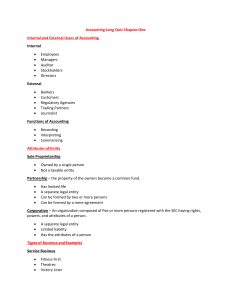

BASIC, PARTNERSHIP, AND CORPORATION ACCOUNTING Diagnostic Examination Multiple Choice. Instruction: Please indicate the letter of your choice. 1. Those that affect the assets, liabilities, equity, income or expenses of a business are referred to as a. accountable events. c. sociological events. b. non-accountable events. d. psychological events. 2. The recognition of identified events is called a. identification. b. summarization c. journalizing. d. communication. 3. The accounting reports are generally referred to as a. cash flow statement. c. statement of comprehensive income. b. statement of financial position. d. financial statements. 4. These are information that are expressed in numbers or units. a. vital information c. quantitative information b. relevant information d. qualitative information 5. The process of recording the accounts or transactions of an entity that normally ends in the preparation of the trial balance is termed as a. accounting. b. bookkeeping. c. summarizing. d. interpreting. 6. Internal users include a. business owners, board of directors and creditors. b. managerial personnel, board of directors, proprietors. c. investors, customers, business owners. d. lenders, government agencies, managers. 7. General purpose accounting information is designed to meet the common needs of most statement users and is provided by a. cost accounting. c. government accounting. b. management accounting. d. financial accounting. 8. Financial reports are the end product of the accounting process that a. are inclusive of quantitative information. b. include other information that improves the users’ ability to make efficient economic decisions. c. are inclusive of both quantitative and qualitative information. d. exclude other information that improves the users’ ability to make efficient economic decisions. 9. The primary objective of financial reporting is a. to provide information about an entity’s economic resources, claims, and changes in those resources. b. to provide information that is useful in assessing the entity’s management stewardship. c. to determine how efficiently and effectively the entity’s management as discharged its responsibilities. d. to determine the compliance to statutory regulations. 1 10. This involves the accumulation and communication of information for use by internal users. a. financial accounting c. government accounting b. management accounting d. auditing 11. Sole or single proprietorship is a business that is a. owned by only one individual. b. run by a creditor. c. managed by two or more individuals. d. created by law. 12. A partnership is registered with the a. Department of Trade and Industry. b. Cooperative Development Authority. c. Bangko Sentral ng Piipinas. d. Securities and Exchange Commission. 13. A corporation as an artificial being means that in the eyes of the law, a. it is like a person who is at the same time the owner of the business. b. it can sue but cannot be sued. c. It can invest in other business entities and incur its own obligations. d. it is exempted from complying with the regulations of other regulatory agencies like the BIR. 14. The founders of a corporation shall a. not be less than 3 but not more than 15. b. not be less than 5 but not more than 12. c. not be less than 3 but not more than 12. d. not be less than 5 but not more than 15. 15. Which of the following statements is true? a. All incorporators are stockholders. b. All stockholders are incorporators. c. Not all incorporators are stockholders. d. Stockholders may not own shares of stocks. 16. Which of the following is an advantage of a corporation? a. Easier to form because only a contractual agreement is needed. b. Relatively lower extent of government regulation. c. Has unlimited liability for its stockholders. d. Greater capital and ease in raising additional funds for investments. 17. Which of the following is a disadvantage of a service business? a. There is no need to worry about inventory warehousing and distribution of costs. b. Only a minimal quantity of supplies is necessary in providing the services. c. There may not be a flexible personal time because of the need for personal involvement in providing services to the customers. d. The owners/managers are perceived to be experts in their chosen fields. 18. A manufacturing business a. has low growth potential. b. need a strategically located retail store. c. need to be continuously innovative and abreast of changes in technology. d. has defective pricing policy. 19. Which of the statements about the accounting concepts and principles is false? a. Accounting concepts are a set of illogical ideas and procedures that guide the accountant in recording and communicating economic information. b. Accounting concepts provide a general frame of reference by which accounting practice can be evaluated. 2 c. Accounting concepts serve as guide in the development of new practices and procedures. d. Accounting concepts provide reasonable assurance that information communicated is prepared in a proper way. 20. It is concept term that means the association of cause and effect. a. relevance. b. comparability c. materiality d. matching 21. When events are recorded in the period in which they are earned rather than when they are collected, the adopted principle is a. going concern assumption. c. prudence. b. accrual basis of accounting. d. matching. 