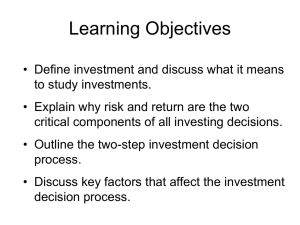

Understanding Investments CHAPTER 1 Objectives To understand the investments field as currently practiced To help you make investment decisions that will enhance your economic welfare To create realistic expectations about the outcome of investment decisions 1-2 What is investments Investment: The commitment of funds to one or more assets that will be held over some future period Investments is the study of process of committing funds to one or more assets Investments is concerned with the management of an investor’s wealth, which is the sum of current income and the present value of all future income Financial assets and Real assets Financial assets are paper (or electronic) claims on some issuer, such as the federal government or a corporation Certificates of deposits Bonds Stocks Or funds Real assets: real assets are tangible, physical assets such as gold, silver, diamonds, art, and real estate Marketable securities Securities? Fungible, negotiable financial instrument that holds some type of monetary value Marketable securities are financial assets that are easily and cheaply tradable in organized Markets What are examples of marketable securities? Examples of non marketable securities? U.S. savings bonds, Why there is a need to invest? Bob video! Investors seek to manage their wealth effectively, obtaining the most from it while protecting it from inflation, taxes, and other factors. What do you require for investment? Funds to be invested come from assets already owned, borrowed money, and savings or foregone consumption. By foregoing consumption today and investing the savings, investors expect to enhance their future consumption possibilities by increasing their wealth. TAKE A PORTFOLIO PERSPECTIVE Investors invest in an “optimal combination” Optimal combination is important because our wealth, which we hold in the form of various assets, should be evaluated and managed as a unified whole Wealth should be evaluated and managed within the context of a portfolio, which consists of the asset holdings of an investor. Like a combination of bonds and stocks Why Study Investments Most individuals make investment decisions sometime ◦ Need sound framework for managing and increasing wealth Essential part of a career in the field ◦ Security analyst, portfolio manager, registered representative, Certified Financial Planner, stock brokers and financial advisors Understanding the investment decision process (Risk and Return) The reason for investing to generate Return Cash as the opportunity cost of forgone return Inflation diminishes the purchasing power Expected Return vs. Realized Return Expected Return: The anticipated return for some future period Realized return: The actual return over some past period Investors invest for the future—for the returns they expect to earn—but when the investing period is over, they are left with their realized returns. Expected Return is not usually the same as realized return Risk Risk: The possibility that the realized return will be different than the expected return Investors are Risk-Averse! It is easy to say that investors dislike risk, but more precisely, we should say that investors are risk-averse A risk-averse investor will not assume risk simply for its own sake a incur any given level of risk unless there is an expectation of adequate compensation for having done so. Investor’s Risk Tolerance Investors deal with risk by choosing the amount of risk they are willing to incur— that is, they decide their risk tolerance. Can we say that investors, in general, will choose to minimize their risks? The expected Risk Return Tradeoff This tradeoff always slopes upward, because the vertical axis is expected return, and rational investors will not assume more risk unless they expect to be compensated. Ex Post vs. Ex Ante Risk-return tradeoff depicted in Figure is ex ante, meaning “before the fact.” Ex post means “after the fact” For a given period, the tradeoff may turn out to be flat or even negative. Structuring the decision process Two step Process 1) Security Analysis - valuation and analysis of individual securities Value is a function of the expected future returns on a security and the risk attached. 2) Portfolio Management ◦ Selected securities viewed as a single unit ◦ How efficient are financial markets in processing new information? ◦ How and when should it be revised? ◦ How should portfolio performance be measured? Other considerations Foreign financial assets: opportunity to enhance return or reduce risk The Internet and investment opportunities Regulation of Fair Disclosure (FD) Ethical Practices