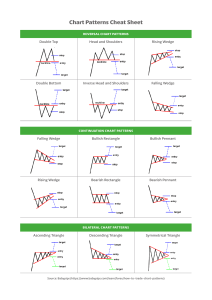

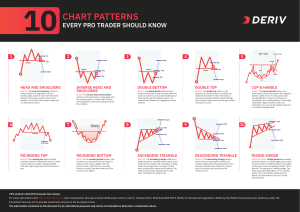

Table Of Contents What Are Forex Chart Patterns? 9 Type of Chart Patterns 9 Continuation Chart Patterns 9 Reversal Chart Patterns 9 Neutral Chart Patterns 10 Continuation Chart Patterns 10 Pennant Chart Pattern 10 Rectangle Chart Pattern 11 Corrective Wedge Pattern 12 Reversal Chart Patterns 13 Reversal Wedge Pattern 13 Double Top and Double Bottom Patterns / Triple Top and Triple Bottom Patterns 14 Head and Shoulders Pattern 15 Ascending Triangle Pattern / Descending Triangle Pattern 16 Neutral Chart Pattern – Symmetrical Triangle 17 Trading Chart Patterns 18 What is the Forex Flag Pattern? 21 Structure of the Forex Flag Pattern 21 The Flag Pole 21 The Flag 21 Flag Pattern Potential 22 Target 1: Size of the Flag 22 Target 2: Size of the Pole 23 Price Action Trade Management 24 Types of Flag Patterns 24 Bear Flag Pattern 24 Bull Flag Pattern 25 Trading the Flag Formation 26 Flag Pattern Trade Entry 27 Flag Pattern Stop Loss 27 Flag Pattern Take Profit 27 Technical Analysis Using Flag Patterns 28 Difference between Flags and Pennants 29 Conclusion 30 What Is The Pennant Chart Pattern? 31 Recognizing The Pennant Technical Formation 33 Bullish Pennant Pattern 34 Bearish Pennant Pattern 35 Pennant Patterns vs. Flag Patterns 36 Technical Analysis Using Pennant Chart Pattern 38 Pennant Trading Strategy Example 1 39 Pennant Trading Strategy Example 2 41 Summary 42 What is a Triangle Chart Pattern 43 Ascending/Descending Triangle 43 Ascending Triangle Pattern 43 Descending Triangle Pattern 44 Rising/Falling Wedge 45 Rising Wedge 45 Falling Wedge 46 Symmetrical Triangle Pattern 47 Pennants 48 Bullish Pennant 48 Bearish Pennant 50 Expanding Triangle 51 Symmetrical Lines 51 Increasing Lines 52 Decreasing Lines 52 One Side Stronger than the Other 52 Trading Triangles in Forex 52 Conclusion 53 Wedge Chart Pattern 54 Rising Wedge Pattern 55 Falling Wedge Pattern 56 Broadening Wedges 58 Trading Wedge Patterns 60 Rising Wedge Pattern Trade Example 61 Falling Wedge Pattern Trade Example 63 Summary 64 Double Tops and Double Bottoms 64 Double Top Chart Formation 65 Double Bottom Chart Formation 66 Confirmation of Double Tops and Bottoms 67 Drawing the Neck Line 67 Neck Line Breakout 68 Potential of the Double Top and Bottom Reversal Patterns 68 Size of the Double Top and Double Bottom Reversal Patterns 69 Projecting the Move 69 The 11 Step Process for Trading Double Tops and Bottoms 70 Step 1: Trend Identification 70 Step 2: Creation of a Top 71 Step 3: Trend Interruption 71 Step 4: Creation of a Bottom 71 Step 5: Creation of the Second Top 71 Step 6: Drawing the Neck Line 71 Step 7: Neckline Breakout 72 Step 8: Trade Entry 72 Step 9: Stop Loss 72 Step 10: Size of the Pattern 72 Step 11: Exit the Trade 72 Double Top and Bottom Trading Example 72 Conclusion 75 Head and Shoulders Pattern in Forex 76 Psychology of the H&S Technical Pattern 77 Head and Shoulders Pattern Rules 77 Drawing the Head and Shoulders Chart Pattern 78 Head and Shoulders Neckline 79 Head and Shoulders Breakout 80 Head and Shoulders Stop Loss 80 Head and Shoulders Price Target 81 Measuring the Size of the Head and Shoulders Pattern 81 Applying the Size of the Head and Shoulders Pattern 81 Inverted Head and Shoulders Pattern 82 Technical Analysis Using Head and Shoulders 83 Inverted Head and Shoulders Trading Example 86 Conclusion 86 Rectangle Pattern In Technical Analysis 87 Rectangle Trading Pattern Dynamics 89 Rectangle Breakout and Continuation 90 Rectangle Trading Strategy 91 Bullish Rectangle Trade Setup 93 Bearish Rectangle Trade Setup 95 Summary 96 Rounding Top Chart Pattern 96 Rounding Top Chart Example 97 What Does the Rounding Top Tell Us About the Market? 98 Trading the Rounding Top Pattern 98 How To Manage The Trade 99 Where Best to Trade the Pattern? 99 Benefits of The Rounding Top Chart Pattern? 100 The Rounding Bottom Chart Pattern 100 Rounding Bottom Chart Example 100 What Does the Rounding Bottom Tell Us About the Market? 101 Trading the Rounding Bottom Pattern 102 How to Manage the Trade 103 Where to Trade the Rounding Bottom Pattern? 103 Benefits of The Rounding Bottom Pattern? 103 Points to Consider When Trading Rounding Tops and Bottoms 104 The Benefits of Trading Rounding Tops and Rounding Bottoms 105 Diamond Chart Pattern 105 Bearish Diamond Pattern 108 Bullish Diamond Pattern 109 Diamond Pattern Trading Strategy 110 Diamond Trade Setup In EURCAD 112 Diamond Pattern Signal In USDJPY 113 Summary 115 Cup and Handle Pattern 115 Structure of the Cup and Handle Technical Pattern 116 Cup and Handle Formations in Forex 117 Bullish Cup and Handle Pattern 117 Bearish Cup and Handle Pattern 118 Drawing the Cup and Handle 119 Cup with Handle Signal 119 Cup and Handle Trading System 120 Opening a Trade 120 Stop Loss 120 Take Profit 121 Trading the Cup and Handle Chart Pattern 121 Bullish Cup and Handle Trading Example 121 Bearish Cup and Handle Trading Example 122 What are Chart Pattern Failures? 123 Failure Patterns and Trapped Traders 124 Types of Failure Patterns in Forex 125 Non-Confirmed Patterns that Fail 126 Already Confirmed Patterns that Fail 126 How to Trade Failed Chart Setups 126 Entering a Failed Pattern Trade 126 Stop Loss on a Failed Pattern 126 Take Profit when Trading Failed Patterns 127 Failed Chart Pattern Trading Example 127 Useful Indicator for Trading Forex Failure Patterns 129 Trading Failed Chart Formations with the Volume Indicator 130 If you have been around the Forex market for any length of time, then you de nitely have heard about chart patterns and their importance in technical analysis. If you want to learn more about chart patterns and their corresponding signals in trading, then this article will provide you a starting point from which to increase your knowledge of classical chart pattern trading. Today we will go through the most important chart gures in Forex and we will discuss their potential. What Are Forex Chart Patterns? Forex chart patterns are on-chart price action patterns that have a higher than average probability of follow-through in a particular direction. These trading patterns offer signi cant clues to price action traders that use technical chart analysis in their Forex trading decision process. Each chart pattern has the potential to push the price toward a new move. Thus, Forex traders tend to identify chart patterns in order to take advantage of upcoming price swings Type of Chart Patterns Forex trading patterns are divided in groups based on the potential price direction of the pattern. There are three main types of chart patterns classi ed in Forex technical charting. Continuation Chart Patterns The trend continuation chart pattern appears when the price is trending. If you spot a continuation chart pattern during a trend, this means the price is correcting. In this manner, continuation patterns indicate that a new move in the same direction is likely to occur. Some of the most popular continuation chart formations are: pennants, rectangles and corrective wedges. Reversal Chart Patterns The trend reversal chart patterns appear at the end of a trend. If you see a reversal chart formation when the price is trending, in most of the cases the price move will reverse with the con rmation of the formation. In other words, reversal chart patterns indicate that the current trend is about to end and a new contrary move is on its way! The most popular reversal chart patterns are: double (or triple) top/bottom, head and shoulders, reversal wedges, ascending/ descending triangle. Neutral Chart Patterns These are the chart formations which are likely to push the price toward a new move, but the direction is unknown. Neutral chart patterns may appear during trends or non-trending periods. You may wonder what value there may be in neutral chart formations, since we are unable to know the likely direction. But actually, spotting a neutral chart pattern is still quite valuable as you can still trade an upcoming move. When the price con rms a neutral chart pattern, you can open a position in the direction of the breakout! Continuation Chart Patterns Pennant Chart Pattern The pennant is a corrective/consolidating price move, which appears during trends. It resembles a symmetrical triangle by shape, as both are bound by trendline support and resistance lines. The difference is that pennants typically occur during a trend phase, while triangles can be formed during both trends and general consolidation periods. Pennants could be bearish or bullish depending on the trend direction. When a pennant occurs during a trend, it has the potential to push the price in the direction of the overall trend. The expected move is usually a measured move, meaning the target from the breakout point equals the size of the pennant itself. Below is an illustration of Pennants: The green lines indicate the size of the pennant and measures the expected price move, which equals the size of the pennant. When you trade a pennant you should open your position whenever the price closes a candle beyond the pennant, indicating con rmation of the formation. At the same time, your stop loss should be placed right beyond the opposite level of the pennant. Rectangle Chart Pattern The rectangle chart pattern is a trend continuation formation, which resembles price consolidation within horizontal support and resistance levels. During a trend, when the price starts moving sideways forming a rectangle, another trending move is likely to occur once price eventually breaks out of the rectangle formation. This move is likely to be at least as big as the size of the rectangle. Rectangles could be bearish or bullish depending on the trend direction. Take a look at the illustrations below for the Rectangle formations: When you trade rectangles, you should put a stop loss beyond the opposite extreme of the formation. Notice that this trading pattern is similar to the pennant, the difference is the swings of the rectangle formation occur within the same price zone. Corrective Wedge Pattern We have a rising wedge when the price closes with higher tops and even higher bottoms. We have a falling wedge when the price closes with lower bottoms and even lower tops. Wedges are very interesting chart patterns. The reason is that wedges could be a trend continuation or trend reversal formation. Thus, I decided to distinguish the two types of wedges in order to provide a more detailed classi cation – So wedges are of two types: corrective wedges and reversal wedges. There is no difference in overall apperance between these two types of wedges. They look absolutely the same – for example, a regular rising wedge and a regular falling wedge. The corrective/reversal character is determined by the previous price movement. The corrective wedges form as a retracement opposite to the trend direction. In this manner, if you have an uptrend and a falling wedge, you have a corrective falling wedge, which has trend continuation character. If you have a downtrend and a rising wedge, you have a corrective rising wedge, which has trend continuation character. If a corrective wedge occurs during a trend, it has the potential to push the price toward another trending move equal to the size of the wedge itself. This is how corrective wedges appear: When you trade corrective wedges your stop loss should be placed right beyond the side, which is opposite to the breakout. Reversal Chart Patterns Reversal Wedge Pattern I will start with the reversal wedges because the previous chart patterns we discussed were the corrective wedges. This way you will see the difference between these two. Reversal rising/falling wedges look absolutely the same way as corrective rising/falling wedges. The difference, though, is the relation between the wedge and the trend direction. Every rising wedge has bearish character. This means a rising wedge reverses bullish trends and continues bearish trends. At the same time, every falling wedge has bullish character. So, falling wedges reverse bearish trends and continue bullish trends. Still not getting it? Have a look at the image below: You see? The reversal wedges are absolutely the same as the corrective wedges in appearance. The difference is where they appear in relation to the trend. When a reversal wedge occurs at the end of a trend, it has the potential to push the price to an opposite movement equal to the wedge itself. When you trade reversal wedges you should place your stop loss order right beyond the level, which is opposite to the wedge breakout. Double Top and Double Bottom Patterns / Triple Top and Triple Bottom Patterns These are another example of reversal chart patterns. We have a double top pattern when after an uptrend the price creates two tops approximately on the same level. And on the contrary, we have a double bottom pattern when after a downtrend the price creates two bottoms approximately on the same level. It is absolutely the same with the triple top and triple bottom formations. The difference, though, is that the tops and bottoms here are three and not two. This is how these formations look: The green lines here indicate the size of the formation and its respective potential. We determine the size when we take the highest top and the lowest bottom of the formation. When we con rm the authenticity of these trading patterns, we expect a price move equal to the size of the formation. This is typically referred to as a 1 to 1 measured move. But how do we con rm the formation? When we trade double and triple tops and bottoms we need to settle on the signal line for the formation. The signal line of the double top is the horizontal line which goes through the bottom between the two tops. The signal line of the double bottom is the horizontal line, which goes through the top located between the two bottoms. With the triple tops and bottoms it’s almost the same. This time, the signal line goes through the lowest bottom for a triple top formation and through the highest top in case of a triple bottom formation. When the price closes a candle beyond the signal line, we have a pattern con rmation. Then you can open a position and place a stop loss around half the size of the formation or at the pattern extreme. Head and Shoulders Pattern This is one of the most reliable chart patterns in the technical analyst’s arsenal. Head and shoulders are a reversal formation and indicate a topping reversal after a bullish trend. At the same time, this chart pattern has its opposite equivalent – inverted (or inverse) head and shoulders. The inverted head and shoulders typically appears after a bearish trend and calls for a bottom in price. Below you will nd illustrations of this pattern: As you see, the head and shoulders formation really looks like a head with two shoulders. After an uptrend, the price creates a top, then it corrects. It creates a second, higher top afterwards and then it drops creating a third, lower top – head and shoulder. It is the same with the inverted head and shoulders but instead of an uptrend we have a downtrend and instead of tops the price creates bottoms, as shown on the image above. The bottoms forming the head are two points which create the signal line of the formation. This signal line is called a Neck Line. When the price closes a candle beyond the neck line, the head and shoulder formation is con rmed and we can enter the market with the respective position. This position should be short in case of head and shoulders and long in case of inverted head and shoulders. Your stop loss should be placed right above the last shoulder of the formation. Ascending Triangle Pattern / Descending Triangle Pattern The ascending triangle has tops, which lay on the same horizontal line and has higher swing bottoms. The descending triangle has bottoms, which lay on the same horizontal line and lower swing tops. Although many people consider these chart patterns as neutral, their chance to reverse the trend is a bit higher. Thus, I put them with the trend reversal chart patterns. This is how the ascending and the descending triangles look: As you see, ascending and descending triangles are very similar to the rising and falling wedges. The difference is that rising wedges have higher tops and falling wedges have lower bottoms, while ascending triangles have horizontal tops and descending triangles have horizontal bottoms. When an ascending/descending triangle is con rmed, we expect a reversal price movement equal to the size of the formation. This is shown with the green lines on the image above. The stop loss should be placed right beyond the horizontal level of the triangle. Neutral Chart Pattern – Symmetrical Triangle Symmetrical triangles have two sides, which are approximately the same size. Since the two sides of the triangle are usually the same, this creates a technical force equivalency, which creates the neutral character of the formation. The image below shows how a symmetrical triangle appears: When a symmetrical triangle occurs on the chart, we expect the price to move in an amount equal to the size of the formation. However, the direction of the breakout is typically unknown due to the equivalency of the two sides of the triangle. Thus, price action traders tend to wait for the breakout in order to con rm the potential trade direction of the formation. If you trade a symmetrical triangle, you should place a stop loss right beyond the opposite end of the breakout side. Trading Chart Patterns Now that I introduced you to the most important patterns for chart reading it is now time to show you an example of the chart patterns in action. Have a look at the image below: This is the daily chart of EUR/USD for Oct 29, 2012 – Apr 12, 2013. Our chart analysis shows seven successful chart patterns. The green lines show where we could open our positions. The red lines show where stop losses should be placed. First, we start with a double bottom formation. The green line is the signal line of the gure and the moment where we would go long. The red line is the stop loss, which is approximately in the middle of the formation. The EUR/USD price increases to 187 pips in 5 days. The price increase turns into a rising wedge afterwards. Since the wedge comes after a price increase, it has a reversal character. The lower level of the wedge gets broken in bearish direction and would be a potential short on the EUR/USD. The could be closed after two days when the price reached the size of the formation. The pro t gain would have been 190 pips. Then the price starts a new increase which leads us to a symmetrical triangle. Look how the sides are approximately the same size and under the same angle. Since the symmetrical triangle has neutral character, we wait for a breakout. And here it is in bearish direction. We could have shorted the EUR/USD and placed the stop loss right above the gure. In the same day the price completes the size of the formation – 137 pips that same day. The decrease after the symmetrical triangle leads us to the rst bottom of a double bottom formation. When we spot the second bottom, we would put the signal line right above the top between the two bottoms. The price breaks the signal line and a long trade is con rmed. We would place the stop loss around the middle of the gure. In this particular case, one could have stayed in the market for twice the size of the formation! Soon afterwards, price starts consolidating. Notice how the consolidation resembles a rectangle? Indeed! This is a bullish rectangle! The price breaks the upper level of the rectangle and a buy setup occurs in this EUR/USD Forex pair. We could manage to stay with this long position more than the potential of the rectangle, because we get no bearish behavior after the bullish potential is ful lled. The price starts hesitating afterwards and we see some bearish attitude on a lower time frame chart (H4). Furthermore, on our daily chart the price closes a Doji candle which has a potential reversal character. Suddenly, the price nally starts to drop. Do you see something? See the black lines on the image above. The last double bottom followed by the bullish rectangle creates a shoulder and a head. The following decrease creates a second shoulder afterwards. This is a nice head and shoulders formation. In order to con rm the setup, we need price to break and close beyond the neck line of the formation. So, we connect the two bottoms which create the head and we get our neck line. A shorting opportunity in the EUR/USD occurs right after the price breaks the neck line. We could sell the EUR/USD and put a stop loss right above the last shoulder of the gure as shown on the image. We would want to stay with the short position until the price completes the size of the gure. Then a corrective rising wedge appears. It is up to you if you are going to close the head and shoulders position and then open another short position to trade the rising wedge. The other option is to stay with the head and shoulders short position until the wedge is completed. In both cases you would have generated solid pro t from the head and shoulders pattern. Conclusion Forex chart patterns are technical on-chart patterns which clue us in on eventual price moves. Chart patterns are classi ed within three types: Continuation Chart Patterns Reversal Chart Patterns Neutral Chart Patterns Some of the most important trend continuation chart patterns are: Pennants Rectangles Corrective Wedges Some of the most important trend reversal chart patterns are: Double/Triple Top/Bottom Head and Shoulders Reversal Wedges Ascending/Descending Triangles One of the most popular neutral chart pattern is the Symmetrical Triangle All these chart patterns have a tendency for a price move equal to the size of the formation itself. This is referred to as a measured move price potential. What is the Forex Flag Pattern? Chart patterns are a crucial component of technical analysis. Each classical chart pattern provides the trader with a unique outlook on potential price movement. In general, chart patterns can be classi ed into two classes based on their potential price move – continuation and reversal. Today we will discuss one high probability continuation chart formation known as the Flag pattern. The following material will teach you how to recognize and trade the bearish and the bullish Flag pattern like a Pro. The Forex Flag pattern is one of the best-known continuation formations in trading. It is an on-chart gure, which typically appears as a minor consolidation between impulsive legs of a trend. When this pattern forms on the chart, there is a high likelihood that the price action will breakout in the direction of the prevailing trend. We will discuss this in more detail but for now, let’s get familiar with the technical structure of the Flag pattern. Structure of the Forex Flag Pattern The Flag pattern consists of two parts – a ag pole and a ag. Let’s take a closer look at each