22. When information is presented in a factual manner, it is in adherence to the characteristics of a. relevance. c. comparability. b. faithful representation. d. verifiability. 23. Under this concept, amounts in the financial statements are stated in Philippine pesos and changes in it purchasing power die to inflation re generally ignored. a. prudence c. stable monetary unit b. materiality concept d. ignoring concept 24. Striking a balance between the cost of information and its usefulness relates to the concept of a. reporting period. c. stable monetary unit. b. cost-benefit. d. prudence 25. The practice of projecting a sound financial performance despite the entity’s incurrence of losses is termed as a. faithful representation. c. window dressing. b. consistency. d. fraud. 26. The basic storage of information in accounting and serves as a record of increases and decreases in a specific item of the five major accounts is termed as a. account. b. t-account. c. journal. d. ledger. 27. A business shall use account titles that conform to the PFRS and industry practices to promote a. transparency. b. accountability. c. comparability. d. materiality. 28. These are the terms used for delivery expense except a. freight out. c. carriage outwards. b. transportation in. d. transportation out. 29. Land, building, and equipment are collectively referred to as these except the term a. property, plant, and equipment. c. available for use assets. b. capital assets. d. fixed assets. 30. This represents the price that a lender charges a borrower for the use of lender’s money. a. borrowing cost. c. principal. b. loan. d. surcharges. 31. Written evidences containing information about transactions are referred to as a. statement of accounts. c. references. b. evidential documents. d. source documents. 32. The difference between the total debits and credits in the account represents a. the sum of the account. c. the overall total of the accounts. b. the balance of the account. d. nothing in accounting. 33. Future interest, salaries and utilities a. must be recorded first before they are incurred. b. must be earned first before they are recorded. c. must be incurred first before they are recorded. d. must be recorded first before they are earned. 3 34. The selling of an item to a customer who immediately paid the sales price is recorded in the a. sales journal. c. cash receipts journal. b. cash disbursements journal. d. general journal. 35. A report that a business sends to its customers listing the transactions with the customer during the period, the payments made and the balances is called a. source document. c. references. b. statement of account. d. customer data. 36. This represents other items that meet the definition of income and may or may not arise in the course of the ordinary activities of the business. a. revenue. b. gains. c. assets. d. expenses. 37. Which of the following is true? a. The word prepaid connotes an expense, while the word unearned connotes a liability. b. The word prepaid connotes an asset, while the word unearned connotes an expense. c. The word prepaid connotes an asset, while the word unearned connotes a liability. d. The word prepaid connotes an income, while the word unearned connotes an expense. 38. This views each transaction as having a two-fold effect on a value received and a value parted with. a. congruency. b. equality. c. duality. d. exigency. 39. The allocation of costs over the periods where a fixed asset is used is termed as a. allocation. b. usage. c. amortization. d. depreciation. 40. The concept that requires the recording of each transaction in terms of equal debits and credits is the a. duality. b. equilibrium. c. consistency. d. accountability concept. 41. The minimum ending balance of an account is a. zero. b. one and above. c. one peso. d. no minimum is set. 42. The financial statement that shows the financial position of a business is the a. balance sheet. c. income statement b. cash flow statement. d. changes in equity statement. 43. When the accountant gathers information from source documents and determines the effect of the transactions on the accounts, he/she is said to be a. journalizing. c. preparing the trial balance. b. posting to ledger. d. identifying and analyzing. 44. The adjunct accounts are presented in the financial statements as a. addition b. deduction. c. equal. d. supplemental to their related accounts. 45. Which of the following statements is true? a. If an account has a normal credit balance, its adjunct account has a normal debit balance. b. If an account has a normal debit balance, its adjunct account has a normal credit balance. c. If an account has a normal credit balance, its adjunct account has no effect on its balance. d. If an account has a normal credit balance, its adjunct account has a normal credit balance. 