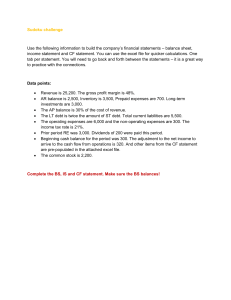

i Copyright © 2020 Justin Spencer-Young All rights reserved. i Dedicated to my father, Russell, who gave me the gift of an enquiring mind and the drive to be better. My dad always believed in me and showed up every time I needed him. He gave me the fight to play hard and the humility to play fair. Thanks Dad. ii Self-Published – Justin Spencer-Young Kinross Rd Dainfern North Johannesburg All rights reserved Copyright © 2020 Spencer-Young & Associates No part of this book may be reproduced or transmitted in any form or by any electric or mechanical means, including photocopying and recording, without the written permission of the author. First edition – October 2020 iii Table of Contents Foreword ............................................................................................................. 1 Acknowledgements ............................................................................................. 3 Introduction ......................................................................................................... 4 Why I Wrote This Book?.................................................................................. 4 Are There Really Secrets? ............................................................................... 6 Who Is This Book For? ..................................................................................... 8 What Will You Get from This Book? ............................................................... 9 The Cycle of Business ........................................................................................ 11 Capital ................................................................................................................ 15 Equity Capital................................................................................................. 15 Debt Capital ................................................................................................... 17 Characteristics of Capital .............................................................................. 19 Capital on the Balance Sheet ........................................................................ 20 Operations on the Balance Sheet ................................................................. 23 The Difference Between the Accounting View and the Finance View of Business ......................................................................................................... 26 What is Your Work Address? ........................................................................ 29 Profitability ........................................................................................................ 31 Income Statement Basics .............................................................................. 31 What is Your Street Address? ....................................................................... 32 Operations and Capital Streets ..................................................................... 33 Income Statement Gymnastics ..................................................................... 34 Operating Leverage ....................................................................................... 42 Accounting for Gill’s Bookshop ......................................................................... 47 Getting Ready to Start Trading ..................................................................... 47 The First Year of Trade .................................................................................. 49 The Difference Between Profit and Cash ..................................................... 53 iv Growth ............................................................................................................... 57 Sustainable and Actual Growth Rates .......................................................... 59 Measuring Performance.................................................................................... 61 Performance of the Operations .................................................................... 61 Weighted Average Cost of Capital ................................................................ 65 The Return on Equity..................................................................................... 67 Managing ROE is Like Herding Cats .............................................................. 71 The Lighter Than Air Balance Sheet .............................................................. 73 How Much Profit is Enough? ......................................................................... 74 Value Creation Dressed in a New Suit .......................................................... 75 The Application of Value Creation .................................................................... 78 Shoprite Holdings (SHP) ................................................................................ 78 Pick ‘n Pay (PIK) ............................................................................................. 82 Woolworths (WHL) ........................................................................................ 84 Clicks (CLS) ..................................................................................................... 86 Summary of Secrets .......................................................................................... 88 References ......................................................................................................... 90 Complimentary Resources ................................................................................ 91 Finance on Steroids ....................................................................................... 91 Company Value on Excel Steroids................................................................. 92 Online Business Simulation........................................................................... 93 v vi Foreword If the quality of our relationships affects the quality of our thinking, then it behooves us to know a little about the author of a book that has the potential to alter how we see the world. Whilst the subject matter of this book is largely about financial value, it is underpinned by the author’s personal values. It is therefore both a privilege and honor to write this foreword for Justin, above all, a man of value. I first noticed Justin when he said a few words of thanks and goodbye on behalf of his MBA class of 2003. Appropriately these words were aimed at Professor Mike Ward his finance lecturer and my boss at Wits Business School. Whilst Justin’s words escape my memory, it is the sincerity with which he spoke that remain with me. I expect you will have a similar experience with the words in this book. Turn them over and you will find sincerity and a sound foundation. Value is a word full of opportunity and optimism. Justin has taught me how value can be measured, evaluated, and created. I invite you to engage with this book and the author with the widest possible lens. For the past two decades Justin has searched for the intersection where organizational value is created. Do not be surprised if the mystery of finance is resolved as you work through the secrets of finance. Justin’s gift is the ability to debunk and demystify the accounting constructs and complications of finance. His talent is to simplify on the one hand whilst also encouraging a more complex engagement with the topic. Allow me to draw on an analogy to explain this phenomenon: Justin is an above average golfer and as I have stood alongside him on many golf courses I have observed his grasp of the swing mechanics and fundamentals but more importantly I have seen how he overcomes the 1 constraints of these swing ‘laws’. He frees his mind to imagine, envision and feel the weight and subtle breaks that will impact on the underlying fundamentals. This is the kind of author we need. One that can build a foundation without limiting the possible. It is no surprise then that Justin positions himself as a builder at heart. This book will help you build a strong financial foundation; one on which future value can be created. Sean Temlett BA, MBA (Wits), Gapologist 2 Acknowledgements My finance learning journey stared when Max Mackenzie shared with me the most unaccounting way of looking at a balance sheet. Max drew it on the lecture room black board early on in my MBA studies. It was as if a light bulb went on for me and suddenly, I could see. From that moment on the world of finance opened for me and I knew that I would find a new career in finance. Later in my learning journey Chris Muller revealed the world of Monte-Carlo simulations, delta hedging, and real option theory amongst other exciting finance concepts that stoked the flames of interest in finance. Since then I have had the privilege of spending many hours with Chris, both in the classroom and at his home where he has taught me more that I could ever imagine. The most valuable teaching asset that I could ever have is a database of historical financial data of many listed companies. Chris is the source of this data…it is priceless. Thank you, Chris. My good friend Sean Temlett has spent many hours in the classroom with me on assignments for corporate clients. Sean always inspired me to be better in my delivery and to raise my game. We spent many hours discussing how to deliver our message more efficiently. Sean always had the best ideas, and I am way better as a finance teacher because of what I have learnt from Sean. 3 Introduction Why I Wrote This Book? There are more than enough textbooks on this subject matter. By this subject matter I mean the subject of accounting, business finance, business performance, value creation, finance for non-financial managers, you name it. These are all books that are written with the intent of helping non-accountants understand the world of accounting. I have been learning and teaching business finance for two decades. I have used many textbooks as part of my courses. Every time I use them, I think to myself, “this will do, it kind of ticks the boxes”. I still have not found the ideal textbook that is written with the intent to teach non- financial professionals and managers about business performance. Since the ideal book on this subject does not exist, or at least I have not found it yet, I decided to write it. I decided to write this book based on the material that I use and the process that I follow in my teaching. That means that this book is intended to fulfil two functions. One is to be an educational read about business finance and the second, to be a comprehensive set of course notes for a subject that I teach daily. You will see very quickly that the way that I teach this subject is nothing like how it is laid out in your average business finance book, hence my need for this book. It is important to point out that I am not an accountant. I am simply a builder. My career started as a project manager in the commercial construction industry. I came to the world of business finance after realising that as a builder, with an undergraduate degree in BSc Building, I knew nothing about accounting and finance. I wanted to change that. After 7 years in the construction industry I gave up my job and went back to university full time to get a master’s degree. On my second round through university, this time a business school, I discovered my love for the subject of finance. I also discovered that the subject of business finance is hugely over-complicated by accountants. Over the last 10 years of teaching the subject of business finance almost every day, I have worked out how to deliver the learning that non-accountants need. How do I know what they need? I ask them, and those that know what they need, tell me. They need to 4 understand business performance so that they can manage a business better. They also tell me that accountants and the information that they provide are not conducive to doing this. Mostly because the information needs to be decoded from accounting-speak into a language that non-accountants can easily understand. I call that the language of business. Here is a short story that will give some colour to what I am talking about. Several years ago, I was consulting for a large, well known, JSE listed corporate in South Africa. I was working with the company on several investment deals in the small medium enterprise (SME) sector. Whilst meeting with the chief financial officer and several other board members of the listed company, a question came up. The question was about how an investment in an SME would be consolidated and reported on the balance sheet of the listed corporate. The chief financial officer (CFO), who was of course an accountant, did not know the answer and was hesitant to decide about the way forward before getting clarity. During the meeting he phoned the managing partner of the audit firm to get an opinion. The two accountants had a conversation and were not able to reach consensus. Apparently, the managing partner had to ask another accountant who was a specialist in the area. The result is not important. What I want to point out is that even a collection of accountants need help to understand the rules of the game that they have written. The meeting was abandoned because the accountants could not decide at that time. The accounting function in a business fulfils two major functions. The first is compliance. This includes verification of accuracy and truth. The second is to provide information so that business performance can be measured and used in decision making. All those textbooks that are “not ideal” and do not really do the job are trying to cover the detail of both functions. They end up doing a poor job of both. The intention of this book is to cover business performance only. This book is written such that it covers both simple and complex subjects of business performance. If this is the first time that you are venturing into this world then you will find the basics of business performance here. If you have some experience of accounting 5 and business finance then you too will find something that will make you sit up and think…” oh wow, I never saw it like that”. Managing expectations when it comes to learning business finance is important. There is a big difference between knowing your ABCs and being able to understand a Shakespeare classic. Naturally, one needs to develop skills over time. This takes practise and may require one to cover certain material several times before the nuances can be fully internalised. As you start reading this book be aware of where you are on your business finance learning journey. Are you just starting out with the ABCs? Or are you looking for the Shakespeare classic? This book contains both. The book starts out slow with the basics and then ramps up as it progresses. A word of caution, there are some insights in the basics that are important when it comes to the more complex material later. Over many years of teaching business finance I have found that in one class there can be a broad range of accounting capabilities. Extraordinarily little at one end and a qualified accountant at the other. My teaching has evolved over the years so that I deliver ABCs and Shakespeare in the same class. This book is written in the same way. I am sure that you will find what you are looking for here. Are There Really Secrets? The subject of business finance has been written about extensively, of course there are no secrets! However, the subject matter is known to just a few people and is continually made to be more complicated. There might as well be secrets that are kept from many people. Ask yourself this…when looking at the qualifications of those who make up most of the c-suite, what is the common denominator? You will notice that generally the CEO and CFO of most substantial businesses have an accounting qualification. They are the holders of the secrets. Although accountants would strongly disagree that there is anything secretive about their profession. The use of the word “secrets” is used to 6 suggest that the knowledge is held by some and not others. This is not solely the fault of accountants but rather of an outcome of education systems. Accountants are trained in a way that they get exposure to all corners of a business and are required to process every transaction in the book of accounts. Through this training a natural outcome is a holistic understanding of business. So, the fact that accountants often make up most of the c-suite is not unusual. This is not a problem. The problem is that those who are not accountants, the vast majority of employees in business, have little or no idea or understanding of the financial metrics of a business. Poor education and complexity are a high barrier to entry. Typically, only a university degree gets you access to the business world of accounting and finance. It is well known that in South Africa the math education has been poor for a large majority of people. This continues today. The result of this poor education is that for those who do not become accountants, there is extraordinarily little financial education and understanding in business. So many people are financially illiterate, both in terms of personal finance and business finance. I am on a mission to change this. I was once one of those