CHAPTER 1

THE MANAGER AND MANAGEMENT ACCOUNTING

See the front matter of this Solutions Manual for suggestions regarding your choices of

assignment material for each chapter.

Management accounting information is specifically provided for the internal usage of

organizations, and the preparation and presentation of management accounting reports are not

governed by standardized rules and regulation. Management accounting reports have no definite

time frame for preparation. Management accounting reports combine historical data with present

data for the purpose of influencing the future. Thus, it is considered futuristic in nature. The

objective of management accounting is to provide financial information to managers to enable

them to effectuate their planning, control and decision-making responsibilities.

Financial accounting reports focus on providing standardized information to external

users or those that do not have access to detailed private information of the entity. The users of

financial accounting reports comprise existing and potential shareholders; employees–both

within and outside the organization; financial and investment analysts; the government; the

company’s auditor; the public at large to mention a few. The preparation of financial accounting

statements is governed by rules and regulations commonly referred to as generally accepted

accounting principles (GAAP). These reports are usually presented to stakeholders on an annual

basis. Due to the historical nature of financial accounting reports, the degree of estimation and

approximation allowable in the course of writing the report is limited. The objective of financial

accounting reports is firstly to fulfil the doctrine of stewardship in accounting and secondly to

meet the statutory or regulatory requirement. It also provides information primarily to external

decision-makers (even employees might need it for their private decision-making) about

providing resources to the entity.

1-1

Note: Financial accounting is regulated in some jurisdictions by the International Financial

Reporting Standard (IFRS) for private firms and the International Public Sector Accounting

Standards (IPSAS) in the government sector. There are also national accounting standards for

preparation of financial information. This therefore implies that management accounting reports

are influenced by guidelines or legislations. For example, IAS 2 outlines how inventories can be

valued, and what production costs should be included in inventory valuation.

1-2

Financial accounting is governed by generally accepted accounting principles (GAAP).

Management accounting does not suffer such restrictions to these principles. The net effect is

that

Management accounting allows managers to charge interest on owners’ capital to help

appraise a division’s performance, whereas such a charge is not permissible under GAAP.

Financial accounting reports must be prepared in accordance with statutory requirements

(Companies Law, IFRS, IPSAS, GAAP, etc.), whereas no such legal requirements are there

for management accounting.

Financial accounting reports focus more on historical information, whereas management

accounting places greater emphasis on reporting future costs and revenues.

Management accounting reports are produced at intervals that are more frequent and are

less accurate as they are based on estimates.

1-1

Management accounting can include assets or liabilities (such as “brand names” developed

internally) not recognized under GAAP.

Management accounting can use asset or liability measurement rules (such as present

values or resale prices) not permitted under GAAP.”

Note: Under the IFRS jurisdictions, the preparation of financial statements must comply with

both the format prescribed by the Standards and further disclosures required. This is not the case

with management accounting.

Management accounting information helps manager to develop, communicate, and

implement strategies by answering the following questions, which could contribute to an

effective formulation of the strategies:

Who are our most important customers, and what critical capability do we have to be

competitive and deliver value to our customers?

What are the bargaining power of our customers, and our suppliers?

What substitute products exist in the marketplace, and how do they differ from our

products in terms of features, price, cost, and quality?

Will adequate cash be available to fund the strategy, or will additional funds need to be

raised?

1-3

Value chain analysis helps organizations to assess their competitive advantage by

determining the implications of all strategic activities to the organization. Cost accounting

provides the financial analysis of each of the strategic activities. Cost accounting provides the

financial estimates by undertaking the following analysis:

1. Internal cost analysis: this involves estimating the cost of each internal value chain

process, determining the financial implications and viability.

2. Vertical linkage analysis: this cost analysis estimates the sources of differentiation within

internal value-creating processes. Vertical linkages require obtaining information on

operating costs, revenues and assets for each process throughout the industry’s value

chain.

3. Internal differentiation analysis: this analysis requires the estimation of the effect of cost

supplies and other processes within the value chain and the business performance.

1-4

1-5

Supply chain describes the flow of goods, services, and information from the initial

sources of materials and services to the delivery of products to consumers, regardless of whether

those activities occur in one organization or in multiple organizations.

Cost management is most effective when it integrates and coordinates activities across all

companies in the supply chain as well as across each business function in an individual

company’s value chain. Attempts are made to restructure all cost areas to be more cost-effective.

1-6

Management accounting is concerned largely with looking at current issues and problems

and the future in terms of decision-making and forecasting. As management accounting outputs

are mainly for internal users, a confidential report is usually produced before the directors of the

company.

1-2

Management accounting enables organizations in the following decision-making

activities: forecasting revenues and costs, planning activities, managing cost, identification of

sources and costs of funding, evaluation of investments, measurement and controlling

performance. Management accounting is therefore involved in managing the scorecard of the

firm.

Management accounting provides forward-looking information to help managers plan

and control operations as they lead the business. This includes managing the company’s plant,

equipment, and human resources.

1-7

Management accountants can help improve quality and achieve timely product deliveries

by recording and reporting an organization’s current quality and timeliness levels and by

analyzing and evaluating the costs and benefits—both financial and nonfinancial—of new

quality initiatives, such as TQM, relieving bottleneck constraints, or providing faster customer

service.

1-8

The five-step decision-making process is (1) identify the problem and uncertainties;

(2) obtain information; (3) make predictions about the future; (4) make decisions by choosing

among alternatives; and (5) implement the decision, evaluate performance, and learn.

1-9

Planning decisions focus on selecting organization goals and strategies, predicting results

under various alternative ways of achieving those goals, deciding how to attain the desired goals,

and communicating the goals and how to attain them to the entire organization.

Control decisions focus on taking actions that implement the planning decisions, deciding

how to evaluate performance, and providing feedback and learning to help future decision

making.

1-10

The three guidelines for management accountants are:

1. Employ a cost-benefit approach.

2. Recognize technical and behavioral considerations.

3. Apply the notion of “different costs for different purposes.”

Agree. Technical and basic analytical competences are necessary for preparing and

interpreting management accounting reports. However, these competencies are insufficient.

Management accountants are required to know:

a) how to work well in cross-functional teams and be an efficient business partner;

b) how to possess high integrity, and communicate clearly, openly and candidly;

c) how to lead and motivate people to change and be innovative;

d) how to promote fact-based analysis and make tough-minded, critical judgments without

being adversarial.

1-11

The new controller could reply in one or more of the following ways:

a) Explain to the plant manager how he or she could benefit from activities and tasks

performed by accountants and the controller such as ‘reporting and interpreting relevant

data’ and highlight how the controller can influences the behavior of all employees and

helps line managers make better decisions.

1-12

1-3

b) Demonstrate to the plant manager how accountants and the controller can help them with

Global Financial Planning/Budgeting and making correct decision/s when there is a

variation between budgeted costs and actual costs.

c) Demonstrate to the plant manager how accountants and the controller can help them in

identifying and analyzing problem situations and evaluating financial and nonfinancial

aspects of different alternatives, such capital budgeting, make or buy decisions, special

prices, outsourcing decisions, product-mixed decisions, etc.

d) Demonstrate to the plant manager that what accountants and the controller can do is not a

duplication of what accounting software and packages are capable of, and provide them

with a list of activities which need more in depth insights from accountants and the

controller such as customer satisfaction reporting, profitability reporting, performance

reporting and etc.

e) Explain that while the existing accounting software is able to provide information for the

smooth operation of current operational activities, the controller would be able to provide

information that would help the manager to become aware of and prepare for shifts in the

external environment, which would require changes in production processes.

