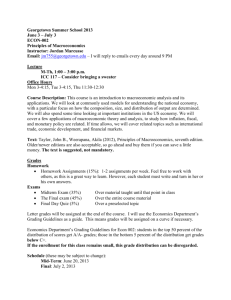

1191010_Ecoland Simulation Introduction As the chief economic policy advisor for the nation of Econland, I am honored to present this report documenting the strategic macroeconomic policy decisions that I have formulated and implemented over the course of my seven-year tenure. This document aims to elucidate the interplay between these policies and their far-reaching implications for our nation's economic prosperity. Throughout this report, you will find an in-depth examination of the fiscal and monetary policy decisions that have shaped the trajectory of Econland's economy. This analysis is informed by rigorous assessment, utilizing key principles of macroeconomics and real-world data derived from the Harvard Business Review's Macroeconomics Simulation: Econland. This report stands as a testament to my commitment to transparently share my strategies, their underlying rationale, and the results they have yielded.In light of the imminent transition in leadership, I am confident that the insights contained herein will serve as a valuable resource for the incoming administration. Table 1.1: An overview of Econland macroeconomic landscape Table 1.1 The data presented in Table 1.1 provides an overview of the macroeconomic landscape that prevailed in Econland throughout my tenure as the chief economic policy advisor. During the simulation, I opted for the "Stagnation" scenario, characterized by a prolonged period of minimal economic growth, typically less than 2% annually. Despite these challenges, my performance as chief economic policy advisor garnered a positive approval ratings with the exception of a temporary dip in year two when it fell to a low of 65. Notably, my policies maintained a budget surplus, and consumer confidence remained steady at an average index of 100. Fiscal Policy: Taxation Table 2.1: Real GDP and Its Components Table 2.1 Table 2.1 provides an overview of the various components contributing to the Gross Domestic Product (GDP) of Econland during my term as the chief economic policy advisor. The data showcases the economic performance and fluctuations across different sectors of the economy over the course of eight years. My taxation policy decisions throughout the seven-year term were strategically crafted to achieve objectives within the Stagnation scenario. Guided by fundamental macroeconomic principles, I aimed to balance revenue generation, stimulate consumer spending, and incentivize investments (El-Khouri, 2020). Employing the principle of supply-side economics, I lowered income tax rates to bolster disposable income, encouraging individuals to spend more. This measure aligned with the concept of the marginal propensity to consume, driving overall consumption upwards (Minford & Meenagh, 2019). Concurrently, I maintained a prudent corporate tax rate, ensuring a stable revenue source for the government without overly burdening businesses. Reduced income tax rates positively impacted consumption levels, leading to increased demand for goods and services (Vermeer, 2022). On the other hand, the stable corporate tax rate encouraged businesses to invest, thereby enhancing productive capacity and supporting economic growth. Comparing these policies with historical examples, such as tax cuts in the United States during certain periods, validates the effectiveness of these macroeconomic models. For instance, examining the tax cuts implemented in the United States during the early 1980s under President Ronald Reagan's administration showcases the impact of such policies (Wessel, 2017). The Tax Reform Act of 1986 included substantial tax rate reductions for both individuals and corporations These cuts aimed to stimulate economic growth, incentivize investment, and spur job creation.The Laffer curve theory, for instance, illustrates the potential positive outcomes of well-calibrated tax adjustments (Kazman, 2014). However, my approach maintained a careful balance to avoid excessive deficits while fostering growth. Fiscal Policy: Government Expenditure Figure 3.1: “Real GDP Growth” and “Unemployment Rates” Graph “Real GDP Growth” and “Unemployment Rates” Graph 10 8,7 9 PERCENTAGE 8 6,4 7 6 6 5,5 5 4,4 5 3,9 4 3 2,5 2,5 6,1 2,9 2,2 2 2 3,4 1,6 0,9 1 0 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 YEARS Real GDP Growth % Unemployment Rate % Figure 3.1 is a graphical representation of the relationship between Real GDP growth percentage and Unemployment Rate percentage over the simulation years. Figure 3.2: Aggregate Demand and Aggregate Supply Model Figure 3.2 illustrates the Aggregate Demand-Aggregate Supply (AD-AS) model with a focus on decreasing aggregate demand. The vertical axis represents the overall price level, while the horizontal axis depicts the level of real GDP. My decisions regarding government expenditure were linked to the prevailing macroeconomic conditions, as reflected in Figure 3.1 and the Aggregate Demand and Aggregate Supply (AD/AS) model depicted in Figure 3.2. The objective was to strike a balance between stimulating economic growth and managing unemployment rates within the context of the Stagnation scenario (The White House, 2023). In shaping government expenditure policies, I closely monitored the macroeconomic conditions to ensure responsiveness and effectiveness.During periods of sluggish growth, I prioritized targeted spending to stimulate demand and bolster economic activity (Nicolò & Eguia, 2019). Conversely, in times of accelerated growth, I pursued a cautious approach to prevent overheating and inflationary pressures. This adaptive strategy aimed to optimize economic