CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

CSCIE89 Final Project. Pastor, Marcos.

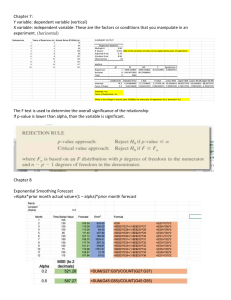

Fraud in credit card transactions.

Problem Statement.

Every card transaction submitted to the payment network for approval can potentially be a

fraudulent transaction, the business necessity to predict this feature is very high and the amount

of available data around the transaction and the billions of transactions submitted every day

makes this a very good candidate for a Machine Learning solution. Some of the available

business features that will help with this prediction are amount, card present versus remote, debit

or credit, expiration date, cardholder personal data…

Dataset:

The only public dataset that I found is a very well-known dataset in Kaggle with anonymized

credit card transactions. https://www.kaggle.com/mlgulb/creditcardfraud/downloads/creditcardfraud.zip/3

This dataset presents transactions that occurred in two days, where we have 492 frauds out of

284,807 transactions. The dataset is highly unbalanced, the positive class (frauds) account for

0.172% of all transactions.

The main constraint is that we lose all the possible business knowledge and intuition that can be

applied with the meaning of the original variables.

Hardware:

Intel Nuc7i7bnh, Intel(R) Core(TM) i7-7567U CPU @ 3.50GHz with 4 Cores, 32 GB DDR4

GTX 1070 Graphic Card GV-N1070IXEB-8GD eGPU

Software:

Ubuntu 18.04.2 LTS

Python 3.6.7, pip 19.1, venv with tensorflow-gpu==1.13.1 and many others

NVIDIA-SMI 418.43

Driver Version: 418.43

CUDA Version: 10.1

Strategy:

I’ll use a simple Sequential Deep Learning Network with Keras to predict the fraud transactions

and I’ll play with the hyperparameters to obtain the best possible solution. Because of the highly

unbalanced of the data, we’ll use the confusion matrix and the precision and recall for success

measurement.

I’ll also solve the same problem using Auto Encoders and compare the results, this will make the

final solution more robust to business questions. Auto Encoders provides a fresh view where the

network is trained only using normal transactions, and detecting the fraud is a high abnormal

value of the measurement of the distance between the original transaction and the reconstruction.

YouTube:

https://youtu.be/PSKYrhpp70g

https://youtu.be/VHPsXJePL_c

1

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

Problem understanding.

Any highly unbalanced problem has the main concern about predicting always the value with

bigger weight and get naive very good accuracy, in this example, if we take any percentage for

testing in a perfect linear way, and we always predict normal (not fraud) transaction, the

accuracy would be 1 – 0.00173 = 0.9983. The primary goal is to create a model that can predict

fraud transactions, improve the accuracy is not the goal. That’s the reason that we’re adding

precision and recall measures.

cc = pd.read_csv('creditcard.csv')

cc.head()

# visualize correlation between all variables

corr = cc.corr()

sns.heatmap(corr)

#Quick view of correlation between variable Class and rest ov variables sorted

2

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

corr.Class.sort_values()

No high correlation between any variables and Class, and the ones with some correlation don’t

have any special meaning, we can see also that Time and Amount won’t have any special impact

by themselves to predict a fraud transaction.

V17

-0.326481

V14

-0.302544

V12

-0.260593

V10

-0.216883

V16

-0.196539

V3

-0.192961

V7

-0.187257

V18

-0.111485

V1

-0.101347

V9

-0.097733

V5

-0.094974

V6

-0.043643

Time

-0.012323

V24

-0.007221

V13

-0.004570

V15

-0.004223

V23

-0.002685

V22

0.000805

V25

0.003308

V26

0.004455

Amount

0.005632

V28

0.009536

V27

0.017580

V8

0.019875

V20

0.020090

V19

0.034783

V21

0.040413

V2

0.091289

V4

0.133447

V11

0.154876

Class

1.000000

Name: Class, dtype: float64

Based in a simple manual observation of the data, we have 28 unknown variables result of a PCA

transformation that should be useful to predict the fraud or not of a transaction, the amount that

we’ll normalize to train the model, and time.

Time by itself don’t add a business intuition to make fraud decisions unless it’s tight to person by

person patterns, having only 2 days of information and with no information linked to specific

users, suggest that this variable could be not useful, we’ll drop it from the model.

