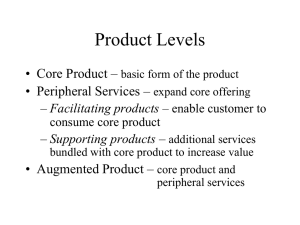

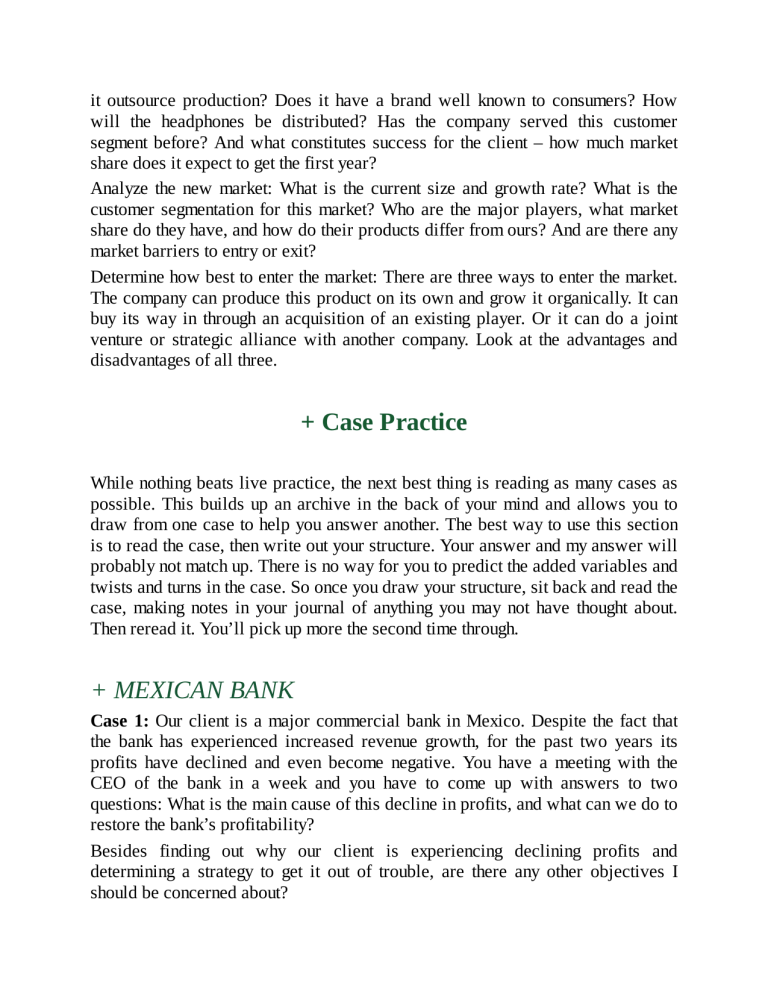

it outsource production? Does it have a brand well known to consumers? How will the headphones be distributed? Has the company served this customer segment before? And what constitutes success for the client – how much market share does it expect to get the first year? Analyze the new market: What is the current size and growth rate? What is the customer segmentation for this market? Who are the major players, what market share do they have, and how do their products differ from ours? And are there any market barriers to entry or exit? Determine how best to enter the market: There are three ways to enter the market. The company can produce this product on its own and grow it organically. It can buy its way in through an acquisition of an existing player. Or it can do a joint venture or strategic alliance with another company. Look at the advantages and disadvantages of all three. + Case Practice While nothing beats live practice, the next best thing is reading as many cases as possible. This builds up an archive in the back of your mind and allows you to draw from one case to help you answer another. The best way to use this section is to read the case, then write out your structure. Your answer and my answer will probably not match up. There is no way for you to predict the added variables and twists and turns in the case. So once you draw your structure, sit back and read the case, making notes in your journal of anything you may not have thought about. Then reread it. You’ll pick up more the second time through. + MEXICAN BANK Case 1: Our client is a major commercial bank in Mexico. Despite the fact that the bank has experienced increased revenue growth, for the past two years its profits have declined and even become negative. You have a meeting with the CEO of the bank in a week and you have to come up with answers to two questions: What is the main cause of this decline in profits, and what can we do to restore the bank’s profitability? Besides finding out why our client is experiencing declining profits and determining a strategy to get it out of trouble, are there any other objectives I should be concerned about? – No. I would like to approach this case in two parts. First, I will try to diagnose the cause of the decline in profits, despite the growth in revenues. Then, based on the findings in the first part, I will try to come up with solutions to our problems and put the bank on a path to profitability. Let’s start with the first issue: the diagnosis of the problem. Here, I would like to look at three main aspects: the overall banking industry in Mexico, our bank’s revenues and, finally, the costs. – Sounds like a good plan. What would you like to know? The student writes down E(P=R–C)M? First, I would like to look at the banking industry in Mexico. Is this an industrywide problem or does it primarily affect our client? Also, can you tell me more about our client’s competitive positioning within this industry? – It’s actually just our client that’s experiencing the severe decline in profits. While the other banks have also experienced declines, they have been more moderate. Our client is a major player in the industry, owning 20 percent of the market share. There are three other major national competitors with similar market shares and many smaller, regional competitors. Anything else? It looks like it is mainly an internal problem rather than an industrywide problem. Before analyzing the bank’s costs, both fixed and variable, I’d first like to look at the bank’s revenues in more detail. I’m assuming that banks make their money from interest income and from fees. Also, on the cost side, I would like to analyze both the fixed costs and the variable costs. – That’s right. The bank makes money in two main ways: interest income and fee income. Our client has about 70 percent of its revenues coming from interest and the remaining 30 percent coming from fees. However, I would like you to look at the following graph and analyze it for me. Our client currently has 8 million customers. That’s a very interesting graph. If our client has 8 million customers, the average cost per customer is higher than the average revenue per customer, thus resulting in a loss. Let’s take them one by one. Our client is experiencing declining average revenues per customer. There are several hypotheses why this might be happening. As the bank was growing, it was acquiring new customers that are not as profitable as the