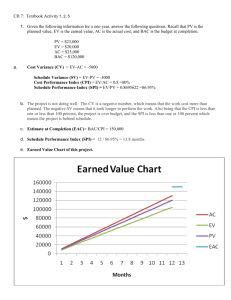

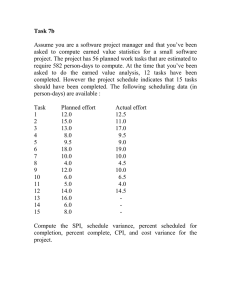

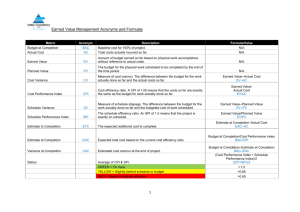

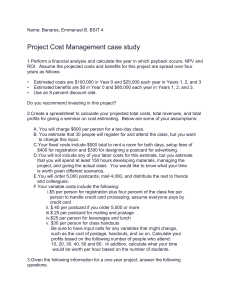

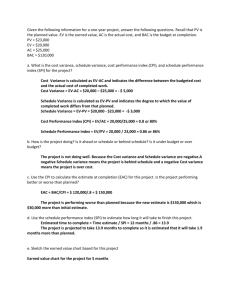

Exam practice Chapter 1 1.1 - 75000 + 20000/1.2 + 25000/(1.2^2) + 30000/(1.2^3) + 50000/(1.2^4) = 501.54 A = 20 + 40 + 20 + 30 + 20 + 25 + 10 = 165 B = 40 + 60 + 10 + 30 + 10 + 50 + 10 = 210 C = 60 + 20 + 30 + 20 + 10 + 75 + 10 = 225 -65000 + 20000/1.2 + 25000/(1.2^2) + 30000/(1.2^3) + 35000/(1.2^4) = 3267.75 DPI = NPV / Io = 3267.75 / 65000 = 0.05 Exercise 4.1 4.1: Your firm designs PowerPoint slides for computer training classes, and you have just received a request to bid on a special project to produce the slides for an 8‐session class. From previous experience, you know that your firm follows an 85 percent learning rate. For this contract it appears the effort will be substantial, running 50 hours for the first session. Your firm bills at the rate of $100/hour and the overhead is expected to run a fixed $600 per session. The customer will pay you a flat fixed rate per session. If your nominal profit margin is 20 percent, what will be the total bid price, the per session price, and at what session will you break even? 𝑇𝑛 = 𝑇1𝑛𝑟 R = log(0.85)/log(2) = -0.23446525363 Session 1 = 50 Session 2 = 50 * 1^ -0.23446525363 = 42.5 Session 3 = 38.6457418352 4: 36.1250000004 5: 34.2835530784 6: 32.8488805601 7: 31.6828235058 8: 30.7062500004 Total bid price is total cost * 1.2 = 41400 Total bid price / 8 = total session price Total cost / total session price = 6.66 whatever Chapter 7 7.1 - Earned value (EV) of a task (or project) = The budgeted cost of the work actually performed Cost performance Index (CPI)= Earned value (EV) / Actual cost (AC) Scheduled Performance Index (SPI)= Earned value (EV) / Planned cost (PV) Cost spending Variance = Earned value (EV) – Actual cost (AC) of the work performed Schedule Variance= Earned value (EV) - the planned cost (PV) of the work budgeted 272 – 270 = 2000 variance 272 – 261 = 9000 schedule variance SPI = 272 / 261 = 1.042 CPI = 272 / 270 = 1.007 7.2 EV = 162000 AC = 156000 PV = 168000 Spending variance = 6000 Schedule variance = -6000 SPI = 162000 / 168000 = 0.964 CPI = 162000 / 156000 = 1.038 Estimated (remaining cost) to completion (ETC) = (Budget at completion (BAC) – Earned value (EV)) / Cost performance index (CPI) Projected (total cost) estimated to completion (EAC) = Estimated (remaining cost) to completion ETC + Actual cost (AC) Variance at completion (VAC)= Budget at completion (BAC) – Projected (total cost) estimated to completion (EAC) Critical Ratio= (actual progress/schedules progress) x (budgeted cost/actual cost) Cost Ratio= Budgeted cost/ Actual cost If earned value data is available, then it is Cost Ratio= EV/AC EV = 950 AC = 1480 PV = 750 + 480 + 200 = 1430 950 – 1430 = -480 = cost variance 950 – 1480 = -530 = schedule variance SPI = 950 / 1430 = 0.664 CPI = 950 / 1480 = 0.642 CR = SPI * CPI = 0.664 * 0.642 = 0.426 (1750 – 950) / 0.642 = 1246,11 = ETC 1246,11 + 1480 = 2726,11 AC = 12000 PV = 13000 EV = 13000 * 0.80 = 10400 / 3.2 R = 1.5 cars per minute I = 10 cars T= I=R*T T = I / R = 6 2/3 minutes 3.3 I = 3000 R= T = 2 months 3000 / 2 = 1500 per month 1. 25 / 100 = ¼ day 2. 