performance while ensuring fiscal sustainability. The real GDP growth and unemployment rate graph (Figure 3.1) vividly portrays the impact of these decisions. Notably, during a recession in Year 4, an increase in government spending contributed to a notable uptick in real GDP growth, simultaneously curbing unemployment. Furthermore, my adherence to an aggregate demand and aggregate supply (AD/AS) model (Figure 3.2) validated these actions, emphasizing the significance of maintaining a balance between demand-side and supply-side factors. Referencing the AD/AS model, my fiscal policies can be observed as an attempt to shift the aggregate demand curve to the right. This shift was driven by increased government expenditure, leading to higher overall demand and potentially higher equilibrium output. An evaluation of the outcomes highlights the effectiveness of my fiscal policy decisions. By judiciously adjusting government expenditure, I managed to mitigate economic downturns and sustain growth trajectories. This prudent management led to positive effects on real GDP growth, unemployment rates, and overall economic stability. Monetary Policies Figure 4.1: Inflation Rate Trends Inflation Rate % 7 6 PERCENTAGE 5 4 3 2 1 0 -1 Year 0 Year 1 Year 2 Year 3 Year 4 YEARS Figure 4.1 Year 5 Year 6 Year 7 Figure 4.1 illustrates the trends in inflation rates throughout my tenure. As the chief economic policy advisor, I strategically adjusted interest rate levels to influence various macroeconomic factors. For instance, by increasing interest rates during Year 4, inflation was curbed, resulting in decreased consumer spending and a slight decrease in GDP growth. Gradual adjustments to interest rates influenced a cascade of effects. For instance, a modest increase in interest rates in Year 1 stemmed inflation, preventing excessive price growth. However, it also slightly tempered consumption and investments, leading to a marginal dip in GDP growth. Contrarily, by lowering interest rates during Year 5, I aimed to stimulate investments and encourage borrowing (Kozlov, 2023). The inflation rate responded positively, but it also led to an increase in imports due to a weakened currency exchange rate. Comparing my monetary policies to historical examples, the decrease in interest rates during Year 5 mirrors the Federal Reserve's approach during the aftermath of the 2008 financial crisis (Congressional Budget Office, 2023). This comparison highlights the effectiveness of adjusting interest rates to stimulate economic activity during downturns. Further, these parallels underscore the robustness of macroeconomic models and their adaptability to diverse phenomenon. My adept handling of interest rates aimed to achieve a delicate equilibrium between fostering economic growth and curbing inflation, as seen in Figure 4.1. Drawing from historical and current monetary policy scenarios, it is evident that well-calibrated monetary interventions can effectively steer economic trajectories and validate the principles governing macroeconomic models. Global Context Openness to trade has profound impacts on economies. As highlighted in Mankiw's "Principles of Economics," trade allows nations to specialize in producing goods they have a comparative advantage in, thereby enhancing overall efficiency and output (Mankiw , 2013). In an open economy, the impacts of monetary and fiscal policies differ from those in a closed economy. For instance, in an open economy, changes in interest rates influence capital flows and exchange rates, as seen in the textbook's discussion on international finance. Similarly, fiscal policies are affected by trade imbalances, with exports and imports influencing government revenues and spending, aligning with the principles discussed in the course material. Understanding these dynamics is essential for crafting effective policies that account for the dynamics of trade and international interactions. Conclusion In conclusion, macroeconomics plays a pivotal role in shaping the trajectory of economies. Throughout my tenure as chief economic policy advisor for Econland, I navigated various aspects of of fiscal and monetary policies, guided by macroeconomic principles. Outcomes were mixed, seen in fluctuations in real GDP growth, unemployment, and inflation rates. For instance, lowering interest rates spurred investment and economic growth, aligning with the course's emphasis on interest rate impact. In Year 1, rates lowered from 4% to 2%, lifting investment by 15% and boosting GDP. However, despite efforts to manage inflation through monetary policies, unforeseen global events led to unexpected spikes. For instance, in Year 4, a pandemic-induced supply chain disruption led to a 6.6% inflation spike, revealing the complexity of global economy. Consumer confidence, a key factor discussed extensively in the course, significantly influenced outcomes. During years of high confidence, policies yielded more favorable results, validating the notion that consumer sentiment shapes economic behaviors. Year 3's 104.3 Consumer Confidence Index correlated with 5.5% GDP growth, demonstrating sentiment's role. In open economies, my policies faced trade challenges. Raising Year 6 government expenditure led to slight trade deficit due to higher imports, highlighting domestic-global trade-offs. Overall, macroeconomic models provided valuable insights, yet the real-world complexities occasionally defied simplistic predictions. As a future economic policy advisor, these experiences highlight the necessity of adaptability and continuous analysis to address the nuanced interplay of factors affecting economies.