of these two components: The Flag Pole The rst component of the Flag chart pattern is the Flag Pole. It represents a trend impulse on the chart. Every trending move could transition into a Flag, which brings us to the statement that every trend impulse could appear to be a ag pole. As a Flag pattern is emerging you will note the large impulse move, which is referred to as the Flag Pole. A brief consolidation will follow and this consolidation takes on the appearance of a Flag. The Flag After creating the pole, a valid Flag pattern will then begin to trade within a tight range, taking on the shape of a Flag. The Flag consists of price action with evenly distributed tops and bottoms. At the same time, this price action has a corrective character on the graph. In this manner, it is angled contrary to the trend impulse creating the pole. Take a look at this image below, which will make the picture clearer for you: This is a sketch of the Flag chart pattern. The red line is the pole of the ag and the blue channel is the ag. This is how the Flag pattern is created, and as the name implies it really does look like a ag, doesn’t it? This chart pattern is relatively easy to recognize once you know what to look for. Flag Pattern Potential As we said, the Flag Pattern has a continuation potential on the chart. And so, a valid ag pattern is likely to push the price action further in the direction of the Flag Pole – the trend impulse. In addition to this, when you spot a Flag formation on your price chart, you will be equipped to measure the approximate price target of the formation. There are two targets related to the Flag chart gure: Target 1: Size of the Flag The rst target of a con rmed Flag pattern can be derived using the measured move technique. The measured move target is a distance equal to the size of the ag. To measure the size of the ag, you would just take the vertical distance between the upper and the lower channel within the ag. Then you would apply this distance starting from the breakout point. Your rst target is located at the end of this distance. Target 2: Size of the Pole The next target of the Flag formation equals the size of the Flag Pole. So, to get this target 2, you need to measure the vertical distance between the high and the low of the Pole. Once you get that distance, you will need to apply it to the pattern. Again, as we did with Target 1, you would apply it starting from the breakout point. The sketch above shows the two targets of the pattern. The rst target is marked with the magenta arrows and the magenta line. It measures the vertical size of the ag contained within the channel marked in blue. The second target is marked with the purple arrows and the purple line on the chart. It measures the vertical size of the Flag Pole. Notice that both lengths are applied starting from the breakout level of the pattern. Price Action Trade Management Most times, after the Flag completes the two targets, you would want to close out the entire position and bank your pro ts. But in some instances, you may decide to keep a small position open to ride out a larger trend move. So, if you continue to see signs of a strong trend even after Target 2 has been reached, then by all means, keep a portion of the position open. Make sure to manage your trade using price action based clues to determine a nal exit point. For example, the trend line indicator can be very helpful in managing a possible runner. You can decide to stay with the trade as long as the trend line is intact. Support and Resistance rules are of a great importance too. If you see the price hitting a level, and then bouncing contrary to the trend, then the trend might be getting exhausted. On the other hand, if you see the price breaking a level with increasing momentum, then this might mean that the trend is gaining strength. Another important consideration would be candlestick signals and the chart patterns. A reversal pattern might provide enough reason to close out the trade and book pro ts. Types of Flag Patterns There are two types of Flag chart patterns based on their structure and potential – a bearish Flag and a bullish Flag. Each of these is the absolute opposite of the other. Let’s dive a little deeper into the details of each now. Bear Flag Pattern The bear Flag pattern forms during bearish trends. The gure starts with a bearish trend impulse and turns into a correction, which is directed upwards. During the correction phase, the tops and the bottoms are evenly distributed, creating a parallel channel. The con rmation of the Bear Flag setup comes when the price action breaks the ag channel boundary downwards. When the breakout occurs, we have the opportunity to short the currency pair. This is how the bear ag pattern appears: Notice that the Flag Pole is in a bearish direction. The Flag is a bullish correction. Upon breakout of the lower channel line, we expect to see a continuation of the prevailing bearish trend. Bull Flag Pattern The Bull Flag pattern is the absolute opposite of the Bear Flag pattern in appearance. First, it forms during bullish trends. The pattern begins with a bullish trending move, which then pauses and turns into a minor bearish correction. The tops and the bottom of this correction are parallel as well. The con rmation of the Bullish Flag pattern happens with the upside breakout, and we would prepare for a long position. Then we apply the same target rules as discussed earlier. Now let’s look at a sketch of the Bull Flag Pattern: Notice the bullish Flag pattern starts with a bullish Flag Pole, which turns into a bearish correction. Upon breakout of the upper channel line, we expect to see a continuation of the prevailing bullish trend. Trading the Flag Formation Now that we have discussed some of the characteristics of the Bull and Bear Flag, I now want to shift the attention to creating a concrete trading strategy around this setup. Next, we will develop some rules and guidelines for effectively trading with the Flag pattern. Flag Pattern Trade Entry To enter a Flag pattern trade, should rst attain a con rmation signal. The con rmation of the Flag comes with the breakout. If you have a bullish ag, you will buy the Forex pair when the price action closes a candle above the upper side. If you have a bearish ag, then you would sell the pair when you see a candle closing below the lower level of the pattern. Flag Pattern Stop Loss After you open your Flag trade, you should position your stop loss order. This is needed to protect your trade from unexpected price moves. One basic rule should be considered when determining the proper stop loss placement for this type of trade. If the price breaches the opposite side of the breakout, then you should immediately exit the trade, because the pattern is most likely false. The most logical location to place the stop loss would be beyond the most extreme swing within the Flag structure. So, if you were trading a bullish ag, then your stop should be placed below the lowest bottom in the Flag. Conversely, if you were trading a bearish Flag, then your stop should be placed above the highest top in the Flag. Flag Pattern Take Profit The take pro t for the Flag pattern should be addressed using the two targets we discussed earlier. It is up to you which target you are going to pursue. However, I would suggest taking pro ts at each target level to reduce risk and book pro ts. Of course, each trader will have their own trade management style that best suits them. Below is one example of how you might choose to manage a Bullish Flag trade. When you open your Flag trade, you put a stop loss below the extreme point of the Flag. When the price increases and completes the size of the Flag, you can close out 1/3 of your position size and book the pro ts. Also, you would adjust your stop loss order by raising it just below the initial target level. Then if the price continues to increase and reaches your second target level, you can close another 1/3 of the position to lock in your pro ts further. Now on your remaining trade, you adjust your stop again so that it will be located just below the second target. If the price continues to trend upwards, then you could carefully monitor price action and hold the last 1/3 of the trade position for as long as it seems prudent. Technical Analysis Using Flag Patterns By now you should be getting more familiar with trading the Flag chart formation. But there is nothing like actual charts to clarify the ideas presented so far. So now we will shift our attention to some practical chart examples using Flag Patterns. This is the hourly chart of the GBP/USD Forex pair. The image illustrates how you would perform your analysis to arrive at a potential trading opportunity. You will see the red Flag Pole and the blue Flag channel on the chart. In the green circle, you see the moment when the price action broke through the upper level of the Flag. This con rmed the pattern, which creates a long opportunity on the chart. The green circle is the appropriate time in which to buy the GBP/USD Forex pair. Once the trade is executed, you should put your initial stop loss right below the lowest point of the ag as shown on the image (S/L 1). Then with each target the Stop Loss order should be moved upwards, locking in pro ts as price advances. The two-other trailing stop loss orders are shown with S/L 2 and S/L 3. The magenta and the purple arrows measure the size of the Flag and the size of the Pole. As you can see, these two sizes are applied on the chart starting from the breakout point. Each of these two targets are reached. And as each target is hit, the stop loss order should be adjusted accordingly as shown on the image above. The end of the trade would come when the GBP/USD price breaks the third Stop Loss order (S/L 3). As you see, the price reverses afterward, which would have created unpleasant conditions for the long trade. Difference between Flags and Pennants The Pennant formation is another continuation pattern which strongly resembles the Flag. The main difference between the two patterns is the shape of the correction which comes after the Pole. The Flag pattern creates a channel correction, while the Pennant creates a triangle correction. In both cases, though, the potential of the patterns is the same. As with Flags, there are two types of Pennants – bullish Pennant and bearish Pennant. They are traded the same way as the Flag and the target rules are absolutely identical. If the Flag is bullish, you go long when the price breaks the upper level of the Flag. If the Pennant is bullish, you go long when the price action breaks the upper level of the triangle correction. Let me illustrate a Pennant setup on the chart below: We are now looking at the H4 chart of the GBP/USD, which shows a bullish Pennant chart pattern. The pattern consists of the blue triangle and the thicker red bullish line, which is the Pole of the Pennant. The buy signal on this chart comes when the price action creates a bullish breakout through the upper level of the pennant. This is shown with the green circle on the chart. In this case you should put a stop loss order below the lowest point of the pennant as shown on the image. Then you need to apply the targets of the pattern. This is shown with the purple and the magenta arrows on the chart. The rst target equals the vertical size of the blue triangle measured from the highest point. The second target equals to the vertical size of the Pole. Notice that the price completes both targets, which means the stop loss order could be adjusted twice. This is shown with the red horizontal lines on the image (S/L 2; S/L 3;). The trade could be held until the price action crosses the last stop loss order downwards. As you can see, The Pennant formation is very similar to the Flag pattern, and the same rules apply for trading both. Remember, the only difference between Flags and Pennants is in the nature of the correction. Conclusion The Flag pattern is one of the most popular continuation patterns. It consists of two basic elements: Flag Pole – the current trend Flag – a trend correction with a channel structure There are two main targets related with the Flag pattern: Target 1 – equals the vertical size of the Flag and should be applied starting from the moment of the breakout Target 2 – equals the vertical size of the Flag Pole and should also be applied starting from the moment of the breakout There are two types of Flags based on their potential: Bearish Flag It starts with a bearish move, followed by a channel correction in bullish It has bearish potential. Bullish Flag It starts with a bullish move, followed by a channel correction in bearish It has bullish potential. Some rules for trading Flags in Forex: Enter a trade when the price action breaks the Flag in the direction of the trend. Put a stop loss beyond the opposite extreme of the Flag. Take pro ts at each of the targets. You can adjust your stop loss just beyond the completed target. The difference between Flags and Pennants is in the correction, which comes after the Pole. The Flag has a channel correction. The Pennant has a Triangle correction, which is angled contrary to the trend. What Is The Pennant Chart Pattern? There are many different forms of technical analysis methods used by traders. One of the more common approaches is to trade using classical chart patterns. In this lesson, we’re going to take a deep dive into one of those classical chart patterns, the pennant pattern. You’ll learn how to identify a pennant pattern, compare and contrast it to other similar patterns, and build an effective strategy for trading it in any market. A pennant is a continuation chart pattern that often precedes a price move in the direction of the prior trend leg. It has the characteristics of a quiet time within the market or a short consolidation phase. In terms of the appearance of the pennant formation, it resembles a small symmetrical triangle with converging trendlines that contain the price action. Pennants can be described as bullish or bearish in nature depending on its potential future price direction following the breakout from the structure. Along with ag formations, pennant patterns are among the most reliable chart based trading patterns. And in most cases pennants offer a solid risk reward pro le when traded correctly. We will be comparing and contrasting the ag versus pennant chart pattern in a later section, but for now, it’s important to understand that one of the main differentiating factors between a ag and pennant pattern is in the appearance of the support and resistance lines within the formations. Speci cally, a ag pattern has two parallel channel lines which make up the formation, whereas in the pennant pattern, the support and resistance lines converge towards an apex. In markets where the volume gures are readily available, such as the stock market and futures markets, it is useful to analyze the breakout from a pennant technical formation alongside volume. However, in the forex market where the volume gures are not really available, we can use momentum indicators to gauge the strength of the breakout. For traders, who prefer to ride the underlying trend of the market, pennant patterns offer an excellent opportunity to trade with the trend. Although pennant formations are fairly easy to recognize on the price chart, we must take care in entering trades at the most opportune times in order to avoid fakeouts that can and do occur from time to time. It’s important to understand that pennant patterns are fractal in nature, meaning that they can occur at all degrees of trend from the shortest to the longest. Additionally they can form in any freely traded liquid market. Below you will nd an example of a pennant formation shown on the price chart. Recognizing The Pennant Technical Formation Now that you have a basic understanding of what the pennant formation looks like on the price chart, let’s continue along the same lines as we dissect this formation further. So what are some of the primary characteristics that we should look for to con rm the pennant chart pattern? Below are listed a few key elements to look for when trying to label a chart pattern as a pennant. Prior Impulsive Move – there should exist a sharp price move prior to the consolidation phase within the pennant formation. This impulsive move is often seen as the agpole. The price behavior in the case of a bullish movement higher should be accompanied on high-volume and strong momentum, with a large percentage of up bars. And the price behavior in the case of a bearish movement lower should be accompanied on highvolume and increasing momentum as well, but with a large percentage of down bars. Triangle-like Formation – The pennant pattern appears as a shortened triangle within the price action. The duration of a pennant pattern is often much less than that of a traditional triangle formation. As such it should be a relatively brief pause in the price action rather than a sustained sideways price movement. In addition, the volatility within the pennant formations often decreases as the pattern progresses. As such, we should be able to draw two converging lines as support and resistance trendlines around the price action within the pennant. Strong Breakout – Pennant structures will eventually break out to the side from which the original trend move originated. The candle that breaks out from the pennant formation should do so on high-volume and with increasing momentum. Typically, you will nd a bullish marubozu candle that breaks the resistance line of a bullish pennant pattern, and along the same lines, you will often nd a bearish marubozu candle that breaks the support line of a bearish pennant pattern. Bullish Pennant Pattern A bullish pennant formation provides clues for a price continuation to the upside following the breakout. The con rmation of the breakout occurs upon a candle close above the resistance line of pennant pattern. When this occurs, we expect price to move higher, often with a target that is equivalent to the length of the prior impulsive move, also referred to as the agpole. Let’s take a closer look at an illustration of a bullish pennant formation. Notice on the image above, the bullish pennant pattern occurs after a sharp price move to the upside. We call this the impulsive leg or the agpole. Also notice how the bullish pennant pattern appears as a short symmetrical triangle. Can you see how the upper resistance trendline is sloping downward, while the lower support trendline is sloping upward? This creates a convergence of the two trendlines that will lead to a breakout near the apex point. Furthermore, you would wait until you recognize a strong bullish candle that breaks above the resistance line of the pennant formation and closes above it. Most technical chart traders prefer to enter a long position at the beginning of the following candle following this breakout candle. As for the target price following the breakout, we can use a measured move technique. This means that we would measure the length of the agpole and project that same length forward from the breakout point as the potential target. The psychology within the bullish pennant pattern can be explained as a period wherein the bulls who got in on the trend early are now looking to lock in some of those pro ts. This is what causes the brief consolidation, which will ultimately lead to another push higher. Bearish Pennant Pattern A bearish pennant structure indicates selling pressure on the price following the breakout. The con rmation of a bearish pennant pattern comes after a breakout and close below the support line of the formation. When this happens, we would anticipate prices to move lower, with the target price that is the same as the distance traveled in the prior agpole. You will nd an illustration of the bearish pennant pattern below. The bearish pennant pattern can be seen following a strong price movement to the downside, which is often seen as an impulsive leg. We refer to this impulsive leg as the agpole. As with the bullish variation of this pattern, the bearish pennant appears as a short pause within the price action and resembles a shortened version of a contracting or symmetrical triangle. The price action will be contained within this contracting structure, and we can expect a breakout to the downside as the price progresses towards the apex point. We want to see a break and close below the support line to con rm a valid bearish pennant. This is often seen with a bearish marubozu candle. The target price measurement works similar to the method we discussed earlier. That is to say that we will measure the length of the agpole and project that lower from the breakout point to come up with a level that the price should fall to within the subsequent leg. Essentially in a bearish pennant pattern, many sellers who have realized a healthy pro t from the previous impulsive move down, are taking some of those pro ts off the table. Soon after this period of relative quiet ends, we can expect another push lower as the selling pressure intensi es once again. Pennant Patterns vs. Flag Patterns Both Pennants and Flags are considered continuation patterns and display congestive behavior. It’s as if the market is taking a breather following a sharp price move. There are however a few key differences that we should be aware of when labeling a chart pattern as a pennant versus a ag. Even though the price following a breakout from either the ag or pennant pattern will result in a price move in the same direction from which it came, we still need to try to correctly label it so as to ensure the correct construction of the trendlines that contain the price action within the patterns. As we’ve mentioned earlier a pennant pattern is similar to a symmetrical triangle formation. However, the duration of a pennant pattern is typically much less than the duration of a traditional triangle structure. The trendlines that comprise the pennant formation are contracting in nature. The ag formation on the other hand resembles a lightning bolt or zigzag formation. The trendlines that compose the ag pattern are parallel in nature, and appear as traditional price channels. But unlike traditional price channels, ag patterns are also relatively short in duration. Sometimes the ag pattern appears as a rectangle formation rather than as a zigzag formation. Regardless, the implications are the same. You can see a side-by-side comparison of a pennant formation versus a at formation on the illustration below: Technical Analysis Using Pennant Chart Pattern By now you should have a good understanding of pennant formations, and some best practices for correctly labeling such a pattern. We will now expand on that knowledge and begin to create a trading strategy around the pennant chart pattern. As with any viable trading strategy, we need to create rules for each component within the