1-13 The controller is the chief management accounting executive. The corporate controller

reports to the chief financial officer, a staff function. Companies also have business unit

controllers who support business unit managers or regional controllers who support regional

managers in major geographic regions.

1-14

1. Setting professional ethical standards is important due to the following facts:

They offer confidence in the employee-employer affiliation,

Standards embody a locus point of reference for management accountants

confronted with ethical impasses;

They allow for an assurance to the information users that the quality and integrity

of the information made available by the management accountants is without

doubt.

2. The five fundamental principles of ethics for professional management accountants as

advanced by the Chartered Institute of Management Accountants (CIMA) are:

There are five fundamental principles of ethics for professional management

accountants:

(a) Integrity — to be straightforward and honest in all professional and business

relationships

(b) Objectivity — not to compromise professional or business judgments because of

bias, conflict of interest or undue influence of others.

(c) Professional competence and due care to:

(i) Attain and maintain professional knowledge and skill at the level required to

ensure that a client or employing organization receives competent professional

service, based on current technical and professional standards and relevant

legislation; and

(ii) Act diligently and in accordance with applicable technical and professional

standards.

1-4

(d) Confidentiality - to respect the confidentiality of information acquired as a result of

professional and business relationships.

(e) Professional behavior — to comply with relevant laws and regulations and avoid

any conduct that the professional accountant knows or should know might

discredit the profession.

When basic ethics is weak, suppliers might not improve the quality of their products or

lower the costs while at the same time win supply contracts by bribing executives. This situation

can lead to customers’ dissatisfaction when they receive low quality products at a high price.

When the quality of products is low, customers are discouraged to buy them, causing the market

to fail.

The price of products increases as a result of higher prices (which incorporate the bribes)

paid to suppliers while fewer products being produced and sold.

1-15

Choice ‘c’ is correct. Preparation of financial statements and cash flow statement are not

the responsibilities of the management accountant. This is usually handled by the financial

accountant.

Choice ‘a’ Preparation of cost estimates, project planning, and analysis, Choice ‘b’

Budgetary controls and investigation, and Choice ‘d’ Performance evaluation and reporting are

all duties of the management accountant.

1-16

1-17

(15 min.) Value chain and classification of costs, computer company.

Cost Item

a.

b.

c.

d.

e.

f.

g.

h.

1-18

(15 min.)

Cost Item

a.

b.

c.

d.

e.

f.

g.

h.

Value Chain Business Function

Production

Distribution

Design of products and processes

Research and development

Customer service or marketing

Design of products and processes

(or research and development)

Marketing

Production

Value chain and classification of costs, pharmaceutical company.

Value Chain Business Function

Marketing

Design of products and processes

Customer service

Research and development

Marketing

Production

Marketing

Distribution

1-5

1-19

(15 min.) Value chain and classification of costs, fast-food restaurant.

Cost Item

a.

b.

c.

d.

e.

f.

g.

h.

1-20

Value Chain Business Function

Production

Distribution

Production

Production

Marketing

Marketing

Design of products and processes (or research and development)

Customer service

(10 min.) Key success factors.

Change in Operations/

Management Accounting

a.

b.

c.

d.

e.

1-21

Key Success Factor

Innovation

Cost and efficiency and quality

Time and cost and efficiency

Innovation, sustainability, and cost and efficiency

Cost and efficiency

(10 min.) Key success factors.

Change in Operations/

Management Accounting

a.

Key Success Factor

Cost and efficiency, quality, and

sustainability

Cost and efficiency, time

Cost and efficiency

Efficiency, time and quality

Innovation, cost and efficiency, and

quality

b.

c.

d.

e.

1-22

(10–15 min.) Planning and control decisions.

Action

a.

b.

c.

d.

e.

Decision

Planning

Control

Control

Planning

Planning

1-6

1-23

(10–15 min.) Planning and control decisions.

Action

a.

b.

c.

d.

e.

1-24

Decision

Planning

Planning

Control

Planning

Control

(10 mins.) Five-step decision-making process.

The five-step decision-making process includes:

a.

b.

c.

d.

e.

Identification of the problem and uncertainties.

Obtaining relevant information.

Make predictions about the future.

Make decisions by choosing among alternatives.

Implementation of decision, evaluation of performance and learning curve.

Identification of the problem and uncertainties: they have to identify where to obtain

the additional $15,000 from. What is the certainty that the bank will offer them the loan?

Are there other alternative sources of finance if the bank refuses to offer them the loan?

Obtaining relevant information: they have to obtain information on the number of

customers which justifies the expansion. Would this expansion increase demand or

require an increase in price?

Make predictions about the future: how many units will be produced following the

expansion? What will be the sales figure and demand? They will need to estimate the

breakeven units required to cover the costs of the expansion.

Make decisions by choosing among alternatives: based on the above analysis, they

have to decide whether to go ahead with the expansion or maintain the current level of

production.

Implementation of decision, evaluation of performance and learning curve: if the

loan is obtained and the expansion is carried out, they will compare and analyze the

actual sales with the breakeven. Where the actual sales vary from the breakeven,

investigation of the variances will be carried out to establish the cause and correct further

shortfalls.

1-7

1-25

(15 min.) Five-step decision-making process, service firm.

Action

a.

b.

c.

d.

e.

f.

1-26

Step in Decision-Making Process

Make decisions by choosing among alternatives.

Identify the problem and uncertainties through obtaining

information.

Obtain information and/or make predictions about the future.

Obtain information and/or make predictions about the future.

Make predictions about the future.

Obtain information.

(10–15 min.) Professional ethics and reporting division performance.

1. Wilson’s ethical responsibilities are well summarized in the IMA’s “Standards of Ethical

Conduct for Management Accountants” (Exhibit 1-7 of text). Areas of ethical responsibility

include the following:

Competence

Confidentiality

Integrity

Credibility

The ethical standards related to Wilson’s current dilemma are integrity, competence, and

credibility. Using the integrity standard, Wilson should carry out duties ethically and

communicate unfavorable as well as favorable information and exercise his professional

judgments and/or opinions. Competence requires Wilson to perform his professional duties in

accordance with relevant laws, regulations, and technical standards and provide decision support

information that is accurate. Credibility requires that Wilson report information fairly and

objectively and disclose deficiencies in internal controls in conformance with organizational

policy and/or applicable law. Wilson should refuse to include the $150,000 of defective

inventory. Both financial accounting and management accounting principles maintain that once

inventory is determined to be unfit for sale, it must be written off. It may be just a timing issue

but reporting the $150,000 of inventory as an asset would be misleading to the users of the

company’s financial statements.

2. Wilson should refuse to follow Leonard’s orders. If Leonard persists, the incident should be

reported to the corporate controller of Garman Enterprises. Wilson should support his line

management wholeheartedly without jeopardising his ethical conduct.

1-27

(10–15 min.) Professional ethics and reporting division performance.

Gilpin’s ethical responsibilities are well summarized in the IMA’s “Standards of Ethical

Conduct for Management Accountants” (Exhibit 1-7 of text). Areas of ethical responsibility

include the following:

Competence

Confidentiality

Integrity

Credibility

1.

