Commodity Futures as Inflation Hedge: A Markov-Switching Approach

advertisement

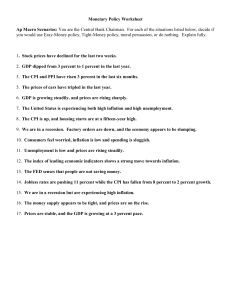

Are commodity futures a hedge against inflation? A Markov-switching approach June 8, 2022 Abstract This study examines the inflation-hedging ability of commodity futures. Applying a Markovswitching vector error correction model to a sample of commodity futures that cover the period between January 1983 and December 2017, we find that total commodity futures fail to provide a hedge against inflation. However, commodity futures in the markets of industrial metals exhibit significant inflation-hedging properties. Other sub-indices, including energy, precious metals, agriculture, and livestock, do not have significant inflation hedging ability. The hedging capacity of industrial metal futures exhibits substantial variation over time, with most of the inflation hedging power occurring during the relatively longer and more common regimes covering the Great Moderation and post-subprime crisis. The results are robust to the inclusion of stocks and bonds in the model. Keywords: Inflation hedge; Commodity futures; Markov-switching; Vector error correction JEL Codes: C50; E31; G11; G13 1 1 Introduction The inflation protection ability of various asset classes (e.g., Treasury inflation-protected securities, commodities, real estate) has attracted much attention from both researchers and the finance industry, as unexpected inflation can have significant impact on the market and investors’ portfolio. Among these assets, commodity futures have always been the topic of debate. Historically, commodity prices were closely related to inflation and sometimes business cycles (Bernanke, 2009). In particular, commodities and CPI tend to have a positive relationship, making them a natural candidate as an inflation hedge. Many asset managers cite the inflation-hedging ability of commodities as they allocate such assets into their portfolios on a regular basis.1 Recently money managers are over-weighting assets that are traditionally believed to provide inflation hedge (e.g., commodities) under the pressure of inflation spike as the economy rebounds from the pandemic-driven recession.2 The ever-increasing financialization of commodity markets has significantly redefined the role of commodity indexes in portfolio allocation of asset managers (e.g., index funds), and has significantly unleashed the potential of using this class of assets as an inflation hedge (Singleton, 2012; Hamilton and Wu, 2014). However, research on the hedging ability of commodity futures is far from conclusive, cautioning against using them as a strategic inflation hedge. Our study seeks to investigate the inflation protection ability of this particular asset class (Lawrence, 2003, Beckmann and Czudaj, 2013, Apergis, Cooray, Khraief, and Apergis, 2019, Shin, Yu, and Greenwood-Nimmo, 2014, Van Hoang, Lahiani, and Heller, 2016). The existing literature has paid increased attention to the investigation of the inflation-hedging effectiveness of commodity futures. Herbst (1985); Jensen, Johnson, and Mercer (2000); Gorton and Rouwenhorst (2006); Erb and Harvey (2006); Hoevenaars, Molenaar, Schotman, and Steenkamp (2008); Gorton, Hayashi, and Rouwenhorst (2013); and Spierdijk and Umar (2014) are among recent 1 Vanguard is one of the proponents of the idea that commodity futures could offer inflation protection if mixed with a traditional stock/bond portfolio. On June 25 of 2019, Vanguard launched a fund that seeks to provide diversification benefits and inflation protection to traditional stock/bond portfolios. 2 For instance, Ontario Teachers’ Pension Plan increased its net investment in commodities from 8% at the end of 2020 to 12% in the first half of 2021, as part of its effort to combat rising inflation that is mostly due to governments’ fiscal responses as well as the loose monetary policy that aim to lift the economy. ATP of Denmark also overweights its exposure to commodities recently to prevent the erosion of their assets by inflation risks. 2 papers that have focused on an aggregate commodity or commodity futures index.3 A variety of empirical techniques have been employed to investigate the inflation protection ability of commodities and other asset classes. Conventional tools include: the Johansen cointegration vector (Mahdavi and Zhou, 1997); the vector error correction model (Levin, Montagnoli, and Wright, 2006); the vector autoregressive model (Hoevenaars, Molenaar, Schotman, and Steenkamp, 2008; Spierdijk and Umar, 2014); the structural vector autoregressive model (Cologni and Manera, 2008; Lippi and Nobili, 2012; and Blanchard and Riggi, 2013). However, none of the aforementioned methods are able to incorporate the distinct nature of regimes present in the economy.4 Several recent papers are notable exceptions. For instance, Bampinas and Panagiotidis (2015), Lucey, Sharma, and Vigne (2017), and Bilgin, Gogolin, Lau, and Vigne (2018) look at the link between gold prices and inflation using a time-varying cointegration methodology. The evidence for instabilities in the relationship between commodity futures prices and inflation verifies the application of the time-varying methodology. This study extends the existing literature by adopting a Markov-switching vector error correction model (MS-VECM) approach, which is a comprehensive framework to capture the relationship that changes from state to state. The data used in this study are monthly data of returns on the S&P Goldman Sachs Commodity Index (GSCI) Total Return Index, ranging from January 1983 to December 2017. In additional to the total commodity futures index, we also examine the hedging ability of commodity futures across different markets, including energy, industrial metals, precious metals, agriculture and livestock. Finally, we evaluate the inflation hedging ability of commodity futures by including stocks and bonds into the model. The main findings of this study are as follows. Over the full sample period, the aggregate commodity futures return index does not show significant ability to hedge against inflation. We then dive into exploring the inflation protection ability of several subindexes of commodity futures. According to the coefficients related to the error-correction mechanism, industrial metals provide the best hedge. 3 There are also research that focuses on a specific commodity market, such as Hoevenaars, Molenaar, Schotman, and Steenkamp (2008); Bekaert and Wang (2010); Baur and McDermott (2010); Wang, Lee, and Thi (2011); Beckmann and Czudaj (2013); Lucey, Sharma, and Vigne (2017); and Bilgin, Gogolin, Lau, and Vigne (2018). 4 As demonstrated by Chinn and Coibion (2014), there exists significant heterogeneity within the sample period in terms of inflationary regimes and commodity futures prices. 3 However, the hedging capacity exhibits substantial variation over time. In the model of inflation and industrial metals, inflation hedging is relatively fast in pace and is of relatively high statistical significance in a stable regime, which prevails most of the time and covers the Great Moderation and post-subprime crisis. The results of the model comprising inflation and precious metals reveal that the precious metals index shows some ability to hedge inflation but with low statistical significance. In addition, the energy, agriculture, and livestock indices do not have good inflation hedging ability. In line with Bilgin, Gogolin, Lau, and Vigne (2018), this relationship could be explained by the predominantly industrial nature of industrial metals. The results are also robust to the introduction of common stocks and government bonds into the model. This exercise is meaningful as the bulk of portfolios are usually allocated to common stocks and bonds, with commodity futures used as a tool to hedge against inflation. Besides, it enables us to benchmark our results using findings in prior studies that examine the hedge and safe haven properties of commodities, such as previous metals (Baur and Lucey, 2010; Baur and McDermott, 2010). After including these two assets in our system, we find that aggregate commodity futures are unable to provide inflation hedging ability. However, industrial metals futures continue to show strong inflation hedging ability, with the error correction coefficient positive in sign and statistically significant. The fact that industrial metals are a hedge against inflation in this analysis implies that investors that hold industrial metals receive compensation through positive industrial metal returns as bond returns turn negative in response to higher inflation. Moreover, the results also suggest that industrial metals subindex is a hedge against stocks in the normal regime, but not a safe haven in the crisis regime. Despite being yield-free commodities, industrial metals should be considered as meaningful components of a well-diversified investment portfolio. Our paper contributes to the literature in the following ways. First, when we extend the previous model to include latent regime shifts governed by one ergodic and irreducible Markov chain, we test whether there is evidence of a need to incorporate additional parametric flexibility when investigating the long-run relationship between commodity futures and inflation. Our paper sits in the growing line of 4 literature that examine the potentially