Revision Exercise

Question 1

May Chan operates a retail business. The capital balance of her business as at 1 January 2019 was

$1,000,000. The assets and liabilities of his business as at 31 December 2019, the year-end date, were

as follows:

$

Trade receivables

50,000

Trade payables

25,000

Inventory

32,000

Cash at bank

Office equipment

Prepayments

110,000

500,000

3,000

During the year, May took cash of $12,000 and inventory of $500 each month for her personal use.

Required:

(a)

(b)

Prepare for May Chan’s business a statement of affairs as at 31 December 2019.

Calculate the net profit or net loss for the year.

(3.5 marks)

(3.5 marks)

Answer:

(a)

May Chan

Statement of Affairs as at 31 December 2019

$

Assets

Office equipment

Trade receivables

Inventory

Cash at bank

Prepayments

Liabilities:

Trade payables

Capital as at 31 December 2019

500,000

50,000

32,000

110,000

3,000

695,000

0.5

0.5

0.5

0.5

0.5

25,000

670,000

0.5

Less

(b)

Net profit / (loss) = Closing capital balance + Drawings – Opening capital balance

= $670,000 + [($12,000 + $500) × 12] – $1,000,000

= ($180,000)

0.5

3

0.5

Question 2

Given the following information on Eric Lee’s business for the year ended 31 December 2018:

Cash purchases

Discounts received

Cash refund received from a trade creditor on over-payment

Cash and cheque payments to trade creditors

Returns outwards

Carriage inwards

Carriage outwards

$

400,000

325,000

35,000

2,546,500

23,500

50,000

26,500

As at 1 January 2018, trade payables totalled $564,100. As at 31 December 2018, trade payables

totalled $734,900.

Required:

Determine the total amount of purchases for the year ended 31 December 2018.

(5 marks)

Answer:

Returns outwards

Discounts received

Cash and bank

Balance c/f

Total Trade Payables

$

23,500

Balance b/f

325,000

Cash — Refund

2,546,500

Credit purchases (balancing figure)

734,900

3,629,900

Total purchases = Cash purchases + Credit purchases

= $400,000 + $3,030,800

= $3,430,800

$

564,100

35,000

3,030,800

0.5

0.5

1

0.5

0.5

0.5

0.5

3,629,900

1

Question 3

Larry Ltd performed an inventory count on 31 March 2016. However, the inventory sheets were lost.

Further investigation revealed the following information:

(i) Goods were sold at a uniform mark-up of 20%.

(ii) Inventory as at 1 January 2016 was valued at $495,880.

(iii) Purchases totalling $783,650 for the three months ended 31 March 2016 were recorded in the

books.

(iv) Sales for the three months ended 31 March 2016 amounted to $1,350,000.

(v) Goods returned by customers during the three months ended 31 March 2016 amounted to

$5,650 at cost.

(vi) On 31 March 2016, goods totalling $38,450 were received from a supplier. This transaction

was not recorded in the books.

(vii) An inventory sheet as at 1 January 2016 was overcast by $4,500.

(viii) Gross profit for the three months ended 31 March 2016 was $217,940.

Required:

Prepare for Larry Ltd an income statement extract, showing sales, cost of goods sold and gross profit

for the three months ended 31 March 2016.

(5 marks)

Answer:

Larry Ltd

Income Statement for the three months ended 31 March 2016 (extract)

$

Sales

Less Returns inwards ($5,650 × 120%)

Less

Cost of goods sold:

Opening inventory ($495,880 – $4,500)

Add Purchases ($783,650 + $38,450)

Less Closing inventory (balancing figure)

Gross profit

491,380

822,100

1,313,480

188,200

$

1,350,000

6,780

1,343,220

0.5

1

1

1

1,125,280

217,940

1

0.5

Question 4

Tony Tam is a sole trader. His business had a capital balance of $500,000 as at 1 January 2019.

During the year ended 31 December 2019, Tony withdrew cash of $10,000 for personal use each

month. His business had a capital balance of $1,000,000 as at 31 December 2019.

Required:

(a) Calculate the net profit for the year.

(b) Calculate the return on capital employed.

(2.5 marks)

(2.5 marks)

(Calculations to two decimal places)

Answer:

(a)

(b)

Net profit = Closing capital balance + Drawings – Opening capital balance

= $1,000,000 + ($10,000 × 12) – $500,000

= $620,000

2

0.5

Return on capital employed

= Net profit ÷ Average capital × 100%

= $620,000 ÷ [($1,000,000 + $500,000) ÷ 2] × 100%

= 82.67%

2

0.5

Question 5

Cherry Au is a sole trader. Her business’s summarised statement of financial position as at

31 December 2016 is as follows:

Cherry Au

Statement of Financial Position as at 31 December 2016

$

Assets

Capital and liabilities

Furniture and fittings

190,000 Capital

Inventory

27,500 Trade payables

Trade receivables

46,000

Cash at bank

2,700

266,200

$

202,050

64,150

266,200

As at 31 December 2017, the liabilities of her business consisted of trade payables $50,050 and a

loan of $47,500 from Lemon Ltd (repayable within one year). The assets included furniture and

fittings $167,500, inventory $22,750, trade receivables $40,250 and cash at bank $8,100. Drawings

in 2017 totalled $93,500 and the owner also contributed additional capital of $25,000. The gross

profit ratio was 20% and the net profit ratio was 12%.

Required:

From the above information, prepare the following:

(a) A statement of financial position as at 31 December 2017.

(b) An income statement for the year ended 31 December 2017.

(5 marks)

(5 marks)

Answer:

(a)

Cherry Au

Statement of Financial Position as at 31 December 2017

$

$

Non-current assets

Capital

Furniture and fittings

167,500 Balance as at 1 January 2017

Add Capital introduced

Current assets

Inventory

22,750

Add Net profit for the year

Trade receivables

40,250

(balancing figure)

Cash at bank

8,100

71,100

Less Drawings

Current liabilities

Trade payables

Loan from Lemon Ltd

238,600

$

$

202,050

25,000

227,050

7,500

234,550

93,500

141,050

50,050

47,500

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

0.5

97,550

238,600

(b)

Cherry Au

Income Statement for the year ended 31 December 2017

$

Opening inventory

27,500 Sales (W1)

Add Purchases (balancing figure)

45,250

72,750

Less Closing inventory

22,750

Cost of goods sold

50,000

Gross profit c/d (W2)

12,500

62,500

Operating expenses (balancing figure)

5,000 Gross profit b/d

Net profit

7,500

12,500

Workings:

(W1)

Net profit ratio = 12%

$7,500 ÷ Sales = 12%

Sales = $62,500

(W2)

Gross profit ratio = 20%

Gross profit ÷ $62,500 = 20%

Gross profit = $12,500

$

62,500

0.5

0.5

0.5

0.5

1

62,500

12,500

12,500

0.5

0.5

1

Question 6

Wilson Lam commenced business on 1 October 2015. He did not maintain a full set of accounting

records. All purchases and sales were made on credit. All other transactions were made by cheque.

For the year ended 30 September 2016, Wilson provided the following information:

$

Capital introduced on 1 October 2015 (cheque)

1,000,000

Machinery and equipment (purchased on 1 October 2015 by cheque)

670,000

Bad debts

2,600

Sales

685,000

Discounts received from suppliers

10,000

Payments to suppliers

Returns to suppliers

Returns from customers

424,000

15,000

2,000

Allowance for doubtful accounts

Inventory, 30 September 2016: At cost

At net realisable value

12,500

42,800

40,000

Trade receivables, 30 September 2016

Trade payables, 30 September 2016

Cash at bank

57,000

37,000

144,200

Expenses paid

?

Required:

(a) Calculate the net purchases for the year ended 30 September 2016.

(3.5 marks)

(b) Calculate the amount received from customers during the year ended 30 September 2016.

(3 marks)

(c) Calculate the amount of expenses paid by cheque during the year ended 30 September 2016.

