheets and Hyperion Enterprise for Management, the consolidation solution supporting management control at headquarters. At plant level, Excel spreadsheets, partly specific to each site, usually developed by the local plant controller, calculated and reported product costs and variances. Additionally, plant controllers used an interface to import product costs to their local level Hyperion application; they then emailed that local application output to headquarters management controllers, who introduced it into their central Hyperion application. Central actors commonly expressed concerns about diversity in local practices and systems as being difficult to identify and overcome: There was a procedure manual for management control. But not all plant controllers did it the same way. Sometimes, people had different visions due to having completely different figures about something, because the figures were not even comparable – although people believed they were (IT manager, 2005). Not all companies were taking advantage of [a financial functionality of the legacy operational system], because they preferred to do it through other tools, like Excel. Some people from headquarters said that that should happen. But then, in practice, it didn’t happen, because they couldn’t pass that message almost as a law, as obligatory. And so plant controllers kept thinking “OK, as long as this is not compulsory, we won’t do it” (IT manager, 2005). Financial and management accounting had limitations for central actors who produced, interpreted or used organisation-wide consolidated information for purposes of decision making, coordination and control. Different IT solutions, charts of accounts and practices caused significant difficulties and reliability concerns in consolidation activities. “When I’m working on an Excel spreadsheet, I can remove a cell [intentionally or not], and that’s it” (IT manager, 2005). In a nutshell: IndCo was a decentralised and diverse organisation, information systems supporting production, financial accounting and management accounting were not integrated at a local level, and importantly, local and central accounting systems were also not integrated. Collectively, these techniques limited the capacity of central actors to access, interpret, validate, control and compare local information. Central oversight was limited in scope and depth, episodic and dependent on locally produced information that was often not timely, comparable, reliable or verifiable. Extant rules favoured local definitions of objectives and interests. Limited detailed control over local actors and corporate-wide visibility and knowledge limited the capacity to intervene effectively at local levels. 4.2.4 Extant circuits of power and their provisional nature. Formal power of decision did not determine power relations. Despite overwhelming formal control over decisions and deployment of resources, the central actors’ power limitations emerged from characteristics of the structural circuits of social and systems integration. Collectively, these features reduced central actors’ structural capacity to discipline and guide decisions and actions throughout the company. IndCo had a traditional multi-divisional organisational form (Chandler, 1962; Perrow, 2014), with mostly high-level responsibilities retained at headquarters. However, until the late 1990s, the inherent limitations attaching to significant decentralisation of activities and decision rights did not hinder success. IndCo’s remarkable historical growth had been based on this “amalgam” of largely autonomous, loosely controlled sub-units, which operated in small, relatively self-contained “natural” markets, within the competitive and technological context of the time. In addition, Mr A strongly relied on Portuguese key directors based in Spain with whom he kept a close relationship. The informal “people-based” approach in part redressed the shortcomings of centrally oriented information systems, processes and structures, although its effects were restricted to a high hierarchical level: Follow-up was much more based on a relation of personal trust between – let’s put names on this – Mr A and, in Spain, [Mr X], rather than in an organised system working more or less independently from people A, B or C occupying whatever function (senior manager, 2008). As stated by a plant director working at IndCo for over 20 years: It was a bit surprising: [after the early 1990s acquisition of the Spanish competitor], we might expect increased control, but this did not happen, because it was not needed. Only later [after the 1998 acquisition] we started a tighter control stage (2008). The 1998 acquisition of a troubled large competitor marked, as already mentioned, the start of a financially stressed period, while an increasingly sophisticated market required greater coordination. As discussed next, the three major innovations marking the new “controlling” stage were triggered by distinct motivations. These innovations, although initially somewhat separate, became mutually supportive in co-assembling a new organisation underpinned by the emergence of a new organisational centre, with new power relations and possibilities. 4.3 Phase 2: accounting for innovations Our second research question enquires “why and how did central actors introduce and mobilise technological and organisational innovations?”. Three system integration innovations were introduced between the end of the 1990s and the start of 2001: an ERP, a CC and a SSC. 4.3.1 The first innovation: the adoption of SAP FI. In 1997, IndCo decided to replace existing financial accounting solutions in some sites to avoid a potential “Year 2000” bug. IndCo opted for SAP software and its ERP financial accounting module, SAP Financials (SAP FI), to be implemented in all Portuguese entities, a process soon extended to two other countries and then to all other countries (except one) until 2001. SAP FI, as initially designed in IndCo, included various features promoting company-wide uniformity and central vision – an initial orientation supported, first, by a decision of IndCo’s group regarding the consolidation solution and, second, by beliefs and rules within the IT Department. A group-wide norm required the SAP FI model to interface with the consolidation solution Hyperion, functioning as an “obligatory passage point” (OPP) constraining the “conditions of possibility” of the development of financial accounting solutions: Paradoxical puzzles 433 QRAM 12,4 434 There was a group-wide norm imposing Hyperion. All sub-holdings had to use that tool and those data structures. That group-wide norm, right at the start, worked both in favour of the project (since the SAP template of the first implementation project developed that interface functionality) and against the project, when someone wanted to get away from that straight-jacket (IT consultant, 2005). At the start of the project there were no explicit organisational concerns but when the system went live the historical preference for diversity became evident. Three initial technical options allowed diversity to emerge across countries, contradicting the objective of promoting uniformity. First, a different production server was installed in each country. Second, since each country had an independent chart of accounts, it could be changed without affecting the others. Third, local IT actors were given the technical possibility to change local configurations – in particular the local chart of accounts in their local server. Initially, the implementation team did not anticipate major consequences from these options. However, local actors’ usage of the system, after it “went live”, soon led to divergence of the models across the sites. The implementation team, aligned with centrally located actors, realised that this divergence would not facilitate consolidated activities and analyses. The implementation of the SAP commercial module, started shortly after, made clear that diverging SAP FI modules across IndCo would greatly complicate communication