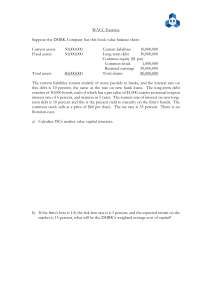

Capital Structure I Dr Yifan Zhou Capital Structure I • Does debt policy matter? • How much should a corporation borrow? • Calculate and interpret the weighted average cost of capital (WACC) Capital Structure I “A company grows by making investments that are expected to increase revenues and profits. It acquires the capital or funds necessary to make such investments by borrowing (i.e., using debt financing) or by using funds from the owners (i.e., equityfinancin g).” Capital Structure I “By applying this capital to investments with long-ter m benefits, the companyis producing value today. How much value? The answer depends not only on the investments’ expected future cash flows but also on the cost of the funds.” Capital Structure I The cost of this capital is: ✓ an important ingredient in company’s investment decision making. ✓ important for valuation of the company by investors. Capital Structure I If a company invests in projects that produce: ✓ Created value: a return in excess of the cost of capital ✓ Destroyed value: returns are less than cost of capital Capital Structure I The cost of capital is Lenders: rate of return that the suppliers of capital. Owners: compensation for their contribution of capital. Capital Structure I The cost of capital is opportunity cost of funds for ers of capital: the suppli 1. A potential supplier of capital will not voluntarily invest in a company 2. Their expected return meets or exceeds what the supplier could earn elsewhere in an investment of comparable risk Capital Structure I To raise new capital, the issuer must: price the security to offer a level of expected return that is competitive with the expected returns being offered by similarly risky securities. Capital Structure I MM’s proposition 1 states that all combinations of debt and equity are equally good. • In a perfect market any combination of securities is as good as another • The value of the firm is unaffected by its choice of capital structure Capital Structure I MM proposition 1: “The market value of any firm is independent of its capital structure.” Choice of capital structure There are two firms U and L: 1. Generate the same stream of operating income 2. Differ only in their capital structure Choice of capital structure Firm U is unlevered: Total value of equity EU = total value of the firm VU EU = VU Choice of capital structure Firm L is levered: Total value of the firm VL=value of equity EL + value of debt DL The value of its stock is, therefore, equal to the value of the firm less the value of the debt: EL = VL – DL Choice of capital structure Which of these firms you would prefer to invest in? U or L? 1. To buy 1% of firm U’s shares, your investment is 0.01VU and you are entitled to 1% of the gross profits Choice of capital structure Which of these firms you would prefer to invest in? U or L? 1. To purchase the same fraction of both the debt and the equity of firm L. • Both strategies offer the same payoff: 1% of the firm’s profits. • The law of one price tells us that in well-functioning markets two investmen ts that offer the same payoff must have the same price. • Therefore, 0.01VU must equal 0.01VL • Therefore, 0.01VU must equal 0.01VL: • The value of the unlevered firm must equal the value of the levered firm. Choice of capital structure The investors can borrow or lend on their own account on the same terms as the f irm: They can “undo” the effect of any changes in the firm’s capital structure. MM proposition 1: “The market value of any firm is independent of its capital structure.” Choice of cap ital structure Slice a pizza into five. We have one pizza, Slice a pizza into ten. We have two pizzas? No, we still have one! Capital Structure I MM’s argument that debt policy is irrelevant is an application of a simple idea. • Law of conservation of value • The value of an asset is preserved regardless of the financial claims. The Law of Conservation of Value MM’s argument that debt policy is irrelevant is an application of a simple idea. • Firm value is determined on the real assets • Not by the proportions of debt and equity securities issued to buy the assets Capital Structure I “The market value of any firm is independent of its capital structure.” • These assumptions are used to prove MM’s proposition 1. • • • • No taxes No bankruptcy costs No effect