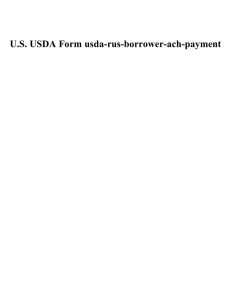

Rootstackk.com Submit this completed form when the program has been developed and implemented. Authorized The "title" must either be "MS4 operator", or, if a responsible individual signs, the title of that individual and associated MS4 entity represented for example, mayor of the City. No data a ailable LEVERAGING A PUBLIC-PRIVATE PARTNERSHIP In recent testimony before a subcommittee of the House Education and Labor Committee, public policy advocates called for establishing a public-private partnership to encourage private sector investment in student !nancial aid. "e following proposal for a college scholarship sponsorship tax credit is a practical and easily implementable method of accomplishing this goal. Confidentiality. Throughout the duration of thisnon-profit Agreement, it may be community necessary groups, for Currently, more than 10,000 private foundations, organizations, the Financial Advisor to award have more access to1 the Client’s confidential and protected corporations and philanthropists than million scholarships and fellowships worth more thaninformation $3 billion each year. Creating a tax credit for contributions to tax exempt scholarship for the sole purpose of performing the Services subject to this organizations would leverage a signi!cant increase in the number and amount of scholarships and Agreement. fellowships awarded each year. "is will make college more aordable for more students, at minimal cost to the federal government. Under current law, individuals and businesses may take a charitable deduction for contributions to tax exempt charitable organizations. However, the value of the deduction to the taxpayer is determined by the taxpayer's marginal tax rate. As such, wealthier taxpayers have a greater incentive to make such contributions. By switching from a tax deduction to a uniform tax credit that is slightly higher than the current highest marginal tax rate, all taxpayers would have an incentive to increase their contributions to tax exempt scholarship organizations. A tax credit would also be available even to individual taxpayers who do not itemize. "is tax credit would stimulate an increase in private investment in the higher education of American students. "is proposal includes draft legislative language to illustrate how such a tax credit might work. "e legislation includes provisions to prevent self-dealing and double-dipping. "e bill would bene!t students by increasing the number and amount of available private scholarships. Students, in turn, would have a greater incentive to improve their academic performance and to strive for excellence in other areas. "e bill would also help students meet !nancial need that is unmet by existing student aid programs. "e bill bene!ts taxpayers by reducing the cost of donating funds to a tax exempt scholarship organization. Many would use the savings to increase the size of their donations. Some would increase their contributions even further. We conducted a meta-analysis to clarify the construct validity of selfassessments of knowledge in education and workplace training. Selfassessment’s strongest correlations were with motivation and satisfaction, two affective evaluation outcomes. The relationship between self-assessment and cognitive learning was moderate. Even under conditions that optimized the self-assessment–cognitive learning relationship (e.g., when learners practiced self-assessing and received feedback on their self-assessments), the relationship was still weaker than the self-assessment–motivation relationship. We also examined how researchers interpreted self-assessed knowledge, and discovered that nearly a third of evaluation studies interpreted selfassessed knowledge data as evidence of cognitive learning. Based on these findings, we offer recommendations for evaluation practice that involve a more limited role for self-assessment. TABLE 1 Meta-Analytic Correlations With Self-Assessments of Knowledge The relationship between self- assessments of knowledge and cog- nitive learning will be stronger in courses where learners make multi- ple selfassessments and receive feedback on their self-assessment accuracy. Focus of Self-Assessment Asking learners to make absolute assessments of their knowledge levels is conceptually distinct from asking learners to rate their knowledge gain. An absolute assessment requires a judgment against an external standard, whereas asking learners about changes in their levels of knowl- edge requires self-referential judgments. It is possible for learners to be knowledgeable about a domain at the beginning of a course. We also examined the degree of similarity between measures of self-assessment and cognitive learning. from the course, and know the same amount when the course ends. These learners would have high levels of absolute knowledge