46. At year end, unrecorded interest expense due to the creditors was P4,000 payable in the next year. The adjusting entry is a. Interest income P4,000 Interest payable P4,000 4 b. Interest expense Interest income c. Interest expense Interest payable d. Interest expense Interest receivable P4,000 P4,000 P4,000 P4,000 P4,000 P4,000 47. The type of adjusting entry that is often reversed on the first day of the next accounting period is the a. accrual. b. deferral. c. depreciation. d. amortization. Items 48 through 52 are based on the following information. A company borrowed a P100,000 on December 1 by signing a six-month note that specifies interest at an annual percentage rate of 12%. No interest or principal payment is due until the note matures on May 31. The company prepares financial statements at the end of each calendar month. 48. What date should be used to record the adjusting entry? a. December 1. b. December 31. c. May 31 d. no date necessary 49. How many accounts are involved in the adjusting entry? a. one b. two c. three d. four 50. What is the account that should be debited? a. interest payable c. interest expense b. interest income d. interest receivable 51. What is the account that should be credited? a. Interest payable c. interest expense b. Interest income d. interest receivable 52. What is the amount of both debit and credit? a. P6,000 b. P1,200 c. P500 d. P1,000 e. none of the choices 53. The adjusting entries involve a. accruals of assets, liabilities, and equity. b. deferrals of assets, liabilities, and equity. c. accruals of permanent accounts. d. splitting of mixed accounts. 54. Accounts are classified into the following except a. real b. nominal c. mixed d. debit and credit. 55. The Supplies asset account beginning is P190. During the year, supplies in the amount of P490 were purchased. At the end of the year, the inventory of the supplies on hand was P220. What is the year-end adjusting entry? a. Supplies expense Prepaid supplies b. Supplies expense Prepaid supplies c. Prepaid supplies Supplies expense d. Prepaid supplies Supplies expense P460 P460 P490 P490 P460 P460 P220 P220 5 56. The three expense recognition principles are a. Matching, systematic and rational allocation, and deferred recognition. b. Matching, systematic and irrational allocation, and immediate recognition. c. Matching, systematic and rational allocation, and immediate recognition. d. Matching, automatic and rational allocation, and immediate recognition. 57. All adjusting entries involve a. at least one balance sheet account and one income statement account. b. all balance sheet accounts. c. all income statements account. d. several balance sheet and income statement accounts. 58. Only the adjusting entries for the following may be reversed except a. deferrals for income or expense. b. prepayment recorded using the expense method. c. advance collections recorded using the income method. d. accruals for income or expense. 59. Adding or subtracting amounts vertically in accounting reports is called a. cross-footing. b. footing. c. verticalling. d. mathematics. 60. Prepaid insurance account beginning is P230. During the year, insurance in the amount of P570 was purchased. At the end of the year, December 31, the amount of insurance still unexpired was P350. The adjusting entry would be: a. Insurance expense Insurance payable b. Insurance expense Insurance payable c. Insurance expense Prepaid Insurance d. Insurance expense Prepaid Insurance P350 P350 P570 P570 P350 P350 P450 P450 61. Advanced collections of income are recorded using either the a. liability or income method. c. liability or expense method. b. asset or expense method d. asset or income method. 62. Prepayments of expenses are recorded using either the a. liability or income method. c. liability or expense method. b. asset or expense method. d. asset or income method. 63. An analytical device that is used to facilitate the gathering of data for adjustments, the preparation of financial statements and closing entries is termed as a. balance sheet. c. worksheet. b. income statement. d. cash flow statement. 64. The post-closing trial balance contains a. income statement accounts only. b. nominal accounts only. c. balance sheet accounts only. d. both real and nominal accounts. 65. The adjusting entries are NOT made a. prior to the preparation of the financial statements. b. to update certain accounts. c. to reflect correct balances. d. to take up recorded income and expenses of the period. 6 66. The balancing figure in the income statement and balance sheet columns in the worksheet represents the a. amount that the accountant cannot balance. b. ending balances of the worksheet. c. profit or loss for the period. d. amount of cash hidden in the books of accounts. 67. Which of the following statement is correct? a. The post-closing trial balance contains income and expense accounts. b. Income is recorded in the period it is collected regardless of when it was earned. c. The expired portion of a prepayment is income. d. Interest is earned or incurred based on passage of time. 68. At year end, unrecorded interest receivable from a loan with a rate of 10% is P1,700. The adjusting entry is a. Interest receivable P1,700 Unearned Interest P1,700 b. Interest receivable P1,700 Interest income P1,700 c. Interest receivable P170 Unearned interest P170 d. Interest receivable P170 Interest income P170 69. The profit or loss of an entity is shown in the a. trial balance. b. balance sheet. c. income statement. 