with the commercial module: Each country started diverging in a different way. We were lucky that we started implementing the commercial modules in Portugal and right after that in another country, which made us realise: “Be careful, there will be problems”. So we quickly revised our initial options. And the SSC was also the moment for that (IT manager, 2007). The team returned to the design stage and (re)mobilised the package differently to enforce uniformity: a single server in Portugal; a parallel accounts solution[3]; capacity to modify the country-level charts of accounts restricted to central actors in Portugal. The same IT manager concluded: Initially, whenever there was a roll-out in operational modules, there were always problems in SAP FI that I had to solve. But later, with the single chart of accounts, the roll-outs required almost no intervention of mine (2007). As Quattrone and Hopper (2005, p. 753) argued: [m]echanistic depictions of ERP projects based on linear and predictable progress towards predetermined ends ignore organisational members’ goals. Organisations must tolerate variety and negotiate order under uncertainty with consequences for control and order. Although some interviewees considered this divergence drift (and its correction) as a mere IT issue, its consequences for shaping conditions of possibility in the accounting and control domain were much broader. It defined which alternative courses of action were offered (or denied) to actors, delimiting the scope of human agency of local actors and whether accounting models and practices could evolve differently across locations. After its remobilisation, SAP FI became an OPP since no other tool existed to carry out financial accounting tasks and it started “routing” all local actors through the same path, through the same standardised structures. Although SAP FI became an OPP, the decentralised execution of financial accounting activities by local actors limited SAP FI’s effectiveness in producing uniform, comparable information. Even with SAP, there was still a lack of criteria consistency in posting accounting transactions, late reporting of local information to the centre, and some local sites adopting less strict control processes, even lacking some elementary control mechanisms. The lack of enactment by local actors of centrally defined rules, regarding accounting records, reports and controls, compromised consolidation work and ultimately affected central actors’ capacity to control and take decisions – albeit to a lower extent than before. Centrally defined rules failed to become OPPs in the circuit of social integration, limiting the power of central actors in this circuit; only with the creation of a SSC (the third innovation, analysed below) were central actors’ ambitions about SAP FI attained. 4.3.2 The second innovation: the relocation of the CC. Countering the established belief that Spain had become IndCo’s organisational centre during the 1990s, in 1998 the CC and its top managers were brought back to Portugal, to the same location as Mr A. However, even with the support of Mr A and his control over resources, the process of restoring the CC in Portugal was slow and gradual. With SAP FI at that time only emerging in financial accounting and no innovations in management accounting, short-term ambitions were also limited to gradually creating an organisational structure aligned with central actors’ surveillance and control objectives. Such an innovation was not only symbolic (the shift of “a centre” from Spain to Portugal) but it also changed IndCo’s actor-network, by introducing a new collective actor and an increasing number of CC managers. However, as explained, SAP FI had only reduced, while not eliminating, the problems regarding information timeliness, reliability and comparability, which continued to be unsatisfactory to central actors. At this stage, a SSC was created. 4.3.3 The third innovation: the creation of a SSC. The SSC was introduced in 2001 to perform heavily transactional financial accounting activities (e.g. data posting and reconciliation) centrally in Portugal. A new corporate model, with three areas, was implied: the Strategic Business Units, focused on sales and/or production in defined geographical areas; the CC, focused on global, company-wide issues; the SSC, providing services to the Strategic Business Units. Mr A was the key proponent of the SSC, backed by other central actors. The decision to create the SSC was coterminous with the decision about its location in Portugal, on the same site as IndCo’s CC and IndCo’s group headquarters. Cost reduction was expected to derive from lower labour costs, elimination of duplicate activities, economies of scale and faster and more systematised operations, achieved through continuous learning. In addition, there was a large skilled labour market and substantial competence and organisational and technological structures in place in key areas, such as IT, finance, accounting and legal support. Finally, improving accounting information quality was mentioned as the primary objective by interviewees from central accounting and finance areas. Respondents outside accounting and finance, less affected by low accounting information quality, emphasised cost reduction and considered the SSC mostly as a “plant of transactions” (IT manager, 2007), proving standard, commoditised services (see Seal and Herbert, 2013). A key member of the SSC implementation team indicated one factor that was: […] definitely decisive: […] the fact that IndCo’s Centre of Decisions was in [city C]-Portugal: with the SSC, the information supporting the decision-making process would be centralised […] and, therefore, should be situated as close as possible to those who need it the most […]. Paradoxical puzzles 435 QRAM 12,4 436 The very location promotes a greater control by the CC of the administrative and financial processes carried out by the SSC (Unpublished report). With a clear aim to reinforce central actors’ control objectives and structural power, the new corporate model had a strong central component, transferring significant human resources and processes from business units to the SSC and CC and representing a marked evolution from the previous multi-divisional form (Seal and Herbert, 2013). Local actors’ resistance to the SSC during both its implementation and its early stages of operation remained high, based on the perception that the elimination of local teams would reduce autonomy. The lower level actors declared redundant afforded extremely high resistance, with no cooperation with the implementation team. However, resistance from remaining local employees and managers gradually diminished. Some interviewees explained the change in actors’ dispositions as being based simply on the passage of time; however, relying on this as an explanatory factor alone is simplistic, since time and its effects are non-linear (Quattrone and Hopper, 2005). Local actors’ resistance to the SSC was a particular case of a broader phenomenon: the traditional misalignment between local and central actors. The reduction of resistance needs to be understood within the wider context of the emergence, consolidation and acceptance of an organisational centre and its objectives and rules, involving various innovations and repercussions in the circuits of power, discussed next. 4.4 Phase 3: repercussions of innovations in circuits of power We now explore the third research question: how the three innovations led to repercussions in the circuits of system and social integration, influencing rule acceptance and enactment, reconfiguring the relations of power and in particular increasing the power of central actors. Figure 1 integrates the case insights in a visual narrative and contributes, in the ensuing section, to further theoretical developments. We first analyse interdependencies in the development of the innovations in the facilitative circuit of power (at the top of Figure 1) and then discuss the role of non-human actors (on the left side), before considering the more direct innovation consequences from the perspective of central actors (on the right side). Finally, we analyse the central area, depicting interrelated repercussions on local actors, with a particular focus on the dispositional circuit of social integration. Ultimately, all these repercussions affected practices and increased central actors’ positional relations of power. 