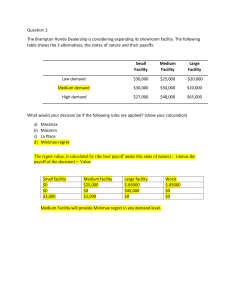

Question 2 Mackerel a) Risk faced by Mackerel It is natural to assume that the main objective of a business is the maximisation of shareholder wealth and in the context of the APV project the main measure of performance will be the profit made on the contract as this will drive the earnings over which the institutions are concerned. However, in a decision where there is risk and uncertainty, the company also has to decide on its appetite for risk. Risk appetite is usually divided into three categories: • risk averse individuals tend to assume the worst outcome and seek to minimise its effect • risk seekers are interested in the best outcomes and seek to maximise their returns under these circumstances • risk neutral individuals are interested in the most probable outcome The risks for Mackerel arise from uncertainties in its external environment. The key stakeholders in this situation are the government (the customer) and Mackerel’s shareholders. The other factor giving rise to uncertainty is the forecast price of steel, the main raw material in the APV’s construction. The shareholders have indicated a concern over earnings volatility and so seem to be risk averse. This is commercially sensible in a recessionary situation where the company’s survival could be placed at risk if a large project (such as the APV) were to fail. The project can be seen to be large for Mackerel as the expected profit is $5m if package 1 is chosen and this is material when compared to the current operating profit of $20.4m. A risk averse approach might also be called for where winning the bid could lead to additional future work so that securing a deal is more important than optimising profit. This appears to be the case here as the government is the major customer of Mackerel. The demand level for the APV is also uncertain as the recession could lead to cuts in government expenditure. Defence spending is often considered more discretionary than spending on public services (such as pensions) especially if there is not an immediate threat of conflict. Thus, it has been difficult to predict the probabilities of the different demand levels. Given that there are significant fixed costs of design and development, these different levels have a material impact on the return from the project. These problems in quantifying the level of risk will affect the choice of method of analysing the return from the contract. Mackerel should evaluate the contract using different methods and come to a conclusion based on the most appropriate one for its objectives and risk appetite. A further source of risk is the danger of cost over runs. If successful in its tender, Mackerel will be working towards a fixed price for the contract ($7.5 m + budgeted variable cost per unit plus 19%). In the budget, total cost per unit is under $70,000, however, any over runs of actual cost as compared to budget will reduce the profit margin earned. Cost per unit Type 1 Type 2 Type 3 500 62900 65400 67900 750 57900 59567 61233 1000 55400 56650 57900 A major cost risk is the cost of the primary raw material of production (steel). However, this has been fixed by the forward purchase of the steel for the contract. This has eliminated the risk of price fluctuations during the contract. ii) type 1 type 1 type 1 type 2 type 2 type 2 type 3 type 3 type 3 demand VC FC 500 23950 7500 750 35925 7500 1000 47900 7500 500 23950 8750 750 35925 8750 1000 47900 8750 500 23950 10000 750 35925 10000 1000 47900 10000 iii) Maximax Max Profit Type 1 Type 2 Type 3 9101 7851 6601 Maximin Min profit Type 1 Type 2 Type 3 4551 3301 2051 TC V. REV F.REV 31450 28500.5 7500 43425 42750.75 7500 55400 57001 7500 32700 28500.5 7500 44675 42750.75 7500 56650 57001 7500 33950 28500.5 7500 45925 42750.75 7500 57900 57001 7500 Minimax regret profit table Type 1 Type 2 Type 3 500 4550.5 3300.5 2050.5 750 6825.75 5575.8 4325.75 1000 9101 7851 6601 Regret table Type 1 Type 2 Type 3 500 0 1250 2500 750 0 1250 2500 T. REV PROFIT Probability EV 36000.5 4550.5 0.85 3867.925 50250.8 6825.75 0.1 682.575 64501 9101 0.05 455.05 5005.55 36000.5 3300.5 0.25 825.125 50250.8 5575.75 0.5 2787.875 64501 7851 0.25 1962.75 5575.75 36000.5 2050.5 0.2 410.1 50250.8 4325.75 0.5 2162.875 64501 6601 0.3 1980.3 4553.275 1000 Max regret 0 0 1250 1250 2500 2500 To minimise the max regret, Mackerel should choose type 1 Risk seekers and the risk averse will use profit under the different demand scenarios to make the appropriate choice. Risk seekers will aim to maximise the possible returns from the different demand scenarios. The maximax method would be appropriate in this situation and here the company would be advised to choose design package 1 which will have a maximax profit of $9.1m. Risk averse decision-makers will aim to maximise the minimum possible returns from the different demand scenarios. The maximin method would be appropriate in this situation and here the company would be advised to choose design package 1 which will have a maximin profit of $4.6m. Pessimistic decision-makers will choose to focus on the lost profit (regret) compared to the best choice under that demand scenario. They aim to minimise the maximum level of regret that they can suffer under any demand scenario. This minimax regret method shows the company would be advised to choose design package 1 which will lead to no regret. These conclusions should not be surprising as design package 1 has considerably lower fixed costs and yet is scalable to cope with all levels of demand. A risk neutral manager does not take an optimistic or pessimistic stance. They will choose the option that yields the maximum expected value. This method depends on the use of probabilities for each of the outcomes. The risk manager has attempted to quantify the probabilities of the different levels of demand given the different design packages employed. It would be wise to involve both the design and sales teams in these estimates as such estimates are usually highly subjective, and a broad canvassing of opinion may help to gain more accurate values. The estimated probabilities allow the calculation of an expected profit for each choice of design package. The maximum expected profit of $5.6m arises if design 2 is chosen. This is due to the much greater likelihood of higher demand in that case. Design 3 does not seem to increase