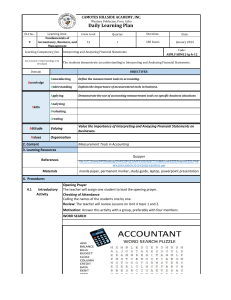

CAMOTES HILLSIDE ACADEMY, INC. Western Poblacion, Poro, Cebu Daily Learning Plan DLP No.: 9 Learning Area: Fundamentals of Accountancy, Business, and Management Grade Level: Quarter: Duration: Date: 12 I 180 hours January 2024 Code: ABM_FABM12-lg-h-12 Learning Competency/ies: Interpreting and Analyzing Financial Statements Key Concepts / Understandings to be Developed The students demonstrate an understanding in Interpreting and Analyzing Financial Statements. Domain OBJECTIVES: Remembering Define the measurement tools in accounting. Understanding Explain the importance of measurement tools in business. Applying Demonstrate the use of accounting measurement tools on specific business situations Knowledge Analyzing Skills Evaluating Creating Attitude Value the importance of Interpreting and Anayzing Financial Statements on businesses. Valuing Values Organization 2. Content Measurement Tools in Accounting 3. Learning Resources References Materials Quipper file:///C:/Users/HP/Desktop/CHA%20FILES/MY%20SUBJECTS/ABM/unit%205/lesson%201/FAB M%202%20SG%2012%20Q1%200501.pdf manila paper, permanent marker, study guide, laptop, powerpoint presentation 4. Procedures 4.1 Introductory Activity Opening Prayer The teacher will assign one student to lead the opening prayer. Checking of Attendance Calling the names of the students one by one. Review: The teacher will review Lessons on Unit 4 topic 1 and 2. Motivation: Answer this activity with a group, preferably with four members. WORD SEARCH 30 minutes Choose 3 words from the word search above and elaborate to the class your understanding about your chosen words. 4.2 Activity This activity is composed of 4 members. Analyze the situation and answer the questions that follow. Paul's Financial Growth for the Year Paul has finally closed his books for the year ended 2021 and is very happy to see the audited financial statements furnished to him by the external auditors. The balance sheet shows the following accounts for the years 2020 and 2021, respectively: From the supplementary report given by the accountant, Paul could measure the growth of assets and liabilities for the year 2021. He was able to establish that the total assets increased by a total of P21,000.00, and the total liabilities decreased by P45,000.00. Guide Question: 1. What accounts increased for Paul's 2021 operations? 2. What does the decrease in total liabilities mean for Paul's business? 25 4.3 20 4.4 3. Why is it important to measure such an increase or decrease in business? minutes Analysis minutes Abstraction The students will orally answer the guide question on the activity. (Integrated HOTS) MEASUREMENT TOOLS IN ACCOUNTING Once a company's financial statements are available for use by its intended users, the next step is to measure the results of operations based on the data presented in the financial statements for the period. This process is done using measurement tools typically utilized in accounting. Accounting data reflected in the financial statements will only be useful once an understanding of how to interpret and analyze them is attained. Interpretion and analysis of the financial statements involves analysis of data presented in three primary financial statements. Measurement tools are metrics used to measure or evaluate the productivity and performance of a business. These tools are used to assess information reported on the balance sheet, income statement, and cash flows. 60 minutes TYPES OF MEASUREMENT TOOLS USED IN ACCOUNTING Liquidity measures the ability of a business to meet and satisfy demands for cash arising from currently maturing obligations (Dauderis and Annand 2017). Assets are usually presented in terms of liquidity. We call such a presentation the order of liquidity, this is how assets are typically presented on the balance sheet. The order in which such assets are presented is based on the amount of time it will take to convert them into cash. Thus, cash is always presented first as it is readily available, and no further conversions are needed. Instruction Solvency is the ability of a business to meet its long-term debts and financial obligations. When a company is solvent, it mean it can achieve its long-term goals while meeting financial obligations in the conduct of its operations. A business is considered solvent whe its realizable value is greater than its liabilities. Coincidentally, a business is considered insolvent when its realizable value is lower than it total liabilities. Realizable value is simply the difference between total assets and total liabilities. Stability is the ability of a business to withstand financial imbalances from external factors. These factors may be consequences of the financial crisis on a domestic or even a global scale. Profitability To understand profitability, one must establish the difference between profit and profitability. These two terms, although closely related, are very distinct from each other. Profit is an absolute amount and is the desired bottom line of a business operations, while profitability is a relative level. Profitability is a measurement of business profits that quantifies them so that intended users can determine whether the achived level of profits justify the activities performed. Both exhibits show a profit amounting to P60,000.00 but differ in the amount of investment. When you consider the investments made and relate them to the resulting profit, you will be able to identify that Company A is more profitable than Company B. 4.5 Application Practice Your Skills Using the Measurement Tools Demonstrate how measurement tools can be used by answering the questions related to specific business scenarios. Provide a brief justification for your answers. 1. Suppose you are an officer of a financial institution. A company wants to take a shortterm loan that will mature in less than one year. What measurement tools is most appropriate in deciding whether you would approve the loan application or not? 2. Assume that you plan on taking a five-year loan; what measurement tool will be most appropriate in deciding whether it is wise to take the loan? 3. Should business owners give more emphasis on profit or profitability? Explain your answer. 25 minutes 4.6 Assessment A. True or False. Write true if the statement is correct. Otherwise, write false. Anlysis of Learners' Products 20 4.7 minutes Reinforcing / strengthening the day’s Study in advance Unit 5 Lesson 2. minute lesson Assignment 1 5. B. Matching Type. Match the words in Column A with the words in Column B. Remarks 6. Reflections A. No. of learners who earned 80% in the B. No. of learners who require additional E. Which of my learning strategies worked well? F. What difficulties did I encounter which my G. What innovation or localized materials did I Prepared: C. Did the remedial lessons work? No. of learners who have caught up with the lesson. D. No. of learners who continue to require remediation. Teacher