4.4.1 Redefining the socio-technical network through the co-development of SAP FI, the CC and the SSC. The upper section of Figure 1 depicts the innovations in the circuit of system integration (SAP FI, the CC and the SSC). These innovations redefined IndCo’s organisational field in social, legal and technological terms, constituting new individual and collective, human and non-human actors. Significantly, the SSC entailed the virtual disappearance of many local accounting actors. The CC and the SSC were charged with explicit group-wide concerns to achieve cost efficiencies (in the case of the SSC) and produce information and insights crucial for central actors. Complementarity and reinforcement between organisational and technological innovations, between human and non-human actors strategically situated and designed to be OPPs, was evident in the linked evolution of the CC and SAP FI. The early stage of development of integrated systems initially compromised the possibility of the CC adopting a radical and “completely distinct logic” (Senior manager, 2005). Moreover, Central actors introducing innovations in circuits of social and system integration Extant obligatory passage points (OPPs) SAP FI (+ other technological innovations) Corporate Centre (CC) Shared Services Centre (SSC) Technologically embedded rules Organizationally embedded rules Concerning local actors (mostly) Scope of agency Production & direct benefits Compatibility of objectives (Dis)incentives for (non)compliance Resources scarcity Control within organizational normalcy Control as natural Paradoxical puzzles 437 Concerning central actors Integrated, detailed, timely, comparable information Visibility Dispositions to accept rules / self-discipline Rules accepted by human actors Rules enacted by non-human actors Rules enacted by human actors External rule control/ discipline Decision making Favourable outcomes for central actors in specific socio-technical relations (episodes) SAP FI was not enough to ensure central visibility, based on timely and fully comparable information, even after additional mobilisation to align it better in support of central actors’ objectives. The interdependency varied with developmental stages. Initially, the embryonic state of each limited possibilities for development of the other; later, as each innovation matured, mutual reinforcement occurred. A similar interdependency later emerged between SAP FI and the SSC: SAP FI was crucial for the SSC’s creation and operations (cf. Herbert and Seal, 2012) but the concentration of most accounting activities at the SSC facilitated further development of SAP FI: It works both ways. Without a single system and technological platform, an SSC would never exist. But the SSC facilitates uniformity and developments in technological platforms; everything is a lot easier, because there is a global [organisational] platform here. (Senior SSC manager, 2007) These innovations were interdependent in terms of organisational repercussions. Their power effects depended on their capacity to become OPPs within the actor-network. Complementarity was the main type of interdependency between control devices and substitution was present only to a minor degree (Grabner and Moers, 2013), mostly as a backup to address control failures (since no OPP is totally impossible to outflank), echoing the more general finding that new forms of control tend to be added to supplement and complement extant forms, rather than substitute them (Kärreman and Alvesson, 2004). Figure 1. Tracing circuits of power: from innovations to rules and practices QRAM 12,4 438 The organisational innovations (the CC and the SSC) were particularly relevant. Most research emphasises technological innovations but in this case the introduction of a single technological innovation (SAP FI) produced only limited repercussions. On the contrary, the power repercussions emerged, in non-linear ways, from the combined, reciprocal and cumulative repercussions of all innovations within the entire network. It was not enough to assemble resources, or to implement information systems, or to create organisational structures. Organisation was critical (Clegg, 1989) and the actor networks the crucial consideration – hence the multiple linkages between the three OPPs at the top of Figure 1. The embeddedness of rules in SAP, technologically redefining agency and rules enactment, went well beyond technological considerations (Oliveira and Quinn, forthcoming; Volkoff et al., 2007). Rules (transactional rules or behavioural rules, related to roles) were structurally defined and embedded in both technological and organisational innovations. Later, throughout the analysis of the right and central parts of Figure 1, we discuss the organisational embeddedness of rules, particularly in processes conducted through the SSC, and whose effects emerge in combination with technological actors. Organisational embeddedness of rules promoted organisation and day-to-day functioning becoming structurally based on the enactment of certain rules by all actors, particularly those subject to control through various mechanisms impinging on actors’ dispositions, in the circuit of social integration. 4.4.2 Redefining agency and enacting rules through technology. The left side of Figure 1 depicts key structural constraints technologically imposed on local actors, redefining the scope of local agency, by selective extension and restriction. Two major choices regarding mobilisations of technology were deployed. The first choice related to information systems’ fundamental architecture. SAP FI became the single financial accounting solution for local actors and, later, the parallel accounts solution was adopted, with restrictions for local actors. The definition of user profiles excluded local actors from creating accounts and posting transactions; by defining what each actor could and could not do in the system, human involvement and agency was shaped – and excluded. As Carter et al. (2010, p. 585) note, “by limiting enrolment and involvement to certain actors, the micro-politics […] get played out”. A second choice was embedding business rules within SAP during current operations, beyond the SAP FI module, to ensure certain sequences of actions were followed (e.g. no production could be planned without the prior definition of a product code and costing). Other rules automatically removed the possibility of agency from certain actors and attributed it to others (e.g. when a client’s credit limit was exceeded). Therefore, central actors created structural conditioning (the first cycle of social change proposed by Volkoff et al., 2007). Rules technologically embedded in SAP acquired a “material aspect”. Later, during the second cycle of social interactions, “there are no choices to be made” by individuals while the technological actant SAP produced “direct” repercussions – what Volkoff et al. (2007, p. 840) labelled “first-order effects”, depicted by the vertical arrow on the left side of Figure 1. SAP directly enacted technologically embedded rules. Therefore, at an episodic level of action, of specific socio-technical relations and episodes (depicted at the bottom of Figure 1), favourable outcomes for central actors were promoted without requiring central actors directly to deploy “naked power” (Clegg et al., 2006; Lapsley and Giordano, 2010). 