strategy, so that there is little if any ambivalence when the right pennant trade setup appears in front of us. Our trading strategy should start with trend identi cation. When we are trading a pennant pattern, trend identi cation becomes a bit easier since one of the characteristics of a valid pennant pattern requires a strong price move prior to its formation. As a result, we will need to evaluate the price move within the agpole to ensure that it displays impulsive characteristics. As a continuation pattern, we would expect that the pennant formation should not retrace more than 50% of the previous price leg. In the event that it does, the chances of a signi cant rebound in the direction of the prior trend begins to diminish. As a result we will use the 50% retracement level as our maximum limit for trading the pattern. These are the two primary conditions that must be met for this pennant trading strategy. Let’s now outline the rules for entering a long position: The agpole of the pennant pattern must display strong bullish characteristics in the price action. The extreme swing low within the pennant pattern must not exceed the 50% retracement of the prior move, the agpole. Enter a buy order, when the price breaks out and closes above the resistance trend line of the pennant pattern. This will serve as the pennant pattern signal. Stop loss to be placed at a recent swing low below the breakout point. Targets will be calculated using the measured move technique. Target 1 will be set at 50% of the length of the agpole and Target 2 will be set at 100% of the length of the agpole, measured from the breakout point. The rules for the short position will be the same but in reverse: The agpole of the pennant pattern must display strong bearish characteristics in the price action. The extreme swing high within the pennant pattern must not exceed the 50% retracement of the prior move, the agpole. Enter a sell order, when the price breaks out and closes below the support trend line of the pennant pattern Stop loss to be placed at a recent swing high above the breakout point. Target 1 will be set at 50% of the length of the agpole and Target 2 will be set at 100% of the length of the agpole, measured from the breakout point. Pennant Trading Strategy Example 1 Let’s now apply the rules for the pennant trading strategy that we created earlier to an actual price chart. Below you will nd the price chart for the Australian Dollar to US Dollar currency pair. Once we recognize a consolidation pattern that could be a potential forex pennant pattern, you want to take the necessary steps to ensure that our criteria for such a pattern has been met. The very rst thing that we want to do is to look back in the price action and see if we can recognize a strong impulsive price move leading up to the pennant pattern. This is what’s referred to as the agpole component. Now with that said, we can see the strong bearish price move that occurred just before the consolidation phase of our potential pennant continuation pattern. Notice how there are a large percentage of red candles that make up the sharp move lower. So now that we have con rmed that characteristic, we can move along to analyze the second component of our trade strategy. So what is that second component that we will need to analyze? Well, if you recall we want to ensure that the extreme swing high within the pattern does not exceed the 50% retracement of the prior move the agpole. Now, although it’s not marked, it’s fairly obvious from the chart that the retracement against the agpole did not exceed the 50% mark. And so the second condition for the Bearish pennant has been satis ed. Now that our two primary trading lters have passed the test, we want to prepare ourselves for a downside break to enter a short position. The sell order to go short occurs when the price breaks below and closes below the support line of the pennant pattern. We can see that event triggered on the price chart as shown within the orange circled area and noted as entry. Immediately following our short entry, we need to place a stoploss order to protect ourselves in case our analysis turns out to be incorrect. The stop loss placement per our rules would be entered just beyond the recent swing high prior to the entry signal. The red line above our entry signal shows where that stoploss placement should be. What about our take pro t exit? Where will we get out on this trade? Our strategy calls for a tiered exit plan. The rst target will be at the 50% projection of the agpole as measured from the breakout point. This is noted on the chart as target 1 and circled in green. Our second and nal target will be at the 100% projection of the agpole as measured from the breakout point. You can see that level marked as the lower red line on the chart. You will also see the bar that triggered our second target circled in green as well. Pennant Trading Strategy Example 2 Let’s look at another example of trading pennants in the context of the strategy that we’ve described. This example will also be of a bearish variety of the pennant pattern in forex. The chart below shows the price action of the Euro Yen currency pair based on the 480 minute timeframe. Starting from the left side of the chart, we can see a sharp move lower that forms the agpole. Notice how there is a large percentage of red bearish candles compared to green bullish candles. This is an indication of a strong bearish impulsive price move. You can see that the pennant formation has been outlined with the two converging trendlines. Furthermore, I have plotted the 50% Fibonacci retracement of the agpole. Recall that for the purposes of our pennant trading method, we do not want prices to retrace more than 50% of the agpole. If you look closely, you will see that as the pennant was forming, that it’s extreme swing high moved just below the 50% retracement level before resuming back to the downside. A second test of the 50% retracement level occurred sometime afterwards, but again was rejected from that level. As such our Fibonacci based lter has been satis ed for this set up. Our entry trigger will be a breakout and close below the support line of the pennant pattern. Notice here that entry occurred quite a bit below the support level just one bar prior. In any case, this would have served as the entry trigger for the trade. Sometimes when the entry trigger is quite a distance away from the breakout point, it might make sense to wait for a possible pullback to get a more favorable execution price. However, the risk in doing so is that there is no guarantee that the price will actually retrace to give us that opportunity. In this case, based on our simpli ed rules, we would have gone short on the bar following the breakout close as shown by the orange circled area. Our two-tier target is also shown on the price chart. The rst target was reached a short time after the entry, and represents the price that measures 50% the length of the agpole measured from the breakout point. And the second target would be set at the price which equates to the 100% length of the agpole measured from the breakout point. Notice how the price reaches our second target, and soon afterwards begins to nd demand in the market from buyers that act to push the price higher once again. Summary The pennant pattern is a popular chart pattern used by many technical analysts. It can be applied to any number of nancial markets, and can be found at all degrees of trend from the very minor to the very long term. It’s a simple pattern to recognize on the price chart, however, there are some nuances in correctly labeling it. We outlined some of the best practices in identifying the pennant pattern, some of the differences between it and other classical patterns, and shown a method for trading the pennant within a trend. It’s a simple chart pattern that you should consider adding to your trading arsenal because it provides for a high probability of success when applied correctly. What is a Triangle Chart Pattern I am sure you have heard about chart patterns in Forex trading and their relation to technical analysis. You probably know about Double and Triple Tops, Head and Shoulders, or Rectangles. In order to have a complete understanding of chart pattern trading, we should also gain a good understanding of one of the most common on-chart formations. What I referring to are the triangle trading patterns. So in this lesson, we will discuss the basic triangle formations and some ways to properly identify and trade these patterns. The triangle pattern is a speci c gure formed on the price chart, typically identi ed when the tops and the bottoms of the price action are moving toward each other like the sides of a triangle. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. As such, many breakout traders use triangle formations for identifying breakout entry points. There are different kinds of triangles that can be seen on a Forex chart. Before you jump into triangle trading you should understand the difference between the formations. We will now take a closer look at the various triangle chart patterns and the corresponding trade setups. Once you are equipped with this knowledge, you should be able to add a triangle trading strategy to your trade setup arsenal. Ascending/Descending Triangle These types of triangles have one at horizontal side, and one sloping side, which is moving toward the at horizontal side. The Ascending and Descending Triangle patterns are a mirror image of each other. They are identi ed as Ascending or Descending depending on which side is the at horizontal side, and which side the slope is on. Ascending Triangle Pattern This triangle pattern has its upper side at, and the lower one ascending. In this manner, the tops of this triangle are on the same level and the bottoms are increasing. This type of triangle typically has a bullish character. When you spot this triangle on the chart, you should be prepared to catch a bullish price move equal to at least the size of the triangle. In this manner breakouts through the upper level (the at side) are used for setting entry points for long positions. This is a sketch of the ascending triangle chart pattern: The black lines above indicate the price action within the triangle formation. The blue lines refer to the sides of the triangle, which contains the price action. The red lines correspond to the size of the triangle and its potential target, which is typically a 1:1 measured move. When an ascending triangle is formed during a bullish trend, we expect a continuation of the trend. Descending Triangle Pattern As noted earlier, the ascending and descending triangles are a mirror image of each other. As such, the descending triangle pattern has the opposite characteristic. The at side of the descending triangle is below the price action. The upper side of the triangle is inclined downwards. In a bearish market, the descending triangle has a bearish potential equal to at least the size of the pattern. For this reason, the descending triangle is used to open short positions after the price has broken its lower ( at) side. Let’s see the sketch of the descending triangle: When the descending triangle is created during a bearish price tendency, we expect the trend to continue. It is very important to mention that the ascending and the descending triangles sometimes break through the inclined level, causing false signals and trapping some traders along the way. The same holds true for the horizontal price zone. You should always try to wait for the close of the candle to con rm the breakout. This will help reduce many of the false signals. Rising/Falling Wedge The rising and falling wedges are similar to the ascending and the descending triangle patterns. However, the rising and the falling wedges have no at side. Both sides of the wedges are sloping in the same direction. Let’s describe the two kinds of wedges you will nd on the price chart. Rising Wedge This is a triangle chart pattern, where both sides are inclined upwards. The price creates higher tops and even higher bottoms. This causes the two ascending lines to interact, creating a type of triangle pattern on the chart. The rising wedge has a strong bearish character. In this manner, the trigger side of the wedge pattern is the lower line. When you spot a breakout through the lower level of a rising wedge, you should expect a sharp price drop equal to at least the size of the pattern. Therefore, breakouts through the lower level of a wedge are used for opening short positions. This is what the rising wedge formation looks like: Falling Wedge With the falling wedge pattern, both sides are inclined downwards. The price creates lower bottoms and even lower tops. In this manner, the two sides of the triangle are descending and contract to a tight point. Opposite to the rising wedge, the falling wedge has a strong bullish character. Therefore, the trigger side of the falling wedge formation is the upper line. When the price breaks the upper level of a falling wedge, you should aim at for a bullish move at least as large as your wedge formation. As such, traders use the falling wedge to set long entry points on the chart. Below you will see a sketch of a falling wedge: Now that you know what the rising and the falling wedges look like, we should share one more detail regarding these formations. Wedges could have trend continuation, or trend reversal character. When the wedge appears after an extended price move, we expect a reversal of the trend, when the wedge appears earlier in the trend, we expect it to be a temporary retracement that will continue the main trend in place. Typically the more powerful wedge formation is the potential trend reversal formation which occurs after a prolonged trend move. Symmetrical Triangle Pattern The symmetrical triangle is a situation on the chart where the tops of the price action are lower and the bottoms are higher. Also, the two sides of the triangle are inclined with the same angle. This creates the symmetrical character of the triangle. Typically with a symmetrical triangle pattern, the expected directional breakout is unknown. The reason for this is that the bullish and the bearish move have equal strength as seen thru the price action. When a breakout eventually occurs, it is likely to provoke a price move equal to the size of the pattern. Therefore, you should carefully identify a potential breakout in the upper and the lower level of the symmetrical triangle in order to take the right position in the market. The sketch below illustrates the symmetrical triangle formation and possible breakout scenarios: As you see from the example above, the potential target is based on the size of the triangle formation. With this type of measured move analysis, you will know what to expect from the symmetrical triangle breakout, whether it breaks upwards, or downwards. Pennants Pennants on the chart have a similar shape to that of symmetrical triangles. They typically appear during trends and have a trend continuation character. Bullish Pennant The bullish pennant is similar to a symmetrical triangle in appearance, but the Bullish pennant formation comes after a price increase. Since pennants have trend continuation character, the bullish pennant is likely to continue the bullish trend on the chart. When the upper side of the pennant gets broken upwards, we are likely to see an increase equal to at least the size of the pennant, and typically larger. And so when trading pennants, a second target should also be used to catch a larger move. When calculating the second target, you would analyze the price leg immediately following the pennant. You could set the target to 1:1 of the previous leg or .618 of that leg. When the trend seems strong and has a steep slope a 1:1 measured move would be an appropriate second target, and in all other cases the .618 of the leg could be used. Let’s take a look at the bullish pennant below: See that here we have two targets. The red target is the rst one, which is as big as the size of the pennant. The green target corresponds to the size of the previous up move, which should be applied starting from the upper side of the pennant. Bearish Pennant As you have probably guessed, the bearish pennant is the mirror image of the bullish pennant. Bearish pennants start with a price decrease and end up with a symmetrical triangle appearance. Since pennants have trend continuing character, bearish pennants are likely to continue the bearish trend. When the price goes through the lower level of the bearish pennant, you should rst look to capture the rst target, which is equal to the size of the pennant itself. When the price completes this target, you can then try to catch the expected further decrease, which is equal to the size of the previous leg or .618 of that leg. Refer to the image below for a Bearish Pennant: Expanding Triangle You can hardly mistake an expanding triangle on the chart. The reason for this is that it has very unique parameters. Both sides of the expanding triangle are inclined, but in opposite directions. The direction of the potential price move of this chart pattern is very tricky to determine. Therefore, we will now introduce a few rules, which will help you to identify the direction of the expected price move. Symmetrical Lines If the expanding triangle is a horizontal mirror image of a symmetrical triangle, then you should trade the formation as a trend continuation pattern. The image below shows a sketch of an expanding triangle with symmetrical lines: Increasing Lines If the two sides of the expanding triangle are increasing, then the pattern is likely to have bearish character. Decreasing Lines If the two sides of the expanding triangle formation are decreasing, then the gure is likely to have bullish potential. One Side Stronger than the Other If the tops of the price action are increasing, but the bottoms are decreasing with higher intensity, then the pattern has bearish character. On the contrary, if the bottoms are decreasing, but the tops are increasing with higher intensity, then the pattern is likely to have bullish character. In other words, you should trade in the direction of the side, which has higher inclination. Trading Triangles in Forex Now that we have discussed most of the important triangle patterns in Forex, I will now show you how a triangle trading system could work. The image above shows the H4 chart of the USD/CHF Forex pair for Jan – Feb, 2016. The chart illustrates ve triangle examples and their potential outcome. The chart starts with a big symmetrical triangle. The price creates three decreasing tops and three increasing bottoms on the chart. The red arrow in the beginning of the triangle measures its size. As you see, the same red arrow is applied when the price breaks the upper level of the triangle. The red arrow indicates the potential target of the pattern, which gets completed after a week. Meanwhile, on the way up the price action creates a rising wedge chart pattern. As we discussed, the rising wedge has bearish potential. With the the breakout through the lower level of the wedge we notice a minor correction. (yellow arrows) At the end of the bullish tendency the price creates another symmetrical triangle. Later on the price breaks through the lower level and completes the size of the pattern (pink arrows). While decreasing, the price action actually creates a bearish pennant. This is the consolidation after the rst impulse of the bearish trend. The price breaks the lower level of the pennant afterwards. On the way down we see the price completing the rst target, which equals the size of the pennant (red arrows). Then the decrease continues and the decrease is extended to a size equal to the previous leg. (green arrows). The USD/CHF then creates a double bottom reversal pattern and switches to a bullish direction. On the way up the price action creates an expanding triangle pattern. Notice that both the upper and the lower level of the pattern are increasing. In this case, the expected price move is bearish and should be equal to the size of the pattern. Notice that this time the size of the pattern is measured from the ending side of the formation. The reason for this is that we take the widest side when we measure the expected move from the triangle breakout. The red arrows on the chart show us that this pattern also completes its target. Conclusion Triangles are among the most important chart patterns in Forex trading. You have a contracting triangle on the chart when the tops and the bottoms of the price action are moving toward each other. The basic Forex triangles are: Ascending Triangle – at tops; higher bottoms; bullish potential; Descending Triangle – at bottoms; lower tops; bearish potential; Wedges – sides increase/decrease in the same direction; Rising Wedge – higher tops; even higher bottoms; bearish potential; Falling Wedge – lower bottoms; even lower tops; bullish potential; Symmetrical Triangle – lower tops; higher bottoms; sides have the same angle of movement Bullish Pennant – comes after price increase; ends with a small symmetrical triangle; bullish potential Bearish Pennant – comes after decrease; ends with a small symmetrical triangle; bearish potential; Expanding Triangle – sides move against each other. The potential of the expanding triangle varies depending on the lines inclination: Sides are Symmetrical – the potential price move is in the direction of the trend. Both Sides are Increasing – bearish potential Both Sides are Decreasing – bullish potential One Side is Steeper than the other – the potential price move is in the direction of the steeper side. Wedge Chart Pattern If you are a chart pattern trader, you have inevitably come across the wedge pattern. It is an interesting pattern that has a few different variations. Depending on when and where the pattern appears within the price action, it can be classi ed as a reversal or continuation pattern. We’ll dive into the basics of recognizing and labeling wedge patterns, with the ultimate goal of learning how to trade it pro tably in the market. A wedge pattern is a corrective price structure that often precedes a new trend leg. Wedge patterns are considered consolidation phases wherein there is a contraction within the price movement. Volume will also contract during the formation of a wedge pattern. Most wedge patterns form as a contracting variety, and the contracting variety can be classi ed as a rising wedge or a falling wedge. In rare cases, a wedge pattern can form as a broadening or expanding variation. When this occurs the wedge structure can be further classi ed as either an ascending wedge, or a descending wedge. We will detail all of these different types of wedge structures as we move through this lesson, however, for now it’s important to understand that a wedge pattern is a prolonged consolidation pattern that can form in both