time-varying nature of relationships between commodity prices and inflation (Bampinas and Panagiotidis, 2015; Lucey, Sharma, and Vigne, 2017; Bilgin, Gogolin, Lau, and Vigne, 2018). Second, we also contribute to the literature that applies Markov-switching models to the asset class of commodities (Alizadeh, Nomikos, and Pouliasis, 2008; Bae, Kim, and Mulvey, 2014; and Giampietro, Guidolin, and Pedio, 2017). Different to existing studies that focuses on the time-varying moments in commodity returns, we investigate the time-varying inflation hedging ability of commodity futures. Our third contribution is that we test the inflation hedging ability of commodity futures in a framework including stocks and bonds. This is particularly useful in light of the recent developments in the commodity markets. Numerous studies examine the performance of portfolios composed of stocks and bonds, and demonstrate the advantages of adding new asset classes to portfolios (Jensen, Johnson, and Mercer, 2000; Gorton and Rouwenhorst, 2006; and Erb and Harvey, 2006). We extend prior work by demonstrating that one of the economic rationales for including commodity futures (i.e., industrial metals) as a portfolio component is their ability to hedge against inflation. The remainder of this paper is organized as follows. Section 2 describes the econometric methodology as well as the data used in this paper. In section 3, we estimate the autoregressive orders of the considered vector autoregressions and implement the Johansen’s cointegration test. Section 4 presents the main results concerning the Markov-switching multistate vector error-correction analysis. The final section concludes. 2 Literature review The literature has paid a particular attention to the relationship between commodity price and inflation (Herbst, 1985; Erb and Harvey, 2006; Kat and Oomen, 2007; Spierdijk and Umar, 2014), but the empirical evidence is not always conclusive. For instance, utilizing the data of the GSCI, Erb and Harvey (2006) perform a linear regression analysis with the annual data from 1969 to 2003, and document 5 that the sensitivity to inflation varies widely across individual commodities. Their results reveal that the roll returns of energy futures index are positively correlated with unexpected inflation component. Kat and Oomen (2007) then compare the inflation-hedging properties of roll and spot returns. Their findings suggest that the correlation between commodity futures and inflation primarily stems from the spot market, while the correlation of roll returns with unexpected inflation is largely insignificant, contradicting the results of Erb and Harvey (2006). In a recent paper, Spierdijk and Umar (2014) implement a rolling-window analysis and document that the inflation hedging capacity of commodity futures exhibits substantial variation over time. The literature also deals with the inflation-performance of portfolios including commodity futures (Jensen, Johnson, and Mercer, 2000; Becker and Finnerty, 2000; Gorton and Rouwenhorst, 2006; Demidova-Menzel and Heidorn, 2007). Becker and Finnerty (2000) document that the inclusion of commodity futures contracts in equity/bond portfolios improves the performance. As inflation has positive impacts on commodity prices, the improvement is more pronounced during the high inflation periods. Moreover, Gorton and Rouwenhorst (2006) examine the inflation-hedging properties of stocks, bonds, and commodities at horizons covering one month to five years. They report that the stocks and bonds are negatively correlated with inflation at all horizons, while the commodities are positively associated with inflation. Demidova-Menzel and Heidorn (2007) further investigate the risk return relationship in equity/bond portfolios incorporating commodities and document that commodities are sensible addition assets during high inflationary periods. The foundation of inflation-hedging properties investigation methodology comes from the the hypothesis of Fisher (1930). As stated in the hypothesis, the expected nominal return of any assets should be equal to the expected inflation plus the expected real return of the asset. Thus, commodity futures returns have a direct link to inflation. As we mentioned in the introductory section, previous studies implement a variety of empirical techniques (Fama and Schwert, 1977; Bodie, 1982; Mahdavi and Zhou, 1997; Levin, Montagnoli, and Wright, 2006; Hoevenaars, Molenaar, Schotman, and Steenkamp, 2008; Spierdijk and Umar, 2014; and Blanchard and Riggi, 2013). However, these studies use single-state 6 models, failing to take into account the nonlinearity. More recently, Bampinas and Panagiotidis (2015), Lucey, Sharma, and Vigne (2017), and Bilgin, Gogolin, Lau, and Vigne (2018) adopt a time-varying cointegration method to investigate the relationship between gold prices and inflation. We add to this line of research by applying MS-VECM to a broad class of commodity indexes, including the total commodities index and several subindexes. While the literature has mainly utilized Markov-switching models in the context of stocks and bonds (Guidolin and Timmermann, 2006), the number of studies that apply the time-varying coefficient models to commodities is relatively limited (Alizadeh, Nomikos, and Pouliasis, 2008; Beckmann and Czudaj, 2013; Bae, Kim, and Mulvey, 2014; Giampietro, Guidolin, and Pedio, 2017). 3 Econometric methodology and Data 3.1 Econometric methodology The review of the most relevant literature in this area shows that single-state models used in the previous research may not be the best description of the dynamic relationships in the data. This paper allows for regime shifts in autoregressive parameters and error-correction (EC) speed coefficients. The model specification in this paper is an M-regime, p-th order autoregressive with r cointegrating vectors, Markov-switching vector error-correction model. ∆Xt = µ(st ) + p X i=1 Ai (st )∆Xt−i + r X αj (st )Zt−1 + t , t |st ∼ N ID(0, Σst ), (1) j=1 where Xt denotes the time t column vector of observations, st = 1, 2, ..., M represents the regime in time t, µ(st ) collects the regime-dependent intercepts, Ai (st ) is a row vector of i-th order autoregressive parameters in regime st , αj (st ) measures the speed of error correction in regime st , and Zt is b t − CX b t, the column vector containing the residuals from the error-correction equation, i.e., Zt = CX b is the estimated cointegration matrix. In order to provide a regime-specific equilibrium correcwhere C 7 tion, αj should be negative and significantly different from zero. These unobservable states are generated by a discrete-state, irreducible and, ergodic first-order Markov chain: P r(st = j | st−1 = i) = pij , where pij is the generic [i, j] element of the M × M transition matrix P . The long-run error correction and cointegration is explained as a mixture of M different regimespecific equilibrium adjustments. ∆Xt |Ft−1 ∼ Pp Pr N µ(s1,t ) + i=1 Ai (s1,t )∆Xt−i + j=1 αj (s1,t )Zt−1 , Σ1 , with prob. qs1,t P P N µ(s2,t ) + pi=1 Ai (s2,t )∆Xt−i + rj=1 αj (s2,t )Zt−1 , Σ2 , with prob. qs2,t .. . P P N µ(sM,t ) + pi=1 Ai (sM,t )∆Xt−i + rj=1 αj (sM,t )Zt−1 , ΣM , with prob. qsM,t (2) where Ft−1 is information content at time t − 1 and qsj,t is the predicted probability of being in regime 0 j at time t and qsj,t = ej P ξt−1|Ft−1 . Here, ej is a unit column vector with a unit value at the j-th position, ξt|Ft is a column vector of the filtered regime probabilities at time t, and ξ is defined as ergodic probabilities of the long-run equilibrium Pr(st = 1|Ft ) Pr(st = 1) Pr(s = 2|F ) Pr(s = 2) t t t with ξ t = . ξt|Ft = . . .. .. Pr(st = M |Ft ) Pr(st = M ) (3) As a result, it can be concluded that unconditionally the MS(M)-VECM(p, r) has a long-run equilibrium and provides an unconditional cointegration if the long-run error-correction coefficients are negative and statistically different from zero. Krolzig (1997) provides an exhaustive overview of Markov-switching vector autoregressions. In the first stage, the Johansen (1991) cointegration test is applied in order to test if cointegration exists and to determine the number of cointegrating vectors. The trace test and the L-Max test of Johansen’s 8 , procedure are provided in this study.5 The second stage of the MS model estimation is performed in Ox with the MS-VAR package and the MS-VECM code reported in Krolzig (1998). In particular, estimation and inferences are based on the expectation-maximization algorithm described by Dempster, Schatzoff, and Wermuth (1977) and Hamilton (1989). This algorithm is a filter that enables the iterative calculation of the one-step ahead forecast of the state vector ξt|t−1 given the information set and the construction of the log-likelihood function of the data. The cointegration matrix estimated in the first stage is used in order to calculate the error-correction residuals, which enter equation (1) as Zt . 