Budgeting, Standard Costing & Variance Analysis Presentation

advertisement

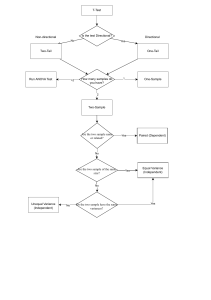

MN20485 Accounting and Decision Making for Managers Lectures 8 & 9 Budgeting, Standard costing & Variance Analysis Lecture Objectives • Standard costing • Variance analysis Materials Labour Variable overheads Fixed overheads Sales • Reconciliation of budgeted profit and actual profit operating statements • Interpret and offer explanations for variances Standard Costing Standard Costing Standard Costing: A control technique that establishes predetermined estimates of costs and compares these with actual costs as incurred • Standard costs predetermined costs • Most suitable for: - Mass production or repetitive assembly work - Where inputs for production can be specified Difference between standard and actual = Variance Standard Costs Standard costs predetermined costs • average expected target costs under efficient (normal) operating conditions • represents what should happen vs. what has happened • Calculated based on expectations of: - Efficiency levels in the use of materials and labour - Expected price of materials, labour and expenses - Budgeted overhead costs and activity levels • Standard price, standard cost, standard profit (absorption costing), standard contribution (marginal costing) Standard Cost Card Standard cost card Product X £ per unit: (40kg @ £5.30) 212 Bonding: (48 hours @ £2.50) 120 Finishing (30 hours @ £1.90) 57 Direct materials Direct wages: Prime cost 389 Variable production overhead: Bonding (48 hours @ £0.75) 36 Finishing (30 hours @ £0.50) 15 Variable production cost 440 Fixed production overhead 40 Total production cost 480 Selling and distribution overhead 20 Administration overhead 10 Total cost 510 Purpose of Standard Setting 1. To provide a prediction of future costs that can be used for decision-making 2. To provide a challenging target that individuals are motivated to achieve. 3. To assist in setting budgets and evaluating performance. 4. To act as a control device by highlighting those activities that do not conform to plan. 5. To simplify the task of tracing costs to products for inventory valuation. Budgets vs. Standards A budget is a quantified monetary plan for a future period A standard is a predetermined quantity/target Similarities: • Future perspective • Both used for control purposes (interrelated & similar) i.e. use a standard cost as basis for cost budgets Differences: • Budgets: (planned) total aggregate costs, prepared for all functions, expressed in monetary terms • Standards: show resources used for a single task i.e. limited to situations where repetitive actions are performed and output can be measured: and don’t need to be expressed in monetary terms Standard Costing System Overview Variance Analysis Variance Analysis Variance analysis: the evaluation of performance by means of variances, whose timely reporting should maximise the opportunity for managerial action – CIMA Purpose: Explain the difference between actual and expected results, and facilitate performance evaluation and control purposes • Variances can be calculated for both costs and sales. • Favourable (F) variance Actual better than expected results • Adverse (A) variance Actual worse than expected results Three types: 1. Variable cost variances 2. Fixed overhead variances 3. Sales variances Variances Sales Variance +/- Variable Cost Variances +/- Fixed Cost Variances Profit Variances Profit variance Total production cost variance Total sales margin variance Sales margin price variance Total direct materials variance Materials price variance Materials usage variance Total direct labour variance Labour rate variance Labour efficiency variance Total variable o/h variance Variable o/h expenditure variance Sales margin volume variance Fixed o/h expenditure variance Variable o/h efficiency variance Fixed o/h volume variance Traditional Variance Analysis Abbreviations Materials Fixed overheads • SP = standard price • BFO = budgeted fixed overhead • AP = actual price • AFO = actual fixed overhead • SQ = standard quantity (of the actual output) • BO = budgeted output • AQ = actual quantity Labour • SR = standard rate • AR = actual rate • SH = standard hours (of the actual output) • AH = actual hours • AO = actual output Sales • BV = budgeted volume • AV = actual volume • SM = standard margin (either profit or contribution) Cost Variances 3 