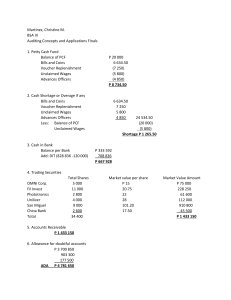

Financial Freedom community Unclaimed investments in India: Reclaim your lost money today! Discover how millions of rupees in shares, mutual funds, and more are waiting to be claimed. Hey FinFam, today let’s talk about something that might surprise you – unclaimed investments! Did you know that over Rs 25,000 crore worth of shares are lying unclaimed in India as of March 2023? That’s a lot of money just waiting to be reclaimed! Unclaimed investments: A hidden challenge Ever wondered why investments remain unclaimed? Here are some top reasons why there is a huge heap of unclaimed money! Lack of Awareness Address Changes Many of us aren’t aware of the importance of keeping our contact details updated. Moving homes or changing contact details can lead to lost connections. Inoperative Accounts Succession Issues Forgotten bank or Demat accounts linked to investments can remain unclaimed. Not planning for the future or informing nominees can leave investments in limbo. Physical Certificates Holding onto old physical share certificates? They may be preventing you from claiming your dividends. Unclaimed investments by category Mutual Funds Insurance Over Rs 35,000 crore lies unclaimed in mutual funds alone. It’s time to check if any of it belongs to you. There’s a significant amount unclaimed in life insurance and endowment benefits, waiting to be rediscovered. Provident Fund Bank Deposits An estimated Rs 48,000 crore lies unclaimed with the EPFO. Is any of it yours? Unclaimed bank deposits in India exceed Rs 62,000 crore. Your money might be sitting in an inactive account. UNCLAIMED INVESTMENTS Category Amount (₹ Crore) Stocks ₹25,000/- Mutual Funds ₹35,000/- Life Insurance (with LIC) ₹21,500/- Employees Provident Fund ₹48,000/- Bank Deposits ₹63,000/- Source: IEPF, AMFI, LIC, EPFO and RBI Recovery process If you've found yourself wondering how to reclaim your unclaimed investments, we’ve got you covered! Here’s a step-by-step guide to get back what’s rightfully yours: Identify your unclaimed assets Gather your documents First, identify which investments are unclaimed, such as shares, mutual funds, provident funds, and insurance policies. Collect and verify documents like identity proof, address proof, and investment statements to prove ownership. Contact the relevant authorities Submit your claim Contact relevant authorities or companies based on your investment type, such as RoC for shares, mutual fund houses, insurance companies, or EPFO for provident funds. Once you've gathered your documents and contacted the authorities, submit your claim by filling out forms, providing copies, and verifying them. Let’s face it, the process can be a bit of a headache. But don’t worry, there are firms out there ready to help you recover your unclaimed investments. They'll identify your assets, collect and verify your documents, and manage the claim process for you! Takeaway: Don’t let your money go unclaimed. Take action today to reclaim what’s rightfully yours. Check for unclaimed investments and give your finances the attention they deserve.