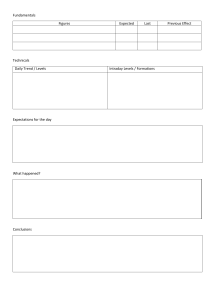

Profitable Day and Swing Trading Using Price Volume Surges and Pattern Recognition to Catch Big Moves in the Stock Market ( PDFDrive )

advertisement