the chances of higher demand sufficiently to outweigh the extra fixed cost of $1.25m compared to design 2. iv) Recommendation In this situation, the choice of method will depend on the risk appetite of Mackerel, whether this type of decision is likely to be repeated many times and the accuracy of the probability estimates. As Mackerel shareholders seem risk averse, the profit under the contract is significant compared to the operating profit of the whole company and the economic environment is difficult so the low-risk method of maximin seems appropriate. The use of expected values appears questionable as the probability estimates have not been widely debated and in the current economic circumstances, the company’s survival may be at risk and so the repeated trials necessary to make this method valid may not arise. Design package 1 should be chosen as with unknown probabilities, it carries the least risk. The company could seek to sharpen the probability estimates and review the implications for company survival before considering the use of expected values although there is the potential to make an additional expected profit of $573k if we could justify choosing design 2 over design 1. The risk over steel prices has been removed by using forward (advance) contracts to cover the purchase of the material required. As steel is used in many of the company’s products, this should be investigated as a general risk management technique for the company. Marking Scheme i) ii) iii) 1 mark per risk identification (1 x 3) and suggestion to overcome it (1 x 3) 12 marks for pay-off table. 1 mark for Maximax 1 mark for maximin 2 marks for expected value 2 marks for minimax regret 4 marks for discussion iv) 2 marks for JUSTIFIED recommendation Question 3 Choice of current and proposed performance measures Current measures The current measures are all historic, financial ones and so the BSC approach will bring a longer term view by using non-financial measures which consider those factors which might drive future growth, for example, those in the learning and growth perspective. The current measures do not directly link to shareholder value which appears to be the overall aim of the company. A measure such as economic value added would do this more effectively. The three measures do give a broad view of financial performance. ROCE is a widely-used measure which it should be possible to benchmark against competitors. As far as the divisions are concerned, there is a measure of success in selling through revenue growth, though this may not be due to only the sales division but also the drugs brought to market by the development division. Average cost to develop a new drug is a financial measure of the development division’s performance but this does not measure its aim of innovation in development. Indeed, this measure may conflict with that aim as cost control of development may hinder innovative thinking. It would appear more appropriate to have a cost control measure associated with manufacturing as its goal is to be more efficient. The performance of the manufacturing division is only measured indirectly through its effect on the financial performance of the company as a whole. Consultants’ proposed measures Monza is planning to implement strategy by innovating drug development, Efficiency in drug development manufacturing and success in selling their product. The suggested measures do not seem to deviate much from the existing measures, though there may be an advantage in this as the new system would be using existing information systems and known measures in that case. However, this advantage is secondary to the need to find measures which will drive useful performance in the four perspectives. The proposed measures from the consultants’ interim report mostly fit within the standard four perspectives of the BSC, although revenue growth is more appropriate as a measure from the financial perspective. Customer perspective measures should focus on the strategies which will achieve success in the eyes of the customers rather than just measuring the results of those strategies. Examples of this would be measuring the efficacy of the drugs which are developed by Monza or the reputation of Monza’s medicines among the medical community. Acquisition of sales to different hospitals via contract can also be measured to increase its sales. This can be directly linked with the third objective of company. Taking the others in turn, ROCE does not seem to be directly linked to shareholder value as, for example, economic value added or net present value would be. ROCE considers the performance over the whole capital base while the shareholders will be more directly concerned with returns on their equity investment. As a profit-based measure, ROCE may also be failing to target cashgeneration which is ultimately driving dividend payments and value creation for shareholders. As already indicated, cost control in business processes is important but other measures of success such as time to market for the development of new products and quality initiatives should also be considered. The fourth perspective is particularly relevant to a high-technology and linked with the first strategy of Monza where they want to innovate drug development. There will be considerable competitive advantage in having a highly skilled workforce, however, the measure proposed is imprecise as it values all training days, whether for knowledge workers or unskilled labourers, as equally valuable. Measures of the number of innovations within each division may be appropriate as these will be qualitatively different (new compounds developed, manufacturing quality improvements and sales techniques/initiatives developed). Overall, the initial proposed set of measures does appear limited and does not address the overall aim of Monza or the problem of the narrowness of the existing set of measures. Note: This is suggested answer. Other relevant justified indicators will earn equal points Critical evaluation of current performance indicator with JUSTIFIED reasoning 1.5 marks per perspective Critical evaluation of proposed performance indicators and suggestions with JUSTIFIED reasoning 1.5 marks per perspective Connection of proposed KPI with the mission statement 3 marks No marks will be awarded in case of any recommendation or suggestion without JUSTIFICATION