1-8

The ethical standards related to Gilpin’s current dilemma are integrity, competence and

credibility. Using the integrity standard, Gilpin should carry out duties ethically, and

communicate unfavorable and favorable information, professional judgments as well as opinions.

Competence demands that Gilpin perform her professional duties in accordance with relevant

laws, regulations, and technical standards, providing accurate decision support information.

Credibility requires that Gilpin report information fairly, objectively, and disclose deficiencies in

internal controls in conformance with organizational policy and/or applicable law. Gilpin should

use her professional judgment to decide if reclassifying the costs of packing materials is

appropriate according to accounting principles. She should not take a decision solely on the basis

of avoiding overhead cost allocation.

2. Gilpin should discuss her concerns with Myers. Any overhead not allocated to Blakemore

would be allocated to other divisions of Eastern Glass and Window. Gilpin may want to consider

consulting the IMA for ethical guidance. Support for line management should be wholehearted,

but it should not entail unethical conduct.

1-28

(15 min.) Planning and control decisions, Internet company.

1.

Planning decisions

a. Decision to raise monthly subscription fee from July

c. Decision to offer e-mail service to subscribers and upgrade content of online services

(later decision to inform subscribers and upgrade online services is an implementation

part of control)

e. Decision to decrease monthly subscription fee starting in November.

Control decisions

b. Decision to inform existing subscribers about the rate of increase—an implementation

part of control decisions

d. Dismissal of VP of Marketing—performance evaluation and feedback aspect of

control decisions

2.

Other planning decisions that may be made at PostNews.com: decision to raise or lower

advertising fees; decision to charge a fee from on-line retailers when customers click-through

from PostNews.com to the retailers’ websites.

Other control decisions that may be made at PostNews.com: evaluating how customers

like the new format for the weather information and evaluating whether the waiting time for

customers to access the website has been reduced.

1-29

(20 min.) Strategic decisions and management accounting.

1. The strategies the companies are following in each case are:

a. Product differentiation strategy

b. Cost leadership strategy

c. Cost leadership strategy

d. Product differentiation strategy

2. Examples of information the management accountant can provide for each strategic decision

follow:

1-9

a.

b.

c.

d.

1-30

Market share of the close competitors in anti-ageing cream

Price of close competitive products

Costs of producing anti-ageing cream with natural ingredients

Total investments in the microprocessor

Cost advantages for the developed technology

Sensitivity of target bulk customers to change in price of microprocessor

Total investments for installing bio-metric system and sources of fund

Estimated monetary value for increase in productivity and efficiency

Effect of cost advantages on product pricing

Number of remote customers who are willing to take telemedicine service

Potential increased sales as a result of telemedicine service

Price charged by other companies who provide similar service

(20 min.) Strategic decisions and management accounting.

1. The strategies the companies are following in each case are:

a. Product differentiation strategy

b. Cost leadership or low-price strategy

c. Cost leadership or low-price strategy

d. Product differentiation strategy

2. Examples of information the management accountant can provide for each strategic decision

are as follows:

a. Cost to produce and sell special tetrazzini

Prices of tetrazzini sold by other competitors

The customers which the company may target to sell its special tetrazzini

Extra price the customers would be willing to pay considering the specialty of the

product

Yearly cash surplus after producing and selling special tetrazzini

b. Cost of producing the low-cost soap

Price of the homogenous products produced by the competitors

The present surplus production capacity of Vanford Soap

Market size of the low-cost soap in terms of sales volume

Estimated growth in the low-cost soap market in terms of sales volume and revenue

Sensitivity of target customers to price and quality

c. Cost of producing the drill machine as per the specification of the tender

The present surplus production capacity of Diato Inc.

Price of the homogenous products produced by the competitors who may compete for

the tender

Minimum order size to reach the break-even-point

Cash surplus that is going to be achieved by producing and selling 1,000 drill

machines

d. Cost to produce and sell the newly featured tablet

Present cash surplus of Smart Pixel to develop, produce, and sell the newly featured

tablet

Prices of tablets with standard features sold by other competitors

Price sensitivity of the target customers

1-10

Present market size of tablets in terms of sales volume

Premium price the target customers will be willing to pay for the new features

1-31

(10–15 min.) Management accounting guidelines.

a. Cost-benefit approach: managers continually face resource-allocation decisions, such as

decisions on the purchase of machinery, establishment of a new branch, or building of new

factory. The cost-benefit approach helps managers to weigh both the costs and expected

returns from such projects before making the decision.

b. Behavioral and technical considerations: Behavioral consideration impels managers to

discuss issues with their employees on any aspect of the organization. Such interaction creates

opportunity to understand both the needs of staff and the strategic focus of the organization.

Technical considerations enable managers to make wise economic decisions by providing

desired information in an appropriate format and at the required intervals.

c. Different costs for different purposes: Managers apply various ways in computing costs

depending on whether the costs evaluation is for external or internal use. For example, costs

that are inherent to a project may be written off or capitalized depending on the judgement of

the management in assessing the performance of the project.

1-32

1.

2.

3.

4.

5.

6.

7.

1-33

(15 min.) Management accounting guidelines.

Cost-benefit approach

Cost-benefit approach and/or behavioral and technical considerations (for example: how

the overall morale of employees will be impacted due to retrenchment, and whether the

machines will operate normally after the new start-up)

Different costs for different purposes

Cost-benefit approach or behavioral and technical considerations (for example: how

employees will react to more supervisory control)

Cost-benefit approach or behavioural and technical consideration (for example: how to

design the performance bonus to correctly improve productivity without sacrificing other

aspects)

Cost-benefit approach

Cost-benefit approach and/or behavioral and technical considerations (for example: how

employees will react to the production process)

(20 min.) The roles of chief financial officer (CFO) and controller

The roles of the CFO include:

Controllership – the CFO provides financial information for reports to managers and

shareholders and oversees the overall operations of the accounting system.

Tax – the CFO plans all tax liabilities and receipts of the business including value added tax

(VAT)

1-11

Treasury – the CFO oversees banking, short and long-term financing, investments and cash

management of the business.

Risk management – the CFO manages the financial risk resulting from interest rate and exchange

rate changes, and the management of the derivatives.

Investor relations – the CFO communicates with stakeholders of the organization including the

shareholders, suppliers and investors.

Strategic planning – the CFO defines the financial strategy of the organization and allocates

resources to implement such strategies.

The roles of the controller (also known as chief accounting officer) include:

Globally financial planning

Budget preparation

Managing working capital

Profitability reporting

Subsidiary and liaison accounting

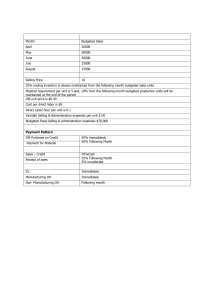

Figure 1: Flowchart indicating the roles and relationship between CFO and financial controller.

1-12

1-34

(30 min.) Pharmaceutical company, budgeting, ethics.

1.

The overarching principles of the IMA Statement of Ethical Professional Practice are

Honesty, Fairness, Objectivity and Responsibility. The statement’s corresponding “Standards for

Ethical Behavior…” require management accountants to

Perform professional duties in accordance with relevant laws, regulations, and

technical standards.

