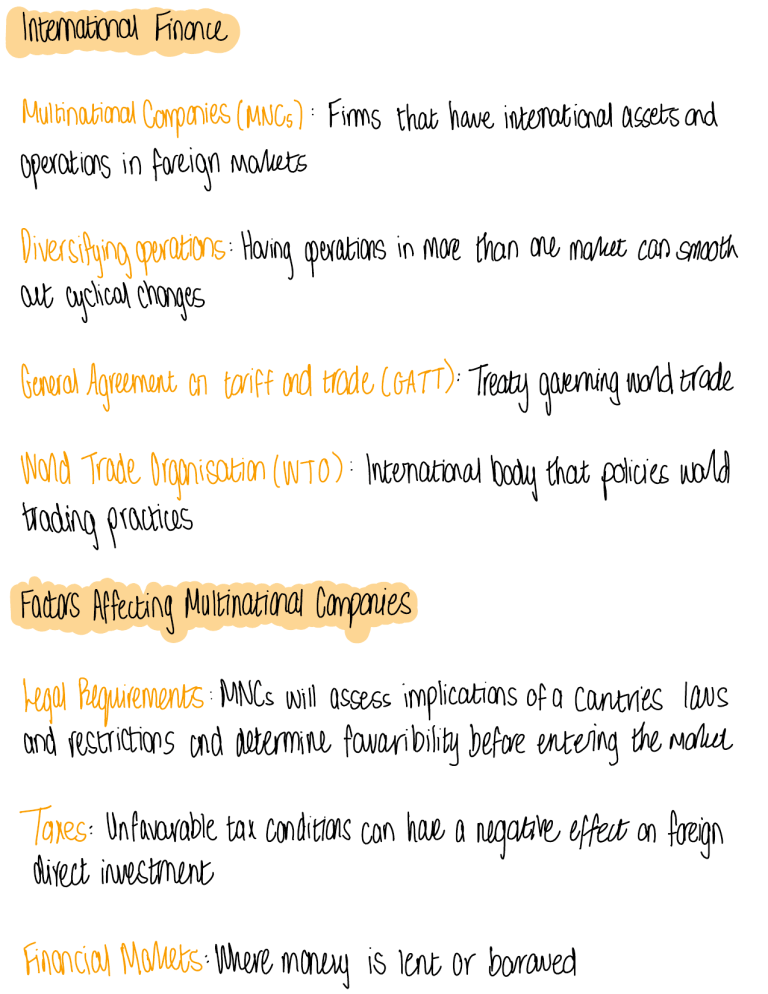

International Finance Multinational Companies MNCs operations Firms that have internationalassetsand in foreign markets Diversifyingoperations Haring operations in more than one manet cansmooth at cyclicalchanges GeneralAgreement on tariff and trade GATT Treaty governingworldtrade Wald Trade Organisation WTO International bodythat policies wold tradingpractices Factors Affecting Multinational Companies Legal Requirements MNCs will assess implications of a cantries laws and restrictions and determine favaribility before entering themarket Tunes Unfavorable tax conditions can have a negative effecton foreign direct investment Financial Mallets Wheremoney is tent or baraved Euro Markets International financial market that provides forborrowing and lending currencies outside country of of Major Participants USD origin is the dominant currency EUR and Yuan are emerging Exchange Rate Risk As multinational companies operate in many foreign markets pations of revenue and costs are based on foreign currency Exchange rate between 2 or more companies will cause exchange rate risk exposure Forex Exposure Translation Exposure effectthat change in exchangerate willhaveanrecorded results of a company Transaction Exposure Importing andexporting as well as loansstated in foreign currency le the effect therand exchange rate has onsuch transactions Economic Exposure longterm realeffects of a change in exchange rates Causesof change in ExchangeRates Political unrest stability Social Any factors having a positivenegativeimpactoncurrency Economic Interest Rate Inflation unemployment SpotRates and ForwardRates SpotRate Price quoted for immediate settlementon interestrate commodity security anency Spot Price anent market value FawadRate Contracted price for a transaction that will becompleted at an agreedupon future date Forward rates areused to hedge risk or explorepotentialpricefluctuations T mostimpotent driving forcesbehindexchangerate movements C Inflation Rates www Interest Rates Interest Rate Parity Fundamental equation that governs relationship between interest rates and currency exchange rates Hedged returns from investing in different cantries should be the same regardless of exchange rates SA Interest Rates higher than US Interest rates hand forwardrate wouldbelaver than spot Dolla is premium Witferenuinturestates DiffgggynygspotandyMe we F I r I rf rf F Forward Exchange Rate 8 Spot exchange rate rt foreign interest rate r domestic interest rate Fg I tr I r f HedgingInstruments Forward Contracts Money market hedges Currencyoptions Currency of Invoice Leads and lags Futures contracts Currency swaps