4.4.3 Direct benefits of innovations to central actors. The innovations introduced, in particular SAP FI in its intertwined relation with the CC and the SSC, and the technological and organisational embeddedness of rules benefiting central actors’ interests, granted central actors increased visibility and panoptical scrutiny. In the circuit of system integration, this had two main effects (depicted on the right side of Figure 1): “direct” disciplinary effects derived from monitoring and improved decision-making. A parallel accounts solution granted central actors greater visibility over local figures, reducing the possibility of data manipulation, since local systems could now be accessed and details verified (rather than final figures being sent by local actors, with limited possibilities of verifying reliability). The IT-based process supporting the accounting workflow included the central posting of documents. Documents received in local sites were digitalised immediately to support the entire accounting process through the IT solution IXOS, allowing central verification/authorisation of all transactions through a number of checkpoints. Purchases of fixed assets used an IT solution, named IDAR, to ensure prior authorisation. Payment of a fixed asset purchase required prior posting of an invoice, necessitating prior creation of a record for the future fixed asset in IDAR, in turn requiring prior authorisation. Deviance from centrally prescribed processes is detectable as the entire process is carried out by the SSC. The IT solutions IDAR and IXOS became additional machine-based obligatory passage points tightly linked with other actors (SAP FI, the SSC and the CC) and tightly woven with organisational processes. Finally, although the SSC had a control role, some subtle manipulation remained difficult to capture in its mainly transactional focus; in this case, the Management Control area of the CC (rather than the SSC), supported by information systems, could detect and query possible manipulation. Visibility over company-wide figures by central, higher-level actors also allowed benchmarking, better informed decision-making and greater intervention. Innovations enabled enhanced scrutiny by central actors to acknowledge previously unnoticed issues, question existing arrangements and consider changes. In particular, SAP FI’s (re)mobilisation towards uniformity and centralisation facilitated further fundamental organisational changes. In this sense, these consequences, along with expected cost savings, enabled typical modernistic innovations with the aim of improving company-wide efficiency and effectiveness. 4.4.4 Changes in local rules of meaning and membership. SAP FI (and other related IT tools), together with the CC and the SSC, helped change rules of meaning and membership, mostly not by addressing rules and dispositions directly. Instead, proposed rules were embedded in the technological and organisational innovations and the way they operated as a mutually reinforcing network. We will now explore the central area of Figure 1, depicting multiple repercussions among local actors ultimately leading to favourable outcomes for central actors (at the bottom of Figure 1). There were self-disciplinary repercussions of visibility, based on enactment of rules of membership by local actors. As a direct enabling effect for local actors, a parallel accounts solution provided locally needed reports (such as tax reports) and the possibility of creating local accounts (although a constrained possibility, as discussed below). Since, as already stated, SAP FI’s common structure alone was not sufficient to achieve the desired level of consistency in rules of meaning, organisational structure, in particular the SSC, was crucial in two highly related ways. First, the SSC Paradoxical puzzles 439 QRAM 12,4 440 disseminated knowledge about the global accounting structures among local actors. Second, the SSC became an OPP through which any attempt to materialise deviations from centrally defined rules of meaning had to pass. In particular, defined SAP user profiles restricted creation of new accounts to only a very few actors, all from the SSC. Local actors’ ambitions to create new accounts were informed to the SSC, evaluated and approved (or, by general policy, tended not to be approved) – ambitions which, if centrally unconstrained, had the potential to (re)create diverse rules of meaning. Therefore, by restricting the scope of agency (cf. Figure 1) and direct enabling and disciplinary repercussions, SAP and the SSC contributed to changing rules of meaning and membership. In an indirect way, SAP FI’s enabling role promoted the enactment of new rules of membership. The IT-supported financial control of purchasing, particularly of fixed assets (monitored through the IT solution IDAR), included rules such as not exceeding budgeted values and obtaining authorisation prior to ordering, when required. IDAR provided the SSC with disciplinary visibility and enactment of these two rules of membership. Innovations enabled disciplinary visibility and the enactment of desired rules (Ribeiro, 2003), collectively forming a disciplinary network, with OPPs that local actors had to use to carry out activities and be recognised as “good” organisational members. Successful membership work (Munro, 1999) meant working in an aligned way with these OPPs, with control rules embedded in these OPPs strongly promoting self-discipline. Local accountants had to use the only available tool, SAP FI, to perform financial accounting. Plant managers needed local actors to enact all required purchasing procedures; otherwise, payments might be blocked by the SSC, endangering regular supplies to plant and production activities. Finally, production actors needed product costing defined, so that a production order could be introduced in SAP. Therefore, SAP and the SSC became essential for local actors’ administrative and physical production (cf. Figure 1). These technological and organisational OPPs frequently produced benefits (cf. Figure 1) not only for central but also local actors. SAP FI was more sophisticated than previous solutions and SAP production modules benefited local actors by promoting better knowledge and control, through virtually on-line information and high visibility over production processes. Even with regard to IDAR, an OPP with a strong control purpose, local actors also acknowledged benefits. The SSC also produced local benefits. After an initial major disruption (and downsizing) in local units, the remaining actors gradually started experiencing benefits. For example, a plant controller considered that the SSC “helped a lot” by drawing attention to financially important aspects possibly unnoticed by local actors subject to daily pressures, bringing some “reassurance because I know there is someone verifying the correction of the work” (2008). As one plant director put it: We are subject to a discipline that sometimes can be seen as a constraint preventing an attack on an urgent situation. But that doesn’t happen, because if something has to be bought, we buy it anyway, with or without SAP, with or without authorisation, and we’ll be accountable later. When something is urgent, no one places administrative limitations. [Gesture representing a call to the boss, with tacit approval] Indeed, there is more control, we are more “controlled” (between commas), but that doesn’t create any problem. It doesn’t bother me that someone is looking at what I do. Because I don’t do any more, or any less, because of that. It’s natural that such a large company has a control system. It’s normal, logical, reasonable. (2008) The mobilisation of certain OPPs promoted some central and local objectives becoming compatible (cf. Figure 1). For example, SAP FI parallel accounting benefited central actors able to draw on the common chart of accounts; simultaneously, information in locally relevant formats, drawing from the country-level charts of accounts – hence not implying the loss of previous features – could be drawn on, a “heteromogeneity” (Quattrone and Hopper, 2006) expressing a “win-indifference” situation. Overall, mutual benefits were key to fostering consent, cooperation and commitment underlying a positive and productive view of power and management control (Kärreman and Alvesson, 