70. The income that is already earned but not yet collected is an a. accrued expense. c. earned income. b. deferred expense. d. incurred income. d. ledger. 71. Wages are paid every Saturday for a five-day work week (Mon-Fri). Wages are P2,000 per week. What is the adjusting entry on June 30, assuming July 1 falls on a Wednesday? a. Salaries expense Salaries payable b. Salaries payable Salaries expense c. Salaries expense Salaries payable d. Salaries payable Salaries expense P400 P400 P600 P600 P800 P800 P2,000 P2,000 Items 72 and 73 are based on the following information. On July 3, a deposit in the amount of P5,000 was received for services to b performed. By the end of the month, services in the amount of P1,200 were performed. 72. The entry for the receipt of the deposit is a. Cash P5,000 Service Income P5,000 b. Cash P5,000 Unearned income P5,000 7 c. Unearned income Cash d. Unearned income Service income P5,000 P5,000 P5,000 P5,000 73. The adjusting entry on July 31 would be a. Service income P1,200 Unearned income P1,200 b. Earned income P3,800 Service income P3,800 c. Unearned income P3,800 Service income P3,800 d. Unearned income P1,200 Service income P1,200 74. Accruals give rise to a. both income and payable accounts. b. both income and expense accounts. c. both expense and receivable accounts. d. both income and receivable accounts. 75. When preparing the closing entries of a business with the Income Summary account debited and the Equity account being credited, the implication is that a. The business earned profit during the period. b. The business incurred loss during the period. c. Drawings were made during the period. d. No profit or loss was made by the business. 76. This is an unincorporated association of two or more individuals to carry on, as coowners, a business , with the intention of dividing the profits among themselves. a. sole proprietorship. c. partnership. b. merchandising company. d. corporation. 77. Any stipulation which excludes one or more partners from any share in the profits or losses is a. legal and binding. c. valid. b. void. d. considered if stated in the by-laws. 78. The measurement of inventory as partners’ contribution, per PFRS, shall be based on a. lower of cost or net realizable value. c. fair value. b. net realizable value. d. lower of cost and net realizable value. 79. The entry to record the purchase of interest by remaining partners is a. Outgoing partner’s capital (dr.); Selling partner’s capital (cr.) b. Purchasing partner’s capital (dr.); Outgoing partner’s capital (cr.) c. Incoming partner’s capital (dr.); Selling partner’s capital (cr.) d. Outgoing partner’s capital (dr.); Purchasing partner’s capital (cr.) 80. Which of the following is an advantage of a partnership? a. limited life. c. lesser capital contribution. b. unlimited liability. d. relative lack of government regulation. 81. In partnership liquidation, actual liquidation expenses are allocated to the partners’ capital balances based on a. ending capital balances. c. profit and loss ratio. b. beginning capital balances. d. average capital balances. 82. Net realizable value of an inventory is the a. estimated selling price less estimated costs of completion and costs to sell. b. estimated selling price less estimated costs of completion. 8 c. estimated selling price less estimated costs to sell. d. estimated selling price less estimated costs of sales and marketing costs. 83. A corporation is formed by a. 5 to 20 b. 3 to 12 c. 3 to 15 d. 5 to 15 natural persons. 84. In a transfer within equity, a. The transaction is considered as a personal one between and among the partners. b. The transaction is recorded in the books of the partnership. c. A corresponding increase is made on the capital accounts of the selling partners. d. A gain or loss is recognized in the partnership’s books. 85. The partnership characteristic of it requiring less formality is a. mutual agency. c. co-ownership of property. b. ease of formation. d. transfer of ownership. 86. Normally, a(n) a. capitalist partner c. dormant partner b. industrialist partner d. nominal partner receives salary in addition to his share in the partnership’s profits as compensation for his services to the partnership. 87. Each partner’s capital account is a. credited for the book value of his net contribution. b. credited for the net realizable value of his total contribution. c. credited for the fair value of his total contribution. d. credited for the fair value of his net contribution. 88. The termination of business operations or the winding up of affairs of a partnership is a. formation. b. operations. c. dissolution. d. liquidation. 89. Which of the following is a disadvantage of a partnership? a. ease of formation. c. conflict among partners. b. flexibility in decision-making. d. shared responsibility in running the business. 