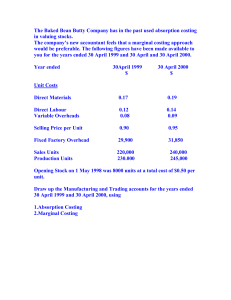

ACCA (F5) PERFORMANCE MANAGEMENT COMPLETE SUBJECT NOTES BY VERTEX LEARNING SOLUTIONS VALID UNTIL DEC 2024 Copyright Notice ©️ https://vls-online.com 2023. All Rights Reserved The material contained within this electronic publication is protected under International and UK Copyright Laws and treaties, and as such any unauthorized reprint or use of this material is strictly prohibited. You may not copy, forward, or transfer this publication or any part of it, whether in electronic or printed form, to another person, or entity. Reproduction or translation of any part of this work without the permission of the copyright holder is against the law. You’re downloading and use of this eBook requires, and is an indication of, your complete acceptance of these ‘Terms of Use.’ You do not have any right to resell or give away part, or the whole, of this eBook. 1 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content TABLE OF CONTENTS CHAPTER TOPIC PAGE NO. A1 Costing - Absorption Costing 4 A2 Costing - Absorption and Marginal Costing 7 A3 Costing - Under-Over Absorption of Overheads 9 A5 Costing - Target Costing 10 A6 Costing – Life Cycle Costing 15 A7 Costing - Throughput Accounting 18 B1 Decision Making - CVP Analysis 24 B2 Decision Making - Limiting Factors 35 B3 Decision Making - Shadow Pricing 36 B4 Decision Making - Make or Buy Decision 40 B5 Decision Making - Linear Programming 43 B6 Decision Making - Pricing Decisions 46 B7 Decision Making - Pricing Methods 51 B8 Decision Making - Relevant Costing 57 B9 Decision Making - Shutdown Decision 63 B10 Decision Making - Risk & Uncertainty Introduction 65 B11 Decision Making - Decision Trees 68 B12 Decision Making - Sensitivity Analysis 70 C1 Budgeting - Introduction to Budgeting I 72 C2 Budgeting – Introduction to Budgeting II 79 C3 Budgeting - Quantitative Analysis in Budgeting (High- 84 Low Method) C4 Budgeting - Time Series Analysis, Regression and 86 Correlation C5 Budgeting - Quantitative Analysis in Budgeting 91 (Learning Curve) C6 Budgeting - Standard Costing 93 2 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content C7 Budgeting - Implications of Standard Costing 96 C8 Variance Analysis - Material Variances 98 C9 Variance Analysis - Material Yield & Usage Variances 101 C10 Variance Analysis - Sales Mix and Quantity Variances 105 C11 Variance Analysis - Sales Variance 108 C12 Planning and Operational Variances 111 C13 Variances - Labor Variances 114 C14 Variance- Fixed Overheads Variance 119 C15 Variance Analysis - Variances Summary Formulas for 122 revision D3 Performance Measurement - Balance Scorecard 124 D4 Performance Measurement - Building Block Model 126 D5 Performance Measurement - Divisional Performance 129 Measure D6 Performance Measurement - Transfer Pricing 132 D7 Performance Measurement - Not for Profit Organization 144 3 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content A1 - Costing - Absorption Costing 1.1 Definition of Absorption Costing Absorption costing is based on the idea that the cost of a product or a service should be: Its direct costs (direct materials, direct labor, and sometimes direct expenses) plus, a share of overhead costs. Absorption costing is therefore a system of costing in which a share of overhead costs is added to direct costs, to obtain a full cost. This might be: a full production cost, or a full cost of sale. An absorption costing system might be used to decide the full production cost of the product so that only a share of production overheads is added to production costs. Administration overheads and selling and distribution overheads are simply charged as an expense to the period in which they occur. Income Statement: Absorption Costing $000 $000 Sales $000 950 Cost of inventory at the beginning of the period 80 Production cost of items manufactured in the period: Direct materials 280 Direct labor 120 Direct expenses (if any) Production overhead added to cost (‘absorbed’) 0 240 640 720 4 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Less: Cost of inventory at the end of the period (120) Production cost of items sold 600 Gross profit 350 Administration overhead 100 Selling and distribution overhead 200 300 Net operating profit 50 Inventory valuation is an important feature of absorption costing because the cost of production in any period depends partly on the valuation of opening and closing inventory, including work-in-progress and finished goods inventory. In some costing systems,a share of administration overhead and selling and distribution overhead might be added to the full production cost, to obtain a full cost of sale. However, it is not common practice to calculate a full cost of sale, because it has only limited value as management information. 1.2 The Purpose of Absorption Costing There are several reasons why absorption costing is sometimes used, and production overhead costs are added to direct costs to calculate the full production cost of products (or services). • There is a view that inventory should include a fair share of production overhead cost. • This view is applied in financial accounting and financial reporting. It can therefore be argued that inventory should be valued similarly in the cost accounting system. (However, inventory valuations may differ between the cost accounts and the financial accounts.) • There is also a view that to assess the profitability of products or services, it is appropriate to charge products and services with a fair share of overhead 5 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content costs. Unless products contribute sufficiently to covering indirect costs, their ‘profitability’ might be too low, and the business might not be profitable. 