Duty Drawback: Significance & Mechanisms in International Trade

advertisement

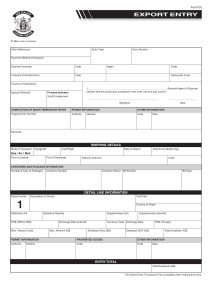

Title: Maximizing Trade Benefits: Exploring the Significance and Mechanisms of Duty Drawback Introduction: In the dynamic landscape of international trade, duty drawback stands as a significant mechanism offering economic advantages to businesses engaged in both import and export activities. This essay delves into the multifaceted concept of duty drawback, elucidating its types, mechanisms, benefits, and implications on global trade dynamics. Understanding Duty Drawback: Duty drawback refers to the refund of certain duties, taxes, and fees paid on imported goods when those goods are subsequently exported. It serves as a mechanism to promote exports, enhance competitiveness, and stimulate economic growth by alleviating the burden of double taxation on businesses engaged in cross-border trade. Duty drawback programs vary across nations, each designed to address the specific needs and priorities of their economies. Types of Duty Drawback: Duty drawback programs encompass various types, each tailored to different scenarios encountered in international trade: 1. Manufacturing Direct Identification Drawback: This type of drawback entails the refund of import duties on materials used in manufacturing products subsequently exported. It requires meticulous tracking of duty-paid imported materials throughout the production process. 2. Manufacturing Substitution Drawback: Here, duties are refunded when domestically sourced materials, identical in kind and quality to imported duty-paid materials, are used in manufacturing exported goods. This facilitates flexibility in sourcing while still benefiting from duty refunds. 3. Unused Merchandise Direct Identification Drawback: Import duties are refunded when unused imported goods are later exported. Similar to manufacturing drawback, it necessitates tracking the imported materials from importation to exportation. 4. Unused Merchandise Substitution Drawback: This type allows for the refund of duties on exported goods made from domestically sourced materials that are interchangeable with the imported duty-paid materials. It offers flexibility in material utilization while still availing duty benefits. 5. Rejected Merchandise Drawback: Businesses can claim drawback on imported goods that are later exported due to non-conformance, shipment without consent, or determined defects upon importation. This type addresses instances of rejected or unsuitable imports, ensuring businesses do not bear unnecessary financial burdens. Benefits of Duty Drawback: The implementation of duty drawback programs yields several benefits for businesses and economies: 1. Cost Savings: Duty drawback enables businesses to recover import duties, thereby reducing production costs and enhancing competitiveness in global markets. 2. Promoting Exports: By incentivizing exports through duty refunds, drawback programs stimulate trade activity, leading to increased export volumes and revenue generation. 3. Supply Chain Optimization: Manufacturing drawback and substitution drawback allow businesses to optimize their supply chains by sourcing materials competitively while still benefiting from duty refunds. 4. Economic Growth: Duty drawback contributes to economic growth by fostering a conducive environment for international trade, attracting foreign investment, and generating employment opportunities. 5. Compliance and Risk Mitigation: Drawback programs encourage compliance with trade regulations and mitigate the risk of customs violations by providing clear guidelines for duty refunds. Implications on Global Trade Dynamics: The widespread adoption of duty drawback programs has significant implications on global trade dynamics: 1. Competitiveness: Nations with robust duty drawback mechanisms enhance the competitiveness of their domestic industries in international markets, influencing trade patterns and market shares. 2. Trade Balances: Duty drawback programs impact trade balances by incentivizing exports and influencing import decisions, thereby shaping the overall trade dynamics between nations. 3. Trade Negotiations: Duty drawback provisions often feature prominently in trade negotiations and agreements, reflecting their importance in facilitating fair and equitable trade relations between nations. 4. Supply Chain Integration: Duty drawback encourages supply chain integration by promoting seamless movement of goods across borders and facilitating global production networks. Conclusion: In conclusion, duty drawback emerges as a pivotal instrument in the realm of international trade, offering a plethora of benefits to businesses, economies, and global trade dynamics. Its diverse types and mechanisms cater to the varying needs of businesses engaged in cross-border trade, fostering competitiveness, promoting exports, and driving economic growth. As nations continue to navigate the complexities of global trade, duty drawback remains an indispensable tool for maximizing trade benefits and fostering sustainable economic development.