3.2 Data We use monthly data of returns on the S&P GSCI Total Return Index, an index of commodity sector returns that represents a broadly diversified and long-term investment in commodity futures. This index is widely used in prior literature to assess the hedging potential of commodities, such as Hoevenaars, Molenaar, Schotman, and Steenkamp (2008) and Spierdijk and Umar (2014). The aggregate S&P GSCI Total Return Index includes 24 commodity futures contracts, categorized into five groups, namely energy, industrial metals, precious metals, agriculture, and livestock. We adopt the US seasonally adjusted CPI for all urban consumers as our inflation index. The monthly returns on the S&P GSCI Total Return Index were obtained from Thomson Reuters Datastream, and the inflation index was provided by the Bureau of Labor Statistics. We also use the CRSP U.S. Treasury 10-Year Bond Index and the CRSP value-weighted U.S. market index, a comprehensive proxy for U.S. stocks that are publicly traded on NYSE, NASDAQ, and AMEX. Our sample covers the time period from January 1983 to December 2017. We choose January 1983 as the starting month of our sample period as it is when we start to have data on energy futures index. Table 1 provides summary statistics of the main variables. Commodity futures returns exhibit substantially more volatility than the slowly moving process of inflation. The average monthly return on the S&P GSCI Total Return Index is 0.486%, with a standard deviation of 5.677%. Among the five 5 The trace test tests the null hypothesis that the number of cointegrating vector is equal to r and the L-Max test has a null hypothesis that the number of cointegrating vectors is no greater than r. 9 subsector indexes, industrial metals have the highest average monthly return of 0.820% and agriculture has the lowest average monthly return of 0.082%. In terms of volatility, the return of energy futures is the most volatile, with a standard deviation of 8.913%, and livestock futures return has the lowest volatility of 4.176%. The average monthly inflation rate is 0.222%, and volatility equals 0.254%. The kurtosis of the returns on the S&P GSCI Total Return Subsector Indexes covers from 3.560% to 7.465%. By contrast, the inflation index has some excess kurtosis. We adopt Jarque-Bera statistics to test the hypothesis of normality and reject the null of normality in all series. Figure 1 depicts the evolution of these commodity futures prices during 1983-2017. Unsurprisingly, the subindexes of commodity futures are highly correlated with each other. Agriculture and livestock subindexes are exceptions. Different to other subindexes, they exhibit a downward trend throughout the sample period. In order to perform the augmented Dickey-Fuller (ADF) unit root test, an assumption on the most appropriate maximum lag of an autoregressive (AR) representation of each of the time series needs to be made. Table A1 presents the Akaike and Schwarz information criterion (AIC and SIC, respectively) of each series. Due to the fact that the AIC tends to choose models that include relatively more parameters and the SIC information chooses more parsimonious models, whenever there is conflicting evidence from the two information criteria, the preference is given to the SIC with which we can keep the saturation ratio high. The results show that the most appropriate AR order for the CPI is equal to 3, indicating that the inflation index has some persistence. The AR orders for total commodity, energy and precious metals are 2, while the AR orders for industrial metals, agriculture, and livestock are equal to 1. Table A2 shows the results of the ADF for all the seven considered series. It includes three different specifications: an unrestricted specification with a trend and with an intercept, as well as two restricted specifications, one without trend and the other without trend and without intercept. With reference to three different types of the ADF test on a level series, the null hypothesis of a unit root cannot be rejected for all the nine indexes at a 1% significant level. When all series are first-differenced, the null hypothesis of a unit root is significantly rejected. 10 4 Single-state cointegration analysis In this section, we investigate whether commodity futures index and CPI is cointegrated in our sample period. We first determine the autoregressive orders of the VAR models and then implement the Johansen’s cointegration test. 4.1 Selection of the autoregressive order of the VAR multivariate models Panel A of Table 2 presents the values of AIC and SIC corresponding to different autoregressive orders. In the model of inflation and commodity, AIC indicates an autoregressive order equal to 3, while SIC suggests an order equal to 2. In order to keep the saturation ratio high, we rely on SIC statistics and estimate a VAR model with an autoregressive order of 2. Moreover, the autoregressive orders selected based on SIC are equal to 2 for the rest of the models except the one of industrial metals. With reference to the VAR models with two series, AIC suggests autoregressive orders of 4 for the models of industrial metals and livestock, while showing autoregressive orders of 3 for the rest of the models. 4.2 Johansen’s cointegration test An application of Johansen’s cointegration test requires that the VAR models are changed into their corresponding vector error-correction form. This means that lag p of a vector autoregressive model corresponds to lag p−1 of a vector error-correction model. Panel B of Table 2 summarizes the results of Johansen’s cointegration test applied to the VAR models and shows both L-Max and trace test statistics. For the first model that examine the cointegration between CPI and the aggregate commodity futures return index, Johansen’s trace test suggests the existence of one cointegrating vector. The Mackinnon, Haug, and Michelis (1999) p-values of the trace test as well as the L-Max test p-value suggest that the null hypothesis of no cointegration is rejected at a 1% significance level. Neither of these two tests can reject the null hypothesis of one cointegrating vector at conventional level. We therefore demonstrate that there is one cointegrating vector in the model and hence a long-run relationship between CPI 11 and commodity futures index. The estimation of the cointegrating vector, normalized with respect to the inflation index, is also presented in Panel C. To save space, we only present the normalized coefficients of the corresponding commodity index. The coefficient attached to the commodity index has a negative sign, indicating that the larger difference between the two series has a larger impact on the error-correction mechanism. An intercept in the cointegrating vector allows for a long-run relationship in which the series do not need to reach the same level for the error-correction mechanism to revert its direction of influence. In the second model of CPI and energy subsector index, Mackinnon, Haug, and Michelis (1999) p-values of both the tract test and the L-Max test indicate one cointegrating equation. Column (2) of Panel C presents the cointegrating equation of the CPI and energy index. The statistical significance of the coefficient suggests a long-run relationship between these two series. The coefficient of energy equals -0.114, implying that the larger the difference between the CPI index and the energy subsector index, the stronger is the error-correction strength. In the third model of CPI and industrial metals index, we identify one cointegrating vector. The coefficient of industrial metals equals -0.195 and its t-statistic is -6.650, implying a very strong error-correction mechanism embedded in the system. According to the fourth column of Panel B, we are able to identify one cointegration vector for the VAR model of CPI and the precious metals index. However, we fail to find a significant cointegration vector, although the sign of the coefficient is still negative, as shown in Column (4) of Panel C. Similar conclusions can be drawn according to the coefficient estimates of the rest two models that examine the relationship between CPI and agriculture as well as livestock futures indexes. In sum, our findings here support a cointegrating relationship between CPI and the commodity futures index. There exists some heterogeneity within subindexes of commodity futures with regard to their cointegration relationship with inflation. Over the long-run, commodity futures (i.e., energy and industrial metals futures) are useful as inflation hedges since a cointegrating relationship prevails. However, during some periods when no price adjustment is observed, they are not able to protect a portfolio against inflation risks.6 6 For instance, fund managers may invest in commodities at the beginning of a month with no price adjustment and sells at the end of the corresponding month. Hence, they can not use commodities to hedge against inflation risks. 12 5 Markov-switching multistate vector error-correction analysis In this section, we estimate an Markov-switching vector error-correction model using various commodity futures indexes as well as CPI. Based on information criteria statistics, we first select the right form of model specification and then present the corresponding model estimation results. 