Uploaded by

alessioalfonso2000

Business Strategy: Strategic Map, SWOT, & Financial Analysis

advertisement

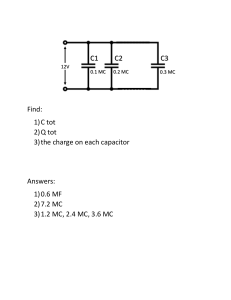

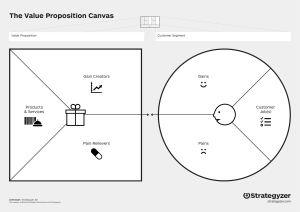

Chapter 1 (final part) Summarizing the business vision: the strategic map How to find the right mix of financial and non-financial measures? Kaplan and Norton framework=> it classifies performance indicators across four different perspectives: - Financial => how is success measured by shareholders? Economic consequences of strategy design and identify whether their implementation helps increase profits - Customer => how is value created for customers? Identify customers and market segment where to excel and develop measures to understand customer satisfaction… - Process => at which process must the company excel to satisfy its customers and shareholders? Where to improve productivity and efficiency - Learning and growth => What employee capabilities, information systems, and organizational capabilities are required to improve our processes and customer relationships continually? Identification of tangible and intangible infrastructures that the organization must build to evolve for a long term improvement. This framework is the strategic map and it is a bottom up approach => strategic map is used to monitor the progress in the business strategy because it contains the word statements of strategic goals in the four perspectives and the links among them. Balance scorecard: tool describing the four perspectives illustrating goals, logical links as well as measures targets and initiatives for each perspective. It can also contain an estimation of the new OPEX and CAPEX. Controlling the timeline Representation of the milestones to be reached in the business model => aantt Chart: bar chart representing the duration of each activity by showing start and end date Assumptions’ definition and modelling Define assumptions on volume growth, pricing trends, production rate… in order to define BS, CFS, IS Ratio analysis. Chapter 2 1. The analysis of the opportunity SWOT analysis => Internal factors: Strengths, Weaknesses; External factors: Opportunities, Threats Strength: is a resource or a capability on which the firm plans to build a sustainable value proposition. Weakness: an obstacle to the development of the value proposition that the company plans to try to overcome. Opportunity: may facilitate the creation of additional financial value if it is properly addressed in the short term. Threat: possible change in the market environment that is likely to erode value generation if it is not opposed. A company can get competitive advantage by getting a strategy that can gain/cope against these factors. The swot analysis helps the planner to assess the quality of the firm’s mission statement. 2. Define the opportunity The industry and the value proposition Focus on industry or market segment => competitive analysis, it should include: • • • • • • • • The prices and pricing history of competitors’ brands, including the reasons for potential alterations in pricing strategies The timing, themes and concepts of competitors’ promotional campaigns Their market sectors, packaging and distribution arrangements, sales promotions and public relations events Their product-development strategies: their introduction of new products and product features and their acquisitions of other businesses in order to obtain their brands Their terms of sale, credit periods, levels of after-sales service Their financial performance Why they operate in particular markets How they are organized or structured: distribution systems; departments, branches, or functions; nature of subsidiaries In defining the competitive adv of our company we should get to know: - competitors’ strategy - our Firm’s business positioning - Industry structure What factors drive the dynamics of a strategy => 5 forces of Porter (detailed on page 41) - Power of customers Power of suppliers Competition in the industry Power of similar products New market entrants Swot analysis to test mission statements // 5 forces to test value proposition of the BM The market: customer relationship and revenues stream The customers building block in the BM explains the customers groups the company wants to serve => target market, you should identify: - Distinguish characteristics of the target market (demographics, cyclical trends, needs and wants…) Size of the target market (size of potential customers, number of goods purchasable in a year…) Why the firm should be able to increase its market share Company’s target pricing and gross profit margin Media to be used to reach out customers Trends and changes that can modify target market Purchasing cycle (interval time between each purchase) and tastes and habits of potential customers It is important to highlight the consumers’ perceptions by market positioning. Market share: company revenues/tot revenues of the industry Market growth: expected change in sales for the total market, grow opportunities… WTP => willingness to pay by clients (set the price below) The external value chain: channels and key partnerships The supply chain is a network of facilities and distribution options that performs the function of material acquisition, transformation of these materials into intermediate and finished products, and distribution of these finished products to customers. The external value chain analysis is a method particularly useful for: • identifying any “bottlenecks” in the supply chain • maximizing the quality of the final product by overseeing all stages that can affect the quality of the value proposition • identifying potential partners that can leverage the company’s business model and that may be involved, for example, in complementing the value proposition by bringing in specialist competencies or to helping deliver to clients. With the full unitary cost representation we can signal the portion of the WTP that the company leaves to internal employees and external suppliers Steps to analyze a supply chain: 1. Clear definition of the channels the company will exploit to sell the product and first assumption on WTP to be left to other players 2. Company evaluates the channels and the strategic business unit 3. Identify assumptions about Unitary cost and supplier unitary cost that represent the value consumed in making the product/service and the value threshold below which external suppliers prefer to sell their raw materials and services to others You need to analyze the external value chain as well as the internal one: Five primary activities: 1. Inbound logistic: They include receiving, warehousing and inventory control of input materials 2. Operations: activities that transform inputs in final products 3. Outbound logistic: storing finished items and distributing them to clients 4. Marketing and sales: activities that involves getting buyers to purchase the products 5. Service: customer’s support, repair activities Four support activities: 1. Procurement: purchasing raw materials and other inputs 2. Technology development: includes product and process research and development, process automation and other technology development that is used to support the value-chain activities 3. Human resource management: employee recruiting, development and compensation 4. Firm infrastructure: finance, legal, quality and management When you have coordinated and optimized the links between primary and support activities, you can compute the Value Chain analysis => value: WTP by customers. In addition to primary and support activities, 3 key internal resources affect strategy formulation: - Corporate structure: communication processes, work flow and authority and responsibility relationships; - The culture (beliefs, expectations and values shared and transmitted between generations); - Resources (financial, physical and human) 3. Translating ideas and strategies into numbers: IS, CF stat, BS The income statement Revenues, COaS, aross profit, gross margin, operating profit, net profit With reclassification => EBITDA, Net sales, OPEX, EBIT, Net income => you can divide the opex into variable and fixed costs in order to derive the contribution margin (Rev – var costs) The cash flow statement Operating activity, investing activity and financing activity => you can compute the CF statement with the direct and the indirect method (take a look to images and excel to understand how to explain them) The balance sheet Summarizes the company’s situation in a specific point in time => Assets (current, fixed), liabilities and equity Reclassification => Net op. working capital, Net fixed assets, Net operating cap, invested, equity and NFP Ratio analysis Profitability ratios, efficiency ratios, liquidity ratios, solvency ratios, market ratios Ebitda margin, ROS, ROI, ROE, Capital intensity ratio (TOT A/Net sales *100), Net debt to ebitda ratio (= number of periods needed to repay financial debt with stable ebitda), Net gearing (NFP/Equity). Chapter 3 1. Planning report 2. Common features of business plan and strategic plan TUTTA LA PRIMA PARTE DEL CAPITOLO 3 (FINO A BUSINESS DESCRIPTION) E’ NELLE SLIDE STRATEGIC PLAN VS BUSINESS PLAN Business description A planning document must present the company’s starting situation, providing basic information about the company, including its name, its founding date, the legal form of organization, the type of business (products and services), its location, the business model (as discussed in Chapter 1), the organizational structure, and the management. Moreover, if the company is already existing, the business description should include a short history of the company’s milestones, its main historical financial data, and a description of critical issues and need for change. It’s important to show the company organization in order to show stakeholders who leads the company as the future success depends on these people. Structure of the organization can be represented with a diagram and it: • Designates formal reporting relationships, including the number of levels in the hierarchy and the span of managers’ and supervisors’ control; • Identifies how individuals are grouped into departments and departments are grouped into the overall organisation; • Includes the design of systems that are in place to ensure effective communication, coordination, and integration of efforts across departments. The management team must hold the key competencies, skill sets and experience to perform valuegene- rating activities and to implement the strategy in an effective and efficient way => it is therefore important to provide names, positions, responsibilities, education, experience, and skills. Legal ownership information is required in terms of the business’s legal structure Strategic business area: segment of the market that is usually identifiable by a precise combination of products/ brands, technology, channel, customer segment, or geographical area (For example, furniture and food inside the same department store may be two strategic business areas, as may sales in Asia and sales in Europe for an auto- maker, and traditional customers vs. low-cost customers for an airline) Business unit: an internal unit of a company that is responsible for developing strategy in a