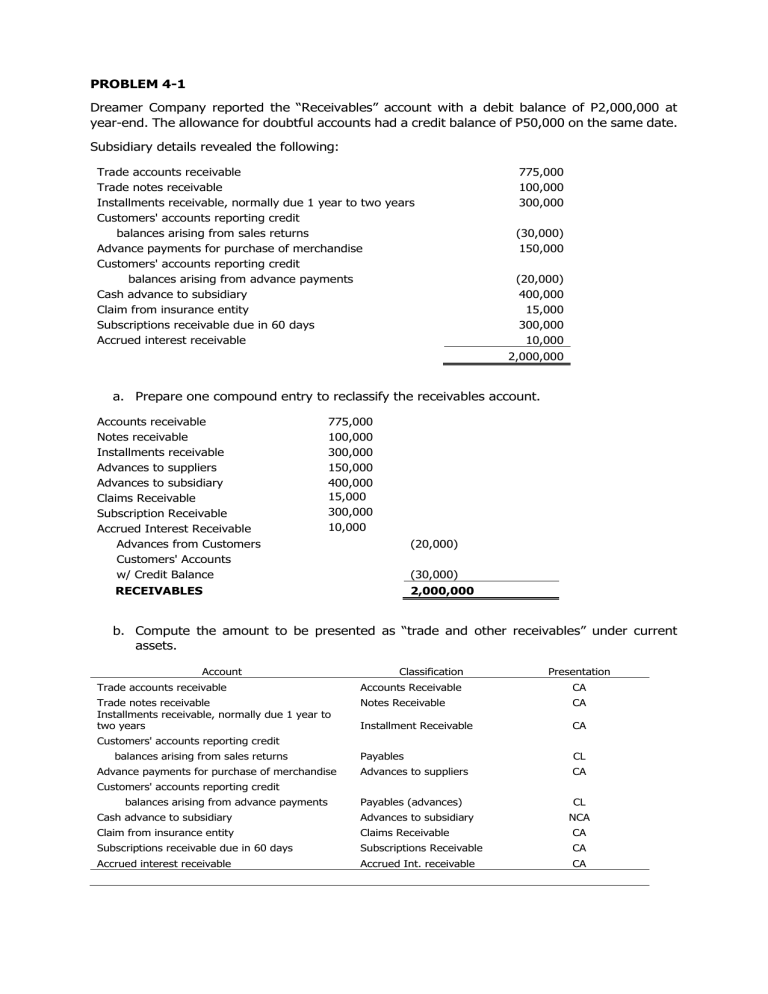

PROBLEM 4-1 Dreamer Company reported the “Receivables” account with a debit balance of P2,000,000 at year-end. The allowance for doubtful accounts had a credit balance of P50,000 on the same date. Subsidiary details revealed the following: Trade accounts receivable Trade notes receivable Installments receivable, normally due 1 year to two years Customers' accounts reporting credit balances arising from sales returns Advance payments for purchase of merchandise Customers' accounts reporting credit balances arising from advance payments Cash advance to subsidiary Claim from insurance entity Subscriptions receivable due in 60 days Accrued interest receivable 775,000 100,000 300,000 (30,000) 150,000 (20,000) 400,000 15,000 300,000 10,000 2,000,000 a. Prepare one compound entry to reclassify the receivables account. Accounts receivable Notes receivable Installments receivable Advances to suppliers Advances to subsidiary Claims Receivable Subscription Receivable Accrued Interest Receivable Advances from Customers Customers' Accounts w/ Credit Balance 775,000 100,000 300,000 150,000 400,000 15,000 300,000 10,000 (20,000) (30,000) RECEIVABLES 2,000,000 b. Compute the amount to be presented as “trade and other receivables” under current assets. Account Classification Presentation Trade accounts receivable Accounts Receivable CA Trade notes receivable Installments receivable, normally due 1 year to two years Notes Receivable CA Installment Receivable CA Customers' accounts reporting credit balances arising from sales returns Advance payments for purchase of merchandise Payables CL Advances to suppliers CA Payables (advances) CL Customers' accounts reporting credit balances arising from advance payments Cash advance to subsidiary Advances to subsidiary NCA Claim from insurance entity Claims Receivable CA Subscriptions receivable due in 60 days Subscriptions Receivable CA Accrued interest receivable Accrued Int. receivable CA Accounts receivable Allow. For Doubtful Accounts Notes receivable Installments receivable Advances to suppliers Claims Receivable Subscription Receivable Accrued Interest Receivable 775,000 (50,000) Trade & Other Rec’l (current) 725,000 100,000 300,000 150,000 15,000 300,000 10,000 1,600,000 PROBLEM 4-2 Credible Company provided the following T-account summarizing the transactions affecting the accounts receivable for the current year: Jan. 1 Balance Charge sales Shareholders' subscriptions Deposit on Contract Claims against common carrier for damages IOUs from employees Advances to affiliates Advances to supplier Accounts Receivable 600,000 Collections from customers 6,000,000 Write-off Merchandise returns 200,000 Allowances to customer 120,000 for shipping damages Collections on carrier claims 100,000 Collections from subscription 10,000 100,000 50,000 5,300,000 35,000 40,000 25,000 40,000 50,000 a. Compute the correct amount of accounts receivable. Accounts receivable, beg. Charge sales Total Less: Collections from Customers Write-off Merchandise Returns Allowances to customers Accounts receivable, ending. 600,000 6,000,000 6,600,000 5,300,000 35,000 40,000 25,000 5,400,000 1,200,000 b. Prepare one compound entry to adjust the accounts receivable. Subscriptions Receivable Deposit on Contract Claims Receivable Advances to Employees Advances to Affiliates Advances to Suppliers Accounts Receivable 150,000 120,000 60,000 10,000 100,000 50,000 490,000 c. Compute the amount to be presented as trade and other receivables under current assets. Accounts Receivable, end Claims Receivable Advances to Employees 1,200,000 60,000 10,000 Advances to Suppliers Trade and other Receivables 50,000 1,320,000 d. Indicate the classification and presentation of items. Account Explanation Presentation Jan. 1 Balance Beginning AR Balance Charge Sales Increases AR Balance Shareholders Subscriptions Subscriptions Receivable Deposit on Contract Special Deposits on Contract Claims against common carrier Claims Receivable IOUs from employees Advances to employees Cash advance to affiliates Advances to affiliates NCA Advances to supplier Advances to supplier CA Collections from customers Decreases AR Balance Write-off Decreases AR Balance Merchandise Returns Decreases AR Balance Allow. To customer for shipping