5.1 Inflation and commodity futures To determine the model specification, we compare the information criteria statistics between two major types of models, i.e., linear and Markov-switching vector error-correction models. Within each category, we consider models with different specifications. Specifically, for Markov-switching vector error-correction models, we allow for multiple regimes (e.g., two or three) and different forms of VECM. Table 3 presents relevant statistics of models that use the total commodity futures index as well as the five subindexes. As shown in Panel A, both AIC and SIC imply that Markov-switching models are better than the linear models. In particular, the AIC shows that the best model specification is an MSIAH(3)-VECM(1,1), while the SIC suggests MSIAH(2)-VECM(1,1).7 Because SIC is known to suggest more parsimonious models than AIC does, the latter was chosen as the decisive one in our analysis. Therefore, we estiamte an MSIAH(2)-VECM(1,1) model that features two regimes, heteroscedastic errors and an autoregressive order of 1. The Krolzig (1997) algorithm converged after 26 iterations. The number of observations in the system is 836, and the number of parameters in Markov switching system equals 24, while the corresponding linear model has 11 parameters. With two nuisance parameters specified in the multi-state model, the likelihood ratio linearity test should be implemented under a chi-square with 11 degrees of freedom.8 Table 4 presents the results of the estimation of an MSIAH(2)-VECM(1,1) using CPI and the total 7 MSIAH stands for Markov-switching regime dependent intercept, matrix of autoregressive coefficients, and variance model, while MSIA stands for Markov-switching regime dependent intercept and matrix of autoregressive coefficients model. 8 The p-values of both the LRT and the Davies (1977) test, which avoids the estimation of nuisance parameters, are less than 0.01%, indicating the rejection of the null hypothesis at a 1% level. As a result, the tests confirm that the Markovswitching model is better than the linear model. 13 commodity futures index. The long-run relationship is explained by the coefficients corresponding to the error-correction component. In regime 1, there is no significant adjustment in the inflation index since the corresponding coefficient is not statistically significant (t-statistic = -1.005). In regime 2, the coefficient equals -0.002 and its t-statistic is -3.924, implying a significant error-correction in the inflation index. The positive sign of the coefficient on the error-correction term for the commodity index in regime 2 is the correct one for the error-correction mechanism to work. It implies that if the previous month CPI increases, then the total commodity price in this month would increase. But this coefficient is not statistically significant (t-statistic = 0.456). As a result, we do not find evidence that total commodity futures have significant inflation hedging ability. Figure 2 depicts the two regimes identified by the MS model, showing the smoothed probabilities of being in regime 1 and regime 2. Regime 2 prevailed from 1983 through 1987 (with a short regime 1 in early 1986); from 1991 through 1998; from 2000 through 2005 (with regime 1 appearing at late 2001 and early 2003 for a short time period); and from mid-2009 through the end of 2017. Regime 1 prevailed from 1988 through 1991, and from 2007 through 2009. Between January 2005 and July 2007, both regimes seem to have been present. The estimated transition matrix and ergodic probabilities suggest that regime 2 predominates, characterizing 73.1 % of months with spells lasting 11.28 months on average; regime 1 occurs during only 26.9 % of months, with spells lasting just 4.15 months on average. 5.2 Inflation and subindexes of commodity futures In this section, we present estimation results of models that use CPI and each of the five subindexes of commodity futures. Based on the estimated coefficients, we evaluate the ability of these subindexes in providing inflation protection. 14 5.2.1 The energy futures subindex According to AIC and SIC statistics in Panel B of Table 3, we estimate an model in the form of MSIA(2)-VECM(1,1) using CPI and the energy futures index. In other words, we estimate a MSVECM model with two distinct regimes and a homoscedastic error covariance matrix. The number of observations in the system is again 836, which corresponds to approximately 40 observations per estimated parameter since there are 21 parameters in total.9 Panel A of Table 5 presents the estimation results. The coefficients related to the error-correction mechanism implies that the long-run relationship between the CPI and the energy futures index changes from regime to regime. In regime 1, the negative sign and the related t-statistic of the long-run error-correction coefficient in the energy index indicate that energy prices diverge from the inflation index, suggesting the opposite to adjusting toward equilibrium. However, regime 1 lasts a relatively short time because its expected duration is less than 4 months. During regime 2, the sign of the error-correction coefficient on the energy index is negative, suggesting that the divergence from equilibrium won’t be closed. In regime 2, there is strong long-run equilibrium adjustment in inflation, which is confirmed by the negative error-correction coefficient and the corresponding t-statistic of -5.455. Figure 3 (a) shows the smoothed probabilities, with regime 1 prevailing during 1983, 1986, 2001, 2005, 2006, 2008 and 2014. Regime 2 prevailed during 1984, 1985, 1987-2000, 2002-2004, 2007, and covered the Great Moderation and 2009-2017. Both regimes are strongly persistent, with regime 2 lasting 42.64 months on average and prevailing 91.6 % of the time, while regime 1 lasts 3.93 months on average and prevails during the remaining 8.5 % of months. 5.2.2 The industrial metals futures subindex A model in the form of MSIAH(2)-VECM(1,1) is selected based on the information criteria shown in Panel C of Table 3. Here, the model features two regimes, heteroscedastic errors and an autoregressive order of 1. Panel B of Table 5 summarizes the results of estimation of an MSIAH(2)-VECM(1,1) for 9 Both the LRT and the Davies (1977) test confirm that the Markov-switching model is better than the linear model. For brevity, we do not report these statistics for later models. 15 the CPI index and the industrial metals futures index. In regime 1, the EC coefficient on inflation indicates an error-correction in inflation because it has a negative sign, but the equilibrium adjustment is not statistically significant. At the same time, the negative sign on industrial metals provides an indication that industrial metals diverge from the inflation index. In regime 2, there is a significant error-correction in inflation and a significant long-run adjustment in industrial metals, confirmed by the negative error correction coefficient on the inflation index (coefficient = -0.003, t-statistic = -3.976) and by the positive speed coefficient on industrial metals (coefficient = 0.057, t-statistic = 2.353). Regime 1 lasts a much shorter time period, namely 2.83 months on average, and prevails 20.1% of the time. Regime 2 lasts 11.23 months on average and prevails during 79.9% of months. These results suggest that if the inflation increases, the industrial metals price would increase. The ability of industrial metals to hedge inflation risks could be due to the predominantly industrial nature of such assets. This finding is in line with the previous paper by Bilgin, Gogolin, Lau, and Vigne (2018) who examine the inflation-hedging effectiveness of white precious metals and indicate that platinum and palladium are more reliable inflation hedges because of their industrial nature. Figure 3 (b) depicts the smoothed probabilities of being in regime 1, which prevailed during 1983, 1986, 1988-1990, 2001, 2005-2006, and 2008-2009, 2015, and regime 2, which prevailed during in the rest of the time in our sample periods and covers the Great Moderation and post-subprime crisis. The results of the MS-VECM model show that industrial metals provide a good long-run hedge against inflation for most of the time. The regime-specific EC coefficient implies that under regime 2, the most persistent regime prevailing around 80% of months, inflation hedging is relatively fast in pace and is of relatively high statistical significance. It is also worth noting that regime 2 covers a relatively stable inflationary period, such as the Great Moderation and post-subprime crisis. In this regime, low inflation tends to go hand in hand with low industrial metals futures returns. 16 5.2.3 The precious metals futures subindex Again, the information criteria provided in Panel D of Table 3 reveals that MSIAH(2)-VECM(1,1) is the appropriate model. The model estimation results are summarized in Panel C of Table 5. As reflected by the transition matrix, both regimes are very persistent. In regime 1, there exists an equilibrium adjustment in CPI, with the estimated error-correction term marginally insignificant. At the same time, there is no significant adjustment in precious metals. Regime 1 lasts for a fairly short time period (6.10 months) and occurs around once in every four observations. Regime 2 prevails during 73.1% of our sample period and lasts 16.57 months on average. In regime 2, there is significant equilibrium adjustment in the inflation index as the EC coefficient has a significantly negative sign. In addition, the EC coefficient on precious metals reveal that the precious metals index provides some ability to hedge against inflation but with low statistical significance (coefficient = 0.023, t-statistic = 1.592). According to Figure 3 (c), regime 2 prevails during the period 1983-2004 (with a short period of regime 1 in 1986, 1990 and 2000-2001). In the period between 2007 and 2009, both regimes seem to have been present. Overall, we do not find that precious metals have significant inflation hedging ability. This is perhaps due to the multi-facet nature of precious metals, with industrial use being one of the many attributes of this asset (Bilgin, Gogolin, Lau, and Vigne, 2018). 