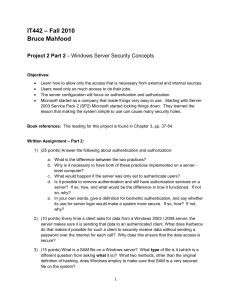

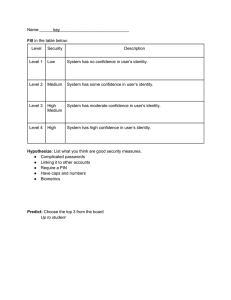

Design Brief: Secure Savings+ 1. Product Overview Product Name: Secure Savings+ Project Objective: Develop a comprehensive savings solution that integrates advanced technology with traditional banking services to meet the evolving needs of modern consumers. Background In today's digital world, the landscape of financial security is constantly evolving. Cybercriminals are becoming increasingly sophisticated, exploiting vulnerabilities to access and steal personal information. Traditional security measures like simple passwords and single-factor authentication are no longer sufficient. This creates a dilemma for savers: prioritizing security often comes at the expense of convenience, leading to frustration and a less than ideal user experience. Secure Saving+ aims to bridge this gap, offering a solution that is both secure and user-friendly. 2. Target Audience Demographic: Primarily Millennials and Gen Z, tech-savvy individuals who prioritize convenience and security in their banking experience. Psychographic: Customers who value financial empowerment, personalized services, and seamless digital experiences. 3. Product Description Secure Savings+ is a digital savings solution offered by our bank that aims to revolutionize the way customers save money. It combines innovative features such as biometric authentication, personalized savings goals, round-up savings, high-interest savings account, financial education tools, and a customer rewards program to provide a secure, convenient, and rewarding savings experience. Secure Saving+ represents a paradigm shift in the way we think about saving money. It's a mobile application that prioritizes both security and convenience. The app employs the latest advancements in cybersecurity, including multi-factor authentication and biometric verification, to provide robust protection against unauthorized access. This multi-layered approach significantly reduces the risk of fraud and ensures your hard-earned savings remain safe. Additionally, the app boasts an intuitive and user-friendly interface, allowing you to effortlessly manage your account, track your progress, and make transactions – all from the comfort of your smartphone. 4. Key Features Multi-factor authentication (MFA): Requires multiple verification steps beyond a simple password, adding an extra layer of protection. Biometric Authentication: Ensure secure access to accounts using fingerprint or facial recognition. Advanced encryption: Employs industry-standard encryption methods to safeguard your data both in transit and at rest. Personalized Savings Goals: Allow customers to set and track their savings goals based on their financial aspirations. Round-Up Savings: Automatically round up purchases and transfer the spare change to savings. High-Interest Savings Account: Offer competitive interest rates to accelerate savings growth. Financial Education Tools: Provide resources to improve financial literacy and decision-making. Customer Rewards Program: Incentivize saving with cashback rewards and discounts. 5. Design Requirements User-Friendly Interface: Design an intuitive and visually appealing interface for the Secure Savings+ mobile app and online platform. Seamless Integration: Ensure seamless integration with existing banking systems and processes to provide a cohesive user experience. Security: Implement robust security measures, including encryption and biometric authentication, to protect customer data and funds. Accessibility: Ensure accessibility for customers of all abilities by adhering to accessibility standards and guidelines. Personalization: Enable customers to customize their savings goals and preferences to suit their individual needs and preferences. 6. Branding Guidelines Brand Identity: Maintain consistency with the bank's brand identity, including logo, colors, typography, and tone of voice. Brand Values: Reflect the bank's commitment to trust, reliability, innovation, and customer-centricity in the design of Secure Savings+. Brand Experience: Create a seamless and memorable brand experience that resonates with customers and reinforces their trust in the bank. 7. Timeline The project timeline will be divided into distinct phases, including design, development, testing, and launch. A detailed project schedule will be established to ensure timely completion of each phase, with regular progress updates and milestone reviews. 8. Budget Sufficient resources will be allocated, including funding, personnel, and technology infrastructure, to support the development and launch of Secure Savings+. Monitor and track project expenses to ensure adherence to budgetary constraints while maximizing the value delivered to customers. 9. Stakeholder Collaboration We will foster collaboration and communication between cross-functional teams, including design, development, marketing, and customer service, to ensure alignment with project goals and objectives. We will also solicit feedback from key stakeholders, including customers and internal teams, throughout the design and development process to incorporate their insights and perspectives. 10. Success Metrics Key Performance Indicators (KPIs) will be established to measure the success of Secure Savings+, including customer adoption rates, engagement metrics, customer satisfaction scores, and revenue growth. Regular performance reviews and analysis will be conducted to assess the effectiveness of the product and identify opportunities for optimization and improvement. 11. Conclusion Secure Savings+ represents an exciting opportunity for our bank to innovate and differentiate ourselves in the competitive banking landscape. Secure Saving+ prioritizes not only security but also an outstanding user experience. With the intuitive and user-friendly mobile app, you can manage your account effortlessly, anytime, and anywhere. Track your progress towards your financial goals with easy-to-understand dashboards and visual representations of your savings journey. Making transfers and transactions is also a breeze – all within the secure confines of the app. This convenient and accessible approach empowers you to take control of your finances with ease, removing the traditional barriers and frustrations associated with managing savings accounts. By prioritizing customer needs, leveraging advanced technology, and maintaining a strong focus on security and reliability, we can create a best-in-class savings solution that delivers value and enhances the overall customer experience.