damage Decreases AR Balance Collection from carrier claims Decreases claims receivable Collection on subscription Decreases subscription receivable SHE CA CA PROBLEM 4-3 Affectionate Company sold merchandise on account for P500,000. The terms are 3/10, n/30. The related freight charge amounted to P10,000. The account was collected within the discount period. Prepare journal entries to record the transactions under the following freight terms: a. FOB Destination and Freight Collect To record sale: Accounts Receivable Freight Out Sales Allowance for Freight Charge To record collection: Cash Sales Discount Allowance for Freight Charge Accounts Receivable 500,000 10,000 500,000 10,000 475,000 15,000 10,000 500,000 b. FOB Destination and Freight Prepaid To record sale: Accounts Receivable Freight Out Sales Cash To record collection: Cash Sales Discount Accounts Receivable 500,000 10,000 500,000 10,000 485,000 15,000 500,000 c. FOB Shipping Point and Freight Collect To record sale: Accounts Receivable Sales 500,000 To record collection: Cash Sales Discount Accounts Receivable 485,000 15,000 500,000 500,000 d. FOB Shipping Point and Freight Prepaid To record sale: Accounts Receivable Sales Cash To record collection: Cash Sales Discount Accounts Receivable 510,000 500,000 10,000 495,000 15,000 510,000 PROBLEM 4-4 Fiancee Company records sales returns during the year as a credit to accounts receivable. However, at the end of the accounting period, the entity estimates the probable sales returns and records the same by means of an allowance account. The following transactions occurred in summary form: Sale of merchandise on account Collection within the discount period Collection within the discount period Sales returns granted Sales return estimated at the end of the year 4,000,000 1,470,000 1,000,000 100,000 20,000 Prepare journal entries to record the transactions. 1 Accounts Receivable Sales 4,000,000 Cash Sales Discount Accounts Receivable 1,470,000 30,000 Cash 1,000,000 4,000,000 2 1,500,000 3 Accounts Receivable 1,000,000 4 Sales Return Accounts Receivable 100,000 100,000 5 Sales Return Allow. For Sales Returns 20,000 20,000 PROBLEM 4-5 On June 15, 2022, Romela Company sold 100 air conditioning units. The sale price for each unit is P45,000. All of sales are subjected to terms 2/10, n/30. The entity used the gross method for accounting for accounts receivable. a. Prepare journal entry to record the sale. Accounts Receivable Sales 4,500,000 4,500,000 b. Prepare journal entry to record receipt of payment assuming the correct amount was received June 25, 2022. Cash Sales Discount Accounts Receivable 4,410,000 90,000 4,500,000 c. Prepare journal entry to record receipt of payment assuming the correct amount was received July 10, 2022. Cash Accounts Receivable 4,500,000 4,500,000 PROBLEM 4-6 On February 14, 2022, Prime Company sold 50 air conditioning units. The sale price for each unit is P50,000. All of the sales are subjected to terms 2/10, n/30. The entity used the net method for accounting for accounts receivable. a. Prepare journal entry to record the sale. Accounts Receivable Sales 2,450,000 2,450,000 b. Prepare journal entry to record receipt of payment assuming the correct amount was received June 25, 2022. Cash Accounts Receivable 2,450,000 2,450,000 c. Prepare journal entry to record receipt of payment assuming the correct amount was received July 10, 2022. Cash Accounts Receivable Sales Discount Forfeited 2,500,000 2,450,000 50,000 PROBLEM 4-7 Raven Company started business in March 2022. Sales for the first year totaled P4,000,000. The entity priced its merchandise to a yield of 40% gross profit based on sales. Industry statistics suggest that 10% of the merchandise sold to customers will be returned. The entity estimated sales returns based on the industry average. During the year, customers returned goods with a sale price of P300,000. Prepare journal entries to record sales, sales returns and the year-end adjusting entry for estimated sales returns. a. Sales Accounts Receivable Sales 4,000,000 4,000,000 b. Sales Returns Sales Return Accounts Receivable 300,000 300,000 c. AJE for estimated sales returns Est. Sales Return Less: Actual Sales Returns BALANCE 400,000 300,000 100,000 Sales Return Allow. For Sales Return 100,000 100,000