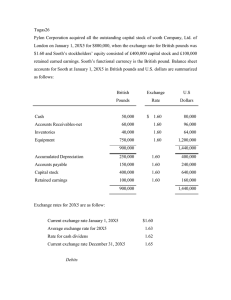

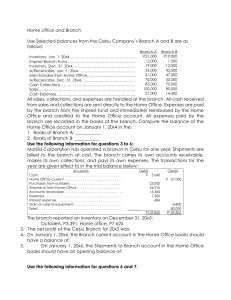

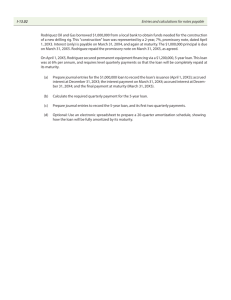

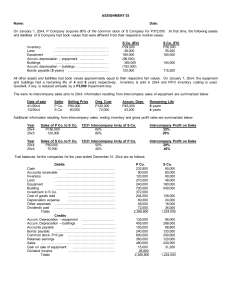

Applied Knowledge Financial Accounting (FA/FFA) Mock Exam 1 – Questions Time allowed: 2 hours This examination is divided into TWO sections: Section A 35 questions, each worth 2 marks 70 marks in total Section B 2 questions, each worth 15 marks 30 marks in total All questions are compulsory ©2023 ACCA. All rights reserved Section A This section of the exam contains 35 questions, each worth 2 marks. This exam section is worth 70 marks in total. All questions are compulsory. 1 Botox receives rent for subletting part of its office premises to a number of tenants. During the year Botox received cash of $378,600 from its tenants. Details of rent in advance and in arrears at the beginning and end of the year are as follows: 20X5 $ 38,400 28,300 Rent received in advance Rent owing by tenants 20X4 $ 34,600 26,900 All rent owing was subsequently received. What figure for rental income should be included in Botox’s profit or loss for the year? $ 2 The following statements relates to goods despatched notes. i) ii) Goods despatched note are completed by the customer on delivery of the product. Goods despatched notes are primarily used to check that the products delivered are the products ordered. Which of the following statement(s) is/are true? A B C D 3 i) only ii) only Both i) and ii) None of the above The plant and equipment at cost account of a business for the year ended 30 June 20X5 was as follows: Plant and equipment – cost 20X4 $ 1 July Balance 576,000 20X5 1 Jan Cash-purchase of plant 384,000 20X4 30 Sept Transfer disposal account 20X5 30 Jun Balance $ 144,000 816,000 ───── ───── ───── ───── 960,000 960,000 The company’s policy is to charge depreciation at 20% per year on the straight line basis, with proportionate depreciation in the years of purchase and disposal. What should be the depreciation charge for the year ended 30 June 20X5? A B C D $163,200 $153,600 $146,400 $132,000 © ACCA. All rights reserved. 2 4 An entity’s draft financial statements for the year ended 30 June 20X5 showed a profit of $91,300. It was later found that $21,000 paid for the purchase of a motor van had been debited to motor expenses account. It is the company’s policy to depreciate motor vans at 20% per year, with a full year’s charge in the year of acquisition. What is the profit for the year after adjusting for this error? $ 5 Carol had receivables of $598,600 at 30 November 20X5. Her loss allowance for receivables at 1 December 20X4 was $12,460 and she wishes to change that to 2% of receivables at 30 November 20X5. On 29 November 20X5 she received $635 in full settlement of a debt that she had written off in the year ended 30 November 20X4. What total amount should be recognised for receivables in the statement of profit of loss for the year ended 30 November 20X5? A B C D 6 $1,123 credit $488 credit $147 debit $11,972 debit Which TWO of the following costs should be included in valuing the inventories of a manufacturing company, according to IAS 2 “Inventories”? Carriage outwards Non-recoverable taxes on purchases Salary of factory supervisor Abnormal amounts of wasted materials 7 The inventory value for the financial statements of Cutie-Q for the year ended 31 December 20X5 was based on an inventory count on 4 January 20X6, which gave a total inventory value of $119,460. Between 31 December and 4 January 20X6, the following transactions had taken place: $ Purchases of goods 1,230 Sales of goods (at 30% mark-up on cost) 1,820 Goods returned by Cutie-Q to supplier 200 What adjusted figure should be included in the financial statements for inventories at 31 December 20X5? A B C D $119,304 $119,704 $119,830 $120,250 © ACCA. All rights reserved. 3 8 Johnsons uses the imprest method of accounting for petty cash. The petty cash was counted and there was $57.22 in hand. The following petty cash slips were found for the following: $ 16.35 12.00 18.23 20.20 Stamps Sale of goods to staff Coffee and tea purchase Birthday cards for staff What is Johnsons’ imprest amount (to two decimal places)? $ 9 The following receivables ledger account prepared by a trainee accountant contains a number of errors: Receivables ledger account $ Opening balance Cash from credit customers Contras against payables 476,230 287,450 7,020 ───── 770,700 ───── $ Credit sales 294,760 Discounts allowed 2,190 Irrecoverable debts written off 18,420 Interest charged on overdue accounts 1,700 Closing balance 453,630 ───── 770,700 ───── At the point of sale, customers are not expected to take advantage of settlement discounts. What should the closing balance on the receivables account be after the errors in it have been corrected? A B C D 10 $442,990 $454,210 $457,610 $471,650 Tulip Co acquired 70% of the voting share capital of Daffodil Co on 1 September 20X4. The following extracts are from the individual statements of profit or loss of the two companies for the year ended 28 February 20X5: Tulip Daffodil $ $ Revenue 61,000 23,000 Cost of sales (42,700) (13,800) ───── ───── Gross profit 18,300 9,200 ───── ───── What should be the consolidated gross profit for the year ended 28 February 20X5? $ © ACCA. All rights reserved. 