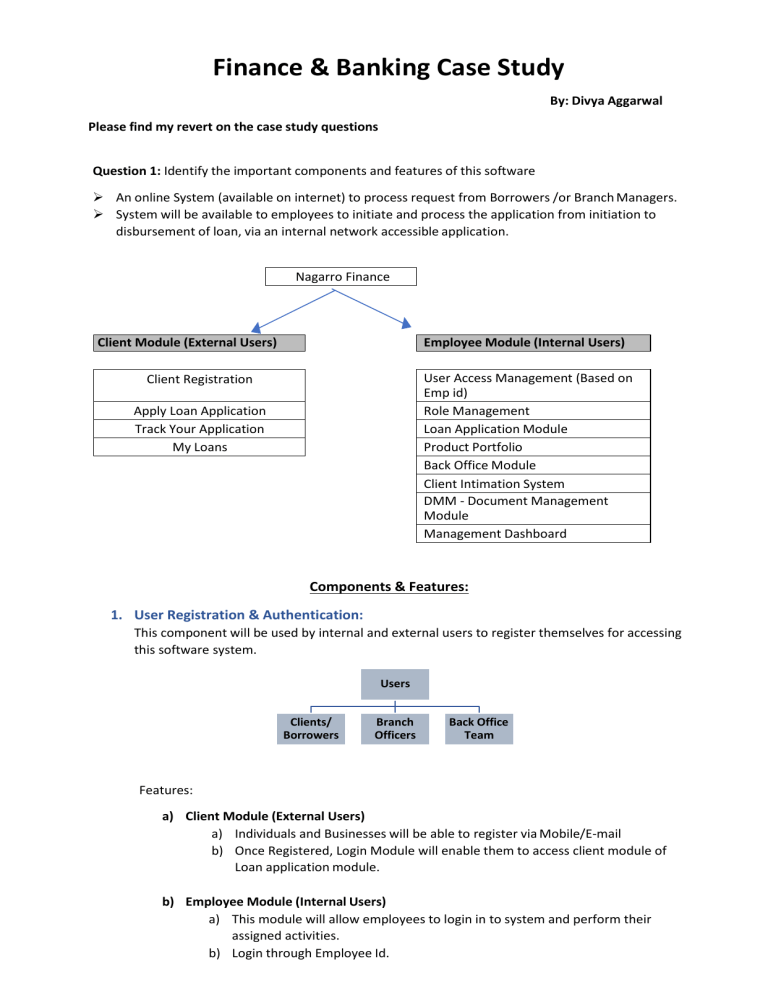

Finance & Banking Case Study By: Divya Aggarwal Please find my revert on the case study questions Question 1: Identify the important components and features of this software An online System (available on internet) to process request from Borrowers /or Branch Managers. System will be available to employees to initiate and process the application from initiation to disbursement of loan, via an internal network accessible application. Nagarro Finance Client Module (External Users) Employee Module (Internal Users) User Access Management (Based on Emp id) Role Management Loan Application Module Product Portfolio Back Office Module Client Intimation System DMM - Document Management Module Management Dashboard Client Registration Apply Loan Application Track Your Application My Loans Components & Features: 1. User Registration & Authentication: This component will be used by internal and external users to register themselves for accessing this software system. Users Clients/ Borrowers Branch Officers Back Office Team Features: a) Client Module (External Users) a) Individuals and Businesses will be able to register via Mobile/E-mail b) Once Registered, Login Module will enable them to access client module of Loan application module. b) Employee Module (Internal Users) a) This module will allow employees to login in to system and perform their assigned activities. b) Login through Employee Id. c) Role Management: This module will allow creation/assignment of access-based roles for internal employees a) Branch Officers b) Back Office Team 2. Loan Application Module (LAM): This component is used to raise and track loan application. This flow for this module will start from applying loan till disbursement, to tracking of loan details post disbursement. This module will be used by Client Internet Module, Branch Officers and by Back office teams. TAT for each process step will be configured. In case of breach, mails/reminders will be sent as per defined escalation matrix. Client Module Accessible over Internet to external clients/borrowers Users can initiate new loan application Allows to upload required document Allows to track application status My Loans Module: Made avalaible list of all active/inactive loans, repayment facility, NOC statement, EMI schedule reports etc Branch Officers Module Accessible over Internet as well as LAN to branch front endofficers Allows to initiate new loan application on behalf of External Users Allows to upload required document Allows scanning of documents which will be sent to back-office team. Back Office Module Accessible over Organizational network Accessible to Back-office team for verification of documents and processing of loan application documents Communicate back if any discrepancy found Facility to issue sanction leter Disbursement Module - To release funds to customer accounts. 3. Product Portfolio: This component is available to internal users to maintain the list of services being offered to customers e.g. Home Loan, Car Loan etc Features: a) Allows Admin team to manage (add, remove or update) list of services being offered b) Allow user to configure details for each service being offered eg. Rate of Interest, Type of Loans etc c) Enabling/disabling services at customer, geographical levels. 4. Document Management Module (DMM): This component is used to maintain repository for all documents uploaded/processed for each loan application. This will be tightly integrated with Loan Application Module at each level. Features: a) b) c) d) Central Repository of all uploaded documents List of all required documents w.r.t. to each service. KYC and other legal check norms. Ensures document is available in Client Module, Branch Officers Module and to Back-office team which will help them in processing of loan application. 