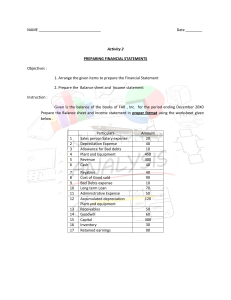

ASSESSMENT ACTIVITY (ANSWER KEY) TRUE OR FALSE 1. The balance sheet is also known as the statement of financial position. Answer: True 2. Worksheets include account titles, trial balance, adjusting entries, adjusted trial balance, net income, and balance sheet. Answer: True 3. The purchase of equipment is an example of a financing activity. Answer: False (Investing Activity) 4. Depreciation Expense is found on the balance sheet. Answer: False (Income Statement) 5. The worksheet is a type of accountant’s working paper. Answer: True MULTIPLE CHOICE 1. Which of the following types of information is not found in the financial statements? a. Profits b. Revenue c. Selling prices d. Assets 2. Which of the following is a cash inflow from financing activities? a. Receipts from collections of notes receivable. b. Receipts from interest on notes receivable. c. Receipt from issuance of notes payable. d. Receipt from sale of property and equipment. 3. Which column of the accounting work sheet show unadjusted amounts? a. Trial Balance b. Adjustments c. Income Statement d. Balance Sheet 4. Which situation indicates a loss on the income statement? a. Total debits equals total credits b. Total credits exceed total debits c. Total debits exceed total credits d. None of the above PROBLEM Worksheet Extensions Classify each of the accounts listed below as assets (A), liabilities (L), owner’s equity (OE), revenue (R), or expense (E). Indicate the normal debit or credit balance of each account. Indicate whether each account will appear in the Income Statement columns (I) or the Balance Sheet columns (B) of the worksheet. Account Classification Normal Balance Income Statement or Balance Sheet Columns Example: Rent Expense E Debit I A Debit B b. Depreciation Expense- E C. eqpt. Debit I c. Accounts Payable L Credit B d. Supplies A Debit B e. Computer Equipment A Debit B Credit B g. Accum. Depreciation- A C. Eqpt. Credit B h. Christopher Withdrawals Debit B a. Accounts Receivable f. Christopher Capital Biore, OE Biore, OE i. Consulting Revenues R Credit B j. Prepaid Insurance L Credit I Worksheet Preparation The May 31, 2019 trial balance Rosalina Besario Surveyors is presented as follows: Rosalina Besario Surveyors Trial Balance May 31, 2019 Cash Accounts Receivable Prepaid Expense Supplies Equipment Acc Depreciation – Equipment Accounts Payable Unearned Revenues Notes Payable Besario, Capital Besario, Withdrawals Service Revenues Salaries Expense Rent Expense Insurance Expense Utilities Expense Miscellaneous Expense TOTALS P210,000 930,000 360,000 270,000 1,890,000 P640,000 190,000 120,000 500,000 1,120,000 700,000 6,510,000 3,270,000 960,000 250,000 160,000 80,000 P9,080,000 P9,080,000 The following information pertaining to the year-end adjustments is available: a. The 360,000 prepaid expense represents expenditure made on January 1, 2019 for monthly advertising over the next 18 months. Advertising Expense P100,000 Prepaid Expense P100,000 b. A count of the supplies at May 31, 2019 amounted to P90,000. Supplies Expense P180,000 Supplies P180,000 c. Depreciation on equipment amounted to P160,000. Depreciation Expense P160,000 Acc. Depreciation P160,000 d. One third of the unearned revenues has been earned at year end. Unearned Revenue P40,000 Service Revenue P40,000 e. At year end, salaries in amount of P140,000 have accrued. Salaries Expense P140,000 Acc. Salaries Payable P140,000 f. Interest of P60,000 on the notes payable has accrued at year end. Interest Expense P60,000 Acc. Interest Payable P60,000 Required: Prepare the adjustments on the worksheet and complete the worksheet.