(3.5 marks)

(d) Which inventory value, $42,800 or $40,000, should be used to value the closing inventory?

State the accounting principle or concept that has been applied. Assuming the wrong figure was

used, state the effect on net profit for the year ended 30 September 2016 and

30 September 2017, respectively.

(6 marks)

(a)

Discounts received

Bank

Returns outwards

Balance c/f

Total Trade Payables

$

10,000 Purchases (balancing figure)

424,000

15,000

37,000

486,000

$

486,000

0.5

0.5

0.5

0.5

0.5

486,000

Net purchases = $486,000 – $15,000 = $471,000

1

(b)

Total Trade Receivables

$

685,000 Bad debts

Returns inwards

Bank (balancing figure)

Balance c/f

685,000

Sales

$

2,600

2,000

623,400

57,000

685,000

0.5

Amount received from customers = $623,400

0.5

0.5

0.5

0.5

0.5

(c)

Capital

Trade receivables (from (b))

Bank

$

1,000,000 Machinery and equipment

623,400 Trade payables

Expenses (balancing figure)

Balance c/f

1,623,400

$

670,000

424,000

385,200

144,200

1,623,400

Amount of expenses paid by cheque = $385,200

(d)

0.5

0.5

0.5

0.5

0.5

0.5

0.5

Inventory should be valued at the lower of cost and net realisable value. As the net

realisable value of the closing inventory is lower than cost ($42,800), the inventory

should be valued at its net realisable value of $40,000.

2

The lower of cost and net realisable value is an application of the prudence concept.

1

If the wrong figure (i.e., $42,800) was used, net profit for the year ended 30

September 2016 would be overstated by $2,800 ($42,800 – $40,000).

1

On the other hand, net profit for the year ended 30 September 2017 would be

understated by $2,800 as the opening inventory for that year would be overstated by

$2,800, which would result in a higher cost of goods sold figure.

2

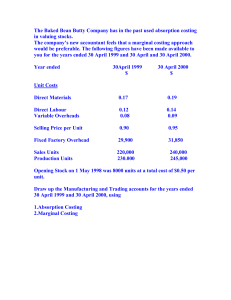

Question 7

During the year ended 31 December 2016, Ace Ltd produced a total of 204,500 notebook computers,

with 205,000 units sold for $3,900 each. The following details relate to the notebook computers:

$

Salesmen’s commissions

100 per unit sold

Advertising expenses

10,000,000

Administrative expenses

15,000,000

Direct labour

500 per unit

Direct materials

800 per unit

Manufacturing overheads: Variable

200 per unit

Manufacturing overheads: Fixed

184,050,000

Inventory, 1 January 2016

3,600,000

The unit costs of the computers produced in 2015 were $2,400. The company uses absorption

costing.

Required:

(a)

(b)

Calculate the closing inventory in units and then compute the value of closing

inventory.

Prepare an income statement for the year ended 31 December 2016.

(c)

Compute the following:

(i) Prime cost

(ii) Conversion costs

(iii) Product costs

(iv) Period costs

(6.5 marks)

(5.5 marks)

(1.5 marks)

(2 marks)

(1.5 marks)

(2 marks)

Answer:

(a) Unit costs of a notebook computer:

Direct labour

Direct materials

Manufacturing overheads: Variable

Fixed ($184,050,000 ÷ 204,500)

$

500

800

200

900

2,400

0.5

0.5

0.5

1

0.5

Closing inventory in units:

Opening inventory in units ($3,600,000 ÷ $2,400)

Units produced

Less Units sold

Closing inventory in units

Value of closing inventory = 1,000 ´ $2,400 = $2,400,000

1,500

204,500

206,000

205,000

1,000

1

0.5

0.5

0.5

0.5

(b)

Ace Ltd

Income Statement for the year ended 31 December 2016

Sales (205,000 ´ $3,900)

Less Cost of goods sold:

Opening inventory

Add Manufacturing cost of goods completed (204,500 ´ $2,400)

Less Closing inventory

Gross profit

Less Expenses:

Administrative expenses

Advertising expenses

Salesmen’s commissions (205,000 ´ $100)

Net profit

(c)

$000

3,600

490,800

494,400

2,400

15,000

10,000

20,500

$000

799,500

1

0.5

1

492,000

307,500

0.5

0.5

0.5

45,500

262,000

1

0.5

(i) Prime cost:

Direct materials (204,500 ´ $800)

Direct labour (204,500 ´ $500)

$000

163,600

102,250

265,850

0.5

0.5

0.5

(ii) Conversion costs:

Direct labour

Manufacturing overheads [(204,500 ´ $200) + $184,050,000]

$000

102,250

224,950

327,200

0.5

1

0.5

(iii) Product costs:

Direct materials + Direct labour + Manufacturing overheads

= $163,600,000 + $102,250,000 + $224,950,000 = $490,800,000

(iv) Period costs:

Administrative expenses

Advertising expenses

Salesmen’s commissions

$000

15,000

10,000

20,500

45,500

0.5

0.5

0.5

0.5

Question 8

Sun Co’s budgeted information for next month (based on four different output levels) is as follows:

Output level

Direct labour

Direct materials

Water and electricity

Rent and rates

Marketing expenses

10,000 units

$50,000

$100,000

$10,000

$100,000

(vi)

20,000 units

$100,000

(ii)

$20,000

$100,000

$30,000

30,000 units

(i)

$300,000

(iv)

(v)

$33,000

50,000 units

$250,000

(iii)

$50,000

$100,000

$39,000

Required:

(a)

(b)

Fill in the missing figures.

Classify the costs into variable, fixed or mixed costs.

Answer:

(a) (i) $150,000

(ii) $200,000

(b)

(6 marks)

(5 marks)

1

1

(iii) $500,000

(iv) $30,000

(v) $100,000

1

(vi) $27,000

1

Variable costs: Direct materials, Direct labour, water and electricity

Fixed costs: Rent and rates

Mixed costs: Marketing expenses

1

1

1 each

1

1 each

Question 9

Lemon & Co is a manufacturer that produces a single product. The firm planned to produce 100,000

units for the year ended 31 December 2016. Budgeted fixed manufacturing overheads for the year

amounted to $1,000,000.

In January 2017, the following information for the year ended 31 December 2016 became available:

Production

80,000 units

Fixed manufacturing overheads

$1,000,000

Required:

(a) Calculate the fixed manufacturing overhead absorption rate.

(3 marks)

(b)

(3 marks)

State the amount of fixed manufacturing overheads over- or under-absorbed.

Answer:

(a)

(b)

Fixed manufacturing overhead absorption rate under normal costing

= $1,000,000 ÷ 100,000

= $10 per unit

Over- or under-absorption of fixed manufacturing overheads

= $1,000,000 – (80,000 × $10)

= $200,000 (under-absorption)

1

0.5

1

0.5

Question 10

Abby Co is a manufacturer that produces a single product. You are provided the following budgeted

information on the product for the year ended 31 December 2019:

Production and sales

35,000 units

Selling price

$400 per unit sold

Direct labour

$55 per unit produced

Direct materials

$125 per unit produced

Variable manufacturing overheads

$30 per unit produced

Fixed manufacturing overheads

$3,500,000

Machine hours

1 hour per unit produced

Variable non-manufacturing overheads

$25 per unit sold

Fixed non-manufacturing overheads

$1,000,000

There was no opening inventory. Fixed manufacturing overheads were absorbed by applying a

predetermined absorption rate on the basis of budgeted machine hours.

Actual data for the year are as follows:

(i)

(ii)

A total of 40,000 units were produced. There was closing inventory of 3,000 units.

The selling price, direct labour cost per unit and direct materials cost per unit were as

budgeted.

(iii) Variable manufacturing overheads were $25 per unit produced.

(iv) Fixed manufacturing overheads amounted to $3,800,000.

(v) Non-manufacturing overheads were as budgeted.

Required:

(a) Calculate the predetermined fixed manufacturing overhead absorption rate.

