Uploaded by

Atilla Kahraman

International Finance Assignment: Risk & Balance of Payments

advertisement

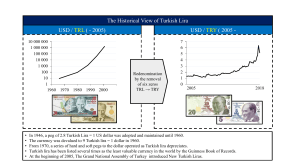

M422 - Assignment 1 - Spring 2024 (Due: Feb 22, 2024 at 10:40) You may work with a friend and submit as a group but DO NOT copy from others 1. According to the Reuters, Thu 21 Feb 2019 07.51 GMT: ....One of China’s biggest ports has banned imports of Australian coal and will cap overall coal imports for 2019 through its harbours at 12m tonnes, an official at Dalian Port Group has said. The indefinite ban on imports from Australia, which is China’s top coal supplier, comes as major ports elsewhere in China prolong clearing times for Australian coal to at least 40 days, Reuters has reported. China rejects Australian parliament cyber attack claims as ‘baseless’ and ‘irresponsible’ Read more Coal is Australia’s biggest export earner and the Australian dollar tumbled more than 1% to as low as US70.86 on the news... Please explain this is an example of (Exchange rate risk/Political risk/Market imperfections/None of these)? 2. Tesla is slashing its prices in China again, CNN Business, November 22, 2018 .... Tesla is slashing prices in China for the second time this year, taking a bigger hit from the country’s trade war with the United States in a bid to protect sales. The electric carmaker announced Thursday that it will slash prices of its Model S sedan and Model X SUV by between 12% and 26%, even though higher Chinese tariffs on US autos have made it more expensive to import cars. “We are absorbing a significant part of the tariff to help make our cars more affordable for customers in China,” a Tesla (TSLA) spokesperson said in a statement. Please explain this is an example of Exchange rate risk/Political risk/Market imperfections/None of these. 3. Consider the following balance of payments data (in billions of dollars): Merchandise Exports 100 Merchandise Imports 125 Service Imports 90 Service Exports 80 Income received from abroad 110 Income payments to foreigners 150 Increase in Turkish ownership of private assets abroad 160 Increase in foreign ownership of private Turkish assets 200 Increase in home official reserve assets 30 Increase in foreign official assets in Turkey 35 Assuming that unilateral transfers are zero, find the trade balance, the current account balance, and the financial accounts balance. In order Balance of Payments to hold, what would be the statistical discrepancy? 4. According to Financial Times article on 22 March 2021, there is as statement of follows: Turkey’s currency tumbled as much as 14 per cent in frenetic trading on Monday, while the stock market shed almost a tenth of its value and investors rushed out of the country’s local and foreign currency debt. The article says that this is triggered by sacking the central bank chief. If Turkish Lira tumbled by 14 percent against USD, can you calculate how much USD escalate against Turkish Lira (TRY)? Please show your work and don’t do too much rounding! 5. Read the following news and answer the questions below: ... The Trump administration is trying to accelerate efforts to break ties with Chinese tech giant Huawei when it comes to building out next-generation 5G cell networks, The Wall Street Journal reports. The goal is to create common engineering standards for 5G networks that would allow tech and telecom companies to use US-made equipment over Huawei’s. As it stands right now, Huawei is the world’s leading telecom hardware provider, and its best-in-class products are sold to large companies that help cell towers and smartphones communicate, among other technical feats. “The big-picture concept is to have all of the US 5G architecture and infrastructure done by American firms, principally,” Larry Kudlow, a White House economic adviser, tells the WSJ. “That also could include Nokia and Ericsson because they have big US presences.” Since President Donald Trump took office in early 2017, the White House has taken aim at the Chinese tech industry over both security concerns and trade agreements (The Verge, Feb 5, 2020). If you work in Huawei, can you explain what type of risk discussed in the Verge for U.S. market (Exchange rate risk, market imperfection, political risk or expanding opportunities). Explain briefly. 6. Today the parity between Turkish lira and US dollar is 30.7631. Please whenever you are doing your assignment enter the following link: Oanda Live and fid the the parity at that time and calculate depreciation or appreciation of TRY in percentages.