5.2.4 The agriculture futures subindex The estimation results of an MSIAH(2)-VECM(1,1) model using CPI and the agriculture futures index are presented in Panel D of Table 5. In regime 2, the EC coefficient on the CPI is statistically significant, implying an error correction mechanism in inflation (coefficient = -0.001, t-stat = -3.990). The error correction coefficient is only marginally significant in regime 1. Moreover, the EC coefficients on the agriculture index in both regimes are insignificant. It can be concluded that the agriculture futures are not able to provide a hedge against inflation. Interestingly, the inflation index significantly depends on its own lagged returns in both regimes; it also depends on the past return of the agriculture index, but 17 only in regime 1. Regime 1 lasts a relatively short period (7.01 months), prevailing 35.1% of the time, while regime 2 lasts 12.96 months on average and prevails during the remaining time of our sample period. The smoothed probabilities of being in regime 1 and regime 2 are depicted in Figure 3 (d). 5.2.5 The livestock futures subindex Among all the models that use CPI and the livestock futures index, the SIC chooses the specification of MSIAH(2)-VECM(1,1). The estimation results of this model are presented in Panel E of Table 5. The transition matrix indicates that both regimes, especially regime 2, are highly persistent. The expected duration of regime 2 is 16.67 months. According to Figure 3 (e), regime 2 prevailed in years 1984-1985, 1987-1988, 1991-1998, 2002-2004, from mid-2009 to mid-2011 and 2015-2017. Regime 1 prevailed during the rest of the sample period. In regime 2, the significantly negative EC coefficient on CPI indicates an error correction mechanism embedded in inflation. However, we cannot find significant error-correction coefficient in regime 1. Moreover, in both regimes, the estimated EC coefficients of the livestock index are statistically insignificant, implying that the livestock futures lack the ability to hedge inflation risk. 5.3 Including stocks and bonds In this section, we further evaluate the inflation hedging ability of commodity futures by including common stocks and government bonds into the model. This exercise is meaningful as the bulk of portfolios are usually allocated to common stocks and bonds, with commodity futures used as a tool to hedge against inflation risk. Several prior studies examine the hedging and safe haven properties of precious metals against stocks and bonds (Baur and Lucey, 2010; Baur and McDermott, 2010; Lucey and Li, 2015; Li and Lucey, 2017). In particular, Baur and Lucey (2010) document that gold is in general a hedge against stocks and a safe haven in bear stock markets, while gold is never a safe haven for bonds. In this section, we follow this line of literature and identify the inflation hedging potential of commodity futures, taking into account the inter-relatedness between commodities and conventional 18 financial assets (i.e., stocks and bonds). In unreported results, Johansen’s test indicates one cointegrating vector for the model consisting of inflation, commodity, stocks, and bonds. When comparing different specifications of linear and MSVECM models, the SIC suggests MSIAH(2)-VECM(1,1) as the best model.10 The estimation results of the new model is presented in Panel A of Table 6. The estimated transition matrix and ergodic probabilities suggest that regime 2 dominates, characterizing 76.0% of months with spells lasting 13.48 months on average; regime 1 occurs during 24.0% of months with spells lasting just 4.25 months on average. In both regimes, there is a significant short-term dependence of the inflation index on the lagged commodity returns, as reflected by the significantly positive coefficients of ∆COM M (t − 1). However, we fail to find such a relationship between CPI and stocks or bonds. The error-correction coefficient explains the direction and pace of the long-run adjustment mechanism. Based on the coefficient of the error-correction term (coefficient = -0.003, t-statistic = -4.787), there is a significant long-run equilibrium adjustment within the inflation index in regime 2. The same coefficient is negative but statistically insignificant in regime 1. Similar to the main analysis in Table 4, we find that inflation hedging is slow in pace (coefficient = 0.009) and is of low statistical significance (t-statistic = 0.530) after we take common stocks and government bonds into consideration. The smoothed probabilities of being in regime 1 and regime 2 are depicted in Figure 3 (e). We also examine the inflation hedging ability of the five aforementioned subindexes of commodity futures separately in the new model. Consistent with the model without stocks and bonds, we find that industrial metals futures continue to provide significant hedging against inflation. The coefficient estimates of an MSIAH(2)-VECM(1,1) model on industrial metals futures are shown in Panel B of Table 6. The smoothed probabilities of being in regime 1 and regime 2 are depicted in Figure 4. Compared with the model using total commodity futures index, the positive error correction coefficient of industrial metals in regime 2 (coefficient = 0.028, t-statistic = 2.084) implies that the hedging ability of industrial metals futures is much stronger than the total commodity futures. Moreover, combined 10 The estimation algorithm converged after 23 iterations. The number of observations in the system is 1,672. The number of parameters in our Markov-switching model is 70. 19 with the significantly negative EC coefficient on bond returns (coefficient = -0.017, t-statistic = -3.357), our results indicate that investors who hold industrial metals receive compensation through positive industrial metal returns as bond returns turn negative in response to higher inflation. Moreover, the coefficient on stock returns for industrial metals in regime 1 is not significant, while that in regime 2 is significantly negative. These results suggest that industrial metals subindex is a hedge against stocks in the normal regime covering the Great Moderation and post-subprime crisis. Taken together, these results suggest that our main findings are robust to the inclusion of stocks and bonds into the model. 6 Conclusion This study aims to answer the question whether commodity futures provide the ability to hedge against inflation. Markov-switching framework, a comprehensive framework to describe the relationship that changes from state to state, has been used in the past but not in the area of inflation hedging by commodity futures. Because of the heterogeneity of the sample period in terms of inflationary regimes and commodity futures prices, we adopt an MS-VECM approach in order to characterize the changing nature of the long-run inflation hedging properties of commodity futures. We find that commodity futures fails to hedge US inflation over a sample period ranging from January 1983 to December 2017. By analyzing the coefficients related to the error-correction mechanism, we show that commodities futures in the markets of industrial metals are the best inflation hedges. However, the hedging capacity exhibits substantial variation over time. Most of the actual inflation hedging is obtained under the relatively longer and more common regimes covering the Great Moderation and post-subprime crisis periods. We do not find evidence that energy, precious metals, agriculture and livestock subindexes have significant inflation hedging ability. Our main findings are robust to the inclusion of common stocks and government bonds into the model. Results in this paper have implications to future academic research on this topic as well as industry practitioners. Applying refined Markov-switching models to historical data, we demonstrate the time- 20 varying nature of the inflation-hedging ability of commodity futures. As demonstrated at the beginning of this paper, various types of assets managers tend to over-weight commodities, motivated by the wisdom that commodities provide protection from inflation spikes as the economy rapidly recovers from the pandemic recession. Our findings provide two alerts to such practice. First, we find that not all commodities can hedge inflation. In fact, historical data reveals that only industrial metals display inflation-hedging ability. Second, from an investor’s point of view, the effectiveness of commodity futures as an inflation hedge crucially depends on the time horizon. Over the long run, commodity futures are useful as a partial hedge since a cointegrating relationship prevails. However, during some periods where no price adjustment is observed, commodity futures are not able to shield a portfolio from inflation risks. In terms of future research, we believe it to be interesting to calculate hedge ratios as well as the degree of hedging effectiveness. 