(2 marks)

(b) Calculate the amount of fixed manufacturing overheads absorbed.

(2 marks)

(c) Prepare an income statement for the year ended 31 December 2019 under absorption costing

based on actual data.

(8 marks)

Answer:

(a) Predetermined fixed manufacturing overhead absorption rate

= Budgeted fixed manufacturing overheads ÷ Budgeted machine hours

= $3,500,000 ÷ (35,000 × 1)

= $100 per machine hour

(b)

1.5

0.5

Fixed manufacturing overheads absorbed

= Actual machine hours × Predetermined fixed manufacturing overhead absorption rate

= (40,000 × 1) × $100

= $4,000,000

1.5

0.5

(c)

Abby Co

Income Statement for the year ended 31 December 2019

Sales [(40,000 – 3,000) ´ $400]

Less Cost of goods sold:

Opening inventory

Add Cost of goods manufactured (W1)

Less

Closing inventory (W2)

Less Over-absorption of fixed manufacturing overheads (W3)

Gross profit

Less Variable non-manufacturing overheads (W4)

Fixed non-manufacturing overheads

Net profit

$

-

12,200,000

12,200,000

915,000

11,285,000

200,000

925,000

1,000,000

$

14,800,000

2

1

11,085,000

3,715,000

1,925,000

1,790,000

Workings:

(W1) Cost of goods manufactured = 40,000 × ($55 + $125 + $100 + $25)

= $12,200,000

(W2) Closing inventory = $12,200,000 × 3,000/40,000

= $915,000

(W3) Over-absorption of fixed manufacturing overheads = $4,000,000 – $3,800,000

= $200,000

(W4) Variable non-manufacturing overheads = (40,000 – 3,000) ´ $25

= $925,000

1.5

1

0.5

1

0.5

0.5

Question 11

Master Ltd commenced business on 1 January 2017 and produces a single product. The following

information is available for its first year of operations.

2017

Units sold

86,000

Units manufactured

94,000

Cost and price data for 2017:

Selling price per unit

Variable production costs per unit produced

Variable administrative and marketing costs per unit sold

$240

$58

$15

The company incurred fixed production overheads of $282,000 in 2017. Fixed administrative and

marketing costs in 2017 totalled $110,000.

Required:

(a) Prepare an income statement for the year ended 31 December 2017 using:

(b)

(i) Absorption costing

(ii) Marginal costing

Reconcile the difference in net profit between the two costing approaches.

(6.5 marks)

(5.5 marks)

(2 marks)

Answer:

(a) (i) Under absorption costing:

Master Ltd

Income Statement for the year ended 31 December 2017

$000

Sales (86,000 ´ $240)

Less Cost of goods sold:

Cost of goods manufactured (W1)

5,734

Less Closing inventory (W2)

488

Gross profit

Less Variable administrative and marketing costs (86,000 ´ $15)

1,290

Fixed administrative and marketing costs

110

Net profit

$000

20,640

5,246

15,394

1

2

1

0.5

1

1,400

13,994

0.5

0.5

Workings:

(W1) Cost of goods manufactured = 94,000 ´ [$58 + ($282,000 ÷ 94,000)]

= 94,000 ´ ($58 + $3)

= $5,734,000

(W2) Closing inventory = (94,000 - 86,000) ´ $61

= $488,000

1.5

0.5

0.5

0.5

(ii) Under marginal costing:

Master Ltd

Income Statement for the year ended 31 December 2017

$000

Sales

Less Cost of goods sold:

Cost of goods manufactured (94,000 ´ $58)

Less Closing inventory [(94,000 - 86,000) ´ $58]

Product contribution margin

Less Variable administrative and marketing costs

Total contribution margin

Less Fixed production overheads

Fixed administrative and marketing costs

Net profit

(b)

5,452

464

282

110

$000

20,640

0.5

1

4,988

15,652

1,290

14,362

392

13,970

1

0.5

0.5

0.5

0.5

0.5

0.5

The difference in net profit is reconciled as follows:

Net profit under absorption costing

Less Fixed production overheads absorbed in closing inventory (8,000 ´ $3)

Net profit under marginal costing

$000

13,994

24

13,970

0.5

1

0.5

Question 12

Treasure Ltd manufactures a single product. The company’s financial year ends on 31 December.

Inventory as at 1 January 2019 amounted to 3,000 units, with a value of $216,000 (under absorption

costing). The company incurred fixed production overheads of $798,000 in 2019.

Information on unit costs in 2018 and 2019:

$

15

22

21

Direct materials

Direct labour

Variable production overheads

Production (units)

Sales (units)

2019

57,000

59,000

Selling and administrative overheads are as follows:

Variable selling and administrative expenses

Fixed selling and administrative expenses

$19 per unit sold

$180,000 per annum

The selling price of the product in 2018 and 2019 was $260 per unit.

Required:

(a) Calculate the unit production costs for 2019 under:

(i) Absorption costing

(ii) Marginal costing

(b) Prepare an income statement for the year ended 31 December 2019 using:

(i) Absorption costing

(ii) Marginal costing

(c) Reconcile the difference in net profit between the two costing approaches.

(2 marks)

(2 marks)

(6.5 marks)

(6.5 marks)

(4 marks)

Answer:

(a) (i) Unit production costs under absorption costing

= $15 + $22 + $21 + ($798,000 ÷ 57,000)

= $15 + $22 + $21 + $14

= $72

1.5

0.5

(ii) Unit production costs under marginal costing = $15 + $22 + $21

= $58

(b)

1.5

0.5

(i) Under absorption costing:

Treasure Ltd

Income Statement for the year ended 31 December 2019

$000

Sales (59,000 ´ $260)

Less Cost of goods sold:

Opening inventory

216

Add Cost of goods manufactured (57,000 ´ $72)

4,104

4,320

Less Closing inventory [(3,000 + 57,000 - 59,000) ´ $72]

72

Gross profit

Less Variable selling and administrative expenses (59,000 ´ $19)

1,121

Fixed selling and administrative expenses

180

Net profit

$000

15,340

1

0.5

1

4,248

11,092

1.5

1,301

9,791

0.5

0.5

1

0.5

(ii) Under marginal costing:

Treasure Ltd

Income Statement for the year ended 31 December 2019

$000

Sales

Less Cost of goods sold:

Opening inventory (3,000 ´ $58)

Add Cost of goods manufactured (57,000 ´ $58)

Less Closing inventory (1,000 ´ $58)

Product contribution margin

Less Variable selling and administrative expenses

Total contribution margin

Less Fixed production overheads

Fixed selling and administrative expenses

Net profit

(c)

174

3,306

3,480

58

798

180

$000

15,340

0.5

1

1

3,422

11,918

1,121

10,797

978

9,819

1

0.5

0.5

0.5

0.5

0.5

0.5

The difference in net profit is reconciled as follows:

Net profit under absorption costing

Add Fixed production overheads absorbed in opening inventory

{3,000 ´ [($216,000 ÷ 3,000) - $58]}

Less Fixed production overheads absorbed in closing inventory (1,000 ´ $14)

Net profit under marginal costing

$000

9,791

42

9,833

14

9,819

0.5

2

1

0.5

Question 13

Snowball Ltd produces a single product. The company uses absorption costing but is considering

adopting marginal costing instead. It wants to compare the results under these two costing systems.

Fixed production overheads are absorbed at the rate of $30 per unit, based on the normal production

level of 400,000 units per annum. The company’s year-end date is 31 December. The following

information was extracted from the books:

2018

Production units

380,000

Sales units

370,000

Cost and price data for 2017 and 2018:

Direct materials per unit produced

$

34

Direct labour per unit produced

Variable production overheads per unit produced

Selling price per unit

12

9

170

Non-manufacturing overheads for the past two years are as follows:

Variable non-manufacturing overheads

$27 per unit sold

Fixed non-manufacturing overheads

$8,000,000 per annum

As at 31 December 2018, 90,000 units of the product remained unsold.

