Cash and Cash Equivalents: Accounting Definitions & Classifications

advertisement

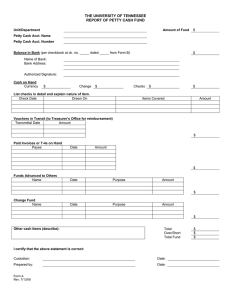

Cash and Cash Equivalents CASH - includes money and any other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. Cash Items: ● Cash on Hand - undeposited collection and waiting to be deposited ○ ○ ○ ○ ○ ○ Bills and Coins Customer’s Check - from the customer, can not ensure that it has a balance Cashier’s or Manager’s Check - approved by the cashier or manager, certain that it has a balance Traveler’s Check - used by the travelers, certain that it has a balance Bank Drafts - guaranteed by the bank, certain that it has a balance Money Order - drawn from post offices or other financial institutions, used like a check ● Cash in Bank - unrestricted as to withdrawal ○ ○ ○ Demand Deposit or Checking Account Saving Deposit Others ■ Foreign Currency Deposit ■ Compensating Balance ■ Undelivered Checks ■ Post-dated Checks ■ Stale Checks ● Cash in Fund - set aside for current purpose ○ ○ ○ ○ ○ Petty Cash Fund - for a small expense Payroll Fund - for salary Dividend Fund - for investors Change Fund - for day-to-day operation Others ■ Revolving Fund ■ Interest Fund ■ Tax Fund ■ Travel Fund CASH EQUIVALENTS - short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rate. ● ● ● ● Three-month BSP Treasury Bill Three-month Time Deposit Three-month Money Market or Commercial Paper TB, TD, MM, CP, and redeemable Preference Shares that were purchased three months before the maturity date RMD Recognition Unrestricted and Readily Available or if Restricted for Current Operation it is considered Cash Fund Measurement Face Value Initial: Face Value Disclosure Subsequent: Face Value or Estimated Realizable Amount First Line Item in Current Assets that will be disclosed the details in Notes to FS Other types of Checks: ● ● ● Undelivered Checks - the check has not yet been delivered Postdated Checks - the check is not available for encashment Stale Checks - the check is expired and cannot be encashed (usually 6 months) Excess Cash Investments ● ● ● 3 months - Cash Equivalents more than 3 months but not more than 12 months - Short-Term Investment more than 12 months - Long-Term Investment Internal Controls over Cash ● ● ● ● ● ● ● ● Segregation of Incompatible Duties – The duties of (a) authorization, (b) execution, (c) recording, and (d) custody over cash should be segregated. Imprest System – the imprest system requires that all cash receipts should be deposited intact and all cash disbursement should be made by checks. Bank Reconciliation – bank reconciliation should be prepared regularly, immediately upon the receipt of the monthly bank statements, to reconcile on a timely basis the differences between the cash balance per book and the cash balance per bank statement. The differences should be duly investigated and accounted for. Cash Counts – periodic cash counts should be performed to provide reasonable assurance that actual cash tallies with the balance per records. Minimum Cash Balance – minimum cash balance should be maintained, especially for cash funds, sufficient only to defray specific business requirements. Lockbox Accounts – Entities often utilize lockbox accounts to expedite cash collections and to ensure that cash collections are deposited intact. Non-Encashment of personal checks from petty cash fund – encashment of personal checks from the petty cash fund should be prohibited to discourage concealment of cash shortages. Voucher System – the voucher system is an internal control over all cash disbursements. Under this system, a voucher is prepared for every cash disbursement in order to ensure that each disbursement is properly authorized, made for a valid expenditure and property recorded PETTY CASH FUNDS - money set aside to pay small expenses which cannot be paid conveniently by means of a check Imprest Fund System ○ ○ ○ ○ Periodic Constant Cash in Bank Record Expense upon Replenishment Fluctuating Fund System ○ ○ ○ ○ Perpetual Changing Petty Cash Fund No Adjustments Petty Cash Custodian creates Petty Cash Memorandum Book ● ● Petty Cash Accounted Petty Cash Accountability Imprest System ● ● All cash receipts should be deposited intact All cash disbursements should be made by means of a check. Petty Cash Accounting Procedures ● ● ● ● ● ● Establishment Payment of Expenses Replenishments Increase Decrease End of the Accounting Period Concealment of Cash Shortages ● ● Lapping – occurs when a collection of receivables from one customer is misappropriated and then concealed by applying a subsequent collection from another customer. Lapping occurs when the incompatible duties of recording and cash custody are combined. Kiting – occurs when cash shortage is concealed by overstating the balance of cash. Kiting is made possible by exploiting the float period (i.e., the time it takes for a check to clear at the bank where it was drawn). Notes: ● ● ● ● ● ● ● If different in currency and need to convert, use the Current Exchange Rate. Whenever you make a check, you need to record it. Bank Overdraft is not allowed in the Philippines. Offsetting is not allowed in the Bank overdraft. Exception to the rule of overdraft are entity has two or more accounts in one bank and the amount is immaterial. Compensating Balance - if it is an informal agreement or if the problem is silent it is considered cash. Cash short or over will be the account name used regardless if it is short or over.