people who had little to no financial education, despite having an undergraduate degree. I did a Bsc (Building Science) and came out of university with almost no training in business finance. I did do Accounting 1 and Accounting 2 as part of my undergraduate degree. However, I did these courses with the full-time accounting students. They wanted to be accountants and I wanted to be a builder. I was not really interested in debits and credits. I was more interested in bricks and cement. My youth and lack of understanding of the importance of accounting meant that I did just enough to scrape by. Only later in life did I come to understand the importance of business finance. Part of the problem was also the way in which the accounting course was taught. Third year accounting students taught the course, and the learning process was about following the Generally Accepted Accounting Principles (GAAP) textbook. There was no context on how GAAP and business were related. A sterile GAAP explanation by 7 a third-year student was not going to get this wannabe builder inspired to understand business finance. Years later I see the missed opportunity. But I was not ready to learn about business finance until much later in life. My mission is to make financial education more accessible. To obtain a financial education there are generally only two paths. One path is to go to university and study accounting. The second path is the route that I followed. That is to go to business school and focus on a financial path of learning. This is a less direct route as it normally follows an undergraduate degree in an unrelated field. Both routes require a significant commitment of time and money, which are barriers to attaining a financial education. This book is one step of many in my mission to educate people about money, business performance and value creation. An important component of my mission is to make access to financial education easy and affordable. Please join me on my mission to provide financial education to more people. You can start by educating yourself. This book is a great place to begin. Who Is This Book For? This book is really for those who fit into the category of a non-accountant. That is not to say that there is no value here for accountants and financial professionals. The reason I say non-accountants is because my intention in this book is not to turn you into an accountant. Rather, to share insights and as I call them “secrets” about how to analyse and interpret financial information. Then, to enable you to use this information to make better management decisions and investments. The style and philosophy of my approach is quite un-accounting. That is why many students who have come through my classroom over the years have told me how much they have learnt from my process. 8 I often have accountants tell me that they were able to gain a whole new perspective on business performance after attending my business finance classes. Here is a list of problems that you may want to overcome as far as financial knowledge is concerned. If any of the items on this list resonates with you, then this book is for you. 1. You feel like the accountant in your business is speaking a foreign language. 2. You rarely understand the information that accountants give you. 3. You want to understand business performance better. 4. You want to understand the levers that drive business performance. 5. You want to find out if your business is creating or destroying value. 6. You want to find value-creating businesses to invest in. 7. You want to make better business decisions using financial data. 8. You want to understand how all the silos (HR, marketing, operations, IT, etc.) of business link together. 9. You want to understand business growth. 10. You want to understand investor expectations. What Will You Get from This Book? You will learn a practical way to understand business performance. Most importantly, you will learn how to interpret financial information. The perspective taken in this book is a business perspective rather than an accounting perspective. At this stage you may not know what the difference is. I like to use the analogy of looking at business through different lenses. The accounting lens gives one perspective. The business lens gives another. One of my favourite hobbies is flyfishing. If you have ever stood on the side of a stream and tried to look into the water to spot the fish, then you will know that the reflection of light on the water makes this very difficult. When you put on a pair of polaroid lenses it is as if the reflection disappears completely. You can see deep into the water and 9 finding the fish is much easier. I hope that this book will act as a pair of polaroid lenses that helps you to see into businesses more clearly. To continue the fishing analogy, a different perspective from polaroid lenses makes a difference. However, there are also certain skills required to spot fish in the water. In the context of accounting and busines performance, learning and knowledge is best gained through application and practise. There is a reason why accountants spend years doing company audits. This is the practise part of their learning. The challenge with simply reading a book is that the practise is often omitted. To overcome the lack of practise this book contains the analysis of several listed companies. In the analysis of these business we will use the tools and frameworks that are outlined in the book. I will show you how financial data can reveal tremendous secrets if you know what to look for. This book will elevate your knowledge of business performance and value creation to a level that 90% of employees do not have. But ultimately the following statement will be true: “If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.” 10 The Cycle of Business Several years ago, I read a book called “The Origin of Wealth” by Eric Bienhocker. Amongst the many words of wisdom in his book, this quote stood out for me the most: “The objectives of every business are to endure and grow” The complexity and simplicity of this statement fascinates me. When I think of the word “endure”, I think of sustainability, survival, living to fight another day, resilience, and overcoming tough times. You may think of even more. But the reality is that a business cannot endure if it is not profitable or at least have the prospect of becoming profitable soon. But profits are not enough. A business must produce cashflow. Understanding the difference between profit and cashflow is particularly important. I am amazed how often I come across well educated people who just assume that what the profit is in the income statement is what is in the bank account. I will cover more on the difference between profit and cashflow later. The word “grow” can mean so many different things. It generally means more of something. More revenue, more profits, more assets, more customers, more employees and as the cynic might say, more problems. Growth seems like such a natural endeavour. We grow as human beings and when we stop growing, we start dying. The same can be said for business. Inspired by Erik Bienhocker’s endure and grow, the following diagram represents the “Cycle of Business”. 11 Profit Value Growth Capital Cycle of Business Think of the Cycle of Business as a train track on the floor of a kids bedroom. Profit, growth, capital, and value are the stations. The arrows are the train tracks connecting the stations. Let’s start with profit. That is the number one priority of any business. The simplest definition of profit is to earn income (sales from a customer) that is higher than the expense of generating that income (cost of manufacture and overheads). Unfortunately, there is a lot more to consider when talking profit. Short term opportunistic profit versus long term sustainable profit are two vastly different concepts. Erik Bienhocker’s endure and grow cycle is based on long term sustainable profit. Long term sustainable profit requires a business to consider several broader elements such as: • Will the customer return to buy again? • Can the business sustain the quality and service at higher volumes? • Can the suppliers continue to meet the demand for raw materials? • Will capacity constraints impact on profitability? • Are enough human capital skills available to meet the demand requirements? • Is the business environment conducive to retaining human talent? • What capital requirements are needed to grow the profitability of the business? Today, the pursuit of profit is demonised by many. Mostly by those who don’t fully understand the nuances that are behind the numbers in the income statement. The pursuit of profit is an ongoing trade-off to balance the needs of many stakeholders. But 12 ultimately all these stakeholders come second let’s the those who risk their capital. That being the shareholders. More on profitability to come later…for now, to progress to the next step in the endure and grow cycle. Let’s assume that we are considering a business that is profitable. Once we have a track record and we are making profits there is pressure from shareholders to make more profits. This is the winner’s curse. No good deed goes unpunished. The better you perform, the greater the expectations. Thus, we find ourselves moving onto GROWTH to meet these demands for more. Growth requires capital. Capital comes from two sources - equity and debt. Equity is money from shareholders and debt is money from banks. Capital comes at a cost. Shareholders have an expectation of a return and so do banks. The “contract” on how the business provides those returns to shareholders and banks is different. But the expectation of a return is still there. These expectations of return are loosely referred to as the cost of capital. We will explore the relative cost of capital at a later stage. The next station on our cycle of business is the VALUE station. The business objective is to provide returns to the capital providers that are greater than the cost of capital. This principle of a business producing returns that are greater than the cost of capital is what it means for a business to create value. Returns > Cost Of Capital The concept of returns needing to be greater that the cost of capital is not a perspective that is taken by accountants. Accountants are primarily concerned with the compliance of reporting historical data. As I said before, this book is not about compliance with reporting standards. The philosophy of this book is about business performance and value creation. This philosophy requires us to view a business through a different lens 13 than that of an accountant. The principal of returns needing to be greater than the cost of capital is the cornerstone of this philosophy. On the surface the cycle of business looks quite simple. However, underneath the simplicity is a complex set of interactions between the different components. The capital structure influences the profitability. More debt creates interest expenses that reduce profits. The profitability impacts the ability of a business to grow. A more profitable business produces internal equity capital for growth. The profitability and capital structure determine the ability to create value. This web of cross influence gets complicated. The purpose of this book is to reveal how this web can be interpreted and translated into business performance. Profit Value Growth Capital This brief explanation of the “Cycle of Business” started with PROFIT, then went on to GROWTH, CAPITAL and VALUE. That is the framework that many business finance books follow. In this book we are going to start with CAPITAL. That is after all the source of all businesses. 14 Capital Equity Capital Capital by the simplest definition is money. A capitalist is someone who has money and wants to put that money to work to earn a return. Just as a farmer might put a horse to work to plough a field. The return is a field ready for planting. Providers of capital typically have descriptors of investor, shareholder, partner, and others. We will use the term shareholder. We cannot really discuss capital without discussing risk. Each shareholder has their own appetite for risk. Risk is often seen as the downside if the investment does not work out. However, risk is the double-edged sword of the probability of reward or loss. Capitalists seek a return in exchange for taking risk and providing capital. A capitalist will balance the expectations of return based on the amount of risk he/she is prepared to take on. Hence, the well know saying of higher risk requires a higher return. But of course, higher risk also means potential for higher loss. The most well-known academic model that relates to capital and risk is the Capital Asset Pricing Model otherwise known as CAPM. This model attempts to quantify risk and return for equity investors. Despite the CAPMs ubiquity of use there is a significant amount of research that highlights its shortcomings. We are not going to explore the CAPM or its shortcomings in this book. The References section contain articles that document this well. Several years ago, I discovered that empirical market data is the best source of information about what shareholders expect as a return. Empirical data is useful in that it can be used to describe the risk that relates to an investment. Unfortunately, empirical data is always historic and only describes what happened. We need to know how to use this data to forecast what might happen in the future. The following graph (on the next page) uses empirical data to show the historic returns of the All Share Index (ALSI). The timeline for this data is forty years (1980 – 2020). The 15 interesting story in the data is that it includes many different socio-political events. The nature of the economy that it describes has changed immensely over the timeline. Chart 1: ALSI Returns Chart 1980 - 2020 In the 1980’s the South African economy had a strong mining bias. Today the economy has a bias towards financial and industrial services. The data includes the darkest days of Apartheid. It includes the transition to an open economy in the mid 1990’s. There are several major events that caused significant market corrections. These events often had their source in international markets and here in South Africa we suffered from the secondary fall out. More recently, however, we appear to be creating our own ball and chain. The ALSI indicates the recession that South Africa has been in for the last five years. While the technical definition of a recession is two quarters of negative GDP growth, the sideways movement of the ALSI is telling a story about the state of the South African economy. Chart 1 above represents share price returns using the natural log (Ln) of the change in share price from one month to the next. One can see from the chart that there is a strong upward trend in the data. We use empirical data to calculate the cumulative average 16 growth rate (CAGR) of the returns. Over the last 40 years the CAGR of the share price returns is 15.5%. Add to this the average annual dividend yield of 2.5% and we end up with a total return CAGR of 18% per annum. There are 388 companies listed on the JSE at the time of writing. The ALSI consists of approximately 160 companies measured and ranked by market capitalisation, which is share price multiplied by issued shares. These 160 companies represent 99% of the value of the whole JSE market. CAGR of the historical returns of the JSE ALSI are used as a proxy for future returns. Investors can use this information as a benchmark against which to measure other investments. It is important to recognise that the CAGR of 18% per annum is an average across all companies that are part of the ALSI. Different sectors like mining, retail, telecommunications, etc. will have their own CAGR based on the data for those sectors. Using the 18% CAGR of the ALSI, investors can use this as a benchmark for other investments. One might call the 18% CAGR a “high water mark” and aim to achieve returns above that level in exchange for the risk of investing. This is the source of equity capital for a business. Debt Capital The other source of capital for a business is debt. Debt has quite different characteristics to equity. Debt providers (banks) are not in the business of taking risk in the way that equity providers are. Debt providers require surety to protect themselves from loss. In exchange for taking less risk, banks accept a lower return for the capital that they provide to businesses. 