Required:

(a) Calculate the unit production costs for 2018 under:

(i) Absorption costing

(ii) Marginal costing

(b) Prepare an income statement for the year ended 31 December 2018, using:

(i) Absorption costing

(ii) Marginal costing

(c) Reconcile the difference in net profit between the two costing approaches.

(2 marks)

(2 marks)

(8.5 marks)

(6.5 marks)

(3 marks)

(a)

(i) Unit production costs under absorption costing= $34 + $12 + $9 + $30 = $85

(ii) Unit production costs under marginal costing = $34 + $12 + $9 = $55

(b)

(i) Under absorption costing:

Snowball Ltd

Income Statement for the year ended 31 December 2018

$000

Sales (370,000 ´ $170)

Less Cost of goods sold:

Opening inventory (W1)

6,800

Add Cost of goods manufactured (380,000 ´ $85)

32,300

39,100

Less Closing inventory (90,000 ´ $85)

7,650

31,450

Add Under-absorption of fixed production overheads (W2)

600

Gross profit

Less Variable non-manufacturing overheads (370,000 ´ $27)

9,990

Fixed non-manufacturing overheads

8,000

Net profit

$000

62,900

1

2

1

1

32,050

30,850

1

0.5

1

17,990

12,860

0.5

0.5

Workings:

(W1) Opening inventory in units = 370,000 + 90,000 - 380,000 = 80,000 units

Opening inventory in value = 80,000 ´ $85 = $6,800,000

1

1

(W2) Under-absorption of fixed production overheads

= (400,000 - 380,000) ´ $30 = $600,000

(ii) Under marginal costing:

Snowball Ltd

Income Statement for the year ended 31 December 2018

$000

Sales

Less Cost of goods sold:

Opening inventory (80,000 ´ $55)

Add Cost of goods manufactured (380,000 ´ $55)

Less Closing inventory (90,000 ´ $55)

Product contribution margin

Less Variable non-manufacturing overheads

Total contribution margin

Less Fixed production overheads (400,000 ´ $30)

Fixed non-manufacturing overheads

Net profit

(c)

4,400

20,900

25,300

4,950

12,000

8,000

$000

62,900

0.5

1

1

20,350

42,550

9,990

32,560

1

0.5

0.5

1

20,000

12,560

0.5

0.5

The difference in net profit is reconciled as follows:

Net profit under absorption costing

Add Fixed production overheads released from opening inventory (80,000 ´ $30)

Less Fixed production overheads absorbed in closing inventory (90,000 ´ $30)

Net profit under marginal costing

$000

12,860

2,400

15,260

2,700

12,560

0.5

1

1

0.5

Question 14

Jumbo Ltd manufactures a single product. Fixed factory overheads were absorbed at the rate of $12

per unit, based on the normal production level of 360,000 units per annum. For the year ended

31 December 2017, both sales and production volumes increased considerably. As at 1 January 2017,

the inventory consisted of 90,000 units.

The company’s financial year ends on 31 December. Its production and sales data are as follows:

2017

Production units

430,000

Sales units

490,000

Selling price per unit

$180

Unit costs for 2016 and 2017:

Direct materials

$45

Direct labour

Variable factory overheads

$31

$10

Non-manufacturing costs for the year ended 31 December 2017 are as follows:

Variable non-manufacturing costs

$18 per unit sold

Fixed non-manufacturing costs

$12,000,000 per annum

Required:

(a) Prepare an income statement for the year ended 31 December 2017 using:

(i) Absorption costing

(ii) Marginal costing

(b) Reconcile the difference in net profit between the two costing approaches.

(9 marks)

(7 marks)

(3 marks)

Answer:

(a) (i) Under absorption costing:

Jumbo Ltd

Income Statement for the year ended 31 December 2017

$000

Sales (490,000 ´ $180)

Less Cost of goods sold:

8,820

Opening inventory [90,000 ´ ($45 + $31 + $10 + $12)]

Add Cost of goods manufactured (430,000 ´ $98)

42,140

50,960

Less Closing inventory [(90,000 + 430,000 - 490,000) ´ $98]

2,940

48,020

Less Over-absorption of fixed factory overheads

[(430,000 - 360,000) ´ $12]

840

Gross profit

Less Variable non-manufacturing costs (490,000 ´ $18)

8,820

Fixed non-manufacturing costs

12,000

Net profit

$000

88,200

1

2

1

1.5

47,180

41,020

1

0.5

20,820

20,200

0.5

1

0.5

(ii) Under marginal costing:

Jumbo Ltd

Income Statement for the year ended 31 December 2017

$000

Sales

Less Cost of goods sold:

Opening inventory [90,000 ´ ($45 + $31 + $10)]

Add Cost of goods manufactured (430,000 ´ $86)

Less Closing inventory (30,000 ´ $86)

Product contribution margin

Less Variable non-manufacturing costs

Total contribution margin

Less Fixed factory overheads (360,000 ´ $12)

Fixed non-manufacturing costs

Net profit

(b)

7,740

36,980

44,720

2,580

4,320

12,000

$000

88,200

0.5

1.5

1

42,140

46,060

8,820

37,240

1

0.5

0.5

1

16,320

20,920

0.5

0.5

The difference in net profit is reconciled as follows:

Net profit under absorption costing

Add

Fixed factory overheads absorbed in opening inventory (90,000 ´ $12)

Less Fixed factory overheads absorbed in closing inventory (30,000 ´ $12)

Net profit under marginal costing

$000

20,20

0

1,080

21,28

0

360

20,92

0

0.5

1

1

0.5

Question 15

Una Ltd uses a predetermined overhead absorption rate (based on direct labour hours) to absorb

fixed manufacturing overheads. Budgeted figures for the year ended 31 March 2020 are shown

below:

Opening inventory

Nil

Production and sales

40,000 units

Unit selling price

$300

Direct materials

$30 per kg, 2.5 kg per unit

Direct labour

$40 per hour, 2 hours per unit

Manufacturing overheads:

Variable

$35 per unit

Fixed

$800,000

Non-manufacturing overheads:

Variable

Fixed

$20 per unit sold

$1,200,000

Actual production and sales levels for the year were 45,000 and 43,000 units, respectively. Actual

fixed manufacturing overheads were $920,000. Other figures were as budgeted.

Required:

(a)

(b)

Calculate the predetermined fixed manufacturing overhead absorption rate.

(2 marks)

Prepare the income statement for the year ended 31 March 2020 under absorption costing

based on actual data.

(8 marks)

(Calculations to the nearest dollar)

Answer:

(a) Predetermined fixed manufacturing overhead absorption rate

= Budgeted fixed manufacturing overheads ÷ Budgeted direct labour hours

= $800,000 ÷ (40,000 × 2)

= $10 per direct labour hour

1.5

0.5

(b)

Una Ltd

Income Statement for the year ended 31 March 2020

Sales (43,000 ´ $300)

Less Cost of goods sold:

Opening inventory

Add Cost of goods manufactured (W1)

Less

Closing inventory (W2)

Add Under-absorption of fixed manufacturing overheads (W3)

Gross profit

Less Variable non-manufacturing overheads (W4)

Fixed non-manufacturing overheads

Net profit

$

-

9,450,000

9,450,000

420,000

9,030,000

20,000

860,000

1,200,000

$

12,900,000

2.5

1

9,050,000

3,850,000

2,060,000

1,790,000

Workings:

(W1) Cost of goods manufactured = 45,000 × [(2.5 × $30) + (2 × $40) + $35 + (2 × $10)]

= $9,450,000

(W2) Closing inventory = $9,450,000 × 45,000 – 43,000/45,000

= $420,000

(W3) Under-absorption of fixed manufacturing overheads = $920,000 – (45,000 × 2 × $10)

= $20,000

(W4) Variable non-manufacturing overheads = 43,000 ´ $20

= $860,000

1

1

0.5

1

0.5

0.5

ABSORPTION COSTING AND

MARGINAL COSTING

Ch. 2 0 Classwork Questions

2020 – 2021 DSE

1

Calculation of predetermined overhead absorption rate

Question 1

Winter Ltd calculates its overhead absorption rate annually on the basis of machine hours. For the year ended

31 December 2012, the total budgeted manufacturing overheads were $345,000 and the total budgeted

machine hours were 25,000 hours.