90. The maximum number of shares that a corporation can issue is termed as a. paid-up capital. c. preferred shares. b. authorized capital stock. d. subscribed capital stock. 91. The permanent withdrawals of capital by any partner are a. debited to the partner’s capital account. b. debited to the partner’s drawing account. c. credited to the partnership’s income and loss summary. d. not recorded in the books of accounts of the partnership. 92. The partnership agreement may stipulate that capitalist partners may be entitled to a. An annual interest to their net capital after profit sharing. b. A monthly interest to their capital contributions. c. An annual interest to their capital contributions. d. A monthly interest to their net capital after profit sharing. 93. The conversion of other assets to cash is termed as a. realization. b. dissolution. c. liquidation. d. absorption. 94. The partnership characteristic of being able to transact and acquire properties in its name is the a. mutual agency. c. separate legal personality. b. co-ownership of property. d. transfer of ownership. 95. To amend the articles of incorporation, a. a majority vote of the board is needed. b. a 1/3 vote of the shareholders is needed. c. a 2/3 vote of the board is needed. d. no number of votes is needed. 96. The partners’ ledger accounts are 9 a. capital accounts, drawing accounts, payable to partner accounts. b. capital accounts, drawing accounts, receivable from/payable to partner accounts. c. capital accounts, drawing accounts, receivable from partner accounts. d. capital accounts, and drawing accounts. 97. In accounting for share capital in a corporation, a. journal entry method is used. b. memorandum entry method is used. c. chart of accounts is used. d. direct entry method is used. 98. The equity of a partnership is similar to that of a sole proprietorship except that a. The former is subdivided into the partner’s capital contribution. b. The former is subdivided into the partner’s capital share in the profits. c. The former is subdivided into the partner’s capital share in the profits and losses. d. The former is subdivided into the partner’s capital balances. 99. In the journal entry method in corporation accounting, the authorized capitalization is recorded by a. Debiting “authorized share capital” and crediting “unissued share capital”. b. Crediting “unauthorized share capital” and debiting “unissued share capital”. c. Crediting “unissued share capital” and debiting “unauhtorized share capital”. d. Crediting “authorized share capital” and debiting “unissued share capital”. Items 100 through 102 are based on the following: A and B formed a partnership. A contributed cash of P500,000, while B contributed land with a carrying amount of P400,000 and fair value of P800,000. The land has an unpaid mortgage of P200,000 which is assumed by the partnership. 100. The total assets of the partnership is a. P 900,000. b. P 1,100,000. c. P 1,300,000. d. P 1,000,000. 101. The adjusted capital balance of B is a. P 600,000. b. P 800,000. c. P 400,000. d. P 200,000. 102. The journal entry for the above is a. Cash P 500,000 Land 600,000 A, capital P 500,000 B, capital 600,000 # b. Cash P 500,000 Land 800,000 A, capital P 500,000 B, capital 800,000 # c. Cash P 500,000 Land 600,000 Mortgage payable P 200,000 A, capital 500,000 B, capital 400,000 # d. Cash P 500,000 Land 800,000 Mortgage payable P 200,000 A, capital 500,000 10 B, capital 600,000 # 103. Each partner, including the industrial ones, may be held liable for partnership debts after all partnership assets have been exhausted. This is a characteristic of a. transfer of ownership. c. separate legal personality. b. mutual agency. d. unlimited liability. 104. The more commonly used practice in accounting for share capital in a corporation is a. memorandum method. c. outright recognition method. b. journal entry method. d. revaluation method. 105. When a partnership is dissolved but not liquidated, a. the partnership remains the same. b. the partners’ share in profit and loss are automatically based on ratio and proportion. c. a new partnership is created. d. the admission of the new partner is recorded first before allocation of the adjustments to the existing partners. 106. The equity of a corporation is similar to the equity of a a. sole proprietorship. c. cooperative. b. partnership. d. government agency. 107. This represents the portion of the authorized share capital not yet issued and is still available for subscription and issuance. a. Authorized share capital. b. Subscribed share capital. c. Unissued share capital. d. Ordinary shareholders’ capital. 108. The payment of claims of creditors and owners is referred to as a. settlement. b. liquidation. c. disbursements. d. obligation. Items 34 through 36 are based on the following information. A and B formed a partnership. A contributed cash, P500,000 and accounts receivable of P100,000. B contributed building, P700,000. The accounts receivable includes a P20,000 account that is deemed uncollectible. The building is under-depreciated by P50,000. The building has an unpaid mortgage of P100,000, but this is not assumed by the partnership. Partner B promised to pay for the mortgage himself. 