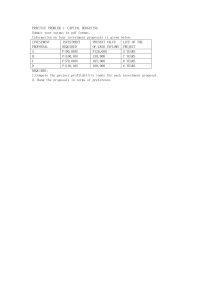

BULLET NOTES ON CAPITAL BUDGETING Capital Budgeting Evaluation Process The process of making capital expenditure decisions in business is referred to as capital budgeting. Capital budgeting involves choosing among various projects to find the one(s) that will maximize a company’s return on its financial investment. The capital budgeting evaluation process generally has the following steps: 1. Project proposals are requested from departments, plants, and authorized personnel. 2. Proposals are screened by a capital budget committee. 3. Officers determine which projects are worthy of funding. 4. Board of directors approves capital budget. Cash Flow Information While accrual accounting has advantages over cash accounting in many contexts, for purposes of capital budgeting, estimated cash inflows and outflows are preferred for inputs into the capital budgeting decision tools. Sometimes cash flow information is not available, in which case adjustments can be made to accrual accounting numbers to estimate cash flows. The capital budgeting decision, under any technique, depends in part on a variety of considerations: o The availability of funds. o Relationships among proposed projects. o The company’s basic decision-making approach. o The risk associated with a particular project. Commonly Used Methods of Evaluating Capital Investment Projects Methods that do not consider the time value of money o Payback Period o Accounting rate of return Methods that consider the time value of money (discounted cash flow methods) o Net present value (NPV) o Profitability Index (PI) o Internal Rate of Return (IRR) Payback Period The formula when net annual cash flows are equal is: Payback Period = Cost of Capital Investment ÷ Net Annual Cash Flow The shorter the payback period, the more attractive the investment. The cash payback technique recognizes that: The earlier the investment is recovered, the sooner the company can use the cash funds for other purposes. The risk of loss from obsolescence and changed economic conditions is less in a shorter payback period. Net annual cash flow is computed by adding back depreciation expense to net Depreciation expense is added back because it is an expense that does not require an outflow of cash. In the case of uneven net annual cash flows, the company determines the cash payback period when the cumulative net cash flows from the investment equal the cost of the investment. The cash payback technique is relatively easy to compute and understand. BULLET NOTES – CAPITAL BUDGETING Compiled by Vhin It should not ordinarily be the only basis for the capital budgeting decision because it ignores the expected profitability of the project. Bail-out Payback Period is a modified payback period method wherein cash recoveries include not only the net cash inflows from operations but also the estimated salvage value realizable at the end of each year of the project life. Accounting Rate of Return The annual rate of return method is based directly on accounting data rather than on cash flows. The annual rate of return method indicates the profitability of a capital expenditure and its formula is: Expected Annual Net Income ÷ Average Investment Management compares the annual rate of return with its required rate of return for investments of similar risk. The required rate of return is generally based on the company’s cost of capital. The decision rule is: A project is acceptable if its rate of return is greater than management’s required rate of return. It is unacceptable when the reverse is true. The higher the rate of return for a given risk, the more attractive the investment. The principal advantages of this method are the simplicity of its calculation and management’s familiarity with the accounting terms used in the computation. A major limitation of this method is that it does not consider the time value of money. Net Present Value Discounted cash flow techniques are generally recognized as the most informative and best conceptual approaches to making capital budgeting decisions. These techniques consider both the time value of money and the estimated net cash flow from the investment. The primary discounted cash flow technique is the net present value method. The net present value method in values discounting net cash flows to their present value and then comparing that present value with the capital outlay required by the investment. The difference between these two amounts is referred to as net present value (NPV). Company management determines what interest rate to use in discounting the future net cash flows. This rate is often referred to as the discount rate or required rate of return. A proposal is acceptable when net present value is positive, because this means the rate of return on the investment equals or exceeds the discount rate (required rate of return). The higher the positive net present value, the more attractive the investment. The discount rate used by most companies is its cost of capital—that is, the rate that the company must pay to obtain funds from creditors and stockholders. The net present value method demonstrated in the text requires the following assumptions: All cash flows come at the end of each year. All cash flows are immediately reinvested in another project that has