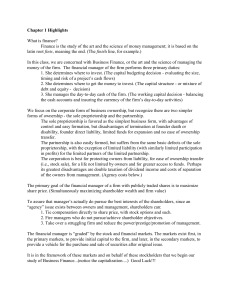

ETHICS - HANDOUT 1 Topic: Nature and Form of Business Organizations I. Introduction Businesses play an important role in our economy. They are considered as the “engine” through their many contributions - examples include paying corporate taxes that will be used for social welfare projects, as well as job opportunities for people in the society. III. Comparing the Three Business Organizations Sole Proprietorship Easiest establish Partnership Corporation to Can be easily Hard to establish established like a sole proprietorship Limited life Limited life Life is 50 years and can be extended II. Nature of the Business 1. Regular Process: It is an activity which is performed repeatedly to generate profit. 2. Economic Activity: The whole sole purpose is maximizing wealth. 3. Creates Utility: The goods or service must be such that it creates form utility – conversion of products in a consumable form, time utility – making the goods and services available when needed; and place utility – availability of goods or services wherever required, for the consumers. 4. Capital Requirement: Any venture requires funds depending on the size and its type. 5. Deals in Goods and Services: It is related to manufacturing and offering goods for sale or catering services 6. Risk: All businesses have a risk factor or uncertainties of failure and loss. 7. Profit Earning Motive: The initial motive of a businessman is making a profit out of his venture. 8. Satisfaction of Consumer’s Need: It is concerned with the fulfillment of the customer’s demands and needs. 9. Involves Buyer and Seller: There are majorly two parties involved, the customer and the merchandise. 10. Social Obligations: It has some social responsibilities, like creating job opportunities, dealing with licensed products, etc. III. Forms of Business Organizations Businesses come in different forms - let us look at how different businesses are structured. A. Sole Proprietorship – It is a type of business owned and operated by a single person. B. Partnership – It is a business owned by two or more people who contribute resources into the business. The partners divide the profits of the business among themselves. C. Corporation – It is an enterprise authorized by law, with most legal rights of a person, such as to conduct a business, to own and sell a property, to borrow money, and to sue and be sued. It is a business organization that has a separate legal personality from its owners. Small amount of Large amount of Large amount of capital is needed capital capital Owns all profits Profits / losses Shared / losses are shared according to the among partners stockholder’s percentage of ownership interest Unlimited liability Unlimited Stockholders liability of the have limited partners liability Minimum legal requirements Subject minimum government regulations Business secrecy Business secrecy to Subject numerous government regulations to Lack of secrecy Personal interest Each partner as Lack of personal in managing the a right to interest business participate Tax savings Tax savings Several taxes to pay, as required by law and ordinances Depending on your perspective, the economy can provide opportunities to establish different business organizations. Entrepreneurs must consider different factors such as their resources, the business vision, their openness to risk, and the current market conditions in deciding what kind of business organization they should set up. REFERENCES: Business Ethics and Social Responsibility, Quarter 1 Module 1: Forms of Business Organization (Ownership), 1st Edition, 2020.