4 11 The following bank reconciliation statement has been prepared for a company: $ 27,600 11,900 ───── 39,500 18,100 ───── 21,400 ───── Overdraft per bank statement Add: Deposits credited after date Less: Outstanding cheques presented after date Overdraft per cash ledger Assuming the amount of the overdraft per the bank statement of $27,600 is correct, what should be the balance in the cash ledger? A B C D 12 $2,400 overdrawn $21,400 overdrawn as stated $33,800 overdrawn $57,600 overdrawn Which TWO of the following statements concerning intangible non-current assets are true? Intangible assets have no physical form Research costs may be capitalised as intangible non-current assets Development expenditure may be capitalised as intangible non-current assets Intangible assets remain in non-current assets at cost 13 A sole trader fixes his prices by adding 50% to the cost of all goods purchased. On 30 June a fire destroyed a significant amount of inventory and all inventory records. The trading account for the year ended 30 June included the following figures: $ Sales Opening inventory at cost Purchases Closing inventory at cost 340,640 698,080 ─────── 1,038,720 491,020 ─────── Gross profit $ 675,000 547,700 ─────── 127,300 ─────── Using this information, what inventory loss has occurred? A B C D $28,340 $97,700 $146,550 $210,200 © ACCA. All rights reserved. 5 14 A company has an opening inventory balance on 1 January 20X8 of 20 items with a total value of $120. During January the following inventory movements occurred: Date 2 January 20X8 9 January 20X8 16 January 20X8 Description Purchase Issue Purchase Quantity 40 50 40 Unit Price $6.30 $6.50 A cumulative weighted average method of inventory valuation is used. What value will be given to the closing inventory at 31 January 20X8? $ 15 Aubrey made a profit for the year of $345,687 and has closing net assets of $435,195. During the financial year, $40,000 cash and $20,000 in non-current assets were introduced as capital. Drawings of $6,000 were taken out of the business each month. What was the opening balance of net assets? A B C D 16 $768,882 $121,508 $101,508 $35,508 Which TWO of the following statements about qualitative characteristics are correct? Information may be excluded if it is too difficult for certain users to understand Materiality is a fundamental qualitative characteristic Neutral depiction of financial information can influence the decisions of users Consistent measurement, classification and presentation of similar items help to achieve comparability 17 A limited liability company issued 75,000 equity shares of $0.50 each at a premium of $0.25 per share. The cash received was correctly recorded but the full amount was credited to the share capital account. Which of the following journal entries is needed to correct this error? A B C D 18 Debit Share premium account Share capital account Share capital account Share capital account $ 18,750 37,500 18,750 37,500 Credit Share capital account Share premium account Share premium account Cash $ 18,750 37,500 18,750 37,500 Which of the following provides advice to the International Accounting Standards Board (IASB) as well as informing the IASB of the implications of proposed standards for users and preparers of financial statements? A B C D The Standards Advisory Council The Monitoring Board The IFRS Foundation trustees The IFRS Interpretations Committee © ACCA. All rights reserved. 