School Canteen Financial Report Observations & Compliance

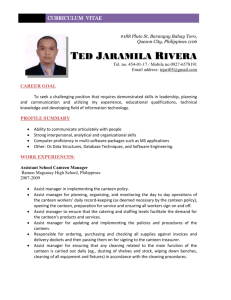

advertisement

. Observation for financial reports Reference No school accounts for canteen earnings and cash received DepEd Order No. 8 s. 2007 6.6. Earnings and cash received from canteen operations shall be deposited daily in the nearest government depository bank. In the absence of such government depository bank, deposits shall be made at any nearest reputable commercial bank. In no case shall the deposits be made in the personal account of any school official. A schoolmanaged canteen shall have a bank account “in trust for” the name of the school, whereby the school head/principal and the Canteen Teacher shall be the joint signatories. Unposted school canteen statement of operation on transparency board DepEd Order No. 8 s. 2007 5.4.3. Audited financial statements shall be posted on bulletin boards for the information of everybody. DepEd Order No. 17 s. 2005 6.1 All entities operating and managing a school canteen shall prepare a monthly statement of operations which shall be posted on the school’s bulletin board and/or in any conspicuous place within the school canteen premises for purposes of public view and access as well as to ensure transparency. Utilization of net income Erroneous posting of financial expenses (expenses for feeding, clinic, school dev. Etc. was deducted already in gross profit instead from net income) Canteen SBFP must be implemented and observed. DepEd Order No. 8 s. 2007 6.5 The net income derived from the operation of the canteen shall be utilized for, but not limited to the following: SBFP -35% School Clinic Fund- 5% Faculty and student dev. Fund -15% H.E Instructional Fund -10% School Operation -25% Revolving -10% No proper reporting of liquidation of expenses from net income (lack of receipt /proof of payment) 6.8 Disbursement of canteen funds shall be in accordance with the approved budget and existing accounting and auditing rules and regulations. DepEd Order No. 17 s. 2005 8.1.3 The disbursement chargeable against the net income derived from the operation shall be in accordance with the budget approved for the year, for the purpose related to the school operations and activities, – and the same shall be properly recorded, accounted for and supported by receipts and proofs of disbursement in accordance with the accounting rules and regulations. Improper expenditure of revolving fund DepEd Order No. 8 s. 2007 Amount set aside to cover disbursement for recurring transactions. Transactions covered by this fund is subject to immediate liquidation… No proper turnover of accountability from previous canteen manager *new canteen managers are not well informed about how to create accurate reports due to lack of proper handover of information and responsibilities Other matters of improper expenditure reporting: Gift, token, pauwi, pakain for SDS, PSDS, Mayor, visitors, etc. was as is reported on expenses as per attached reports of expenses on school financial reports. no breakdown of school sharing in expenses DepEd Order No. 8 s. 2007 6.9 Teachers and canteen personnel shall be required to secure clearance from money and property accountabilities in relation to their involvement in the operation and management of the school canteen before they are allowed to retire and/or resign from government service, or transfer to other posts for purposes of re-assignment or promotion to a higher position. DepEd Order No. 17 s. 2005 8.1.3 no portion of the net income derived from the operation shall be set aside and in any manner in favor of regional/division /district office.