17 Chart 2: Repo and Prime Rates 2004 – 2020 The REPO rate is the rate that the South African Reserve Bank lends to the commercial banks. The commercial banks add 3.5% and the result is the PRIME lending rate that is advertised to customers. Banks then assess each customer based on their criteria to offer a lending rate that may be higher or lower than the Prime rate. At the time of writing, the Repo and Prime rates shown in the chart at 3.5% and 7% respectively are uncharacteristically low. The average long-term prime rate in South Africa is approximately 10% per annum. There is a significant difference between personal debt and business debt. The difference is primarily based on when tax is paid. In our personal capacity, as an employee of a business we must pay taxes before we pay any of our personal expenses, including interest expenses. The actual payment of the taxes is largely the responsibility of the employer to pay it on behalf of the employee. In a business, taxes are paid after expenses are deducted from income. Specifically, interest expenses are paid before taxes are paid. This means that if a business increases 18 its debt on the balance sheet it will have the effect of reducing the profit in the income statement due to the increase in the interest expense. The reduction in profit will reduce the tax. This is referred to in business as the tax shield. The tax shield creates a tax incentive for business to borrow money. The ability to borrow money, because it has a tax incentive, is restricted by the fact that debt adds risk and reduces profits. This means some debt is beneficial, too much is deadly. Characteristics of Capital We can now compare the cost of debt with the expectation of return that shareholders have. We loosely call the shareholders expectation of return – “cost of equity”. Cost of Debt 10% Cost of Equity 18% Since equity costs 18% per annum and debt costs 10% per annum (before we consider the tax effect), we can see that debt is cheaper than equity. There are many more characteristics than cost, but cost is probably the most important when it comes to comparing the two sources of capital. The Comparative Characteristics of Debt and Equity Characteristics Debt Equity Cost 10% (South Africa) 18% (South Africa) Tax deductible Yes No Source of return Interest Dividend/share price growth Participation Contractual Vote at AGM Risk Capital repayment Share price / bankruptcy Time Defined Undefined 19 How a company uses capital is largely driven by where it is in its life cycle. Typically, new start-up businesses are confined to the use of equity. This is mostly because banks are not in the business of taking risk on start-up businesses unless a shareholder signs surety with a bank for the debt. In an expansion phase of a growing business, the use of debt is quite common. Especially if the business has developed a track record of profitability and positive cash flows. We will cover various ratios that are used to measure the proportions of debt and equity in the business. For now, we are still exploring the mechanics of using different sources of capital. Capital on the Balance Sheet Let us look at how these sources of capital may be represented on a balance sheet. The series of diagrams that follow represent how the balance sheet of a business might evolve from the start of a business to a more mature phase of development. Equity Cash Uses of Capital Sources of Capital Basic Balance Sheet 1 This balance beam is the simplest and most visual way to show how capital is represented in a business. The shareholder provides equity to the business by way of buying ordinary shares. This is facilitated by a cash transaction between the shareholder and the business where the shareholder transfers the cash to the business. Thus, we 20 represent the source of the capital on the one side of the balance beam and the use of the capital on the other side of the balance beam. The term, “sources and uses of capital” is common when referring to the balance sheet. The next step in representing the use of capital on a balance sheet would be to add the debt component. That would look as follows: Equity Cash Debt Sources of Capital Uses of Capital Basic Balance Sheet 2 In this representation the business is using a combination of debt and equity to fund the business. For now, the capital is simply sitting in cash. The intention is to put the cash to work by investing it in productive assets. It is important to notice that the height of the towers on each side of the balance beam are the same, suggesting the balance beam is in a state of balance. Therefore, Sources of Capital = Use of Capital. At this stage it is important to highlight the relative costs of capital. The shareholders have an expectation of return of 18%. Remember the ALSI graph. This is based on empirical data of a portfolio of shares on the JSE over the last 40 years. The bank has an expectation of receiving interest on the debt that it lends to a business. The bank’s expectation is around 10% based on a long-term average of the cost of debt in South 21 Africa. Combining the cost of equity and the cost of debt in the proportion that these sources are used in business produces a weighted average cost of capital (WACC). If we simply put these two expectations together and assume that half the capital is equity and half is debt, we would get a weighted average cost of capital of 14%. [(18% + 10%)/2]. This is a simplistic view of the cost of capital. However, at this stage it is useful to plant the seed about the cost of capital. We will expand on it later. Equity 18% Cash Debt 10% Ave 14% Cost of Capital Balance Sheet 3 The capital providers (shareholders and bank) have a combined expectation of return of 14% per annum. We loosely refer to this as the cost of capital. The business has a responsibility to provide a return to the shareholders and the bank that at least meets their expectations. How would the business go about doing this? Simply, the business must put the cash to work. Putting the cash to work means investing it in some productive way that it can generate returns. Leaving the cash in the bank might generate a return of 5% per annum from a money market account. The problem is that 5% is not enough to meet the expectations of the capital providers. After all, the capital providers could simply keep their cash in a bank and get the 5% return without having to invest it in the business. The business must put the cash to work in a way that it generates a return that is higher than the average cost of capital of 14%. This is the basic principle of 22 value creation. Generating returns that are higher than the cost of capital. This is what is meant by “VALUE” in the business cycle. Profit Value Growth Capital Operations on the Balance Sheet The next step is to put the cash to work. A business could do so by investing in productive assets. For now, we will assume that this business is a manufacturing business. The next iteration of the development of the balance sheet would see the cash being turned into fixed assets or as many accountants still call it…PP&E (property, plant, and equipment). Equity Fixed Assets Debt Cash Capital Operations Operations Balance Sheet 4 23 After acquiring the fixed assets, the business may be ready to start producing products for sale to customers. The business must buy raw materials from a supplier and produce finished goods for sale. This would cause further developments in the balance sheet. Let us assume that the business can buy raw materials on credit from a supplier. This would create a current liability in the form of a creditor or accounts payable. If we also assume that the business sells its product on credit to a customer who pays 30 days later. This would create a current asset in the form of a debtor or accounts receivable. At this point it is important to explore how accountants handle these transactions in the balance sheet and how we are going to do it differently. Accountants see the world through the lens of ASSETS and LIABILITIES. Business operates in a world of CAPITAL and OPERATIONS. Most of the employees in a business are involved in or are responsible for some or other operational function. Only a few senior employees are responsible for the capital sources of a business. The diagram below represents a balance sheet seen through the lens of accountants. Equity Fixed Assets Debt Current Liabilities Current Assets Liabilities Assets Accountants View of the Basic Balance Sheet 5 24 Accountants simply see money owing to a supplier (creditor) as a liability, specifically a current liability which is likely to be settled within the next 12 months. Hence the word current. The current liabilities are grouped together with the other liabilities. We are going to explore why this makes sense when viewed through the lens of accountants. But when viewed through the lens of business operations it makes no sense. From a business operations perspective the supplier is critical to the operations of the business, even though technically, the money owing to a supplier is a liability. Viewing the supplier as part of the operations rather than simply a liability helps one get a different perspective of the business. Especially when it comes to measuring performance. There is also another important consideration in the context of the sources of capital. Whilst a supplier can be an important source of funding for a business, typically, the funding is free. We may say that it does not have a cost like debt and equity does. We call it “free” because the supplier does not charge interest on the funding assuming that it is paid within the agreed time of 30, 60, or 90 days. The creditor or supplier funding is not always free, specifically if the supplier is offering an early settlement discount. By choosing not to take an early settlement discount the credit is costing the business money. For the purposes of looking at a business through the lens of CAPITAL and OPERATIONS we are going to put the suppliers and thus the creditors and other current liabilities on the operations side of the balance sheet. To do this we have to change the sign and deduct the current liabilities from the current assets on the operations side of the balance sheet. The result is a term called working capital. Working capital is current assets minus current liabilities (CA – CL) and represents the short-term assets and liabilities used in the operations of the business. 25 The Difference Between the Accounting View and the Finance View of Business Accountants see a business through the lens of ASSETS and LIABILITIES and use the following formula to represent the balance sheet of a business: Assets = Equity + Liabilities We can expand this formula to include the sub-components. Assets can be broken down into long-term assets, known as fixed assets (FA) and short-term assets, known as current assets (CA). Liabilities can also be broken down into long-term liabilities or L-T Debt and short-term liabilities, known as current liabilities (CL). The expanded formula would look like this: Assets FA + Liabilities CA = Eq + L-T Debt + CL As we discussed earlier, creditors are a major part of the current liabilities and can be seen to be part of the operations of a business rather than simply as a liability. If we colour code the components of the formula to represent the items that are part of capital and operations, then the formula would look like this: FA + CA = Eq 26 + L-T Debt + CL If we re-write the formula, grouping the operations items and capital items together, the formula would look like this: Working Capital FA + CA - = CL Operations Eq + L-T Debt Capital When we convert the formula to the balance sheet, it would look like this: Equity Fixed Assets Debt Working Capital Capital Operations Capital and Operations Balance Sheet 6 Now that we have laid out the framework, let’s add some detail and ensure that all the terminology is covered. The emphasis is on some as accountants have created a great deal of complexity over time and not all of that will be covered here. 27 Equity generally consists of two parts. The first part being the share capital that was put into the business in exchange for share certificates that represent the shareholder’s ownership of the business. The second part is the retained earnings that represents the profits that have been made in the income statement and kept in the business after dividends have been paid. Hence the word retained. Retained earnings in the balance sheet are cumulative. As a business makes profits that are kept in the business over time the retained earnings get bigger…assuming that the business is profitable. Making a loss would reduce the retained earnings in the balance sheet. Debt on the capital side of the balance sheet is long-term debt which the accountants call non-current liabilities. This debt is repayable over a period of more than a year; hence it is long-term debt. Adding the total equity to the total debt (Equity + Debt) gets us the total capital or simply CAPITAL as it is displayed in the balance sheet image below. The fixed assets consist of long-term assets like buildings, property, vehicles, computers, furniture…you name it, there are many. The general definition of a fixed asset is if you can drop it on your toe and it hurts then it is a fixed asset. This analogy suggests its tangible nature. Accountants call fixed assets, non-current assets. Accounts like to call things what they are not. Terms like non-current assets and non-current liability are just a sophisticated way of telling the reader that this asset is not a short-term asset or the loan from the bank is not a short-term loan. There is an age-old suspicion that if the accountants were responsible for naming the days of the week then Sunday would be called “not- Monday”. The accounting balance sheet also includes Intangible Assets and Investments and Loans. For the purpose of our balance sheet and for the sake of simplification we will include these as part of the fixed assets. 28 Equity Debt Share Capital Retained Earnings Long-term Debt Non-current Liabilities Capital Fixed Assets Property, Plant Equipment, Vehicles Intangibles, Investments & Loans Working Capital Debtors, Inventory Creditors, Overdraft, Tax Operations Terminology and the Balance Sheet 7 What is Your Work Address? The best way to understand the dynamics of the balance sheet is to explore how you might impact the balance sheet in your daily job. If we were to refer to the two sides of the balance sheet as the Capital suburb and the Operations suburb, which suburb do you work in? Most people will put themselves in the Operations suburb. If you are tempted to put yourself in the capital suburb, then ask yourself these questions: • Are you responsible for determining the amount of dividends that are paid to shareholders? • Are you responsible for negotiating with the banks about the contractual terms of long-term debt? • Are you responsible for raising equity capital from shareholders through rights issues? 29 These are the responsibilities of those who work in the capital suburb. Typically, these responsibilities fall to the CEO, CFO and other senior members of the board of directors. Everyone else in the business is responsible for using the operating assets in some way to generate sales and make a profit to provide returns to the capital providers. It is highly likely that you work in the operations suburb. If you are a typical entrepreneur, then you have a work address in both the capital and the operations suburbs…entrepreneurs are required to do a bit of everything in their business. When we discuss the income statement, we will find out your street address in the suburb that you work in. 30 Profitability Profitability is the subject of the income statement. The best way to explore this subject is with a visual representation, the same way that we did it with the balance sheet. Income Statement Basics Sales Sales represents income from selling products or services. COS Cost of sales represents the cost of producing the products that we sold. GP Gross Profit is Sales minus Cost of Sales (GP = Sales – COS). Exp Expenses or overheads (E.g. rent, salary, admin) Dep Depreciation is a non-cash expense that represents the use of fixed assets. PBIT Profit before interest and tax also known as EBIT or operating profit. Int Interest is the cost of borrowing money. It is not debt repayments. PBT Profit before tax or earning before tax (PBT = PBIT – Interest). Tax Tax payable based on the PBT. (28% corporate tax rate in South Africa). PAT Profit after tax or earning after tax (PAT = PBT – Tax). Div Dividends are the reward to shareholders for their investment. RE Retained earnings is the portion of the profits that the business keeps. Notice the use of the term profits, it is more common these days to talk earnings. Profits and earnings can be used interchangeably. Net income also used to refer to the profit after tax. 31 The layout of the income statement can vary a great deal. In the income statement displayed above, dividends and retained earnings have been included. Normally these items are not included in the income statement but rather in a statement called “Changes in Equity”. The changes in equity are important for compliance but we can use the information in the balance sheet for our purpose of understanding business performance. What is Your Street Address? When we discussed your work address in the balance sheet you were able to determine which suburb you worked in. Operations or Capital. Now we are going to find out which street you work in. The income statement can also be broken into Operations and Capital, as we did in the balance sheet. The profit before interest and tax (PBIT) or EBIT is commonly referred to as operating profit…put another way we might call it the profit from the operations. There are only three “streets” in the operations suburb. They are SALES, COST of SALES and EXPENSES. Determining your street address is largely based on the activities that you do in your job that impact the income statement the most. Here are the activities or job roles that go with the different “streets” in the operations suburb: 1. Sales street Customer facing, key accounts manager, sales manager, advertising, marketing. 