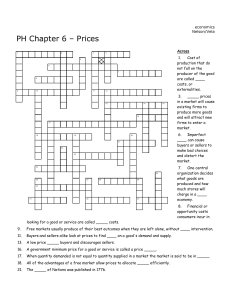

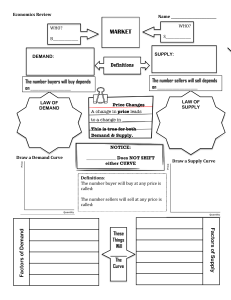

Chapter 1: Ten principles: 1. People face trade-offs. 2. The cost of something is what you give up to get it. 3. Rational people think at the margin. 4. People respond to incentives. 5. Trade can make everyone better off. 6. Markets are usually a good way to organize economic activity. 7. Governments can sometimes improve market outcomes. 8. A country’s standard of living depends on its ability to produce goods and services. 9. Prices rise when the government prints too much money. 10. Society faces a short-run trade-off between inflation and unemployment. Chapter 3: Q: Why Frank’s production possibilities frontier is a straight line? A: Frank’s technology for producing meat and potatoes allows him to switch between the two goods at a constant rate. He produces the same amount of potatoes or meat in one hour regardless of how much he is already producing. Absolute advantage: the ability to produce a good using fewer inputs than another producer. Opportunity cost: whatever must be given up to obtain some item. Comparative advantage: the ability to produce a good at a lower opportunity cost than another producer. The opportunity cost of one food is the inverse of the opportunity cost of the other, if a person’s opportunity cost of one good is relatively high, the opportunity cost of the other good much be relatively low. When each person specializes in producing the good for which he or she has a comparative advantage, total production in the economy rises. Trade can benefit everyone in society because it allows people to specialize in which they have a comparative advantage. For both parties to gain from trade, the price at which they trade must lie between the two opportunity costs. Chapter 4: Market: A group of buyers and sellers of a particular good or service. Competitive market: a market in which there are many buyers and many sellers so that each has a negligible impact on the market price. Characteristics of perfectly competitive market: (1) The goods offered for sale are all exactly the same. (2) The buyers and sellers are so numerous that no single buyer or seller has any influence over the market price. (3) Buyers and sellers are free to enter the market. Quantity demanded: the amount of a good that buyers are willing and able to purchase. Law of demand: other things being equal, the quantity demanded of a good falls when the price of the good rises. Demand curve: a graph of the relationship between the price of a good and the quantity demanded. Slopes downward. The variables that shift the demand curve: Income, Prices of related goods, Tastes, Expectations, Number of buyers Normal good: a good for which, other things being equal, an increase in income leads to an increase in demand. Inferior good: a good for which, other things being equal, an increase in income leads to a decrease in demand. Substitutes: two goods for which an increase in the price of one leads to an increase in the demand for the other. Complements: two goods for which an increase in the price of one leads to a decrease in the demand for the other. Quantity supplied: the amount of a good that sellers are willing and able to sell. Law of supply: other things being equal, the quantity supplied of a good rises when the price of the good rises. Supply curve: a graph of the relationship between the price of a good and the quantity supplied. Slopes upward. Variables that shift the supply curve: Input price, Technology (the advance in technology raises the supply of the good), Expectations, Number of sellers Equilibrium: a situation in which the market price has reached the level at which quantity supplied equals quantity demanded. Equilibrium price: the price that balances quantity supplied and quantity demanded. Surplus: a situation in which quantity supplied is greater than quantity demanded. (sometimes called a situation excess supply) Shortage: a situation in which quantity demanded is greater than quantity supplied. (sometimes called a situation of excess demand) Law of supply and demand: the claim that the price of any good adjusts to bring the quantity supplied and the quantity demanded for that good into balance. Three steps for analyzing changes in equilibrium: 1. Decide whether the event shifts the supply or demand curve (or perhaps both) 2. Decide in which direction the curve shifts. 