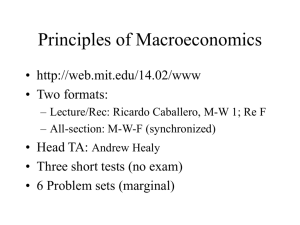

Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f 1. T/F. A vacant and unused lot is an ordinary asset to a T real estate dealer. 2. T/F. For taxpayers no engaged in business, assets T shall cease to be ordinary assets when they are discontinued from active use for more than two years. 3. Real and other properties acquired are ordinary as- T sets to banks even if they are not engaged in the realty business. 4. T/F. Capital assets will not become ordinary assets when used in business. F 5. T/F. An ordinary asset becomes automatically become F a capital asset when it is withdrawn from active use. 6. T/F. The sale of real property capital assets will never F be subject to regular income tax. 7. T/F. Donated assets become ordinary assets even if donee do not employ the same in business F 8. T/F. An ordinary asset continues to be an ordinary asset even if idled for more than two years if the taxpayer is engaged in realty business. T 9. T/F. The real properties used by exempt corporation in T their exempt operations are capital assets. 10. T/F. Dealers in realties are subject to the regular tax on T their sale of properties. 11. T/F. Capital gains from assets other than domestic stocks and real properties are subject to regular income tax. T 12. T/F. Dealers in securities are not subject to the stock T transaction tax but are subject to the regular income 1 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f tax on gains realized upon the sale of stocks through the Philippine Stock Exchange. 13. T/F. Unit of participations in golf, polo, and similar clubs are considered domestic stocks. T 14. T/F. The excess premium on the re-issuance o treasury stocks is subject to capital gains tax. F 15. T/F. The issuance of shares of stock for property is subject to capital gains tax. F 16. T/F. The sale of foreign stocks directly to a buyer is subject to capital gains tax. F 17. T/F. The two-tiered final tax cannot apply unless and T until there is a gain on the sale, exchange, and other disposition of stocks directly to a buyer. 18. T/F. The stock transaction tax on the sale of stocks F through the PSE cannot apply unless there is a gain on the transaction. 19. T/F. The 6% capital gains tax cannot apply unless there F is a gain on the sale of real property. 20. T/F. The sale of real properties located abroad is sub- F ject to the 6% capital gains tax. 21. T/F. The annual capital gains tax return is simultane- T ously due with the annual regular income tax return. 22. T/F. The basis of properties received by way of inheri- F tance is the basis in the hands of the last owner who did not acquire the same by donation. 23. T/F. When specific identification is impossible, the F cost of the stocks sold is determined by the weighted average method. 2 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f 24. T/F. The basis of stocks received in tax-free exchanges F is the basis of the shares given. 25. T/F. The transactional capital gains tax return is reT quired to be filed within 30 days from the date of sale. 26. T/F. The gain on sale of stocks for stocks pursuant T to a plan of merger and consolidation es exempt if it resulted in the transferor acquiring corporate control over the absorbed corporation. 27. T/F. Installment payment of capital gains tax is allowed F if the ratio of downpayment over the selling price of the sale does not exceed 25%. 28. T/F. The selling price is used to determine the proT priety of using the installment method but the contract price is used to determine the capital gains tax payable in installment. 29. T/F. The excess of mortgage over the basis assumed F by the buyer constitutes an indirect receipt which is part of the initial payment and selling price. 30. T/F. Wash sales occur when there is a repurchase of T shares within 30 day before and 30 days after the date of disposal of securities at a loss. 31. T/F. Control means more than 50% ownership in the voting power of a corporation. T 32. T/F. The sale of delisted stocks is subject to stock transaction tax and not to capital gains tax. F 33. T/F. Gain and loss in a share-for-share swap pursuant T to a plan of merger or consolidation shall be recognized up to the extent o the cash and other properties received. 34. T 3 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f T/F. The sale by the National Housing Authority of commercial lots is subject to capital gains tax. 35. T/F. If the assessor's fair value is lower than the selling F price, then the air value o the property is the zonal value. 36. T/F. Title to a property shall not be registered by the T Registry of Deeds unless the Commissioner or his representatives ahas certified that the tax on he transfer has been paid. 37. T/F. Domestic corporations are exempt from capital F gains tax on the sale, exchange, and other disposition of real properties. 38. T/F. The sale of land pursuant to the Agrarian Reform T program is exempt from capital gains tax. 39. T/F. Foreign corporations are required to pay capital F gains tax on the sale of domestic stocks and on the sale of real property capital assets. 40. T/F. The alternative taxation on an expropriation sale T is not applicable to corporate taxpayers. 