(a) Calculate the predetermined overhead absorption rate for the year ended 31 December 2012.

Given the following information:

Machine hour consumed per unit

Product A

Product B

Product C

3.5 hours

5 hours

7 hours

(b) Calculate the predetermined overhead absorption rate for each unit of product A, B and C for the year

ended 31 December 2012.

Answers

(a)

Predetermined overhead absorption rate = $345,000 ÷ 25,000 = $13.8 per machine hour

(b)

Predetermined overhead absorption rate of:

Product A: $13.8 x 3.5 = $48.3 per unit

Product B: $13.8 x 5 = $69 per unit

Product C: $13.8 x 7 = $96.6 per unit

2

Question 2

Lemon & Co is a manufacturer that produces a single product. The firm planned to produce 100,000 units for

the year ended 31 December 2016. Budgeted fixed manufacturing overheads for the year amounted to

$1,000,000. The fixed production overheads were absorbed based on the number of units produced.

In January 2017, the following actual information for the year ended 31 December 2016 became available:

Production

80,000 units

Fixed manufacturing overheads

$1,000,000

Required:

(a)

Calculate the fixed manufacturing overhead absorption rate.

(3 marks)

(b)

State the amount of fixed manufacturing overheads over- or under-absorbed.

(3 marks)

Answers

(a)

Fixed manufacturing overhead absorption rate under normal costing

= $1,000,000 ÷ 100,000

1

= $10 per unit

(b)

0.5

Over- or under-absorption of fixed manufacturing overheads under normal costing

= $1,000,000 – (80,000 × $10)

1

= $200,000 (under-absorption)

0.5

3

Question 3

Data of a firm for the past period are as follows:

Total machine hours

8,000

Number of material requisitions

350

Number of purchase orders

200

Number of production runs

200

Production overheads:

$

Absorption base:

Short run variable costs

560,000

Machine hours

Production scheduling costs

600,000

Production runs

Stores receiving costs

50,000

Purchase orders executed

Materials handling costs

70,000

Requisitions raised

(a)

Calculate the production overhead absorption rate for each of the four production overheads activities.

(b)

Assume 6,000 machine hours, 50 production runs, 100 purchase orders and 200 material requisitions

were incurred on product P1, calculate the production overheads absorbed for P1.

4

Answers

(a)

Overhead absorption rate for Short run = ($560,000 ÷ 8,000) = $70 per machine hour

Overhead absorption rate for Production scheduling = ($600,000 ÷ 200) = $3,000 per production

runs

Overhead absorption rate for Stores receiving = ($50,000 ÷ 200) = $250 per purchase orders

Overhead absorption rate for Materials handling = ($70,000 ÷ 350) = $200 per material requisitions

(b)

The production overheads absorbed for P1

= 6,000 x $70 + 50 x $3,000 + 100 x $250 + 200 x $200

= $635,000

5

Question 4

J Hui operates a plant producing custom-made shoes. There are two manufacturing departments: cutting and

assembly. The budgeted manufacturing overheads and levels of activity for the year ended 31 December 2010

were as follows:

Cutting department

Assembly department

Manufacturing overheads

$250,000

$320,000

Machine hours

1,000,000

200,000

Direct labour hours

160,000

800,000

Job No. 334 was completed during the year. It consumed 5,000 and 850 machine hours in the cutting and

assembly departments, respectively, and 760 and 3,600 direct labour hours in the cutting and assembly

departments, respectively.

(a)

Calculate the manufacturing overheads of Job No. 334, using a plant-wide predetermined overhead

absorption rate based on direct labour hours.

(b) Calculate the manufacturing overheads of Job No. 334, using departmental predetermined overhead

absorption rates for each manufacturing department. The absorption base for cutting and assembly

department is machine hours and direct labour hours respectively.

6

(a)

Plant-wide predetermined overhead absorption rate

= ($250,000 + $320,000) ÷ (160,000 + 800,000)

= $0.59375 per direct labour hour

(b)

Departmental predetermined overhead absorption rate for the cutting department

= $250,000 ÷ 1,000,000

= $0.25 per machine hour

Departmental predetermined overhead absorption rate for the assembly department

= $320,000 ÷ 800,000

= $0.4 per direct labour hour

7

Question 5

Wimo Ltd is a decoration company, using job costing approach to calculate the project cost. The following

is the budgeted information of the company in 2014:

$

Direct materials

389 000

Indirect materials

555 000

Direct labour

238 000

Indirect labour

742 000

Administrative overheads

618 000

Budgeted level of activity includes:

Machine hours

39 000 hours

Direct labour hours

8 000 hours

Since Wimo Ltd only has one department, it has used a plant-wide production overheads absorption rate

based on machine hours to allocate production overheads.

REQUIRED:

(a)

Calculate (to two decimal places) the pre-determined production overhead absorption rate in 2014.

(b)

Explain the situations that are suitable for the plant-wide pre-determined production overheads

absorption rate.

8

Answers

(a)

Pre-determined production overhead absorption rate

2

= ($555 000 + $742 000) ÷ 39 000

= $33.26 per machine hour

(b)

Suitable situations:

2

-

Only one department in the company

-

There are more than one department in the company, but each department had similar usage

time

9

Question 6

DS Company has two production departments: the machining department and the assembly department.

Two products, Product X and Product Y, are produced by both departments. The actual production of

Product X and Y in 2014 was 10,000 units and 15,000 units respectively. The budgeted production in 2015

was expected to be 20% more than the actual production in 2014. The budgeted production overheads of

the machining and assembly departments in 2015 were $560,000 and $743,000 respectively. The hourly

wage rate for all departments is $32.

The budgeted direct labour cost of each product is as below:

Product X

Product Y

Machining department

$48

$64

Assembly department

$80

$32

The budgeted machine hours of each product are as below:

Product X

Product Y

Machinery department

3 hours

2 hours

Assembly department

1.5 hours

2.5 hours

The absorption rate of the machining department and assembly department are based on machine hours

and direct labour hours respectively.

REQUIRED:

(a)

Calculate (to two decimal places) the predetermined production overhead absorption rates of

machining and assembly departments in 2015 respectively.

(b)

State the reason for adopting different absorption bases for machining and assembly departments in

2015.

10

(a)

The budgeted production overhead absorption rate of the machinery department:

$560,000

3 ×10,000 ×120% + 2 ×15,000 ×120%

= $7.78 per machine hour

The budgeted production overhead absorption rate of the assembly department:

$743,000

$80 ÷ $32 ´ 10,000 ´ 120% + $32 ÷ $32 ´ 15,000 ´ 120%

= $15.48 per direct labour hour

(b)

Machining department: machine-oriented

Assembly department: labour-oriented

11

Question 7

Terry Co calculates the predetermined overhead absorption rate for the business based on machine hours.

At the end of March 2019, it is estimated that 60,000 machine hours would be used during the next

financial year.

Estimated fixed production overheads for the year would be $720,000, while variable production

overheads would be $5 per machine hour throughout the year.

Actual production overhead for the year amounted to $1,000,000 and the actual number of machine hours

was 50,000 hours.

Required:

(a) Calculate the predetermined overhead absorption rate for the year ended 31 March 2020. (2 marks)

(b) Is there any over-absorption or under-absorption for the year? Show your calculations.

(2 marks)

(c) Based on your answer in (b), state the accounting treatment and its impact on the net profit for the

year ended 31 March 2020.

(2 marks)

(d) State an example of a variable manufacturing cost which would increase with an increase in machine

hours.