3. Use the supply and demand diagram to see how the shift changes the equilibrium price and quantity. A shift in the supply curve is called a “change in supply”, but a movement along a fixed supply curve is called a “change in the quantity supplied”. In market economics, prices are the signals that guide economic decisions and thereby allocate scarce resources. For every good in the economy, the price ensures that supply and demand are in balance. The equilibrium price then determines how much of the good buyers choose to consume and how much sellers choose to produce. Chapter 5: Elasticity: a measure of the responsiveness of quantity demanded or quantity supplied to a change in one of its determinants. Price elasticity of demand: a measure of how much the quantity demanded of a good respond to a change in the price of that good. What influence the price elasticity of demand: Availability of close substitutes, Necessities versus luxuries, Definition of the market, Time horizon…… Demand tends to be more elastic if close substitutes are available, if the good is a luxury rather than a necessity, if the market is narrowly defined, or if buyers have substantial time to react to a price change. Computing the price elasticity of demand: percentage change in quantity demanded / percentage change in price Midpoint method: price elasticity of demand: (Q2-Q1)/[(Q2+Q1)/2] / (P1P2)/[(P2+P1)/2] Demand is considered elastic when the elasticity is greater than 1, which means the quantity moves proportionately more than the price. Demand is considered inelastic when the elasticity is less than 1, which means the quantity moves proportionately less than the price. The price elasticity of demand is closely related to the slope of the demand curve. Rule: the flatter the demand curve that passes through a given point, the greater the price elasticity of demand. The steeper the demand curve that passes through a given point, the smaller the price elasticity of demand. Total revenue: the amount paid by buyers and received by sellers of a good, computed as the price of the good times the quantity sold. (P x Q) The impact of a price change on total revenue depends on the elasticity of demand: When the demand is inelastic, an increase in the price leads to a decrease in quantity demanded that is proportionately smaller, so total revenue increases. When the demand is elastic, an increase in the price leads to a decrease in quantity demanded that is proportionately larger, so total revenue decreases. At points with a low price and high quantity, the demand curve is inelastic. At points with a high price and low quantity, the demand curve is elastic. Income elasticity of demand: a measure of how much the quantity demanded of a good respond to a change in consumers’ income. The cross-price elasticity of demand: a measure of how much the quantity demanded of one good responds to a change in the price of another good. For substitutes, the cross-price elasticity is positive. For complements, the cross-price elasticity in negative. The price elasticity of supply: a measure of how much the quantity supplied of a good respond to a change in the price of that good. In most markets, supply is more elastic in the long run than in the short run. Computing the price elasticity of supply: percentage change in quantity supplied / percentage change in price As the elasticity rises, the supply curve gets flatter. Supply is perfectly inelastic when the supply curve is vertical. Supply is perfectly elastic when the supply curve is horizontal. From the point of demand curve, the value of the elasticity depends on the slope and its position. The lower the price, the smaller the elasticity; the steeper the absolute value of the slope, the bigger the elasticity. Chapter 6: Price ceiling: A legal maximum on the price at which a good can be sold. If the equilibrium price is below the ceiling, the price ceiling is not binding. If the equilibrium price is above the price ceiling, the ceiling is a binding constraint on the market. When the government imposes a binding price ceiling on a competitive market, a shortage of the good arises, and sellers must ration the scarce goods among the large number of potential buyers. Price floor: A legal minimum on the price at which a good can be sold. If the equilibrium price is above the floor, the price floor is not binding. If the equilibrium price is below the floor, the price floor is a binding constraint on the market. A binding price floor causes a surplus. Tax incidence: the manner in which the burden of a tax is shared among participants in a market. When the government levies a tax on a good, the equilibrium quantity of the good falls. That is, a tax on a market shrinks the size of the market. Taxes discourage market activity. When a good is taxed, the quantity of the good sold is smaller in the new equilibrium. Buyers and sellers share the burden of taxes. In the new equilibrium, buyers pay more for the good, and sellers receive less. Taxes levied on sellers and taxes levied on buyers are equivalent. In the new equilibrium, buyers and sellers share the burden of the tax. The only difference