5. Client Intimation Module: This component is used to communicate or notify the status of application via Email/Message various time to time Features: a) Email/text message on submission of application b) Email/text message on approval/rejection of application c) Email/text message if any further information is required in reference to application 6. Management Dashboard: This component will allow Senior Management to track various metrics of the business/branch operations Features: a) Dashboard for Management team/ Branch officials to see pending and complete cases in form of MIS Reports b) Graphs and pictorial representations for easy information c) Reports for outliers and processes which are taking more time Question 2: As part of your analysis, you may have questions which will help you design the solution. List such questions wherever necessary? Please find below my set of questions: 1. What is the current process being followed by the organization? 2. Is there any system currently available or manually processing the complete activities? 3. What are the features present in current system? 4. Existing Data needs to be migrated? 5. What would be the expected customer/Employee base? 6. Any preference on which platform the new software should be developed like web /mobile? 7. What are all documents required to apply for loan, is there any standard format? 8. How pending requests are being tracked at Branch, Zones and company level? 9. What matrices are currently being used to track Branch performance? 10. List of validations required in the system for each module? 11. If Lead Generation system required to be incorporated in Client Module? Question 3: While defining the solution, you may need to make certain assumptions. State those assumptions clearly? Below are the assumptions made while proposing the solution: 1. System is designed with assumption that company have its own Data Center and internal network already in place. So, application will be hosted on servers at Data centers. 2. Maker – Checker concept is required at each step 3. Branches office will act as front end for collecting loan processing documents. All the documents will be verified and all loan processing and approval workflow will be managed by back-office teams which may not be at the same geographical location of branch. 4. Admin Teams will manage and configure all the list of services/loans offered by company Question 4: For any one scenario, draw a Wireframe and write a use case? Scenario: User Registration Use Case: User Registration Goal: Signup user for new account Main Success Scenario: 1. Customer clicks on signup on Login page. 2. User fills in mandatory information. 3. System runs required validations on each field. 4. Users chooses a password (Must qualify the strength and password rules). 5. User re-enters the password. 6. System runs required validations on password. 7. System gives confirmation and moves user to next screen for KYC document upload. 8. User uploads/scans the required documents. 9. System confirms the submission and shows verification pending in a tracker. 10. Back-office team open the system and checks the pending KYC verification items. 11. Back office approves the KYC. 12. Tracker shows status in customer login and customer receives an email notification. KYC Rejection Scenario: 1. Customer clicks on signup on Login page. 2. User fills in mandatory information. 3. System runs required validations on each field. 4. Users chooses a password (Must qualify the strength and password rules). 5. User re-enters the password. 6. System runs required validations on password. 7. System gives confirmation and moves user to next screen for KYC document upload. 8. User uploads/scans the required documents. 9. System confirms the submission and shows verification pending in a tracker. 10. Back-office team open the system and checks the pending KYC verification items. 11. Back office rejects the KYC. 12. Tracker shows status in customer login and customer receives an email notification. WIREFRAMES: Attached in separate PDF