a similar return. All cash flows can be predicted with certainty. BULLET NOTES – CAPITAL BUDGETING Compiled by Vhin Profitability Index In theory, all projects with positive NPVs should be accepted. However, companies rarely are able to adopt all positive-NPV proposals because: The proposals are mutually exclusive (if the company adopts one proposal, it would be impossible to also adopt the other proposal). Companies have limited resources. Proposals are often mutually exclusive—if the company adopts one proposal, it would be impossible to also adopt the other proposal. In choosing between two projects, one method that takes into account both the size of the original investment and the discounted cash flows is the profitability index. The profitability index is a method that compares the relative merits of alternative capital investment projects. It is computed by dividing the present value of net cash flows by the initial investment. Profitability Index = Present Value of Future Cash Flows ÷ Initial Investment The higher the profitability index, the more desirable the project. The project with the greater profitability index should be the one chosen. Internal Rate of Return The internal rate of return method differs from the net present value method in that it finds the interest yield of the potential investment. The internal rate of return is the interest rate that will cause the present value of the proposed capital expenditure to equal the present value of the expected net annual cash flows. Determining the internal rate of return can be done with a financial (business) calculator, computerized spreadsheet, or by employing a trial-and-error procedure. Determine the present value factor (PVF) for the internal rate of return (IRR) with the use of the following formula: PVF for IRR = Net investment cost ÷ Net cash inflows Once managers know the internal rate, of return, they compare it to the company’s required rate of return (the discount rate). The decision rule is: Accept the project when the internal rate of return is equal to or greater than the required rate of return. Reject the project when the internal rate of return is less than the required rate. Intangible Benefits Intangible benefits, such as increased quality, improved safety, or enhanced employee loyalty, are difficult to quantify, and thus often are ignored in capital budgeting decisions. To avoid rejecting projects that should actually be accepted, managers can either: o Calculate the net present value (NPV) ignoring intangible benefits, and if the resulting NPV is negative, evaluate whether the intangible benefits are worth at least the amount of the negative NPV. o Incorporate intangible benefits into the NPV calculation by projecting rough, conservative estimates of their value. If, after using conservative estimates, the net present value is positive, the project should be accepted. BULLET NOTES – CAPITAL BUDGETING Compiled by Vhin Sensitivity Analysis Another consideration made by financial analysts is uncertainty or One approach for dealing with uncertainty is sensitivity analysis. Sensitivity analysis uses a number of outcome estimates to get a sense of the variability among potential returns. In general, a higher risk project should be evaluated using a higher discount rate. Post-Audit of Investment Projects A post-audit is a thorough evaluation of how well a project’s actual performance matches the projections made when the project was proposed. Performing a post-audit is important for several reasons. o Since managers know that their results will be evaluated, there is an incentive for them to make accurate estimates rather than presenting overly optimistic estimates in an effort to get projects approved. o A post-audit provides a formal mechanism for determining whether existing projects should be continued, expanded, or terminated. o Post-audits improve future investment proposals because managers improve their estimation techniques by evaluating past successes and failures. A post-audit involves the same evaluation techniques that were used in making the original capital budgeting decision—for example, use of the net present value method. The difference is that, in the post-audit, actual figures are inserted where known, and estimation of future amounts is revised based on new information. COST OF CAPITAL Source Capital Creditors Long-term debt Cost of Capital After-tax rate of interest I * ( 1 – tax rate) Stockholders: Preferred Preferred stock Common Common stock Preferred dividends per share ÷ Current market price or Net issuance price CAPM or DDM 1. CAPITAL ASSET PRICING MODEL (CAPM) R = RF = β(RM – RF) where: R = rate of return RF = risk-free rate determined by government securities β = beta coefficient of an individual stock which is the correlation between the volatility (price variation) of the stock market and the volatility of the price of the individual stock. 2. THE DIVIDEND DISCOUNT MODEL (OR DIVIDEND GROWTH MODEL) a. Cost of Retained Earnings (D1 ÷ P0) + G where: P0 = current price D1 = next dividend G = growth rate in dividends per share (it is assumed that the dividend payout ratio, retention rate, and therefore the EPS growth rate are constant) b. Cost of New Common Stock D1 ÷ P0 (1 – Flotation Cost) + G Flotation Cost = the cost of issuing new securities.