up trending and down trending markets. Often the wedge pattern resembles a triangle formation that has been tilted either up or down. As such, these formations are sometimes referred to as a triangle wedge. Wedge patterns often occur at the terminal point of a trend. That is to say that a rising wedge pattern can form near the terminal point of a bullish trend, while a falling wedge pattern can form near the terminal point of a bearish trend. Elliott wave traders will recognize the technical wedge formation as an ending diagonal. When the wedge pattern occurs in the direction of the trend and within the late stages of the trend is considered a reversal pattern. The price action following the break of the lower line within a rising wedge will often lead to a sharp price reversal to the downside. And similarly the price action following the break of the upper line within a falling wedge will often lead to a sharp reversal to the upside. Rising Wedge Pattern Let’s now take a closer look at the rising wedge pattern. Below you will see an illustration of the rising wedge pattern. The rising wedge pattern can be seen as two contracting trendlines sloping upward and wherein the majority of the price action is contained within these trendlines. Notice the upper line of the rising wedge pattern which represents the diagonal resistance level for the price action, and how the lower line of the rising wedge pattern represents the diagonal support level for the price action. Both lines are clearly pointing upward and are converging towards each other. The most important level to watch for within the rising wedge pattern is the lower support line. We expect that the price will break this lower trendline, which will lead to a bearish price move. As such a rising wedge structure is considered a bearish wedge pattern in terms of its price potential. The rising wedge is often seen at the end of a bullish price move. When the rising wedge appears in the direction of the uptrend and after a prolonged price move higher, the most likely implication is for a reversal of the current trend. The rising wedge can also occur within the context of a down trending market. When the rising wedge formation occurs within this market context, it is considered as a continuation pattern, meaning that, the breakout should occur at the lower trendline and lead to continued bearish price movement. In either case, the implications for the rising wedge pattern are the same. And that is to say prices should move lower following the downside break out. Falling Wedge Pattern Let’s now take a look at the opposite scenario with the falling wedge pattern. The illustration below shows what the falling wedge pattern appears like. The falling wedge pattern will also be outlined using two contracting trendlines. But in this case the two converging trendlines that contain the price action will be pointing downward. The upper trendline represents diagonal resistance, while the lower trendline represents diagonal support. In the case of a falling wedge pattern the most important line to watch for is the upper resistance line. When the price breaks above this upper trendline, prices will often be propelled higher into a new trend leg. As such, a falling wedge structure is considered a bullish wedge pattern in terms of its price potential. The falling wedge pattern can also be a terminal pattern or a continuation pattern. When the falling wedge pattern appears in the direction of the downtrend and near the end of a sustained price movement lower, the implication is for the current downtrend to end, as demand enters the market pushing prices to higher levels. In this scenario, the falling wedge pattern would be classi ed as a reversal pattern. In the case where the falling wedge pattern occurs within an overall uptrend, and can be seen as moving against the uptrend, it would be considered a continuation pattern. In either case the breakout should occur to the upside and lead to higher prices. It should be noted, however, that the intensity of the price movement higher will often be much more pronounced when the falling wedge pattern is a reversal pattern. The same tendency also holds true for a rising wedge pattern. That is to say that the intensity of the price drop following the wedge breakout to the downside will often be much more pronounced in the context of a trend reversal. Broadening Wedges Broadening wedges are a less common variation of the wedge pattern formation. There are also referred to as an expanding wedge formation. Within broadening wedges the price action expands rather than contracts. And so, on the price chart a broadening wedge formation will appear as two diverging trendlines that contain the price action. There are two variations of the broadening wedge formation. The rst is the ascending broadening wedge which occurs in the context of an uptrend, and the second is the descending broadening wedge which occurs in the context of a downward. Let’s take a look at the ascending broadening wedge rst. Below you will nd an illustration of the ascending broadening wedge. Notice how the upper trendline connects higher highs, and how the lower trendline connects lower lows. As such, this wedge is expanding or broadening as the price action progresses. The implications of the broadening wedge are similar to that of the rising wedge. More speci cally, when the price breaks below the lower line of the broadening wedge formation, we can expect continued follow-through to the downside following the breakout. We will often see the slope within upper line within the broadening wedge to be steeper than that of the lower line. However, this is just a tendency and not necessarily a requirement for de ning an ascending broadening wedge. Now let’s turn our attention to the illustration below which represents the descending broadening wedge formation. With the descending broadening wedge the upper and lower trendlines will also diverge from one another. The most important line within the descending broadening wedge formation is the upper trendline with acts a diagonal resistance level. Once the price breaks above this upper line, we would expect prices to move higher following the breakout. Additionally, we will often see the slope of lower line of the descending broadening wedge to be steeper than that of the upper line within the pattern. Broadening wedges are trickier to trade compared to the traditional contracting wedge formation. One of the reasons for this is that the broadening variety creates a less attractive risk to reward pro le compared to the contracting wedge formation. Within the normal wedge formation, we can often place a stop loss just beyond the extreme swing point of the structure. This can provide for a fairly tight stop loss. Due to the expanding nature of the broadening wedge, the stop loss placement is often a far distance away from the breakout point. As such, we are left with either choosing between a distant stoploss level or a less than optimal stoploss placement within the broadening wedge structure. Trading Wedge Patterns Now that we have a good understanding of the different types of wedge formations, and their implications, let’s try to build a wedge pattern trading strategy. We will focus on the rising and falling wedge patterns that occur as terminal structures. These offer the best tradable opportunities. So essentially, our strategy will start with scanning for rising wedges that appear in the context of an uptrend, and after a prolonged price rise. Similarly we will scan for falling wedges that appear in the context of a downtrend, and after a prolonged price decline. Once we have located a well-de ned wedge structure, will want to add a few additional elements to the trade strategy to isolate the best trade setups. For one, we want to ensure that the current market conditions are pointing to an overextended price move. Essentially, we want to clearly de ne an overbought market during an uptrend, and an oversold market during a downtrend. The way that we will do that is with the Bollinger band overlay. We will utilize the standard Bollinger band settings of 20, 2 as the parameters. Speci cally, during an uptrend we want to see the price within the nal leg of the wedge penetrate above the upper Bollinger band. This would indicate an overextended bullish market sentiment that should lead to a reversal in the price movement. Similarly, during a downtrend we want to see the price within the nal leg of the wedge penetrate below the lower Bollinger band. This would clue us in to an overextended bearish market condition that should bounce back to the upside. Here are the rules for a long trade set up: A well-de ned rising wedge formation can be seen on the price chart, which is sloped upward and occurs after a prolonged price move to the upside. The price action within the nal leg of the rising wedge pattern penetrates above the upper Bollinger band. Enter a short position one PIP below the low of the bar that penetrated the upper Bollinger band. Stop loss to be placed above the most recent swing high preceding the entry signal. The target will be the touch of the opposite side of the Bollinger band, which in this case would be the lower band. Here are the rules for a short trade set up: A well-de ned falling wedge formation can be seen on the price chart, which is sloped downward and occurs after a prolonged price move to the downside. The price action within the nal leg of the falling wedge pattern penetrates above the lower Bollinger band. Enter a long position one PIP above the high of the bar that penetrated the lower Bollinger band. Stop loss to be placed below the most recent swing low preceding the entry signal. The target will be the touch of the opposite side of the Bollinger band, which in this case would be the upper band. Rising Wedge Pattern Trade Example Now that we have outlined the rules for our wedge trading strategy, let’s now see what that would look like on an actual price chart. Below you will nd the price chart for the Australian Dollar Japanese Yen currency pair based on the four hour timeframe. The green bands overlaid on the price chart is the Bollinger band study. You can also see the rising wedge formation outlined with the two orange trendlines. As a price was moving higher, it became evident that there was a contraction in the price movement that resembled a rising wedge formation. Once we are able to recognize this, we would begin to go through the process of validating this potential set up. Firstly, we want to con rm that the rising wedge is a reversal type pattern. The way that we would do that is by con rming that the rising wedge occurs after a prolonged price move. As we can see from the price chart, the price action leading up to the rising wedge was clearly bullish. Next, we want to wait for the nal leg within the rising wedge to penetrate above the upper end of the Bollinger band. Notice how the bullish candle immediately to the right of the upper trendline of the wedge pattern moves above the upper Bollinger band. This is the penetration signal that con rms the rising wedge pattern. Now, we will need to take steps to prepare for a short entry. The short entry signal would occur at the break of the low of the candle that penetrated the upper limit of the Bollinger band. You can see that entry level marked on the price chart with the black dashed horizontal line. Shortly afterwards the price did break below this entry level, which served as our entry signal. Once the short entry order was lled, we would immediately place a stop loss to protect our position. The stop loss would be placed just above the swing high prior to the entry signal. That stoploss level can be seen on the chart and is noted accordingly. At this point, we will need to be patient and monitor the price action closely to execute our exit, assuming that prices continue to move lower in our favor. Following the short entry signal, the price did begin to slide lower eventually reaching the lower end of the Bollinger band, which would have signaled the take pro t exit point. Falling Wedge Pattern Trade Example Let’s now shift our attention to a trade that demonstrates the falling wedge pattern. On the chart below, you will nd another example of a wedge pattern in forex. The chart shows the New Zealand Dollar to Japanese Yen currency pair based on the 240 minute timeframe. Again, notice the green bands that contain the price action. These bands are the Bollinger band study overlaid on the price chart. The downward sloping trendlines represent the falling wedge formation. You can see how the price action was contracting during the late stages of this bearish trend. Let’s now go through the process of con rming the falling wedge set up. First and foremost, after we have identi ed the falling wedge formation, we want to analyze the price action leading to the falling wedge formation to con rm that a bearish price trend was underway. As we can see, this was clearly the case. Next, we will need to wait for the price action to cross below the lower Bollinger band. This would con rm the set up for the falling wedge based on our trading rules described. If you look closely, you can see the hammer candle that clearly broke below the lower Bollinger band. The hammer candlestick formation is essentially a bullish pin bar that often occurs at or near the termination point of a downtrend. The entry signal would be set at one tick above the high of this pin bar formation. We have noted this level with the black dashed line labeled, Entry. After a few bars of consolidation following the pin bar, the price broke above this threshold which would have executed our buy order. We would immediately place a stop loss just below the swing low preceding the entry signal. That would coincide with the low of the pin bar as noted on the price chart. Our signal to take pro t and exit the trade would occur upon the price touching the upper band within the Bollinger band. You can see the exit level marked accordingly. It’s important to keep in mind that this Bollinger band exit strategy is dynamic, meaning that, it will print a new level with each passing bar. As such, we must monitor the price action closely to con rm that event. Alternatively, you can set up a scan within your trading platform to alert you when that speci c event is triggered. Summary The wedge pattern is a popular chart formation used by many technical traders. As we discussed, the wedge pattern can appear as a reversal pattern or as a continuation pattern. In our discussion here, we have focused on the reversal wedge pattern for the most part. This was done intentionally because the reversal variation offers the best tradable opportunities as it relates to this formation. Chartists can trade the wedge pattern in a number of ways. We have illustrated one such methodology here. Depending on your style of trading you may integrate some of your own techniques and analysis into the mix. This is completely natural and worth the effort. Just make sure to backtest any ideas before committing your hard earned money to trading your preferred wedge strategy in the market. Double Tops and Double Bottoms Chart patterns are an integral part of the technical trader’s arsenal. Their effectiveness has been studied and validated. One reason why many traders nd chart trading attractive is because these patterns can offer precise entry and exit points based on the rules of each pattern. Today we will discuss two of the most popular chart patterns used in Spot Forex. This is the Double Top and its reversed equivalent the Double Bottom. We will discuss the structure of these two patterns and the potential they create on the chart. Finally, we will show you how to trade the Double Top and Bottom reversal formations using practical examples. Double Tops and Double Bottoms are reversal chart patterns. They consist of two price swing located approximately on the same level. These patterns typically appear after a trend move. After the con rmation of the pattern, you expect the trend to be reversed. Let’s now dissect the structure of each of the two patterns: Double Top Chart Formation The Double Top technical formation starts with a bullish trend. The trend gets interrupted at some point and the price of the currency pair starts to range. The range consists of two swing tops on the chart. After the creation of the second top, the price action drops and starts a new bearish trend. The diagram below will help you visualize this process: Above you see the structure of the Double Top chart pattern. Notice that the initial trend is bullish but later it gets reversed after the Double Top formation. Double Bottom Chart Formation The structure of the Double Bottom technical formation is absolutely the same as the Double Top pattern, but upside down. The Double Bottom chart pattern starts with a bearish trend, which gets interrupted at some point. The price action then enters a range, which creates two bottoms on the chart. After the second bottom, the price breaks the range to start a new bullish trend. Look at the sketch of the Double Bottom chart pattern below: As mentioned, this is pretty much the same situation as the Double Top, but this time the price action starts with a bearish trend, which gets reversed into a fresh bullish move. Confirmation of Double Tops and Bottoms Although the pattern is fairly easy to recognize and can be traded using a basic set of rules, you cannot simply jump into a trade whenever you see two bottoms or tops on the chart. To initiate a trade based on this pattern, you should rst con rm its validity. There are two details related to the con rmation of the Double Top and the Double Bottom reversal patterns. This includes the Neck Line and the breakout. Drawing the Neck Line The Neck Line of the Double Top pattern is the horizontal level at the bottom between the two tops. Opposite to this, the Neck line of the Double Bottom pattern is the horizontal level at the top between the two bottoms. This is how the neck line looks: The rst thing you need to do when you spot the pattern is to manually add the Neck Line on the chart. It plays the role of a trigger for your trade. Therefore, this level is of a great importance for your pattern. Neck Line Breakout The con rmation of the pattern comes when the price action breaks the Neck Line. Closing a candle beyond the Neck Line means that there is a valid breakout of the range, which comes after the initial trend. Since the breakout is opposite to the trend, we con rm the emergence of a new trend. If you have a Double Top pattern, you will wait for a bearish breakout. If you have a Double Bottom pattern, you will wait for a bullish breakout for your con rmation. Then you would trade the pattern in the direction of the breakout. Potential of the Double Top and Bottom Reversal Patterns As we already said, the Double Top and the Double Bottom have a reversal character. In this manner, they are expected to change the direction of the trend, creating a brand-new tendency. In addition, when you spot the Double Top or Bottom reversal pattern, you can use the structure to extrapolate how far the potential price move could go. There are two things you need to do in order to identify the minimum potential of your Double Top/Bottom chart pattern. We will discuss this in the next section. Size of the Double Top and Double Bottom Reversal Patterns First, you need to measure the size of the pattern. To do so, connect the two tops/bottoms with a single line. Then add a perpendicular line to the line between the two tops/bottoms starting from the Neck Line. This distance is the size of your Double Top or Bottom pattern. The size of the Double Top pattern is illustrated with the magenta colored arrow on the image above. It works the same way with the Double Bottom pattern, but in reverse. Projecting the Move After you measure the size of the pattern, you need to apply this distance starting from the opposite side of the neck line. In other words, your minimum target equals the size of the pattern. This time we have added a second arrow which is equivalent to the rst arrow. So, the rst arrow measures the size of the pattern and the second arrow applies this size as a minimum target of the pattern. Again, the same is in force for the Double Bottom gure, but in a bullish direction. The 11 Step Process for Trading Double Tops and Bottoms To trade Double Tops and Bottoms properly, you need to implement some basic trading rules. The following steps will help you identify and trade the Double Top reversal: Step 1: Trend Identification The rst thing you need in order to identify a Double Top pattern is a bullish trend. You cannot con rm the pattern in the absence of a trend. Although Tops and Bottoms can and do occur when the market is not trending, a valid Double Top/Bottom formation must exist in the context of a trend. Step 2: Creation of a Top Each top within a bullish trend could be the beginning of a Double Top pattern. Therefore, you should carefully observe the price action at swing highs on the chart. Step 3: Trend Interruption To continue with your analysis, you need to see the price action interrupting its current trend. Typically, this would come in the form of a price retracement that breaks the bullish trendline. It is important to note that this (Step 3) may sometimes come at a later point in the sequence of events. Step 4: Creation of a Bottom After the top is created on the chart, the pattern needs to create a bottom. Many times, this bottom could be located on a bullish trend line, but that is not a requirement. Step 5: Creation of the Second Top After a bottom has formed, the price action needs to create a second top on the chart. This is often referred to as the retest. The perfect Double Top pattern will have a second top, which is slightly lower than the rst top. This indicates that the trend is at least slowing down and likely exhausted. In many instances the two tops are on the same level, and sometimes the second top could even be slightly higher than the rst top. If the second top is higher than the rst top, you will typically see a divergence pattern forming as well. Step 6: Drawing the Neck Line The sixth step of our trade identi cation process is to plot the actual neck line of the pattern. To do this you need to reference the swing bottom, which is located between the two tops. Then you would draw a horizontal line at this level. This would be the Double Top Neck Line. Step 7: Neckline Breakout The next step is to con rm the validity of the pattern. If the price action closes a candle below the Neck Line, we con rm the validity of the formation. Step 8: Trade Entry Since you have a con rmed Double Top pattern on the chart, you now have the go ahead signal to enter a position. For the Double Top, you would open a short (bearish) trade. Step 9: Stop Loss You should always secure your open trades with