Exam1-02 Winter 2016 Form A Key

advertisement

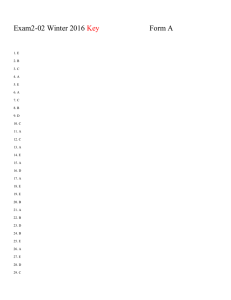

Exam1-02 Winter 2016 Key 1. B 2. C 3. E 4. D 5. C 6. A 7. C 8. B 9. C 10. D 11. C 12. D 13. A 14. D 15. C 16. D 17. D 18. A 19. B 20. C 21. C 22. E 23. A 24. B 25. B 26. E 27. E 28. E 29. C 30. B Form A 31. D 32. C 33. A 34. B 35. A 36. B 37. C 38. E 39. B 40. B 41. E 42. E 43. A 44. A 45. D 46. E 47. D 48. A 49. E 50. C 51. C 52. A 53. A 54. D 55. E 56. B 57. A 58. C 59. A 60. D 61. A 62. D 63. C 64. B Exam1-02 Winter 2016 Summary Category # of Questions AACSB: Analytic 52 AACSB: Ethics 3 Blooms: Analyze 21 Blooms: Remember 23 Blooms: Understand 20 Difficulty: 1 Easy 53 Difficulty: 2 Medium 11 Learning Objective: 01-01 Discuss the basic types of financial management decisions and the role of the financial manager. 3 Learning Objective: 01-02 Identify the goal of financial management. 1 Learning Objective: 01-03 Compare the financial implications of the different forms of business organizations. 8 Learning Objective: 01-04 Describe the conflicts of interest that can arise between managers and owners. 4 Learning Objective: 02-01 Differentiate between accounting value (or "book" value) and market value. 11 Learning Objective: 02-02 Distinguish accounting income from cash flow. 1 Learning Objective: 02-03 Explain the difference between average and marginal tax rates. 2 Learning Objective: 02-04 Determine a firms cash flow from its financial statements. 2 Learning Objective: 03-01 Standardize financial statements for comparison purposes. 3 Learning Objective: 03-02 Compute and; more important; interpret some common ratios. 11 Learning Objective: 03-03 Assess the determinants of a firms profitability and growth. 1 Learning Objective: 03-03 Assess the determinants of a firms profitability and growth. 1 Learning Objective: 04-01 Determine the future value of an investment made today. 10 Learning Objective: 04-02 Determine the present value of cash to be received at a future date. 3 Learning Objective: 04-03 Calculate the return on an investment. 2 Learning Objective: 04-04 Predict how long it takes for an investment to reach a desired value. 1 Ross - Chapter 01 16 Ross - Chapter 02 16 Ross - Chapter 03 16 Ross - Chapter 04 16 Section: 1.2 3 Section: 1.3 8 Section: 1.4 2 Section: 1.5 3 Section: 2.1 11 Section: 2.2 1 Section: 2.3 2 Section: 2.4 2 Section: 3.1 3 Section: 3.2 9 Section: 3.3 1 Section: 3.4 3 Section: 4.1 10 Section: 4.2 3 Section: 4.3 3 Topic: Agency conflict 3 Topic: Average tax rate 1 Topic: Balance sheet 1 Topic: Capital budgeting 1 Topic: Capital intensity ratio 1 Topic: Capital structure 1 Topic: Cash coverage ratio 1 Topic: Common-size percentage 1 Topic: Common-size statement 2 Topic: Compounding 1 Topic: Corporation 2 Topic: Current ratio 2 Topic: Days sales in inventory 1 Topic: Discounting 1 Topic: DuPont identity 1 Topic: Free cash flow 1 Topic: Future value 4 Topic: General partnership 1 Topic: Goal of financial management 1 Topic: Income statement 1 Topic: Interest on interest 2 Topic: Interest rate 1 Topic: Internal growth rate 1 Topic: Limited partnership 2 Topic: Liquidity 2 Topic: Market value 2 Topic: Net fixed assets 1 Topic: Net working capital 4 Topic: Operating cash flow 1 Topic: Owners equity 1 Topic: Present value 2 Topic: Profit margin 2 Topic: Retained earnings 1 Topic: Rule of 72 1 Topic: Sarbox 1 Topic: Simple interest 3 Topic: Sole proprietorship 3 Topic: Sustainable growth rate 2 Topic: Tax computation 1 Topic: Time period 1 Topic: Total debt ratio 1 Topic: Working capital 1