on management incentives Investors do not need choice or there are sufficient alternative securities Capital Structure I To raising capital: 1. Equity 2. Debt 3. Hybrid instruments that share characteristics of both debt and equity: ✓ Preferred stock ✓ Convertible debt Capital Structure I Component cost of capital • Each capital source selected becomes a component company’s funding and • also has a cost (required rate of return) Capital Structure I Component cost of capital A company with higher-than-average-risk investments must pay investors a higher rate of return competitive with other securities of similar risk higher cost of capital Capital Structure I Component cost of capital A company with lower-than-average-risk investments Investor will have lower rates of return demanded lower associated cost of capital Capital Structure I To estimate this required rate of return: 1. calculate marginal cost of each of various sources of capital 2. calculate a weighted average of these costs The weighted average is referred to as the weighted average cost of capital (WACC). Capital Structure I The WACC is also referred to as marginal cost of capital (MCC) • cost that a company incurs for additional capital The current cost: what it would cost the company today Capital Structure I Weighted average cost of capital (WACC): The weights are the proportions of the various sources of capital that the company uses to support its investment program. weights should represent the company’s target capital structure Not the current capital structure Capital Structure I The implications of MM’s proposition 1 for the expected returns • Expected return on assets ( rA) = expected operating income total market value of all securities rA = [D/(D + E)](rD) + [E/(D + E)](rE) Capital Structure I The expected return to equity for a levered firm: rA = [D/(D + E)](rD) + [E/(D + E)](rE) = rD(D / V) + rE(E / V) The overall expected return rA is called: company cost of capital or weighted-average cost of capital (WACC) Capital Structure I WACC = rA = [D/(D + E)](rD) + [E/(D + E)](rE) = rD(D / V) + rE(E / V) The overall expected return rA is called: weighted-average cost of capital (WACC) where: V = the total value of the firm D / V = percentage of debt in the capital structure E / V = percentage of common stock in the capital structure Capital Structure I After-tax WACC = (1 – TC) (D/V) rD + (E/V) rE where: V = the total value of the firm Tc = the firm’s marginal tax rate D / V = percentage of debt in the capital structure E / V = percentage of common stock in the capital structure Capital Structure I After-tax WACC = (1 – TC) (D/V) rD + (E/V) rE +(P/V) rp where: V = the total value of the firm Tc = the firm’s marginal tax rate D / V = percentage of debt in the capital structure E / V = percentage of common stock in the capital structure P/V = percentage of preferred stock in the capital structure Capital Structure I After-tax WACC = (1 – TC) (D/V) rD + (E/V) rE +(P/V) rp For the cost of preferred stock: Cost of preferred stock = dividend/stock price Capital Structure I Suppose firm A ’s target capital structure is as follows: D/V = 0.4, and E/V = 0.6. Its before-tax cost of debt (rD ) is 7%, its cost of equity (rE ) is 10%, and its marginal tax rate (T) is 30%. Calculate firm A ’s WACC. After-tax WACC = (1 – TC) (D/V) rD + (E/V) rE = (1-30%)(0.4) (7%) + (0.6)(10%) = ? Capital Structure I Suppose firm A ’s target capital structure is as follows: D/V = 0.4, and E/V = 0.6. Its before-tax cost of debt (rD ) is 7%, its cost of equity (rE ) is 10%, and its marginal tax rate (T) is 30%. Calculate firm A ’s WACC. After-tax WACC = (1 – TC) (D/V) rD + (E/V) rE = (1-30%)(0.4) (7%)( + (0.6)(10%) = 0.0796 Capital Structure I EXAMPLE: Computing WACC Suppose Dexter’s target capital structure is as follows: Debt%: D/V = 0.45, common sock%: E/V = 0.45, preferred stock%: P/V = 0.10. Its before-tax cost of debt (rD ) is 7.5 %, its cost of equity (rE ) is 11.5 %, cost of preferred stock (rp ) is 9%, and its margin al tax rate (T) is 40%. Calculate Dexter’s target capital structure (WACC). WACC = (1 – TC) (D/V) rD + (E/V) rE+ (P/V) rP WACC = (0.45)(0.075)(0.6) + (0.10)(0.09) + (0.45)(0.115) = 0.081 = 8.1% Capital Structure I • Does debt policy matter? • How much should a corporation borrow? • Calculate and interpret the weighted average cost of capital (WACC)