a stop loss order. Although the success rate of these patterns is relatively high, there is never a guarantee that the trade will work in your favor. The optimal place to put your stop loss order is just above the second top of the Double Top reversal pattern. Step 10: Size of the Pattern Now that you are short based on the Double Top pattern, you need to project a possible target. You should measure the size of the pattern as discussed earlier and then apply it downwards starting from the Neck Line. This would be your minimum target. Step 11: Exit the Trade You should exit your trade when the price action reaches the minimum target of the Double Top chart pattern per Step 10. This 11-step process works absolutely the same way with the Double Bottom reversal. However, the rules are applied in the opposite direction. Double Top and Bottom Trading Example Now that we have discussed the steps for trading the Double Top, we will shift our attention to an actual price chart which has a Double Top formation. Have a look at the following example: This is the four-hour chart of the EUR/USD currency pair. The image covers the period during August 2016 and shows each of the 11 steps designated with different colors, which will help you connect them to the respective events on the chart. Step 1: We have the yellow bullish trend on the chart. Step 2: The price creates the rst top. Step 4: Notice that the next bottom created is on the trend line and not through the trend line. Therefore, the trend is not broken yet and Step 4 appears right after Step 2. Step 3 comes at a later point. Step 5: The price creates another top, which is slightly lower than the rst top on the chart. Step 3: The price action nally breaks the trend line, which puts Step 3 right after Step 5. Step 6: We plot the neck line on the bottom between the two tops of the pattern. Step 7: The price action breaks the blue neck line of the Double Top reversal pattern. Step 8: Sell the EUR/USD when you identify the breakout and candle close beyond the neck line. Step 9: Put a stop loss order right above the second top of the pattern. Step 10: Then you measure and apply the size of the pattern as your minimum target. Step 11: You close the trade when the price action reaches the minimum target. Notice that after the break through the Neck line, the price action creates a big bullish correction as a result of high volatility. A bearish candle with a very big upper candlewick is created and it nearly hits our stop. However, our stop loss order is well positioned and it sustains the pressure. Now let’s take a look at a Double Bottom chart formation and apply the same 11 step process. You are now looking at the daily chart of the USD/JPY for Sep – Nov, 2013. The image illustrates the 11 step process you need to follow to trade this Double Bottom. Let’s evaluate each one: Step 1: We have the yellow bearish trend on the chart. Step 2: The price creates the rst bottom. Step 3: This time the price action breaks the trend line after creating the rst bottom. Step 4: The price action creates a top afterwards. Step 5: The second bottom is created after the top. Step 6: We plot the neck line on the top between the two bottoms of the pattern. Step 7: The price action breaks the blue neck line of the pattern, creating a neckline breakout. Step 8: Buy the USD/JPY pair when you identify the breakout and closing candle through the neck line. Step 9: Place a stop loss order below the second bottom of the pattern. Step 10: Then you measure and apply the size of the pattern as your minimum target. Step 11: You close the trade when the price action reaches the minimum target. Take note that in the two examples we discussed, the trend line breakout appeared at different times in the process. In the rst case the price broke the trend after the creation of the second top. In the second case the trend breakout came right after the creation of the rst bottom. In both cases the patterns were valid and led to a price move equal to the size of the pattern. Conclusion Double Top and Double Bottom patterns are two of the most prevalent and popular reversal chart patterns. These patterns consist of two price extremes located approximately on the same level. The Double Top is a mirror image of the Double Bottom pattern: The Double Top starts with a bullish trend, which turns into a sideways movement. The range then gets broken downwards and the price action reverses. The Double Bottom starts with a bearish trend, which turns into a sideways movement. The range then breaks through the upper level and the price action reverses. We need two things in order to con rm the pattern: Neck Line – a manually added horizontal line on the bottom between the two tops (for a Double Top) or on the top between the two bottoms (for a Double Bottom) Neck Line breakout – a candle closing beyond the Neck Line. The trade signal occurs when the price action breaks the neck line: Open a short trade if the pattern is Double Top. Open a long trade if the pattern is Double Bottom. The Double Top/Bottom pattern has a xed minimum potential. You can project the minimum target by applying the following: Size of the Pattern – the distance between the Neck Line and the perpendicular line which connects the two tops/bottoms Applying the Size as a Target – The potential of the pattern is equal to its size applied from the Neck Line. The 11 Steps for Trading Double Tops (reversed for Double Bottoms): Step 1: Trend Identi cation Step 2: Creation of the rst Top Step 3: Trend Interruption Step 4: Creation of a Bottom Step 5: Creation of the Second Top Step 6: Plotting the Neck Line Step 7: Neckline Breakout Step 8: Trade Entry at Neckline Breakout Step 9: Stop Loss above second Top Step 10: Measure Size of the Pattern for a Target Step 11: Exit the Trade at Minimum Target Projection Head and Shoulders Pattern in Forex Chart pattern recognition is one of the most popular techniques to trading the forex market. There are many different types of chart formations that a trader can study and incorporate into their setup arsenal. Today we will go through one of the more reliable chart patterns within the pattern universe. What I am referring to is the classic Head and Shoulders Pattern. The Head and Shoulders pattern is a chart gure which has a reversal character. As you might image, the name of the formation comes from the visual characteristic of the pattern – it appears in the form of two shoulders and a head in between. The pattern starts with the creation of a top on the chart. The price action then creates a second top, which is higher than the rst top. A third top is created afterwards, but it is lower than the second top and is approximately at the same level as the rst top. The image above is a sketch of the Head and Shoulders chart pattern. The tops at (1), (2), and (3) create the three important swing points of the pattern. Top (1) corresponds to the rst shoulder of the pattern. Top (2) is the “head” of the pattern. Top (3) corresponds to the second shoulder of the pattern. Notice in the sketch above, there is an initial bullish trend (green arrow). Then the left Shoulder is created, followed by the Head, and nally the right shoulder is completed. Often you will see a divergence pattern between the left shoulder and the Head. Psychology of the H&S Technical Pattern As I have mentioned, the Head and Shoulders formation is a reversal chart pattern. In this manner, the formation represents the loss of faith in the prevailing trend. The right shoulder on the chart which is lower than the head presents some important clues to the trader. The tops have been increasing initially until the creation of the third top (right shoulder). This decreasing top on the chart, represents the deceleration of the trend which is likely to lead to a trend reversal. Head and Shoulders Pattern Rules Let’s now discuss some trading rules surrounding the Head and Shoulders Pattern. After we go through these guidelines, you will be ready to start scanning for this pattern on your own price charts. Drawing the Head and Shoulders Chart Pattern The rst important sign of an emerging Head and Shoulders reversal pattern comes from the bottom created after the head is formed. If you have and established trend on the chart, this bottom is likely to create a slowdown in the trend’s intensity. In many cases this bottom also creates a breakout from a bullish trend line. This is the rst indication of a reversal potential and an emerging Head and Shoulders reversal pattern on the chart. We have two tops which are increasing and correspond to the bullish trend. However, the bottom created after the head formation, typically breaks the trend line and ends near the same level as the previous bottom. This indicates that the bullish momentum is slowing. After the head is completed, followed by a bottom outside the trend line, we should anticipate the third top, which will be lower than the head. Sometimes, during the formation of the right shoulder, price may test the already broken trendline as a resistance. The creation of a third, lower top on the chart creates the H&S formation on the chart. However, this doesn’t mean that the pattern is con rmed. We will discuss how to con rm a valid Head and Shoulders pattern in the next section. Head and Shoulders Neckline The Head and Shoulders neckline is considered the most important component in trading the H&S pattern. The reason for this is that the H&S neckline acts as the trigger line for trading the pattern. The neckline needs to be manually drawn on your chart. To draw the neckline, you need to locate two bottoms – the bottom just prior to the head formation, and the bottom just after the head formation. Then you should connect these two swing points with a line. The sketch above shows you how a Head and Shoulder neckline should be built. It is important to note that this line could be horizontal, or it could be inclined if the H&S chart pattern is inclined itself. Also, it is possible for the neckline to be declined, but that is less common. Regardless, it makes no difference whether the pattern has a straight, inclined, or declined neckline, as long as the price action follows the Head and Shoulders pattern rules. Head and Shoulders Breakout The Head and Shoulders breakout is the signal we need in order to open a short trade. To get a valid H&S breakout, we need to see the price action breaking through the neck line of the pattern. It is when a candle closes below the neckline, that a short signal is triggered for the Head and Shoulders setup. Head and Shoulders Stop Loss The Head and Shoulders trade setup should be used in conjunction with a stop loss order. Obviously, the H&S pattern, like any other pattern, does not provide a 100% success rate, so we must protect our trading account in case price moves against us. The optimal place for your stop loss order is above the second shoulder on the chart. This corresponds to top (3). When you short the Forex pair after a Head and Shoulders breakout signal, you place the stop above the 3rd top of the pattern. Head and Shoulders Price Target The next question we must ask ourselves is “How long should we stay in the Head and Shoulders trade?” The answer to this question is a two-step process: Measuring the Size of the Head and Shoulders Pattern The size of the Head and Shoulders structure holds a direct relationship with the potential target for the trade. Therefore, it is paramount to understand how to measure the size of the H&S pattern. To do so, you need to take the distance between the tip of the head and the neck line. This will yield the size of the head and shoulders pattern. Applying the Size of the Head and Shoulders Pattern Now that you have the size of your H&S pattern on the chart, you should apply this length downwards, starting from the initial breakout through the neck line. This is the price move you should expect when trading the Head and Shoulders setup. In other words, the expected price move after the H&S pattern equals to the size of the pattern. This is often referred to by chart technicians as a measured move. Take a look at the diagram below: Notice that in this diagram, we have applied the target of the Head and Shoulders pattern. The size should match the distance between the head and the neck as shown on the image. After you measure the size, you simply add it downwards from the point of the breakout. When the price reaches the minimum target, it is an opportune time to close out the trade in full, or at least a sizable portion of it. So, as an option you can keep a portion of your position open beyond the minimum target. After all, if the price is trending in your favor, you may want to see if you can catch a runner. If you want to extend the target on the chart, you can do this by using simple price action rules or a trailing stop. Be on the lookout for important support and resistance levels, as well as trend lines, price channels, or reversal candles and chart patterns. Each of these might help you to determine your exit point on the chart. Inverted Head and Shoulders Pattern The Head and Shoulders pattern has its bullish equivalent. This is the inverted Head and Shoulders pattern. Contrary to the H&S pattern, the inverse H&S pattern appears during a bearish trend and it implies that the existing bearish tendency is likely to be reversed. This pattern looks the same as the standard Head and Shoulders, but inverted. And so, the inverted Head and Shoulders pattern formation concerns bottoms, and not tops. This is how the inverted Head and Shoulders gure appears: This sketch shows you that the inverse Head and Shoulders is an exact mirror replica of the Head and Shoulders pattern. Thus, the potential of the formation is reversed. The Head and Shoulders pattern has a bearish potential outlook, while the inverted Head and Shoulders has a bullish potential outlook. Technical Analysis Using Head and Shoulders Now that we have discussed both the bullish and the bearish versions of the Head and Shoulders reversal pattern, I will now show you a couple of H&S trading examples as part of a technical analysis approach. You are looking at the EUR/USD chart for Nov, 2012 – Apr, 2013. The image illustrates a Head and Shoulders trading example. The chart starts with a bullish trend which lasts from November, 2012 to January, 2013. On the way up the price action creates a Head and Shoulders chart pattern. We have marked the gure with the black lines on the graph. Since we have now identi ed the pattern, we will now draw in its neck line. This is the blue horizontal line on the chart. A short position could be opened in the EUR/USD when a candle closes below the blue neck line. Also, a stop loss order should be placed above the second shoulder of the pattern as shown on the image. The minimum target of the pattern is applied with the two green arrows. The minimum target equals the size of the pattern as we discussed earlier. As you can see, the EUR/USD price enters a bearish trend after the pattern gets con rmed. Fourteen periods after the Head and Shoulders breakout, the price action completes the minimum potential of the pattern. At this point you could either close out your entire position or decide to keep a portion of it open, to try to gain further momentum from the trade. If you decide to keep a small position open, you will want to take clues from the price action so that you can exit the remaining position in an informed manner. The yellow bearish line on the chart is the trend line, which marks the bearish price action. The Head and Shoulders trade could be held as long as the price is located under the yellow trend. When the price closes a candle above the yellow trend line, the trade should be closed on the assumption that the bearish trend has been interrupted. Let’s now turn our attention to another Head and Shoulders trading example: This is the H1 chart of the AUD/USD major currency pair for Feb 3 – Feb 10, 2016. The image shows another trading opportunity based on a Head and Shoulders chart pattern. The H&S gure is illustrated with the black lines on the image. The blue line represents the neck line of the pattern, which goes through the two bottoms at the base of the head. The short trade should be opened when the price action breaches the blue neck line of the pattern. A stop loss should be placed above the second shoulder as shown on the image. Then the size of the pattern needs to be measured in order to attain the minimum potential price move. This is shown with the green arrows on the chart. The price action enters a strong bearish trend after the short Head and Shoulders signal on the chart. I have outlined the bearish price move with a bearish trend line on the chart (yellow). Although the price action completes the minimum target of the pattern in just three periods, the trade could be held further since the AUD/USD momentum was sharply downwards. This short Head and Shoulders trade could be held until the price action breaks the yellow bearish trend line in the bullish direction. Inverted Head and Shoulders Trading Example Let’s now look at a trading example of the Inverted Head and Shoulders setup. We will apply the same pattern rules we used for the Head and Shoulders pattern, but reversed. Here is the daily USD/CAD chart for Feb, 2011 – Jul, 2011. The black lines on the chart illustrate an inverted Head and Shoulders chart pattern. Notice that the pattern comes after a bearish trend and reverses the price action. The blue line on the image is the neck line of the pattern. This time the neck connects tops and not bottoms, because the pattern is upside down. The USD/CAD pair could be bought when the price action closes a candle above the blue neck line. A stop loss should be placed under the second shoulder which forms the pattern. Then you need to determine the size of the inverse Head and Shoulders pattern and to apply it upwards starting from the breakout through the neck line. This is illustrated by the green arrows on the chart. The price starts increasing after the long signal on the chart. However, the price increase is not very sharp and it shows price hesitation. The pink lines on the image show that the price increase resembles a consolidation in the shape of a Rising Expanding Triangle. This type of triangle has a strong reversal potential. Therefore, the best option in this case would be to close the trade immediately upon reaching the minimum target of the inverted Head and Shoulders Pattern. Conclusion The Head and Shoulders pattern is one of the most reliable chart patterns in Forex. It forms during a bullish trend and has the potential to reverse the uptrend. The name of the Head and Shoulders pattern comes from its visual structure – two tops with a higher top in between. The H&S pattern consists of three tops: The rst top should be found in the context of a bullish trend. The second top should be higher than the rst top. The third top should be lower than the second top and should be approximately on the same level as the rst top. To trade the Head and Shoulders chart pattern you should apply the following rules: Identify a valid H&S pattern and draw each of the three tops that form the pattern. Apply a neck line through the two bottoms at the base of the head. Identify a Head and Shoulders breakout. Open a short trade when the price action breaks the neck line downwards. Put a stop loss above the second shoulder – the top prior the neck line breakout. Stay in the trade for a minimum price move equal to the size of the pattern – the distance between the tip of the head and the neck line. You can stay in you trade longer and use price action clues to exit, if you expect additional gains from your H&S trade. The Head and Shoulders chart pattern has its opposite equivalent – the inverse Head and Shoulders pattern. The inverted H&S pattern could be found during a bearish trend and it is expected to reverse the downtrend. The Inverse H&S pattern requires analyzing bottoms to con rm the formation. The neck line should go through the two tops that are immediately before and after the head formation. The stop loss order should be placed below the bottom, which corresponds to the second shoulder on the chart. Determine your price target using the Measured Move rule. Rectangle Pattern In Technical Analysis The rectangle chart formation is considered a part of the family of classical chart patterns within technical analysis. It is one of the more easily recognizable chart formations, and is a fairly simple pattern to trade. We will review some of the basics of identifying this structure, and provide some best practices for incorporating it within your own trading arsenal. The rectangle technical pattern is a classical chart pattern that appears as a well-de ned trading range. It is typically considered a continuation type pattern and serves as a temporary pause within the market. After which, another price leg forms in the direction of the preceding trend. Rectangle patterns are fairly easy to recognize on the price chart. Essentially, to identify a rectangle pattern, you will need two swing highs that occur along the same line, and two swing lows that can be seen along the same line. When you plot a horizontal line connecting the two swing lows and the two swing highs, it will appear as a horizontal parallel channel that contains the price action. Below you can nd an example of a rectangle pattern: Let’s analyze a few of the primary characteristics of a continuation rectangle pattern, in this case a bullish version. First and foremost, we need to ensure that we are correctly labeling a structure as a rectangle formation. As we’ve noted, the rectangle formation should appear as a trading range or consolidation phase with two swing highs, and two swing lows that occur along the same plane respectively. As the chart shows this is clearly the case in this example. Next, we want to make sure that there is a clear trend leading up to the rectangle chart formation. This will provide us the best expectation for the future breakout from the rectangle formation. In the case of an uptrend, we would expect a bullish breakout from the rectangle formation. Conversely, in the case of a downtrend, we would expect a bearish breakout from the rectangle formation. In this example, we can see that the trend is up prior to the rectangle formation. As such we would anticipate a breakout of the resistance level, and a subsequent price increase. In addition to this, we want to analyze the overall structure of the rectangle pattern. More speci cally, we want to ensure that there are at least 40 bars that make up the rectangle formation. Now, this is a general guideline to keep in mind and not necessarily a hard and fast rule. The reason for this, is that the best rectangle formations tend to be a prolonged consolidation phase. As such, we want to ensure that the structure is relatively signi cant and one