Class is the dependent variable that we want to predict.

#Read the data, normalize amount, and drop original amount and time for now

cc['n_amount'] = StandardScaler().fit_transform(cc['Amount'].values.reshape(-1,1))

cc = cc.drop(['Amount'],axis=1)

cc = cc.drop(['Time'],axis=1)

cc.head()

3

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

Model sequential solution.

My first approach for the network architecture was a naive sequential architecture with fully

connected layers. In this case, we are ignoring that we almost don’t have any data for the fraud

transactions and in therory, it would be difficult for the network to learn how to differenciate the

normal from the fraud transactions.

The results were better than expected, the training was overall very fast and I adjusted the

network using the loss function, the activation function, the optimizer and trying diverse sizes of

a similar network architecture.

In order to compare different options and choose the network with the best performance, I was

using the loss of the training and the confusion matrix applied to the test dataset. I tried to use the

validation loss, but the model was not performing correctly.

my_pred = model.predict(x_test)

my_score = model.evaluate(x_test, y_test)

confusion_compare = (my_pred > 0.5)

cm = confusion_matrix(y_test, confusion_compare)

print(cm)

We’ll see in the next results of the different tests this type of confusion matrix:

[[a1 a2]

[b1 b2]]

a1 = transactions predicted as normal that were actually normal

b2 = transactions predicted as fraud that were actually fraud

a2 = false positive, transactions predicted as not-fraud that were actually fraud

b1 = false negative, transactions predicted as fraud that were actually not-fraud

The sizes that worked better for my network were with 64 and 128 neurons with 2 layers, and

128, 256 and 512 with 3 layers, some other sizes that I tried with 3 layers were 64-128-64 and

64-128-256.

I tested different activation functions, for example ReLU and LeakyRelu.

my_alpha = 0.05

model = Sequential()

model.add(Dense(128,input_dim=29))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(256))

model.add(LeakyReLU(alpha=my_alpha))

4

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

model.add(Dense(512))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(1,activation='sigmoid'))

model.compile(optimizer = 'adam', loss = 'binary_crossentropy', metrics =

['accuracy'])

LeakyRelu with alpha = 0.05

Epoch 48/100

227845/227845 [==============================] - 9s 38us/step - loss: 0.0016 - acc:

0.9998

Epoch 00048: early stopping

Confusion Matrix:

[[56829

[

26

30]

77]]

LeakyRelu with my_alpha

= 0.01

Epoch 37/100

227845/227845 [==============================] - 9s 38us/step - loss: 0.0016 - acc:

0.9997

Epoch 00037: early stopping

Confusion Matrix:

[[56850

[

27

9]

76]]

I also tested the model with RMSprop, Adam and Adagrad. RMSProp performed very poorly and

discarded in the first attempt. Adam was performing good, as we can see in the previous results,

but Adagrad was the one with better results in terms of loss and Confusion Matrix:

my_alpha = 0.01

model = Sequential()

model.add(Dense(128, input_dim=29))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(256))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(512))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(1,activation='sigmoid'))

model.compile(optimizer = 'adagrad', loss = 'binary_crossentropy', metrics =

['accuracy'])

Epoch 96/100

227845/227845 [==============================] - 8s 34us/step - loss: 1.3001e-04 acc: 1.0000

Epoch 00096: early stopping

Confusion Matrix:

[[56856

[

24

3]

79]]

Although the training seems not to be overfitting, we’ll test also adding a regularizer and check if

the model can train more epochs and learn better weights. Adding the regularizer to the 3 Dense

layers didn’t work as expected, the loss was having problems to keep going down and the

progress was slower than expected. I finally kept the regularizer in the last Dense layer and train

again:

my_alpha = 0.01

5

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

model = Sequential()

model.add(Dense(128, input_dim=29))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(256))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(512,kernel_regularizer = regularizers.l2(0.001)))

model.add(LeakyReLU(alpha=my_alpha))

model.add(Dense(1,activation='sigmoid'))

model.compile(optimizer = 'adagrad', loss = 'binary_crossentropy', metrics =

['accuracy'])

Results after 200 epochs:

Epoch 100/100

227845/227845 [==============================] - 9s 38us/step - loss: 5.6172e-04 acc: 0.9999

Confusion Matrix:

[[56854

[

24

5]

79]]

Results after 400 epochs:

Epoch 200/200

227845/227845 [==============================] - 8s 35us/step - loss: 3.0213e-04 acc: 1.0000

Confusion Matrix:

[[56854

[

24

5]

79]]

I concluded that regularization is not adding any value and we can obtain the same results faster

with less training if we remove the regularization.