2004; Seeck and Kantola, 2009). Regarding (dis)incentives for (non)compliance (cf. Figure 1), there was a concern to minimise additional workload while complying with central rules. Examples were the parallel accounting solution (in which local actors enter data only once and then SAP automatically enacts the equivalence rules between charts of accounts) and the usage of “user-exits to obtain detailed information without an added workload for the user, which the system performs and the user doesn’t even realise” (IT manager, 2007). The opposite incentive was also found: noncompliance entailed substantial additional work for local actors – in addition to entropy on organisational processes, as discussed above. After the creation of the SSC, associated with heightened compulsory requirements by increasingly powerful central actors, local actors became much more selective about allocating their increasingly scarce resources, including time (Wagner et al., 2011) (cf. Figure 1), producing only compulsory information to central actors. For instance, “‘shadow’ accounting systems” (Seal and Herbert, 2013, p. 198), typically based on Excel, were disappearing. Local enactment of rules with an exclusively local perspective and usefulness not aligned with central actors’ objectives, using scarce resources, would likely be detected and countered. The awareness of this risk promoted self-discipline through the enactment of a “rule of anticipated outcome” (Bachrach and Baratz, 1963), which adds to the self-discipline brought by the panopticon view from centralised systems. Both centrally and locally, actors perceived the existence of control as “natural” (cf. Figure 1), entailing acceptance and enactment of some centrally defined rules. Some control measures are “something one cannot be against”, “‘imperatives’ no one can oppose” (Busco et al., 2007, p. 130; Quattrone and Hopper, 2006): they were taken-for-granted, providing an important support in the circuit of social integration for increasing control through system integration. Control became a pervading feature of organisational processes, exercised in a capillary and continuous way by a network of actors, rather than merely and exclusively exercised by a given, identifiable entity to which control functions had been attributed (Clegg, 1989; Foucault, 1975/1977). The same plant director again: Nowadays, which appears to be the stage with the highest control, I feel that we have highest independence to work at the plant. Control does not remove action potential. They are simply watching what you are doing. It’s a control that controls, it’s not a control which imposes a straightjacket and you can’t do hardly anything without authorisation. Our activity is as always. At least, in my case. There are colleagues [other local actors] who feel differently. (Plant director, 2008) Organisational processes constitute the normalcy of organisational life: without processes (with variable formalisation and structuration) there is no organisation. Although referring to the normalcy of organisational processes may seem mundane, Paradoxical puzzles 441 QRAM 12,4 442 once innovations were introduced in the circuit of system integration, the OPPs promoting the interests of central actors became effective because they became embedded in re-engineered organisational processes within the new actor network configuration. Control OPPs became an integral part of many organisational processes in the daily workflow, with control becoming a part of organisational normalcy (cf. Figure 1). Organisation is an essential element of power (Clegg, 1989; Lapsley and Giordano, 2010) and power becomes most effective through its normalisation (Clegg et al., 2006). Accepting the existence of central control and rules provided a very basic but fundamental basis for agreement between organisational actors. That enhanced control became part of organisational normalcy suggests that actors may be less likely to notice particular interests underlying control. Therefore, mundane normalcy is where researchers should look for power – even if, or precisely because, it is less visible. 5. Theoretical developments 5.1 ERPs, CCs and SSCs as innovations within the network of management control This case provides insights on the close relationships between ERPs, CCs, SSCs and management control. In line with Quattrone and Hopper (2005), the ERP was important for the effectiveness of the CC as a control entity, a capacity that was achieved neither immediately nor as a result of a linear implementation of the package. Instead, central control only gained reliability after unanticipated remobilisations of the software and, in particular, after the actor-network was further reconfigured and the circuits of power were structurally changed. The elimination of many local, plant-level accountants and the creation of the SSC, a new collective actor closely aligned with central actors, was essential, along with additional non-human actors such as document management software. A new assemblage of human and non-human actors was required (Latour, 2005). Therefore, this case furthers our insights on the potential but also the limits of technology as a control tool (Dechow and Mouritsen, 2005; Joseph, 2006; Quattrone and Hopper, 2005). While consistent with Gospel and Sako’s (2010) account of how previous ERP developments affected SSC development, this paper goes further by highlighting not only that the ERP was an indispensable condition for the very existence of a SSC (Herbert and Seal, 2012), but also that the SSC greatly facilitated further development of the ERP. Interdependencies between these innovations (and the produced control) concern not only their daily operation, but also their development. They limit the conditions of possibility of the organisational field. The transactional scope of the SSC activities at IndCo (and at most SSCs – Bergeron, 2003) may suggest downplaying the SSC strategic and structural reach, in line with an interviewee’s derogative description of the SSC as a mere “plant of transactions”, further reinforced by a “factory-like appearance” (Seal and Herbert, 2013, p. 201). On the contrary, the SSC potential as a control tool is grasped only by considering how it became an OPP difficult to outflank due to its centrality to organisational processes (Herbert and Seal, 2012), across an assembled network of complementary (Kärreman and Alvesson, 2004) control devices. The organisation of actors and processes within the network enabled productive power to emerge (Clegg, 1989). The potential as well as the limits of accounting innovations in shaping everyday practices in the circuit of system integration are evident. Beyond the direct effects of these innovations, their described multiple repercussions in local actors’ rules of meaning and membership were critical in further organising the structural circuits of power to benefit central actors. This paper provides further evidence of the importance of soft power to managing the “conduct of conduct” (Dean, 2013) successfully, by aligning local actors’ rational self-interested behaviour and by promoting the perception of the inevitability and normalcy of central control. The accounting controls were, directly and indirectly, key in the creation of local regimes of governmentality, by framing mentalities and rationalities (Ahrens and Chapman, 2007; McKinlay et al., 2010; Spence and Rinaldi, 2014). 