that provides a viable trading opportunity. Although we have been discussing rectangle patterns as continuation patterns, they can also display countertrend characteristics from time to time. This is particularly true when we are looking at rectangle top and rectangle bottom formations. Unfortunately, it is quite dif cult to gauge beforehand whether a rectangle pattern will materialize into a continuation pattern, or reversal pattern. Having said that, the most dominant type of rectangle pattern seen in the market is the continuation pattern. And so, rectangle tops and bottoms as reversal structures should be in the back of our mind, but the highest probability play is to the trade the structure as a continuation pattern. Rectangle Trading Pattern Dynamics We should always attempt to understand the underlying dynamics within various price structures, and the rectangle pattern is no exception. So what is the psychology within a rectangle pattern? What is going on behind the scenes? Well, we know that the rectangle pattern is a consolidation pattern with trading occurring within two well de ned price levels, and upper resistance level, and a lower support level. If you look at this phenomenon at a deeper level, you will come to realize that what is actually occurring during this time, is that the market is in equilibrium, with the bulls and bears having an equal amount of conviction. This is why the price trades up and down within a clearly de ned range. As the price moves higher, supply from sellers comes in to push prices lower, and similarly, as price moves lower, demand enters the market via the buyers pushing the prices higher. Ultimately, the price will give way and either the bulls or bears will take control. A potential breakout to the upside signals that the bulls are in control, while a breakout to the downside signals that the bears are in control. Another way to view the underlying market psychology within this congestion phase is as a period of complacency or pro t-taking. During a rectangle formation, some traders who have realized pro ts from the prior leg are now taking pro ts on their positions. This often creates that prolonged sideways price movement that is indicative of rectangle formations. Rectangle Breakout and Continuation Now let’s dive a little bit deeper and talk about how we might go about trading a rectangle pattern breakout. Obviously, we will rst need to identify the rectangle structure. Once we have done so, we will draw our support levels connecting the two swing lows that lie along the same plane, and the two swing highs that lie along the same plane. Once we have the price action contained within the newly formed sideways parallel channel, we will want to wait for a breakout and close above the resistance line in the case of an upside breakout, and below the support line in case of a downside breakout. Once this important breakout event occurs, we can either enter into the trade immediately following the close of the breakout candle, or we can wait for a potential pullback to the broken horizontal level, and execute a trade near that area. The choice of which rectangle breakout method you should utilize depends on your own trading style and preference. Keep in mind that each type of breakout trade described will have its advantages and disadvantages. For example, entering a trade immediately after the breakout close has been con rmed, will allow you to participate in every market move following the breakout con rmation signal. The downside to this method comes in the form of an entry price that may be less than ideal. For example, the breakout candle could be a wide range bar that penetrates quite a bit beyond the horizontal price level. This can have the effect of entering a position that has stretched too far and is now more prone to a retracement, which could put you at a higher risk of getting stopped out. So what about waiting for a pullback following the con rmed rectangle breakout? In that case, you will usually wait for prices to retrace back to the horizontal price level, and execute a limit order entry near that level, as prices are moving towards it. Alternatively, you could use some price action signal near the horizontal line as a con rmation signal. Either way, the major advantage to this entry execution strategy is that it will likely provide a much better price for your trade, allowing you to realize a much healthier reward to risk ratio on your position. Now, the drawback of the breakout pullback method for trading the rectangle formation, is that, such an event may never be realized. That is to say that prices could continue to move in the direction of the breakout in an accelerated manner, leaving no opportunity for prices to return back to the breakout level. In such an event, we would incur the opportunity cost of not having participated in that speci c trade. Below you can see an illustration of the immediate breakout close entry, and the breakout pullback entry within the rectangle structure. Rectangle Trading Strategy Let’s now start to build a rectangle strategy that seeks to trade breakouts. As we’ve noted, a majority of rectangle formations tend to be continuation patterns. As such, we will focus on trading in the direction of a breakout that is in alignment with the larger trend. In other words, we will seek to trade an upside breakout from a rectangle formation when we have a discernible bullish trend leading up to the rectangle formation. And along the same lines, we will look to trade a downside breakout from a rectangle structure when we can recognize a bearish price trend preceding the rectangle pattern. Along with these conditions, we will also incorporate the momentum technical indicator, which will help us to validate the strength of the breakout. As you should be aware, breakouts from rectangle pattern trading ranges tend to be much more signi cant when there is strong underlying momentum behind the move. This helps to validate the breakout signal, and helps reduce the number of fake outs that can occur near horizontal price levels. So here are the rules entering into a long position: There exists a clearly de ned rectangle formation, wherein, the price move leading to the rectangle is of a bullish nature. The rectangle structure should be comprised of at least 40 price bars. The breakout from the rectangle must occur through the resistance level. The breakout candle must penetrate the upper resistance line, and close above it. The momentum indicator, with a look back of 10 periods based on the close, should be above the zero line. Enter a market order to buy at the start of next candle. The stop loss will be placed at the middle point of the rectangle’s trading range. The target will be measured using the width of the range. More speci cally, the target will be set at the level at which the price would be equal to the width of the range, measured from the breakout point. And here are the rules entering into a short position: There exists a clearly de ned rectangle formation, wherein, the price move leading to the rectangle is of a bearish nature. The rectangle structure should be comprised of at least 40 price bars. The breakout from the rectangle must occur through the support level. The breakout candle must penetrate the lower support line, and close below it. The momentum indicator, with a look back of 10 periods based on the close, should be below the zero line. Enter a market order to sell at the start of next candle. The stop loss will be placed at the middle point of the rectangle’s trading range. The target will be measured using the width of the range. More speci cally, the target will be set at the level at which the price would be equal to the width of the range, measured from the breakout point. Bullish Rectangle Trade Setup Let’s now take a look at an example of the rectangle breakout strategy that we just described. In this example, we’re going to show the rectangle breakout strategy in the context of an uptrend. Below you will nd the price chart for the Euro to British pound forex pair shown on the daily timeframe. We can see that there was a clear uptrend in the market preceding the range bound price movement which forms the rectangle formation. Notice the series of higher highs and higher lows that make up the up trending market move. Let’s now take a closer look at the actual rectangle structure. We know that we would need to connect two signi cant swing highs to form the resistance level of the rectangle, and two signi cant swing lows that form the support level within the rectangle. We’ve plotted this on the price chart, and we can see that it resembles a sideways parallel channel. Remember, we want to make sure that the rectangle structure is not just a minor sideways correction, but rather a prolonged sideways price movement. The way that we do this is by counting the bars within the rectangle structure. We want to see a minimum of 40 price bars comprising the rectangle formation. We can clearly see that the structure shown here has many more bars making it up than this minimum requirement. Now that we have recognized the rectangle structure, and con rmed that it has occurred within the context of a bullish market, we should know that the breakout from the upper resistance line is the level that we will need to watch closely for our entry trigger. As the price progressed within the rectangle formation we can see that the third major test of the resistance level led to a con rmed breakout. Remember, a con rmed breakout is one wherein the breakout candle penetrates beyond the horizontal line, and closes above it. If you refer to the magni ed area on the price chart, you will recognize the bullish candle that ultimately broke above and closed above the upper line of the rectangle structure. At the same time that this breakout candle occurs, we can see that the momentum indicator, as shown on the lower pane of this chart, was registering a reading above zero. The blue line shown on the momentum indicator represents the zero line. Now that all of our conditions have been met for this bullish rectangle trade set up, we want to prepare for entering our long position. We would enter a market order to buy at the beginning of the very next candle following the breakout candle. The stop loss for this trade would be placed at the midpoint of the rectangle’s trading range as is illustrated by the black dashed line below the entry signal. Finally, our take pro t target would need to be set so that we can exit our trade at the most opportune time. Based on our rules, the target would be set at a price level at which it would be equivalent to the width of the rectangle itself. And this would be measured from the breakout point. You can see where that exact target would have been triggered by referring to the green vertical brackets which represents a one to one relationship of the rectangle’s range. Bearish Rectangle Trade Setup Let’s now move on to our second example. In this example, we will see what the bearish variety of the rectangle pattern in forex appears like. On the chart image below, you will nd the price action for the Australian Dollar to Japanese Yen currency pair based on the 240 minute timeframe. We can see here that there was a clear down trending price movement leading to the rectangle formation. We’ve outlined the upper and lower lines within the rectangle formation, which serves as the resistance and support levels respectively. Additionally, we can con rm that this rectangle structure is a relatively large pattern which exceeds a minimum of 40 price bars. This validates the rectangle pattern based on the trading rules outlined. As price was trading within this clearly de ned range, we can see towards the right end of this chart, that the supply in the market forced a bearish breakout from this rectangle formation. Keep in mind that since the preceding trend was bearish, it is the support line within this rectangle pattern that is of most interest to us. The breakout candle appears as a strong bearish price move. The candle has been magni ed for easier viewing, and we can see that it breached below the support line and was able to close below it as well. As such, this can be considered a valid breakout below the rectangle formation. If we refer to the lower portion of the chart, we can see the momentum indicator plotted. Again, the black line represents the actual momentum indicator reading, while the blue horizontal line represents the zero line. At the time of the breakout, we can see that the momentum indicator was registering a reading that was below the zero threshold. As such, this con rms the bearish rectangle set up based on our trading rules. Immediately following this event, we would place a sell order at the market. The stop loss would be placed at the center of the rectangle’s trading range. The target point for this trade set up would be calculated using the width of the rectangle’s trading range. More speci cally, we will want to exit the trade for pro t when the price reaches a level that is equivalent to the width of the rectangle. Essentially, this creates a two to one risk reward ratio for us. We can see from the green vertical brackets on the price chart, which represents this measurement, that our target was easily reached. Summary Trading with classical chart patterns is one of the more popular trading methods used by technical analysts. It is a timeless trading technique that offers many advantages. Our focus here has been on one such type of classical pattern, the rectangle formation. We have learned that the rectangle pattern is most often a continuation pattern, offering a solid opportunity to trade in alignment with the larger trend. We have outlined one speci c strategy for trading rectangle patterns, but the pattern can be traded in many different ways. As you gain experience in recognizing these structures on your price chart, you will begin to gain more con dence in executing your own variation of the set up on your preferred instruments. Rounding Top Chart Pattern In the world of technical trading, identifying chart patterns and price structures has always been one of the most popular ways to analyse and trade the market. These formations give us an insight into the underlying order ow in the market. As traders they help us make decisions on where to buy and sell. The beauty of trading using chart patterns is that they can be identi ed without the use of technical indicators. Discretionary traders who have spent the necessary time learning these formations will be able to identify these exciting market opportunities. Over the years, there are a few patterns in particular which have carved out a reputation among technical traders as being the most reliable and effective structures to use. Two of these structures are going to be covered in this article. This includes the rounding top chart pattern and the rounding bottom chart pattern. So, let’s jump right in and take a look at the rounding top chart pattern rst. We’ll introduce how you can identify the pattern on your chart, explain what the pattern is revealing about the market direction and walk through how to trade the pattern. The rounding top chart pattern is a bearish reversal pattern. This means that the presence of the pattern indicates there is a likelihood that the market will reverse lower, offering selling opportunities for traders. In this respect, the pattern can be thought of as similar to a head and shoulder pattern. The pattern is identi ed via the presence of a series of highs which follow an arc: lower highs on the left, slightly higher peaks in the middle, and then lower peaks again on the right. Rounding Top Chart Example In the image above you can see a great example of a rounding top chart pattern. Price is rising initially before making the rst peak on the left. We then see a small correction before price continues higher, rising into the peaks found in the middle of the arc. Price then corrects again before making another attempt to rise. This time however, price is unable to surpass the peaks found in the middle of the arc, forming another lower peak, allowing us to draw in our arc to highlight the pattern. What Does the Rounding Top Tell Us About the Market? So, now we know how to identify the rounding top technical formation, you might be asking, why is it important? Well, the beauty of the rounding top chart pattern is that it tells us some important information about the underlying order ow in the market. If we think about what is happening in the market to create this formation, we know that bulls were in control initially, driving price higher before sellers take price lower. However, price once again meets demand which takes price higher into the centre of the arc. Then the bulls are met with strong selling pressure taking price lower. Price then runs into one nal stage of buying but bulls are only able to take price back up partially giving us our lower right-hand peak, before sellers drive price down. Ok, so now we know how to identify the rounding top reversal pattern. We also understand what the rounding top technical formation is telling us about the underlying order ow. The next question is, how do we trade the pattern? Trading the Rounding Top Pattern Based on the information the pattern is giving us, the best way to trade this pattern is to place a sell trade as price reverses lower. Looking at the example from earlier you can see that we are able to draw in a support line at the lows established after the correction from the rst peak. This essentially gives us a trade line. Following the reversal from the nal peak in the pattern, we can then sell as price trades below that level. We can also place a protective stop just above the nal peak of the pattern. How To Manage The Trade In terms of a target, as with all trading methods and strategies, the trader’s focus should always be on achieving an acceptable risk to reward. This means always banking more on a winning trade than you lose on a losing trade. So, once you have set your stop loss and entered your trade, a good rule of thumb is to set a target which is at least 2 x your stop loss. So, if your stop loss is 100 pips, set a target of at least 200 pips. This will help you achieve more sustainable pro tability with your trades in the long run. Where Best to Trade the Pattern? Given the nature of the pattern, it is usually best to trade the structure following a price run up where the rally has met resistance (selling pressure). On the other hand, the pattern can also be useful if it forms during the correction during a bearish trend. Benefits of The Rounding Top Chart Pattern? The great thing about the rounding top pattern is that once you have learned to identify it, it becomes very easy to spot. So long as you can draw in the arc, and identify a trade line, you have the right view. Another bene t to the pattern is that it can be found and traded in all instruments and asset classes and on any time frame. Let’s now move onto the rounding bottom chart pattern. The Rounding Bottom Chart Pattern The rounding bottom chart pattern is simply the inverse of the rounding top chart pattern. The pattern is a bullish reversal pattern. This means that the presence of the pattern identi es the likelihood of a reversal higher and offers buying opportunities to traders. In this respect, the pattern can be thought of as similar to the inverse head and shoulder pattern. The pattern is identi ed via the presence of a series of price lows which follow a gentle “U” shape or an inverted arc. So, there will be initial lows, lower lows in the middle of the pattern and then higher lows on the right-hand side completing the rounding bottom technical formation. Rounding Bottom Chart Example So, in the rounding bottom chart above you can see a great example of a rounding bottom technical formation. We have our initial low on the left. Price then makes a small correction higher before continuing lower into the lowest points found during the middle of the “U” shape. Price then corrects higher again, before once more turning lower. However, this time we put in higher lows which complete the right-hand side of the structure, giving us our rounding bottom chart pattern. What Does the Rounding Bottom Tell Us About the Market? The rounding bottom technical formation tells us that there has been a shift in power between sellers and buyers. So, if we think about what is happening in the underlying order ow to create the pattern: sellers are in control initially driving price down to the rst lows on the left-hand side. However, buyers then step in at this point to drive price higher. However, this move higher runs into selling pressure once again and price is driven down rmer to new lows. However, at this point, in the middle of the round bottom, buyers step in to drive price higher once again. This upside move meets selling pressure again, but the pressure is weaker and price is unable to form a new low. At this point we have our higher lows on the right-hand side of the pattern. At this point, the pattern is complete. Trading the Rounding Bottom Pattern Ok, so now we know how to identify the pattern and we understand what the pattern is telling us about the underlying order ow in the market the next question is: how do we trade the rounding bottom pattern? So, remember how the rounding top is a bearish pattern and we look to sell a breakdown as price reverses lower? Well, this time around because the rounding bottom technical formation is a bullish pattern, we will look to buy a rounding bottom breakout higher. So, if we refer back to the example of a rounding bottom pattern we used earlier, let’s walk through how to trade a rounding bottom reversal. As with the rounding top, we need to establish a trade line. So, if we look at the high that was established following the move up from the rst low at the start of the pattern, this gives us our trade line. So, we want to place a buy trade as price breaks out above the trade line because this con rms the bullish reversal suggested by the pattern. We can then place out protective stop just beneath the last low in the pattern on the right-hand side. How to Manage the Trade So, once you have entered your buy trade and placed your protective stop, it is time to think about targets. As we discussed earlier, the best option is to always use a target which is at least 2 or 3 x your stop loss to ensure that you achieve a solid risk to reward ratio. If we think about the shift in sentiment which is happening as the pattern forms, we can almost think of the market as a coiled spring. So, when the pattern has formed and price eventually breaks above the trade line, we are looking to capture a burst of momentum as the rounding bottom breakout occurs. So, when managing the trade, you really have two options. The rst is to proceed with a set target in place. Or, if you are a longer-term trader who is comfortable with the ebb and ow of holding a longer position, you can look to move your stop to break even as the rst target is hit and then keep your position open longer. This will allow you to capture a bigger pro t if the move develops into a proper trend reversal. Where to Trade the Rounding Bottom Pattern? Due to the nature of the pattern as a bullish reversal pattern, the rounding bottom chart pattern is best traded at the end of a bearish trend. When the trend runs out of steam or runs into support and we can identify a rounding bottom pattern, this alerts us to a shift in market sentiment and the potential for a reversal to occur. Similarly, if we can identify the pattern during the correction in a bullish trend, this can be a great way to get in as the longer-term trend resumes. Benefits of The Rounding Bottom Pattern? As with the rounding top chart pattern, the rounding bottom reversal structure can be identi ed and traded on all instruments and asset classes and on all time frames. So long as you can draw in the “U” shape and identify the trade line, you know you have the correct view and the pattern is there to be traded. Points to Consider When Trading Rounding Tops and Bottoms As brie y touched upon at the start of article, the beauty of trading rounding tops and bottoms is that the patterns can only be identi ed by the naked eye. There are no indicators which plot the pattern for you. As a technical trader you will need to develop the skill in identifying the pattern and picking the trade. The best advise here is simply to practice. If you need to you can print off the examples used above and keep them as a handy guide to measure any potential chart formation you nd against it. With that in mind, here are key tips to keep in mind when identifying the patterns: Shallow is better You will notice that in both the examples used here for rounding tops and bottoms, the price structure is fairly shallow. Even the “U” shape describing the rounding bottom is more of a gentle smile shape than a “U”. The reason for this is because if we think again about what is taking place in the underlying order ow to create these patterns, it is essentially a war being fought out around a certain price point where power is shifting. With the rounding top, power is shifting from the buyers to the sellers and with the rounding bottom power is shifting from the sellers to the buyers. Now, due to the way this shift in sentiment takes place, this is why the patterns are comprised of many peaks and lows. A gentle pattern suggests that the market has undergone the proper shift in power between supply and demand and therefore, has a higher likelihood of working. If the pattern is not shallow, and the moves up and down are much bigger (more volatile), this suggests that the price action is too erratic and is not favorable for placing a trade. Combing rounding top and rounding bottom patterns with other technical elements Another key aspect to point out about the patterns is that they can be used in conjunction with other forms of technical analysis in order to bolster the chances of success. Whilst it is perfectly valid to place a trade upon identifying the pattern, traders can incorporate other technical elements such as trend lines, support and resistance and technical indicators. Combing technical elements can be a great way to gain stronger conviction in your trading idea. Focus on location of the pattern Finally, it is worth noting that as with all technical formations and strategies, the set-up is not guaranteed to be successful. It is the job of a good technical analyst and trader to study the markets and identify the best conditions for placing a trade. As we discussed earlier in the article, there are certain locations which are better for taking a trade than others. As you spend time practicing identifying the patterns and trading them you will learn to identify the best locations and trading conditions for the speci c markets you prefer. Finally, it is worth considering the bene ts of trading rounding tops and bottoms over other price structures and patterns. The Benefits of Trading Rounding Tops and Rounding Bottoms The main bene ts of the rounding top reversal and rounding bottom reversal lie in its ability to catch other traders off guard. To traders who have not learned to identify the structure, it can simply look like a period of consolidation before trend continuation. However, as we have learned, the underlying order ow shift taking place is signi cant and when the reversal occurs, it can be powerful, offering great opportunities for traders. As we have seen in the examples, because the changeover in order ow causes demand or supply to become pent up like a coiled spring, as the rounding top breakout or rounding bottom breakout occurs, the moves can nd a lot of momentum. Remember, to set your stops and targets and always focus on achieving a good risk to reward pro le. Diamond Chart Pattern The diamond pattern is an advanced chart formation that occurs in the nancial markets. It is one that is less well known to technical traders and investors alike. As such, many traders are not very familiar with its structure or trading application. In this lesson, we will dive into the speci cs of recognizing and trading the diamond pattern. The diamond formation is part of the family of classical chart patterns. But unlike the commonly seen ag, pennant, head and shoulders, and rectangle patterns, the diamond chart pattern occurs less frequently on the price chart. As such there are not as many opportunities to trade the diamond chart pattern as some of the others mentioned. Nevertheless, technical traders should become familiar with this pattern as it provides a solid trading opportunity when it is recognized early enough. The diamond chart pattern is often confused with the head and shoulders chart pattern. Though there are similarities between both of these formations, there are some distinct differences between the two formations. We’ll be diving into the speci cs of the diamond pattern structure momentarily, but for now it’s important to understand that the diamond pattern is a more advanced chart pattern that has reversal characteristics. The diamond pattern occurs most often after a prolonged trend phase. When it occurs within the context of a bullish market, the pattern is referred to as a diamond top, or a bearish diamond pattern due to its bearish implication. Conversely, when it occurs within the context of a bearish market, the pattern is referred to as a diamond bottom, or a bullish diamond pattern due to its bullish implication. Let’s take a closer look at the illustration below which details the structure of the diamond chart pattern. On the illustration above we can see what the diamond top formation appears as. Notice the strong uptrend preceding the diamond structure. The market rallies to a high point, and then retraces lower. Then the market makes a higher high. After which the prices drop below the previous swing low and creates a new swing low point. Prices then move higher once again creating the peak within the structure. Following that, the price action moves lower, but does not take out the previous swing low point. Prices resume higher once again, and settle below the peak point reached earlier. The price again falls, and it stays above the prior swing low point. Once this price action completes, we can draw four fairly equal sized trendlines that connect the swing highs at the top of the structure, and the swing lows at the bottom of the structure. This creates a diamond shaped appearance which is where the pattern gets its name from. Sometimes, we may not see each and every up and down price leg noted earlier within the pure de nition of the diamond structure. This will not necessarily invalidate the labeling of the structure as a diamond pattern. What is most important is that we can plot four trendlines around the structure that are of relatively similar length. Bearish Diamond Pattern The bearish diamond pattern variety, also known as, a diamond top was described in the earlier section. Again the pattern can be seen as a series of up-and-down price swings that resemble the structure of the head and shoulders formation. More speci cally, the left shoulder and head will connect to form a trendline, the head and the right shoulder will connect to form a second trendline. This completes the trendlines for the upper section of the bearish diamond formation. Then, for the lower portion, we would connect the swing lows within the troughs which will form a V shape. Referring to the illustration above, we can see the bearish diamond pattern once again. Additionally on this diagram we have shown the breakout entry signal for trading the structure, along with the target level for the pattern. As for the short entry signal, that would be triggered at the break and close below the lower right-hand line sloping upward. Some traders prefer to wait for just the breakout below this line without the requirement for a close below it. This is a viable entry point as well, however, keep in mind that it will lead to more false signals as compared to waiting for the breakout and close condition. The price target for the structure is calculated using a measured move technique. More speci cally, we want to measure the peak to valley distance within the structure, and then project that distance downward from the breakout point. This will provide a level at which we can expect the followthrough on the breakout to begin to subside or potentially reverse. As such, it represents an excellent take pro t level and trade exit. Bullish Diamond Pattern Let’s now look at the inverse of the bearish diamond pattern, which is the bullish diamond pattern. A bullish diamond pattern variety, also referred to as a diamond bottom, occurs in the context of a downtrend. Typically we will see a strong price move lower, and then a consolidation phase that carves out the up and down swing points of the diamond bottom. In this case, the appearance will be similar to the inverted head and shoulders formation. We will connect the peaks and troughs within the structure in a similar manner as described earlier. Once we have drawn the four trendlines around the structure, and can con rm that the four lines are fairly equivalent in size, we will be able to validate the structure as bullish diamond pattern. Looking at the illustration above of the diamond bottom, we can see that the formation is preceded by a downward price move. We can then see the up down sequence within the diamond structure which is outlined by the two upper trendlines pointing downward, and the two lower trendlines pointing upward. The long entry signal is triggered at the break and close above the upper right-hand line sloping downward. Again, the preferred method would be to wait for an actual breakout and close rather than just a breakout above this trendline in order to prevent the occurrence of false signals and potential whipsawing price action around this area. We would calculate the upper price target by measuring the high to low within the enclosed structure. Once we have that distance calculated and plotted on the chart, we would extend that same distance from the breakout point projected upward to arrive at the preferred target level. Once price reaches this level we should consider exiting the entire position or at least a large portion of it, and possibly leave a smaller portion open if desired. Diamond Pattern Trading Strategy Let’s now shift our focus to creating a trading strategy that incorporates the diamond pattern. We have seen that the diamond technical formation occurs both in the context of an uptrend and a downtrend. When a bullish price move precedes the diamond pattern it is called a diamond top and which has a bearish implication. When a bearish price move precedes the diamond pattern is called a diamond bottom which has a bullish implication. In this particular diamond trading strategy, we will attempt to keep it as simple as possible by utilizing a pure price action-based approach. We know that the diamond pattern is one that does not occur very often in the market. As such we do not want to put too many variables into the strategy which would lter out an otherwise good set up. Here are the rules for trading the diamond top chart pattern. A clear uptrend must be in place prior to the diamond top formation. The diamond top formation should be clearly de ned with four trendlines that connect to each other, and which are relatively close in length to one another. Enter a sell order at the market upon a break and close below the upward sloping trendline near the completion of the pattern. The stoploss should be placed at the most recent swing high preceding the breakout point. The target level will be calculated based on a measured move calculation. We will measure the distance between highest high and lowest low within the structure, and project that downward from the breakout point. This projected level will act as the pro t exit point. There will be an additional time stop component on the trade. Speci cally, if after the passing of 50 candles, the price has not triggered either our stoploss or target level, we will immediately exit the trade at the market. Here are the rules for trading the diamond bottom chart pattern. A clear downtrend must be in place prior to the diamond bottom formation. The diamond bottom formation should be clearly de ned with four trendlines that connect to each other, and which are relatively close in length to one another. Enter a buy order at the market upon a break and close above the downward sloping trendline near the completion of the pattern. The stoploss should be placed at the most recent swing low preceding the breakout point. The target level will be calculated based on a measured move calculation. We will measure the distance between highest high and lowest low within the structure, and a project that upward from the breakout point. This projected level will act as the pro t exit point. There will be an additional time stop component on the trade. Speci cally, if after the passing of 50 candles, the price is not triggered either or stoploss or target level, we will immediately exit the trade at the market. Diamond Trade Setup In EURCAD We’ll now look at an example of the diamond pattern in the Forex market. This example of the diamond top trade set up is based on our previously outlined strategy and will be shown on EURCAD cross currency pair. Below you’ll nd the price chart for the EURAD pair based on the eight hour trading timeframe. As we’re well aware, our diamond strategy is based on a pure price action analysis. As such we will need to monitor the price closely for potential signs of an emerging diamond chart formation. If we look at the EURCAD price chart again, we can see the diamond top pattern outlined. Notice how the diamond formation starts with prices making a swing low, and then making a higher high, followed by another swing low, followed by another swing high, and nally the last swing low before the breakout. Notice how the two lines connecting the swing highs, and the two lines connecting the swing lows are of relatively similar lengths. This provides us with con rmation that this is indeed a symmetrical diamond top pattern, worthy of further consideration. Now that we have labeled the structure as a diamond formation, we must ensure that there is a clear uptrend preceding this diamond top formation. As we can see from the price action leading up to the diamond top, there was a strong and consistent uptrend present in the market. This con rms our trend requirement per our outlined strategy. And with that we can make preparations for a potential short trade. If you look closely at the price chart you can see where that breakout and close occurs to the downside. This is also shown by the red arrow noted as Sell. Once this sell entry order was executed, we would turn our attention to the stoploss and take pro t level. The stoploss would be placed at the recent swing high prior to the breakout point. You can see that noted on the price chart above the sell trigger. The target level is calculated using a measured move technique. That is to say that the price move following the breakout from this structure should be at least the length of the entire structured measure from peak to valley. That distance is represented by the orange vertical bracket shown to the left of the diamond top chart formation. The second bracket represents an equal length to the rst bracket measured from the breakout point. You can see where the target level rests based on this measured move target technique. You will note that after the breakout there was some follow-through to the downside, however, the bearish momentum zzled out, and the price began to trade in a sideways manner forming a long horizontal consolidation structure. But based on our strategy rules, we would not have had to endure this extended consolidation phase. This is because our diamond trading strategy incorporates a 50 candle time stop. You can see where that time stop would have triggered taking us out of the position entirely. Though the price did not reach our intended target, we would’ve still booked a pro t on the trade. Diamond Pattern Signal In USDJPY We will now illustrate an example of the bullish diamond bottom pattern. For example, we will be looking at the daily chart of the US Dollar to the Japanese Yen forex pair. If we look at the lower part of this price chart, we can see the forex diamond pattern outlined by four trendlines. Notice how the center of the diamond bottom formation has the longest length within the formation. We can see the two swing high points that connect each of the two upper sections of the diamond bottom formation. Similarly we can see the two swing low points that connect each of the two bottom sections of the diamond bottom formation. This overall structure resembles a diamond appearance, and each of the four trendlines containing the price action within the pattern are of relatively similar length. Now that we have properly classi ed this as a diamond formation, let’s now dissect the other aspects of this potential trading opportunity. We know that based on our strategy rules, the diamond bottom pattern should be preceded by a clear downtrend. Referring to the price chart once again, we can see that this condition was met. The prices were moving lower in a nice stairstep manner prior to the formation of the diamond bottom. At this point, we could move forward with preparing for a potential long trading opportunity. If you look closely at the trendline that acts as our signal line, you will note that there was initially a false breakout to the upside. This then led to the price action breaching the lower right-hand trendline temporarily, but then the prices recovered and the second breakout opportunity provided us another buy entry. As soon as this buy order was executed, we would have placed a stop loss at the most recent swing low preceding this breakout. The price target would be measured using the measured move method. We would calculate the peak to valley length within the diamond bottom formation and then project that upward from the breakout point. The left vertical bracket represents the high low of the diamond bottom formation, and the right vertical bracket shows that projection from the breakout point. As we can see, the target was reached quite easily, and occurred prior to our 50 candle time stop exit. As such would have been able to capture the entire price move from the entry to the target level. Summary We have learned that the diamond pattern can have both a bullish and bearish implications. A bullish diamond pattern is often referred to as a diamond bottom, while a bearish diamond pattern is often referred to as a diamond top. Diamond reversal patterns are seen across all different types of nancial markets including the stock market, forex market, crypto market, and futures markets. The diamond pattern is not seen as often as many other classical chart patterns. However, it is important that you understand the pattern and are able to recognize it, because when it does occur, it can provide for an excellent trading opportunity. Based on backtesting we have found that the diamond top pattern which occurs after a rise in market prices tends to provide for a higher probability trade set up then the diamond bottom pattern which occurs after a decline in market prices. You will need to do your own testing to see if this tendency aligns with the markets you trade. Cup and Handle Pattern We have discussed many different types of chart patterns to date. Today we will talk about a somewhat lesser known pattern but one that is still highly effective. I am referring to the Cup and Handle Pattern for Forex trading. The following material will outline the unique structure of this pattern as well as a strategy for successfully trading it. The Cup and Handle pattern is a chart gure, which has a bullish potential. The pattern could appear after a price increase or a price decrease. Of course the pattern has its bearish equivalent, the Inverted Cup and Handle, which we will touch upon later as well. It is important to remember that the pattern could act as a reversal or continuation signal. This depends on the price move prior to the pattern formation. We could have a bullish Cup and Handle after a bullish price move, in which case the pattern will be considered a continuation. If the bullish Cup and Handle comes after a bearish price move, it will act as a reversal pattern. Structure of the Cup and Handle Technical Pattern The Cup and Handle pattern is aptly named because this technical pattern actually resembles a cup with a handle on the chart. The pattern starts with a price decrease, where the Forex pair gradually changes its direction. The change in the move is so gradual that the price action creates a rounded bottom on the chart. The beginning of the price decrease and the end of the price increase are approximately on the same level. This rounded structure is the Cup portion within the pattern. Then comes the handle, which is expressed by a bearish price move. In many cases, the handle is locked within a small bearish channel on the chart. Below you will see a sketch of the Cup and Handle formation: This is the shape of a Cup and Handle pattern. Sometimes, the beginning of the decrease and the end of the increase could diverge in terms of the level they are supposed to be located at. However, a small discrepancy between the tops of the two trends is admissible. The handle should reach the mid. point of the Cup and Handle pattern. The decrease could stop a bit before the midpoint, or could go a bit below. Cup and Handle Formations in Forex There are two variations of Cup and Handle chart patterns in Forex based on their potential. There is the bullish Cup with Handle and the bearish Inverted Cup with Handle. Bullish Cup and Handle Pattern The bullish Cup and Handle pattern is the one we have been discussing so far. It starts with a bearish price move, which gradually reverses. The new bullish move nishes approximately around the top of the prior bearish move. Then the price action begins to create the handle, which is a bearish channel type structure. When you con rm the pattern, the price is likely to break the channel of the handle, initiating a bullish move. This move has two targets. The rst target equals the size of the channel during the handle. The second target equals to the size of the cup starting from the moment of the breakout. Below you will see an example of a bullish Cup and Handle pattern: This is the H1 chart of the most traded currency pair – EUR/USD. The time frame covered is August 10-18, 2016. In the middle of the image you see a bullish Cup and Handle pattern, which is illustrated with the blue lines on the graph. See that the bottom of the pattern is rounded. The two tops of the cup are approximately on the same area. The handle starts right after the end of the cup. Notice that it is sloped downwards. The price action breaks upwards and we apply the two targets. The rst one is with the size of the handle and the second with the size of the cup. They are both applied from the moment of the breakout as shown on the image. Bearish Cup and Handle Pattern As we said, the classic cup and handle pattern has its bearish equivalent – the bearish Cup & Handle, which is a mirror image of the standard Cup & Handle. Therefore, the bearish Cup and Handle is upside down. The bearish Cup & Handle starts with a bullish price move, which gradually slows down and turns into a bearish move. The handle of the pattern is slanted upwards. The con rmation of the pattern comes when the price action breaks the channel of the handle in the bearish direction. The rst target of the pattern equals to the size of the bearish channel around the handle, applied downwards starting from the moment of the breakout. The second target equals to the size of the cup, applied downwards starting from the moment of the breakout. This is how the bearish Cup with Handle pattern appears: Here we are looking at the H4 chart of the GBP/USD Forex pair for May 5 – June 8, 2016. You will see the bearish Cup and Handle pattern on this chart. Notice that the pattern comes after a bullish trend, which means it acts as a reversal. Also notice how the pattern starts with a bullish trend, which gradually reverses. In this manner, the created top is rounded. At the end of the reversed bearish move, the price reverses again and starts the creation of a bullish handle. After the price breaks the handle downwards, we see the creation of a new bearish move. Thus, we apply the two targets as shown on the image. Drawing the Cup and Handle Drawing the Cup and Handle pattern might seem tricky at times. The reason for this is that the pattern cannot be drawn with a straight line. Due to the rounded bottom (or top) of the pattern, you should use a curved drawing tool. If the pattern is bullish, take the two tops of the cup and stretch a curved line downwards until the rounded part reaches the low of the pattern. Then take the right side of the cup and draw the shape of the bearish handle. If the pattern is bearish, take the two bottoms of the cup and stretch a curved line upwards until the rounded part reaches the top of the pattern. Take the right side of the cup afterwards and draw the shape of the bullish handle. Cup with Handle Signal The Cup with Handle formation has a very speci c signal. When we get this indication, we can buy or sell the Forex pair depending on the potential of the pattern. The Cup with Handle trigger signal is at the break out of the handle. The handle breakout acts as a con rmation of the pattern. When you identify the handle breakout, you can plot the two targets of the pattern – the size of the handle and the size of the cup. Below you will see a valid Cup with Handle Signal: Above you see the bearish Cup with Handle Pattern. The con rmation signal of the gure comes at the moment when the price action breaks the handle downwards. This is shown with the red circle on the chart. After the bearish Cup with Handle signal, you can start pursuing the bearish potential of the pattern. Cup and Handle Trading System Now that we have a better understanding of the structure of the pattern, we are going to summarize some trade management ideas around this pattern. Let’s take a look at a potential Cup and Handle trading system and the rules we need to follow when trading this pattern. Opening a Trade As we point out earlier, you would prefer to open a trade after con rming the Cup with Handle pattern. If the pattern is bullish, the signal should be a bullish breakout through the handle. In this case, you could open a long trade. If the pattern is bearish, the signal should be a bearish break out of the handle. In this case, you could open a short trade. Stop Loss As with most if not all patterns, a stop loss is needed when you trade the Cup and Handle price pattern. If you trade a bullish Cup with Handle pattern, you should place your stop loss order below the lower level of the handle. If you trade a bearish Cup with Handle your stop loss order should be placed above the upper level of the handle. Take Profit The take pro t targets for the Cup & Handle corresponds to the two targets we mentioned earlier. Your rst take pro t target should be located on a distance equal to the size of the handle, starting from the breakout point. If this target is completed, you can then start pursuing the next target. The second target is located on a distance equal to the size of the cup, applied again from the moment of the breakout. An additional option is to stay in the trade as long as the price is trending in your favor. You may not want to completely exit the trade, where the price move is offering more potential to add pro t to your trade. Thus, you can watch for price action clues in order to extend the gains from the trade. Trading the Cup and Handle Chart Pattern Now let’s demonstrate the bullish and the bearish Cup and Handle strategy in action. The examples below will help clear out any questions you may have related to trading the Cup and Handle pattern in Forex. Bullish Cup and Handle Trading Example We will start with the bullish Cup and Handle trading example. The image below will show you how to trade this version of the pattern from an actual chart: This is the H4 chart of the AUD/USD Forex pair for Sep 3-21, 2016. The image shows a bullish Cup with Handle chart gure with the blue lines on the chart. The con rmation of the pattern comes in at the green circle at the moment when the price action moves above the handle. You would typically look to buy the AUD/USD Forex pair when the candle closes above the handle. The stop loss order of this trade needs to be placed below the lowest point of the handle. This is shown with the red horizontal line on the image. The magenta arrows and lines represent the two targets on the chart. As you see, the price reached the rst target of the pattern prior to the entry, had you waited for the candle close to enter. Sometime afterwards, the price action reaches the second target on the chart. You have the option to close your entire position at this second take pro t target. However, you could opt to hold a portion of the trade for further gains if you see price action continuing to trend upwards. The yellow line on the chart is an upward trend line, which measures the bullish activity of the price action. You could hold the trade as long as the price action is located above the yellow bullish trend line. The break through the trend line is shown in the red circle on the chart, which would signal an opportune time to close out the trade in its entirety. Bearish Cup and Handle Trading Example Let’s now switch to the opposite version of the pattern. Below you will nd a bearish Cup and Handle trading example: This is the hourly chart of the USD/CAD Forex pair for March 25-30, 2016. The image illustrates the way a bearish Cup and Handle pattern could be traded. The pattern is illustrated in blue on the chart. The rounded part is the Cup and the small bearish channel is the handle. The con rmation of the formation is illustrated with the small green circle when the price action breaks the handle downwards. This would be an advantageous time to sell the USD/CAD Forex pair. The stop loss order of the trade needs to be placed above the handle. Its location is shown with the red horizontal line on the chart. The two targets are applied using the two magenta arrows and horizontal lines. As you can see, the price action reaches both of these targets in the next two hourly periods. The trade could be closed afterwards. However, if you decided to keep a portion of the position open, how might you manage the trade? See the second big bearish candle, which reaches the second target. The high and the low of this candle could be used to draw a horizontal support / resistance zone on the chart. The trade should be closed if the price action breaks the upper barrier. You can even adjust your stop loss order right above the upper level of the zone. As you see, the price action breaks to the lower level of the S/R zone, which indicated that the price will probably continue in the bearish direction. Note the large bearish move on the chart following the breakdown. What are Chart Pattern Failures? There is a wide array of chart patterns within the study of technical analysis. Some of these are continuation patterns, and others reversal patterns. Each individual chart pattern has a certain potential that is often achieved. But in some cases, a chart pattern can fail and we will end up with a losing trade. Fortunately, for the astute trader this can sometimes provide for an alternative trading scenario. Today we will learn how to trade and pro t from chart pattern failures. A chart pattern failure occurs when a speci c chart pattern does not materialize as anticipated and is unable to achieve its potential. As a result, the price action moves in the opposite direction than expected. Many times, this causes an in ux of stop loss orders to be triggered and can provide for a unique trading opportunity. Let’s take a look at an example of a chart pattern failure: The image above shows a Double Bottom chart pattern, which is marked with the blue lines on the chart. The magenta line is the Neck Line of the pattern, which plays the role of a con rmation signal. In the green circle you see that the price action breaks the neck like, con rming the bullish potential of the pattern. However, the price action returns and initiates a strong bearish move. The Double Bottom setup failed, which has now caught many traders on the wrong side of the market. Failure Patterns and Trapped Traders Being able to understand why failure patterns occur on the chart is essential for your success when trading a technical analysis pattern failure. Therefore, in this section, we will discuss the reason for the occurrence of failure patterns in Forex. The truth is that failed patterns are usually part of something bigger. In many cases, you will see that your failure pattern is evolving into another pattern, either on your trading timeframe or a higher degree timeframe. Let’s take for example of the Double Bottom pattern from the image above. If you take a closer look, you will notice that the failed Double Bottom eventually turned into an Expanding Triangle. On the chart image above, we have outlined the upper and the lower level of the Expanding Triangle, which appears to be the real pattern on the chart. Although the Double Bottom pattern (blue) gets con rmed, the price action returns and creates another bottom on the lower level of the Expanding Triangle. This provides us valuable information that the black horizontal support is of great importance in accessing future price development. Therefore, when the price action breaks the lower level of the black Expanding Triangle you have suf cient reason to believe that the downward move from the newly established pattern is likely. As you can see, the triangle reaches its full potential after the breakout. Types of Failure Patterns in Forex There are two basic types of failed chart patterns in Forex. They can be classi ed based on how far the price action has gone into the creation of the pattern. There are chart patterns, which are already con rmed, but still fail, and there are patterns, which have formed, but have not yet been con rmed. Non-Confirmed Patterns that Fail These patterns are forming or formed on the chart, but actual breakout through the trigger line of the chart gure has not yet taken place. Further price action then proves that the anticipated pattern is false and the price proceeds in the opposite direction than expected. Already Confirmed Patterns that Fail These chart patterns, have already been con rmed by their trigger line, creating the con rmation. This means that the trader has a very strong reason to pursue the potential of the chart formation. However, the pattern fails and leaves many traders on the wrong side of the market. How to Trade Failed Chart Setups In many cases before you trade a failed chart setup, you will probably have experienced a loss caused by the initial false breakout. This is totally normal, and you should not worry about that as long as you follow a strict risk management strategy. When you realize that the pattern is a fakeout or false breakout, you can prepare to trade in the opposite direction to catch the real price move. Next, will now discuss some basic rules you can use when trading failed chart setups. Entering a Failed Pattern Trade To enter a Failed Pattern trade, you should rst identify the point of failure in the pattern. Typically, you will notice a weak breakout and follow thru, then a swift return to the breakout point. You should simply notice that the price action is beginning to return to the critical level of the pattern on stronger momentum compared to the momentum during the initial breakout. When this happens, then you have a good possibility of a failed chart pattern setup. You can enter a failed pattern trade when the price action breaks and closes beyond the original breakout level, but this time in the opposite direction. Stop Loss on a Failed Pattern You should never leave your failed pattern trade setup unprotected. Therefore, you should always use a stop loss order when trading this type of pattern or any type of forex setup for that matter. After all, nothing is 100% certain in Forex. Even failed patterns can fail, so you must make sure to use prudent risk management measures at all times. You should position your stop loss order at least beyond the critical level, which was used as the trigger line for the original chart pattern, before its failure. Take Profit when Trading Failed Patterns The use of proper price action rules is crucial when trading and managing failed patterns in Forex. The rst thing that you should do when you consider a failed pattern trade is to observe if the price action is likely to evolve into a new chart pattern. If this happens, then you should simply follow the take pro t rules of the newly created pattern to exit your trade. However, if the price action doesn’t create a new chart pattern, you should then rely on your price action knowledge to carefully manage the exit. This could be in the form of channel breakouts, ascending/descending price moves, other chart or candle patterns, breakouts from support/resistance levels, etc. When the currency pair starts to stall, you should keep a lookout for reversal signs and continually monitor swing highs and lows for potential exit opportunities. Failed Chart Pattern Trading Example Now let’s demonstrate the way a failed pattern technical strategy might work. This is the H4 candlestick chart of the USD/CHF currency pair a.k.a. Swissy for Sep – Oct, 2016. The image shows how to take advantage of failed patterns in Forex and how you can achieve nice pro ts from this type of trading scenario. The image begins with a range, which comes after a price decrease. The range is indicated with the black lines on the chart. Suddenly, the range breaks through the lower level, creating the impression that the price action will resume the bearish trend. However, three periods later we see that the Swissy is back into the black channel. Only a couple of periods later we see the Swissy breaking the black horizontal channel through the upper level on strong momentum. This provides a high probability entry signal that is generated after the USD/CHF fails to breakout through the lower level. You could buy the USD/CHF as shown in the green circle, placing a stop loss order below the lowest part of the range. The proper place for your stop loss order is shown with the red horizontal line below the range. In this rst example, this range trade falls into the group that attains initial con rmation but fails after all and reverses direction. The price action then enters a bullish trend. See that on the way up the Swissy creates a Rising Wedge chart pattern. This is a chart formation, which is known to have a strong bearish potential. You will need to exit the trade if the price action breaks the wedge downwards. Furthermore, such a breakout will coincide with a trend line breakout as well, giving you an even stronger exit signal. However, the Rising Wedge pattern fails to break the downside as anticipated. The good thing is that the pattern fails before any bearish con rmation, giving us no reason to close the trade. This Rising Wedge falls into the group of non-con rmed patterns that fails to materialize. In this particular case, the pattern failure is in our favor because we are already in a long position. The bullish trend resumes afterward. The price creates another big bullish impulse. Then a new corrective move appears on the chart. This correction has the shape of an Ascending Triangle (yellow) and breaks the trend line sideways. Here, based on the current price action clues, it would be wise not to close the trade at the time of the trend line breakout, but instead hold it until the triangle breaks downwards. Unfortunately, the yellow triangle breaks downwards indeed, generating a strong exit signal. Soon thereafter, the price action quickly reverses and moves above the triangle. So the initial downside move was a false triangle breakout. Therefore, you should reopen the trade after the upper level of the yellow triangle is broken and you should place a stop-loss order below the lowest point of the yellow triangle as shown on the image. The price action creates another bullish impulse, which on rst sight con rms the resumption of the bullish trend. However, the price action creates a couple of unsuccessful attempts to return above the green bullish trend line. And this is a strong signal that the bullish trend is probably done after all. Also, the blue bearish channel at the end of the chart shows that the price action is descending, giving you further reason to exit the trade. This is a very good example of how to effectively trade failed chart patterns in combination with price action. The image demonstrated three chart patterns that failed. Two of them were con rmed patterns that eventually failed. One of them was a non-con rmed pattern that failed which we used to recognize the real potential direction of the trend. Useful Indicator for Trading Forex Failure Patterns Although trading Forex failure patterns using pure price action analysis is very effective, I will also show you a valuable indicator to con rm a pattern failure. And this is the Volume Indicator. There are two simple rules when trading with the Volume indicator. If a breakout occurs on high or increasing trading volume, then the breakout is most likely authentic. If a breakout occurs on low or decreasing volume, then the breakout is probably false. These two rules are extremely helpful when distinguishing real patterns from fake patterns. By using the Volume Indicator, you will reduce the number of cases where you become trapped inside a failed chart pattern. Furthermore, if a pattern fails, then you will be able to identify it easier and position yourself to take advantage of the actual move afterward. Trading Failed Chart Formations with the Volume Indicator And now we will demonstrate how exactly to combine the Volume Indicator with chart pattern failures to achieve better accuracy in our trades. Above we have the daily chart of the EUR/USD for the period is Aug – Dec 2015. The image shows a chart pattern failure, which transitions into an opposite move. At the bottom of the chart, we have the Volume Indicator, which helps us to gauge market conditions better. The chart begins with a price consolidation, which has the shape of a Symmetrical Triangle. As you can see, the pattern makes a clear breakout through the upper level. However, the volumes at this time are decreasing, which is shown with the red line on the Volume Indicator. After the price breaks the triangle upwards, it creates a top and reverses. The price moves below the original breakout point of the Symmetrical Triangle. At the same time, the Volume Indicator prints a big bar, which breaks the downward sloping red line showing the progressively decreasing volume. This gives con rmation for the price drop, creating a nice opportunity to short the EUR/USD. You could sell the EUR/USD in this case, placing a stop-loss order at the top created through the upper level of the triangle. As you can see, the price of EUR/USD decreases afterwards. The trend is relatively sharp compared to the previous price action and it is easy to distinguish. However, the bottom formations begin to slow down and consolidate. This creates another pattern on the chart, which is marked with the yellow lines. It is a Falling Wedge formation. This pattern is known to have a strong bullish potential. Therefore, your rst thought when the price action breaks the wedge upwards should be to exit your trade. But is this wedge a real or a false chart pattern? Well let’s take a look at the Volume Indicator. Notice that volume is increasing at the time of the breakout through the upper level of the wedge. This implies that the breakout is likely real and should have a good follow thru. Therefore, based this assumption, you should use this breakout to close your trade. Notice the sharp price reversal out of the falling wedge. The handy Volume Indicator helped guide us during three breakouts. The rst breakout happened during decreasing volume, which indicated that it was probably false. The second breakout occurred on high volume, revealing that it was likely real, and the third one happened on increasing volume, con rming that it was most likely going to be a real breakout as well.