21 References Alizadeh, Amir, Nikos Nomikos, and Panos Pouliasis, 2008, A markov regime switching approach for hedging energy commodities, Journal of Banking & Finance 32, 1970–1983. Apergis, Nicholas, Arusha Cooray, Naceur Khraief, and Iraklis Apergis, 2019, Do gold prices respond to real interest rates? evidence from the bayesian markov switching vecm model, Journal of International Financial Markets, Institutions and Money 60, 134–148. Bae, Geum, Woo Chang Kim, and John Mulvey, 2014, Dynamic asset allocation for varied financial markets under regime switching framework, European Journal of Operational Research 234, 450– 458. Bampinas, Georgios, and Theodore Panagiotidis, 2015, Are gold and silver a hedge against inflation? a two century perspective, International Review of Financial Analysis 41, 267–276. Baur, Dirk G, and Brian M Lucey, 2010, Is gold a hedge or a safe haven? an analysis of stocks, bonds and gold, Financial Review 45, 217–229. Baur, Dirk G, and Thomas K McDermott, 2010, Is gold a safe haven? international evidence, Journal of Banking & Finance 34, 1886–1898. Becker, Kent G, and Joseph E Finnerty, 2000, Indexed commodity futures and the risk and return of institutional portfolios, Office of Futures and Options Research. Working paper. Beckmann, Joscha, and Robert Czudaj, 2013, Gold as an inflation hedge in a time-varying coefficient framework, The North American Journal of Economics and Finance 24, 208–222. Bekaert, Geert, and Xiaozheng Wang, 2010, Inflation risk and the inflation risk premium, Economic Policy 25, 755–806. Bernanke, Ben S, 2009, Outstanding issues in the analysis of inflation, Understanding Inflation and the Implications for Monetary Policy: A Phillips Curve Retrospective p. 447. 22 Bilgin, Mehmet Huseyin, Fabian Gogolin, Marco Chi Keung Lau, and Samuel A Vigne, 2018, Timevariation in the relationship between white precious metals and inflation: A cross-country analysis, Journal of International Financial Markets, Institutions and Money 56, 55–70. Blanchard, Olivier J, and Marianna Riggi, 2013, Why are the 2000s so different from the 1970s? a structural interpretation of changes in the macroeconomic effects of oil prices, Journal of the European Economic Association 11, 1032–1052. Bodie, Zvi, 1982, Inflation risk and capital market equilibrium, Financial Review 17, 1–25. Chinn, Menzie D, and Olivier Coibion, 2014, The predictive content of commodity futures, Journal of Futures Markets 34, 607–636. Cologni, Alessandro, and Matteo Manera, 2008, Oil prices, inflation and interest rates in a structural cointegrated var model for the g-7 countries, Energy Economics 30, 856–888. Davies, Robert B, 1977, Hypothesis testing when a nuisance parameter is present only under the alternative, Biometrika 64, 247–254. Demidova-Menzel, Nadeshda, and Thomas Heidorn, 2007, Commodities in asset management, Frankfurt School-Working Paper Series. Dempster, Arthur P, Martin Schatzoff, and Nanny Wermuth, 1977, A simulation study of alternatives to ordinary least squares, Journal of the American Statistical Association 72, 77–91. Erb, Claude B, and Campbell R Harvey, 2006, The strategic and tactical value of commodity futures, Financial Analysts Journal 62, 69–97. Fama, Eugene F, and G William Schwert, 1977, Asset returns and inflation, Journal of Financial Economics 5, 115–146. Fisher, Irving, 1930, The theory of interest, Macmillan Co., New York 43. 23 Giampietro, Marta, Massimo Guidolin, and Manuela Pedio, 2017, Estimating stochastic discount factor models with hidden regimes: Applications to commodity pricing, European Journal of Operational Research 265, 685–702. Gorton, Gary, and K Geert Rouwenhorst, 2006, Facts and fantasies about commodity futures, Financial Analyst Journal 62, 47–68. Gorton, Gary B, Fumio Hayashi, and K Geert Rouwenhorst, 2013, The fundamentals of commodity futures returns, Review of Finance 17, 35–105. Guidolin, Massimo, and Allan Timmermann, 2006, An econometric model of nonlinear dynamics in the joint distribution of stock and bond returns, Journal of Applied Econometrics 21, 1–22. Hamilton, James D, 1989, A new approach to the economic analysis of nonstationary time series and the business cycle, Econometrica: Journal of the Econometric Society 57, 357–384. Hamilton, James D., and Jing Cynthia Wu, 2014, Risk premia in crude oil futures prices, Journal of International Money and Finance 42, 9–37. Herbst, Anthony F, 1985, Hedging against price index inflation with futures contracts, The Journal of Futures Markets 5, 489. Hoevenaars, Roy PMM, Roderick DJ Molenaar, Peter C Schotman, and Tom Steenkamp, 2008, Strategic asset allocation with liabilities: Beyond stocks and bonds, Journal of Economic Dynamics and Control 32, 2939–2970. Jensen, Gerald R, Robert R Johnson, and Jeffrey M Mercer, 2000, Efficient use of commodity futures in diversified portfolios, Journal of Futures Markets 20, 489–506. Johansen, Søren, 1991, Estimation and hypothesis testing of cointegration vectors in gaussian vector autoregressive models, Econometrica: Journal of the Econometric Society 59, 1551–1580. Kat, Harry M, and Roel CA Oomen, 2007, What every investor should know about commodities part ii: multivariate return analysis, Journal of Investment Management 5, 16–40. 24 Krolzig, Hans-Martin, 1997, Markov-switching vector autoregressions: Modelling, statistical inference, and application to business cycle analysis . vol. 454 (Springer Berlin). , 1998, Econometric modelling of Markov-switching vector autoregressions using MSVAR for Ox (Oxford University. Manuscript). Lawrence, Colin, 2003, Why is gold different from other assets? an empirical investigation, London, UK: The World Gold Council. Levin, Eric J, A Montagnoli, and RE Wright, 2006, Short-run and Long-run Determinants of the Price of Gold (World Gold Council). Li, Sile, and Brian M. Lucey, 2017, Reassessing the role of precious metals as safe havensâĂŞwhat colour is your haven and why?, Journal of Commodity Markets 7, 1–14. Lippi, Francesco, and Andrea Nobili, 2012, Oil and the macroeconomy: a quantitative structural analysis, Journal of the European Economic Association 10, 1059–1083. Lucey, Brian M., and Sile Li, 2015, What precious metals act as safe havens, and when? some us evidence, Applied Economics Letters 22, 35–45. Lucey, Brian M, Susan Sunila Sharma, and Samuel A Vigne, 2017, Gold and inflation (s)–a timevarying relationship, Economic Modelling 67, 88–101. Mackinnon, James G, Alfered A Haug, and Leo Michelis, 1999, Numerical distribution functions of likelihood ratio tests for cointegration, Journal of Applied Econometrics 14, 563–577. Mahdavi, Saeid, and Su Zhou, 1997, Gold and commodity prices as leading indicators of inflation: tests of long-run relationship and predictive performance, Journal of Economics and Business 49, 475–489. Shin, Yongcheol, Byungchul Yu, and Matthew Greenwood-Nimmo, 2014, Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ardl framework, in Festschrift in honor of Peter Schmidt . pp. 281–314 (Springer). 25 Singleton, Kenneth J., 2012, Investor flows and the 2008 boom/bust in the oil prices, Stanford University working paper. Spierdijk, Laura, and Zaghum Umar, 2014, Are commodity futures a good hedge against inflation, Journal of Investment Strategies 3, 35–57. Van Hoang, Thi Hong, Amine Lahiani, and David Heller, 2016, Is gold a hedge against inflation? new evidence from a nonlinear ardl approach, Economic Modelling 54, 54–66. Wang, Kuan-Min, Yuan-Ming Lee, and Thanh-Binh Nguyen Thi, 2011, Time and place where gold acts as an inflation hedge: An application of long-run and short-run threshold model, Economic Modelling 28, 806–819. 26 Table 1: Summary statistics The table displays sample statistics (in %) of the inflation rate as well as the nominal returns on bonds, stocks, the S&P GSCI Total Return Index and subsector indexes during the period January 1983 December 2017. It shows mean, median, maximum, minimum, standard deviation, skewness, excess kurtosis, and the p-value of Jarque-Bera (JB) test. The JB statistic is used to test the hypothesis of normality of the series. COMM stands for the aggregate index, EN for energy, IM for industrial metals, PM for precious metals, AGR for agriculture, LS for livestocks. All sample statistics are on a monthly basis. Variables Mean Median Max. Min. Std. Dev. Skewness Kurtosis JB p-values CPI Bonds Stocks COMM EN IM PM AGR LS 0.222 0.615 0.969 0.486 0.778 0.820 0.332 0.082 0.320 0.225 0.630 1.342 0.478 0.554 0.453 -0.042 -0.334 0.288 1.377 8.538 12.850 22.940 37.713 38.435 15.578 17.815 17.175 -1.771 -6.682 -22.536 -28.199 -31.199 -26.662 -18.615 -18.968 -15.757 0.254 2.119 4.333 5.677 8.913 6.565 4.785 5.256 4.176 -1.375 0.096 -0.886 -0.207 0.383 0.686 0.026 0.236 -0.139 14.257 3.713 5.960 5.184 4.875 7.465 4.150 4.547 3.560 0.000 0.009 0.000 0.000 0.000 0.000 0.000 0.000 0.033 27 Table 2: Johansen cointegration test The table presents results of the cointegration test, using monthly index series between January 1983 and December 2017. We test whether total commodity futures index as well as each of the five subindexes have cointegration relationship with CPI. Among the five subindexes, COMM stands for the aggregate index, EN for energy, IM for industrial metals, PM for precious metals, AGR for agriculture and LS for livestocks. Panel A shows the information criteria with different autoregressive orders that determine the VAR order. The minimum is displayed in bold fonts. Panel B shows the L-Max and Trace statistics, along with the corresponding p-value. Null hypotheses of cointegration and one cointegration vector are tested respectively. Panel C reports the