5.2 Contributions to theories of power: refining Clegg’s framework As Burns (2014) suggested, accounting and management control researchers should increasingly go beyond their traditional areas and not only draw on theories from other fields, such as organisational studies, but also seek to contribute towards them. This paper, by drawing on power theories to explore changes in organisational control, makes a useful, albeit incremental, contribution to the literature of power – and hence further contributes to the management control literature and to bridging both areas. Some authors adapted Clegg’s graphical framework (Ribeiro, 2003; Taylor, 1995) or its interpretation and terminology (Davenport and Leitch, 2005; Lagendijk and Cornford, 2000) but did not revise the framework. Drawing on the case insights, we suggest an improved representation of the ways that power operates (Figure 2), modifying several concepts, depictions and linkages of the original framework. In the revised framework, the OPPs depiction clearly encompasses both circuits of social and systems integration. OPPs are constituted not only by rules but also by techniques[4] – those rules and techniques which have succeeded in becoming fixed within the network (one of the clearest outcomes of the case study), though not all rules and techniques introduced will succeed. Therefore, the proposed framework removed the “fix/re-fix” indication (which only existed between rules and OPPs) and depicts both types of OPPs fixing relations and, as further discussed below, empowering agents in the network. The case study revealed how technological and organisational innovations made a deep impact on socio-technical relations. Innovations in the facilitative circuit of system integration influence rule acceptance and enactment (dispositional social integration) – although in non-linear ways, beyond technological determinism. Ribeiro (2003) consistently links “techniques” to “rules”, in contrast to the technological determinism of Lagendijk and Cornford (2000) and Taylor (1995). The interdependence of the two structural circuits is a main consequence of the integrated nature of the framework. Together, they are involved in the creation of organisation/processes-based or technology-based OPPs. The notion of interdependence replaces a hypothetical opposition between social integration as a stabiliser versus system integration as a destabiliser. Therefore, the original unidirectional downward arrow from rules to techniques was replaced by a bidirectional arrow. Mutual influence is shaped by the whole array of extant OPPs, collectively constituted by the multiple rules and techniques that have become fixed. Extant OPPs, potentially introduced by various actors with distinct objectives, constitute different conduits of power and may enter into conflict to become the prevalent passage point(s) while making others “less obligatory”, easier to be circumvented. Paradoxical puzzles 443 QRAM 12,4 Episodic circuit of power: based on causal power Socio-technical relations 444 Fix/ re-fix Agencies Control and deploy resources (within standing conditions) Outcomes Empower/ disempower Control / contest Reproduce/ transform Structural circuits of power: Obligatory Passage Points (OPPs): Dispositional power in the circuit of social integration: based on Rules of meaning and membership Figure 2. Revised framework of “Circuits of Power”, based on Clegg (1989) and Ribeiro (2003) Facilitate / restrict Facilitative power in the circuit of system integration: based on Techniques of discipline and production Transform Exogenous environmental contingencies Seeing power as relationally attributed to actors, “[t]o the extent that the relational conditions which constitute power are reproduced through fixing their obligatory passage points, then possession may be fixed and ‘reified’ in form” (Clegg 1989, p. 207). Therefore, agents are the entities that can be empowered, through socio-technical relations – rather than social relations themselves being empowered, as potentially suggested by the original framework. Consequently, arrows representing empowerment now flow from techniques and (as unrecognised in the original framework) rules to agents, going not only through all OPPs but also through the socio-technical relations at stake. Clegg depicted “social relations” occurring among agencies in the episodic circuit, although both human actors and technological actants have agency. Technological innovations can replace human agents in a recurrent and permanent episodic way. Therefore, in the episodic circuit the proposed framework conceptualises socio-technical relations, rather than merely social relations.[5] Moreover, through actors’ acceptance of proposed rules, episodic exercises of central power are less necessary, being replaced by appropriate dispositions emerging from accepted rules. So, OPPs in both structural circuits may replace episodic exercises of power. Three final developments concern stability and change across all circuits. First, pressures from episodic level outcomes are now linked with both structural circuits – not only with rules, as in the original depiction. Second, the term “innovation” was removed from “innovation in techniques”, to consider both new and extant techniques (as well as new and extant rules). Third, exogenous environmental contingencies are now also linked to the episodic circuit – not only to rules and techniques as in the original framework, which only implicitly included this proposed linkage in its effects through the structural circuits. These proposals add and clarify linkages either absent or unclear in the original framework. We clarify that the structural realm is comprised by all OPPs, constituted by the rules and techniques that have become fixed. We highlight the interdependence between rules and techniques, mediated through extant OPPs. We clarify that rules and techniques that successfully become OPPs, mediated through all extant OPPs, can empower agencies through socio-technical relations. Success at episodic level can be achieved through the structural OPPs in the facilitative and dispositional circuits, dispensing the direct episodic involvement of the actors who succeeded in introducing those OPPs. Together, these clarifications have significant repercussions as to how power strategies can be conceived and carried out and shed further light on how power operates structurally and episodically (Fleming and Spicer, 2014). 6. Conclusion The paper contributes to two fields. First, it contributes to the literature on power, by complementing, clarifying and revising several aspects of Clegg’s framework of circuits of power, enhancing its theoretical and empirical utility. Strategic power typically depends on the creation of a network of OPPs, complementing and reinforcing each other. If effective, OPPs cannot be circumvented by actors – at least, not collectively; therefore, should one OPP be circumvented by actors, should its obligatory nature be challenged, another OPP is expected to ensure the desired rule following and enactment. The subjection of the actor is at stake. Second, it contributes to the emerging literature on SSCs (and related technologies, such as ERPs) and their organisational control consequences, by providing a novel and explicit perspective on power issues. The paper is largely supportive of other recent accounts such as Seal and Herbert (2013, p. 202), and follows their suggestion to expand their “critical discourse”. As in these authors’ case, structure and working processes were reconfigured and the bureaucratic order suggested by the iron cage analogy (DiMaggio and Powell, 1983) became more effective and less easily outflanked. By providing a detailed account, drawing on Clegg’s theory of power, of the mechanisms and interrelationships involved, this paper develops this line of research on SSCs. In particular, it explains how reconfiguring the initially multi-divisional organisation, through the CC and the SSC innovations, could only become effective, and can only be understood, within an organised network in which rules of meaning and membership, supportive of central actors’ interests, became technologically embedded in an ERP and organisationally embedded in business processes. The reshaped network not only produced “productive” effects through company-wide “modernistic” improvements such as quicker and more reliable accounting information, greater potential for benchmarking and cost savings, but it also produced governmentality through dispositional effects, supporting central actors’ objectives. Therefore, SSCs (and ERPs) may produce not only “power to” and “power