6 19 The statement of financial position of Cartwright, a limited liability company, shows closing retained earnings of $320,568. The statement of profit or loss showed profit of $79,285. Cartwright paid last year’s final dividend of $12,200 during the current year and proposed a dividend of $13,500 at the year end. This had not been approved by the shareholders at the end of the year. What is the opening retained earnings balance? A B C D 20 $241,283 $253,483 $254,783 $387,653 In the year ended 31 October 20X5, Galleon Co purchased non-current assets with a cost of $140,000, financing them partly with a new loan of $120,000. Galleon Co also disposed of non-current assets with a carrying amount of $50,000 making a loss of $3,000. Cash of $18,000 was received from the disposal of investments during the year. What should be Galleon Co’s net cash flow from investing activities according to IAS 7 “Statement of Cash Flows”? A B C D 21 $45,000 $48,000 $69,000 $75,000 In finalising the financial statements of a company for the year ended 30 June 20X5, which TWO of the following material matters should be disclosed as nonadjusting events after the reporting period? A receipt of $295,000 in July 20X5 from a major customer whose debt had been written off in 20X3. The sale in August 20X5 for $350,000 of inventory items included in the statement of financial position at cost, $500,000. A warehouse included in the financial statement at $2,500,000 was seriously damaged by flooding in July 20X5. Warehouse operations were resumed later in August 20X5 but the value of the building had fallen to $1,500,000. The company issued 1,000,000 equity shares of $1 in August 20X5. 22 Are the following disclosures required in the notes to the financial statements, according to IAS 38 “Intangible Assets”? REQUIRED NOT REQUIRED not Impairment losses written off intangible assets during the period The aggregate amount of research and development expenditure recognised as an expense during the period The amortisation methods used A description recognised © ACCA. All rights reserved. of significant intangible assets 7 23 Which TWO of the following statements about goodwill are correct, in accordance with International Financial Reporting Standards? Goodwill represents the future economic benefits arising from assets acquired in a business combination that are not individually identified and separately recognised Goodwill may only be revalued to a figure in excess of cost if there is relevant and reliable evidence to support the revaluation The period over which goodwill is amortised must be disclosed in a note to the financial statements Internally-generated goodwill cannot be recognised as an intangible asset 24 25 Are each of the following a role of the audit committee or a role of the board of directors? AUDIT COMMITTEE BOARD OF DIRECTORS Monitoring of the integrity of the financial statements Presenting a balanced and understandable assessment of the company’s position Reviewing the internal controls and risk management systems Maintaining a sound system of internal control Mo gives his customers a 12-month warranty on their purchases. In the past, 5% of customers have successfully claimed on this warranty. At the end of 20X4, the provision for warranties was $60,000. At the end of 20X5 Mo believes the provision should be $55,000. What is the accounting entry needed to reflect the new provision? A B C D 26 DR Expenses $5,000. CR Provisions $5,000 DR Provisions $5,000. CR Expenses $5,000 DR Expenses $55,000. CR Provisions $55,000 DR Provisions $55,000. CR Other income $55,000 Maxwell received a statement from one of its suppliers, Rica, showing a balance due of $2,650. The amount due according to Maxwell’s payables ledger account for Rica was only $265. Comparison of the statement and the ledger account revealed the following differences: (1) Rica has not allowed for goods returned by Maxwell with a sales value of $265. (2) Maxwell made a contra entry, reducing the amount due to Rica by $1,800, for a balance due from Rica in Maxwell’s receivables ledger. No such entry has been made in Rica’s records. (3) A payment sent by Maxwell for $320 has not been reflected in Rica’s statement. What difference remains between the two companies’ records after adjusting for these items? A B C D $0 $265 $530 $640 © ACCA. All rights reserved. 8 27 Which TWO of the following statements are correct for material items? The nature and amount of all adjusting events after the reporting period must be disclosed in the notes to the financial statements Contingent liabilities are disclosed unless the possibility of loss is remote A contingent asset should be recognised as an asset in the financial statements when the inflow of economic benefits is virtually certain The receipt after the reporting date of a material debt, which had been written-off as irrecoverable, must be disclosed as a non-adjusting event in the notes to the financial statements 28 A company has made a gross profit of $600,000 for the year ended 31 December 20X5, which represented a mark-up of 50%. Opening inventory was $120,000 and closing inventory was $180,000. What was the rate of average inventory turnover (to one decimal place)? times 29 Charles entered into the following transactions: (1) Sale of