109. The adjusted capital balance of A is a. P600,000. b. P 580,000. c. P 500,000. d. P650,000. 110. The adjusted capital balance of B is a. 650,000. b. P 600,000. c. P 700,000. d. P750,000. 111. The total adjusted capital balance for the partnership is a. P1,250,000. b. P1,100,000. c. P1,230,000. d. P1,350,000. 112. The partners’ ability to legally bind the partnership to a contract or agreement in line with partnership operations is the characteristic of a. transfer of ownership. c. separate legal personality. b. mutual agency. d. unlimited liability. 11 113. These items include the excess of assets pledged to fully secured creditors over the related liabilities. a. Current assets. b. Assets pledged to partially secured creditors. c. Free assets. d. Partially-pledged assets. 114. The method wherein a certain partner is allowed to have a capital credit which is greater than the fair value of his contribution, with such accounted for as deduction from the capital of the other partners is the a. goodwill. b. bonus c. fair value. d. net of contribution method. 115. These are liabilities that, although not secured by any asset, are mandated by law to be paid first before other unsecured liabilities. a. Unsecured liabilities with priority. b. Unsecured labilities without priority. c. Partially secured liabilities with priority. d. Partially secured liabilities without priority. 116. The following are the major considerations in the accounting for the equity of a partnership, except a. formation . b. realization. c. operations. d. dissolution. 117. The difference between the restated assets and liabilities represents the a. net assets after creditor claims. b. partially secured liabilities. c. estimated deficiency in settlement. d. settlement of unsecured non-priority creditors. 118. In purchase of interest, a. the incoming partner’s contribution is recorded in the partnership’s books. b. partnership capital is increased by the incoming partner’s contribution. c. no gains or losses are recognized in the partnership’s books. d. partnership capital remains the same before and after the admission of the incoming partner. 119. The estimated recovery percentage of unsecured creditors without priority is computed as follows: a. Total free assets / total unsecured liabilities without priority. b. Total free assets / total secured liabilities without priority. c. Net free assets / total partially secured liabilities without priority. d. Net free assets / total unsecured liabilities without priority. Items 120 through 122 are based on the following information. A, B and C formed a partnership. Their contributions are as follows: A – Cash, P40,000; B – Cash, P10,000, and Equipment, P80,000; and C – Cash, P100,000. The equipment has an unpaid mortgage of P20,000, which the partnership assumes to repay. The partners agree to equalize their interest. Cash settlements among the partners are to be made outside the partnership. 120. Which partner(s) shall receive cash payment for the other partner(s)? a. A from B and C. c. B from C. b. B from A and C. d. C from A. 121. The net contribution of B is a. P 180,000. b. P 90,000. c. P 70,000. d. P 170,000. 122. The net cash receipt of A is 12 a. P 30,000. b. (P 30,000). c. (P 40,000). d. P 70,000 123. The assets to be realized represents the a. Total non-cash assets available for disposal at the end of the period measured at carrying amount. b. Total non-cash assets available for disposal at the beginning of the period measured at fair value. c. Total non-cash assets available for disposal at the end of the period measured at fair value. d. Total non-cash assets available for disposal at the beginning of the period measured at carrying amount. 124. The partnership may be dissolved by a. any event that makes it lawful to carry out the partnership. b. when a specific thing that a partner has promised to contribute to the partnership perishes after the delivery. c. expulsion, death, solvency, or civil interdiction of a partner. d. by the termination of a definite term stipulated in the contract. 125. This represents the actual net proceeds from the conversion of non-cash assets into cash during the period. a. assets to be realized. c. assets realized. b. assets acquired. d. assets not realized. 126. The agreement that interest shall accrue on the outgoing partner’s unpaid balance from the date of his disassociation up to the date of settlement is a type of a. Purchase by one or all of the remaining partners. b. Settlement by partnership. c. Pending settlement. d. Deferred settlement. 127. This represents the total liabilities to be settled at the beginning of the period and is measured at book value. a. liabilities to be liquidated. c. liabilities liquidated. b. liabilities assumed. d. liabilities not liquidated. 128. A partnership’s legal existence begins from a. the moment the contract is executed, unless otherwise stipulated. b. the initial investment of the partners. c. the moment the partners agree to form the partnership. d. the time the partnership is registered with the Securities and Exchange Commission. 