41. Which is an ordinary asset? A. Personal car B. Delivery truck C. Principsl residence of the taxpayer D. Wedding ring of the taxpayer C 42. Which is not an ordinary asset? A. Personal laptop of the taxpayer B. Machineries and equipment C. Real property held for sale D. Leasehold improvements A 43. Which is a capital asset to a realty developer? A. Construction equipment C 4 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f B. Domestic stocks C. Vacant lot for future development D. Head office building of the developer 44. Which is an ordinary asset? A. Home appliances B. Personal car C. Personal cellphone D. Offices supplies D 45. Which of the following assets, if not used in business, D is subject to regular tax? A. Real property B. Domestic stocks rights C. Domestic stocks option D. Taxpayer's personal car 46. Which is a capital asset for a security dealer? A. Domestic stocks B. Domestic bonds C. Real property held for speculation D. Office equipment C 47. Which is subject to the 5%-10% capital gains tax? A A. Sale of domestic stocks directly to a buyer within or outside the Philippines B. Sale of domestic bonds directly to a buyer within the Philippines C. Sale of domestic stocks through the Philippine Stock Exchange D. All of the above 48. Who is not subject to capital gains tax on the sale of C domestic stocks directly to a buyer? A. Dealer of cars B. Real property developer C. Dealer of securities D. Realty dealer 49. D 5 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f Which of the following when sold, is not subject to capital gains tax? A. Boarding house B. Warehouse C. House and lot D. A and B 50. Which is not subject to the 6% capital gains tax? A A. Donation of property B. Foreclosure of a mortgaged property C. Expropriation of one's property in favor of the government D. Sale of property for an insufficient consideration 51. Statement 1: capital gains may arise from sale, exC change, and other disposition of movable properties used in business Statement 2: ordinary gains may arise from sale, exchange, and other disposition of real properties not used in business. Which is true? A. Statement 1 is correct B. Statement 2 is correct C. Both statement are false D. Both statement are correct 52. S1: the gain on sale of domestic stocks directly to a D buyer is presumed. S2: the gain on sale of real properties is presumed. Which of the following is correct? A. Both statement are true B. Both statement are false C. Only S1 is true D. Only S2 is true 53. Which of the following properties when sold may be A subject to capital gains tax? A. Domestic stocks 6 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f B. Foreign stocks C. Patent D. Office buildings 54. S1: only depreciable assets of business qualifies as D ordinary assets. S2: land used in business is a capital asset since it is not subject to depreciation. which of the following is correct? A. S1 is false B. S2 is false C. Both statements are false D. A, B and C 55. S1: ordinary gains may arise from, sale, exchange, and C other dispositions of real properties used in business. S2: capital gain may arise from sale, exchange, and other dispositions of real properties not used in business. Which is false? A. S1 is correct B. S2 is correct C. Both statement are false D. Both statement are correct. 56. Which of the following properties, when sold, may be D covered by regular income tax? A. Share options B. Preferred stocks C. Share warrants D. Promissory notes 57. Which of the following assets may be subject to capi- C tal gains tax upon disposal? A. Parking lot B. Dormitory C. Farm lot D. Office supplies 7 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f 58. The sale of an office building will be subject to A. 60% of 1% percentage tax B. 6% capital gains tax C. 15% capital gains tax D. Any of these D 59. The term "other disposition" covers A. Foreclosure sales B. Auction sale C. Expropriation by the government D. Any of these D 60. Which of the following sales of domestic stocks is C subject to capital gains tax? A. Sale of domestic stocks through the PSE B. Issue of domestic stocks to subscribers C. Sale of domestic stocks directly to a buyer D. Exchange of stocks for stocks in a corporate merger 61. The sale of listed shares will never be subjected to A. 6% capital gains tax B. 60% of 1% percentage tax C. 15% capital gains tax D. Any of these A 62. The sale of non-listed shares may be subjected to A. 6% capital gains tax only B. 60% of 1% percentage tax only C. 15% capital gains tax only D. Any of these C 63. Which of the following when sold may be exempted form the 6% capital gains tax? A. Unused land to the government B. Residential lot C. Developed residential properties for sale D. Principal residence D 8 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f 64. S1: the sale or exchange must result to an actual gain C before the 15% capital gains tax is imposed. S2: the sale or exchange must result to an actual gain before the 6% capital gains tax is imposed. A. Both statement are correct B. Both statement are incorrect C. Only statement 1 is correct D. Only statement 2 is correct 65. When the annualized capital gains tax exceeds the transactional capital gains tax, the excess is a A. Tax credit B. Tax payable C. Tax refundable D. A or B B 66. S1: properties acquired by real estate dealers are or- D dinary assets. S2: properties of real estate dealers continue to be classified as ordinary assets even if they change the nature of their business. A. First statement is correct B. Second statement is correct C. Neither statement is correct D. Both statement are correct 67. S1: when realty businesses discontinue use of assets D for more than two years, the same shall be reclassified as capital assets S2. When realty businesses discontinue use of assets for more than two years, the same shall be reclassified as capital assets. 