goods on credit to Cody with a list price of $3,200. He allowed a 10% trade discount and a further 2% discount on the trade price for payment within seven days, Charles expected Cody to take advantage of the discount offered. (2) A credit sale to Mary allowing a 5% trade discount on the list price of $640. How much revenue should be initially recognised as a result of the above transactions? A B C D 30 $3,488 $3,430 $3,424 $3,840 The following information is available for the year ended 31 October 20X5: Property Cost as at 1 November 20X4 Accumulated depreciation as at 1 November 20X4 $ 102,000 (20,400) ───── 81,600 ───── On 1 November 20X4, the company had revalued the property to $150,000. The company’s policy is to charge depreciation on a straight-line basis over 50 years. On revaluation there was no change to the overall useful economic life. It has also chosen not to make an annual transfer of the excess depreciation on revaluation between the revaluation surplus and retained earnings. What should be the balance on the revaluation surplus and the depreciation charge as shown in the financial statements for the year ended 31 October 20X5? A B C D Depreciation charge $ 3,750 3,750 3,000 3,000 © ACCA. All rights reserved. Revaluation surplus $ 68,400 48,000 68,400 48,000 9 31 The following balances have been extracted from Grim’s financial statements for the year ended 31 December 20X5: $000 Inventory 50 Trade receivables 70 Cash at bank 10 Trade payables 88 Interest payable 7 What is Grim’s quick ratio? A B C D 32 33 Are the following statements comparing sole traders and limited liability companies true or false? TRUE FALSE Only companies have capital invested into the business A sole trader’s financial statements are private; a company’s financial statements are sent to shareholders and may be publicly filed A sole trader is fully and personally liable for any losses of the business; a company’s shareholders are not personally liable for any losses of the company Extracts from the financial statements of Miller Co for the year ended 31 October 20X5 are shown below: $000 Revenue 475 Cost of sales (342) ──── Gross profit 133 Expenses (59) Finance cost (26) ──── Profit before tax 48 ──── What is the interest cover ratio for the year ended 31 October 20X5? A B C D 34 0.80 0.84 0.91 1.37 5.12 times 2.85 times 1.85 times 0.35 times Are the following items required to be disclosed in the notes to the financial statements? YES NO (1) Useful lives of assets or depreciation rates used (2) Increases in asset values as a result of revaluations in the period (3) Depreciation expense for the period (4) Reconciliation of carrying amounts of non-current assets at the beginning and end of period © ACCA. All rights reserved. 10 35 Carter Co has non-current assets with a carrying amount of $2,500,000 on 1 December 20X4. During the year ended 30 November 20X5, the following occurred: Depreciation of $75,000 was charged to profit or loss Land and buildings with a carrying amount of $1,200,000 were revalued to $1,700,000 An asset with a carrying amount of $120,000 was disposed of for $150,000. The carrying amount of non-current assets at 30 November 20X5 was $4,200,000. What amount should be shown for the purchase of non-current assets in the statement of cash flows for the year ended 30 November 20X5? $ 000 (70 marks) © ACCA. All rights reserved. 11 Section B This section of the exam contains 2 questions, each worth 15 marks. This exam section is worth 30 marks in total. Both questions are compulsory 36 Background Petrotrest purchased 55% of the equity share capital of Sputnik on 1 September 20X2 when the reserves of Sputnik were $632,000. At 31 August 20X5 the two companies have the following statements of financial position: Petrotrest Sputnik Assets Non-current assets, at carrying amount Property, plant and equipment Investment: Shares in Sputnik at cost Current assets Total assets Equity and liabilities Equity share capital ($1 shares) Retained earnings Current liabilities Total equity and liabilities $000 $000 16,056 6,120 14,238 ───── 36,414 ───── 3,672 5,364 ───── 9,036 ───── 21,420 6,570 ───── 27,990 8,424 ───── 36,414 ───── 5,200 1,550 ───── 6,750 2,286 ───── 9,036 ───── Additional information: On acquisition the fair value of Sputnik’s land was $600,000; on that date the carrying amount of land was $500,000. At 31 August 20X5 the fair value of Sputnik’s land had increased by a further $50,000. Petrotrest applies the cost model of IAS 16 Property, Plant and Equipment to all its noncurrent assets. Non-controlling interest is valued at fair value; the share price of one Sputnik share can be taken to give fair value. On acquisition the market price of one Sputnik share was $2.10, and as at 31 August 20X5 the market price of one Sputnik share is $2.70. © ACCA. All rights reserved. 