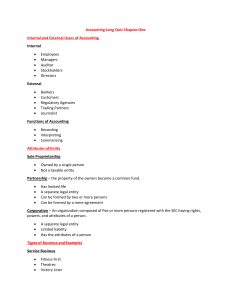

Financial Accounting Textbook: Reporting, Analysis, Decision Making

advertisement