129. The available cash of the partnership is used to settle claims with priority given to a. outside creditors. c. owner’s capital balances. b. inside creditors. d. partners. Items 130 through 132 are based on the following information. A and B formed a partnership. The partnership agreements stipulates the following: Annual salary allowances of P100,000 for A and P40,000 for B. The salaries are recognized as expenses. The partners share in profits and losses on a 60:40 ratio. The partnership earned profit of P360,000. 130. The profit before salaries amounts to 13 a. P460,000. b. P 360,000. c. P500,000. d. P 400,000. 131. The amount allocated for A is a. P316,000. b. P360,000. c. P144,000. d. P184,000. e. not given. 132. The allocation of the remaining profit to B amounts to a. P216,000. b. P184,000. c. P144,000. d. P316,000. e. not given. 133. The partners share in partnership profits or losses a. in accordance with their by-laws. b. based on initial discussions. c. in accordance with their partnership agreement. d. solely on the basis of their capita contribution. 134. This represents previously unrecorded liabilities that were recognized during the period. a. liabilities to be liquidated. c. liabilities liquidated. b. liabilities assumed. d. liabilities not liquidated. 135. The entry for the purchase of interest by a new partner is a. Selling partner’s capital (dr.); Incoming partner’s capital (cr.) b. Incoming partner’s capital (dr.); Selling partner’s capital (cr.) c. Outgoing partner’s capital (dr.); Payment made (cr.) d. Outgoing partner’s capital (dr.); Purchasing partner’s capital (cr.) 136. The right to offset allows a deficit in a partner’s capital account to be offset by a. the capital balances of the other partners. b. the loan payable to that partner. c. a cash settlement by that partner. d. declaration of insolvency by that partner. 137. If a partner is personally insolvent, a. his share in the partnership debts shall be assumed by the others. b. his share in the partnership debts shall be assumed by a new partner. c. his share in the partnership debts shall be extinguished outright. d. his share in the partnership profits shall be assumed by the others. 138. The first step in the cash priority program is to a. determine the minimum safe payments amount to the partners. b. determine the minimum loss absorption capacity of each partner. c. determine the maximum safe payments amount to the partners. d. determine the maximum loss absorption capacity of each partner. 139. The change in in the relation of the partners caused by any partner being disassociated from the business is termed as a. dissolution. b. formation. c. operations. d. liquidation. 140. In corporate liquidation, fixed assets are usually a. Restated to realizable values rather than book values. b. Restated to book values rather than fair values. c. Restated to fair values rather than realizable values. d. Restated to realizable values rather than fair values. 141. Contributions of partners to the partnership are initially measured a. at book value. c. based on agreed value. b. at existing market price. d. at fair value. 142. In the statement of realization and liquidation, the debit side is composed of the following, except a. assets to be realized. b. assets acquired. c. supplementary expenses. d. liabilities to be liquidated. 14 143. The If only the share of each partner in the profits have been agreed upon, the share of each in the losses shall be a. in proportion to the contribution. b. based on a fixed agreed share. c. in the same proportion. d. agreed upon later when losses have actually been incurred. 144. Under the cash priority program, when all of the priorities are paid, the remaining cash is distributed to the partners based on a. beginning capital balances. b. ending capital balances. c. capital balances plus payable to partners. d. profit and loss ratio. 145. The following are the major considerations in partnership dissolution, except a. admission of a partner. b. withdrawal, retirement or death of a partner. c. realization of non-cash assets. d. incorporation of a partnership. 146. The legal doctrine of a. realizing the assets c. revaluation of assets b. conversion of assets d. marshalling of assets is applied when the partnership and some of the partners are insolvent. 147. A limited partnership includes at least a. One general partner with limited liability. b. One limited partner with limited liability. c. One general partner with unlimited liability. d. One limited partner with unlimited liability. 148. The financial report that highlights the receipt of asset disposals and the settlement of creditors’ and partners’ claims is the a. cash priority program. c. statement of affairs. b. statement of realization. d. statement of liquidation. 149. An industrial partner a. shall still be liable for the losses. b. shall share in it based on a just and equitable computation. c. shall not be liable for the losses. d. may be exempted from sharing in the losses if stipulated in the by-laws. 150. When measuring the contributions of partners, based on the PFRS, cash and cash equivalents shall be measured at a. fair value. b. market value. c. face amount. d. net realizable value. GOOD LUCK!!! 15