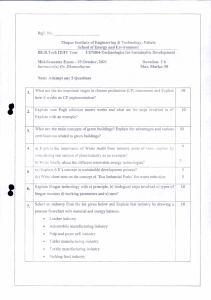

Biogas Technologies in Ukraine and Germany: Report

advertisement