1.3 Criticisms of Absorption Costing There are criticisms of absorption costing. The main criticisms are as follows: • Absorption costing does not provide reliable information about profitability. Methods of charging overhead costs to products, as we shall see, are not ‘scientific’, and rely on arbitrary assumptions. • There are better methods of measuring profitability, such as marginal costing. There are also better ways of providing cost information to help managers make decisions (relevant costs). Marginal costing and relevant costs are explained in later chapters. When absorption costing was first used in manufacturing, well over 100 years ago, total overhead costs were fairly small compared with direct costs. Manufacturing was laborintensive, and direct labor costs were a significant proportion of total costs. Adding a share of overheads to product costs, usually in proportion to the cost of direct labor or direct labor time, was therefore a reasonable method of dealing with overhead costs. In a modern manufacturing environment, however, direct labor is a small proportion of total costs. Most work in production now consists of the ‘support’ activities of indirect labor employees, and the cost of this labor is an overhead cost. Overhead costs are high compared to direct labor costs. Therefore, it is often argued that a costing system should use a different approach to overhead costing and try to present overhead costs in a way that is more useful to management for information purposes. 6 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content A2 - Costing - Absorption and Marginal Costing 2.1 Overview of Absorption and Variable Costing Absorption Marginal/Variable Costing Costing Direct Material Product Direct Material Cost Variable Manufacturing Overhead Product Cost Fixed Manufacturing Overhead Period Variable Non-Manufacturing Overhead Cost Fixed Non-Manufacturing Overhead • Marginal Costing is good for decision making. • Absorption is for reporting. Period Cost 2.2 Marginal Cost and Marginal Costing • Marginal Costing – it is an alternative to absorption costing method. • Only variable costs are charged as a cost of sale and a contribution is calculated. (sales revenue minus the variable cost of sales) • Closing inventories of WIP or finished goods are valued at marginal production cost (variable cost) • Fixed costs are treated as a period cost and are charged in full to the profit and loss account. 2.3 Absorption Versus Marginal Costing Profit Statements Absorption costing allows you to add overheads in the inventory, and if any units are unsold then units are transferred to the next period, and they also take their fixed 7 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content overheads to the next period. Fixed cost in unsold units is transferred to the next period. Marginal costing on the other hand says that fixed costs are period costs and cannot be transferred to next period. Whether you sell full years fixed costs for the period must be deducted in full of the income statement. 2.4 Absorption Versus Marginal Costing • Absorption costing is used for routine profit reporting and must be used for financial accounting purposes under IAS 2 Inventories • Marginal costing provides better management information for planning and decision making and is used for internal reporting and decision making. • Reported profit figures using the two different approaches will differ if there is a change in the level of inventories in the period • If inventory level increases, absorption costing will report higher profits • If inventory level decreases, absorption costing will report lower profits. 8 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content A3- Costing – Under/Over Absorption of Overheads Under-Absorption • If the amount absorbed is less than the amount incurred, the difference denotes under-absorption. • It is also termed as “Under Recovery”. • It may be due: ▪ Actual expenses exceeding the estimate ▪ Output or the hours worked may be less than the estimate. Over-Absorption • If the amount absorbed is more than the amount incurred, the difference denotes over-absorption. • Over-absorption is also formed as “Over Recovery”. • It may be due to: • Expenses being less than estimate; and/or • Output or hours worked may be exceeding the estimate. 9 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content A5 - Costing - Target Costing Target Costing for Pm Acca 1 Introduction of Target Costing: This involves setting a target cost by subtracting a desired profit margin from the selling price. It is the system of strategic profit planning and cost management that determine the life cycle cost that each product must achieve to enhance organizational desired level of profit together with the product anticipated selling price. With target costing it is often easier to reduce costs of a product at the design stage rather than after it has entered production. 