with” effects, but also “power over” effects by redistributing relational power through greater organisational control. Empirical enquiry into accounting-related innovations not only traced the circuits of power in a particular organisation but also refined Clegg’ framework. The paper explores the relative capacities of various actors and provides both a “genealogy” of power (by explaining the “conditions of emergence of organized practices and ways of thinking”) as well as an “analytics” of power (“how power Paradoxical puzzles 445 QRAM 12,4 446 operates” in particular situations) (Dean, 2013, p. 3). Complex roles played by accounting and management control practices, rules and structures were determinants of key organisational features, such as actors’ relational power. Strategic actors introduced innovations that targeted actors’ acceptance and enactment of rules. Importantly, willing acceptance and enactment of rules was facilitated when the innovations and OPPs became indispensable for facilitating organisational tasks, hence securing membership status (Munro, 1999), even though divergent interests still remained. The paper highlighted that the routine, transactional, typically low value-added nature of activities performed by SSCs should not lead to underestimating their profound organisational consequences for control and wider relations of power. The SSC centrality, along with the adopted ERP and a realigned CC, made these innovations obligatory passage points. Innovation effects were largely emergent, as actors (re)mobilised by adjusting to unfolding repercussions. The described complementary interdependencies between technological and organisational innovations, both during their daily operation and development, contribute to the ongoing debates around ERPs and SSCs (Gospel and Sako, 2010; Herbert and Seal, 2012; Scapens and Jazayeri, 2003). Technological and organisational embeddedness of rules benefiting central actors produced more than just direct benefits for these actors; it also reshaped the scope of agency and promoted acceptance and enactment of new rules of meaning and membership among local actors. Ultimately, circuits of power changed structurally in favour of central actors, reducing the initial paradox of central actors’ limited control over the organisation. Notes 1. A 90 minutes meeting with 11 diversified managers, presenting and discussing an initial case write-up, generated positive feedback about the case analysis and proposed theorisation. A serendipitous event provided further reassurance about the case accuracy. When the first author informally sketched the case to a colleague who, unknown to the researcher, had been IndCo’s director in the late 1990s and early 2000s, she immediately recognised the organisation and fully agreed with the empirical and theoretical analysis. 2. This capacity of Mr A was noticeable in insights from interviewees, direct observation of employees’ reactions to Mr A’s indications and the researcher’s personal experience at IndCo. General knowledge based on publicly available sources also suggested this capacity. 3. Parallel accounting articulates a common chart of accounts with country-level ones, enabling to produce, simultaneously, a tailored solution to each country and a uniform company-wide basis. 4. By positioning OPPs only at the level of rules, the original framework may have misled authors such as Taylor (1995), who associated the creation of OPPs to the circuit of social integration only. 5. It could be argued, however, that social relations is the broader concept because it encompasses all possible relations – with technologies, animals, ecologies, etc. – constituted in and through social, that is, meaningful, relations. References Ahrens, T., Becker, A., Burns, J., Chapman, C.S. and Granlund, M. (2008), “The future of interpretive accounting research – a polyphonic debate”, Critical Perspectives on Accounting, Vol. 19 No. 6, pp. 840-866. Paradoxical puzzles Ahrens, T. and Chapman, C.S. (2007), “Management accounting as practice”, Accounting, Organizations and Society, Vol. 32, pp. 1-27. Bachrach, P. and Baratz, M.S. (1963), “Decisions and Nondecisions: an analytical framework”, The American Political Science Review, Vol. 57 No. 3, pp. 632-642. Bartlett, C.A. and Ghoshal, S. (1993), “Beyond the M-form: toward a managerial theory of the firm”, Strategic Management Journal, Vol. 11 No. S2, pp. 23-46. Bergeron, B. (2003), Essentials of Shared Services, John Wiley & Sons, NJ. Burns, J. (2000), “The dynamics of accounting change – inter-play between new practices, routines, institutions, power and politics”, Accounting, Auditing and Accountability Journal, Vol. 13 No. 5, pp. 566-596. Burns, J. (2014), “Qualitative management accounting research in QRAM: some reflections”, Qualitative Research in Accounting & Management, Vol. 11 No. 1, pp. 71-81. Busco, C., Quattrone, P. and Riccaboni, A. (2007), “Management accounting: issues in interpreting its nature and change”, Management Accounting Research, Vol. 18 No. 2, pp. 125-149. Callon, M. (1986), “Some elements of a sociology of translation: domestication of the scallops and the fishermen of St. Brieuc Bay”, in Law, J. (Ed.), Power, Action and Belief: A New Sociology of Knowledge?, Routledge and Keegan Paul, London, pp. 196-233. Carter, C., Clegg, S. and Kornberger, M. (2010), “Re-framing strategy: power, politics and accounting”, Accounting, Auditing & Accountability Journal, Vol. 23 No. 5, pp. 573-594. Chandler, A.D. (1962), Strategy and Structure: Chapters in the History of the American Industrial Enterprise, MIT Press, Cambridge. Clegg, S.R. (1989), Frameworks of Power, Sage, London. Clegg, S.R., Carter, C., Kornberger, M. and Schweitzer, J. (2011), Strategy: Theory & Practice, Sage, London. Clegg, S.R., Courpasson, D. and Philips, N. (2006), Power and Organizations, Sage, London. Clegg, S.R. and Haugaard, M. (2009), The Sage Handbook of Power, Sage, London. Dahl, R.A. (1957), “The concept of power”, Behavioural Science, Vol. 2, , pp. 201-215. Davenport, S. and Leitch, S. (2005), “Circuits of power in practice: strategic ambiguity as delegation of authority”, Organization Studies, Vol. 26 No. 11, pp. 1603-1623. Dean, M. (2013), The Signature of Power: Sovereignty, Governmentality and Biopolitics, Sage, London. Dechow, N. and Mouritsen, J. (2005), “Enterprise resource planning systems, management control and the quest for integration”, Accounting, Organizations and Society, Vol. 30 Nos 7/8, pp. 691-733. Dermer, J. (1988), “Control and organizational order”, Accounting, Organizations and Society, Vol. 13 No. 1, pp. 25-36. DiMaggio, P. and Powell, W. (1983), “The iron cage revisited: institutional isomorphism and collective rationality in organizational fields”, American Sociological Review, Vol. 48, pp. 147-160. 447 QRAM 12,4 448 Donaldson, L. (2001), The Contingency Theory of Organizations, Sage, London. Fleming, P. and Spicer, A. (2014), “Power in management and organization science”, The Academy of Management Annals, Vol. 8 No. 1, pp. 237-298. Follett, M.P. (1995), “Power”, in Graham, P. (Ed.), Mary Parker Follet – Prophet of Management: A Celebration of Writings from the 1920s, Harvard Business School Press, Boston, pp. 97-120. Foucault, M. (1975/1977), Discipline and Punish – The Birth of the Prison, Penguin Books, London. Foucault, M. (1991), “Governmentality (Lecture at the Collège de France, 1978)”, in Burchell, G., Gordon, C. and Miller, P. (Eds.), The Foucault Effect: Studies in Governmentality, University of Chicago Press, Chicago, IL, pp. 87-104. Foucault, M. (1998), “The care of the self as a practice of freedom”, in Berbauer, J. and Rasmussen, D. (Eds), The Final Foucault, MIT Press, Cambridge, pp. 1-20. Göhler, G. (2009), “‘Power to’ and ‘power over’”, in Clegg, S.R. and Haugaard, M. (Eds.), The SAGE Handbook of Power, Sage, London, pp. 27-39. Gospel, H. and Sako, M. (2010), “The unbundling of corporate functions: the evolution of shared services and outsourcing in human resource management”, Industrial and Corporate Change, Vol. 