coefficients of the estimated cointegration vector, with the t-statistics provided in the brackets below. Panel A: VAR order selection Model Lag 1 2 3 4 Lag 1 2 3 4 COMM EN IM PM AGR LS -12.422 -12.675 -12.692 -12.684 -12.229 -12.438 -12.462 -12.451 -12.696 -12.865 -12.897 -12.899 -12.364 -12.579 -12.556 -12.509 -12.171 -12.342 -12.326 -12.277 -12.639 -12.769 -12.762 -12.724 AIC -12.166 -12.799 -12.824 -12.818 -11.282 -11.867 -11.882 -11.880 -11.863 -12.051 -12.092 -12.095 SIC -12.108 -12.703 -12.689 -12.644 -11.224 -11.770 -11.746 -11.706 -11.805 -11.954 -11.956 -11.921 Panel B: Johansen co-integration test Model COMM EN IM PM AGR LS Null: no co-integration L-Max 156.315 p-value 0.000 Trace 160.448 p-value 0.000 138.084 0.000 142.389 0.000 88.043 0.000 92.477 0.000 68.356 0.000 74.693 0.000 94.496 0.000 99.970 0.000 95.131 0.000 103.560 0.000 Null: one co-integration vector L-Max 4.133 p-value 0.393 Trace 4.133 p-value 0.393 4.305 0.369 4.305 0.369 4.434 0.351 4.434 0.351 6.337 0.166 6.337 0.166 5.474 0.235 5.474 0.235 8.429 0.069 8.429 0.069 Panel C: Co-integration vectors Index Commodity Constant (1) COMM (2) EN (3) IM (4) PM (5) AGR (6) LS -0.161 [-2.415] -5.135 [-12.347] -0.114 [-2.109] -5.333 [-14.899] -0.195 [-6.650] -4.345 [-22.249] -0.089 [-0.955] -5.519 [-12.211] -0.069 [-0.264] -5.860 [-4.482] -0.157 [-1.044] -5.237 [-5.960] 28 Table 3: Model Selection The table provides AIC and SIC for different specifications of linear and Markov-switching vector error-correction models of the inflation index and the various commodity index. MSIA stands for Markov-switching regime dependent intercept and matrix of autoregressive coefficients model, while MSIAH stands for Markov-switching regime dependent intercept, matrix of autoregressive coefficients, and variance model. Model 1 uses CPI index and total commodity index. Models 2-6 use CPI and each of the five subindex of commodities, including energy, industrial metals, precious metals, agriculture and livestock. The sample spans the period between January 1983 and December 2017. Max LogLikelihood No. Obs. #Par. Saturation ratio SIC AIC LR Linearity Davies Itrarations -12.75 -12.75 -12.93 -12.92 -13.00 -12.96 -12.92 -12.95 -13.01 -12.96 NA NA 113.94 117.70 151.78 147.59 149.89 190.79 210.14 216.84 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 28 53 26 27 72 40 39 43 -11.81 -11.81 -12.06 -12.03 -12.07 -12.03 -12.01 -12.04 -12.02 -11.96 NA NA 140.01 142.67 152.93 152.54 163.14 204.62 186.02 192.65 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 29 44 37 36 61 52 40 56 NA NA 60.31 62.43 177.86 177.53 136.78 152.31 239.41 241.87 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 31 74 31 49 39 35 86 52 NA NA 83.29 98.84 145.81 150.30 145.04 164.49 184.21 189.54 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 37 55 74 30 40 43 100 100 -12.38 -12.39 -12.46 -12.49 -12.67 -12.64 -12.61 -12.58 -12.61 -12.55 NA NA 68.73 92.67 165.50 165.31 175.24 188.17 197.52 195.51 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 100 100 23 25 45 30 78 51 -12.81 -12.82 -12.96 -12.96 -13.04 -13.02 -12.93 -12.98 -13.03 -13.03 NA NA 98.97 108.91 143.17 141.55 129.55 174.13 194.03 213.77 NA NA 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 NA NA 38 37 32 27 100 67 35 39 HQIC Panel A: The selection of models using commodity futures index Model 1 2 States 3 States Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2683.69 2686.32 2740.66 2745.18 2759.58 2760.12 2758.63 2781.72 2788.76 2794.74 Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2488.32 2489.49 2558.32 2560.82 2564.78 2565.76 2569.89 2661.66 2581.33 2585.82 418 417 836 834 836 834 836 834 836 834 11 15 21 29 24 32 33 45 39 51 38.00 27.80 39.81 28.76 34.83 26.06 25.33 18.53 21.44 16.35 -12.68 -12.67 -12.81 -12.75 -12.86 -12.78 -12.72 -12.69 -12.78 -12.67 -12.79 -12.81 -13.01 -13.03 -13.09 -13.08 -13.04 -13.13 -13.16 -13.16 Panel B: The selection of models using energy futures index Model 2 2 States 3 States 418 417 836 834 836 834 836 834 836 834 11 15 21 29 24 32 33 45 39 51 38.00 27.80 39.81 28.76 34.83 26.06 25.33 18.53 21.44 16.35 -11.75 -11.72 -11.94 -11.86 -11.93 -11.84 -11.82 -11.78 -11.79 -11.66 -11.85 -11.87 -12.14 -12.14 -12.16 -12.15 -12.14 -12.21 -12.16 -12.16 Panel C: The selection of models using industrial metals futures index Model 3 2 States 3 States Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2526.89 2533.38 2557.05 2564.59 2615.82 2622.14 2677.60 2609.53 2646.60 2654.31 Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2657.90 2659.15 2699.55 2708.57 2730.81 2734.30 2730.42 2741.40 2750.01 2753.92 Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2607.70 2610.47 2642.06 2656.81 2690.45 2693.13 2695.32 2704.56 2706.46 2708.23 Linear-VECM (1,1) Linear-VECM (2,1) MSIA(2)-VECM(1,1) MSIA(2)-VECM(2,1) MSIAH(2)-VECM(1,1) MSIAH(2)-VECM(2,1) MSIA(3)-VECM(1,1) MSIA(3)-VECM(2,1) MSIAH(3)-VECM(1,1) MSIAH(3)-VECM(2,1) 2696.41 2700.75 2745.89 2755.21 2767.99 2771.53 2761.18 2787.82 2793.42 2807.64 418 417 836 834 836 834 836 834 836 834 11 15 21 29 24 32 33 45 39 51 38.00 27.80 39.81 28.76 34.83 26.06 25.33 18.53 21.44 16.35 -11.93 -11.93 -11.93 -11.88 -12.17 -12.11 -11.94 -11.86 -12.10 -11.99 -12.04 -12.08 -12.13 -12.16 -12.40 -12.42 -12.26 -12.30 -12.48 -12.49 -12.00 -12.02 -12.05 -12.05 -12.31 -12.30 -12.13 -12.13 -12.33 -12.29 Panel D: The selection of models using precious metals futures index Model 4 2 States 3 States 418 417 836 834 836 834 836 834 836 834 11 15 21 29 24 32 33 45 39 51 38.00 27.80 39.81 28.76 34.83 26.06 25.33 18.53 21.44 16.35 -12.56 -12.54 -12.61 -12.57 -12.72 -12.65 -12.59 -12.50 -12.59 -12.47 -12.66 -12.68 -12.82 -12.85 -12.95 -12.96 -12.91 -12.93 -12.97 -12.96 -12.62 -12.62 -12.74 -12.74 -12.86 -12.84 -12.78 -12.76 -12.82 -12.77 Panel E: The selection of models using agriculture futures index Model 5 2 States 3 States 418 417 836 834 836 834 836 834 836 834 11 15 21 29 24 32 33 45 39 51 38.00 27.80 39.81 28.76 34.83 26.06 25.33 18.53 21.44 16.35 -12.32 -12.30 -12.34 -12.32 -12.53 -12.45 -12.42 -12.32 -12.39 -12.25 -12.42 -12.45 -12.54 -12.60 -12.76 -12.76 -12.74 -12.76 -12.76 -12.74 Panel F: The selection of models using livestock futures index Model 6 2 States 3 States 418 417 418 836 834 836 834 836 834 836 11 15 21 29 24 32 33 45 39 51 38.00 27.80 19.90 28.83 34.75 26.13 25.27 18.58 21.38 16.39 29 -12.74 -12.74 -12.84 -12.79 -12.90 -12.83 -12.73 -12.72 -12.80 -12.73 -12.85 -12.88 -13.04 -13.08 -13.13 -13.14 -13.05 -13.16 -13.18 -13.22 Table 4: MSIAH(2)-VECM(1,1) model estimates for CPI and total commodity index This table presents the results of the estimation of an MSIAH(2)-VECM(1,1) model for the CPI and commodity futures index, using monthly series during the period from January 1983 to December 2017. Coefficient estimates under the two regimes are reported, with the corresponding t-statistics shown in the brackets below. The transition matrix between regimes, as well as implied durations and ergodic probabilities of each regime are also provided. Parameter Const. ∆CPI(t-1) ∆COMM(t-1) EC SE Regime 1: ∆CPI(t) ∆COMM(t) 0.002 -0.001 [5.616] [-0.093] 0.134 -2.073 [1.791] [-0.920] 0.037 0.332 [7.624] [2.628] -0.002 -0.105 [-1.005] [-1.915] 0.003 0.079 Transition matrix 0.759 0.241 0.089 0.911 Implied durations Regime 1 4.150 Regime 2 11.280 Ergodic prob. Regime 1 0.269 Regime 2 0.731 30 Regime 2: ∆CPI(t) ∆COMM(t) 0.002 0.010 [12.224] [1.760] 0.228 -0.361 [4.528] [-0.164] 0.015 -0.002 [7.895] [-0.025] -0.002 0.008 [-3.924] [0.456] 0.001 0.041 Table 5: Estimates of MS-VECM models for CPI and prices of commodity subindexes This table presents the results of the estimation of MS-VECM models using various subindexes of commodity futures, including energy (Panel A), industrial metals (Panel B), precious metals (Panel C), agriculture (Panel D) and livestock (Panel E). The sample contains monthly time series during the period from January 1983 to December 2017. Coefficient estimates under the two regimes are reported, with the corresponding t-statistics shown in the brackets below. The transition matrix between regimes, as well as implied durations and ergodic probabilities of each regime are also provided. Panel A: CPI and the energy subindex Parameter Const. ∆CPI(t-1) ∆EN(t-1) EC SE Regime 1: ∆CPI(t) ∆EN(t) 0.003 -0.025 [7.734] [-1.300] 0.028 -3.664 [0.433] [-1.126] 0.051 0.436 [14.073] [2.485] 0.003 -0.275 [1.722] [-2.551] 0.001 0.083 Transition matrix 0.746 0.254 0.024 0.977 Implied durations Regime 1 3.930 Regime 2 42.640 Ergodic prob. Regime 1 0.085 Regime 2 0.916 Regime 2: ∆CPI(t) ∆EN(t) 0.002 0.016 [16.888] [2.321] 0.112 -3.350 [2.808] [-1.444] 0.011 0.120 [11.385] [2.296] -0.002 -0.015 [-5.455] [-0.662] 0.001 0.083 Panel B: CPI and the industrial metals subindex Parameter Const. ∆CPI(t-1) ∆IM(t-1) EC SE Regime 1: ∆CPI(t) ∆IM(t) 0.001 0.019 [1.738] [1.684] 0.381 0.340 [3.449] [0.141] 0.012 0.533 [2.079] [3.780] -0.006 -0.162 [-1.572] [-1.745] 0.004 0.082 Transition matrix 0.646 0.354 0.089 0.911 Implied durations Regime 1 2.830 Regime 2 11.230 Ergodic prob. Regime 1 0.201 Regime 2 0.799 Regime 2: ∆CPI(t) ∆IM(t) 0.002 0.000 [10.071] [-0.060] 0.265 1.116 [4.357] [0.615] 0.004 -0.193 [2.705] [-3.365] -0.003 0.057 [-3.976] [2.353] 0.001 0.049 Panel C: CPI and the precious metals subindex Parameter Const. ∆CPI(t-1) ∆PM(t-1) EC Regime 1: ∆CPI(t) ∆PM(t) 0.001 0.012 [2.845] [1.915] 0.439 -3.640 [4.722] [-3.054] 0.021 -0.092 [2.791] [-0.853] -0.003 0.006 Transition matrix 0.836 0.164 0.060 0.940 Implied durations Regime 1 6.100 Regime 2 16.570 Ergodic prob. Regime 2: ∆CPI(t) ∆PM(t) 0.002 -0.005 [8.804] [-0.844] 0.247 3.273 [3.552] [1.395] 0.001 -0.136 [0.632] [-2.125] -0.002 0.023 Continued on next page 31 Table 5: — continued from previous page SE [-1.617] 0.004 [0.171] 0.046 Regime 1 Regime 2 0.269 0.731 [-4.570] 0.023 [1.592] 0.045 Panel D: CPI and the agriculture subindex Parameter Const. ∆CPI(t-1) ∆AGR(t-1) EC SE Regime 1: ∆CPI(t) ∆AGR(t) 0.001 0.006 [3.993] [0.695] 0.462 -3.416 [6.067] [-2.039] 0.015 -0.060 [3.755] [-0.692] -0.002 -0.024 [-1.718] [-0.850] 0.003 0.070 Transition matrix 0.857 0.143 0.077 0.923 Implied durations Regime 1 7.010 Regime 2 12.960 Ergodic prob. Regime 1 0.351 Regime 2 0.649 Regime 2: ∆CPI(t) ∆AGR(t) 0.002 -0.010 [9.287] [-1.941] 0.212 4.498 [2.911] [2.271] 0.001 0.062 [0.296] [0.891] -0.001 -0.003 [-3.990] [-0.251] 0.001 0.037 Panel E: CPI and the livestock subindex Parameter Const. ∆CPI(t-1) ∆LS(t-1) EC SE Regime 1: ∆CPI(t) ∆LS(t) 0.001 -0.009 [2.875] [-1.616] 0.419 1.718 [4.312] [1.919] 0.011 0.003 [0.911] [0.029] -0.003 -0.031 [-1.493] [-1.438] 0.004 0.033 Transition matrix 0.813 0.187 0.060 0.940 Implied durations Regime 1 5.340 Regime 2 16.670 Ergodic prob. Regime 1 0.243 Regime 2 0.757 32 Regime 2: ∆CPI(t) 0.002 [8.566] 0.298 [4.433] 0.000 [-0.060] -0.001 [-3.787] 0.001 ∆LS(t) 0.000 [-0.040] 2.334 [1.419] 0.017 [0.290] -0.008 [-0.746] 0.043 33 SE EC ∆Bond(t-1) ∆Stock(t-1) ∆IM(t-1) ∆CPI(t-1) Const. Parameter SE EC ∆Bond(t-1) ∆Stock(t-1) ∆COMM(t-1) ∆CPI(t-1) Const. Parameter ∆CPI(t) 0.001 [1.024] 0.436 [3.671] 0.010 [1.677] 0.017 [1.969] 0.008 [0.389] -0.002 [-0.720] 0.004 ∆CPI(t) 0.002 [3.812] 0.223 [2.588] 0.034 [8.336] 0.004 [0.727] -0.006 [-0.491] 0.000 [-0.149] 0.003 Regime 1: ∆IM(t) ∆Stock(t) 0.017 -0.030 [1.390] [-2.727] -1.342 0.171 [-0.619] [0.090] 0.603 0.274 [4.884] [2.549] 0.212 0.201 [1.167] [1.314] -0.651 0.466 [-1.485] [1.292] -0.052 0.073 [-1.187] [1.822] 0.067 0.060 Regime 1: ∆COMM(t) ∆Stock(t) 0.002 -0.023 [0.191] [-2.460] -1.199 0.348 [-0.465] [0.178] 0.367 0.012 [3.037] [0.130] 0.132 0.326 [0.755] [2.437] -0.429 0.446 [-1.108] [1.561] -0.152 0.115 [-1.776] [1.642] 0.076 0.058 Ergodic prob. Regime 1: 0.240 Regime 2: 0.760 Implied durations Regime 1: 4.250 Regime 2: 13.480 Transition matrix 0.764 0.236 0.074 0.926 ∆Bond(t) 0.014 [2.689] -1.143 [-1.580] -0.007 [-0.136] -0.145 [-2.379] -0.045 [-0.310] -0.002 [-0.089] 0.023 Ergodic prob. Regime 1: 0.190 Regime 2: 0.810 Implied durations Regime 1: 2.540 Regime 2: 10.800 Transition matrix 0.606 0.394 0.093 0.907 Panel B: The industrial metals futures model ∆Bond(t) 0.013 [3.367] -0.750 [-1.022] -0.045 [-1.184] -0.080 [-1.693] -0.144 [-1.305] -0.022 [-0.719] 0.022 Panel A: The commodity futures model ∆CPI(t) 0.002 [11.915] 0.224 [4.058] 0.003 [1.919] 0.001 [0.651] -0.006 [-1.310] -0.002 [-4.397] 0.001 ∆CPI(t) 0.002 [13.643] 0.103 [1.959] 0.018 [9.135] 0.002 [0.797] -0.001 [-0.313] -0.003 [-4.787] 0.001 Regime 2: ∆IM(t) ∆Stock(t) 0.007 0.020 [1.245] [6.100] 1.511 -1.573 [0.827] [-1.477] -0.114 -0.063 [-1.852] [-1.872] -0.280 -0.062 [-3.277] [-1.260] 0.139 0.088 [0.878] [0.941] 0.028 0.001 [2.084] [0.162] 0.054 0.033 Regime 2: ∆COMM(t) ∆Stock(t) 0.023 0.020 [4.888] [6.030] -3.808 -0.126 [-2.459] [-0.114] -0.026 -0.102 [-0.451] [-2.398] -0.197 -0.202 [-2.476] [-3.831] -0.151 0.138 [-1.127] [1.435] 0.009 0.012 [0.530] [0.999] 0.042 0.031 ∆Bond(t) 0.004 [2.135] 0.128 [0.208] -0.007 [-0.321] -0.037 [-1.255] 0.038 [0.695] -0.017 [-3.537] 0.019 ∆Bond(t) 0.005 [2.668] -0.432 [-0.657] 0.022 [0.795] -0.074 [-2.022] 0.108 [1.816] -0.031 [-4.127] 0.019 This table presents the results of the estimation of an MSIAH(2)-VECM(1,1) model that investigate the inter-dependence between commodity futures, CPI, common stocks and government bonds, using monthly series from January 1983 to December 2017. The commodity futures index used in Panel A is total commodity futures index. In Panel B, we examine one subindex of commodity futures, i.e., the industrial metals futures index. Coefficient estimates under the two regimes are reported, with the corresponding t-statistics shown in the brackets below. The transition matrix between regimes, as well as implied durations and ergodic probabilities of each regime are also provided. Table 6: Estimates of an MSIAH(2)-VECM(1,1) model with common stocks and government bonds Commodity Energy 12,000 5,000 10,000 4,000 8,000 3,000 6,000 2,000 4,000 1,000 2,000 0 0 1985 1990 1995 2000 2005 2010 2015 2020 1985 1990 1995 Industrial Metals 2000 2005 2010 2015 2020 2010 2015 2020 2010 2015 2020 Precious Metals 5,000 5,000 4,000 4,000 3,000 3,000 2,000 2,000 1,000 1,000 0 0 1985 1990 1995 2000 2005 2010 2015 2020 1985 1990 1995 Agriculture 2000 2005 Livestock 5,000 5,000 4,000 4,000 3,000 3,000 2,000 2,000 1,000 1,000 0 0 1985 1990 1995 2000 2005 2010 2015 2020 1985 1990 1995 2000 2005 Fig. 1. Commodity futures prices. Notes: All futures prices are in US dollar. X-axis plots the time period in months during 1983-2017. Y-axis denotes the value of commodity futures prices. All data are extracted from Thomson Reuters DataStream. 34 1.00 Probabilities of Regime 1 0.75 0.50 0.25 1.00 1985 1990 Probabilities of Regime 2 1995 2000 2005 2010 2015 1985 1995 2000 2005 2010 2015 0.75 0.50 0.25 1990 Fig. 2. Smoothed state probabilities of a MSIAH(2)-VECM(1,1) for CPI and commodity futures index. Notes: X-axis plots the time period in months during 1983-2017. Y-axis denotes the probability value ranging from 0 to 1. 35 36 1995 2000 2005 2010 2015 1995 2000 2005 2010 2015 1995 2000 2005 2010 2015 2000 2005 2010 2015 1995 2000 2005 2010 2015 1995 2000 2005 2010 2015 1990 1995 1995 (e) Livestock subindex 1985 1985 1990 Probabilities of Regime 2 Probabilities of Regime 1 2000 2000 2005 2005 2010 2010 2015 2015 1990 1995 1995 2000 2000 1985 1990 1985 1990 Probabilities of Regime 2 Probabilities of Regime 1 1995 1995 2000 2000 (f) Commodity, stocks, and bonds 0.25 0.50 0.75 1.00 0.25 0.50 0.75 1.00 (c) Precious metals subindex 1985 1985 1990 Probabilities of Regime 2 Probabilities of Regime 1 2005 2005 2005 2005 2010 2010 2010 2010 2015 2015 2015 2015 Fig. 3. Smoothed state probabilities of Markov-switching vector error-correction models. Notes: X-axis plots the time period in months during 1983-2017. Y-axis denotes the probability value ranging from 0 to 1. (d) Agriculture subindex 0.25 0.25 1990 0.50 0.50 1985 0.75 0.75 1.00 0.25 1995 0.50 0.25 1.00 0.50 1.00 1990 (b) Industrial metals subindex 0.75 1985 1990 Probabilities of Regime 2 Probabilities of Regime 1 0.75 1.00 (a) Energy subindex 1985 0.25 0.25 0.25 1990 0.50 0.50 0.50 1985 0.75 1.00 0.75 1985 1990 Probabilities of Regime 2 0.75 1.00 0.25 0.25 0.25 1985 1990 Probabilities of Regime 2 0.50 1.00 0.75 1.00 0.50 Probabilities of Regime 1 0.75 1.00 0.50 Probabilities of Regime 1 0.75 1.00 1.00 Probabilities of Regime 1 0.75 0.50 0.25 1.00 1985 1990 Probabilities of Regime 2 1995 2000 2005 2010 2015 1985 1995 2000 2005 2010 2015 0.75 0.50 0.25 1990 Fig. 4. Smoothed state probabilities of a MSIAH(2)-VECM(1,1) for CPI, industrial metals, stocks, and bonds. Notes: X-axis plots the time period in months during 1983-2017. Y-axis denotes the probability value ranging from 0 to 1. 37 Table A1: Univariate time series AR order selection The table presents the Akaike and Schwarz information criterion of each series for selecting autoregressive order. COMM stands for the aggregate index, EN for energy, IM for industrial metals, PM for precious metals, AGR for agriculture, LS for livestocks. All sample statistics are on a monthly basis. The minimum is displayed in bold fonts. Series CPI Bonds Stocks COMM EN IM PM AGR LS Lag AIC SIC 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 -9.169 -9.344 -9.373 -9.377 -4.891 -4.892 -4.896 -4.896 -3.408 -3.410 -3.405 -3.402 -2.887 -2.918 -2.914 -2.909 -2.019 -2.053 -2.047 -2.042 -2.643 -2.647 -2.640 -2.651 -3.234 -3.282 -3.286 -3.281 -3.056 -3.049 -3.052 -3.045 -3.519 -3.514 -3.508 -3.510 -9.150 -9.315 -9.335 -9.329 -4.872 -4.863 -4.857 -4.847 -3.389 -3.381 -3.367 -3.354 -2.868 -2.889 -2.875 -2.861 -2.000 -2.024 -2.009 -1.993 -2.624 -2.618 -2.601 -2.603 -3.215 -3.253 -3.248 -3.233 -3.037 -3.020 -3.013 -2.996 -3.500 -3.485 -3.470 -3.462 38 Table A2: Results of the ADF stationarity test The table shows results of the ADF stationarity test. I - ADF test with a trend and an intercept, II - ADF test without trend and with an intercept, III - ADF test without trend and without intercept. COMM stands for the aggregate index, EN for energy, IM for industrial metals, PM for precious metals, AGR for agriculture, LS for livestocks. The bottom panel reports the critical values at 1%, 5%, and 10%. Series Lag I Level series II III I First differences II III CPI Bonds Stocks COMM EN IM PM AGR LS 2 0 0 1 1 0 1 0 0 -1.110 -1.751 -2.149 -1.293 -1.607 -1.336 -1.936 -2.035 -1.840 -4.001 -2.488 -1.319 -2.231 -2.181 -1.561 -0.028 -1.555 -2.703 8.744 5.390 3.805 0.723 0.458 1.685 1.251 -0.300 0.925 -13.438 -19.388 -18.607 -16.913 -16.792 -18.432 -23.490 -20.649 -19.751 -12.652 -19.224 -18.605 -16.768 -16.702 -18.410 -23.435 -20.541 -19.426 -6.015 -17.996 -18.002 -16.741 -16.694 -18.281 -23.385 -20.564 -19.395 -3.980 -3.421 -3.133 -3.446 -2.868 -2.570 -2.571 -1.942 -1.616 -3.980 -3.421 -3.133 -3.446 -2.868 -2.570 -2.571 -1.942 -1.616 1% 5% 10% 39