(1 mark)

(Total: 7 marks)

12

(a)

Predetermined overhead absorption rate:

($720,000 ÷ 60,000) + $5 = $17 per machine hour

(b)

Production overheads absorbed (50,000 x $17) = $850,000

Actual production overheads = $1,000,000

Under-absorbed production overheads = $1,000,000 - $850,000 = $150,000

(c)

Under-absorbed production overheads would increase the cost of goods sold. The amount would be debited to

the profit and loss account. Net profit for the year would be decreased by $150,000.

(d)

Electricity / Maintenance and repairment of machines (Any reasonable answer)

13

Question 8

14

15

Income Statements under Marginal Costing and Absorption Costing

l

No Opening Inventory

Question 9

The following are the cost data relating to December 2010 and the management of Free Company wants

to know more about the company’s cost in a more organized way.

$

Total material cost

90,000

Total labour cost

71,500

Total expenses

40,000

Indirect labour

38,000

Direct materials

55,000

Indirect expenses

16,500

Non-manufacturing overheads

56,000

Indirect material, indirect labor and indirect expense are incurred in the production process.

REQUIRED:

(a)

Prepare a statement showing prime cost and total production cost and total cost from the above data.

16

The following are the budgeted information for January 2011:

$ per unit

Direct material cost

6

Selling price

22

Direct labour cost

4

Variable production overheads

3

Sales commission

2

Fixed production overheads: $13,500 per month

The fixed production overheads are absorbed on the budgeted activity level. Budgeted production and sales

were 5,400 units. There was no opening stock on 1 January 2011. Actual production and sales volume in

January 2011 were 4,500 units and 4,000 units respectively. The selling price and variable costs were the

same as the budgeted whereas the actual fixed production overheads were $15,120.

REQUIRED:

(b)

(c)

Prepare income statements for the month ended 31 January 2011 using

(1)

marginal costing and

(2)

absorption costing.

Prepare a statement to reconcile the difference in net profit under marginal and absorption costing.

17

(a)

Statement showing prime cost, total production cost and total cost

$

Direct materials

55,000

Direct labour (71,500 - 38,000)

33,500

Direct expenses (40,000 - 16,500)

23,500

Prime cost

112,000

Manufacturing overheads ($38,000 + $16,500 + ($90,000 - $55,000))

89,500

Total production cost

201,500

Non-manufacturing overheads

56,000

Total cost

257,500

(b) (1)

Free Company

Income statement for the month ended 31 January 2011 (Marginal)

$

Sales ($22 x 4,000)

$

88,000

Less: Variable cost of goods sold

Direct material cost ($6 x 4,500)

27,000

Direct labour cost ($4 x 4,500)

18,000

Variable production overheads ($3 x 4,500)

13,500

58,500

Less: Closing inventory [58,500 / 4,500) x 500]

(6,500)

52,000

Product contribution margin

36,000

Less: Variable costs: Sales commission ($2 x 4,000)

(8,000)

Contribution

28,000

Less: Fixed production overheads

(15,120)

Net profit

12,880

18

.(b) (2)

Free Company

Income statement for the month ended 31 January 2011 (Absorption)

$

Sales ($22 x 4,000)

$

88,000

Less: Cost of goods sold

Direct material cost ($6 x 4,500)

27,000

Direct labour cost ($4 x 4,500)

18,000

Variable production overheads ($3 x 4,500)

13,500

Fixed production overheads [(13,500 / 5,400) x 4,500]

11,250

69,750

Less: Closing inventory [(6 + 4 + 3 + 2.5) x 500]

(7,750)

62,000

Add: Under-absorption of FPO (15,120 – 11,250)

3,870

65,870

Gross profit

22,130

Less: Sales commission ($2 x 4,000)

(8,000)

Net profit

14,130

(c)

Statement to reconcile net profit under two costing approach

$

$

Net profit under absorption costing

14,130

Less: Fixed production overhead in closing inventory (2.5 x 500)

1,250

Net profit under marginal costing

12,880

19

Question 10

Willie Company started production of Product Z on 1 January 2017. The following is the cost information

for the year ended 31 December 2017:

$/unit

Direct material

15

Direct labour

8

Variable production overheads

6

Variable selling and administrative expenses

2

Additional information:

(i)

Product Z was sold at $50 per unit.

(ii) The budgeted production and sales units for 2017 were both 200,000 units.

(iii) The fixed production overheads were absorbed based on the number of units produced.

(iv) Budgeted and actual fixed production overheads for 2017 were the same at $800,000.

(v)

The actual production and sales units for 2017 were 220,000 units and 180,000 units respectively.

(vi) The actual selling and administrative expenses for 2017 were $120,000.

(vii) Any over- or under-absorption of fixed production overheads should be adjusted in the cost of goods

sold.

20

Required:

(a)

Prepare the income statement for the year ended 31 December 2017 using the absorption costing

system.

(b)

Prepare a statement to reconcile the difference in net profit for the year ended 31 December 2017

between the absorption costing and marginal costing systems.

(c)

In addition to the difference in net profit, explain one difference between two systems.

21

(a)

Willie Company

Income statement for the year ended 31 December 2017

$

Sales ($50 × 180,000)

$

9,000,000

½

Less: Cost of goods sold

Direct material ($15 × 220,000)

3,300,000

½

Direct labour ($8 × 220,000)

1,760,000

½

Variable production overheads ($6 × 220,000)

1,320,000

½

Fixed production overheads [$4(W1) x 220,000]

880,000

1

7,260,000

Less: Closing inventory ($7,260,000 × 40,000/220,000)

1,320,000

1

5,940,000

Less: Over-absorption fixed production overheads

($880,000 - $800,000)

80,000

1

5,860,000

Gross profit

Less: Selling and administrative expenses

3,140,000

½

480,000

1

2,660,000

½

($2 × 180,000 + $120,000)

Net profit

(7)

(W1)

Predetermined fixed production overhead absorption rate

= $800,000 / 200,000 = $4

22

(b)

Statement to reconcile the net profit for the year ended 31 December 2017

$

Net profit under an absorption costing system

Less:

2,660,000

½

160,000

1

2,500,000

½

Absorption of fixed production overheads in the closing inventory

($4 × 40,000)

Net profit under a marginal costing system

(2)

(c)

Difference:

–

Max.2

Inventory value under an absorption costing system includes fixed and variable

production costs while inventory value under a marginal costing system only includes

variable production costs.

–

Income statement under an absorption costing system shows the gross profit of the

company while the income statement under a marginal costing system shows the

contribution of the company.

(2 marks for each relevant difference, max. 2 marks)

11 marks

23

l

Have Opening Inventory (OIFO = CIFO)

Question 11

Snowball Ltd produces a single product. The company uses absorption costing but is considering adopting

marginal costing instead. It wants to compare the results under these two costing systems.

Fixed production overheads are absorbed at the rate of $30 per unit, based on the normal production level

of 400,000 units per annum. Actual fixed production overheads were same as the budgeted production

overheads.The company’s year-end date is 31 December. The following information was extracted from

the books:

2018

Production Unit

380,000

Sales Unit

370,000

Cost and price data for 2017 and 2018:

$

Direct materials per unit produced

34

Direct labour per unit produced

12

Variable production overheads per unit produced

9

Selling price per unit

170

24

Non-manufacturing overheads for the past two years are as follows:

Variable non-manufacturing overheads

$27 per unit sold

Fixed non-manufacturing overheads

$8,000,000 per annum

As at 31 December 2018, 90,000 units of the product remained unsold.

REQUIRED:

(a)

Calculate the unit production costs for 2018 under:

(i)

Absorption costing

(ii) Marginal costing

(b)

Prepare an income statement for the year ended 31 December 2018, using:

(i)

Absorption costing

(ii) Marginal costing

(c)

Reconcile the profit figure between absorption costing and marginal costing.