2. Cost of sales street Operations, manufacturing, logistics and delivery, quality, procurement. 3. Expenses street Legal, human resources, information technology, other support roles. 32 The following income statement diagram explains this concept further: Operations and Capital Streets Sales COS Operations GP Exp Dep PBIT Capital Int PBT Tax PAT Div RE Sales street is customer facing. If you are a salesperson, sales manager, or key accounts manager then you work in sales street. Some businesses call these roles business development. That is just another name for sales. If you are advertising or marketing, then you also work in sales street. Cost of Sales street is about manufacturing the product and the delivery of the product or service to the customer. This would include logistics, quality control. Procurement from suppliers is part of cost of sales street. If you work in a call centre that is not a sales call centre than you are in cost of sales street. Expense street is the catch-all street. Strictly speaking from an accounting perspective everyone is expense street as salaries form part of the expenses. However, this is a functional view of the income statement not an accounting view. Expense street is the support facility to those who are in sales and cost of sales street. Therefore, if your responsibilities include legal, information technology, human resources, various financial functions, and let’s say any other support role then you work in expense street. Capital street is made up of interest and dividends. These items relate to the debt and equity on the balance sheet. Street Address in the Income Statement 33 Income Statement Gymnastics Income statement gymnastics is about the dynamics of profit, volume, and expenses. These three elements are interrelated. Understanding how they work together helps with the holistic understanding of the income statement. The profit triangle is the common representation of the profit, volume, expense elements. Margin Profit Volume Expenses The Profit Triangle The profit motive is the driving force of a business. Generally, more volumes drive up profits provided there is a positive margin, and the expenses don’t increase in proportion to the volume increases. Higher margins due to price increases may reduce volumes of sales thus creating the ever-present trade off in business between price and volume. The nature and behaviour of the expenses are important to understand as they have a direct impact on profits. Expenses can be loosely categorised as variable or fixed. Variable expenses are expenses that change as the volume of sales changes. More sales bring about more cost of sales simply because a business must purchase more raw materials to meet the sales demand. Let’s use a simple example to demonstrate this dynamic. The local bookshop called Gill’s Bookshop has an average selling price per book of $22 and an average cost per book of $12. The average profit margin per book is $10 ($22 - $12 = $10). If we assume that the 34 bookshop has monthly fixed costs of rent and salaries that amount to $6,000, how many books would the book shop have to sell to break even. If we set this up using a simple income statement grid, then it would look as follows: Sp Cp M Per unit Vol = - 22 12 10 Sales CoS Gp Exp PBT 6,000 0 Listed on the left-hand side of the income statement are the per unit selling price (Sp), cost price (Cp) and margin (M). On the right-hand side of the income statement is where we will calculate the numbers that represent the business based on the volume of sales. For now, only the fixed expenses and the PBT are listed because that is all the known information that we have. The fixed expenses were given to us as $6,000. Because we are calculating the breakeven position of the business then we can assume that the PBT is zero. We need to calculate the Gp, CoS, Sales and Vol to get the full picture of the business. We will complete the blank spaces next to Sales, CoS and Gp as we proceed. Some clarity on the difference between margin and mark-up would be useful to us at this stage. Measured in currency the margin and the mark-up are the same. SP – CP = Margin $22 – $12 = $10 Mark-up is the increase from the cost price (Cp) to the selling price (Sp), which again is just the difference between the two. When we measure margin and mark-up as a percentage, we get different answers. Margin is measured as a percentage of selling price (Sp). Mark-up is measured as a percentage of cost price (Cp). Margin% = M/Sp x 100 = 10/22 x 100 = 45,45% 35 Mark-up% = M/Cp x 100 = 10/ 12 x 100 = 83.33% Mark-up% is the percentage that we add to the cost price (Cp) to calculate the selling price (Sp). A definition of fixed expenses is required before we continue. Fixed expenses do not change based on an increase in sales volume, provided that the business stays within its capacity. I.e. The business does not have to hire more people or rent more space to service the increased volume. If the expenses of $6,000 are all fixed, then we can assume that the business will need a Gp of $6,000 to break even. Mathematically, Gp – Exp = PBT or 6,000 – 6,000 = 0. The grid is updated as follows: Sp Cp M Per unit Vol = 22 12 10 Sales CoS Gp Exp PBT GP added here 6,000 6,000 0 We can now ask the question…how many profits of $10 per book are needed to make $6,000 in gross profit? Using the formula of Gp/M will calculate the volume of sales (Vol = Gp/M). 6,000/10 = 600 books. The grid would represent this as follows: Vol calculated Sp Cp M Per unit Vol = 22 12 10 Sales CoS Gp Exp PBT 600.00 6,000 6,000 0 From here we can use the volume to calculate the Sales and Cost of Sales. To do this we multiply the volume (Vol) by the selling price (Sp) to get the Sales (Sales = Vol x Sp). We 36 multiply the volume (Vol) by the cost price (Cp) to get the Cost of Sales (CoS = Vol x Cp). This would look as follows: Sp Cp M Per unit Vol = 600.00 Vol = GP/M 22 12 10 Sales CoS Gp Exp PBT 13,200 Vol x Sp 7,200 Vol x Cp 6,000 6,000 0 From this grid we can conclude that the book shop would have to sell 600 books and make $13,200 in Sales to break even. $7,200 would be paid to the supplier and $6,000 would be the gross profit which is used to cover the fixed cost of the business. We can codify this process into a set of rules that we might call them Income Statement Gymnastic Rules and they would be as follows: Rule 1. Use a grid. This helps identify the information that you have what you need to calculate. Rule 2. Put any known information into the grid. Rule 3. At the point of breakeven PBT = 0. This is considered a known position and especially useful place to measure different profit scenarios from. Rule 4. At the point of breakeven, gross profit and fixed expenses are equal. Gp = Exp. This is only true if all the expenses are fixed expenses. Rule 5. Volume = Gp/M. This is the golden rule of income statement gymnastics. If the margin is represented as a percentage, the rule still applies. However, gross profit divided by margin% is equal to Sales, not volume ( Gp/M% = Sales). Rule 6. Once you have calculated the volume using Rule 5 you can calculate Sales (Sales = Vol x Sp). Rule 7. Once you have calculated the volume using Rule 5 you can calculate CoS (Cos = Vol x Cp). 37 In my years of teaching experience, the income statement gymnastics is the part that students battle with the most. I teach these dynamics using a simple one-product business to lay the foundation. Typically, a sustainable business has multiple products. Based on the weighted average of the volume of each of the products sold the business would determine an average gross profit margin percentage. This average gross profit margin is normally represented as a percentage. In the case of Gill’s Bookshop, the average gross margin is 45.45%. Margin% = M/Sp x 100 = 10/22 x 100 = 45,45% This income statement grid includes the margin percentage and the cost of sales percentage. If you are working your way up the income statement from the PBT position the arrow sequence shows the order of calculations. Take a “short left” at Gp. Divide Gp by margin and get volume (Vol = Gp/M) Sp Cp M 100.00% 54.55% 45.45% Per unit Vol = 600.00 22 12 10 Sales CoS Gp Exp PBT 13,200 7,200 6,000 6,000 0 If you are using the margin percentage instead of the currency, the sequence is the same, except Gp divided by Margin percentage results in Sales instead of volume (Gp/M% = Sales). Sp Cp M 100.00% 54.55% 45.45% Per unit Vol = 600.00 22 12 10 Sales CoS Gp Exp PBT 13,200 7,200 6,000 6,000 0 38 In summary the two golden formulas of the income statement would look like this: Vol = Gp Note: This formula uses margin as a currency Margin Sales = Gp Note: This formula uses margin% Margin% To help with the understanding of the behaviour of fixed and variable expenses let’s create another scenario for the book shop. What if the book shop wanted to make a profit of $2,000? Think about what must happen… • We can increase the price and make more profit per book. This might cause the volume to go down as customers might buy less. • We could try and negotiate with the book suppliers to get the books at a lower cost price. The suppliers may lower the cost price if we buy big enough volumes. Let us assume that we are not ready to do that yet as our bookstore is too small to store the additional book stock. • We could reduce the salaries…that might not be met with enthusiasm form the employees. We could also try and negotiate a lower rental from the landlord. That would help reduce the $6,000 fixed cost. Let’s assume for now that we are getting the lowest rental possible. • The only option left is to increase the volume of sales. To do this we might have hire someone to do some direct marketing in the local community to attract 39 more people to the bookstore. If we hired a full-time employee to do this it would add to the fixed costs. This would add more pressure to increase the volume. • Let’s apply some magical thinking for now and assume that we can increase the volume of sales. What volume would be required to make a profit before tax (PBT) of $2,000? The income statement grid would look like this: Sp Cp M Per unit Vol = 800.00 22 12 10 Sales CoS Gp Exp PBT 17,600 9,600 8,000 6,000 2,000 Profit target Working from the bottom of the income statement, we set the PBT to be the target of $2,000 that we want to achieve. Add on the way up the income statement ($2,000 + $6,000), therefore the Gp must be $8,000. As we asked last time, how many $10s do we need to make $8,000. We apply the formula of Vol = Gp/M, the “short left” referred to earlier, to get the volume of 800. Selling more volume means more sales revenue from the customer, but we also must pay more to the supplier for the extra books that they sold us. The cost of sales (CoS) is variable, it went up as we sold more, but the fixed costs remained the same, hence the term fixed. The benefit of being able to do income statement gymnastics is being able to do resource planning based on the business model. For example, in the last scenario where the profit target was increased to $2,000, we were able to determine the new volume of sales required to earn that profit. We could now ask questions like…”do we have enough salespeople to sell the extra 200 books?” In the context of Gill’s Bookshop, perhaps having salespeople may not be appropriate. We might ask about what we would spend on Facebook advertising to bring new customers to the bookshop. The advertising cost 40 would be recognised as a fixed expense for the month. We should ask if we have the supply of book stock to meet this increased volume of sales. If we needed to employ an additional staff member, the fixed cost would increase. We would probably want to know how many book sales would be required to cover the additional fixed expense salary. Let us assume that Gill’s Bookshop employs another staff member at a fixed expense of $2,500. A change in the fixed cost will change the break even point of the business. The new breakeven calculation would be represented as follows: Sp Cp M Per unit Vol = 850.00 22 12 10 Sales CoS Gp Exp PBT 18,700 10,200 8,500 8,500 0 Increased Vol New fixed expenses The original breakeven volume was 600 books. The new breakeven volume with the new employee is 850 books. This means that the new employee would have to sell 250 books to cover their salary cost. This is an example of how the breakeven point and using the grid can work effectively plan and set targets. If Gill’s Bookshop wanted to achieve an after-tax profit (PAT) of $2,000 and the tax rate is 28%, we can extend the income statement grid to include this. Starting with the PAT of $2,000, the first step is to divide the PAT by 1 – Tax rate. The result is the PBT. (PBT = PAT / (1-Tax rate). Per unit Sp Cp M 100.00% 54.55% 45.45% Vol = 1,128 Sales CoS Gp Exp 100% PBT 28% Tax 24,811 13,533 11,278 8,500 2,778 778 72% PAT 2,000 22 12 10 41 From PBT we would follow the same procedure as we did earlier. It is important to note that to get from PAT to PBT one cannot simply add 28% to $2,000. A “short left” as we did earlier with the GP/M% calculation is required to jump up from PAT to PBT. If Gill’s Bookshop wanted to increase the PAT to $3,000, we could re-calculate the income statement grid to find out the increase in Sales and increase in volume required. The following grid shows this scenario. Note how the fixed expenses remained unchanged and how the variable expenses (CoS) increased as the volume did. Sp Cp M 100.00% 54.55% 45.45% Per unit Vol = 1,128 1,267 22 12 10 Sales CoS Gp Exp 24,811 13,533 11,278 8,500 27,867 15,200 12,667 8,500 100% PBT 28% Tax 2,778 778 4,167 1,167 72% PAT 2,000 3,000 Operating Leverage Depending on the nature of a business, the proportion of variable and fixed expenses can differ hugely. Unfortunately, expenses do not always neatly fit into the definition of fixed or variable. Expenses can also move from being fixed to variable and vice versa depending on how certain resources are used in a business. The proportion and nature of variable and fixed expenses in a business is often referred to as the business model. To demonstrate the concept of operating leverage let’s broadly categorise businesses into three different business models. Type 1 is a business that has variable expenses only. Type 2 has a combination of variable and fixed expenses and Type 3 has fixed expenses only. 42 Type 1 – Variable expenses only Sales % change Variable expenses Fixed expeses Total expenses Profit % change Base scenario Scenario 1 Scenario 2 100,000 90,000 110,000 -10% 10% 92,000 82,800 101,200 0 0 0 92,000 82,800 101,200 8,000 7,200 8,800 -10% 10% The base scenario in the Type 1 model describes a business that has $100,000 in sales and $92,000 in variable expenses. There are no fixed expenses. Variable expenses plus fixed expenses equal total expenses. Sales minus total expenses leaves a profit of $8,000. In scenario 1 where the sales are reduced by 10%, the variable expenses are also reduced by 10% and therefore the total expenses are reduced by 10%. The result is a reduction in the profit of 10%. We say that the reduction in profit is directly proportional to the reduction in sales. In scenario 2 where the sales are increased by 10%, we see an increase in the profit by 10%. Again, directly proportional. Can you think of a type of business that consists of variable expenses only? A business that has no fixed expenses is typically an informal business or street vendor. Such a business does not employ anyone or rent any space. This is a low risk business as it is impossible for the business to make a loss. However, growing a business that has variable costs only must deal with continually growing expenses. Type 2 – Variable and fixed expenses Sales % change Variable expenses Fixed expeses Total expenses Profit % change Base scenario Scenario 1 Scenario 2 100,000 90,000 110,000 -10% 10% 52,000 46,800 57,200 40,000 40,000 40,000 92,000 86,800 97,200 8,000 3,200 12,800 -60% 60% 43 The base scenario in the Type 3 model describes a business that has $100,000 in sales and $52,000 in variable expenses and $42,000 in fixed expenses. Variable expenses plus fixed expenses equal total expenses. Sales minus total expenses leaves a profit of R8,000. In scenario 1 where the sales are reduced by 10%, the variable expenses are also reduced by 10%, but the fixed expenses remain the same. The result is a reduction in the profit of 60%. The fixed expenses that are not reduced when the sales are reduced has a large impact on the reduction of the profits. In scenario 2 where the sales are increased by 10% we see an increase in the profit by 60%. The large increase in the profit is because when the sales are increased, a large portion of the expenses do not increase, thus adding leverage to the profit increase. This business model is typical of a manufacturing business. The proportion of fixed to variable expenses can vary substantially in this type of business model. Type 3 – Fixed expenses only Sales % change Variable expenses Fixed expeses