components of Prime Costs 1. Materials 2. Labour 3. Variable overheads Material Variances A General Model for Variance Analysis Materials Price & Usage Variances Material Variances Summary Material Price Variances Example Hanson plc. has the following direct material standard to manufacture one unit: 1.5 kgs per unit at £4.00 per kg. Last week 1,700 kgs of material were purchased and used to make 1,000 units. The material cost a total of £6,630. Required: Calculate Hanson’s material price variance (MPV) for the week Answer: Actual Price (AP) = £6,630 ÷ 1,700 kgs = £3.90 per kg MPV = AQ × (SP - AP) MPV = 1,700 kgs × ( £4 – £3.9 ) MPV = £170 F Material Quantity Variances Example Hanson plc. has the following direct material standard to manufacture one unit: 1.5 kgs per unit at £4.00 per kg. Last week 1,700 kgs of material were purchased and used to make 1,000 units. The material cost a total of £6,630. Required: Calculate Hanson’s material quantity variance (MQV) for the week Answer: Standard Quantity (SQ) = 1,000 units × 1.5 kgs = 1,500 kgs MQV = SP × (SQ - AQ) MQV = £4 × (1,500 kgs – 1,700 kgs) MQV = £800 A Material Variances Summary Material Price Example (cont.) Hanson plc. has the following direct material standard to manufacture one unit: 1.5 kgs per unit at £4.00 per kg. Last week 2,800 kgs of material were purchased at a total cost of £10,920, and 1,700 kgs were used to make 1,000 units. Material Price Example Notes • The price variance is computed on the quantity PURCHASED i.e. 2,800 kgs • Price variance increases because quantity purchased increases. • The quantity variance is computed on the quantity USED for production i.e. 1,700 kgs • Quantity variance is unchanged: i.e. £800 (A) Material Variances Interpretation Material Price Variance: Favourable - Purchase of a lower grade material at a discount - Buying large quantities to take advantage of quantity discounts - A change in the market price of the material, or - Strong bargaining by the purchasing department Material Quantity Variance : Adverse Since this variance is adverse, more materials were used to produce the actual output than were called for by the standard. This could occur for a variety of reasons: - Poorly trained or supervised workers - Improperly adjusted/maintained machines - Defective materials (possibly from the purchase of inferior grade materials above) Labour Variances Labour Rate & Idle Time Variances Labour Efficiency Variance Labour Rate & Efficiency Variances Labour Rate Variance: AH × (SR – AR) Labour Efficiency Variance: SR × (SH – AH) SR: Standard Rate AH: Actual Hours SH: Standard Hours AR: Actual Rate Labour Rate Variances Example Hanson plc. has the following direct labour standard to manufacture one unit: 1.5 standard hours per unit at £6.00 per direct labour hour. Last week 1,550 direct labour hours were paid at a total labour cost of £9,610 to make 1,000 units. Required: Calculate Hanson’s labour rate variance (LRV) for the week Answer: Actual Rate (AR) = £9,610 ÷ 1,550 hrs = £6.20 per hour LRV = AH × (SR – AR) LRV = 1,550 hrs × ( £6 – £6.20) LRV = £310 A Labour Efficiency Variances Example Hanson plc. has the following direct labour standard to manufacture one unit: 1.5 standard hours per unit at £6.00 per direct labour hour. Last week 1,550 direct labour hours were paid at a total Labour cost of £9,610 to make 1,000 units. Required: Calculate Hanson’s labour efficiency variance (LEV) for the week Answer: LEV = SR × (SH - AH) LEV = £6 × ( £1,500 – 1,550) LEV = £300 A Labour Idle Time Variances Example Hanson plc. has the following direct labour standard to manufacture one unit: 1.5 standard hours per unit at £6.00 per direct labour hour. Last week 1,550 direct labour hours were paid (that included 20 idle hours) at a total labour cost of £9,610 to make 1,000 units. Required: Calculate Hanson’s labour idle time variance for the week. Answer: Actual hours paid = 1,550 Actual hours worked = 1,530 £6 × (1,550 – £1,530) = £120 A Labour Variances Summary Labour Variances Interpretation Labour Rate Variance: Adverse - Using highly paid skilled workers to perform unskilled tasks Labour Efficiency Variance: Adverse - Poorly trained workers - Poor quality material - Poor supervision of workers - Poorly maintained equipment Which Managers Influence Cost Variances? Overhead Variances Variable overheads Fixed overheads Variable O/H: Expenditure & Efficiency Variances Expenditure Variance: AH × (SR - AR) Efficiency Variance: SR × (SH - AH) SR: Standard Rate AH: Actual Hours SH: Standard Hours AR: Actual Rate Variable O/H: Expenditure & Efficiency Variances Variable O/H: Expenditure Variances Example Hanson plc. has the following variable manufacturing overhead standard to manufacture one unit: 1.5 standard hours per unit at £3.00 per direct labour hour. Last week 1,550 hours were paid to make 1,000 units, and £5,115 was spent for variable manufacturing overhead. Required: Calculate Hanson’s variable overhead expenditure variance for variable manufacturing overhead for the week Answer: Actual Rate (AR) = £5,115 ÷ 1,550 hrs = £3.30 per hour EV = AH × (SR - AR) EV = 1,550 hrs × ( £3 – £3.30) EV = £465 A Variable O/H: Efficiency Variances Example Hanson plc. has the following variable manufacturing overhead standard to manufacture one unit: 1.5 standard hours per unit at £3.00 per direct labour hour. Last week 1,550 hours were paid to make 1,000 units, and £5,115 was spent for variable manufacturing overhead. Required: Calculate Hanson’s variable overhead efficiency variance for variable manufacturing overhead for the week Answer: EffV = SR × (SH - AH) EffV = £3 × (1,500 hrs - 1,550 hrs) EffV = £150 A Variable Overhead Variances Summary Variable Overhead Variances Interpretation Expenditure Variance: - Results from paying more (or less) than expected for variable overhead items and/or excessive use of these items Efficiency Variance: - Controlled by managing the overhead cost driver - [In the previous example it was labour hours] Fixed Overhead Variances Absorption costing: • Fixed overhead expenditure & volume variances • Adverse variances under-absorbed overhead • Favourable variances over-absorbed overhead Fixed Overhead Variances: AC Actual overhead Overhead Absorbed Under/(Over) absorption X (X) X/(X) Fixed Overhead Variances Example Cola Co’s overhead is absorbed on the basis of machine hours (i.e. using AC). Below is a flexed budget: The estimated level of activity is 3,000 machine hours; therefore OAR = £9k Fixed OH / 3k hours (i.e. £3/hr) Actual production required 3,200 standard machine hours. Actual fixed overhead was £8,450. Total FO Variances = (£3 x 3,200) – £8,450 = £1,150 F i.e. over-absorbed Fixed Overhead Variances Summary Sales Variances Sales Price & Volume Variances Sales Price & Volume Variances Notes Sales Variances: Measure the effect on expected profit of: • Different selling price to the standard • Different volume of sales to the original budget Sales Price Variance = (Standard Price – Actual Price) X Actual Quantity Note: a favourable variance is a negative amount; and vice versa Sales Volume Variance = (BV – AV) * (Standard profit [AC]) Note: Computed in terms of contribution/profit margins rather than sales revenues Sales Variances: Example The budgeted sales for Hans & Co are £110,000 consisting of 10,000 units at £11 per unit. The standard cost per unit is £7 (AC). Actual sales are £120,000 (12,000 units at £10 per unit) and the actual cost per unit is £6. Required Calculate the sales margin variances. Answer Sales price variance = 12,000 × £1 (£11 - £10) = £12,000 A Sales volume variance = £4 ×2,000 (12,000 – 10,000) = £8,000 F Total sales variance in terms of profit margin = £4,000 Adverse Sales Variances Summary Sales Variances Interpretation • Not very meaningful to separate the Sales Variances into price and volume variances for substantive reasoning - Change in selling prices are likely to affect volumes - Due to the price elasticity of demand • E.g. SPV-Adverse & SVV-Favourable - Adverse price variance will tend to be associated with a favourable volume variance (so has an inverse correlation) • Some external factors may not be controllable by management - e.g. competition, economic recession, etc - May have a direct correlation on sales variances • Better/alternative performance appraisal for sales team? - Market share, market dynamics, competitor’s prices, etc. - Balanced Scorecard Operating Statement Reconciliation of budgeted profit and actual profit Operating Statements: Standard ABSORBTION Costing System Valued at st’d profit Interpretation of Variances • • • Consider overall consequence See pdf file on Moodle ‘Operational causes of variances’ Interdependencies of variances: - - Identified for effective interpretation When two variances are interdependent; one is favourable and the other adverse i.e. sales variances