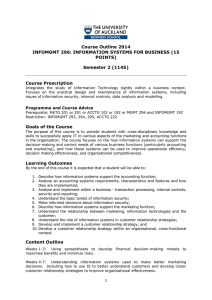

Government Accounting & Accounting for non-profit organizations by: ZEUS VERNON B. MILLAN Chapter 2 The Budget Process Learning Objectives • Enumerate the steps in the budget process. • Describe briefly the principles of responsibility accounting. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan The National Budget The national budget (government budget) is the government’s estimate of the sources and uses of government funds within a fiscal year. This forms the basis for expenditures and is the government’s key instrument for promoting its socio-economic objectives. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan The Budget Cycle 1. Budget Preparation 2. Budget Legislation 3. Budget Execution 4. Budget Accountability GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Budget Preparation • Bottom-up approach • Zero-based budgeting 1. Budget Call 2. Budget Hearings 3. Presentation to the Office of the President GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Budget Legislation 4. House Deliberations 5. Senate Deliberations 6. Bicameral Deliberations 7. President’s Enactment GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan The Approved Budget The approved budget consists of the following: 1. New General Appropriations 2. Continuing Appropriations 3. Supplemental Appropriations 4. Automatic Appropriations 5. Unprogrammed Funds 6. Retained Income/Funds 7. Revolving Funds 8. Trust Receipts GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Appropriation • Appropriation – is the authorization made by a legislative body to allocate funds for purposes specified by the legislative or similar authority. 1. New General Appropriations – annual authorizations for incurring obligations, as listed in the GAA. 2. Continuing Appropriations – authorizations to support the incurrence of obligations beyond the budget year (e.g., multi-year construction projects). 3. Supplemental Appropriations – additional appropriations to augment the original appropriations which proved to be insufficient. 4. Automatic Appropriations – authorizations programmed annually which do not require periodic action by Congress. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Appropriation (continuation) 5. Unprogrammed Funds – standby appropriations which may be availed only upon the occurrence of certain instances. 6. Retained Income/Funds – collections which the agencies can use directly in their operations. 7. Revolving Funds – receipts from business-type activities of agencies which are authorized to be constituted as such. These are self-liquidating and all obligations and expenditures incurred by virtue of said business-type activity shall be charged against the fund. 8. Trust Receipts – receipts by a government agency acting as agent. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Budget Execution 8. Release Guidelines and BEDs Major recipients of budget: a. NGAs b. LGUs c. GOCCs 9. Allotment 10. Incurrence of Obligations 11. Disbursement Authority GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Allotment • Allotment – is an authorization issued by the DBM to government agencies to incur obligations for specified amounts contained in a legislative appropriation in the form of budget release documents. It is also referred to as Obligational Authority. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Disbursement Authority 1. 2. 3. 4. Notice of Cash Allocation (NCA) – authority issued by the DBM to central, regional and provincial offices and operating units to cover their cash requirements. The NCA specifies the maximum amount of cash that can be withdrawn from a government servicing bank in a certain period. Notice of Transfer of Allocation – authority issued by an agency’s Central Office to its regional and operating units to cover the latter’s cash requirements. Non-Cash Availment Authority – authority issued by the DBM to agencies to cover the liquidation of their actual obligations incurred against available allotments for availment of proceeds from loans/grants through supplier’s credit/constructive cash. Cash Disbursement Ceiling – authority issued by the DBM to agencies with foreign operations allowing them to use the income collected by their Foreign Service Posts to cover their operating requirements. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Budget Accountability 12. Budget Accountability Reports 13. Performance Reviews 14. Audit GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan The Budget Cycle GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan Responsibility Accounting • Responsibility accounting is a system of providing cost and revenue information over which a manager has direct control of. • It requires the identification of responsibility centers and the distinction between controllable and non-controllable costs. GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan APPLICATION OF CONCEPTS PROBLEM 2-4: FOR CLASSROOM DISCUSSION GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan QUESTIONS???? REACTIONS!!!!! GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan END GOVT ACCTG & ACCTG FOR NPOs by: Z.B.Millan