Total expenses Profit % change Base scenario Scenario 1 Scenario 2 100,000 90,000 110,000 -10% 10% 0 0 0 92,000 92,000 92,000 92,000 92,000 92,000 8,000 (2,000) 18,000 -125% 125% The base scenario in the Type 3 model describes a business that has $100,000 in sales and $92,000 in fixed expenses. There are no variable expenses. Variable expenses plus fixed expenses equal total expenses. Sales minus total expenses leaves a profit of $8,000. In scenario 1 where the sales are reduced by 10%, there is no reduction in the expenses since all the expenses are fixed. The result is a reduction in the profit of 125%. In scenario 2 where the sales are increased by 10%, we see an increase in the profit by 125%. Again, there is no increase in the fixed expenses so all the extra sales drop to the 44 bottom line and becomes profit. The leverage effect on the profit is higher when there is a greater proportion of fixed expenses. This business model is that of a service business that typically employs a substantial amount of people and rents a large amount of space to accommodate the employees. There is no way to sugar-coat the statement that employing people adds fixed expenses to a business but most importantly it adds risk. Especially in an environment where regulation prevents a business from being flexible in reducing employment expenses. The following table includes all the business models. Type 1 Variable Only Type 2 Semi Fixed Type 3 Fixed Only Base scenario Scenario 1 Scenario 2 Scenario 1 Scenario 2 Scenario 1 Scenario 2 Sales 100,000 90,000 110,000 90,000 110,000 90,000 110,000 % change -10% 10% -10% 10% -10% 10% Variable expenses 92,000 82,800 101,200 46,800 57,200 0 0 Fixed expeses 0 0 0 40,000 40,000 92,000 92,000 Total expenses 92,000 82,800 101,200 86,800 97,200 92,000 92,000 Profit 8,000 7,200 8,800 3,200 12,800 (2,000) 18,000 % change -10% 10% -60% 60% -125% 125% Increasing Fixed Expenses Increasing Risk Notice how as the amount of fixed expenses increase so does the variance in the profits. In Type 1 the profit variance is from -10% to +10%. A variance of 20%. In Type 2 the profit variance is from -60% to +60%. A variance of 120%. In Type 3 the profit variance is from -125% to +125%. A variance of 250%. This variance in profitability is the measure of risk in a business. Simply put, the business risk is the risk of making a loss when sales are reduced. The business models described in this section clearly differentiate between variable and fixed expenses. The difficulty that one faces when looking into the business model is that it is not always clear if an expense is variable or fixed. In addition, in the income statement the variable expenses are not always neatly contained to the cost of sales. Likewise, the fixed expenses don’t always fit neatly into the expense line. Fixed expenses are often included in the cost of sales. Especially if they are labour expenses that are 45 incurred in the manufacturing process. Also, variable expenses are included with fixed expenses in the expense line. There is no common standard on where the costs are recorded in the income statement. This creates problems in comparing the gross profit percentage between two businesses, especially when the costs have been allocated differently between the CoS and expenses lines. If one business includes fixed expenses in its cost of sales and another does not, then the gross profit margins are not comparable. This means that measuring profit further down the income statement at the operating profit level is better for comparison. 46 Accounting for Gill’s Bookshop Getting Ready to Start Trading The purpose of this chapter is to take a step - by- step journey through the set up and operation of Gill’s Bookshop over the timeline of a year. On the journey we will look at all the transactions that a business might make and how these transactions are processed in the book of accounts. The accountants would use what they call a trial balance to account for all the transactions. We are going to do something similar. However, the jargon and the accounting format can get in the way of the understanding. So, we are going to use common business terminology and a simple to understand process. Gill’s Bookshop has two lines of business. The first line of business is selling old secondhand books and the second line of business is printing and book binding. Gill is setting up to operate out of a small retail shop in a busy shopping centre where she has signed a lease for a year. Gill has employed a full-time shop assistant to help customers and look after the “front of shop” while she works in the back office. Gill has invested capital in the business to buy the original book stocks and the printing and binding equipment. Gill invested $50,000 to get her bookshop up and running. The invested capital is recorded under Capital while the cash in the bank is recorded under Operations. Balance sheet showing initial investment Capital Share capital Operations 50,000 Cash 50,000 50,000 50,000 Using the cash invested in the business Gill purchased the printing and binding equipment for $20,000 and shelving for $12,000. This equipment would be considered capital expenditure or capex. The printing and binding equipment will be depreciated over 5 years at a rate of $4,000 per annum. The shelving will be depreciated over 6 years 47 at a rate of $2,000 per annum. The timeline for the depreciation of these assets is based on the “Wear and Tear” schedule that is provided by the tax authority. Balance sheet showing capex or fixed asset purchases Capital Share capital Operations 50,000 Cash Printing & binding equipment Shelving 18,000 20,000 12,000 50,000 50,000 Gill then purchased a healthy supply of second-hand book stock for $8,000. She paid cash for these books. As the $8,000 inventory comes onto the balance sheet the equivalent amount of cash is paid out of the bank account. Balance sheet showing inventory purchases Capital Share capital Operations 50,000 Cash Printing & binding equipment Shelving Stock --> Books 10,000 20,000 12,000 8,000 50,000 50,000 Notice that with each transaction the cash is simply reduced as the cash is used to acquire the assets and the book stocks. In the next transaction, Gill purchases different paper types and ink for the printer from a supplier who granted 30 days credit terms. In this transaction with the supplier, Gill takes ownership of the paper and ink stock but still owes the money to the supplier. This is recorded as a creditor. The supplier credit terms are 30 days from invoice and are interest free as long as the account is not in arrears. 48 Balance sheet showing inventory purchased on credit Capital Share capital Operations 50,000 Cash Printing & binding equipment Shelving Stock --> Books Stock --> Paper & Ink Creditor 10,000 20,000 12,000 8,000 2,000 (2,000) 50,000 50,000 At this point Gill has set up her operation and is now ready to start trading. She has acquired the assets and the inventory that the business needs to start trading. Gill has employees to help her and she has a prime location in the local shopping centre so she can attract passing shoppers. The First Year of Trade The following transactions take place during the year and are recorded in the income statement. • Sales of R$132,000 are generated from both sources of business. 38% of the sales was done on credit to the printing customers and the average settlement period for these customers is 30 days. • The credit sales amounted to $50,160. At the end of the financial year the outstanding debtors amount was $4,122.74. • The cost of sales which represents the raw material cost of paper and ink and the supply of books came to $72,000. • The fixed expenses for the year amounted to $42,000. This amount included all the salaries, rent and administration costs. • The depreciation charge for the printing and binding equipment was $4,000 and the depreciation for the shelving was $2,000. Think of the depreciation as the cost of using the fixed assets. If Gill’s Bookshop rented the shelving, binding 49 and printing equipment assets rather than owning them then we would substitute the depreciation expense for a rental expense. Depreciation is a noncash expense which means we deduct the expense in the income statement, but we do not pay cash to anyone. • There was no interest expense as there was no debt. • The tax rate for the year was 28%. • Gill decided to pay a 20% dividend. The following income statement was compiled at the end of the year. The income statement is for the year ended 31 December 20XX. All the transactions listed above have been considered in this income statement. Income statement for the year ending 31 December 20XX Sales Cos Gp Exp Dep PBIT Int PBT Tax Pat Div RE 132,000 72,000 60,000 42,000 6,000 12,000 12,000 3,360 8,640 1,728 6,912 A full year has passed, and the balance sheet needs to be updated to reflect the changes that have taken place. There have been many cash transactions during the year and the cash account needs to be reconciled to the bank statement to ensure that all the transactions have been recorded. The following transactions need to be processed in the balance sheet: 50 • The retained earnings must be carried over to the balance sheet. The retained earnings are shareholder’s money that is being kept by the business. Hence, it is recorded under equity on the capital side of the balance sheet. Retained earnings is cumulative in the balance sheet. • At the final stock-take at the year-end it was determined that there was $6,800 worth of book stock and $12,00 worth of paper and ink stock. • The fixed assets need to be depreciated since these assets have been used for a year. • The debtors (what customers owe the business) must be included in the balance sheet. There were no debtors at the start of the year, but since Gill’s bookshop made credit sales the debtors has amounted to $4,122.74. • The creditors (what the business owes to suppliers) needs to be updated. Only the supplies of ink and paper provide credit. Since 38% of the sales is made up of printing and binding, therefore the same proportion of the cost of sales is used to determine the creditors. The creditors amount at year end was $2,248.77. The formula for this calculation is: Creditors = (COS x 38%)/365 x 30. • The cash position needs to be updated. There have been inflows and outflows from the cash account since Gill’s Bookshop started trading. All the cash transactions must be reconciled and reported in a cash flow statement. The two balance sheets that follow are the balance sheets at the start of the year and at the end of the year. The differences between the two balance sheets are discussed below. 51 Balance sheet at the START of the year Capital Share capital Operations 50,000 Cash Printing & binding equipment Shelving Stock --> Books Stock --> Paper & Ink Creditor 10,000 20,000 12,000 8,000 2,000 (2,000) 50,000 50,000 Balance sheet at the END of the year Capital Share capital Reatained earnings Operations 50,000 Cash 6,912 Printing & binding equipment Shelving Stock --> Books Stock --> Paper & Ink Debtors Creditor 21,038 16,000 10,000 6,800 1,200 4,123 (2,249) 56,912 56,912 Notice the following differences: 1. The addition of retained earnings on the capital side of the balance sheet. This came from the income statement (Capital) 2. Reduced value of the printing and shelving assets after deducting depreciation (Operations). 3. Lower stock values for both books and printing materials (Operations). 4. The introduction of debtors because of credit sales (Operations). 5. The creditors are slightly different (Operations). 6. The cash figure has increased (Operations). As a reminder: The left-hand side of the balance sheet, as shown above, reflects the CAPITAL which tells the reader where the capital came from and how much is invested in the business. The right-hand side shows how the capital is invested in the 52 OPERATIONS of the business. The money on the left and the money on the right are the same monies. The two sides of the balance sheet describe who gave the business the money and how the money is being used. The Difference Between Profit and Cash Sales COS GP Exp Dep PBIT Int PBT Tax PAT Div RE Sales in the income statement includes both cash and credit sales. Immediately this creates a difference between profit and cash. The income statement does not “care” that the customer has not paid. The profit is deemed to have been earned even if the customer has not paid. The unpaid sales are reflected in the balance sheets as a debtor and an adjustment needs to be made in the cashflow statement to reflect this. Cost of sales creates a similar cash problem to sales. A business can have both cash and credit purchases from suppliers. Again, the income statement does not “care” that the supplier has not been paid. The calculation of profit assumes that the cost of sales has been paid. The unpaid suppliers are represented in the balance sheet as a creditor and an adjustment needs to be made in the cashflow to reflect this. The cost of sales also only represents the inventory that was sold. If a business purchased more inventory than it sold, then this purchase of extra inventory would have the effect of reducing the cash and would be reflected as a build of inventory on the balance. Again, an adjustment for this would have to made in the cashflow. The expenses do not include the purchase of capital equipment. They only reflect the cost of using the capital equipment via the depreciation expense. To determine the cashflow in the business we need to take into account that depreciation is a non-cash expense. That means depreciation has reduced the profit, which benefits the business in that less tax is paid, but it has not reduced the cash. Cash from shareholders and debt from the bank are not reflected in the income statement. These are balance sheet items. Any changes in these components will have an impact on the cash in the business and need to be reflected in the cashflow. 53 The difference between profit and cash is a subject that causes a great deal of confusion for many. The best way to explain the differences is to start with a review of how the income statement records certain activities and thus can produce a profit figure that bears little resemblance to the cash flow. Broadly speaking there are five components to cashflow in a business. We call them the sources and uses of cash. These components are as follows: 1. Cash from operations. This uses the operating profit (PBIT) in the income statement. We add back depreciation to adjust for the fact that depreciation is a non-cash expense. Starting the cashflow with operating profit automatically considers sales, cost of sales and operating expenses. We just need to make the adjustments for debtors, inventory, and creditors. 2. Cash from working capital. Here is where we make the adjustment for changes in debtors, inventory, and creditors. To do this we need to compare two successive balance sheets and find the differences between the two years. The working capital rules are: a. An increase in debtors means customers are taking longer to pay and therefore reduces the cash in the business. b. An increase in inventory holding means that the business has purchased more inventory than it needed for the period and cash has been consumed, thus reducing the cash on hand. c. An increase in the creditors means that payment to suppliers has been delayed. This could be because of negotiating longer payment terms. A delay in paying suppliers will increase the creditors and thus increase the cash in the business. d. All these rules work visa versa. e. Note how the cashflow rules for changes in debtors and inventory are the same because they are both current assets (CA). Creditors are part 54 of the current liabilities (CL) and thus the cashflow rule is the opposite to that of the current assets. 3. Cash from investing activities. This component is generally about the investment in fixed assets. Purchasing new assets to increase the capacity of the business has the effect of reducing the cash. This component also includes the acquisition of new business. Should a business sell off assets then this would increase the cash flow. 4. Cash from financing activities. Financing activities relate to the change in debt in the business. Increasing the amount of debt in the business will increase the cashflow. Increasing the debt results in higher interest expenses. The interest expenses is included in this section and is usually an out flow if the business has debt on the balance sheet. Sometimes the changes in overdraft are also considered in this section of the cashflow. However, this is left up to the discretion of the accountant. 5. Cash from shareholder activities. Issuing new shares to shareholders via a rights issue will increase the cash to the business. Buying shares back from shareholders will reduce the cash. This section also contains the dividends that are paid to shareholders and is an outflow of cash when dividends are paid. The structure of cashflow statement of a business seems to vary a great deal. Accountants have a knack for complicating the cashflow. The best way to simplify the cashflow is to simply create two separate lists for “Cash In” and “Cash out” and list the relevant cash transactions under each heading. 