The Foundation of a Successful Business The Importance of Finance Management

advertisement

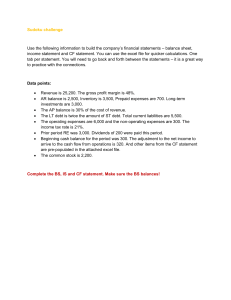

The Foundation of a Successful Business: The Importance of Finance Management Why Finance Management is Critical for Business Success Effective finance management is at the core of any successful business. Without it, businesses struggle to allocate resources, manage expenses, and achieve long-term goals. Understanding the principles of finance management can provide the foundation needed to ensure profitability and sustainability. Optimizing Cash Flow: A Key to Growth Cash flow management is vital for any business to thrive. Companies need to monitor the money coming in and going out to avoid liquidity issues. Regular analysis of cash flow ensures that a business can cover its expenses, invest in growth opportunities, and navigate unexpected challenges with ease. Budgeting for Strategic Planning A well-planned budget is essential for strategic decision-making. By setting financial goals and establishing a budget, businesses can prioritize investments and cut unnecessary expenses. Budgeting allows companies to focus their resources on initiatives that drive growth, profitability, and competitive advantage. Risk Management and Financial Stability Every business faces financial risks, whether it's market fluctuations, economic downturns, or unexpected expenses. By employing financial management strategies, companies can prepare for uncertainties and minimize the impact of risks. Insurance, contingency planning, and diversification are just a few ways to mitigate these risks. Debt Management for Sustainable Growth Many businesses rely on loans or credit to fund operations, but managing debt is crucial for long-term sustainability. Proper finance management ensures that businesses take on manageable levels of debt and make timely repayments. This approach not only preserves creditworthiness but also allows companies to capitalize on future growth opportunities. Investment and Resource Allocation Sound financial management involves allocating resources effectively. Whether it's investing in new technology, expanding operations, or hiring talent, businesses must ensure that their financial decisions are aligned with their overall goals. A good finance strategy maximizes returns on investments and improves operational efficiency. Profitability Analysis for Continuous Improvement Regular analysis of profitability helps businesses identify areas of improvement. By closely monitoring revenue streams and expenses, companies can make data-driven decisions that boost profitability. Financial reports offer insights into what’s working and what’s not, allowing businesses to refine their strategies and optimize performance. Conclusion: Building a Strong Financial Foundation In conclusion, finance management is not just about keeping track of expenses. It's about planning for the future, optimizing resources, and ensuring long-term business success. By mastering the fundamentals of finance, businesses can achieve stability, growth, and profitability in a highly competitive marketplace.