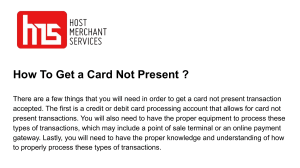

Understanding Virtual Terminals: A Key to Seamless Payment Processing In today’s digital age, businesses and consumers alike are increasingly relying on technology for efficient transactions. One such technological advancement is the virtual terminal, a tool that enables businesses to accept payments remotely. This article explores the concept of virtual terminals, their benefits, and how they are transforming payment processing. A virtual terminal is essentially a web-based application that allows businesses to process credit card payments without the need for a physical card reader. This system can be accessed from any device with an internet connection, such as a computer, tablet, or smartphone. It’s particularly useful for businesses that operate remotely or do not have a traditional point-of-sale (POS) system. The primary advantage of using a virtual terminal is its flexibility. It allows merchants to process payments from anywhere, whether they are on the go or working from home. This is particularly beneficial for businesses in sectors like consulting, delivery services, or freelance work. Instead of relying on face-to-face transactions, a virtual terminal provides the ability to process payments over the phone or through email, increasing convenience for both the merchant and the customer. Another key benefit is the enhanced security it offers. Virtual terminals are typically equipped with encryption technology and other security measures to protect sensitive card information. By using secure payment processing systems, businesses can reduce the risk of fraud and ensure customer data remains safe. In conclusion, a virtual terminal is an essential tool for modern businesses, offering flexibility, security, and convenience. As payment processing continues to evolve, virtual terminals are becoming an indispensable solution for businesses looking to stay competitive in a digital world. Whether you're a small business owner or a large enterprise, adopting this technology can streamline your payment processes and enhance your customer experience.