25

(a) (i)

Unit production costs under absorption costing = $34 + $12 + $9 + $30 = $85

(ii) Unit production costs under marginal costing = $34 + $12 + $9 = $55

(b)

(i)

Under absorption costing:

Snowball Ltd

Income Statement for the year ended 31 December 2018

$000

Sales (370,000 ´ $170)

Less

$000

62,900

Cost of goods sold:

Opening inventory (W1)

Add

6,800

Cost of goods manufactured (380,000 ´ $85)

32,300

39,100

Less

Closing inventory (90,000 ´ $85)

7,650

31,450

Add

Under-absorption of fixed production overheads (W2)

600

Gross profit

Less

32,050

30,850

Variable non-manufacturing overheads (370,000 ´ $27)

9,990

Fixed non-manufacturing overheads

8,000

Net profit

17,990

12,860

W1: Opening inventory in units = 370,000 + 90,000 - 380,000 = 80,000 units

Opening inventory in value = 80,000 ´ $85 = $6,800,000

W2: Under-absorption of fixed production overheads = (400,000 - 380,000) ´ $30

= $600,000

26

(ii) Under marginal costing:

Snowball Ltd

Income Statement for the year ended 31 December 2018

$000

$000

Sales

Less

62,900

Cost of goods sold:

Opening inventory (80,000 ´ $55)

Add

4,400

Cost of goods manufactured (380,000 ´ $55)

20,900

25,300

Less

Closing inventory (90,000 ´ $55)

4,950

20,350

Product contribution margin

42,550

Less

9,990

Variable non-manufacturing overheads

Total contribution margin

Less

32,560

Fixed production overheads (400,000 ´ $30)

12,000

Fixed non-manufacturing overheads

8,000

20,000

Net profit

12,560

(c)

Statement to reconcile net profit under two costing approach

$

Net profit under absorption costing

12,860,000

Add: Fixed production overhead in opening inventory ($80,000 x $30)

240,000

252,860

Less: Fixed production overhead in closing inventory (90,000 x $30)

270,000

Net profit under marginal costing

12,560,000

27

Question 12

The following information is available for a firm producing and selling a single product:

Budgeted costs (at normal level activity of 240,000 unit)

$

Direct material and labour

264,000

Variable production overhead

48,000

Fixed production overhead

144,000

Variable selling and administration overhead

24,000

Fixed selling and administration overhead

96,000

576,000

The fixed production overhead absorption rates are based upon normal level activity per period.

During the period just ended, 260,000 units of product were produced and 230,000 units were

sold at $3 per unit.

At the beginning of the period, 40,000 units were in stock. They were valued at the budgeted costs

as shown above.

Actual costs incurred were as per budget.

28

REQUIRED:

(a) Prepare the absorption costing and marginal costing statement for the period.

(b) Reconcile the profit figure between absorption costing and marginal costing.

(c) State the situation in which the profit figures calculated under both absorption costing and

marginal costing would be the same.

29

30

(b)

Statement to reconcile net profit under two costing approach

$

Net profit under absorption costing

145,000

Add: Fixed production overhead in opening inventory ($40,000 x $0.6)

24,000

169,000

Less: Fixed production overhead in closing inventory (70,000 x $0,6)

270,000

Net profit under marginal costing

127,000

(c) No opening inventory and closing inventory.

31

Question 13

Treasure Ltd manufactures a single product. The company's financial year ends on 31 December. Inventory

as at 1 January 2009 amounted to 3,000 units, with a value of $216,000 (under absorption costing). The

company incurred fixed production overheads of $798,000 in 2009.

Information on unit variable costs in 2008 and 2009:

$

Direct materials

15

Direct labour

22

Variable production overheads

21

2009

Production (units)

57,000

Sales (units)

59,000

Selling and administrative overheads are as follows:

Variable selling and administrative expenses

$19 per unit sold

Fixed selling and administrative expenses

$180,000 per annum

The selling price of the product in 2008 and 2009 was $260 per unit.

Required

(a)

Prepare an income statement for the year ended 31 December 2009 using marginal costing.

(b)

Prepare a statement to reconcile the net profit under two costing approach.

(Suppose fixed production overheads are absorbed based on the units produced in absorption costing.)

32

(a)

(b)

FPO absorbed per unit = $798,000 / 57,000 units = $14/unit

Statement to reconcile net profit under two costing approach

$

Net profit under absorption costing

9,791,000

Add: Fixed production overhead in opening inventory

($216,000 - $174,000) or (3,000 units x $14)

42,000

9,833,000

Less: Fixed production overhead in closing inventory ($14 x 1,000)

14,000

Net profit under marginal costing

9,819,000

l

Have Opening Inventory (OIFO =/= CIFO) ***

33

Question 14 ***

Soap Company manufactures soap and sells it at $6 per unit. The company’s information for the year ended

31 December 2014 is as follows:

(i)

Variable production cost per unit

$

(ii)

Direct material

2

Direct labour

1.8

Production overheads

0.4

Direct labour is $30 per hour.

(iii) On 1 January 2014, the company had 2,000 units of inventory. The total production cost was $15,500,

including the variable production cost of $10,760 and the remaining fixed production overhead.

(iv) Production overheads are composed of fixed and variable elements. It was the company’s policy to

allocate the variable production overheads according to the number of units produced. The company

adopted the predetermined overhead absorption rate to absorb the fixed production overheads into

the product based on direct labour hours. The rate was $4 per direct labour hour.

(v)

Budgeted fixed production overhead is the same as the actual fixed production overhead.

34

(vi) In 2014, the company budgeted to produce 150,000 units of products, but 140,000 units were actually

produced. The sales revenues amounted to $660,000.

(vii) The sales commission of each unit of soap is 5% of the selling price. An office clerk is employed on

a monthly salary of $4,000.

(viii) The inventory cost is calculated with weighted average cost method.

REQUIRED:

(a)

Prepare the income statement for the year ended 31 December 2014 using the absorption costing.

(b)

With reference to the net profit obtained in (a) and the net profit obtained with marginal costing,

prepare a statement and adjust the differences between them.

(c)

State and explain one advantage of adopting marginal costing over absorption costing.

35

(a)

Soap Company

Income statement for the year ended 31 December 2014 (Absorption costing)

$

Sales

$

660,000

Less: Cost of goods sold

Opening inventory

15,500

Direct material ($2 × 140,000)

280,000

Direct labour ($1.8 × 140,000)

252,000

Production overheads

- Variable ($0.16(W1) × 140,000)

22,400

- Fixed ($0.24 (W1) × 140,000)

33,600

603,500

Less: Closing inventory

136,000

[$603,500 ÷ (140,000 + 2,000) × 32,000(W2)]

467,500

Add: Under absorption of production overheads

2,400

(150,000 × $0.24(W1) – $33,600)

469,900

Gross profit

190,100

Less: Sales commission ($660,000 × 5%)

33,000

Salaries of office clerk ($4,000 × 12)

48,000

Net profit

81,000

109,100

(W1)

Fixed production overhead absorbed by each unit = $4 × ($1.8 ÷ $30) = $0.24

Variable production overhead of each unit = $0.4 - $0.24 = $0.16

(W2)

Closing inventory = 2,000 + 140,000 – ($660,000 ÷ $6) = 32,000 units

36

(b)

Net profit reconciliation statement for the year ended 31 December 2014

$

Net profit based on absorption costing

$

109,100

Add: Fixed production overheads absorbed by opening inventory

4,740

($15,500 – $10,760)

113,840

Less: Fixed production overheads absorbed by closing inventory

-

based on absorption costing

-

based on marginal costing

136,000

[ O.I $10,760 + VPC ($2 + $1.8 + $0.16) × 140,000]

÷ (OI 2,000 +P 140,000) × CI 32,000}

(127,360)

Net profit based on marginal costing

(c)

8,640

105,200

Advantage:

Fixed production costs are sunk costs which may not be useful in decision-making

Marginal costing prevents the company from manipulating net profits through adjustments of

inventory level.