strategic business area with a specific cost structure, independent organizational entities, and dedicated responsibilities (For example, kitchen units and living room units in the furniture SBA or fast-food shops and grocery shops in the food SBA of the same department store are business units) Cash generating unit: the smallest group of assets that independently generates cash flow and whose cash flow is largely independent of the cash flows generated by other assets (For example, the different points of sale in a department store or the different dealerships for an automaker are cashgenerating units) Marketing plan A company should be able to identify (by research inside and outside): - - Target market => information about potential (what the population has asked for), available (what they will ask for us), target (what the company’s structure can provide) and penetrated (how long will it take to get that level of penetration) market Market segmentation => classifies targeted customers into sub-groups based on shared characteristics such as common needs, interests, lifestyles… Industry analysis can help the company in defining: - Marketing strategies for each segment Demand estimation by product, geographical area, client type; Estimating market share target and expected goods sold. Different market programs for each market segment. The company can choose between: - Undifferentiated marketing (or mass marketing): simple strategy for all Concentrated marketing: focuses company’s efforts and resources on a single, well-defined market niche or population segment; Differentiated marketing: unique strategy for each segment/niche In defining the market strategies => 4 Ps to consider Product Price Promotion Place The marketing mix should consider production and inventory capacities, cyclical and seasonal demands, and the company’s choice between direct sales and sales through resellers Pricing is strategically significant considering that: - It can modify profitability and ROI Allows to position its products in the marketplace considering market penetration and barriers to entry Can affect consumer’s’ demand Consumer’s’ perceptions In order to define the appropriate pricing strategy, the company must focus on: - External key elements: customers’ purchasing power, perceived benefits, maximum price acceptable in the market, benchmark with competitors…; Internal elements: cost structure, production levels, promotional expenses… The price definition is based on the 3 Cs: Costs, Customers, Competitors Demand = N° of customers x qt x p You need to consider the total population and then by quantitative and qualitative analysis define the customers and the quantity. Sales plan = P x Penetrated market The marketing plan ends with the sales forecast that answers to these questions: How much will the company sell? At which price? When and how? How will the company manage the unsold stock? Reverse pyramid approach => in order to determine the expected volume you need to get external as well as internal sources. - External => to determine the potential population (demographic statistics), the potential market (using census or similar) and the available market (based on competitive pressure); - Internal => to determine market served (based on expected productive capacity) and the market penetrated (adjusting for new product’s time to market and other features that may delay the production) Objective: convince the reader the market penetration is achievable You can compute detailed information of prices and volumes after Net Sales are fixed based on an expected growth rate. Operational plan The operation plan describes what each unit or other part of the company does, it describes the structure that is required in order to obtain the value proposition. It mainly focuses on 5 main issues: 1. 2. 3. 4. 5. Description of the production process (input to output) Who does what in terms of tasks and responsibilities Where the production will take place What resources it needs to buy What suppliers will meet the company’s purchasing requirements The economic analysis of the production activity should consider at least 3 dimensions: 1. Relationship between physical quantities of input and output and, at given prices, the one between input costs and output proceeds (profitability) 2. Relationship between times and models of execution (organization of inputs and size of productive units) 3. Changes that create new inputs and new outputs In particular for the purposes of the business plan a significant role is played by - - The cost plan that deals with OPEX answering to these questions => cost to fulfil production needs, at what prices, when and how, cost structure of the business? More variable or fixed costs? More direct or indirect?, results of break-even analysis?, sales price is coherent with the cost structure? The investment plan that deals with CAPEX and defines the investment needed in order to start operations => the investment plan is key in determining also the choice about make or buy Break-even analysis It shows the volume and sales required to balance the total costs => at what level of sales does the business begin to make profits? TOT COSTS OF THE PERIOD = TOT REVENUES OF THE PERIOD Tot cost => fixed + variable Tot revenues => volume sold * unit selling price Fixed costs => do not change with the production (wages, rent, adv…) Variable costs => they change (raw materials, components…) Break-even point = TOT revenues equals TOT costs, level of production at which the company would make zero profits and losses. You can express the BEP in terms of volume and turnover - Volume