initial customers. For example, instead of signing up more doctors, lawyers, or consultants, it is now signing up students or blue-collar workers who don’t produce as much revenue, thus resulting in the observed decline in average revenues per customer. On the cost side, the average cost per customer is staying constant, instead of declining. We can see that there are little or no economies of scale. Potential reasons behind this would imply that as the bank was adding new customers, the costs were also increasing proportionally. – That’s great – and accurate. Because of the incentive structure, which rewarded new customer acquisition, branch managers have added customers that were not as profitable as the initial ones. In addition, the bank has aggressively expanded its branch structure and has increased the number of tellers to accommodate the increased number of customers. What should the bank do? Well, now that we have diagnosed the main reason for the decline in profits as a combination of newer, less profitable customers and the proportional increase in costs, we can propose a solution. A simple but not ideal solution would be to eliminate the additional, less profitable customers while simultaneously reducing the number of branches and tellers to bring us to the initial profitability. A second, better solution would include two concurrent approaches. First, we should try to increase average revenues per customer, and second, we should decrease average costs per customer. In increasing the revenues, we would come up with new products that would result in increased interest income. We can also increase the fees we charge our customers. In decreasing costs, we could attempt to close off our least profitable branches and reduce our teller personnel. My proposed solution, however, will produce even better results. I propose segmenting our current customers into several customer tiers and adjusting the service level, and implicitly, the costs according to the customer tier. For example, high net worth individuals would have unrestricted access to personal bankers and new services would be tailored to their specific needs. At the other end of the spectrum, our client should educate the students about the benefits of using cheaper delivery systems such as ATMs or online services. They would still have access to the tellers; however, we would limit their free access to two free teller visits per month. After those visits, we could start charging 30 pesos per visit or around $3US. In effect, we would adjust our service delivery model based on the customer’s value to the bank. This would achieve both our goals; increasing revenues, by better addressing the needs of each customer segment, and reducing costs by redirecting the lower-value customers to the cheaper servicing channels. – Okay, good. Type of case: Profit and loss, marketing, customer segmentation Comments: What started out as a profit and loss case quickly changed into a marketing / customer segmentation case. The student did a good job analyzing the chart and came up with a number of good possible solutions for the client. + YELLOW STUFF CHEMICAL COMPANY Case 2: Our client is a manufacturer that makes industrial cleaning solvents and pesticides. Recently, sales have been declining, mostly as a result of new EPA guidelines. The company has been “dumping” its old products overseas into countries with less stringent environmental laws, as well as re-engineering its products to fit the new EPA guidelines. Further evaluation of sales, both past and future, indicates that the chemical industry has grown and will continue to grow slowly over the next five to seven years, with 3 percent annual growth. Management has decided to diversify. While Yellow Stuff wants to keep its chemical business intact, it also wants to enter an industry that has long-term, high-growth potential. Yellow Stuff has hired us to help determine which industry or industries it should enter. While I don’t want you to come up with a list of industries, I do want you to tell me what sort of things you should be researching to determine which industry our client should diversify into. So, as I understand it, our client is a chemical manufacturer who wants to diversify outside the chemical industry into a high-growth industry. – That’s right. And you want me to come up with a strategy on finding the best possible match. – Yes. Besides diversification and profit, are there any other objectives that I should know about? – No. What does the company define as high growth?