14 / 70 + ¼ = Check R = 200 laptops per day I = 21 Iref = 16 T = 37 / 200 = 0.185 days per laptop b. R = 140 Iref = 16 21 / 200 = 0.105 16 / 140 = 0.114 days per laptop Ttotal = 0.219 Yes 3.8 Jasper Valley Motors (JVM) is a family-run auto deal- ership selling both new and used vehicles. In an average month, JVM sells a total of 160 vehicles. New vehicles represent 60 percent of sales, and used vehi- cles represent 40 percent of sales. Max has recently taken over the business from his father. His father always emphasized the importance of carefully man- aging the dealership’s inventory. Inventory financing was a significant expense for JVM. Max’s father con- sequently taught him to keep inventory turns as high as possible. a) b) c) Examining the dealership’s performance over recent years, Max discovered that JVM had been turning its inventory (including both new and used vehicles) at a rate of 8 times per year. What is JVM’s average inventory (including both new and used vehicles)? Drilling down into the numbers, Max has deter- mined that the dealership’s new and used businesses appear to behave differently. He has determined that turns of new vehicles are 7.2 per year, while turns of used vehicles are 9.6 per year. Holding a new vehicle in inventory for a month costs JVM roughly $175. Holding the average used vehicle in inventory for a month costs roughly $145. What are JVM’s average monthly financing costs per vehicle? A consulting firm has suggested that JVM sub- scribe to its monthly market analysis service. They claim that their program will allow JVM to main- tain its current sales rate of new cars while reducing the amount of time a new car sits in inventory before being sold by 20 percent. Assuming the con- sulting firm’s claim is true, how much should Max be willing to pay for the service? a. R = 160 cars per month T = 1.5 month per inventory I = 240 cars b. Tnew = 12/7.2 = 1.667 Tused = 12/9.6 = 1.25 $175 per month T new $145 per month T used 160 * 0.6 = Rnew = 96 160 * 0.4 = Rused = 64 Inew = 1.667 * 96 = 160 Iused = 80 Cost new = 160* 175 = 28000 Cost used = 80 * 145 = 11600 39600 / 240 = 165 per vehicle C: 28000 * 0,2 = 5600 4.2 WonderShedInc.(Example4.3)produces,inaddition to the standard model, a deluxe version for the discriminating customer. The production process for the two models is identical and is depicted in Figure 4.1. The activity times for deluxe models is listed in Table 4.8. All the times mentioned represent flow time at the various activities, and include the effects of waiting. 1. 2. 3. Compute the process flow time for producing a deluxe shed. What is the impact on flow time of the process if the flow time of Activity 2 is increased to 40 minutes? What is the impact on flow time of the process if the flow time of Activity 3 is reduced to 40 minutes? 5.4 A company makes two products A and B, using a sin- gle resource pool. The resource is available for 900 minutes per day. The contribution margins for A and B are $20 and $35 per unit respectively. The unit loads are 10 and 20 minutes per unit. 1. 2. Which product is more profitable? The company wishes to produce a mix of 60% As and 40% Bs. What is the effective capacity (units per day)? 3. At the indicated product mix, what is the financial capacity (profit per day)? 900 / 10 = 90 90 * 20= 1800 90 / 20 = 45 45 * 35 = 1575 A is more profitable 0.6* 10 + 0.4*20 = 14 900 / 14 = 64.3 0.6* 20 + 0.4*35 = 26 64.3 * 26 = answer 5.7 Reexamine Exercise 5.1. Assume that the capacity waste factors of the paralegals, tax lawyers, and senior partners are 20%, 30%, 35%, respectively. a. What is the theoretical capacity of the process?