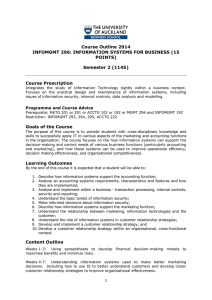

Government Accounting & Accounting for non-profit organizations by: ZEUS VERNON B. MILLAN Chapter 3 The Government Accounting Process Learning Objectives 1. Record the basic transactions of a government entity. 2. Prepare a worksheet. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Books of Accounts and Registries 1. Journals a. General Journal b. Cash Receipts Journal c. Cash Disbursements Journal d. Check Disbursements Journal 2. Ledgers a. General Ledgers b. Subsidiary Ledgers 3. Registries a. Registries of Revenue and Other Receipts (RROR) b. Registry of Appropriations and Allotments (RAPAL) c. Registries of Allotments, Obligations and Disbursements (RAOD) d. Registries of Budget, Utilization and Disbursements (RBUD) GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Object of Expenditures 1. Personnel Services (PS) – pertain to all types of employee benefits. 2. Maintenance and Other Operating Expenses (MOOE) – pertain to various operating expenses other than employee benefits and financial expenses. 3. Financial Expenses (FE) – pertain to finance costs. 4. Capital Outlays (CO) – pertain to capitalizable expenditures. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Basic Recordings GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Basic Recordings (continuation) GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Basic Recordings (continuation) GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan The Revised Chart of Accounts Example: GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan APPLICATION OF CONCEPTS PROBLEM 3-9: FOR CLASSROOM DISCUSSION GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan QUESTIONS???? REACTIONS!!!!! GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan END GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan