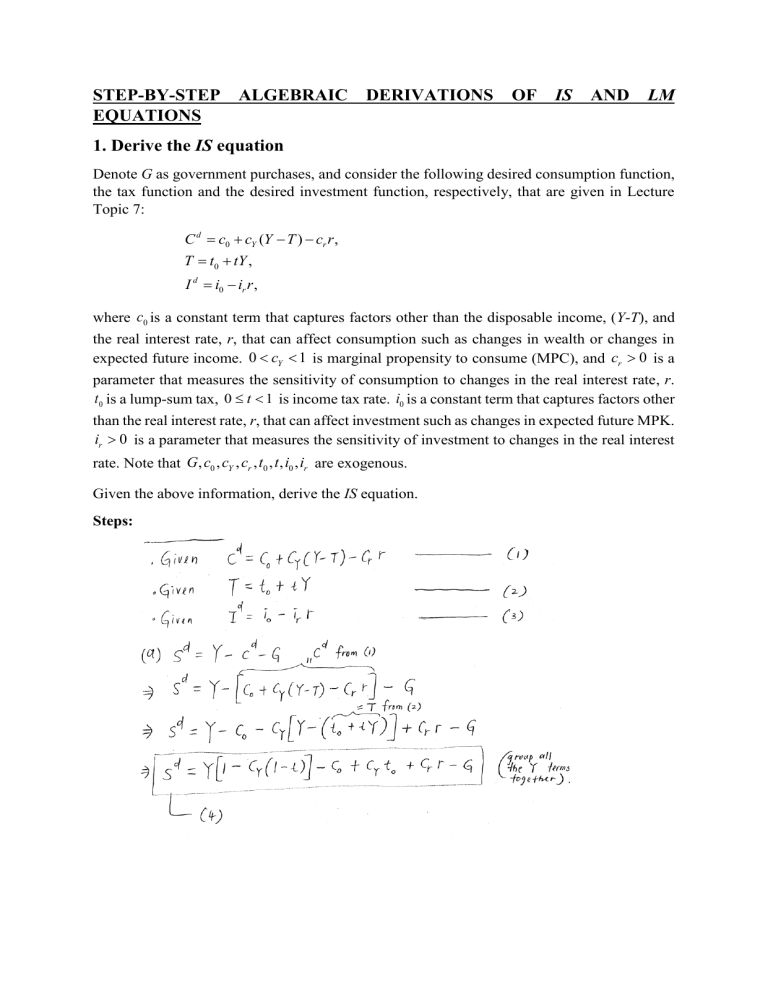

STEP-BY-STEP ALGEBRAIC EQUATIONS DERIVATIONS OF IS AND LM 1. Derive the IS equation Denote G as government purchases, and consider the following desired consumption function, the tax function and the desired investment function, respectively, that are given in Lecture Topic 7: C d = c0 + cY (Y − T ) − cr r , T = t0 + tY , I d = i0 − ir r , where c0 is a constant term that captures factors other than the disposable income, (Y-T), and the real interest rate, r, that can affect consumption such as changes in wealth or changes in expected future income. 0 cY 1 is marginal propensity to consume (MPC), and cr 0 is a parameter that measures the sensitivity of consumption to changes in the real interest rate, r. t0 is a lump-sum tax, 0 t 1 is income tax rate. i0 is a constant term that captures factors other than the real interest rate, r, that can affect investment such as changes in expected future MPK. ir 0 is a parameter that measures the sensitivity of investment to changes in the real interest rate. Note that G, c0 , cY , cr , t0 , t , i0 , ir are exogenous. Given the above information, derive the IS equation. Steps: 2. Derive the LM equation Denote M and P as nominal money supply and the price level, respectively, and consider the real money demand function that is given in Lecture Topic 7: Md = l0 + lY Y − lr (r + e ), P where e is the expected inflation. l0 is a constant term that captures factors other than income, Y, and the nominal interest rate, i = r + e , that can affect real money demand such as changes in liquidity of non-monetary asset or changes in the efficiency of payment technologies. lY 0 is a parameter that measures the sensitivity of real money demand to changes in real income and lr 0 is a parameter that measures the sensitivity of real money demand to changes in the nominal interest rate. Note that l0 , lY , lr , e , M are exogenous. Given the above information, derive the LM equation, taken as given the price level, P. Steps: NOTE: If I want, I can also use 𝛼𝐿𝑀 to denote the intercept, i.e., 𝛼𝐿𝑀 ≡ l0/lr -πe- (1/lr)(M/P). 3. Example Suppose t=0.5, c0 =300, cY =0.8, cr =200, t0 =20, G=50, i0 =258.5, ir =250, M=9150, l0 =0, lY =0.5, lr =250, πe=0.02, and P = 20. What are the equilibrium levels for the real output, real interest rate, consumption and investment when both the goods market and asset market clear simultaneously? Answer: 𝑌 = 950, r = 0.05, C = 654, I = 246. This is because the IS equation can be written as: r =(5925-6Y)/4500; and the LM equation can be written as: r =(-925+Y)/500. Answer guide: Step 1: Substitute all the given numerical values into the solutions for IS and LM equations derived above: Vertical intercept of IS equation: [300+258.5+50-(0.8)(20)]/(200+250) =592.5/450 =5925/4500 Slope of IS equation: -[1-(0.8)(0.5)]/(450) = -0.6/450 = -6/4500 So, IS equation is: r = (5925-6Y)/4500 ------------------------------------------ (i) Vertical intercept of LM equation: [-0.02-9150/5000] = -925/500 Slope of LM equation: 0.5/250 = 1/500 So, LM equation is: r = (-925 + Y)/500 ----------------------------------------- (ii) Step 2: Equilibrium in both goods market and asset market is given by the intersection point between IS and LM equations. So set (i) = (ii), and solve for Y first: (5925-6Y)/4500 = (-925 + Y)/500 So, Y = 950. Then substitute Y=950 into (i) or (ii) yields r = 0.05. Step 3: Substitute the given numerical values (t=0.5, c0 =300, cY =0.8, cr =200, t0 =20, i0 =258.5, ir =250), Y=950, and r =0.05 into the equations for desired consumption and desired investment: C = 300 + 0.8 (950 – 20 -0.5*950) – 200*0.05 = 654 I = 258.5-250*0.05 = 246