between a tax levied on sellers and a tax levied on buyers is who send the money to the government. In a market with very elastic supply and relatively inelastic demand, sellers are very responsive to changes in the price of the good, whereas buyers are not very responsive. When a taxed is imposed on a market with these elasticities, the price received by sellers does not fall much, so sellers bear only a small burden. The price paid by buyers rises substantially. Indicating that buyers bear most of the burden of the tax. In a market with relatively inelastic supply and very elastic demand, sellers bear most of the burden of the tax. A tax burden falls more heavily on the side of the market that is less elastic because that side of the market cannot respond as easily to the tax by changing the quantity bought or sold. Chapter 7: Welfare economics: the study of how the allocation of resources affects economic well-being In any market, the equilibrium of supply and demand maximizes the total benefits received by all buyers and sellers combined. Willingness to pay: the maximum amount that a buyer will pay for a good. Consumer surplus: the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it. At any quantity, the price given by the demand curve shows the willingness to pay of the marginal buyer, the buyer who would leave the market first if the price were any higher. The demand curve reflects buyer’s willingness to pay. The area below the demand curve and above the price measures the consumer surplus in a market. The difference between this willingness to pay and the market price is each buyer’s consumer surplus. The total area below the demand curve and above the price is the sum of the consumer surplus of al buyers in the market for a good or service. How a lower price raises consumer surplus: First, those buyers who were buying Q1 of the good at the higher price are better off because they now pay less. Second, some new buyers enter the market because they are willing to buy the good at the lower price. Consumer surplus measures the benefit that buyers receive from a good as the buyers themselves perceive it. Cost: the value of everything a seller must give up to produce a good. Willingness to sell: the minimum amount that a seller will sell for the good. Producer surplus: the amount a seller is paid for a good minus the seller’s cost of providing it. The producer surplus is closely related to the supply curve. At any quantity, the price given by the supply curve shows the cost of the marginal seller, the seller who would leave the market first is the price were any lower. The area below the price and above the supply curve measures the producer surplus in a market. The difference between the price and the cost of production is each seller’s producer surplus. The total area is the sum of the producer surplus of all sellers. How a higher price raises producer surplus: First, those sellers who were already selling Q1 of the good at the lower price are better off because they now get more from what they sell. Second, some new sellers enter the market because they are willing to produce the good at higher price, resulting in an increase in the quantity supplied. Total surplus = Value to buyers –Cost to sellers Efficiency: If an allocation of resources maximizes total surplus, we say that the allocation exhibits efficiency. The equilibrium of supply and demand maximizes the sum of consumer and producer surplus. Equality: the property of distributing economic prosperity uniformly among the members of society. Three insights about market outcomes: 1. Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. 2. Free markets allocate the demand for goods to the sellers who can produce them at the lowest cost. 3. Free markets produce the quantity of goods that maximizes the sum of consumer and producer surplus. The equilibrium outcome is an efficient allocation of resources. Chapter 8: Deadweight loss: the fall in total surplus that results from a market distortion (变形), such as a tax. Pure deadweight loss: a loss to buyers and sellers in a market that is not offset by an increase in government revenue. The more responsive buyers and sellers are to changes in the price, the more the equilibrium quantity shrinks. Therefore, the more elastic the demand curve, the larger the deadweight loss of the tax. The deadweight loss of a tax rises even more rapidly that the size of the tax. This occurs because the deadweight loss is the area of a triangle, and the area of a triangle depends on the square of its size. The government’s tax revenue is the size of the tax times the amount of the good sold. Tax revenue first rises with the size of the tax, but as the tax increases further, the market shrinks so much that tax revenue starts to fall.