55 The cashflow for Gill’s Bookshop could be set up as follows: Cashflow for the year Cash in Operating profit Add dep Cash out Creditors Stock--> Books Stock--> paper & Ink 12,000 6,000 18,000 249 1,200 800 Sum of cash in 20,249 Debtors Interest Tax Dividends 4,123 3,360 1,728 9,211 Net cashflow Opening cash Closing cash 11,038 10,000 21,038 The opening cash balance at the beginning of the year is $10,000 and the closing cash balance at the end of the year is $21,038. The job of the cashflow statement is to reconcile the cash transactions that account for the difference. The sum of the “cash in” minus the “cash out” is the net cashflow. The ideal net cashflow for a year is zero. A net cashflow of zero represents a perfect balance between cash inflow and cash outflows. The numbers in the above cashflow are calculated as follows: Cashflow transactions Cash in Cash from operations 12,000 + 6,000 Creditors 2,249 -2,000 Stock--> Books 8,000 - 6,800 Stock--> paper & Ink 2,000 -1,200 56 Cash out Debtors Interest Tax Dividends 0 - 4,123 3,360 1,728 Growth Growth is a function of opportunity and funding. Opportunity is about being able to sell more. Selling both new and existing product and services to more customers in new and existing markets. Every business needs to balance their rate of growth with their funding capability. To fund growth a business can access internal funding through using profits that are retained in the business. This source of funding is classified as equity since the profits belong to the shareholder. Should the internal funding sources not be sufficient to fund the growth a business can turn to external sources of new debt and equity. Knowing the sustainable growth rate can help a business find the balance between growth and cashflow to avoid the problem of growing itself bankrupt. Growth is typically measured by the percentage change in Net Assets from one year to the next. Visually, this can be seen in the following diagram. % change in NA Equity Fixed Assets Equity Fixed Assets Debt Working Capital Debt Working Capital TC NA TC NA Capital and Operations Balance Sheet 6 57 The change in Net Assets in the balance sheet can come about for many reasons. Here are some reasons for the Net Assets to change: 1. Increased sales could result in higher debtors. 2. Increased sales could result in higher cash. 3. More inventory may have been purchased. 4. The creditors may have been reduced. 5. The business may have purchased more fixed assets. The increase in Net Assets on the Operations side of the balance sheet must be matched by an increase on the Capital side of the balance sheet. An increase on the Capital side can come from the following sources: 1. Profit from the income statement in the form of retained earnings. 2. New debt. 3. New equity. A business that wants to fund its growth should always look internally for capital first. Assuming that there is no cash readily available to fund the growth, internal capital could be freed up from the following areas: 1. Reduction in debtors and stock. 2. An increase in creditors. 3. The sale of redundant assets. 4. Liquidation of investments and loans made to third parties. Once these internal sources from the Operations have been fully exploited, then the business can consider the Capital funding sources. To increase the profits flowing from the income statement the business must consider its dividend policy carefully. A reduction in the dividend, assuming a dividend is being paid, will increase the retained profits on the Capital side of the balance sheet and increase the cash on the Operations side. Any expense efficiency in the business would 58 also help increase the retained earnings and cash, however, in a growing business the expenses may likely be increasing. If the internal sources of capital and the retained earnings are not sufficient to fund the growth in Net Assets, then the business should look to using new debt. Using new debt assumes that the business hasn’t already exceeded its debt capacity. New debt comes ahead of the new equity option simply because debt is the cheaper source of capital. The business can determine its sustainable growth rate based on the percentage change in Net Assets that can be achieved without having to change the capital structure. A more conservative form of the sustainable growth rate would be the rate that the Net Assets can grow without having to use an external source of new capital. Sustainable and Actual Growth Rates Sustainable Growth Rate (SGR): The SGR is the percentage change in equity that can be funded from the retained earnings flowing from the income statement. SGR = ∆RE/Opening Equity x 100 Actual Growth Rate (AGR): The AGR is the percentage change Net Assets from one year to the next. AGR = ∆NA/Opening NA x 100 59 ∆RE ∆NA Equity Fixed Assets Debt Working Capital TC NA We can codify the decision process based on the outcome of the SGR and AGR calculations. The following rules would apply: Scenario 1: SGR > AGR 1. The company could grow faster. 2. There will be a build-up of cash in the balance sheet. 3. A higher dividend could be paid. 4. The business could do a share buyback to return cash to shareholders. Scenario 2: AGR > SGR 1. There are not sufficient retained earnings coming from the income statement to meet the growth needs. 2. Reduce the dividend. 3. Extract cash from the working capital. 4. Sell redundant assets. 5. Liquidate investment and loans. 6. Raise new debt. 7. Raise new equity. 60 Measuring Performance Performance of the Operations Measuring performance in a business is about getting beneath the numbers and discovering what is really going on. There are countless ratios that can be calculated in business. It can be quite overwhelming. The measure of performance of the operations is called Return On Net Assets (RONA). RONA measures the profit from the operations (PBIT) against the Net Assets used in the operations. The formula for RONA is: RONA = PBIT x 100 Ave Net Assets The reason why we use the components of operating profit (PBIT) and Net Assets is because both items are critical components of the Operations. The specific use of the average net assets is so that we can incorporate any changes in net assets that might occur from one year to the next. This makes for a more accurate calculation. The following diagram represents the location of the components: 61 Sales Capital Operations Equity Fixed Assets Debt Working Capital Dep TC NA PBIT CoS Operations Gp Exp Capital Int PBT Tax PAT Div RE RONA is driven by two underlying components. The components are PROFITABILITY and ACTIVITY. To uncover these components, we need to do some mathematical gymnastics. We do this by multiplying the RONA formula by Sales/Sales. Yes, that is right. We are multiplying by 1. The result of the formula will not change. Let us see what happens. RONA = PBIT Ave Net Assets 62 x Sales Sales The rules of multiplication allow us to swap the denominators and the result of the equation will not change. When we swap the denominators, we are looking to see what each of the functions are measuring. Swapping the denominators would result in this: RONA PBIT = Sales x Sales Ave Net Assets Let us look at each box and see what is being measured. The green box is measuring the profit from the operations or the operating profit percentage (PBIT%). This is simply the proportion of sales that has remained in the business after the operating expenses have been paid. This is called the PROFITABILITY. For those who have their “work address” in the operation suburb, this is the profit output from their efforts. The primary responsibility of those who work in the operations suburb is to generate sales by using the resources that are available to them in the operations (Net Assets). That is what is being measured in the orange box. We call this ACTIVITY. Some might call it efficiency. The ideal Activity is as high as possible. That is, as much Sales as possible, with the need for as little Net Assets as possible in the business. We now have a simple dashboard that we use to measure the performance of the operations. The following diagram contains the dashboard: RONA = PBIT% 63 x Activity To use the dashboard, it helps to know where the different pieces come from in the financial statements. The following diagram represents where the pieces of the dashboard come from: Capital Operations Sales CoS Equity Fixed Assets Debt Working Capital Dep NA PBIT Exp Operations TC Gp Green arrow → The components of PROFITABILITY (PBIT%) Yellow arrow →The components of ACTIVITY PBT *For ease of representation, the average totals in the balance sheet have not been used PAT Capital Int Tax Div RE Earlier when we discussed the weighted average cost of capital (WACC). We determined that those who work in the Capital suburb are responsible for raising the capital that is required to fund the net assets in the Operations. The responsibility of those in the Operations suburb is to provide a return that is higher than the WACC. That is the measure for value creation. 64 RONA PBIT = x 100 > WACC Ave Net Assets Weighted Average Cost of Capital Earlier we touched on the weighted average cost of capital (WACC). WACC is central to business performance. It represents the combined expectations of the shareholders and the debt providers. Our earlier calculation simply added the costs of equity and debt and divided by two on the assumption that equal proportions of capital are being used. We calculated a WACC of 14%. That was suitable at that time. However, WACC has more to it. WACC combines the return expectations of the shareholders and banks based on the proportional use of these sources of capital. The proportional use should be determined based on the market value of the capital. The WACC formula is a s follows: WACC = Ke x Equity% + Kd x Debt% Ke = Shareholders expectation of return. In South Africa we use 18% based on the CAGR of the AlSI. In the USA Ke = 10%. The higher expectation in South Africa is based on higher inflation and higher levels of perceived risk in the South African market. Kd = After tax cost of debt. The theory requires us to determine the market cost of debt. However, since we use WACC as a proxy for risk over the long term we are going to use a long-term average of the cost of debt. In South Africa that is approximately 10% per annum. This is the before-tax cost of debt. An adjustment for the fact that the interest 65 expense is tax deductible and has the effect of reducing the amount of tax payable. The adjustment is made by using the formula, Kd = Interest rate x (1 – tax rate). Equity% and Debt% are part of the same calculation. Calculate the market value of the equity by multiplying the number of issued shares by the most recent share price. The result is the market capitalisation of the business or the market value of the equity. (Market Cap = # issued shares x share price). Add the market cap to the market value of the long-term debt (use the book value of the long-term debt as a proxy). Think of WACC more as an estimation rather than an exact science. The difference between the market value of the debt and the book value of the debt is not material. Add the market cap of the equity to the book value of the long-term debt and get the total capital. Calculate the market value of the equity as a percentage of the total capital. Do the same for the long-term debt. The theory on WACC suggests that a business will aim towards achieving an optimal capital structure over the long term. An optimal capital structure is a combination of equity and debt that results in the lowest WACC. The optimal capital structure is in a Debt% (also known as the debt ratio) range between 30% and 40%. The optimal Debt% is a function of the profit margins of the business. Higher profit margins can support a higher Debt%. Here is a WACC calculation using the generic components of WACC: Ke = 18% Kd = 10% x (1 – 28%) = 7.2% Equity% = 70% Debt% = 30% WACC = (Ke x Equity%) + (Kd x Debt) WACC = (18% x 70%) + (7.2% x 30%) = 14.8% 66 In South Africa, the use of debt is conservative in comparison to the optimal capital structure. A WACC of 17% is quite common. To get a WACC this high the Equity % is 90% and therefore the Debt% is 10%. The Return on Equity There are three areas of the business that drive returns to shareholders. Without the shareholders taking risk and investing their money in the business there can be no product for the customer and no job for the employee. Just like we did for RONA we want to identify levers in a business that influence returns to shareholders. Remember, the philosophy of Eric Beinhocker, to endure and grow. Our intention is to build a long-term sustainable business and to be able to identify the characteristics of such a business. The characteristics can be uncovered through unpacking the return on equity (ROE) formula. Three characteristics will emerge as we investigate the ROE formula. These characteristics are PROFITABILITY, ACTIVITY and LEVERAGE. The problem is that to uncover these three characteristics we need to jump through a few math hoops as we did with RONA. The formula for return on equity (ROE) is: ROE PAT = x 100 Ave Equity If we take a closer look at the components, we see the use of profit after tax (PAT) which is the profit that belongs to the shareholder. As we work our way down the income statement when we get to PAT there are no more expense obligations to be paid. The 67 only decision is how much to give back to the shareholder as a dividend and therefore how much to retain in the business to fund future growth. The average equity is the sum of the total equity from this year is and last year’s balance sheet, divided by 2 years. The ROE formula is measuring the shareholder’s profit that has been generated by using shareholder’s equity. Essentially the formula is dividing shareholder profit by shareholder investment. The following diagram shows where the different parts of the Return on Equity (ROE) formula come from. For simplicity equity is shown as coming from only one balance sheet in the diagram. For more accuracy we should get the average equity from the last two years of balance sheets. Capital Operations Sales CoS Debt Working Capital TC Gp Exp Dep NA PBIT Operations Fixed Assets Int PBT Tax PAT Div RE 68 Capital Equity The next image contains some mathematical gymnastics, this time with one extra hoop to jump through. The outcome is quite revealing. We multiply the ROE formula by Sales/Sales and Net Assets/Net Assets. In other words, we multiply by 1 and then multiply by 1 again. Mathematically the ROE will not change. The formula would look like this: ROE = PAT Sales x x Ave Equity Sales Ave Net Assets Ave Net Assets The rules of multiplication allow us to swap the denominators and the result of the equation will not change. When we swap the denominators, we are looking to see what each of the functions are measuring. Swapping the denominators would result in this: ROE = PAT Sales x Sales x Ave Net Assets Ave Net Assets Ave Equity Let us look inside each box and see what the component is that is being calculated. The green box is measuring Profit After Tax (PAT) in relation to Sales which is a measure of PROFITBILITY. The orange box is measuring the amount of Sales that is generated from the Ave Net Assets. The primary responsibility of those who work in the operations suburb is to generate sales by using the resources that are available to them in the operations. That is what is being measured in the orange box. We call this ACTIVITY. Some might call it efficiency. The red box has a formula in it that is somewhat unintuitive. We can swap out the Ave Net Assets for the Ave Total Capital, which is the same number on the opposite side of the balance sheet. Remember, NA = TC. So, we are just changing our perspective to help us understand the formula better. The result is the same. If we 69 measure the Total Capital (TC) over the Equity, we are measuring how much debt is being used. We call this measure LEVERAGE. We have carried out a decomposition of the ROE formula and the result is that we have uncovered the three drivers of ROE. Accountants would call this a DuPont decomposition. There is nothing new about it. However, this decomposition is not an accounting decomposition using assets and liabilities. This is a decomposition that uses operations and capital. We can now show the formula in the form of a dashboard that would look like this: = ROE PAT% x Activity x Leverage The following diagram helps us identify where each of the ROE components can be found in the financial statements. Capital Operations Equity Fixed Assets Debt Working Capital Sales CoS NA Exp Dep PBIT Operations TC Gp Green arrow → The components of PROFITABILITY (PAT%) Yellow arrow →The components of ACTIVITY Red arrow → The components of LEVERAGE *For ease of representation, the average totals in the balance sheet have not been used PBT Tax PAT Div RE 70 Capital Int Managing ROE is Like Herding Cats Once we understand return on equity and its dynamics, all other performance measures are subcomponents of its three drivers. If a business had opportunity to grow and chose to raise debt to acquire new assets, the following sequence of events might take place. Event #1: The business raises debt capital. Raising debt capital would cause the leverage to increase. We could use an up arrow to represent the increase in debt. 1 ROE = PAT% x Activity x Leverage Event #2: Raising debt would increase the cash in the operations, thus increasing the Net Assets and reducing the Activity because net Assets are the denominator in the activity formula (Activity = Sales / Ave Net Assets). This outcome assumes that no new sales have been achieved yet. The sales will likely only come later once the cash has been invested in new assets. At this point the benefits to ROE from using debt would be negated by the lower activity. In the short term we would use a down arrow to show the decline in Activity. 