Uploaded by

Aryan Shenoy

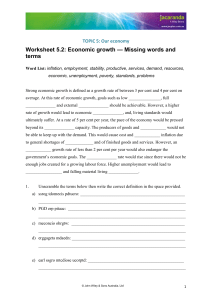

Economics Textbook Answers: Resources, Needs, Opportunity Cost

advertisement