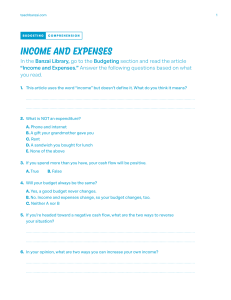

Financial Planning for Sugar Unlocking the sweet success of your cookie business through strategic financial planning. by Diyan Kinigama Overview of Cookie Business The cookie business is a thriving industry, with a wide variety of baked goods ranging from classic chocolate chip to innovative flavor combinations. Cookies are a beloved treat enjoyed by people of all ages, making them a staple in both home kitchens and commercial bakeries. Importance of financial planning Better Decision Making Thorough financial planning allows you to make more informed decisions about your cookie business, from pricing and inventory to investments and growth opportunities. Risk Mitigation Funding and Investment Operational Efficiency By anticipating and planning for potential challenges, you can better protect your cookie business from financial setbacks and ensure its long-term sustainability. A well-crafted financial plan demonstrates the viability of your cookie business, making it easier to secure funding from investors or financial institutions. Financial planning helps you optimize your cookie business's operations, identify cost-saving opportunities, and maximize profitability. Definition: Budgeting, Cost Estimation, Financial Management Budgeting Cost Estimation Financial Management Budgeting is the process of creating a plan for Cost estimation involves researching, gathering your income and quotes, and analyzing Financial management encompasses the expenses. It helps you data to accurately predict efficient use and control track your money and make informed financial the expenses associated with your business decisions. operations. of your company's funds. It includes activities like invoicing, accounts payable/receivable, and cash flow monitoring. Benefits: Funding, Risk Reduction, Decision Making Funding Opportunities Risk Mitigation A well-crafted financial planning allows you to With a solid financial plan can help secure anticipate and plan for plan in place, you can funding from banks, potential risks, ensuring make more confident, investors, or grants to your business is data-driven decisions fuel your cookie prepared to weather that align with your business's growth. any storms. business goals. Careful financial Informed Decision Making Definition: Plan for Income and Expenses Creating a Budget Tracking Cashflow Budgeting involves carefully planning and allocating your expected income to cover necessary expenses, while also accounting for variable costs and one-time payments. Regularly monitoring your actual income and expenses allows you to compare to your budget, identify areas for improvement, and make informed financial decisions. Forecasting & Savings Budgeting also helps you anticipate future expenses and set aside funds for emergency savings or longterm goals, ensuring financial stability and resilience. Components: Fixed, Variable, One-Time Costs Fixed Costs Variable Costs One-Time Costs These are regular expenses that don't change, like rent, insurance, and equipment leases. Costs that fluctuate based on production, like raw ingredients, packaging, and labor. Non-recurring expenses like equipment purchases, website development, or initial certification fees. Cost Estimation Research 1 Gather detailed data on expenses Quotes 2 Obtain accurate pricing from suppliers Data Analysis 3 Crunch the numbers to estimate costs Accurate cost estimation is crucial for effective financial planning. Start by thoroughly researching all potential expenses, from ingredient costs to equipment maintenance. Then gather detailed quotes from suppliers to get precise pricing information. Finally, analyze the data to develop a comprehensive cost estimate that accounts for fixed, variable, and one-time expenses. Managing Funds and Avoiding Pitfalls Managing Funds Avoiding Pitfalls Carefully track income and expenses to ensure you're maintaining a healthy cash flow. Allocate funds to different areas of the business, such as production, marketing, and overhead, to keep the operation running smoothly. Be vigilant about potential financial risks, such as unexpected costs, market fluctuations, or late payments from customers. Implement strategies to mitigate these risks, such as building up emergency savings, diversifying revenue streams, and establishing clear payment terms. Summary of Financial Plan and Planning for Future 1 Comprehensive Financial Plan 2 Consolidate the budgeting, cost estimation, and financial management strategies into a cohesive plan to guide the business's financial decisions. 3 Future Growth Considerations Factor in long-term goals, such as expansion or new product development, and incorporate them into the financial planning process. Ongoing Financial Monitoring Implement a system to regularly review financial performance, identify trends, and make timely adjustments to the plan as needed. 4 Contingency Planning Anticipate potential risks and have a plan in place to mitigate them, ensuring the business's financial stability and resilience.