2 ROE = PAT% x Activity 71 1 x Leverage Event #3: The new debt would likely increase the interest expense in the income statement resulting in a lower PAT%. This could be represented with a down arrow for PAT%. The net outcome in the short term would be a decline the returns to shareholders as measured by ROE. 2 3 ROE = PAT% x Activity 1 x Leverage The business objective in the long term is to generate ROE > 18%. This is considered value creation. In the short term, actions taken to achieve long term value creation can appear as poor performance. The acquisition on new assets almost always reduces the Activity of the business in the short term. Over time the intention of the investment is to drive more volumes of sales at higher margins. To do this the business must continually invest in maintaining its competitive advantage through innovative use of its existing assets and or the development of new assets. It turns out that the most productive way to increase ROE is to improve the profitability of the business. In the ideal world, high profitability with the need for as few net assets as possible (i.e. high activity) to produce profitability is the holy grail of value creation. 72 The Lighter Than Air Balance Sheet Apple is a company that has managed to benefit from the returns that come from the holy grail. Apple’s business model and the ROE dynamics reveal how they have been able to perform so well. The starting point is to look at the profit margins of Apple. For many years Apple has maintained a PAT% of more than 20%. Apple has done this through developing tremendous brand loyalty and many successful products and services that are worldclass. Measuring the Activity of Apple, we find a business that has high Sales with few Net Assets. In other word, high ACTIVITY. • If we look specifically at the fixed assets of Apple, we will see that they have extraordinarily few fixed assets as they have outsourced the manufacturing and delivery logistics to others. One could argue that from a strategic point of view Apple are able to control the manufacturing assets of others without having to own the assets, therefore, requiring less capital to be invested. • The current assets are primarily made up of debtors and inventory. Since no one really buys on credit from Apple the debtor’s book is small. The “just in time” inventory system means that as the products roll off the production line, they find their way to the customer or a franchised retail store. This result is limited inventory in the system and efficient use of working capital. • Apple buys on credit from its suppliers which means that it has a sizable creditors balance. • The combination of low fixed assets and low working capital requirements means that the net assets of Apple are exceptionally low. Hence, the term 73 “lighter than air balance sheet.” Yet the value of the business is remarkably high. It is well known that the value of a business is not reflected in the value of the net assets. The value of the business comes from the cashflow that the business can produce. The primary reason for buying a business is to swap cash today for more cash in the future, considering risk and time value of money. In the discussion above, cash was conveniently left out. Apple holds a large amount of cash. The cash would form part of the working capital. However, the risk of holding cash is low relative to the other risk in a business. Therefore, leaving out the cash helps emphasise the point. The term “lighter than air balance sheet” has a bit of smoke and mirrors to it, but it was conceived more as a marketing gimmick than a real financial objective. Nevertheless, there is a gem of truth hiding in the smoke. How Much Profit is Enough? Ask someone how much profit is enough. The common answer is that there is no such thing as enough profit. We always want to make more profits. To a large degree that is true provided that the pursuit of more profit is done with the long-term sustainability of the business in mind. Once again, the wise words of Eric Bienhocker. The question about “how much profit is enough?” is not to suggest that we stop the pursuit of more profit. The question is to ask at what point the business has made enough profit to meet the expectations of the shareholders and deliver on the promise of returns and value creation. To answer this question, we go back to the expectations that we discussed earlier. The expectation based on historical returns of the All Share Index (ALSI). The shareholders expectation of return on a portfolio of shares is 18% per annum. Thus, the business needs to earn a certain amount of profit that when measured against the average equity, the return to shareholders is greater than 18%. Providing a return to shareholders that is greater than their expectation is the definition of value creation. 74 We could represent this as follows: ROE = PAT x 100 > 18% Ave Equity The DuPont decomposition and the Return on Equity measures have been in use for millennia. There are hardly any secrets here. However, when I explore these concepts in the classroom, they are almost always very new concepts to managers and executives who are just starting their journey of finance learning. Value Creation Dressed in a New Suit If you were to try and sell business performance consulting services to corporates based on the knowledge of DuPont decomposition, you would likely be unsuccessful. C-suite executives will tell you that every accountant knows DuPont analysis like the back of their hand, and they have plenty of accountants to measure the performance of their business. Yet of course, accountants are so busy trying to keep up with the compliance standards that the business performance often gets neglected. It is left for the investment community to reflect on the performance. In the early 1980’s a gentleman by the name of Joel Stern created a measure call economic value add or EVA. The purpose of this measure was to “account” for the cost of equity in the business and measure returns denominated in currency. The income statement accounts for the cost of debt in the interest expense but does not account for the fact that equity has a “cost” and that the business must take this cost into account before declaring the profits. Joel Stern created this formula: 75 = NOPAT -( Net Assets x WACC ( EVA The innovation in the formula is very clever. At the time of its development it went with a sales pitch that asked business executives if they were creating or destroying value. The need to know the answer to this question was a shoe-in for Joel Stern and his consulting business to provide business performance consulting services to corporate America. The term NOPAT, meaning net operating profit after tax, is not an accounting term. It is calculated by subtracting the tax from the operating profit (NOPAT = PBIT – Tax). NOPAT is a rich measure of the performance of the operations of a business. It considers all of the operating expenses and it takes into account the tax. What it leaves out is the interest expenses (debt cost) and the dividend payment (partial equity cost). Therefore, NOPAT is the profit available from the operations of the business to pay the debt and equity costs. The next part of the EVA formula in the brackets is the calculation of the debt and equity cost. Multiplying the net assets by the weighted average cost of capital (WACC) calculates the annual currency denominated cost of the capital for the business. The use of net assets in the EVA formula was a clever inclusion. Net assets are not an accounting measure. It is a measure that we created by converting the balance sheet from assets and liabilities to operations and capital. The EVA formula could have used total capital instead of net assets. This would have made it more obvious. By using net assets in the formula, Joel Stern’s intentions may have been to somewhat deceive the accountants. Accountants are quite familiar with the term net asset value (NAV) which is simply the book value of the equity. This sleight of hand added complexity to EVA. EVA was no doubt sold on the basis that it was too complicated for businesses to try and 76 calculate their own EVA, and the services of Joel Stern would be needed to determine if the CEO was creating value or not. After deducting the capital cost from NOPAT, if the result is positive then the business is deemed to be creating value and the EVA is of course positive. A negative EVA suggests that the business is destroying value. The following diagram compares the components of EVA and ROE to explore the similarities: = NOPAT -( 1 ROE = PAT% x Net Assets 2 x Activity WACC ( EVA 3 x Leverage Unpacking each of these components: #1 Both of these items measure profitability. The only difference is that NOPAT is before interest and dividends and PAT% is before dividends. #2 Activity uses the net assets in its calculation by dividing Sales by net assets. The components are part of the same measure. #3 Leverage is a measure of debt in the business in a similar way to WACC. Leverage and WACC are both measuring proportions of debt and equity. One can only conclude that ROE through the lens of a DuPont decomposition and EVA are essentially the same thing. ROE measure returns in percentage and EVA measures returns in currency. I can only say well done to Joel Stern for dressing DuPont up in a sexy ball gown and selling it to executives. 77 The Application of Value Creation This section covers several great examples of South African JSE listed companies that can be used to apply the dashboard of ROE and EVA. The intent is to determine if the businesses are creating value. Shoprite Holdings (SHP) SHOPRITE HOLDINGS LTD Share Price @ Year End EVA = Ecconomic Value Add ROE = Pa x A x L WACC 101.80 1,434,522,515 37.08% 17.7% 150.67 1,037,429,914 29.54% 17.6% Turnover T/O GROWTH Cost of Sales Gross Profit GP% Expenses Depreciation Operating profit (EBIT) OP% Total Interest Paid Interest Received Profit Before Tax Taxation Profit After Interest and Tax PAT% Ordinary Dividends Paid Retained Profits 30-Jun-11 72,297,777,000 7.3% 57,624,408,000 14,673,369,000 20.3% 9,770,198,000 948,520,000 3,895,960,000 5.4% 125,964,000 94,614,000 3,876,494,000 1,346,826,000 2,529,668,000 3.5% 1,189,411,000 1,340,257,000 30-Jun-12 82,730,587,000 14.1% 65,752,642,000 16,977,945,000 20.5% 11,235,389,000 1,132,907,000 4,480,845,000 5.4% 223,437,000 159,024,000 4,481,833,000 1,438,889,000 3,042,944,000 3.7% 1,421,598,000 1,621,346,000 Balance sheet 185.50 918,392,094 26.18% Declining ROE 17.5% 30-Jun-13 92,747,314,000 12.4% 73,316,296,000 19,431,018,000 21.0% 12,607,369,000 1,347,715,000 5,320,294,000 5.7% 429,059,000 283,494,000 5,193,979,000 1,578,545,000 3,615,434,000 3.9% 1,696,418,000 1,919,016,000 Growing Sales Consistent GP% Increasing OP% Increasing PAT% Total Equity Ordinary Share Capital Share Premium Non-Distributable Reserves Distributable Reserves Outside Shareholders Interest 30-Jun-11 7,143,599,000 616,583,000 293,072,000 (332,478,000) 6,507,523,000 58,899,000 30-Jun-12 12,807,899,000 647,314,000 3,672,069,000 (320,146,000) 8,745,805,000 62,857,000 30-Jun-13 15,252,490,000 647,328,000 Increasing 3,672,069,000 share capital 760,333,000 10,104,346,000 68,414,000 Preference Shares Deferred Tax Other Non-Current Liabilities Long Term Interest Bearing Total Capital 2,450,000 25,377,000 1,058,442,000 23,578,000 8,253,446,000 2,450,000 152,085,000 880,875,000 4,004,066,000 17,847,375,000 2,450,000 197,135,000 831,383,000 3,820,701,000 Increasing debt 20,104,159,000 78 Fixed Assets Intangible Assets Investments & Loans Other Non-Current Assets Net Current Assets Current Assets Inventory Trade Receivables Cash & Near Cash 8,168,749,000 719,105,000 63,964,000 394,362,000 (1,092,734,000) 11,357,577,000 7,055,867,000 2,301,616,000 1,961,551,000 9,668,559,000 894,296,000 107,592,000 816,211,000 6,360,717,000 19,418,860,000 8,680,109,000 2,718,228,000 7,939,333,000 11,713,741,000 1,039,192,000 140,780,000 494,656,000 6,715,790,000 20,100,902,000 10,317,417,000 3,470,269,000 6,138,671,000 Current Liabilities Trade Payables Dividends Payable Tax Payable Short-Term Interest Bearing Net Assets 12,450,311,000 9,911,860,000 4,851,000 464,316,000 2,069,284,000 8,253,446,000 13,058,143,000 12,850,338,000 4,955,000 151,025,000 51,825,000 17,847,375,000 13,385,112,000 12,856,690,000 6,434,000 186,666,000 335,322,000 20,104,159,000 Increase in NA Notice how the ROE dropped between 2011 and 2012 (Highlighted with a red box). Using the ROE dashboard of ROE = P x A x L we can hunt down the cause. Shoprite raised approximately R7.3 billion in new capital in 2012. R4 billion came from new debt and R3.3 billion came from new equity. This capital was intended to fund the expansion plans into Africa. The increase in the Net Assets from R8,2 billion in 2011 to R17.8 billion in 2012 is the cause of the decline in Activity and thus the decline in ROE. This would be represented on the ROE dashboard as a decline in the Activity. 79 The relative performance chart plots the performance of a R1 investment in Shoprite (SHP) over the last 15 years as compared to a R1 investment in the All Share Index (ALSI). The red line is SHP and the blue line is the ALSI. A R1 investment in the ALSI in 2005 would be worth R3.80 today in 2020. A R1 investment in SHP would be worth R7.47 today. However, in late 2012 when SHP raised the capital to invest in Africa the R1 investment was worth R14.77. This might suggest that SHP has not been able to deliver on the promise of higher returns from its African investments. SHP value creation metrics Share Price @ Year End EVA = Ecconomic Value Add ROE = Pa x A x L WACC 154.00 769,554,593 23.99% 17.4% 30-Jun-14 173.50 671,015,560 23.20% 17.4% 30-Jun-15 166.32 1,496,274,282 23.92% 17.2% 30-Jun-16 199.38 1,375,700,122 21.41% 17.2% 30-Jun-17 220.61 409,712,409 17.73% 17.2% 30-Jun-18 Since 2015 SHP has been able to create value. EVA is positive and ROE is consistently above or close to 18%. SHP appears to have suffered from the winner’s curse. Up until the end of 2012 when SHP raised capital for its investments in Africa it had produced consistent returns in the mid 80 30% range. There were plenty of buyers of SHP shares, hence the steep and consistent climb in share price and relative performance. Until SHP can show signs of returning to returns to shareholders in at least the high 20% range, it may not be able attract new buyers to drive the share price back up. 81 Pick ‘n Pay (PIK) PICK N PAY STORES LTD Share Price @ Year End EVA = Ecconomic Value Add ROE = Pa x A x L WACC 52.82 327,324,033 27.92% 17.2% 56.34 451,948,402 29.57% 17.6% 69.45 617,089,394 29.10% 17.6% 11-Aug-20 72.66 663,823,827 26.96% 17.3% 44.34 69.33 974,701,255 31.09% 17.1% Turnover T/O GROWTH Cost of Sales Gross Profit GP% Expenses Depreciation Operating profit (EBIT) OP% Total Interest Paid Interest Received Profit Before Tax Taxation Profit After Interest and Tax PAT% Ordinary Dividends Paid Retained Profits 28-Feb-15 66,940,800,000 6.1% 54,994,300,000 11,946,500,000 17.8% 9,826,500,000 714,500,000 1,250,500,000 1.9% 119,000,000 59,400,000 1,205,200,000 343,500,000 861,700,000 1.3% 461,800,000 462,300,000 29-Feb-16 72,445,100,000 7.9% 59,474,800,000 12,970,300,000 17.9% 10,537,100,000 778,400,000 1,483,700,000 2.0% 119,000,000 60,900,000 1,473,500,000 408,100,000 1,065,400,000 1.5% 589,500,000 571,500,000 28-Feb-17 77,486,100,000 7.3% 63,549,400,000 13,936,700,000 18.0% 11,222,300,000 820,900,000 1,727,500,000 2.2% 119,000,000 126,100,000 1,715,200,000 471,700,000 1,243,500,000 1.6% 753,500,000 769,200,000 28-Feb-18 81,560,100,000 5.3% 66,309,800,000 15,250,300,000 18.7% 12,356,900,000 913,500,000 1,798,900,000 2.2% 119,000,000 184,100,000 1,768,100,000 471,800,000 1,296,300,000 1.6% 866,500,000 299,600,000 28-Feb-19 88,293,200,000 8.3% 71,539,300,000 16,753,900,000 19.0% 13,365,800,000 1,026,100,000 2,181,300,000 2.5% 119,000,000 258,800,000 2,199,800,000 550,300,000 1,649,500,000 1.9% 938,000,000 695,700,000 Total Equity Ordinary Share Capital Share Premium Non-Distributable Reserves Distributable Reserves Outside Shareholders Interest 28-Feb-15 3,130,100,000 6,000,000 (187,300,000) 3,311,400,000 - 29-Feb-16 3,897,800,000 6,000,000 8,900,000 3,882,900,000 - 28-Feb-17 4,079,300,000 6,000,000 (578,800,000) 4,652,100,000 - 28-Feb-18 4,023,600,000 6,000,000 (934,100,000) 4,951,700,000 - 28-Feb-19 4,316,800,000 6,000,000 (1,336,600,000) 5,647,400,000 - Preference Shares Deferred Tax Other Non-Current Liabilities Long Term Interest Bearing Total Capital 1,138,500,000 492,800,000 4,761,400,000 9,500,000 1,239,600,000 83,000,000 5,229,900,000 14,600,000 1,398,600,000 84,000,000 5,576,500,000 13,700,000 1,571,600,000 79,500,000 5,688,400,000 14,200,000 1,719,400,000 6,050,400,000 4,187,000,000 1,010,200,000 280,800,000 442,100,000 (1,158,700,000) 8,786,400,000 4,654,500,000 2,958,100,000 1,173,800,000 4,950,900,000 1,004,900,000 660,400,000 501,600,000 (1,887,900,000) 9,467,100,000 5,152,000,000 3,332,200,000 982,900,000 5,583,600,000 984,300,000 408,500,000 724,400,000 (2,124,300,000) 10,401,600,000 5,994,600,000 3,445,100,000 961,900,000 6,054,400,000 991,300,000 470,600,000 842,300,000 (2,670,200,000) 10,621,900,000 5,963,700,000 3,529,100,000 1,129,100,000 6,189,300,000 970,600,000 286,400,000 745,200,000 (2,141,100,000) 11,662,800,000 5,697,200,000 4,462,400,000 1,503,200,000 9,945,100,000 9,026,800,000 126,800,000 791,500,000 4,761,400,000 11,355,000,000 10,625,400,000 183,000,000 546,600,000 5,229,900,000 12,525,900,000 10,501,900,000 174,800,000 1,849,200,000 5,576,500,000 13,292,100,000 10,829,100,000 213,700,000 2,249,300,000 5,688,400,000 13,803,900,000 10,659,800,000 19,100,000 3,125,000,000 6,050,400,000 Balance sheet Fixed Assets Intangible Assets Investments & Loans Other Non-Current Assets Net Current Assets Current Assets Inventory Trade Receivables Cash & Near Cash Current Liabilities Trade Payables Dividends Payable Tax Payable Short-Term Interest Bearing Net Assets 82 Key Ratios PAT% (Pa) Net Asset Turnover (Activity) Leverage - on the surface 28-Feb-15 1.3% 14.06 1.52 29-Feb-16 1.5% 13.85 1.34 28-Feb-17 1.6% 13.90 1.37 28-Feb-18 1.6% 14.34 1.41 28-Feb-19 1.9% 14.59 1.40 PIK has increasing profit margins year on year from 2015 to 2019. Its activity ratio has been gradually improving since 2016. The leverage has mostly stayed constant. The increasing profit margins and improving Activity are the reason for the increase in ROE over the last few years. The changes are small, and performance is moving in the right direction. For many years PIK has been the underdog to SHP. In comparing the relative performance charts, PIK has underperformed the AlSI. Since 2005 SHP has been the hands down winner. However, over the period from 2015 to 2018 PIK has been the better performer. Unfortunately, 2019 and 2020 has been hard on all the retailers. 