1.1 Target Costing Process It is how a target cost and selling price is derived in a manufacturing company (industry). Target costing begins with taking the price which the market will pay for the product for a given market. From that, the required profit margin is deducted to arrive at a target cost. The difference between the Current estimated cost for the product and the target cost is the cost gap. Where the estimated costs exceed the target cost, steps are taken to reduce the cost gap. The product can then be sold at a price which the market will accept, and which generates an acceptable profit margin. The cost Gap need to be closed before the product is launch. 1.2 Levels Where Target Costing Is Appropriate 1. Where we are designing an entirely new product 2. Where we are introducing new product into an existing value stream 3. To dive our existing improvement 10 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content 1.3 Steps Involve in Target Costing Process 1) Customer Identification & Product Development 2) Setting of Selling Price: 3) Calculation of Target (Desired) Operating Profit Margin 4) Calculation of Target cost: 5) Calculate the estimated Actual cost of the product based on 6) Determination Of Cost Gap: 7) Close/ Remove the cost gap: 8) Negotiation with Customer Whether to Go Ahead or abandon or redesign the product Computation of Desire Profit Note: Desire profit could be calculated using = i. Profit =Sales amount X Profit margin % ii. Profit = (Sales) x (Mark-up % / (100%+Mark-up %)) = xx used for converting Margin to margin iii. iii. Profit = (Sales) x (Margin % / (100% - Margin %)) = XX Used for converting Margin to mark – up Steps to Reduce a Cost Gap In deciding what costs to eliminate, the company will have to consider the effect of these on the quality and perception of the final product. • Cut down non- value - adding activities • Redesign the workflow or manning i.e., Team approach to allow discussion of methods to reduce costs, Open discussion and brainstorming are useful approaches here 11 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content • Review the whole supplier chain • Reduce the number of components inside without making the customer to less value the product • Standardize the component as against specialized or customized component to enjoy economy of scale. • Look into the cost log: a) Materials - Use of cheaper material (Reduce costs without compromising perceived value): b) Labor - Use of cheaper labor grate (Reduce costs without compromising perceived value): c) Training staff in more efficient techniques to improve labor efficiency to reduce the cost of our labor d) Overheads - Increase in productivity to spread fixed overheads: Productivity increases would also help here by spreading fixed overheads over a greater number of units. Equally Activity based costing approach to its overhead allocation; this may reveal more favorable cost allocations or ideas for reducing costs in the business. • Assembly workers - changing working practices: Productivity gains may be possible by changing working practices or by de-skilling the process. • Acquire new more efficient technology or invert new and efficient technology to achieve the same thing at a lower cost. 12 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Benefits Of Adopting Target Costing • Early external focus as against cost plus approach: • Only those features that are of value to customers will be included in the product design. • Cost control will begin much earlier in the process • Costs per unit are often lower under a target costing environment. • It is often argued that target costing reduces the time taken to get a product to market. Target Costing in A Service Organization A service is an activity that is largely intangible that brings about value (i.e., an activity which is of benefit to that individual) which can be transfer/ render to one person or / to the other but does not need transfer of ownership. Four Characteristics of Services • Spontaneity (Inseparability or simultaneity): unlike goods, a service is consumed at the exact same time as it is made available. No service exists until it is being experienced by the consumer. • Heterogeneity/variability (No standardization): services involve people and, because people are all different, the service received may vary depending on which person who performs it. Standardization is expected by the customer, but it is difficult to maintain. • Intangibility: unlike goods, services cannot be physically touched. • Perishability: unused capacity cannot be stored for future use. • No transfer of ownership takes place when a service is provided’ and ‘service 13 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content Difficulties for a Service Company in Using Target Costing • It is difficult to find a precise definition for some of the services • It is difficult to decide on the correct target cost for services • It would be difficult to use target costing for new services • Heterogeneity: Being heterogeneous the price will also be changing. • Intangibility: intangibility make it difficult to apply the target costing because it hinders a survey, it is difficult to say the type of service that customers like most. 14 VERTEX LEARNING SOLUTIONS - https://vls-online.com Click to go to Table of Content