19 No. 5, pp. 1367-1396. Grabner, I. and Moers, F. (2013), “Management control as a system or a package? Conceptual and empirical issues”, Accounting, Organizations and Society, Vol. 38, pp. 407-419. Grabski, S., Leech, S. and Sangster, A. (2009), Management Accounting in Enterprise Resource Planning Systems, CIMA, Oxford. Granlund, M. and Malmi, T. (2002), “Moderate impact of ERPS on management accounting: a lag or permanent outcome?”, Management Accounting Research, Vol. 13, pp. 299-321. Herbert, I. and Seal, W. (2009), “The role of shared services”, Management Services, Vol. 53 No. 1, pp. 43-47. Herbert, I. and Seal, W. (2012), “Shared services as a new organisational form: some implications for management accounting”, British Accounting Review, Vol. 44, pp. 83-97. Hickson, D.J., Hinings, C.R., Lee, C.A., Schneck, R.E. and Pennings, J.M. (1971), “A Strategic Contingencies’ Theory of Intraorganizational Power”, Administrative Science Quarterly, Vol. 16 No. 2, pp. 216-229. Hopper, T. and Major, M. (2007), “Extending institutional analysis through theoretical triangulation: regulation and activity-based costing in portuguese telecommunications”, European Accounting Review, Vol. 16 No. 1, pp. 59-97. Jakobsen, M. (2012), “Intra-organisational management accounting for inter-organisational control during negotiation processes”, Qualitative Research in Accounting & Management, Vol. 9 No. 2, pp. 96-122. Joseph, G. (2006), “Understanding developments in the management information value chain from a structuration theory framework”, International Journal of Accounting Information Systems, Vol. 7 No. 4, pp. 319-341. Judt, T. (2012), “Afterword”, in Judt, T. (Ed.), with Snyder, T., Thinking the Twentieth Century, The Penguin Press, New York, NY, pp. 389-398. Kanter, R.M. (1979), “Power failure in management circuits”, Harvard Business Review, Vol. 57 No. 4, pp. 65-75. Kärreman, D. and Alvesson, M. (2004), “Cages in tandem – management control, social identity, and identification in a knowledge-intensive firm”, Organization, Vol. 11 No. 1, pp. 149-175. Paradoxical puzzles Lagendijk, A. and Cornford, J. (2000), “Regional institutions and knowledge – tracking new forms of regional development policy”, Geoforum, Vol. 31 No. 2, pp. 209-218. Lapsley, I. and Giordano, F. (2010), “Congestion charging: a tale of two cities”, Accounting, Auditing & Accountability Journal, Vol. 23 No. 5, pp. 671-698. Latour, B. (1997), “On actor network theory: a few clarifications”, available at: http://www.nettime. org/Lists-Archives/nettime-l-9801/msg00019.html (accessed 18 August 2015). Latour, B. (2005), Reassembling the Social, OUP, Oxford. Lodh, S.C. and Gaffikin, M.J.R. (2003), “Implementation of an integrated accounting and cost management system using the SAP system: a field study”, European Accounting Review, Vol. 12 No. 1, pp. 85-121. Lukes, S. (2005), Power – A Radical View, 2nd ed., Palgrave Macmillan: Hampshire. McKinlay, A., Carter, C., Pezet, E. and Clegg, S.R. (2010), “Using foucault to make strategy”, Accounting, Auditing & Accountability Journal, Vol. 23 No. 8, pp. 1012-1031. Munro, R.J.B. (1999), “Power and discretion: membership work in the time of technology”, Organization, Vol. 6 No. 3, pp. 429-450. Mutiganda, J.C. (2014), “Circuits of power and accountability during institutionalisation of competitive tendering in public sector organisations – a field study in public care of the elderly”, Qualitative Research in Accounting & Management, Vol. 11 No. 2, pp. 129-145. Oliveira, J. and Quinn, M. (forthcoming), “Interactions of rules and routines: re-thinking rules”, Journal of Accounting & Organizational Change. Perrow, C. (2014), Complex Organisations: A Critical Essay, Echo Point Books & Media, Brattleboro. Pfeffer, J. (1992), Managing with Power: Politics and Influence in Organizations, Harvard Business School Press, Boston. Preston, A., Cooper, D., and Coombs, R.W. (1992), “Fabricating budgets: a study of the production of management budgeting in the National Health Service”, Accounting, Organizations and Society, Vol. 17 No. 6, pp. 561-593. Quattrone, P. and Hopper, T. (2005), “A ‘time-space odyssey’: management control systems in two multinational organisations”, Accounting, Organizations and Society, Vol. 30 Nos 7/8, pp. 735-764. Quattrone, P. and Hopper, T. (2006), “What is IT? SAP, accounting, and visibility in a multinational organisation”, Information and Organization, Vol. 16 No. 3, pp. 212-250. Ribeiro, J. (2003), “Institutionalism, Power and Resistance to Management Accounting – a Case Study”, Unpublished Doctoral Dissertation, Manchester: University of Manchester. Ribeiro, J. and Scapens, B. (2006), “Institutional theories in management accounting change: contributions, issues and paths for development”, Qualitative Research in Accounting & Management, Vol. 3 No. 2, pp. 94-111. Sánchez-Rodríguez, C. and Spraakman, G. (2012), “ERP systems and management accounting: a multiple case study”, Qualitative Research in Accounting & Management, Vol. 9 No. 4, pp. 398-414. 449 QRAM 12,4 Scapens, R. and Jazayeri, M. (2003), “ERP systems and management accounting change: opportunities or impacts? A research note”, European Accounting Review, Vol. 12 No. 1, pp. 201-233. Seal, W. (2003), “Modernity, modernization and the deinstitutionalization of incremental budgeting in local government”, Financial Accountability & Management, Vol. 19 No. 2, pp. 93-116. 450 Seal, W. and Herbert, I. (2013), “Shared service centres and the role of the finance function”, Journal of Accounting & Organizational Change, Vol. 9 No. 2, pp. 188-205. Seeck, H. and Kantola, A. (2009), “Organizational control: restrictive or productive?”, Journal of Management & Organization, Vol. 15 No. 2, pp. 241-257. Silverman, D. (2005), Doing Qualitative Research, 2nd ed., Sage, London. Siti-Nabiha, A.K. and Scapens, R. (2005), “Stability and change: an institutionalist study of management accounting change”, Accounting, Auditing & Accountability Journal, Vol. 18 No. 1, pp. 44-73. Spence, L.J. and Rinaldi, L. (2014), “Governmentality in accounting and accountability: a case study of embedding sustainability in a supply chain”, Accounting, Organizations and Society, Vol. 39, pp. 433-452. Taylor, M. (1995), “The business enterprise, power and patterns of geographical industrialisation”, in Conti, S., Malecki, E.J. and Oinas, P. (Eds), The Industrial Enterprise and its Environment: Spatial Perspectives, Avebury – Ashgate Publishing, Aldershot, pp. 99-122. Volkoff, O., Strong, D.M. and Elmes, M.B. (2007), “Technological embeddedness and organizational change”, Organization Science, Vol. 18 No. 5, pp. 832-848. Wagner, E.L., Moll, J. and Newell, S. (2011), “Accounting logics, reconfiguration of ERP systems and the emergence of new accounting practices: a sociomaterial perspective”, Management Accounting Research, Vol. 22 No. 3, pp. 181-197. Yin, R.K. (2009), Case Study Research: Design and Methods, 4th ed., Sage, London. Paradoxical puzzles Appendix No. of actors 6 6 4 5 21 Actors’ description and years at IndCo IT area: CIO director (16 years), SAP FI head (12 years), 2 SAP operational heads (both 18 years), SAP FI manager (5 years) CC: 2 directors (13 years and 6 years), 4 controllers (5 years, 8 years, 9 years and 2 years – in late 1980s) SSC: Director (7 years), reporting team leader (18 years), reporting team manager (6 years), accounts payable team leader (4 years) Managers: CEO (22 years), 2 sales directors (20 years and 10 years), group board advisor (9 years in 1990s), group-level director (19 years) Total central actors No. of interviews 18 Times each actor was interviewed (1 actor ⫻ 8 times, 1 ⫻ 4, 2 ⫻ 2, 2 ⫻ 1) 11 (1 actor ⫻ 3 times, 3 ⫻ 2, 2 ⫻ 1) 7 (1 actor ⫻ 3 times, 1 ⫻ 2, 2 ⫻ 1) 6 (1 actor ⫻ 2 times, 4 ⫻ 1) 42 Corresponding author João Oliveira can be contacted at: joao.oliveira@fep.up.pt For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com 451 Table AI. Data about central actors and interviews Reproduced with permission of copyright owner. Further reproduction prohibited without permission.