Cash Flow Calculation Problem: Furniture Factory Project

advertisement

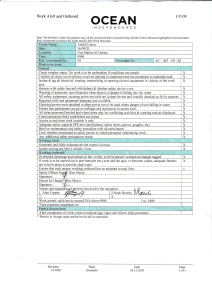

FINANCIAL MANAGEMENT 332 PROBLEM 1: CALCULATION OF CASH FLOW Saikea Ltd is considering the construction of a new furniture factory. The following information regarding the expansion project is provided to you: NEW FACTORY: • The new furniture factory would be erected on an industrial plot that the company acquired seven years ago at a price of R500 000. Similar plots are currently trading at R2 000 000 (ignore any tax implications that may arise). • The total construction cost of the building that would house the new furniture factory would amount to R10 000 000 now. The layout of the factory building would be set up according to a project plan that was compiled two years ago by a project consultant at a total cost of R300 000. • Equipment to the value of R5 000 000 (excluding VAT at 15%) would also need to be purchased now. The transport cost of the equipment would amount to R200 000. The installation cost would amount to a further R150 000, and adjustments to the equipment totalling R350 000 would be required before the production process could start. • No depreciation would be provided on the plot. Straight-line depreciation over a period of ten years would be provided on the factory building, while straight-line depreciation over five years would be provided on the equipment. • If the new furniture factory is constructed, the company’s trade receivables would decrease by R200 000, inventory would increase by R100 000, while the trade payables would increase by R300 000. • The expected sales revenue of the furniture that will be manufactured in the new furniture factory would amount to R2 000 000 per year. The gross profit margin is expected to be 40%, while the total sales and administrative expenses (excluding depreciation) would be equal to 5% of the sales revenue. Finance costs would amount to R100 000 per year. • The company’s effective tax rate amounts to 27%. Assume an inclusion rate of 80% for the purposes of capital gains tax. • Assume that the factory building and the plot could be sold for a total amount of R15 000 000 five years from now. The equipment could be sold for R2 000 000, but the cost to remove the equipment from the factory building would amount to R500 000. FINANSIËLE BESTUUR 332 PROBLEEM 1: BEREKENING VAN KONTANTVLOEI Saikea Bpk. oorweeg die konstruksie van ʼn nuwe meubelfabriek. Die volgende inligting ten opsigte van die uitbreidingsprojek word aan u voorsien: NUWE FABRIEK: • Die nuwe meubelfabriek sal opgerig word op ʼn nywerheidserf wat die maatskappy sewe jaar gelede teen ʼn prys van R500 000 aangeskaf het. Tans verhandel soortgelyke erwe teen R2 000 000 (ignoreer enige belasting-implikasies wat ter sprake mag wees). • Die totale konstruksiekoste van die gebou waarin die nuwe meubelfabriek gehuisves gaan word, sal nou R10 000 000 beloop. Die inrigting van die fabrieksgebou sal geskied na aanleiding van ʼn projekplan wat twee jaar gelede deur ʼn projekkonsultant teen ʼn totale koste van R300 000 opgestel is. • Toerusting ten bedrae van R5 000 000 (BTW teen 15% uitgesluit) sal ook nou aangekoop moet word. Die vervoerkoste van die toerusting sal R200 000 beloop. Die installasiekoste sal ʼn verdere R150 000 beloop, en verstellings ten bedrae van R350 000 sal aan die toerusting benodig word voordat die produksieproses sal kan begin. • Geen waardevermindering sal op die erf voorsien word nie. Reglynige waardevermindering sal oor ʼn periode van tien jaar op die fabrieksgebou voorsien word, terwyl reglynige waardevermindering oor ʼn periode van vyf jaar op die toerusting voorsien sal word. • Indien die nuwe meubelfabriek opgerig sou word, sal die maatskappy se handelsdebiteure met R200 000 afneem, die voorraad met R100 000 toeneem, terwyl handelskrediteure met R300 000 sal toeneem. • Die verwagte verkoopsinkomste van die meubels wat in die nuwe meubelfabriek vervaardig sal word, bedra R2 000 000 per jaar. Die bruto winsmarge sal na verwagting 40% beloop, terwyl die totale verkoop- en administratiewe uitgawes (waardevermindering uitgesluit) gelyk aan 5% van die verkoopsinkomste sal wees. Finansieringskoste sal R100 000 per jaar beloop. • Die maatskappy se effektiewe belastingkoers beloop 27%. Aanvaar ʼn insluitingskoers van 80% vir die doeleindes van kapitaalwinsbelasting. • Aanvaar dat die fabrieksgebou en nywerheidserf vyf jaar van nou af verkoop sal kan word vir ʼn totale bedrag van R15 000 000. Die toerusting sal verkoop kan word vir R2 000 000, maar die koste om die toerusting uit die fabrieksgebou te verwyder sal R500 000 beloop. You are required to calculate the relevant cash flow values associated with the abovementioned investment project. INITIAL INVESTMENT Daar word van u verwag om die relevante kontantvloei waardes verbonde aan die bostaande investeringsprojek te bereken 1.1 TOTAL INITIAL INVESTMENT TOTALE AANVANKLIKE INVESTERING ANNUAL OPERATING CASH FLOW ANNUAL OPERATING CASH FLOW JAARLIKSE BEDRYFSKONTANTVLOEI AANVANKLIKE INVESTERING ( R18 050 000 ) 1.2 JAARLIKSE BEDRYFSKONTANTVLOEI R1 129 300 TERMINAL CASH FLOW TERMINAL CASH FLOW TERMINALE KONTANTVLOEI 1.3 TERMINALE KONTANTVLOEI R13 697 000