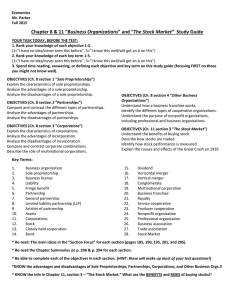

Business Structures: Sole Proprietorship, Partnership, LLC, Corporation

advertisement

Types of Business TYPES OF BUSINESS STRUCTURES The Sole Proprietorship Partnership Limited Liability company Corporation Sole proprietorship Business classification on the basis of ownership/ Types of Business Ownership Sole proprietorship: • A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. • Sole proprietorships are easy to establish and dismantle due to a lack of government involvement, making them popular with small business owners and contractors. • Most small businesses start as sole proprietorships and end up transitioning to a limited liability entity or corporation as the company grows. • One of the main disadvantages of sole proprietorships is that they do not have any government protection, as they are not registered. This means that all liabilities extend from the business to the owner. • Sole proprietors report their income and expenses on their personal tax returns and pay income and self-employment taxes on their profits • The business does not need to be registered with the state. Servicemarks and trademarks can be registered with the Secretary of State’s office if desired. A Federal Employer’s Identification Number is not required as long as there are no employees. The business income is taxed at the sole proprietor’s individual tax rate. All business income and expenses are reported on the individual’s income tax form 1040 schedule C. Estimated income tax payments are required if estimated income in excess of $200. Advantages Easy to form No documents to file with state One level of taxation Disadvantages No tax breaks for company benefits Unlimited personal exposure Liable for all debts incurred No perpetuity of business Partnership General partnership: • A general partnership is a business made up of two or more partners, each obligated for the business's debts, liabilities, and assets. • Partners assume unlimited liability, potentially subjecting their personal assets to seizure if the partnership becomes insolvent. • Partners should create a written partnership agreement or oral. • General partnerships are less expensive to form compared to a corporation. • They are pass-through entities where profits or losses are passed directly to partners, who report them on their personal tax returns. • As with a sole proprietorship, the general partnership does not need to be registered with the Secretary of State’s office. The partnership does need a Federal Employer’s Identification Number even if there are no employees. Each partner follows the same income and tax reporting procedures as a sole proprietor. The partnership itself files a Kansas Partnership Return form each year. Advantages Relatively easy to create One level of taxation Disadvantages No tax breaks for company benefits Liable for debts incurred by each partner No perpetuity of business Limited Partnership: • A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. • An LP is defined as having limited partners and a general partner, which has unlimited liability. • LPs are pass-through entities that offer little to no reporting requirements. • There are three types of partnerships: limited partnership, general partnership, and limited liability partnership. • Most U.S. states govern the formation of limited partnerships, requiring registration with the Secretary of State. • While the partnership does not need any special registration, a Limited Partnership Certificate needs to be filed with the Secretary of State’s office. Tax reporting and payment is carried out the same way as a general partnership. Advantages Limited risk to some partners Relatively easy to create One level of taxation is possible Disadvantages Liable for debts incurred by partners Taxed as corporations under certain circumstances No tax breaks for company benefits No perpetuity of business Limited liability Partnership: • Limited liability partnerships (LLPs) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business. • Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor. • Limited liability means that if the partnership fails, then creditors cannot go after a partner’s personal assets or income. • LLPs are common in professional businesses like law firms, accounting firms, medical practices, and wealth managers. Advantages: Same as partnerships in addition to limited personal liability Disadvantages : Same as other partnerships Advantages : Owners liability limited to amount invested Company can pay for benefits Perpetuity of business Ability to buy and sell assets S-corporation has one tax level Cash can be raised through sale of stock One or many owners Business is own legal entity Disadvantages : More difficult to start than proprietorships and partnerships Two tax levels for C-corporations Limited Liability company A limited liability company (LLC) is a business structure in the U.S. that protects its owners from personal responsibility for its debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. Advantages LLCs do not require annual meetings and require few ongoing formalities. Owners are protected from personal liability for company debts and obligations. LLCs enjoy partnership-style, pass-through taxation, which is favorable to many small businesses. Disadvantages LLCs do not have a reliable body of legal precedent to guide owners and managers, although LLC law is becoming more reliable as time passes. An LLC is not an appropriate vehicle for businesses seeking to become public eventually, or to raise money in the capital markets. LLCs are more expensive to set up than partnerships. LLCs usually requires annual fees and periodic filings with the state. Some states do not allow the organization of LLCs for certain professional vocations. Corporations • A corporation is legally a separate and distinct entity from its owners. Corporations possess many of the same legal rights and responsibilities as individuals. • An important element of a corporation is limited liability, which means that its shareholders are not personally responsible for the company's debts. • A corporation may be created by an individual or a group of people with a shared goal. That does not always involve making a profit. Advantages Owners are protected from personal liability for company debts and obligations. Corporations have a reliable body of legal precedent to guide owners and managers. Corporations are the best vehicle for eventual public companies. Corporations can more easily raise capital through the sale of securities. Corporations can easily transfer ownership through the transfer of securities. Corporations can have an unlimited life. Corporations can create tax benefits under certain circumstances, but note that corporations may be subject to "double taxation" on profits. Disadvantages Corporations require annual meetings and require owners and directors to observe certain formalities. Corporations are more expensive to set up than partnerships and sole proprietorships. Corporations require annual fees and periodic filings with the state