Refrain from engaging in any conduct that would prejudice carrying out duties

ethically.

Communicate information fairly and objectively.

Provide all relevant information that could reasonably be expected to influence an

intended user’s understanding of the reports, analyses, or recommendations.

The idea of capitalizing some of the company’s R&D expenditures (item c) is a direct

violation of the IMA’s ethical standards above. This transaction would not be “in accordance

with relevant laws, regulations, and technical standards.” GAAP requires research and

development costs to be expensed as incurred. Even if Maddox believes his transaction is

justifiable, it violates the profession’s technical standards and would be unethical.

The other “year-end” actions occur in many organizations and fall into the “gray” to

“acceptable” area. Much depends on the circumstances surrounding each one, however, such as

the following:

a. Cut planned bonuses to the Amiven R&D team that would be paid in the third

quarter, knowing that doing so may result in lower productivity and increased

turnover of highly skilled staff. This solution is not a violation of ethical standards,

but this action may not be in the best interest of the company in the long run.

Reducing bonuses may help achieve the budget but losing highly skilled employees

would harm the company’s ability to develop new products in the future and hurt

long-run profits.

b. Sell off rights to the drug, Centrix. The company had not planned on doing this

because, under current market conditions, it would get less than fair value. It would,

however, result in a onetime gain that could offset the budget shortfall. Of course, all

future profits from Centrix would be lost. Again, this solution may solve the

company’s short-term budget crisis, but could result in the loss of future profits for

Pharmex in the long run. If this action does not create value for Pharmex, it would

result in taking an uneconomic action simply to manage accounting earnings in the

third quarter.

2.

While it is not uncommon for companies to sacrifice long-term profits for short-term

gains, it may not be in the best interest of the company’s shareholders. In the case of Pharmex,

the CFO is primarily concerned with “maximizing shareholder wealth” in the immediate future

(third quarter only) but not in the long term. Because this executive’s incentive pay and even

employment may be based on her ability to meet short-term targets, she may not be acting in the

best interest of the shareholders in the long run.

1-13

Maddox definitely faces an ethical dilemma. It is not unethical on Maddox’s part to want

to please his new boss, nor is it unethical that Maddox wants to make a good impression on his

first days at his new job; however, Maddox must still act within the ethical standards required by

his profession. Taking illegal or unethical action by capitalizing R&D to satisfy the demands of

his new supervisor, Emily Alford, is unacceptable. Although not strictly unethical, I would

recommend that Maddox not agree to cut planned bonuses for the Amiven R&D team or sell off

the rights to Centrix. Each of these appears to sacrifice the overall economic interests of Pharmex

for short-run gain. Maddox should argue against doing this but not resign if Alford insists that

these actions be taken. If, however, Alford asks Maddox to capitalize R&D, he should raise this

issue with the chair of the audit committee after informing Alford that he is doing so. If the CFO

still insists on Maddox capitalizing R&D, he should resign rather than engage in unethical

behavior.

1-35

(15-20 min.) Professional standards and management accountants.

The core professional standards governing management accountants include:

1. Competence- Each member:

Has a responsibility to maintain an appropriate level of professional expertise by

continually developing knowledge and skills.

Performs professional duties in accordance with relevant laws, regulations, and

technical standards. Provide decision support information and recommendations

that are accurate, clear, concise and timely.

Recognizes and communicates professional limitations or other constraints that

would preclude responsible judgement or successful performance of an entity.

2. Confidentiality - Each member:

Has a responsibility to keep information confidential except when disclosure is

authorized or legally required.

Informs all relevant parties regarding appropriate use of confidential information.

Monitor subordinates’ activities to ensure compliance.

Refrains from using confidential information for unethical or illegal advantage.

3. Integrity: Each member:

Has a responsibility to mitigate actual conflicts of interest, regularly communicate

with business associates to avoid apparent conflicts of interest.

Advises all parties of any potential conflicts.

Refrains from engaging in any conduct that would prejudice carrying out duties

ethically.

Abstains from engaging in or supporting any activity that might discredit the

profession.

4. Credibility - Each member:

Has a responsibility to communicate information fairly and objectively.

Discloses all relevant information that could reasonably be expected to influence

an intended user’s understanding of the reports, analyses, or recommendations.

1-14

Discloses delays or deficiencies in information, timeliness, processing, or internal

controls in conformance with organization policy and applicable laws.

1-36 (30–40 min.)

Professional ethics and end-of-year actions.

1.

The possible motivations for Controller Sophie Gellar to modify the division’s year-end

earnings are as follows:

(i)

Job security and promotion: The company’s CFO is likely to reward her for

meeting the company’s performance expectations. Alternately, Gellar may be

penalized, perhaps to the extent of losing her job if the division’s performance

expectations are not met.

(ii)

Management incentives: Gellar’s bonus may be based on the division’s ability to

meet certain profit targets. If the House and Home division has already met its

profit target for the year, the Controller may personally benefit if new printing

equipment is sold off and replaced with the discarded equipment that no longer

meets current safety standards, or if operating income is manipulated by

questionable revenue and/or expense recognition.

2.

The overarching principles of the IMA Statement of Ethical Professional Practice are

Honesty, Fairness, Objectivity and Responsibility. The statement’s corresponding “Standards for

Ethical Conduct…” require management accountants to abide by the following principles:

● Perform professional duties in accordance with relevant laws, regulations, and technical

standards.

● Refrain from engaging in any conduct that would prejudice carrying out duties ethically.

● Communicate information fairly and objectively.

● Disclose all relevant information that could reasonably be expected to influence an

intended user’s understanding of the reports, analyses, or recommendations.

Several “year-end” actions are clearly are in conflict with the statement’s principles and required

standards and should be viewed as unacceptable.

(a)

Subscription revenue received in December in advance for magazines that will be

sent out in January or a later date is a liability. Depicting it as revenue falsely

represents next year’s revenue as this year’s revenue.

(b)

Revising the estimate for pension liability and expense would violate Generally

Accepted Accounting Principles unless the pension liability is currently

overstated. Recording this transaction would result in an overstatement of income

and could potentially mislead investors.

(c)

Booking advertising revenues that relate to February in December falsely

represents next year’s revenue as this year’s revenue.

The other “year-end” actions occur in many organizations and fall into the “gray” to

“acceptable” area. Much depends on the circumstances surrounding each one as witnessed

below:

(d)

Cancelling three of the division’s least profitable magazines, resulting in the

layoff of thirty employees. While employee layoffs may be necessary for the

business to survive, the layoff decision could result in economic hardship for

1-15

(e)

(f)

those employees who lose their jobs, as well as result in employee morale

problems for the rest of the division. Most companies would prefer to avoid

causing hardship for their existing employees due to layoffs unless necessary for

the survival of the business as a whole.

Selling the new printing equipment that was purchased in February and replacing

it with discarded equipment from one of the company’s other divisions. The

previously discarded equipment no longer meets current safety standards. Again,

while this method may result in a short-term solution for the Controller and the

Production Manager personally, this decision may harm the corporation

financially as a whole, not to mention the potential resulting injuries to production

workers from hazardous equipment. This method would be also be ethically

questionable and would likely violate the IMA’s ethical standards of integrity and

credibility.

