Transformers Rated 101 MVA to 500 MVA Dominate Market with 62.8% Share

advertisement

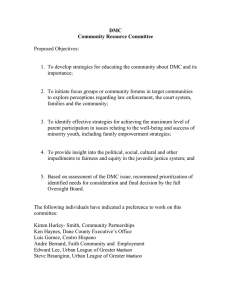

Overview : Dimethyl Carbonate Market size is expected to be worth around USD 1341.5 Million by 2033, from USD 742.0 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033. Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/dimethyl-carbonate-market/request-sample/ The Dimethyl Carbonate (DMC) market encompasses the global industry involved in producing, distributing, and utilizing Dimethyl Carbonate, a versatile and eco-friendly chemical compound with the formula (CH3O)2CO. DMC is a colorless and flammable liquid with a mild, pleasant odor, known for its excellent solvent properties and low toxicity. It is widely used in various industries as a solvent in coatings, adhesives, and inks, and as an intermediate in the synthesis of polycarbonates, pharmaceuticals, and pesticides. Its unique attributes make it a preferred choice in applications requiring safer and more sustainable chemical processes. The importance of the DMC market lies in its support of diverse industrial processes and its alignment with the shift towards greener alternatives. The demand for DMC is propelled by its role in facilitating environmentally friendly production methods and the increasing need for biodegradable and eco-friendly solvents and materials. The market dynamics are influenced by factors such as stringent environmental regulations, technological advancements in chemical manufacturing, and the rising consumer preference for sustainable products. As the industry evolves, manufacturers and stakeholders are focused on enhancing production efficiency, exploring new application areas, and complying with environmental standards, ensuring the DMC market remains a critical segment of the global chemical industry. By Grade Industry Grade: Industry Grade DMC led the market with over a 48.9% share, primarily used as a solvent and reagent in paints, coatings, adhesives, and plastics. Its popularity is due to its excellent solvency and low toxicity, making it ideal for industrial applications. By Application In 2024, polycarbonate synthesis dominated the DMC market, holding over a 45.5% share. This application drives demand for DMC, essential for producing high-performance polymers in industries like automotive and electronics. By End-use Plastics led the DMC market in 2024, capturing over a 36.5% share, driven by its role in manufacturing diverse plastic products for packaging, automotive, and consumer goods. Paints & coatings follow closely, leveraging DMC’s solvent properties in construction and automotive applications. By Sales Channel In 2023, direct sales dominated, accounting for over 56.7% of the market. This channel allows manufacturers to offer personalized service and maintain efficient communication, enhancing customer satisfaction. Key Market Segments By Grade ● Industry Grade ● Pharmaceutical Grade ● Battery Grade By Application ● Polycarbonate Synthesis ● Battery Electrolyte ● Solvents ● Reagents ● Others By End-use ● Plastics ● Paints & Coating ● Pharmaceutical ● Battery ● Agrochemicals ● Others By Sales Channel ● Direct Sales ● Indirect Sales Market Key Players ● Alfa Aesar ● Connect Chemicals ● Dongying Hi-tech Spring Chemical Industry Co., Ltd. ● Guangzhou Tinci Materials Technology Co., Ltd. ● Haike Chemical Group ● Hebei New Chaoyang Chemical Stock Co., Ltd. ● Kishida Chemical Co. Ltd. ● Kowa Company Ltd. ● Lotte Chemical ● Merck KGaA ● Shandong Depu Chemical Industry Science and Technology Co., Ltd. ● Shandong Shida Shenghua Chemical Group Co., Ltd. ● Tokyo Chemical Industry Co., Ltd ● Ube Industries Ltd. ● Qingdao Aspirit Chemical Co., Ltd. Drivers The growing demand for environmentally friendly chemicals is a major driver for the dimethyl carbonate (DMC) market. DMC is preferred for its eco-friendly properties, aligning with sustainability goals and regulatory requirements. Its low toxicity, biodegradability, and minimal environmental impact make it a popular choice across various applications, promoting green chemistry practices and supporting the transition to safer, greener industrial processes. Restraints Competition from substitutes poses a significant challenge to the DMC market. Traditional solvents and reagents like acetone and toluene, as well as established chemicals such as phosgene and bisphenol-A in polycarbonate synthesis, often have lower costs and established supply chains. Additionally, emerging bio-based and renewable chemicals provide alternative options, making it challenging for DMC to achieve widespread adoption despite its environmental benefits. Opportunities The global shift towards sustainable chemical solutions presents a substantial growth opportunity for the DMC market. As industries and governments prioritize reducing their carbon footprint, DMC's eco-friendly properties position it as a key player in the sustainable chemicals market. The expansion of end-use applications and ongoing research into new uses and processes for DMC further enhance its market potential, driving demand growth. Challenges The COVID-19 pandemic caused significant disruptions in the production of electric motors and other industrial components, impacting the availability of key materials for DMC manufacturing. Factory closures, supply chain interruptions, and financial strain on companies have complicated production and distribution efforts, posing ongoing challenges for the DMC market as it navigates recovery and adapts to new operational realities.