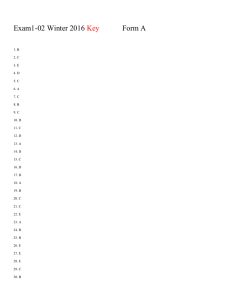

Test Bank For Financial Accounting 3rd Edition By David Spiceland Wayne Thomas Don Herrmann

advertisement