12 Task 1 12 marks Use the information above to complete the following financial statement: Statement of financial position as at 31 August 20X5 Statement of financial position for the year ended 31 August 20X5 Consolidated statement of financial position at 31 August 20X5 Consolidated statement of financial position for the year ended 31 August 20X5 $000 Non-current assets Property, plant and equipment Goodwill Cost + Non-controlling interest Cost – Net assets on acquisition Cost + Non-controlling interest – Net assets on acquisition Cost + Non-controlling interest – Net assets at the reporting date Investment: Shares in Sputnik Current assets ______ Total assets ______ Equity and liabilities Share capital Retained earnings Revaluation surplus 0 50 55 83 100 150 ______ Non-controlling interest (45% × 5,200 × $2.10) (45% × 5,200 × $2.10) + (45% × 1,550) (45% × 5,200 × $2.10) + (45% × (1,550 – 632)) (45% × 5,200 × $2.70) + (45% × (1,550 – 632)) ______ Total equity Current liabilities ______ Total equity and liabilities ______ © ACCA. All rights reserved. 13 Task 2 1 mark Are the following statements regarding the method of accounting for investments true or false? TRUE FALSE Subsidiaries are consolidated in full Associates are equity accounted Task 3 2 marks On 1 September 20X6 Petrotrest acquired 75% of the equity shares of Samara through a 3-for-4 share-for-share exchange. Samara had 200,000 shares of $0.50 each in issue. On the date of acquisition the share price of one share in Samara was $2 and the share price of one share in Petrotrest was $2.40. What was the fair value of the consideration transferred? $ © ACCA. All rights reserved. 000 14 37 Background McMoy Co, a limited liability company, has an accounting year end of 31 August. The accountant is preparing the financial statements as at 31 August 20X5. A trial balance has been extracted. Task 1 5 marks Do each of the following items belong on the Statement of Financial Position (SOFP) as at 31 August 20X5? Account $000 Equity shares ($0.50 each) 8% redeemable preference shares ($1 each) Land and buildings at cost Fixtures and fittings – cost – depreciation at 1 September 20X4 Motor vehicles – cost – depreciation at 1 September 20X4 Revenue Purchases Inventory at 1 September 20X4 10% Loan notes (repayable 20Y8) Share premium Retained earnings 1 September 20X4 Interest paid Distribution costs Administration expenses Trade receivables Allowance for trade receivables at 1 September 20X4 Trade payables Balance at bank The following further information is available: 3,420 80 64 2,480 496 Belongs on SOFP 2,000 500 55 24 4,410 700 230 182 35 654 714 400 48 ──── 8,391 ──── (1) Inventory at 31 August 20X5 amounted to $507,000. (2) Depreciation is to be charged at 20% per annum as follows: $000 15 275 [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] [YES/NO] ──── 8,391 ──── fixtures and fittings – on a straight line basis (an administration expense); motor vehicles – on a reducing balance basis (a distribution expense). (3) Distribution wages totalling $8,000 were unpaid at 31 August 20X5. (4) Office supplies (stationery, etc) amounted to $14,000 on 31 August 20X5. (5) The loss allowance for trade receivables (an administrative expense) should be 5% of amounts owed by customers. (6) The preference dividend and an ordinary dividend of $0.05 per share were declared on 29 August 20X5. (7) Provision should be made for the current year’s income tax expense of $105,000. (8) The loan notes were issued during 20X3. © ACCA. All rights reserved. 15 Task 2 6 marks Using the information above, calculate the following amounts for the statement of profit or loss of McMoy Co for the year ended 31 August 20X5, in accordance with IAS 1 Presentation of Financial Statements. Cost of sales $ Distribution costs $ Administration expenses $ Finance costs $ Task 3 2 marks Complete the following: The amount that should be shown for total current liabilities in the statement of financial position of McMoy Co as at 31 August 20X5 is $ 000. Task 4 2 marks Should each of the following items be included in a statement of changes in equity of a limited liability company in accordance with IAS 1 Presentation of Financial Statements? YES NO Gain on disposal of a revalued asset Issue of equity share capital Dividend on equity shares Dividend on redeemable preference shares Redemption of preference shares Revaluation surplus Share of profit of associates Transfer to retained earnings End of Questions © ACCA. All rights reserved. 16