Delaying maintenance on production equipment that was scheduled for October

until January. Performing regular scheduled maintenance is important for the safe

and efficient operation of production equipment. While a three-month delay may

not seem significant, delaying maintenance may put the production employees at

risk of physical harm, and put company at financial risk should the equipment

malfunction and cause injury. Furthermore, failure to keep a regular maintenance

schedule may void the warranties on the equipment. The Standards of Ethical

Behavior require management accountants to communicate information fairly and

objectively and to carry out duties ethically.

3.

Gellar should directly raise her concerns with the CFO, especially if the pressure from the

CFO is so great that the only course of action on the part of the Controller is to resort to unethical

behavior. If the CFO refuses to change his direction, the Controller should raise these issues with

the CEO, and then the Audit Committee and the Board of Directors, after informing the CFO that

she is doing the same. The Controller could also initiate a confidential discussion with an IMA

Ethics Counselor, other impartial advisers, or her own attorney. Under extreme circumstances,

the Controller may want to resign if the corporate culture of Phoenix Press is to reward

executives who take year-end actions that the Controller views as unethical and possibly illegal.

1-37

(40 min.) Ethical challenges, global company.

1.

The overarching principles of the IMA Statement of Ethical Professional Practice are

Honesty, Fairness, Objectivity, and Responsibility. The statement’s corresponding “Standards

for Ethical Conduct…” require management accountants to

Perform professional duties in accordance with relevant laws, regulations, and technical

standards.

Refrain from engaging in any conduct that would prejudice carrying out duties

ethically.

Communicate information fairly and objectively.

Disclose all relevant information that could reasonably be expected to influence an

intended user’s understanding of the reports, analyses, or recommendations.

1-16

Several of the suggestions made by Armstrong’s staff are clearly in conflict with the statement’s

principles and required standards and should be viewed as unacceptable.

a. Pay local officials to “certify” the ramin used by CI as sustainable. It is not certain

whether the ramin would indeed be sustainable or not. If the payment could be

considered a bribe, the company would be in violation of the Foreign Corrupt Practices

Act. Knowledge of such a violation of law would be considered a violation of

professional ethics.

b. Record executive year-end bonus compensation accrued for the current year when it is

paid in the next year after the December fiscal year-end. GAAP requires expenses to be

recorded (accrued) when incurred, not when paid (cash basis accounting). Therefore,

failure to record the executives’ year-end bonus would violate the IMA’s standards of

credibility and integrity.

c. Pressure current customers to take early delivery of goods before the end of the year so

that more revenue can be reported in this year’s financial statements. This tactic,

commonly known as channel stuffing, merely results in shifting future period revenues

into the current period. The overstatement of revenue in the current period may mislead

investors to believe that the company’s financial well-being is better than the actual

results achieved. This practice would violate the IMA’s standards of credibility and

integrity. Channel stuffing is frequently considered a fraudulent practice.

d. Recognize sales revenues on orders received but not shipped as of the end of the year.

GAAP requires income to be recorded (accrued) when the four criteria of revenue

recognition have been met:

1.

The company has completed a significant portion of the production and sales

effort.

2.

The amount of revenue can by objectively measured.

3.

The major portion of the costs has been incurred, and the remaining costs can be

reasonably estimated.

4.

The eventual collection of the cash is reasonably assured.

Because criteria 1 and 3 have not been met at the time the order is placed, the revenue should not

be recognized until after year-end. Therefore, recording next year’s revenue in the current year

would be a violation of GAAP and would be falsifying revenue. This would be a violation of the

IMA’s standards of credibility and integrity and considered fraudulent.

Three of the suggestions appear to be acceptable:

e. Reject the change in materials. Counter the bad publicity with an aggressive ad

campaign showing the consumer products as “made in the USA,” since manufacturing

takes place in North Carolina. This is an acceptable strategy. Consumers could then

weigh the employment benefits in the United States against the negative

environmental effects of the company’s actions.

f. Redesign upholstered furniture to replace ramin contained inside with less expensive

recycled plastic. Creative changes in product design using recycled materials will

allow CI to address sustainability concerns as well as protect company profits.

1-17

g.

Begin purchasing sustainable North American hardwoods and sell the Indonesian

lumber subsidiary. Initiate a “plant a tree” marketing program, by which the

company will plant a tree for every piece of furniture sold. While this solution would

increase cost of materials and the price CI must charge for its product, sales and profits

may not decline if consumers perceive the value of sustainability and corporate social

responsibility.

The other “year-end” actions occur in many organizations and fall into the “gray” to

“acceptable” area. Much depends on the circumstances surrounding each one, however, such as

the following:

h. Make deep cuts in pricing through the end of the year to generate additional revenue.

Again, this is only a short-term tactic to improve this year’s financial results. Investors

may be content in the short run, but in the long run, the company may see reduced

margins from these actions.

i. Sell-off production equipment prior to year-end. The sale would result in one-time

gains that could offset the company’s lagging profits. The owned equipment could be

replaced with leased equipment at a lower cost in the current year. While this course of

action does not necessarily violate the IMA’s code of ethical standards, it may be only a

short-term tactic to improve this year’s financial results. Armstrong will need to weigh

his options in the long term to make the most cost-effective decision for his company.

2.

It is possible that any of the “year-end” actions that fall into the “gray” area may be good

for investors, depending on the credible evidence that supports the management decision. For

example, replacing owned equipment with leased equipment may result in both short-term gains

for the company and long-term cost reduction. If so, this decision would be in the best interest of

the investors. If the decision only results in short-term gains, but higher costs in the long run,

then the decision may not be in the best long-term interest of the company’s investors and should

not be implemented solely to prop up short-term earnings.

Those decisions that clearly violate the IMA code of ethical standards (a, c, f, and i)

would never be in the best interest of the investor. These options would result in misleading

financial statements and could result in the demise of the company or even in criminal charges,

as was the case with companies such as Enron and WorldCom. If Armstrong asks the

management accountant to take any of the actions that are clearly unethical, he should raise this

issue with the chair of the Audit Committee after informing Armstrong that he is doing so. If

Armstrong still insists on the management accountant taking these actions, he should resign

rather than engage in unethical behavior.

1-18

CHAPTER 2

AN INTRODUCTION TO COST TERMS AND PURPOSES

2-1

When you think of a cost, you invariably think of it in the context of putting a price on a

particular ‘thing’. That ‘thing’ is called a cost object. Therefore, a cost object is anything for

which a cost measurement is desired. For example, an accounting textbook which cost you some

money to purchase, material purchased for use in the factory, an Apple phone which you

purchased from the shop, etc.

2-2

Direct costs of a cost object are those costs that are related to the particular cost object

and can be traced to it in an economically cost-effective manner. For example, in a computer

production company, the cost of the computer screen is directly traceable to the cost of the

computer.

Therefore, the computer screen is a direct cost when computing the manufacturing cost of

the computer. Direct costs make direct input in the production of the product. They must be

incurred if the product is to be produced.

Indirect costs of a cost object are related to the particular cost object but cannot be traced

to it in an economically cost-effective manner. For example, the salaries of security guards at a

computer production company. Though the security guards are securing the computer

production plant, they make no direct input into the manufacturing of the computer.

2-3

Managers believe that direct costs that are traced to a particular cost object are more

accurately assigned to that cost object than are indirect allocated costs. When costs are allocated,

managers are less certain whether the cost allocation base accurately measures the resources

demanded by a cost object. Managers prefer to use more accurate costs in their decisions.