of BEP = Fixed costs / unit gross margin (that is price – var costs) - Turnover of BEP = Fixed costs / unit gross margin % The BEP is normally computed for a period which is longer than a single one (to avoid duplicaton with IS information) Action plan Rarely present in a BP, typical of a strategic plan => aim: to justify why and how the company is setting its new assumptions and new forecasts => focus on selected critical issues related to strategic changes. Thanks to market research and business analyses it explains and elaborate the key assumptions that will change the financial trend. It should present information about: - Actions to achieve aims specifying impacts on financials and a timetable for those; Investment description specifying the impact on Balance sheet; The impact of the individual action to business model, managerial structure, corporate workforce, geographic area to be covered, distribution channels; Measure of product/service… offered to clients; Actions that can vary customer target; Manager responsibility; Conditions/restrictions that may affect the achievement of the results. Action plan should describe whether achievements are obtained by internal efficiency (lower costs) or external effectiveness (boosting revenues). Action plan should: - specify the steps or actions required to attain an objective; (what) designate who will be held accountable for seeing that each step or action is completed; define when these steps or actions will be carried out; define the resources needed to carry out the steps or actions; define feedback mechanisms that monitor the progress of each action step. If the expectation is different for each SBU => Acton Plan broken down into each SBU. Forecast financial data The more consistent the assumptions, the higher reliable the financial forecasts. The forecast need to be compliant with all the other documents. In the BP => direct methodology to compute financial forecast In SP => indirect approach starting from the historical data and shaping the FS thanks to the strategic actions undertaken The assumptions can come considering the type of market: - bottom up from shop floors if in retailing; to down from market analysis if mass production; mix if works to order. Purpose (independent whether for SP or BP) => financial feasibility. Before starting a venture or introducing a new strategy, a company must ask three questions: - When will the company need cash ready to spend? When will it face the peak in its financial commitment? When will it be ready to pay back debt and lines of credit? The company should also ask how to finance the company => equity, debt or profit not distributed? If debt => term loan, lines of credit (debt balance – usually no more than 20% of sales) or convertible bonds/bonds? Will it be sustainable? Is ROI > Cost of debt? How to check for the financial balance? - Monetary balance => produced by treasury plan, shows the monthly cash available Financial balance => matches long term financial expenses with appropriate resources Sensitivity analysis It helps the company to develop a flexible long-term plan that explains how the forecasts will change when assumptions change too. Risk management Purpose of a risk management system: - Understanding the risks and their impacts Individuate the area most potentially affected by these risks and develop controls systems to mitigate the occurrence of these risks Be ready when a crisis/threat occurs and manage it with only little disruption to the business as possible Enterprise risk management => process designed to identify events that may affect the entity and to manage the risk to provide reasonable assurance regarding the achievement of the company’s goals. The process: - Identifying long term and short term risks including a SWOT analysis Assessing likelihood Defining risk mitigation measures Implementing whistleblowing system to encourage open communication and feedback Value analysis It is made in order to estimate the company’s value. Methods: - DCF Average income Multiples DCF: correlate the value of a business with its capacity to produce a cash flow that can satisfy an investor’s expectations of remuneration. EV can be assessed in 4 steps. 1) Compute operating FCF Operating income (EBIT) – income taxes on operating income = net operating income + depreciation/amortization + provisions and other non-cash items +/– decreases/increases in net working capital – investments in fixed assets (net of divestitures) = Operating free cash flow (OFCF) 2) Compute WACC (solita formula) 3) Compute terminal value 4) Determine EV MV E = EV – NFP and MV E – BV E = aoodwill Income method: determines the company’s value of the based on its capacity to generate future income. EV is determined by discounting the expected average operating income (AOI) for three years of operations. EV = AOI/WACC where AOI = Sum of Op incomes of yr 1, 2, 3 / 3 Multiples method: assumes that the company’s value can be deter- mined by using market information about companies whose characteristics are similar to the company’s. It uses comparable companies as benchmark. Common multiples: EV/EBITDA, EV/EBIT, EV/Sales where here EV = market value of E + NFP Normally you compute several EV and then take the average => this is the pre-money valuation The post money is after the injection of venture capitalists. Their ownership is computed dividing their injection for the post money valuation. The goal of this analysis is to determine the percentage of ownership to be sold to new investors, and the relative share premium reserve if the company evaluation is larger than the book value of equity,