83 Woolworths (WHL) WOOLWORTHS HOLDINGS LTD Share Price @ Year End EVA = Ecconomic Value Add ROE = Pa x A x L WACC 74.41 1,587,193,922 41.17% 17.1% 98.60 1,109,473,555 26.10% 16.6% 84.02 120,933,326 25.43% 16.1% 11-Aug-20 61.65 1,239,084,045 28.39% 15.7% 34.46 55.45 (7,231,803,958) -20.95% 15.7% 30-Jun-14 39,707,000,000 12.7% 24,209,000,000 15,498,000,000 39.0% 10,683,000,000 640,000,000 3,943,000,000 9.9% 136,000,000 112,000,000 4,104,000,000 1,114,000,000 2,990,000,000 7.5% 1,999,000,000 577,000,000 30-Jun-15 56,506,000,000 42.3% 33,356,000,000 23,150,000,000 41.0% 15,873,000,000 1,245,000,000 5,587,000,000 9.9% 1,494,000,000 116,000,000 4,432,000,000 1,312,000,000 3,120,000,000 5.5% 2,146,000,000 (1,329,000,000) 30-Jun-16 65,004,000,000 14.7% 38,618,000,000 26,386,000,000 40.6% 17,592,000,000 1,514,000,000 6,969,000,000 10.7% 1,494,000,000 48,000,000 6,033,000,000 1,680,000,000 4,353,000,000 6.7% 2,176,000,000 1,400,000,000 30-Jun-17 67,411,000,000 4.0% 40,739,000,000 26,672,000,000 39.6% 17,097,000,000 1,640,000,000 7,626,000,000 11.3% 1,494,000,000 96,000,000 6,726,000,000 1,278,000,000 5,448,000,000 8.1% 3,014,000,000 2,183,000,000 30-Jun-18 68,592,000,000 1.8% 41,700,000,000 26,892,000,000 39.2% 19,944,000,000 1,692,000,000 (1,668,000,000) -2.4% 1,494,000,000 71,000,000 (2,434,000,000) 1,115,000,000 (3,549,000,000) -5.2% 2,781,000,000 (6,823,000,000) Total Equity Ordinary Share Capital Share Premium Non-Distributable Reserves Distributable Reserves Outside Shareholders Interest 30-Jun-14 6,952,000,000 678,000,000 (741,000,000) 6,692,000,000 323,000,000 30-Jun-15 14,297,000,000 10,802,000,000 (1,914,000,000) 5,363,000,000 46,000,000 30-Jun-16 19,853,000,000 11,237,000,000 1,826,000,000 6,763,000,000 27,000,000 30-Jun-17 19,066,000,000 11,375,000,000 (1,283,000,000) 8,946,000,000 28,000,000 30-Jun-18 13,126,000,000 11,399,000,000 (409,000,000) 2,123,000,000 13,000,000 Preference Shares Deferred Tax Other Non-Current Liabilities Long Term Interest Bearing Total Capital 332,000,000 963,000,000 623,000,000 8,870,000,000 516,000,000 2,634,000,000 14,922,000,000 32,369,000,000 6,000,000 2,850,000,000 15,703,000,000 38,412,000,000 658,000,000 2,541,000,000 12,137,000,000 34,402,000,000 758,000,000 2,607,000,000 11,711,000,000 28,202,000,000 Fixed Assets Intangible Assets Investments & Loans Other Non-Current Assets Net Current Assets Current Assets Inventory Trade Receivables Cash & Near Cash 3,519,000,000 2,946,000,000 907,000,000 820,000,000 678,000,000 14,077,000,000 3,436,000,000 1,090,000,000 9,542,000,000 14,508,000,000 15,700,000,000 949,000,000 2,047,000,000 (835,000,000) 8,251,000,000 5,881,000,000 1,270,000,000 891,000,000 15,402,000,000 18,965,000,000 1,019,000,000 3,664,000,000 (638,000,000) 10,340,000,000 7,117,000,000 1,402,000,000 1,525,000,000 13,846,000,000 19,595,000,000 1,057,000,000 208,000,000 (304,000,000) 10,287,000,000 6,990,000,000 1,258,000,000 1,787,000,000 13,959,000,000 13,410,000,000 1,034,000,000 247,000,000 (448,000,000) 11,497,000,000 7,542,000,000 1,661,000,000 2,023,000,000 Current Liabilities Trade Payables Dividends Payable Tax Payable Short-Term Interest Bearing Net Assets 13,399,000,000 5,171,000,000 189,000,000 8,039,000,000 8,870,000,000 9,086,000,000 8,631,000,000 259,000,000 196,000,000 32,369,000,000 10,978,000,000 10,370,000,000 393,000,000 215,000,000 38,412,000,000 10,591,000,000 9,377,000,000 26,000,000 1,188,000,000 34,402,000,000 11,945,000,000 9,672,000,000 124,000,000 2,149,000,000 28,202,000,000 Turnover T/O GROWTH Cost of Sales Gross Profit GP% Expenses Depreciation Operating profit (EBIT) OP% Total Interest Paid Interest Received Profit Before Tax Taxation Profit After Interest and Tax PAT% Ordinary Dividends Paid Retained Profits Balance sheet 84 Key Ratios PAT% (Pa) Net Asset Turnover (Activity) Leverage - on the surface 30-Jun-14 7.5% 4.48 1.28 30-Jun-15 5.5% 1.75 2.26 30-Jun-16 6.7% 1.69 1.93 30-Jun-17 8.1% 1.96 1.80 30-Jun-18 -5.2% 2.43 2.15 WHL was the champion retailer from 2009 to 2015. Their investment in David Jones in 2015 has turned out to be their kryptonite. WHL took on approximately R14 billion in debt and R10 billion in new equity to make the acquisition. Notice how the ROE declined from 41% in 2014 to 26% in 2015 when the acquisition was made. The new debt reduced the Pat% from 7.5% to 5.5%. The new assets on the balance sheet reduced the Activity from 4.48 to 1.75. The debt worked in its favour but the strength of the downward movement in Profitability and Activity was just too much. In 2018 WHL had to take on an impairment charge of approximately R6 billion. This is a non-cash expense in the income statement which has the effect of reducing the equity in the balance sheet to match the write down in the asset value. The relative performance chart reflects the value destruction from shareholders since the David Jones deal was done in 2015. R1 invested in WHL in2005 would have been worth R10.77 in 2015. It is now worth R3.05. Less than the return of the ALSI. 85 Clicks (CLS) CLICKS GROUP LTD Share Price @ Year End EVA = Ecconomic Value Add ROE = Pa x A x L WACC 69.15 562,113,533 44.32% 17.9% 91.54 675,071,680 50.28% 18.0% 121.10 721,446,950 45.87% 18.0% 11-Aug-20 148.80 793,389,990 43.46% 18.0% 228.59 203.00 802,341,840 38.26% 18.0% Turnover T/O GROWTH Cost of Sales Gross Profit GP% Expenses Depreciation Operating profit (EBIT) OP% Total Interest Paid Interest Received Profit Before Tax Taxation Profit After Interest and Tax PAT% Ordinary Dividends Paid Retained Profits 31-Aug-14 19,149,524,000 9.2% 15,026,159,000 4,123,365,000 21.5% 2,646,274,000 201,769,000 1,247,388,000 6.5% 46,157,000 5,497,000 1,206,728,000 341,883,000 864,845,000 4.5% 429,277,000 (569,250,000) 31-Aug-15 22,070,092,000 15.3% 17,545,318,000 4,524,774,000 20.5% 2,890,127,000 218,543,000 1,386,593,000 6.3% 62,231,000 4,922,000 1,329,284,000 374,709,000 954,575,000 4.3% 490,758,000 464,582,000 31-Aug-16 24,170,879,000 9.2% 19,156,612,000 5,014,267,000 20.7% 3,184,875,000 237,824,000 1,565,248,000 6.5% 62,231,000 6,255,000 1,514,651,000 420,779,000 1,093,872,000 4.5% 585,757,000 508,115,000 31-Aug-17 26,809,101,000 11.2% 21,185,124,000 5,623,977,000 21.0% 3,518,202,000 259,657,000 1,808,709,000 6.7% 62,231,000 10,501,000 1,774,272,000 496,630,000 1,277,642,000 4.8% 677,399,000 602,031,000 31-Aug-18 29,239,688,000 9.1% 23,062,579,000 6,177,109,000 21.1% 3,797,573,000 289,239,000 2,040,394,000 7.0% 62,231,000 25,757,000 2,045,000,000 569,790,000 1,475,210,000 5.0% 811,578,000 719,121,000 Total Equity Ordinary Share Capital Share Premium Non-Distributable Reserves Distributable Reserves Outside Shareholders Interest 31-Aug-14 1,566,973,000 2,754,000 3,497,000 (99,260,000) 1,659,982,000 - 31-Aug-15 2,012,807,000 2,754,000 3,497,000 (118,008,000) 2,124,564,000 - 31-Aug-16 2,452,241,000 2,754,000 3,497,000 (186,689,000) 2,632,679,000 - 31-Aug-17 3,300,350,000 2,752,000 3,497,000 59,391,000 3,234,710,000 - 31-Aug-18 4,427,868,000 2,686,000 513,848,000 (42,497,000) 3,953,831,000 - Preference Shares Deferred Tax Other Non-Current Liabilities Long Term Interest Bearing Total Capital 2,782,000 283,683,000 1,853,438,000 308,503,000 2,321,310,000 405,541,000 2,857,782,000 402,257,000 3,702,607,000 447,546,000 4,875,414,000 Fixed Assets Intangible Assets Investments & Loans Other Non-Current Assets Net Current Assets Current Assets Inventory Trade Receivables Cash & Near Cash 1,135,007,000 475,133,000 35,161,000 126,335,000 81,802,000 4,420,621,000 2,614,196,000 1,609,721,000 195,631,000 1,221,658,000 499,135,000 29,671,000 258,699,000 312,147,000 5,546,775,000 3,249,914,000 1,892,046,000 400,738,000 1,345,024,000 537,593,000 45,948,000 578,642,000 350,575,000 5,869,689,000 3,478,717,000 2,021,172,000 369,800,000 1,533,935,000 561,113,000 52,119,000 707,114,000 848,326,000 6,866,834,000 3,753,794,000 2,412,567,000 700,473,000 1,843,402,000 580,271,000 117,529,000 691,462,000 1,642,750,000 8,331,413,000 4,227,336,000 2,580,262,000 1,523,815,000 Current Liabilities Trade Payables Dividends Payable Tax Payable Short-Term Interest Bearing Net Assets 4,338,819,000 4,244,477,000 94,342,000 1,853,438,000 5,234,628,000 5,118,802,000 115,826,000 2,321,310,000 5,519,114,000 5,426,638,000 92,476,000 2,857,782,000 6,018,508,000 5,885,517,000 132,991,000 3,702,607,000 6,688,663,000 6,621,644,000 67,019,000 4,875,414,000 Balance sheet 86 Key Ratios PAT% (Pa) Net Asset Turnover (Activity) Leverage - on the surface 31-Aug-14 4.5% 10.33 1.18 31-Aug-15 4.3% 9.51 1.15 87 31-Aug-16 4.5% 8.46 1.17 31-Aug-17 4.8% 7.24 1.12 31-Aug-18 5.0% 6.00 1.10 Summary of Secrets This chapter is the equivalent of the postscript (P.S). It is the last paragraph after the letter that people jump to if they do not want to read all the detail. The secrets referred to in the chapter title are not secrets in a way that that the information is new and is being exposed for the first time. Those who have formal training in accounting and finance know these secrets as if they are part of everyday life. However, the case has been made that the financial information of a business is not universally understood. Generally, people are financially illiterate when it comes to business finance. The secrets in this book and the summary that appears below are new information and insights to many who have little financial experience and understanding of a business. The secrets in this summary are expressed as formulas, nuggets of information, and simple financial truths. There is no explanation with them. The explanations are in the book. Some of the secrets are repeated several times where jargon is used to express the same thing in different ways. 1. Shareholders are the primary stakeholders in business. Without a shareholder there is no business. 2. Shareholders trade off risk for return. More risk increases the expectation of return…and loss. 3. Shareholders returns are realised through dividends and share price growth. 4. The weighted average cost of capital (WACC) is the minimum return that is expected to be produced by the operations of the business. 5. Value creation is the generation of returns from the operations that are higher than WACC. 6. Value creation for the shareholder is the generation of returns that exceeds the shareholders expectations, given the risk of the investment. 7. Profits in the income statement are simply the opinion of the accountant. 8. Cashflow and profit can bear little resemblance to each other. 9. Managing Return on Equity (ROE) can be like herding cats. 88 10. More debt can increase the ROE. 11. RONA > WACC 12. ROE > Shareholder expectations (18% in South Africa, 10% in USA). 13. RONA = ROTC = ROFE = ROCE 14. Return on Net Assets = Return on Total Capital = Return on Funds Employed = Return on Capital Employed. 15. NOPAT is the best profit measure of the operations 16. NOPAT = PBIT – Tax 17. RONA = PBIT/Average Net Assets x 100 18. RONA = PBIT% x Activity 19. PBIT% = PBIT/Sales x 100 20. Activity = Sales/Average Net Assets 21. ROE = PAT/Average Equity x 100 22. ROE = Pat% x Activity x Leverage 23. PAT% = PAT/Sales x 100 24. Leverage = Average Total capital / Average Equity 25. Return on Invested Capital (ROIC) = NOPAT/ Average Net Assets x 100 26. NOPAT% = NOPAT/Sales x 100 27. ROIC = NOPAT% x Activity 28. CAGR = (Vfinal/Vbegin)^(1/t)-1 29. EVA = NOPAT – (Net Assest x WACC) 30. Ke = Cost of Equity = Shareholders expectations 31. Kd = After Tax Cost of Debt 32. Kd = Interest rate x (1 – Tax rate) 33. WACC = Ke x Equity% + Kd x Debt% 89 References Mike Ward and Allan Price. 2014. Turning Vision into Value. Erik Beinhocker.2010. The Origin Of Wealth. Mike Ward and Chris Muller. 2012. Empirical testing of the CAPM on the JSE. 90 Complimentary Resources Finance on Steroids Finance on Steroids is a 6-part video training series. This video series compliments this book by exploring the detailed application of the value creation theory. Where this book just dips its toe in the water, Finance on Steroids goes into depth. Finance on Steroids was developed to help use the value creation tools to find great performing businesses to invest in. Included with the Finance on Steroids are: • Detailed historical performance analyses of several different listed companies. • Value creation and value destruction insights on how higher performing management teams can go off the rails. • Company performance charts for 20 listed companies. • Excel spreadsheets containing sample data of historical performance. • An introductory training on company valuation using a listed company Finance on Steroids will give you MBA finance skills without having to pay hundreds of thousands of Dollars to get an MBA. 91 Company Value on Excel Steroids Company Value on Excel Steroids is the next level up from Finance on Steroids. This 18part video training series is all about valuation. The training series takes you on a journey of building a robust Excel valuation model that uses historical data to value large listed companies. You will learn how to: • Measure historical perfromance. • Forecast future potential high road and low road business perfromance using historical data. • Forecast integrated financial statements for use in valuation. • Calculate future growth rates, free cashflows and terminal values. • Discount future cashflows using appropriate risk adjustments. • Value the shares of a company and compare them to the market share price. Ultimately the objective of this training is to equip you with the skills to find great businesses that are undervalued and ripe for long term investment. As an entrepreneur you will gain the skills to be able to get new insights into the value of your own business. You will be able to translate the learning into identifying the levers of valuation that you can pull in your business to drive value creation. 92 Online Business Simulation The Online Business Simulation is the most incredible team learning experience. It is the opportunity to practise all the financial skills that you have learned in this book. You are appointed to the executive team of a multi-national listed company. Your job, with your management team, is to run a motor manufacturing business that competes in several international markets. You will be exposed to the following dynamics: • Working with your team. • Setting the strategic direction of your business. • Managing an international sales force. • Planning the operations to produce products and services. • Implementing your financial learning about performance and value creation. • Marketing and promoting your products and services to grow your business. • Learning to lead under the daily pressure of being in the c-suite. • Exploring your own leadership style and maturity with guidance and feedback from coaches. The simulation is run over 3 days, using online conference facilities and proprietary software. The training facilitators provide feedback and coaching to help you develop your management and leadership skills to raise your game so that you can make the jump to the next level in your career. 93 94