2-4

Yes, it can. This is because everything for which you need to know the cost of is called a

cost object and a business department is one such item. For example, an organization’s supplies

and maintenance department is a cost object for the cost of the maintenance supplies and the

maintenance employees. At a later stage in the organization’s work process, the supplies and

maintenance department costs will be assigned to various products, which will also be regarded

as cost objects.

2-5

Fixed costs are costs that tend to remain the same in amount, regardless of level of

activity. They remain fixed during the relevant range of activity. Typical examples of costs that

are fixed include annual rent of business accommodation, salaries of supervision staff and

insurance. Variable costs are costs that increase or decrease in total as the volume of activity

increases or decreases. Examples of variable costs include raw materials and power for

machinery. It also includes labor where payment is made according to the level of output.

2-6

Variable and direct: Tires used to manufacture a particular kind of car

Variable and indirect: Electricity used in the plant where multiple products are manufactured

Fixed and direct: Depreciation for a machine that is only used for one product

Fixed and indirect: Salary for the company’s CEO

2-1

2-7

A cost driver is a variable, such as the level of activity or volume that causally affects

total costs over a given time span. A change in the cost driver results in a change in the level of

total costs. For example, the number of vehicles assembled is a driver of the costs of steering

wheels on a motor-vehicle assembly line.

2-8

Calculating a unit cost is essential in many cases, especially when managers want to take

a decision regarding the pricing of different cost objects as well as when they want to accept a

special order or prioritize a product mix. The unit cost calculation is vital during these cases

because the manager needs to be certain that they are making the right choice by accepting or

rejecting a special offer for a specific cost object.

2-9

A unit cost is computed by dividing some amount of total costs (the numerator) by the

related number of units (the denominator). In many cases, the numerator will include a fixed cost

that will not change despite changes in the denominator. It is erroneous in those cases to multiply

the unit cost by activity or volume change to predict changes in total costs at different activity or

volume levels.

2-10 Manufacturing-sector companies purchase materials and components and convert them

into various finished goods, for example automotive and textile companies.

Merchandising-sector companies purchase and then sell tangible products without

changing their basic form, for example retailing or distribution.

Service-sector companies provide services or intangible products to their customers, for

example, legal advice or audits.

2-11 Although all manufacturing costs are considered as inventoriable costs, they are not just

peculiar to the manufacturing firms. In the retail industry, for example, inventoriable costs

include the costs of purchasing goods that are for resale, costs of freight, insurance, and any

other handling costs. Inventoriable costs are first converted into work-in-process before the final

finished product, which is an asset in the balance sheet. Therefore, the service sector firms do not

have associated inventoriable costs.

Period costs are all costs in the income statement other than cost of goods sold. In the

manufacturing industry, all non-manufacturing costs including research and development

expenses are treated as period costs. In the retail industry, period costs include all costs shown in

the income statement except the cost of goods sold. Costs such as marketing and distribution

expenses, administration expenses and other operating expenses are considered as period costs.

In the service sector firms, all costs are treated as period costs.

2-12 Inventoriable costs are all costs of a product that are considered as assets in the balance

sheet when they are incurred and that become cost of goods sold when the product is sold. These

costs are included in work-in-process and finished goods inventory (they are “inventoried”) to

accumulate the costs of creating these assets.

Period costs are all costs in the income statement other than cost of goods sold. These

costs are treated as expenses of the accounting period in which they are incurred because they are

expected not to benefit future periods (because there is not sufficient evidence to conclude that

such benefit exists). Expensing these costs immediately best matches expenses to revenues.

2-2

2-13 Overtime premium is the wage rate paid to workers (for both direct labor and indirect

labor) in excess of their straight-time wage rates. Overtime premium is usually considered to be

part of indirect costs or overheads. This is because it is attributable to the general use of the

work done rather to any specific product. However, where overtime premium relates to a single

product, such circumstance will lead to overtime being treated as labor cost rather than overhead.

Idle time is a subclassification of indirect labor that represents wages paid for

unproductive time caused by lack of orders, machine breakdowns, material shortages, poor

scheduling, and the like. This is not related to any product and therefore considered an overhead,

and not a direct labor cost.

2-14 A product cost is the sum of the costs assigned to a product for a specific purpose.

Purposes for computing a product cost include:

pricing and product mix decisions,

contracting with government agencies, and

preparing financial statements for external reporting under GAAP.

2-15 The following three main features of cost accounting and cost management, which can be

used in wide range of applications include:

1. Calculating the cost of products, services and other cost objects – costing systems trace

direct costs and allocate indirect costs to products. For example, job costing and

activity-based costing are used to calculate total costs and unit costs of products and

services.

2. Obtaining information for planning and control, and performance evaluation – budget

is the most commonly used tool for planning and control. A budget forces managers to

look ahead, to translate a company’s strategy into plans, to coordinate and

communicate within the organization. It also provides a benchmark for evaluating the

company’s performance. Managers make efforts to meet their budget targets, thus

budgeting can affect the attitude of staff towards achieving the set target.

3. Analyzing the relevant information for making decisions – when designing strategies

and implementing them, managers must understand which revenues and costs to

consider and which ones to ignore. When making strategic decisions about which

products and how much to produce, managers must know how revenues and costs vary

with changes in output levels.

2-16 Choice “a” is incorrect. Variable costs are not fixed, they change in relation to the level

of activity. Fixed costs are fixed irrespective of the level of activity within the relevant range.

Choice “b” is also incorrect. Cost of materials and wages for factory workers are variable costs.

This is because these costs increase with the level of production. However, the fixed costs

remain the same at all levels of activity. Salaries paid to office staff do not vary with the level of

production. Note that costs are regarded as variable or fixed within a period or over a certain

range of activity.

Choice “c” is correct. Variable costs and fixed costs are only variable or fixed for a specific

activity and for a given time period. A cost may be variable in period one but fixed in period

two. For example, the cost of electricity used in the factory may vary on the level of production

2-3

activity in the factory. However, the company may decide to obtain a fixed bill contract that

allows it to pay a fixed amount irrespective of the level of production activity.

Choice “d” is incorrect. Reducing the level of activity can reduce the total variable cost whilst

for fixed cost, such reduction will not affect the total fixed costs.

2-17 Choice “2” is correct. Costs that maintain production capacity and do not vary regardless

of utilization are classified as fixed costs. In this instance, the salary costs of direct service staff

are required to maintain capacity based on the number of residents (doctors) and will be incurred

whether the facility is full or empty. The costs are fixed.

Choice “1” is incorrect. Direct labor costs mandated by statute do not vary with production, they

vary with the compliance requirement. Consequently, direct labor costs, in this instance, are

fixed, not variable.

Choice “3” is incorrect. Direct costs related to service provider salaries are considered to be

direct costs of the service, not overhead costs.

Choice “4” is incorrect. Comprehensive Care Nursing Home is a service company and does not

have any inventory and therefore no inventoriable costs.

2-18 Choice "3" is correct. The question asks what happens to variable and fixed costs when

cost driver activity changes (i.e., when the cost driver level increases or decreases). Statement I

says that, as the cost driver level increases, total fixed cost remains unchanged. Statement I is

correct. Total fixed cost will remain unchanged regardless of changes in the cost driver because

total fixed cost is unaffected by changes in the cost driver.

