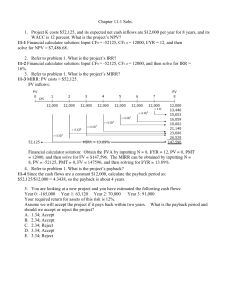

Q1/ Basics of Capital Investment (Ignore Taxes for this Exercise.) Kenn Day, manager of Day Laboratory, is investigating the possibility of acquiring some new test equipment. To acquire the equipment requires an initial outlay of $300,000. To raise the capital, Kenn will sell stock valued at $200,000 (the stock pays dividends of $24,000 per year) and borrow $100,000. The loan for $100,000 would carry an interest rate of 6 percent. Kenn estimates that the new test equipment will produce a cash inflow of $50,000 per year. Kenn expects the equipment to last for 20 years. Required 1. Compute the weighted cost of capital. 2. Compute the payback period. 3. Assuming that depreciation is $14,000 per year, compute the accounting rate of return (on total investment). 4. Compute the NPV of the test equipment. 5. Compute the IRR of the test equipment. 6. Should Kenn buy the equipment? Solution 1. weighted cost of capital= (2/3 * 0.12) + (1/3 * 0.06)= %10 2. payback period = $300,000/$50,000= 6 year. 3. ARR = ($50,000 -$14,000)/$300,000= %12. 4. From Exhibit 20B-2, the discount factor for an annuity with i at 10 percent and n at 20 years is 8.514. NPV = (8.514 * $50,000) - $300,000= $125,700. 5. The discount factor associated with the IRR is 6.00 df = I / CF = $300000 / $50000 = 6 From Exhibit 20B-2, the IRR is between 14 and 16 percent (using the row corresponding to period 20). 6. Since the NPV is positive and the IRR is greater than Kenn’s cost of capital, the test equipment is a sound investment. This, of course, assumes that the cash flow projections are accurate. Q 2/ Each of the following parts is independent. Assume all cash flows are after-tax cash flows. 1. Kaylin Hansen has just invested $200,000 in a book and video store. She expects to receive a cash income of $60,000 per year from the investment. What is the payback period for Kaylin? 2. Kambry Day has just invested $500,000 in a new biomedical technology. She expects to receive the following cash flows over the next five years: $125,000, $175,000, $250,000, $150,000, and $100,000. What is the payback period? 3. Emily Nabors invested in a project that has a payback period of 3 years. The project brings in $120,000 per year. How much did Emily invest in the project? 4. Joseph Booth invested $250,000 in a project that pays him an even amount per year for five years. The payback period is 2.5 years. How much cash does Joseph receive each year? Solution 1. Payback period = $200,000/$60,000 = 3.33 years 2. Payback period: $125,000 1.0 year 175,000 1.0 year 200,000 0.8 year $500,000 2.8 years 3. Investment = annual cash flow × payback period = $120,000 × 3 = $360,000 4. Annual cash flow = Investment/payback period = $250,000/2.5 = $100,000 per year Q3/ Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Jeffrey Akea has purchased a tractor for $62,500. He expects to receive a net cash flow of $15,625 per year from the investment. What is the payback period for Don? 2. Roger Webb invested $600,000 in a laundromat. The facility has a 10-year life expectancy with no expected salvage value. The laundromat will produce a net cash flow of $180,000 per year. What is the accounting rate of return? Use original investment for the computation. 3. Aiddy Markus has purchased a business building for $700,000. She expects to receive the following cash flows over a 10-year period: Year 1: $87,500 Year 2: $122,500 Years 3–10: $175,000 What is the payback period for Aiddy? What is the accounting rate of return (using average investment and assuming straight-line depreciation over the 10 years)? Solution: 1. Payback period = Original investment/Annual cash flow 4 = 62500 / 15625 2. Accounting rate of return = Average income/Original investment 30% = 180000 / 600000 3. Payback period =87500+122500+175000+175000+140000 = $700000 Payback period = 1 +1 +1 + 1 + 0.8 = 4.8 years Accounting rate of return = Average income/Average investment Average investment = (I + S) / 2 = 700000 / 2 = $350000 Cash Flows = 87500 + 122500 + (175000 * 8) = $1610000 Average Cash Flow = 1610000 / 10 = $161000 Average depreciation = 700000 / 10 = $70000 Average income = 161000 – 70000 = $91000 Accounting rate of return = 91000 / 350000 = %26 Q 4/ Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Tada Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be $1,000,000 per year. The system costs $6,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. Should the company buy the new system? 2. Lehi Henderson has just invested $1,350,000 in a restaurant specializing in Italian food. He expects to receive $217,350 per year for the next eight years. His cost of capital is 5.5 percent. Compute the internal rate of return. Did Lehi make a good decision? Solution 1. Year Cash Flow Present Value 0 ($6000000) (6000000) 1-8 $1000000 5335000 NPV Analysis Discount Factor 1.000 5. 335 - ------------(665000) The company should not buy the system 2. df = I/CF= 6.211 IRR = %6 Lehi make a good decision Q 5/ The following data pertain to an investment project: Investment required ........... $34,055 Annual savings .................. $5,000 Life of the project .............. 15 years The internal rate of return is: A) 12% B) 14% C) 10% D) 8% Answer: A Q 6/ James Company is considering buying a new machine costing $30,000. James estimates that the machine will save $6,900 per year in cash operating expenses for the next six years. If the machine has no salvage value at the end of six years and the discount rate used by James is 8%, then the machine's internal rate of return is closest to: A) 8% B) 10% C) 12% D) 14% Answer: B