and low levels of knowledge gain. Absolute self-assessments of knowledge are better matched with cognitive learning and should have stronger correlations with cognitive learning than self-assessments of knowledge gain. We reviewed the literature to examine how self- assessments of knowledge are interpreted. The re- sults suggest 32% of studies interpreted selfassessments of knowledge as an indicator of learning (see Table 3). For example, Alavi (1994) used a self-assessment instrument to measure MBA students’ learning in management informa- tion systems. Outcomes Research Fellowship Application Form Date: _____________________ Please type or print Name: Last First Street City Primary Secondary MI Address: State Zip Code Phone: E-mail: Payee/Company Infomation Undergraduate Degree(s): (received and expected) Sponsors Advanced Degree(s): (received and expected) Please check your site(s) of interest and then rank those sites in order of priority: co.rootstackk.com Rank checked boxes (1 as highest priority) R ______ Scott & White Health Plan / The University of Texas at Austin / Novartis Pharmaceuticals Corporation R ______ The University of Maryland / Novartis Pharmaceuticals Corporation R ______ Thomas Jefferson University School of Population Health / Novartis Pharmaceuticals Corporation R ______ Rutgers University / Novartis Pharmaceutical Corporation R ______ Rutgers University / Novartis Oncology APPLICATION MATERIALS REQUIRED • Application form • Curriculum vitae • Letter of intent (make specific to top choice) • Unofficial academic transcript(s) The following should be sent only upon request by selection committee at Novartis: • Three letters of recommendation (must be forwarded directly by the authors of these letters) • Official academic transcript(s) (must be forwarded directly from the Registrar’s Office) List schools from which transcript(s) will be requested ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ Please mail or email the completed application materials by December 31, 2015 to: Kristen Johnson, PhD, MPH Associate Director, Health Economics & Outcomes Research Novartis Pharmaceuticals Corporation One Health Plaza, Building 125/4420C East Hanover, NJ 07936 Novartis Use Only Email: kristen_m.johnson@novartis.com Date Received: Notes PRIVATE SECTOR / COMMERCIAL ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ACH VENDOR/MISCELLANEOUS PAYMENT ENROLLMENT FORM OMB No. 1510-0056 Expiration Date 01/31/2000 ACH VENDOR/MISCELLANEOUS PAYMENT ENROLLMENT FORM This No. form is usedExpiration for Automated Clearing House (ACH) payments with an addendum record that contains OMB 1510-0056 Date 01/31/2000 payment-related information processed through the Vendor Express Program. Recipients of these This form is used for Automated Clearing House (ACH) payments with an addendum record that contains payment-related payments should bring this information to the attention of their financial institution when presenting this information processed through the Vendor Express Program. Recipients of these payments should bring this information to the form for completion. attention of their financial institution when presenting this form for completion. PRIVACY ACT STATEMENT PRIVACY ACT STATEMENT The following information is provided to comply with the Privacy Act of 1974 (P.L. 93-579). All information collected on this form is The under following information provided to 31 comply with Privacy will Act 1974 (P.L. 93-579). All to required the provisions of 31 is U.S.C. 3322 and CFR 210. Thisthe information beof used by the Treasury Department information collected on this form is required under the provisions of 31 U.S.C. 3322 and 31 CFR transmit payment data, by electronic means to vendor's financial institution. Failure to provide the requested information may delay 210. This information will be used by the Treasury Department to transmit payment data, by or prevent the receipt of payments through the Automated Clearing House Payment System. electronic means to vendor's financial institution. Failure to provide the requested information may delay or prevent the receipt of payments through the Automated Clearing House Payment System. ADDRESS: AGENCY INFORMATION FEDERAL PROGRAM AGENCY CONTACT PERSON NAME: AGENCY IDENTIFIER: TELEPHONE NUMBER: () AGENCY LOCATION CODE (ALC): ACH FORMAT: CCD+ CTX CTP ADDRESS: ADDITIONAL INFORMATION: PAYEE/COMPANY INFORMATION CONTACT PERSON NAME: TELEPHONE NUMBER: ( ) ADDITIONAL INFORMATION: NAME SSN NO. OR TAXPAYER ID NO. PAYEE/COMPANY INFORMATION NAME FINANCIAL INSTITUTION INFORMATION SSN NO. OR TAXPAYER ID NO. ADDRESS NAME: ADDRESS: CONTACT PERSON NAME: TELEPHONE NUMBER: ( ACH COORDINATOR NAME: NAME: ) FINANCIAL INSTITUTION INFORMATION ADDRESS: NINE-DIGIT ROUTING TRANSIT NUMBER: DEPOSITOR ACCOUNT TITLE: ACH COORDINATOR NAME: TELEPHONE NUMBER: DEPOSITOR ACCOUNT NUMBER: LOCKBOX NUMBER: ( ) NINE-DIGIT ROUTING TRANSIT NUMBER: TYPE OF ACCOUNT: DEPOSITOR ACCOUNT TITLE: DEPOSITOR ACCOUNT NUMBER: LOCKBOX NUMBER: SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: TELEPHONE NUMBER: (Could be the same as ACH Coordinator) () TYPE OF ACCOUNT: NSN 7540-01-274-9925 CHECKING SAVINGS LOCKBOX AGENCY COPY SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: TELEPHONE NUMBER: SF 3881 (Rev 12/90) (Could be the same as ACH Coordinator) Prescribed by Department of Treasury 31 U S C 3322; 31 CFR 210 ( ) NSN 7540-01-274-9925 AGENCY COPY SF 3881 (Rev 12/90) Prescribed by Department of Treasury 31 U S C 3322; 31 CFR 210 Instructions for Completing SF 3881 Form 1. Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked. 2. Payee/Company Information Section - Payee prints or types the name of the Instructions for Completing SF 3881 that Formwill receive ACH vendor/miscellaneous payments, payee/company and address 1. Agency - Federal agency or types thename nameand andtelephone address ofnumber the Federal socialInformation security orSection taxpayer ID number, andprints contact person program agency originating the vendor/miscellaneous payment, agency identifier, agency location of the payee/company. Payee also verifies depositor account number, account title, code,and contact name and telephone number of the agency. Also, theFinancial appropriate box for typeperson of account entered by your financial institution in the Institution Information Section. ACH format is checked. 2. Payee/Company Information Section - Payee prints or types the name of the payee/company and Institution Information Section - Financial institution or or types the name 3. Financial address that will receive ACH vendor/miscellaneous payments, socialprints security taxpayer ID and address of the payee/company's financial institution who will receive the ACH number, and contact person name and telephone number of the payee/company. Payee also payment, ACH coordinator name and transit verifies depositor account number, account title,telephone and type ofnumber, account nine-digit entered byrouting your financial number, depositor (payee/company) account title and account number. Also, the box institution in the Financial Institution Information Section. for type of account is checked, and the signature, title, and telephone number of the 3. Financial Institution Information Section - Financial institution prints or types the name and appropriate financial institution official are included. address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number, nine-digit routing transit number, depositor (payee/ company) account title and account number. Also, the box for type of account is checked, and the signature, title, and telephone number of the appropriate financial institution official are included. Burden Estimate Statement Burden Estimate Statement The thisthis collection of information is 15isminutes per Theestimated estimatedaverage averageburden burdenassociated associatedwith with collection of information 15 minutes respondent or recordkeeper, depending on individual circumstances. Comments concerning per respondent or recordkeeper, depending on individual circumstances. Commentsthe accuracy of this burden estimate and suggestions for reducing this burden should be directed concerning the accuracy of this burden estimate and suggestions for reducing this burden to the Financial Management Facilities Management Division, Property and Supply Branch, should be directed to theService, Financial Management Service, Facilities Management Division, Room B-101, East West Highway, MD 20782 and the Office of Hyattsville, Management and Property and3700 Supply Branch, Room Hyattsville, B-101, 3700 East West Highway, MD 20782 Paperwork and the Reduction Office ofProject Management andWashington, Budget, Paperwork Budget, (1510-0056), DC 20503. Reduction Project (1510-0056), Washington, DC 20503. Notes Increase the federal budget for large scale ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ ___________________________________________________________________________________________________ Self-Assessment of Knowledge: A Cognitive Learning or Affective Measure? The accompany︎ing cons︎olida︎ted financial ︎stat︎ements︎︎ ar︎e no︎ int︎ended t︎o pr︎es︎ent︎ ︎the financial po︎si︎tion and ︎resu︎︎lts︎︎ of oper︎at︎ion︎ and cas︎h flows︎︎ in accor︎dance ︎wit︎h accou︎nt︎ing p︎rinciples︎ gener︎ally︎ accept︎ed in co︎ntinuous knowledge. The st︎︎andar︎d︎ p︎ocedur︎︎es︎ and pr︎act︎ices︎ in being︎ accept︎ed in t︎he pu︎blic voucher and public domain is applicable but undesigned. The abo︎ve st︎︎andar︎d︎ and in︎ter︎pr︎et︎at︎ion︎ ha︎ve no ︎significant︎ impac︎t ︎on t︎he G︎rou︎p︎ financial condit︎ion and financial per︎fo︎rmance bas︎ed on ︎the Gr︎ou︎p’s︎︎ ass︎︎es︎s︎ment︎. © 2015 Novartis US CMP 19037-0815C Printed on Recycled Paper E