(2 marks for each relevant advantage, max. 2 marks)

37

Question 15 ***

Peter Company produces components for other companies for the production of computers. The following

is the actual cost information for the year ended 31 March 2016:

Direct materials

$560,000

Direct labour

$660,000

Variable production overheads

$640,000

Fixed production overheads

$420,000

Variable selling and distribution expenses

$0.3 per unit

Fixed selling and distribution expenses

$130,000

During the year ended 31 March 2016, the company produced 320,000 units of goods. On 1 April 2015,

there were 3,000 units of inventory at $8.12 per unit in the warehouse and the total variable production

cost were $20,400. On 31 March 2016, there were 4,000 units of goods. All the goods had already been

sold to customers at $9 per unit. Lee Company bought bulk quantities of goods from Peter Company

totaling 60,000 units, less 10% discount from Peter Company.

38

The fixed production overheads were absorbed based on the number of units produced. Budgeted fixed

production overhead is $540,000 and budgeted production unit is 360,000 units.

The company adopted a weighted average method to calculate the inventory cost.

REQUIRED:

(a)

Prepare the income statement for the year ended 31 March 2016 using absorption costing.

(b)

Prepare a statement to reconcile the net profit calculated in (a) and the net profit under marginal

costing.

(c)

State one non-financial factor that Peter Company would consider when buying components from

suppliers.

39

Marks

(a)

Peter Company

Income statement for the year ended 31 March 2016

$

Sales {($9 × 90% × 60,000) + [$9 × (320,000 – 60,000 – 4,000 + 3,000)]}

$

2,817,000

1

Less: Cost of goods sold

Opening inventories (3,000 × $8.12)

24,360

½

Direct materials

560,000

½

Direct labour

660,000

½

Variable production overheads

640,000

½

Absorbed fixed production overheads

480,000

1

2,364,360

Less: Closing inventory ($2,364,360 ÷ 323,000 × 4,000)

29,280

½

2,335,080

Less: Over-absorbed fixed production overheads

($480,000 – $420,000)

60,000

½

2,275,080

Gross profit

542,920

Less: Selling and distribution expenses (319,000 × $0.3 + $130,000)

225,700

½

Net profit

316,220

½

(6)

40

(b)

Statement to reconcile the net profit

$

Net profit under absorption costing

Add:

$

316,220

½

3,960

1

5,993

1

314,187

½

Absorption of fixed production overheads in opening inventory

Absorption costing

24,360

Marginal costing

(20,400)

Less: Absorption of fixed production overheads in closing inventory

Absorption costing

29,280

Marginal costing

{[OI $20,400 + VPC ($560,000 + $660,000 +

23,287

$640,000) ÷ OI and P 323,000 ´ CI 4,000]

Net profit under marginal costing

(3)

Marks

(c)

Factors:

Max. 2

- whether suppliers can delivery components on time

- whether the quality of components from suppliers is same as self production

(2 marks for each relevant factor, max. 2 marks)

11 marks

41

Question 16 *****

Ryan Limited started operation in October 2014, specialising in the production of Part Y for the production

of washing machines. The company has adopted absorption costing. It has two production departments:

Department A mainly uses machines for production and Department B mainly uses manual labour. The

cost information for the six months ended 31 March 2015 is as follows:

(i)

Sales and production volume (units)

October – December

January – March

Sales

40,000

52,000

Production

45,000

50,000

The selling price for each month is $120 per unit.

(ii)

Material consumed:

Cost per unit ($)

Material P

8

Material Q

4

(iii) Department A and Department B have to use 0.75 machine hours and 0.3 machine hours to produce

a unit of Part Y respectively.

(iv) Department A and Department B have to use 0.5 labour hours and 1 labour hour to produce a unit of

Part Y respectively.

(v)

The basic wages rate for two two departments is $30 per hour. If the production hour per quarter for

Department A exceeds 22,500 hours, the overtime wages rate would increase by $11 and included in

the direct labour cost.

42

(vi) A royalty of $10 has to be paid for every unit produced.

(vii) The predetermined overhead absorption rate for the two departments is:

Department A

$30 per machine hour

Department B

$10 per direct labour hours

The normal production level is 45,000 units per quarter.

The actual fixed production overheads and budgeted apportioned production overheads of the two

departments are the same.

(viii) The actual administrative and selling expenses are:

October – December

January – March

$520,000

$580,000

The administrative expenses remain unchanged for the two quarters while the selling expenses

varies with the sales unit.

(ix) The company has adopted the weighted average cost method to calculate the cost of inventory.

REQUIRED:

(a)

Prepare an income statement for the three months ended 31 March 2015 using the absorption costing

method.

(b)

Prepare an income statement for the three months ended 31 March 2015 using the marginal costing

method.

(c) Prepare a statement to reconcile the net profit under marginal and absorption costing.

43

(a)

Ryan Limited

Income statement for the three months ended 31 March 2015 (Absorption costing)

$

Sales (52,000 × $120)

$

6,240,000

Less: Cost of goods sold

Opening inventories (W1)

497,500

Add: Cost of production (W2)

5,002,500

5,500,000

Less: Closing inventories

300,000

[($5,500,000 ÷ $55,000) × 3,000]

5,200,000

Less: Over-absorption fixed production overheads (W3)

Gross profit

162,500

5,037,500

1,202,500

Less: Administrative and selling expenses

580,000

Net profit

622,500

44

(b)

Ryan Limited

Income statement for the three months ended 31 March 2015 (Marginal costing)

$

Sales

$

6,240,000

½

Less: Variable costs of goods sold

Opening inventories [($12 + $45 + $10) × 5,000]

335,000

1

Add: Cost of production

3,377,500

1

[($12 + $10) × 50,000 + $777,500 + $1,500,000]

3,712,500

Less: Closing inventories

1

[($3,712,500 ÷ 55,000) × 3,000]

202,500

Product Contribution margin

3,510,000

2,730,000

Less: Variable selling expenses

1

[($580,000 – $520,000) ÷ ($52,000 – $40,000) ×52,000]

260,000

Total contribution margin

2,470,000

Less: Fixed costs

Administrative expenses ($580,000 – $260,000)

320,000

½

1,012,500

½

Production overheads

-

Department A ($30 × 45,000 × 0.75)

-

Department B ($10 × 45,000)

450,000

Net profit

1,782,500

687,500

45

½

(W1)

$

Direct materials ($8 + $4)

12

Direct labour (0.5 × $30 + 1 × $30)

45

Royalty

10

Fixed production overheads

-

Department A (30 × $0.75)

22.5

-

Department B (10 × $1)

10

Production cost per unit

99.5

Opening inventories = $99.5 × 5,000

497,500

(W2)

Cost of production (exclude direct labour)

2,725,000

[($99.5 - $45) × 50,000]

Direct labour

- Department A (22,500 × $30 + 2,500 × $41)

777,500

- Department B ($30 × 50,000)

1,500,000

5,002,500

(W3)

Department A Absorbed (50,000× 0.75 × $30) – Actual (45,000× 0.75 × $30)

112,500

Department B Absorbed (50,000 x 1 x $10) – Actual (45,000 × 1 x $10)

50,000

Over-absorption fixed production overheads

162,500

46

(c)

Statement to reconcile the net profit

$

Net profit under absorption costing

Add:

$

622,500

Absorption of fixed production overheads in opening inventory

Absorption costing

497,500

Marginal costing

335,000

162,500

785,000

Less: Absorption of fixed production overheads in closing inventory

Absorption costing

300,000

Marginal costing

202,500

Net profit under marginal costing

97,500

687,500

47

Past Paper Questions

Question 17 (DSEPP Q2)

48

49

Question 18 (2012 DSE Q4)

50

51

Question 19 (2016 DSE Q3)

52

53

Question 20 (2017 DSE Q6)

54

55

Question 21 (2018 DSE Q3)

56

57

Question 22 (2019 DSE Q6)

58

59

Question 23 (2005 AL Q2(a))

60

61

Question 24 (2011 AL Q3)

62

63

64

65