Statement II says that, as the cost driver level increases, unit fixed cost increases. This statement

is asking about unit fixed cost like the previous statement asked about total fixed cost. While

total fixed cost will remain unchanged regardless of changes in the cost driver, unit fixed cost

will not. If the cost driver level increases, total fixed cost will remain the same, but the total

number of units will increase, and unit fixed cost will decrease, not increase. Statement II is

incorrect.

Statement III says that as the cost driver level decreases, unit variable cost decreases. This

statement is asking about unit variable cost like the previous statement asked about unit fixed

cost. Unit variable cost will remain unchanged regardless of what happens to the cost driver.

Statement III is incorrect.

2-4

2-19 Choice “a” is incorrect because overtime premium and idle time are overhead costs. They

are not normally considered as cost of labor since they are not identifiable with specific

production process.

Choice “b” is incorrect because overtime is traceable to a single product, the overtime premium

can be treated as a labor cost.

Choice “c” is incorrect because idle time occurs when labor is not productively used. This may

be caused by breakdown of machine, unavailability of materials and other problems.

Choice “d” is correct as all the above options are accurate descriptions of overtime and idle time.

For example, overtime premium and idle time are both overhead costs. Overtime premium can

be classified as direct labor cost where the overtime related to a single product. However, all idle

time costs are treated as overheads.

2-20 Choice “4” is correct. The question seeks to analyze the flow of inventoriable and period

costs in an organization. Statement I is correct because both cost categories flow through the

income statement at a merchandising business. Statement II is also correct because

inventoriable costs are transformed to current assets in the balance sheet, e.g. work-in-process

and finished goods. Statement III is correct because period costs include all costs in the income

statement except the cost of goods sold.

2-5

2-21

(15 min)

Computing and interpreting manufacturing unit costs.

1. & 2.

Direct material cost

Direct manuf. labor costs

Manufacturing overhead costs

Total manuf. costs

Fixed costs allocated at a rate

of $15M ÷ $50M (direct mfg.

labor) equal to $0.30 per

dir. manuf. labor dollar

(0.30 $16; 26; 8)

Variable costs

Units produced (millions)

Manuf. cost per unit (Total manuf.

costs ÷ units produced)

Variable manuf. cost per unit

(Variable manuf. costs

Units produced)

Supreme

$ 89.00

16.00

48.00

153.00

(in millions)

Deluxe

$ 57.00

26.00

78.00

161.00

4.80

$148.20

125

Regular

$60.00

8.00

24.00

92.00

Total

$206.00

50.00

150.00

406.00

7.80

$153.20

150

2.40

$89.60

140

15.00

$391.00

$1.2240

$1.0733

$0.6571

$1.1856

$1.0213

$0.6400

(in millions)

Deluxe

Regular

Total

$183.60

$203.93

$144.56

$532.09

$177.84

$194.05

$140.80

$512.69

Supreme

Based on total manuf. cost

per unit ($1.2240 150;

$1.0733 190; $0.6571 220)

Correct total manuf. costs based

on variable manuf. costs plus

fixed costs equal

Variable costs ($1.1856 150;

$1.0213 190; $0.64 220)

Fixed costs

Total costs

15.00

$527.69

The total manufacturing cost per unit in requirement 1 includes $15 million of indirect

manufacturing costs that are fixed irrespective of changes in the volume of output per month,

while the remaining variable indirect manufacturing costs change with the production volume.

Given the unit volume changes for August 2020, the use of total manufacturing cost per unit

from the past month at a different unit volume level (both in aggregate and at the individual

product level) will overestimate total costs of $532.09 million in August 2020 relative to the

correct total manufacturing costs of $527.69 million calculated using variable manufacturing cost

per unit times units produced plus the fixed costs of $15 million.

2-6

2-22

(15-20 min)

1. Classify each of the costs listed earlier as either direct or indirect costs.

Cost

Amount (£) Direct costs Indirect costs

(£)

(£)

Materials used in the product

100,000

100,000

Depreciation on factory machine

80,000

80,000

Factory insurance

6,000

6,000

Labor cost for factory workers

120,000

120,000

Factory repairs

10,000

10,000

Advertising expense

35,000

35,000

Distribution expenses

15,000

15,000

Sales commission

20,000

20,000

Secretary’s salary

25,000

25,000

2. Compute the total manufacturing cost.

Cost

Amount (£)

Direct materials:

Materials used in the product

100,000

Direct labor:

Labor cost for factory workers

120,000

Manufacturing overhead:

Depreciation on factory machine

80,000

Factory insurance

6,000

Factory repairs

10,000

Total manufacturing costs

316,000

Note: Advertising, sales commission, distribution and secretary’s salaries are not considered part of

the manufacturing costs. They are regarded as selling and administrative expenses.

2-7

2-23

(10-15 mins.)

1. For each cost item (A-I) from the records, identify the direct and indirect costs

Direct costs

Ink for the pens

Wages of factory staff

Plastics for pens

£’000

600

5,000

10,000

Indirect costs

Depreciation of factory machine

Salary of supervisors

Machine maintenance costs

Depreciation

of

delivery

vehicles

£’000

8,500

2,500

350

4,000

2. Compute Timi Company’s total indirect manufacturing cost.

Indirect costs

£’000

Depreciation of factory machine

8,500

Salary of supervisors

2,500

Machine maintenance costs

350

Total manufacturing overhead

11,350

Items excluded in (2) and the reason for excluding them are as follows: ink for the pens (direct

materials), wages for factory staff (direct labor cost), depreciation of delivery vehicles

(marketing cost), interest expense (financing cost), salary of general manager (administrative

cost), plastics for pens (direct material cost).

2-24

(15-20 min) Classification of costs, merchandising sector.

Cost object: t-shirts sold in apparel section of store

Cost variability: With respect to changes in the number of t-shirts sold

There may be some debate over classifications of individual items, especially with regard

to cost variability.

Cost Item

A

B

C

D

E

F

G

H

D or I

D

I

D

D

I

I

I

D

2-8

V or F

F

F

V

F

F

V

F

V

2-25

(15-20 min) Classification of costs, manufacturing sector.

Cost object: Type of chair assembled (Recliners or Rockers)

Cost variability: With respect to changes in the number of Recliners assembled

There may be some debate over classifications of individual items, especially with regard to cost

variability.

Cost Item

A

B

C

D

E

F

G

H

I

2-26

(20 min)

D or I

D

I

I

D

D

I

D

I

I

V or F

V

F

F

V

V

V

V

F

F

Variable costs, fixed costs, total costs.

1.

Minutes/month

Plan A ($/month)

Plan B ($/month)

Plan C ($/month)

0

0

15

22

50 100 150 200 240 300 327.5 350 400 450 510 540 600 650

5 10 15 20 24 30 32.75 35

40

45

51

54

60

65

15 15 15 15 15 19.80 22 23.80 27.80 31.80 36.60 39 43.80 47.80

22 22 22 22 22 22

22

22

22

22

22 23.50 26.50 29

60

Total Cost

50

40

Plan A

Plan B

Plan C

30

20

10

0

0

100

200

300

400

500

Number of long-distance minutes

2-9

600

2.