68. Which is an incorrect statement? A A. The capital gains tax on the disposition of capital stock presumes the existence of gain on the sales transaction. B. The buyer of real property capital asset shall with9 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f hold the tax at source and remit the same to the government. C. Capital gains tax is identified under the NIRC as a form of final tax. D. The capital gains tax on the disposition of real property presumes the existence of gain on the sales transaction 69. Which of these shall pay the two-tiered capital gains D tax? A. A real property developer B. A dealer in stocks C. A merchandiser or trader of goods D. A or B 70. The sale of teal properties which would otherwise be B subject to the 6% capital gains tax may nevertheless be subject to regular income tax if all of the following conditions are met, except one. Which is the exception? A. The seller must be an individual taxpayer B. The sales involves the principal residence of the taxpayer C. The buyer is the government D. The taxpayer opted to be subjected to regular tax 71. Which of these pay the 6% capital gains tax? A. Security dealer B. Real property dealer C. Real property developer D. None of these A 72. The sale of a principal residence is exempt from the B capital gains tax if all of the following conditions are met, except A. The proceeds is fully utilized in acquiring a new principal residence. B. The reacquisition must be by purchase. c. The reacquisition must have been made withhin 18 10 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f months from the date of sale D. The capital gains tax must be deposited in escrow. 73. The transactional 15% capital gains tax is to be paid A A. Within 30 days from the date of sale or exchange B. Within 30 days from the end of month of sale C. On the 15th day of the fourth month following the close of the quarter when the sale was made D. On the 15th day of the fourth month following the taxpayer's year-end. 74. The annual 15% capital gains tax return is due C A. Within 30 days from the end of the month of sale B. Within 30 days from the date of sale or exchange C. On or before the 15th day of the fourth month following the taxpayer's year. D. On or before the 15th day of the fourth month following the close of the quarter when the sale was made 75. Capital gains tax that is not payable on installment A basis is due A. Within 30 days from the date of sale or exchange B. Within 30 days from the end of month of sale C. On or before the 15th day of the fourth month following the close of the quarter when the sale was made D. On or before the 15th day of the fourth month following the taxpayer's year end 76. Installment payments of the 6% capital gains tax is due A. Within 1 days from the date of each installment payment. B. Within 30 days from the date of each installment payment. C. Within 15 days from the date of each installment payment. D. Within 20 days from the date of each installment payment. 11 / 14 B Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f 77. The installment payment of capital gains tax is applic- C able to the A. 15% capital gains tax only B. 6% capital gains tax only C. Both a and b D. Neither a or b 78. The installment payment of capital gains tax is applic- D able to A. Individual taxpayers only B. Corporate taxpayers only C. Dealers in properties only D. A or B 79. Which of these capital gains is subject to capital gains A tax? A. Gain on the sale of stock rights B. Gain on sale of interest in a professional partnership C. Gain on the sale of derivative financial instruments linked to commodity prices D. Gain on sale of bonds 80. Paulo indicated in his return his intent to avail of the D exemption from the 6% capital gains tax. Under what condition will he be exempted? A. When the proceeds of the sale exceeds the cost basis of the property sold B. When the proceeds of the sale exceeds the acquisition price of the new residence C. When the cost basis of the property sold exceeds its selling price D. When the acquisition price o the new property exceeds the proceeds of the old property sold 81. Partial taxation under the 6% capital gains tax will C result when A. The proceeds from the sale of the old property exceeds both its cost and the acquisition price of the 12 / 14 Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f new property. B. The proceeds of the sale exceeds its zonal value and assessor's fair value. C. The proceeds of the old property exceeds the acquisition price of the new property regardless of the tax basis, zonal value, and assessor's fair value of the old property. D. The zonal vlaue is greater than the sales proceeds of the old property. 82. The transactional capital gains tax in domestic stocks D is A. Not a final tax B. Included in the income tax return C. Creditable to the regular income tax D. Creditable to the annual capital gains tax due 83. The 15% capital gains tax does not apply to A. Resident citizen dealers of stocks B. Non-resident citizen dealers of cars C. Resident alien dealers of computer parts D. Domestic corporations dealing in real properties A 84. The documentary stamp tax on the sale of domestic B stocks directly to a buyer is based on A. Selling price B. Par value C. Fair value D. Cost 85. The documentary stamp tax on the sale of real prop- D erty lis based on A. Selling price B. Fair value C. Cost D. A or , whichever is higher 86. The 6% capital gains tax does not apply to A. Domestic corporations B. Resident aliens 13 / 14 D Income taxation C6 (theory) Study online at https://quizlet.com/_9o9w9f C. Non-resident citizen D. Foreign corporations 87. Who shall file the capital gains tax return for the sale, A exchange, and other disposition of real property? A. Seller B. Buyer C. Transfer agent D. The registry of deeds 14 / 14