Now I’ll try again previous training with 200 epochs, increasing the patience for early stopping

to 30 steps and using the parameter restore_best_weights = True to see if we can improve the

results. Actually, the resulst were slightly interesting:

Epoch 200/200

227845/227845 [==============================] - 8s 35us/step - loss: 1.7455e-04 acc: 1.0000

Confusion Matrix:

[[56850

[

22

9]

81]]

Classification Report:

precision

0

1

1.00

0.90

recall

1.00

0.79

f1-score

support

1.00

0.84

56859

103

I finally decided that although the given time variable makes no sense, none of the others have

also any meaning, therefore I kept the same network architecture, I normalized time and I

6

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

repeated the training. The results are one of the best after training, but the differences are not

significant:

Epoch 200/200

227845/227845 [==============================] - 7s 33us/step - loss: 1.5835e-04 acc: 1.0000

Confusion Matrix:

[[56857

[

26

2]

77]]

Classification Report:

precision

recall

f1-score

support

0

1

1.00

0.97

1.00

0.75

1.00

0.85

56859

103

micro avg

macro avg

weighted avg

1.00

0.99

1.00

1.00

0.87

1.00

1.00

0.92

1.00

56962

56962

56962

Autoencoder solution.

An alternative approach would be to think that the fraud transactions are anomalies and look for

a solution based in autoencoders detecting the anomalies during the reconstruction.

During this approach, I will train the network only using normal transactions, and therefore,

we’ll have a model that should be able to reconstuct as close as possible only normal

transactions.

The goal is in the validation phase, feed into the network normal and fraud transactions, if the

model performs correctly, it should be able to reconstruct normal transactions very good, but

when the model tries to reconstruct a fraud transactions, it should perform worse, therefore we

can measure the distance between the reconstructed transaction and the original transactions, and

above certain threshold, decide that a transactions is an anomaly and therefore is fraudulent.

I kept all the hyperparameters and decisions used for the Sequential model, our optimizer is

Adagrad, I tested both loss = ‘binary_crossentropy’ and ‘mse’, in theory, ‘mse’ should perform

better, but that was not the case, although the difference is not significant. The values of loss are

cominn negatives, I can solve it using ‘mse’ instead of ‘binary_crossentropy’, but the

performance is worse.

I first tested with activation=’relu’ and later with activation=’LeakyReLU’, I didn’t find any

improvement as I found out in the Sequence model. Actually, the implementation of LeakyReLU

is completely different, because it has to be added as a new layer on top of the Dense layer.

I trained the network with several sizes fot the encoder layers, the one that got better results is

the one with encoded layers with sizes 25, 20 y 15, the input layer had 30 values.

7

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

Steps to prepare the data:

#separate data for training and validation,

normal_train = cc[cc.Class == 0]

fraud = cc[cc.Class == 1]

#we only want to train in the normal transactions

x_train_n, x_test_n = train_test_split(normal_train, test_size = 0.2,

random_state=mpg_seed)

x_train = x_train_n.drop(['Class'], axis =1)

x_test = x_test_n.drop(['Class'], axis =1)

# for the reconstruccion we'll combine normal and fraudulent transactions, the model

should be able to detect the

#anomaly of the fraud transactions

xf_test = x_test_n.append(fraud)

# TODO we need to shuffle, separate the Class with 1 and 0 for reconstruccion and

compare

xf_test = shuffle(xf_test)

y_test = xf_test.Class

xf_test = xf_test.drop(['Class'], axis =1)

xf_test.head()

#double check that index is the same

y_test.head()

134042

0

148874

0

147169

0

96893

0

101213

0

Name: Class, dtype: int64

Training looping over different sizes:

input_dim = 30

# possible sizes of our encoded representations

encoding_dims = [27, 25]

encoding_dims_2 = [22, 20]

encoding_dims_3 = [18, 15]