In each region, Ashton chooses the plan that has the lowest cost. From the graph (or from

calculations)*, we can see that if Ashton expects to use 0–150 minutes of long-distance each

month, she should buy Plan A; for 150–327.5 minutes, Plan B; and for more than 327.5 minutes,

Plan C. If Ashton plans to make 100 minutes of long-distance calls each month, she should

choose Plan A; for 240 minutes, choose Plan B; for 540 minutes, choose Plan C.

*Let x be the number of minutes when Plan A and Plan B have equal cost

$0.10x = $15

x = $15 ÷ $0.10 per minute = 150 minutes.

Let y be the number of minutes when Plan B and Plan C have equal cost

$15 + $0.08 (y – 240) = $22

$0.08 (y – 240) = $22 – $15 = $7

$7

87.5

y – 240 =

$0.08

y = 87.5 + 240 = 327.5 minutes

2-27

(20 min.) Variable costs, fixed costs, relevant range.

1. The production capacity is 4,400 jawbreakers per month. Therefore, the current annual

relevant range of output is 0 to 4,400 jawbreakers × 12 months = 0 to 52,800 jawbreakers.

2. Current annual fixed manufacturing costs within the relevant range are $1,300 × 12 =

$15,600 for rent and other overhead costs, plus $9,500 ÷ 10 = $950 for depreciation, totalling

$16,550.

The variable costs, the materials, are 10 cents per jawbreaker, or $3,720 ($0.10 per

jawbreaker × 3,100 jawbreakers per month × 12 months) for the year.

3. If demand changes from 3,100 to 6,200 jawbreakers per month, or from 3,100 × 12 = 37,200

to 6,200 × 12 = 74,400 jawbreakers per year, Dotball will need a second machine. Assuming

Dotball buys a second machine identical to the first machine, it will increase capacity from

4,400 jawbreakers per month to 8,800. The annual relevant range will be between 4,400 × 12

= 52,800 and 8,800 × 12 = 105,600 jaw breakers.

Assume the second machine costs $9,500 and is depreciated using straight-line

depreciation over 10 years and zero residual value, just like the first machine. This will add

$950 of depreciation per year.

Fixed costs for next year will increase to $17,500 from $16,550 for the current year +

$950 (because rent and other fixed overhead costs will remain the same at $15,600). That is,

total fixed costs for next year equal $950 (depreciation on first machine) + $950

(depreciation on second machine) + $15,600 (rent and other fixed overhead costs).

The variable cost per jawbreaker next year will be 90% × $0.10 = $0.09. Total variable

costs equal $0.09 per jawbreaker × 74,400 jawbreakers = $6,696.

If Dotball decides not to increase capacity and meet only that amount of demand for

which it has available capacity (4,400 jaw breakers per month or 4,400 × 12 = 52,800 jaw

breakers per year), the variable cost per unit will be the same at $0.10 per jawbreaker.

Annual total variable manufacturing costs will increase to $0.10 × 4,400 jawbreakers per

2-10

month × 12 months = $5,280. Annual total fixed manufacturing costs will remain the same,

$16,550.

2-28

(10-15 min)

Cost behavior.

Variable Costs: Cost per unit is constant ($5)

10,000 units X $5 per unit = $50,000

20,000 units X $5 per unit = $100,000

50,000 units X $5 per unit = $250,000

Fixed Costs: Total cost is constant ($30,000)

10,000 units X $3 per unit = $30,000

$30,000/ 20,000 units = $1.50 per unit

$30,000/ 50,000 units = $0.60 per unit

2-29

(20 min)

Variable costs, fixed costs, relevant range.

1.

The production capacity is 5,000 jaw breakers per month. Therefore, the current annual

relevant range of output is 0 to 5,000 jaw breakers × 12 months = 0 to 60,000 jaw breakers.

2.

Current annual fixed manufacturing costs within the relevant range are $1,200 × 12 =

$14,400 for rent and other overhead costs, plus $6,500 ÷ 10 = $650 for depreciation, totaling

$15,050.

The variable costs, the materials, are 40 cents per jaw breaker, or $18,720 ($0.40 per jaw

breaker × 3,900 jaw breakers per month × 12 months) for the year.

3.

If demand changes from 3,900 to 7,800 jaw breakers per month, or from 3,900 × 12 =

46,800 to 7,800 × 12 = 93,600 jaw breakers per year, Gummy Land will need a second machine.

Assuming Gummy Land buys a second machine identical to the first machine, it will increase

capacity from 5,000 jaw breakers per month to 10,000. The annual relevant range will be

between 5,000 × 12 = 60,000 and 10,000 × 12 = 120,000 jaw breakers.

Assume the second machine costs $6,500 and is depreciated using straight-line

depreciation over 10 years and zero residual value, just like the first machine. This will add

$650 of depreciation per year.

Fixed costs for next year will increase to $15,700 from $15,050 for the current year + $650

(because rent and other fixed overhead costs will remain the same at $14,400). That is, total

fixed costs for next year equal $650 (depreciation on first machine) + $650 (depreciation on

second machine) + $14,400 (rent and other fixed overhead costs).

The variable cost per jaw breaker next year will be 90% × $0.40 = $0.36. Total variable

costs equal $0.36 per jaw breaker × 93,600 jaw breakers = $33,696.

If Gummy Land decides not to increase capacity and meet only that amount of demand for

which it has available capacity (5,000 jaw breakers per month or 5,000 × 12 = 60,000 jaw

breakers per year), the variable cost per unit will be the same at $0.40 per jaw breaker. Annual

total variable manufacturing costs will increase to $0.40 × 5,000 jaw breakers per month × 12

months = $24,000. Annual total fixed manufacturing costs will remain the same, $15,050.

2-11

2-30

1.

(20 min)

Cost drivers and value chain.

A. Perform market research on competing brands - design of products and processes

B. Design a prototype of the phone app and the security camera - design of products and

processes

C. Test the compatibility of the phone app and the security camera - design of products

and processes

D. Make necessary design changes to the prototype based on testing performed in C

above - design of products and processes

E. Manufacture the security cameras – production

F. Attend trade shows to make wholesalers aware of the camera - marketing

G. Process orders from the trade show orders and wholesalers - distribution

H. Deliver the security cameras to the wholesalers - distribution

I. Provide online assistance to the security camera users - customer service

J. Make additional design changes to the security camera based on customer feedback design of products and processes

2-12

2.

Value Chain

Category

Design of

products and

processes

Production

Marketing

Distribution

Customer

service

Activity

Perform market research on

competing brands

Cost Driver

Hours spent researching competing market

brands

Design a prototype of the

phone app and the security

camera

Engineering hours spent on initial product

design

Test the compatibility of the

phone app and the security

camera

Number of product tests conducted

Make necessary design changes

to the prototype based on

testing performed

Number of design changes

Make additional design

changes to the security

camera based on customer

feedback

Manufacture the security

cameras

Attend trade shows to make

wholesalers aware of the

camera

Number of design changes

Process orders from the trade

show orders and wholesalers

Number of security camera orders processed

Deliver the security cameras to

the wholesalers

Provide online assistance to the

security camera users

Number of deliveries made to wholesalers

2-13

Machine hours required to run the

production equipment

FTEs spent on attending trade shows

Customer-service hours

2-31

(20-25 mins.) Calculating unit cost

1. Prepare the cost of goods manufactured for the year 2019.

£