#placeholders

encoding_dim = 20

encoding_dim_2 = 15

encoding_dim_3 = 10

#parameter for LeakyRelu

my_alpha = 0.01

epochs = 100

#to accumulate and compare

id_r, decod_r, xf_r, hist_r = [], [], [], []

#lopp to repeate trainings using different sizes

for encoding_dim in encoding_dims:

for encoding_dim_2 in encoding_dims_2:

for encoding_dim_3 in encoding_dims_3:

8

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

# this is our input placeholder

input_img = Input(shape=(input_dim,))

# "encoded" is the encoded representation of the input

encoded = Dense(encoding_dim)(input_img)

encoded_2 = Dense(encoding_dim_2)(LeakyReLU(alpha=my_alpha)(encoded))

encoded_3 = Dense(encoding_dim_3,

activity_regularizer=regularizers.l1(10e-5))(LeakyReLU(alpha=my_alpha)(encoded_2))

# "decoded" is the lossy reconstruction of the input

decoded_3 = Dense(encoding_dim_2)(LeakyReLU(alpha=my_alpha)(encoded_3))

decoded_2 = Dense(encoding_dim)(LeakyReLU(alpha=my_alpha)(decoded_3))

decoded = Dense(input_dim,

activation='sigmoid')(LeakyReLU(alpha=my_alpha)(decoded_2))

# this model maps an input to its reconstruction

autoencoder = Model(input_img, decoded)

print(autoencoder.summary())

autoencoder.compile(optimizer='adagrad', loss='binary_crossentropy',

metrics=['mae'])

early_stopping = EarlyStopping(monitor='loss', min_delta=0, patience=10,

verbose=1, mode='auto')

hist = autoencoder.fit(x_train, x_train,

epochs=epochs,

batch_size=256,

shuffle=True,

validation_data = (x_test, x_test),

callbacks=[early_stopping])

id_str = 'auto_encoder'+str(encoding_dim)+'_'+str(encoding_dim_2) +

'_'+str(encoding_dim_3)+ \

'_'+str(epochs)+'_lrelu_bin_cross.h5'

autoencoder.save_weights(id_str)

decoded_imgs = autoencoder.predict(xf_test)

decod_r.append(decoded_imgs)

xf_r.append(xf_test)

id_r.append(id_str)

hist_r.append(hist)

The complexity now would be to define the treshold when a transaction would be fraud because

its reconstruccion has a large distance of the original values.

Let’s reconstruct the values for all the testing dataset that was including about 20% of the normal

transaction + all the fraud transactions.

For every reconstruccion, lets calculate the distance with the original value, and then we’ll order

the results descending by distance. Instead of deciding a threshold value, we make the decision

of compare our results with the 500 transaction with larger distance.

ind =0

for dd in decod_r:

mse_dd = np.mean(np.power(xf_r[ind] - dd,2), axis =1)

mse_test_label_dd = pd.DataFrame({"mse":mse_dd, "Class":y_test})

mse_test_label_sort = mse_test_label_dd.sort_values("mse", axis = 0, ascending =

False)

print(len(mse_test_label_sort.head(500)[mse_test_label_sort["Class"]==1]), ind,

id_r[ind])

ind = ind + 1

221 0 auto_encoder27_22_18_100_lrelu_bin_cross.h5

219 1 auto_encoder27_22_15_100_lrelu_bin_cross.h5

9

CSCIE89 – Fraud in Credit Card Transactions | Marcos Pastor

217

223

222

219

223

224

2

3

4

5

6

7

auto_encoder27_20_18_100_lrelu_bin_cross.h5

auto_encoder27_20_15_100_lrelu_bin_cross.h5

auto_encoder25_22_18_100_lrelu_bin_cross.h5

auto_encoder25_22_15_100_lrelu_bin_cross.h5

auto_encoder25_20_18_100_lrelu_bin_cross.h5

auto_encoder25_20_15_100_lrelu_bin_cross.h5

We know that we have fraud 492 transactions, therefore, for the case with the best results:

True positives = 224

False positives = 500 – 224 = 276

False negatives = 492 – 224 = 268

Precision = 224 / 500 = 0.448

Recall = 224 / 492 = 0.455

Although this methodology could work in theory, the results demonstrate that performs quite

worse than our sequence model.

10